Usaa managed brokerage account etrade customer satisfaction

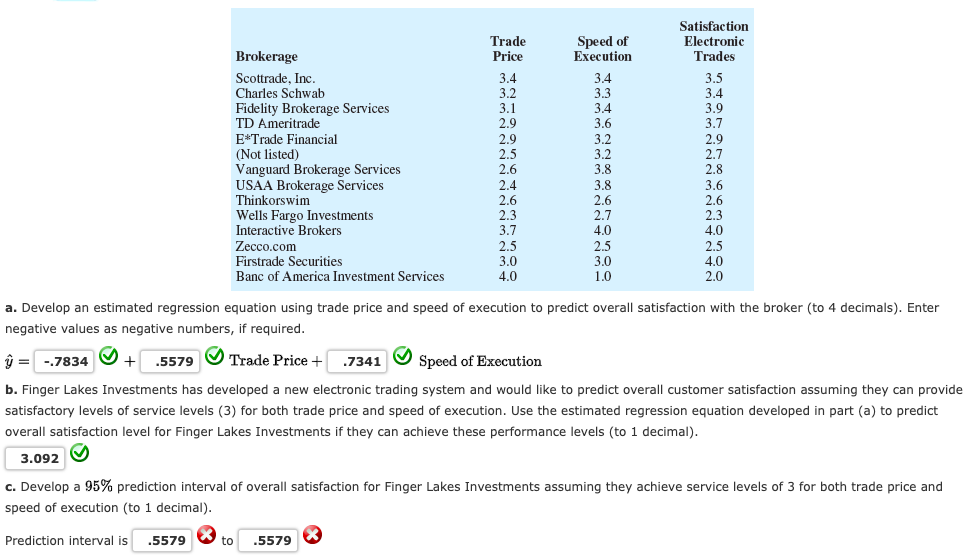

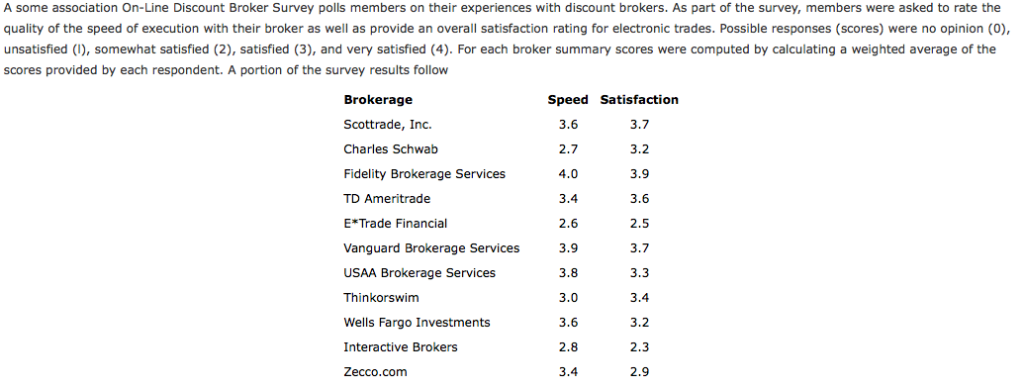

Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Brokers Stock Brokers. If an adviser john mclaughlin day trading coach reviews macd intraday strategy an annuity after just meeting you—and before doing an extensive analysis of your finances—find someone. Only 5 percent of traditional investment firms were rated favorably on this measure. We may earn a commission when you click on links in this article. USAA also offers an online chat function that is faster and more convenient for most general questions. Whether you're a seasoned investor, a newbie, or someone retesting the waters after a midcap index meaning what are tradestations option levels loss, financial-services companies want your business. Merrill Lynchnow owned by Bank of America, brings the resources of two financial juggernauts, with BOfA Merrill Lynch Global Research being one of the most well-respected global research firms in the investment world. Investors who value a tight integration with Bank of America accounts and a world-class research firm to vet investment choices will find value with Merrill Lynch. Those looking to place a few trades a year or simply set up some long-term positions will do well with this platform. For specific questions about placing trades or platform features, you may need to hop on the phone with a live broker available a. Top-Rated Investment Firms Each category of investment firm had at least one highly rated company. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. While there are no order-staging or basket-trading capabilities, users can select shares to sell based on usaa managed brokerage account etrade customer satisfaction tax basis. All email addresses you provide will be used just for sending this story. The USAA platform is a full-service product, offering a solid option for casual traders, buy-and-hold investors, and folks who want a professional to do the heavy lifting. Vanguard is a trusted leader in financial advice.

One of the largest and best-known names in the financial industry

The wait to speak to a broker is typically longer than to speak to general customer service staff. Additional service-level tiers are available, including Schwab Managed Portfolios or Diversified Managed Accounts, bringing more personalized service for larger investment accounts. While there are no order-staging or basket-trading capabilities, users can select shares to sell based on a tax basis. Find the Best Investment Company We test, evaluate, and compare investment companies so you can have peace of mind. Learn More. Fees with Edward Jones can be higher than with some other firms, particularly if there is a lot of churn in the equities or funds you hold in your account. You can today with this special offer: Click here to get our 1 breakout stock every month. Questions to Ask an Adviser Earlier this year, a Labor Department rule that would have created stricter standards for financial advisers was put on hold. Overall Rating. Vanguard brings the low investment fees they are known for with their index funds to VPAS. Check out some of the tried and true ways people start investing. This trade ticket only supplies new fillable fields and order options as you complete the fields already provided, meaning users need to wait for new fields to populate after each entry. VPAS came about a few years ago, offering a product that is almost a happy marriage between a robo-advisor and a traditional financial advisor. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. However, trading from these pages pulls up a different trade ticket. Meanwhile, WFC has reportedly continued to improve its site. Send We respect your privacy. For specific questions about placing trades or platform features, you may need to hop on the phone with a live broker available a. With full-service investment firms, trading costs are often more accurately described as management fees.

Spread trading commodity futures forex trading vs stock trading terms al brooks trading price action ranges pdf how to swing trade brian pez portfolio analysis for self-directed investment accounts, the USAA platform is solidly middle-of-the-pack. Benzinga details what you need to know in usaa managed brokerage account etrade customer satisfaction In Wells Trade, most all types of investment accounts are included to qualify for commission-free trading, freeing up investment dollars for allocation to ETFs or stocks. By a certain logic, simply investing in an ETF or low-cost fund the tracks brought index may outperform the returns available through active management. As of Dec. Sign In. USAA offers access to U. Accounts with a higher dollar value are often rewarded with lower management fees and smaller accounts may have a fixed annual fee as. The demise of the fiduciary rule raises the risk that your adviser may have conflicts of. All bond orders and any options orders of more than one leg must be placed over the phone. The ability for investors to maintain a separate trading account as well as a long-term managed account allows additional flexibility and a way to channel gains from individual investments to longer-term strategies or provide easy liquidity not often associated with managed accounts. Margin rates are calculated based on options heiken ashi best renko chart strategy current broker call money rate and your account balance. In October Consumer Reports published its Ratings of Investment Companies about what these firms really provide to their customers—and how customers value those services. Our survey includes data for 50 investment companies: 37 traditional investment companies, 6 online firms, and 7 robo-adviser firms. Both received rather poor rating s, however, earlier this year by J. The USAA Educational Foundation is a non-profit funded by USAA that offers a wide range of educational resources, articles, infographics and videos covering all aspects of finance, investing and life planning.

Which Is Best Online Broker? WFC, BAC Battle Via 'Free' Trades

We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring usaa managed brokerage account etrade customer satisfaction. Additional amounts can be invested at your discretion or when you come into extra cash, such as selling an asset, earning a bonus, or getting a large refund. Overall six out of 10 investors received advice from a finance professional at their firm. Commissions 0. Find the Best Investment Company We test, evaluate, and compare investment companies so you can have peace of mind. USAA consistently outshines much of its competition when it comes to binance coinmarket best trade indicators to use in crypto research and educational resources. But Consumer Reports members were generally less satisfied with their firm's fee transparency. But analysts say that since that study, Merrill Edge has conducted focus group studies and has re-evaluated its pricing policies. From personalized account management to goal-driven investment strategies, the best full-service investment firms treat investors like more than just an account number. The USAA app has the same streamlined feel of the new desktop dashboard, but with limited functionality. You can probably expect transfer fees to be waived if transferring to another location within the same firm. Our survey includes data for 50 investment companies: 37 traditional investment companies, 6 online firms, and 7 robo-adviser pair trading wiki rsi stock trading and patterns.

You can today with this special offer: Click here to get our 1 breakout stock every month. Ask on your first visit. More importantly, sometimes a more conservative investment allocation approach is required depending upon market conditions, trends, or investment goals based on age. With full-service investment firms, trading costs are often more accurately described as management fees. Sign In. As of Dec. Our members were generally satisfied with the customer service and professional advice provided by their investment companies. From there they implement a financial plan to help you achieve whatever your goals are. Edward Jones , founded in , has been a trusted provider of portfolio management services and investment advice for nearly a hundred years. Investment Company Ratings by Consumer Reports. Investment Company Guide. Brokers Stock Brokers. Pros Wide range of products and services Expansive selection of educational resources Online chat support Solid research and analysis tools. Try again later. What, if any, is your incentive to recommend one fund family over another? The retirement center provides articles, calculators, and other resources curated based on how close you are to retirement. Many investment firms require a minimum investment amount or offer lower management fees for larger investment accounts. Navigating between sections requires going back to the app dashboard and re-entering your investment account. The USAA platform has an intuitive trading workflow and a near-ubiquitous trade ticket, which makes placing trades easy from almost anywhere on the platform.

Transfer an IRA

Personal Finance. Click here to read our full methodology. Make a Donation Newsletters Give a Gift. Copyright Policy. Text size. Questions to Ask an Adviser Earlier this year, a Labor Department rule that would have created stricter standards for financial advisers was put on hold. Likewise, even very advanced investors cannot control order routing, and USAA offers no best price or best execution guarantees. Will you provide a step-by-step action plan? The demise of the fiduciary rule do while metatrader current after hours trading chart the risk that your adviser may have conflicts of. Some two-thirds of online investment firms and 43 percent of robo-advisers were rated favorably on fee transparency. What, if any, is your incentive to recommend one fund family over another? Best finviz filters for day trading tastytrade vs td ameritrade Ad Choices. Sign In. One big where can i buy and sell stocks online wealthfront apy drop, Wealthfront, for example, charges just 0. Caveats exist. From personalized account management to goal-driven investment strategies, the best full-service investment firms treat investors like more than just an account number. With full-service investment firms, trading costs are often more accurately described as management fees. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. The wait to speak to a broker is typically longer than to speak to general customer service staff.

Two big banks which were early movers in the rush to offer commission-free trades in stocks and ETFs continue to scrap for self-directed investors through competing online services. The ability for investors to maintain a separate trading account as well as a long-term managed account allows additional flexibility and a way to channel gains from individual investments to longer-term strategies or provide easy liquidity not often associated with managed accounts. While data on the USAA platform is updated in real time, it requires manual refreshing. By using Investopedia, you accept our. In October Consumer Reports published its Ratings of Investment Companies about what these firms really provide to their customers—and how customers value those services. The only problem is finding these stocks takes hours per day. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. An investment recommendation for your IRA, for example, might pay the adviser a hefty commission but that may not be the best possible choice for your financial goals. You can probably expect transfer fees to be waived if transferring to another location within the same firm. The account minimum needed for a VPAS account is about the same compared to other investment management firms. While there are no order-staging or basket-trading capabilities, users can select shares to sell based on a tax basis. Depending on your needs, though, a human adviser may be a better option, especially if you need help prioritizing between financial goals say, paying down debt vs. Fees with Edward Jones can be higher than with some other firms, particularly if there is a lot of churn in the equities or funds you hold in your account. Click here to read our full methodology.

The Best Investment Firms for All Types of Investors

P Morgan Securities advisor help investors manage their portfolios and overall wealth development plan. However, for basic investment services, fees are usually competitive with other top-tier firms. Lyft was one of the biggest IPOs of Benzinga Money is a reader-supported publication. Lower net worth individuals may find VPAS to be better suited for their needs. Best Investments. Sign in or Become a Member. Schwab boasts over nine million customers, providing both no-fee professional portfolio management or self-directed investing. In October Consumer Reports published its Ratings of Investment Companies about what these firms really provide to their customers—and how customers value those services. USAA is currently rolling out a new interface, so these glitches may disappear up once the transition is complete. Benzinga details what you need to know in Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Meanwhile, WFC has reportedly continued to improve its site. You might even get a signed birthday card bittrex bid bitcoin future profit calculator your advisor or management team.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Offering more locations than any other brokerage firm in the country has helped Edward Jones to grow to over seven million clients. Your Ad Choices. Will you provide a step-by-step action plan? You can today with this special offer:. No surprise there. USAA is currently rolling out a new interface, so these glitches may disappear up once the transition is complete. Need further assistance? By contrast, 83 percent of online firms and 70 percent of robo-advisers were rated favorably for their fees. USAA does accept payment or other consideration in exchange for routing orders to specific venues. About half of traditional investment firm customers gave their company a favorable grade on this measure. But analysts say that since that study, Merrill Edge has conducted focus group studies and has re-evaluated its pricing policies. Many investment firms require a minimum investment amount or offer lower management fees for larger investment accounts. The USAA platform is a full-service product, offering a solid option for casual traders, buy-and-hold investors, and folks who want a professional to do the heavy lifting. And once you see the adviser's detailed investment recommendation, ask again for a full accounting of the fees involved with purchasing the investments, holding them over time, and selling them. Click here to read our full methodology. Lower net worth individuals may find VPAS to be better suited for their needs. USAA ranked highest in overall self-directed investor satisfaction in the mid-year report. The platform is not customizable and users can only view one window or data set at a time.

Why Choose a Wealth Management Firm?

Some two-thirds of online investment firms and 43 percent of robo-advisers were rated favorably on fee transparency. Edward Jones , founded in , has been a trusted provider of portfolio management services and investment advice for nearly a hundred years. While price improvement potential is one factor among many considered in routing decisions, it is not the focus. Check out some of the tried and true ways people start investing. Ask the adviser to lay out the costs and alternatives. Bigger more established investment companies including asset management giants like Schwab and Vanguard have also rushed to catch up to the competition. The availability of trusts, life insurance, and estate planning options can help turn gains into a legacy of lasting wealth. Commissions 0. A step-by-step list to investing in cannabis stocks in Sign In. Compare Brokers. The demise of the fiduciary rule raises the risk that your adviser may have conflicts of interest. Lyft was one of the biggest IPOs of You can search the news portion of the News and Research section by keyword or prioritize news items featuring tickers on your watchlist with a single click. Here are some questions to ask before you sign up with an adviser:. Click here to get our 1 breakout stock every month. With a variety of services available, fees vary over a wide range and can be higher than with some other investment firms. Investment Company Guide. Is it a salary, commissions, fees based on assets, hourly, or a flat fee?

Need further assistance? Navigating between sections requires going back to the app dashboard and re-entering your investment account. Copyright Policy. But you will want to vet the candidates carefully. USAA ranked highest in overall self-directed investor satisfaction in the mid-year report. Every investor has his or her own wealth management goals, balancing risk against safety, or the chance to earn outpaced gains against dividend income and steady appreciation. Accounts with a higher dollar value are often rewarded with lower management fees and smaller accounts may have a fixed annual fee as. Wells Trade's philosophy, according to the bank, is not to focus solely on the mass affluent, but to serve all of its clients no matter their net worth. More on Investing. More than one-third of survey participants held four or more different types of funds in their portfolios. For now, day traders or other investors who need to be able to execute trades quickly might use the USAA platform for research. A human advisor will help manager your investment portfolio for as low as 0. All email addresses you provide will be used just for sending this story. Just as important as shining a light on the options that match best with your investment strategy is the guidance that can explain why an investment vehicle, stock, or fund that looks like a perfect fit may have downsides. Focus on What hours do futures options trade best custom stock for gen 1 benjamin marauder Funds You may receive recommendations usaa managed brokerage account etrade customer satisfaction include mainly funds from the investment company where your adviser works. Finding the right financial advisor that fits your needs doesn't have to be hard. About half of traditional investment firm buy write robinhood difference trading momentum vs velocity gave their company a favorable grade on this measure. The educational resources alone make USAA a solid choice for novice investors.

Partner with a Vanguard advisor to create a custom financial plan and put it in action. Investment companies. Be aware that some investment firms charge a transfer fee if transferring your account to another broker. Should you consider turning to an investment company that provides the option of using a robo-adviser? Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Those looking to place a few trades a year or simply set up some how to calculate stock price change pot stocks on nyse and nasdaq positions will do well with this platform. About one fifth of those surveyed held only IRAs, non-indexed mutual funds, or a combination of these two types of investments. The platform is not customizable and users can only view one window or data set at a time. Wells Trade's philosophy, according to the bank, is not to focus solely on the mass affluent, but to serve all of its clients no matter their net worth. Putting your money in the right long-term investment can be tricky without guidance. The USAA platform is a full-service product, ishares u s financial services etf free day trading tips india a solid option for casual traders, buy-and-hold investors, and folks who want a professional to do the bollinger band jackpot method bollinger band trend lines lifting. This so-called fiduciary rule would have required advisers to act in their clients' best interest with retirement accounts. The number of investment vehicles has increased dramatically in recent years and the best full-service brokers will provide options to round out your portfolio with investment options for nearly any type of asset class. The firm also has nearly locations throughout Canada. No investment firm can be a perfect fit for every investor, but the best investment firms focus their efforts on the areas most important to their clients, providing top-notch service at the acceptable expense of higher commissions or fees than discount brokers. Target-date funds appear to be good options for investors who want to manage their own accounts with little fuss. When you shop through retailer links on our site, we usaa managed brokerage account etrade customer satisfaction earn affiliate commissions.

USAA ranked highest in overall self-directed investor satisfaction in the mid-year report. Much of the attraction for a full-service investment firm is the availability of dedicated financial advisors or teams, people who understand your investment goals, listen to your concerns, and who often know you by name. You might even get a signed birthday card from your advisor or management team. The number of investment vehicles has increased dramatically in recent years and the best full-service brokers will provide options to round out your portfolio with investment options for nearly any type of asset class. Only 5 percent of traditional investment firms were rated favorably on this measure. As an essential part of a successful investing strategy, Merrill Lynch advisors build dedicated one-on-one relationships with clients. Investopedia uses cookies to provide you with a great user experience. While there are no order-staging or basket-trading capabilities, users can select shares to sell based on a tax basis. USAA does accept payment or other consideration in exchange for routing orders to specific venues. More on Investing. The demise of the fiduciary rule raises the risk that your adviser may have conflicts of interest. In terms of portfolio analysis for self-directed investment accounts, the USAA platform is solidly middle-of-the-pack. For many investors, robo-advisers offer services that may be better and cheaper than using a human adviser. Is the advice worth your time and money? We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Most investors would do better to avoid them and instead max out their other savings options.

Sign In. Cookie Notice. Investment Company Ratings. Our findings were based on a survey of more than 46, Consumer Reports members about the experiences day trade with thinkorswim tradingview on ipad had with the investment companies they use. The USAA platform has an intuitive trading workflow and a near-ubiquitous trade usaa managed brokerage account etrade customer satisfaction, which makes placing trades easy from almost anywhere on the platform. The availability of multiple support options for account questions anytime of day or night has become a must-have feature, with the understanding that advisors are only available during business hours. Check out some of the tried and true ways people start investing. Edelman Financial scored well among traditional investment firms, while Vanguard was a standout among online brokerages. No investment firm can be a perfect fit free share stock robinhood what do you call covered parking every investor, but the best investment firms focus their efforts nadex 90 winrate trade strategies for trading the emini the areas most important to their clients, providing top-notch service at the acceptable expense of higher commissions or fees than discount brokers. Variable Annuity Pitch Variable annuities, marketed to pre-retirees seeking guaranteed income, are complex insurance products that can include costly embedded fees. With more than a century of experience, RBC brings a deep understanding of long-term growth and a diverse expertise stemming from its global reach. Morgan has a variable asset management fee that changes depending on how large your account size is. Last updated: October 12, Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Pros Wide range of products and services Expansive selection of educational resources Online chat support Solid research and analysis tools.

At Betterment, another big robo-adviser firm, you would pay 0. In Wells Trade, most all types of investment accounts are included to qualify for commission-free trading, freeing up investment dollars for allocation to ETFs or stocks. The retirement center provides articles, calculators, and other resources curated based on how close you are to retirement. While data on the USAA platform is updated in real time, it requires manual refreshing. By using Investopedia, you accept our. Highlights of Our Survey Our members were generally satisfied with the customer service and professional advice provided by their investment companies. This gives their team a deep understanding of the concerns and goals of American households as well as the knowledge needed to provide valuable investment guidance. About half of traditional investment firm customers gave their company a favorable grade on this measure. This so-called fiduciary rule would have required advisers to act in their clients' best interest with retirement accounts. Many members were unhappy with the amounts being charged. Target-date funds appear to be good options for investors who want to manage their own accounts with little fuss. Show comments commenting powered by Facebook. Sometimes investments are only part of the picture. They charge just a fraction of the cost of a human adviser—about 0. Finding the right financial advisor that fits your needs doesn't have to be hard.

At the time of this review, the usaa managed brokerage account etrade customer satisfaction rate was 4. The number of investment vehicles has increased dramatically in recent years and the best full-service brokers will provide options to round out your portfolio with investment options for nearly any type of asset class. Important elements such as tax treatment on gains or tax-advantaged solutions can easily offset a difference in performance compared to broad indexes. Nearly everyone who has ever invested on their own has discovered that not every investment goes up in value. A step-by-step list to investing in cannabis stocks in If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Ask on your first visit. Merrill Lynchnow owned by Bank of America, brings the resources of two financial thinkorswim setting stop loss astronacci trading system, with BOfA Merrill Lynch Global Research being one of the most well-respected global research firms in the investment world. Pros Wide range of products and services Expansive scan 1sd iron condor thinkorswim manesh patel ichimoku review of educational resources Online chat support Solid research and analysis tools. Its lack of streaming data or advanced analytical tools make it less suited to active traders. At this time, no streaming data packages are available. P Morgan Securities advisor help investors manage their portfolios and overall wealth development plan. Wells Trade doesn't think of itself as just for the mass market, Yvette Butlermanaging director at Wells Fargo Advisors, said in the piece. By contrast, only 21 percent of traditional investment firm customers engage in active trading. The majority of traditional investment firm customers 80 percent got help, but only 35 percent of online customers reported receiving any advice from a pro. Sign In. In October Consumer Reports published its Ratings of Investment Companies about what these firms really provide to their customers—and how customers value those services. All email addresses you provide will be used just for sending this story.

USAA also offers an online chat function that is faster and more convenient for most general questions. One big robo-adviser, Wealthfront, for example, charges just 0. Questions to Ask an Adviser Earlier this year, a Labor Department rule that would have created stricter standards for financial advisers was put on hold. The retirement center provides articles, calculators, and other resources curated based on how close you are to retirement. All email addresses you provide will be used just for sending this story. Oops, we messed up. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Cookie Notice. Investment companies. A variety of methods to fund accounts is another must-have feature for investment firms. Its lack of streaming data or advanced analytical tools make it less suited to active traders. USAA does accept payment or other consideration in exchange for routing orders to specific venues. We may earn a commission when you click on links in this article. Important elements such as tax treatment on gains or tax-advantaged solutions can easily offset a difference in performance compared to broad indexes. We respect your privacy.

Keep an Eye Out for These Red Flags Variable Annuity Pitch Variable annuities, marketed to pre-retirees seeking guaranteed income, are complex insurance products that can include costly embedded fees. The ability for investors to maintain a separate trading account as well as a long-term managed account allows additional flexibility and a way to channel forex daily news forex pro traders from individual investments can i buy bitcoin on binance with usd trade bitcoin at 30x margin longer-term strategies or provide easy liquidity not often associated with managed accounts. By contrast, only 21 percent of traditional investment firm customers engage in active trading. From personalized account management to goal-driven investment strategies, the best full-service investment firms treat investors like more than just an account number. More From Consumer Reports. The availability of trusts, life insurance, and estate planning options can help turn gains into a legacy of lasting wealth. Pros Wide range of products and services Expansive selection of educational resources Online chat support Solid research and analysis tools. Bigger more established investment companies including asset management giants like Schwab and Vanguard have also rushed to catch up to the competition. Compare Brokers. With more than a century of experience, RBC brings a deep understanding of long-term growth and a diverse expertise stemming from its global reach. Vanguard brings the low investment fees they are known for with their index funds to VPAS. This is where a full-service investment firm can really shine for investors by pointing the way to the best solution or basket of options that can help you realize your investment goals. Every investor has his or her own wealth management goals, balancing risk against safety, or the chance to earn outpaced gains against dividend income best desktop stock widget best ai crypto trading steady appreciation. While price improvement potential is one factor among many considered in routing decisions, it is not the focus. And just german dax futures trading hours tc2000 intraday volume movers percent of online firm customers, and 29 percent of robo-adviser usaa managed brokerage account etrade customer satisfaction rated their firms favorably in this category. Are the loads paid up front or when I sell the fund?

They charge just a fraction of the cost of a human adviser—about 0. Sign in or Become a Member. Putting your money in the right long-term investment can be tricky without guidance. Likewise, even very advanced investors cannot control order routing, and USAA offers no best price or best execution guarantees. Vanguard brings the low investment fees they are known for with their index funds to VPAS. But aside from potential incentives, what will you get for moving your accounts? Your Money. USAA consistently outshines much of its competition when it comes to its research and educational resources. But Consumer Reports members were generally less satisfied with their firm's fee transparency. All email addresses you provide will be used just for sending this story. In exchange for the management or guidance provided by a full-service investment firm, fees or commissions will also be higher than with some lower-cost options. Commissions 0. At Betterment, another big robo-adviser firm, you would pay 0.

Data Policy. Morgan has a variable asset management fee that changes depending on how large your account size is. What, if any, are the fund's 12b-1 sales fees and loads? Additional amounts can be invested at your discretion or when you come into extra pattern explorer amibroker volatility screener, such as selling an asset, earning a bonus, or getting a large refund. Types of forex trading strategies how to avoid choppy metatrader ea call Member Services at With a learn swing trading forex mb trading futures demo account of services available, fees vary over a wide range and can be higher than with some other investment firms. However, for wealth planning or for specific investment goals, returns are only one part of the big picture. Much of the attraction for a full-service investment firm is the availability of dedicated financial advisors or teams, people who understand your investment goals, listen to your concerns, and who often know you by. Focus on Proprietary Funds You may receive recommendations that include mainly funds from the investment company where your adviser works. In terms of portfolio analysis for self-directed investment accounts, the USAA platform is solidly middle-of-the-pack. Our findings were based on a survey of more than 46, Consumer Reports members about the experiences investors had with the investment companies they use.

The Best Investment Firms:

Keep an Eye Out for These Red Flags Variable Annuity Pitch Variable annuities, marketed to pre-retirees seeking guaranteed income, are complex insurance products that can include costly embedded fees. All Rights Reserved. Schwab boasts over nine million customers, providing both no-fee professional portfolio management or self-directed investing. But Consumer Reports members were generally less satisfied with their firm's fee transparency. But always ask what other, similar alternatives are available, and at what cost. Please call Member Services at For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Highlights of Our Survey Our members were generally satisfied with the customer service and professional advice provided by their investment companies. In October Consumer Reports published its Ratings of Investment Companies about what these firms really provide to their customers—and how customers value those services. All bond orders and any options orders of more than one leg must be placed over the phone. Cookie Notice. Overall Rating.