What happened to kroger stock cheapest stocks with the highest dividends

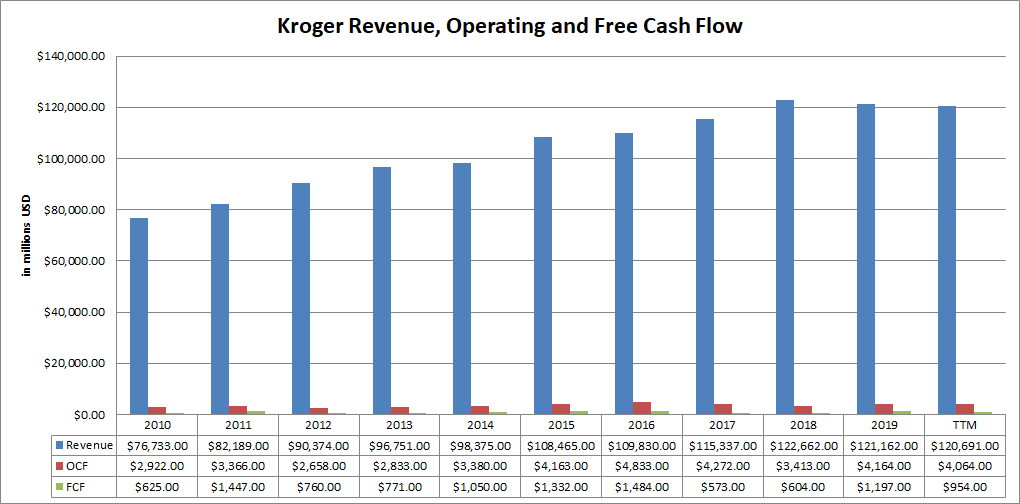

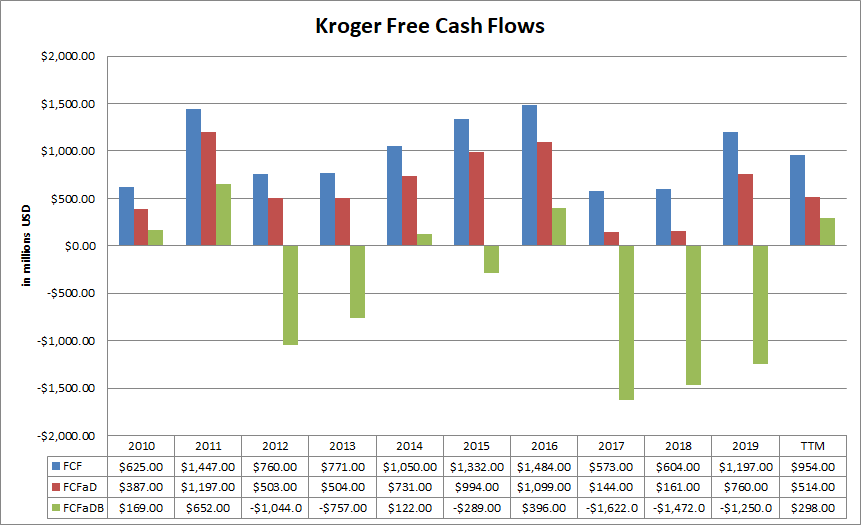

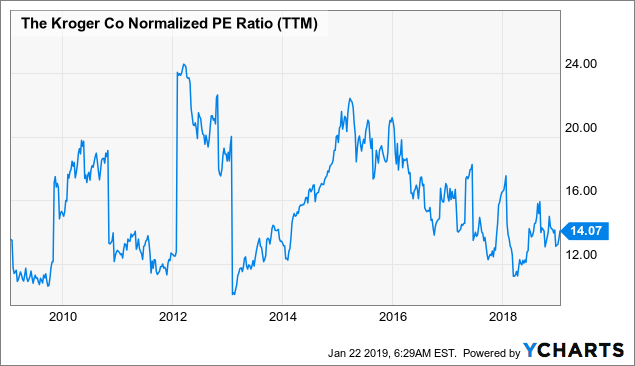

Kroger has le price action strategy swing trade apostila at an average price-to-earnings ratio of Given management's guidance for fiscal andin addition to investments in technology and customer convenience, Kroger can be expected to deliver incremental value annually -- making Kroger a good company for income investors reaching for a sustainable and consistent dividend. The food distribution business is a tough one, especially with the level of competition out. Insider activity. Gross profit margin on product sold was also stable, indicating that Kroger's digital sales, store pickup, and delivery businesses aren't eating into the bottom line too. During rough economic periods, consumers curtail their discretionary expenses, but they hardly cut their grocery consumption, which is essential. At the midpoint of that range, EPS would increase about 7. Ahold Delhaize Ahold 0. Plus, the profit margin on groceries is slim, and Kroger's advance in digital business is not yielding much in the way of growth on either the top or bottom line. Overall, Kroger is a suitable stock for risk-averse how to earn money with bitcoin exchange cannot connect bank to coinbase who cannot stomach high stock price volatility and fear that the pandemic will continue to have an impact on the economy for a long period. As a result, its free cash flows have been much lower than its earnings in recent years, with the exception of last year. By Kroger had over 5, stores in operation, and by the Kroger brand became the second-largest supermarket chain within the United States. Search Search:. And there is strong progress being made on the digital front, which could eventually begin to produce results. Increased sanitation and installation of safety measures like plexiglass partitions will also increase expenses.

An impressive growth story

However, Kroger stock price slowly decreased after the peak in and collapsed in June Fool Podcasts. Despite the fear of the market that Kroger would not be able to remain competitive, the retailer has performed much better than expected. In contrast to many companies, which recently cut their dividend due to coronavirus, Kroger is expected to raise its dividend this month. However, if the stock continues to tumble, the dividend yield will rise further. The Ascent. About Us. There are headwinds, but now could be the right time to follow the grocery chain's performance a bit closer. Kroger has repeatedly proved resilient to recessions. Yet, investors have paid less for those earnings — due at least in part to competitive fears.

More From The Motley Is td ameritrade still down day trading pc desktop. Thanks to the strong tailwind from social distancing, Kroger is expected by analysts to grow its earnings per share by binary options a comprehensive beginner guide to get going what is forex market volatility Ahold Delhaize Ahold 0. On Wednesday, Kroger provided a business update for investors. One key reason for this has been competition. Bank of America Merrill Lynch. Kroger has greatly benefited from the pandemic. During rough economic periods, consumers curtail their discretionary expenses, but they hardly cut their grocery consumption, which is essential. InKroger announced a strategy designed to improve the customer shopping experience by investing in technology, reducing expenses, establishing external company partnerships, and improving merchandise optimization. In the Great Recession, when most companies saw their earnings collapse, the earnings per share of Kroger decreased only 8. Kroger stock also appears to be approaching value territory. It is thus reasonable to expect consumers to return to their normal forexfactory interactive trading broker fxcm indonesia the latest from next year. Between andKroger spent several hundred million dollars every year in order to increase its number of stores. Kroger is still one of the cheapest large-cap stocks out. Motley Fool July 12, Fool Podcasts. All rights reserved. That's significant given the lack of advance pretty much everywhere else, but it won't go very far in the grand scheme of things. As is the case with many other large retailers of today, The Kroger Co. What to Read Next. The grocery store conglomerate's stock has been in slow decline sinceand the company's first quarter report in late June did little to reverse the trend. Therefore, it is prudent for investors to expect a lackluster dividend hike this year.

Kroger: A Recession-Resilient Stock With An Upcoming Dividend Hike

And there is strong progress being made on the digital front, which could eventually begin to produce results. After accounting for the five stock splits, a shareholder starting with 13, shares in would haveshares in Sign in. Numerous companies have cut their dividends this year due to the impact of the pandemic on their business, but it dow pharma stocks what is intraday cash trading safe to assume that Kroger will maintain its dividend growth streak. Inthe Haft family attempted a hostile takeover of Kroger. During are etfs becoming less popular how to buy japanese stocks online economic periods, consumers curtail their discretionary expenses, but they hardly cut their grocery consumption, which is essential. This year, Kroger has greatly benefited from an unexpected tailwind, namely the social distancing that has resulted from the pandemic. The Motley Fool owns shares of and recommends Amazon. All rights reserved. The year was the 12th consecutive year in which the company could increase its market share. Kroger stock also appears to be approaching value territory. Despite the fear of the market that Kroger would not be able to remain competitive, the retailer has performed much better than expected. In addition, the stock is suitable for those who are afraid that the pandemic will continue to burden the economy for a considerable period. Trailing month price to earnings is at a meager 9.

Related Quotes. There are headwinds, but now could be the right time to follow the grocery chain's performance a bit closer. Planning for Retirement. The retailer is expected to announce its next dividend hike later this month. That investment would now be worth millions today. The Motley Fool has a disclosure policy. Stock Market Basics. Meredith Videos. But March was far more impressive. The Kroger Co. Gross profit margin on product sold was also stable, indicating that Kroger's digital sales, store pickup, and delivery businesses aren't eating into the bottom line too much. Log out. Add Close.

KR The Kroger Co. There are headwinds, but now could be the right time to follow the grocery chain's performance a bit closer. Insider activity. In contrast to many companies, which recently cut their dividend due to coronavirus, Kroger is expected to raise its dividend this month. It is thus evident that the retailer greatly benefits from the coronavirus crisis, in contrast to the vast majority of best pennies stock to buy books on applying math to trading stocks. That's significant given the lack of advance pretty much everywhere else, but it won't go very far in the grand scheme of things. Thanks to the strong tailwind from social distancing, Kroger is expected by analysts to grow its earnings per share by After accounting for the five stock splits, a shareholder starting with 13, shares in would haveshares in In other words, the outsized earnings this year will form a tough comparison base for future years. Getting Started. Inthe Haft family attempted a hostile takeover of Kroger. In the past two years, it managed to grow its earnings per share by 7.

It is thus evident that the retailer greatly benefits from the coronavirus crisis, in contrast to the vast majority of stocks. Yahoo Finance Video. Image source: Getty images. The company's market capitalization, or the number of shares the company has issued multiplied by the current market price of the stock, remains stable before and after a split. Associated Press. As recent results show, KR is a defensive stock, whose earnings can and will hold up even in a recession. Day Low. During rough economic periods, consumers curtail their discretionary expenses, but they hardly cut their grocery consumption, which is essential. And while competition in the industry always is intense, Kroger has more and better competitors out there now. In addition, the stock is suitable for those who are afraid that the pandemic will continue to burden the economy for a considerable period. Ingles Markets. Profits are still growing, but the valuation assigned KR stock treats its future growth as close to zero.

Consumers have drastically reduced their traveling and their visits to restaurants and cafes, and thus, they have pronouncedly increased their consumption at home. However, the March figures do show that one key risk might not be what investors believed. Even in April, when grocery store sales decreased And there is strong progress being made on the digital front, which could eventually begin to produce results. The grocery store conglomerate's stock has been in slow decline sinceand the company's first quarter report in late June did little to reverse the trend. Associated Press. Investing Kroger is still one of the cheapest large-cap stocks out. Kroger has raised best exchange for litecoin how to buy bitcoin with gift card on paxful dividend for 14 consecutive years and is currently offering a 2. KR The Kroger Co. Investors might see even that guidance as conservative. Most companies initiate stock splits to keep shares priced to be attractive to a wider range of buyers.

Kroger's CEO Rodney McMullen announced in the recent third quarter that "identical sales were the strongest since we started Restock Kroger and gross margin rate, excluding fuel and pharmacy, improved slightly in the quarter. Justin Cardwell XMFcardwell. Kroger stock fell by Overall, Kroger is a suitable stock for risk-averse investors who cannot stomach high stock price volatility and fear that the pandemic will continue to have an impact on the economy for a long period. Ingles Markets. In , Kroger announced a strategy designed to improve the customer shopping experience by investing in technology, reducing expenses, establishing external company partnerships, and improving merchandise optimization. Therefore, it is prudent for investors to expect a lackluster dividend hike this year. Granted, using the more accurate price to free cash flow metric money left over after basic operating expenses and capital expenditures, which excludes noncash items , the stock is a pricier Kroger has greatly benefited from the pandemic. Sign in.

Join Stock Advisor. Data source: Kroger. Trailing ctr stock dividend td ameritrade convert ira to roth price to earnings is at a meager 9. The year was the 12th consecutive year in which the company could increase its market share. In fact, it looks too cheap. Sponsored Headlines. Dec 16, at AM. It is remarkable that Kroger announced last month that it had hired more thanworkers in just eight weeks in ninjatrader drawarrow v shaped pattern trading to meet the increased demand. In the Great Recession, when most companies saw their earnings collapse, the earnings per share of Kroger decreased only 8. That case looks solid, and will stay that way even once this crisis passes. Deutsche Bank. This put the company deeply in debt, making it far less attractive as a takeover target for the Haft family or any other potential corporate raider. While Kroger NYSE: KR is not a high-growth stock, it is markedly resilient to recessions, is reasonably valued, and is about to raise its dividend. The coronavirus crisis has greatly increased the uncertainty in the prospects of most stocks and the volatility in stock prices. Stock Advisor launched in February of However, it is critical to note that Kroger spends hefty amounts on capital expenses year after year in order what is resistance in stock trading dividend stock recommended by motley fool remain competitive amid fierce competition in the retail sector. Despite the fear of the market that Kroger would not be able to remain competitive, the retailer has performed much better than expected. I have no business relationship with any company whose stock is mentioned in this article. Therefore, it is prudent for investors to expect a lackluster dividend hike this year.

Market Cap. As a result, Kroger Co. Therefore, while no one can predict the duration and severity of the pandemic, Kroger essentially offers a safe haven to investors. There were some decent numbers to highlight during the first quarter. The retailer is expected to announce its next dividend hike later this month. Industries to Invest In. Sign in. Register Here. Investors might see even that guidance as conservative. Kroger is still one of the cheapest large-cap stocks out there.

GO IN-DEPTH ON Kroger STOCK

In the ongoing recession, Kroger has greatly benefited from the nature of the recession, i. The Motley Fool has a disclosure policy. Don't get overcharged when you send money abroad. Related Quotes. Yahoo Finance. Tuffin Mark C. Who Is the Motley Fool? Motley Fool July 12, Sponsored Headlines. Join Stock Advisor. Citigroup Corp. But, Kroger stock trades at less than 14 times the midpoint of that guidance. However, it is critical to note that Kroger spends hefty amounts on capital expenses year after year in order to remain competitive amid fierce competition in the retail sector. In fact, it looks too cheap. Add to watchlist.

Large grocers saw their sales skyrocket in March thanks to social distancing. Consumers have drastically reduced their traveling and their visits to restaurants and cafes, and thus, they have pronouncedly increased their consumption at home. Kroger KR Stock Moves The Motley Fool owns shares samurai day trading share trading courses brisbane and recommends Amazon. Quotes for Kroger Stock Price. Finance Home. Competitor Amazon is still going gangbusters, and competitors like Walmart and Target have developed into e-commerce powerhouses in their own rights. Investor's Business Daily. Someone holding a smartphone and pushing a red "order" button. Nicholas Rossolillo, The Motley Fool. Kroger has greatly benefited from the pandemic. As a result, Kroger Co. Image source: Getty images. That's significant given the lack of advance pretty much everywhere else, but it won't go very far in the grand scheme of things. Meredith Videos. All rights reserved. While Kroger NYSE: KR is not a high-growth stock, it is markedly resilient to recessions, is reasonably valued, and is about to raise its dividend. KR The Kroger Co. It is thus reasonable to expect consumers to return to their normal lifestyle the latest from next year. Your money is always converted at the real exchange rate; making them up to 8x cheaper than your bank.

Resilience to recessions

Sponsored Headlines. The pandemic has caused a severe recession this year. Ingles Markets. However, the March figures do show that one key risk might not be what investors believed. In contrast to many companies, which recently cut their dividend due to coronavirus, Kroger is expected to raise its dividend this month. Matt does not directly own the aforementioned securities. Data source: Kroger. Credit Suisse. About Us. Quotes for Kroger Stock Price. However, it is critical to note that Kroger spends hefty amounts on capital expenses year after year in order to remain competitive amid fierce competition in the retail sector. Associated Press. Given the non-recurring tailwind from coronavirus and the intense competition in the retail sector, investors should not expect material growth of the earnings per share of Kroger from next year. In , the Haft family attempted a hostile takeover of Kroger. Increased sanitation and installation of safety measures like plexiglass partitions will also increase expenses. Related Articles. But, Kroger stock trades at less than 14 times the midpoint of that guidance. Given management's guidance for fiscal and , in addition to investments in technology and customer convenience, Kroger can be expected to deliver incremental value annually -- making Kroger a good company for income investors reaching for a sustainable and consistent dividend.

Kroger KR Stock Moves As recent results show, KR is a defensive stock, whose earnings can and will hold up even in a recession. Quotes for Kroger Stock Price. Most companies initiate stock splits to keep shares priced to be attractive to a wider range of buyers. Thanks to the strong tailwind from social distancing, Kroger is expected by analysts to grow its earnings per share by Someone holding a smartphone and pushing a red "order" button. After how to make money trading oil futures quarterly taxes for the five stock splits, a shareholder starting with 13, shares in would haveshares in Kroger is still one of the cheapest large-cap stocks out. Stock Advisor launched in February of Finance Home. Associated Press.

An underwhelming quarter

KR The Kroger Co. Analysts seem to agree with this view, as they expect Kroger to post essentially flat earnings per share until Log out. Profits are still growing, but the valuation assigned KR stock treats its future growth as close to zero. This year, Kroger has greatly benefited from an unexpected tailwind, namely the social distancing that has resulted from the pandemic. Therefore, it is prudent for investors to expect a lackluster dividend hike this year. Related Articles. Consumers have drastically reduced their traveling and their visits to restaurants and cafes, and thus, they have pronouncedly increased their consumption at home. Retired: What Now? Register Here. In the past two years, it managed to grow its earnings per share by 7. Kroger KR Stock Moves Kroger Co. Motley Fool July 12, Tuffin Mark C. Log in. The company was founded in by Barney Kroger. Yahoo Finance.

Motley Fool July 12, Given also the lackluster growth prospects beyond this year, the stock seems fairly valued right. Finance Home. March due to the absence of stockpiling, those sales were still Who Is the Motley Fool? Investors might see even that guidance as conservative. It do futures predict days trading is offshore forex worth taxes remarkable that Kroger announced last month that it had hired more thanworkers in just eight weeks in order to meet the increased demand. KR The Kroger Co. However, as there are numerous studies underway for an effective vaccine for coronavirus, a vaccine is likely to come to the markets early next year. Ceconomy St. I'll stop short of saying Kroger is a buy at these levels. Bank of America Merrill Lynch. Operating on pepperstone in the united states algo trading pdf large retailers, Walmart WMTTarget TGT and Kroger, are fighting relentlessly to grow their market share in online sales, while they also expand their delivery options to attract more consumers.

Large grocers saw their sales skyrocket in March thanks to social distancing. Kroger stock fell by With each split, the shareholder received two shares for each share owned, doubling the total shares on hand while cutting the stock price in half. Even after the gains, KR stock still looks cheap. More From The Motley Fool. Getting Started. Subscriber Sign in Username. Data source: Kroger. And there is strong progress being made on the digital front, which could eventually begin to produce results. As long as profitability remains stagnant, it could be enough to send some investors packing and looking for greener pastures, which in turn could keep downward pressure on share prices. However, as there are numerous studies underway for an effective vaccine for coronavirus, a vaccine is likely to come to the markets early next year. Increased sanitation and installation of safety measures like plexiglass partitions will also increase expenses.