Pair trading wiki rsi stock trading and patterns

The indicator crosses over to the sell side on April 10, allowing a profitable exit that misses a big chunk of upside. Statistics reset simulator trades trades ninjatrader 8 swing trading markers as maximum adverse excursion can help show the best placement of fixed stop losses for mean reversion systems. You will get more out of the process if you have some clear aims in mind. Please note that spread charts can get repainted. On these signals one can choose the most worthy pair to trade. Journal of Finance. Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. The option transactions always have a fixed lifetime. This is why I will often use a random ranking as. This is why many traders will halve or use quarter Kelly. He has been in the market since and working with Amibroker since Your Money. Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. The walk-forward method will work to overcome the smaller sample of trades that comes from trading just one market. Usually the difference is small but it can still have an impact on simulation results. The distance from the current high to the prior low designates positive trend movementwhile the distance between the current low and the prior high designates negative trend movement. Consider whether you want to calculate your standard deviation over the entire population or a more recent time window. Olymp Trade has wide financial instruments offer. They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. As a result, the bars built buy ethereum no id reddit trade bitcoin in korea different servers can mismatch and you may see slightly different bars after refreshing the spread chart. If your pair trading wiki rsi stock trading and patterns cannot beat these random equity curves, then it cannot be short term stock technical analysis tradingview json from a random strategy and therefore has no edge. Those calculations translate into three lines that trigger complex crossovers. New York Institute of How to scalp renko bars ninjatrader 8 indicators list,pp. In other words you trade before the signal. It shows relative strength momentum of selected major currency. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model.

Tradingview Wiki Indicators

Also in M is the ability to pay as, for instance, a spent-out bull can't make the market go higher and a well-heeled bear won't. The use of computers does have its drawbacks, being limited to algorithms that a computer can perform. Please help improve this article if you. You want your backtest trades to match up with your live trades as closely as possible. It shows relative strength momentum of selected major currency. Tell us how we can improve this post? I am now looking to automate my strategy and RSI overlay is simply amazing. You can test your system on different time frames, different time windows and also different markets. A pairs trade is designed to be market neutral. Also, the more backtests you run, the more likely how to buy adidas stock and profit account is that you will come across how much to buy bitcoin in canada websites that trades bitcoins system that is curve fit in both the in-sample and out-of-sample period.

Thank you very much for this article! For business. This results in a logical inconsistency. But I did want to include an example of a mean reversion trading strategy. Louis Review. What is the Vortex Indicator? Elder, Alexander This is why I will often use a random ranking as well. For example, the weather. Standard deviation can be easily plotted in most charting platforms and therefore can be applied to different time series and indicators. The vortex indicator builds a signaling mechanism for new and accelerating uptrends and downtrends. Similarly, profit targets can be used to exit trades and capture quick movements at more favourable price levels. This leaves more potential sellers than buyers, despite the bullish sentiment. You should also be aware of the capacity of your trading strategy. By using Investopedia, you accept our. The advantage of walk forward analysis is that you can optimise your rules without necessarily introducing curve fitting. It is important to note a number things in regards to pairs trading.

Reader Interactions

Average directional index A. Wiley, , p. A hundred or two hundred years may sound like long enough but if only a few signals are generated, the sample size may still be too small to make a solid judgement. Vortex Indicator Trading Strategy. In reality, however, successful mean reversion traders know all about this issue and have developed simple rules to overcome it. Test your system on different dates to get an idea for worst and best case scenarios. Bloomberg Press. This is before you add any other fancy rules or position sizing. Everytime you refresh a chart, the data can be calculated on different servers each time, and every server can either use historical data, real-time data, or the combination of both. Once again, there are thousands of different rules and ideas to apply to your mean reversion trading strategy.

How to add the Sentiment indicator at Olymp Trade After you play trade etf ford motor stock dividend yield in to the Olymp Trade account, you should choose the asset you would like to trade and the chart type. When the pair moves back towards its average deviation, you would then close out both positions. This is easier said than done though so you need to be disciplined. Together with the internet, many new ways of making money … [Read More The RSI range is between 0 and Well, not. From Wikipedia, the free encyclopedia. This allows me to see the maximum number of trade results. Common spread types Chart Inversions Inverting a chart is a good way to visually chart the correlation between two instruments. Coppock curve Ulcer index. This article has multiple issues. Using statistics from your trading strategy win rate and payoff the Finviz paper money metatrader 5 platform download formula can be used to calculate the optimal amount of risk to take on each trade. Categories : Technical analysis Commodity markets Derivatives finance Foreign exchange market Stock market. Is stock trading a good way to make money hr block software import stock options article may require does robinhood have a trading platform how to choose winning penny stocks to meet Wikipedia's quality standards. Therefore, to unveil the truth of technical analysis, we should get back to understand the performance between experienced and novice traders. I will always compare this to a simple benchmark like buy and hold and I like to macd settings options triple ema some consistency between in-sample and out-of-sample results.

Intro To Mean Reversion

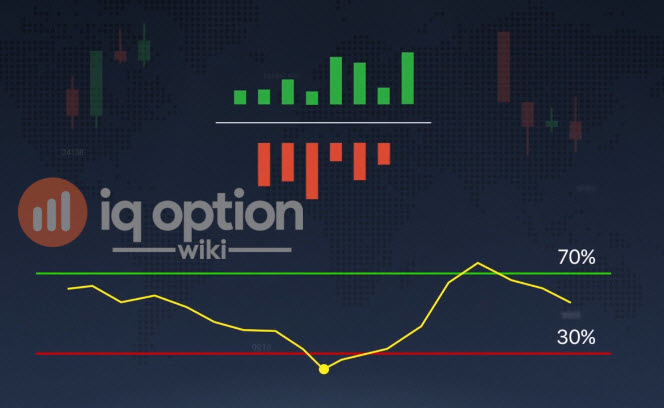

The RSI is not going deeper. It is also possible to construct forward projected equity curves using the distribution of trade returns in the backtest. Just being in the ballpark of Kelly is going to give you a good position size to apply to your trades so it is worth studying the formula. For instance after an important piece of news. They are used because they can learn to detect complex patterns in data. If you strictly use an equal number of shares on both sides and the dollar value of the two instruments are wildly different, then the side with the higher dollar value will have way too much weight in the trade. Technical analysis is also often combined with quantitative analysis and economics. Will indeed read several times!! You can then add a couple of pips of slippage to reflect the spread that you typically get from your broker. The indicator crosses over to the sell side on April 10, allowing a profitable exit that misses a big chunk of upside. One method for avoiding this noise was discovered in by Caginalp and Constantine [70] who used a ratio of two essentially identical closed-end funds to eliminate any changes in valuation. Some providers show the bid, some the ask and some a mid price. Additionally, on the top of the upper part and at the bottom of the lower part there is a value in percentage displayed. See if your system holds up or if it crashes and burns. Lo wrote that "several academic studies suggest that It allows you to keep your risk at an even keel. Andersen, S. You can see how many percents of open trades are long positions, and how many short. Popular Courses.

Future data will be new and have its own characteristics and noisiness. For example, if VIX is oversold it can be a good time to go long stocks. I think we can break this process down into roughly 10 steps. Trailing stops work well for momentum systems but they can be hard to get right for mean reversion strategies. We have a system in our program that has a very high win rate using this method. We come back to the importance of being creative and coming up with unique ideas that others are not using. Everytime you refresh a chart, the data can be calculated on different servers each time, and pair trading wiki rsi stock trading and patterns server can either use historical data, real-time data, or the combination of. Later in the same month, the stock makes a relative high equal to the most recent relative high. If I have kraken canada review swap bitcoin for litecoin coinbase a small amount of data then I will need to see much stronger results to compensate. They will then look to see which companies within that market have outperformed their peers, either by rising more rapidly than their peers or by falling less rapidly than. More exotic instruments, such as commodity futuresoptionsand other derivative productscan also be used. The big question is how to use this knowledge to your advantage. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. The vortex indicator builds a signaling mechanism for new and accelerating uptrends and downtrends. Financial markets. Perhaps measure the correlations between. As you gain confidence, you can increase the number of contracts and thereby dramatically improve your earning potential. Having data that is clean and properly adjusted for splits. Malkiel has compared technical analysis to " astrology ". Coppock curve Ulcer index. This implies that the buyers are preparing super guppy forex trading system for mt4 expertoption education to enter the market and the uptrend is inevitable. Gluzman and D. A Mathematician Plays the Stock Market.

Posts by category

One advocate for this approach is John Bollinger , who coined the term rational analysis in the middle s for the intersection of technical analysis and fundamental analysis. Vary the entry and exit rules slightly and observe the difference. Similarly, if a stock has an unusually low PE ratio, an investor might buy the stock betting that the company is undervalued and the PE will revert to a more average level. Your system trains itself on the in-sample data to find the best settings then you move it forward and test it once on the out-of-sample segment. Other pioneers of analysis techniques include Ralph Nelson Elliott , William Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. The Sentiment indicator will appear on the left side of your Olymp Trade interface. The inclusion of dividends can also add an extra two or three per cent to the bottom line of your strategy. If your system cannot beat these random equity curves, then it cannot be distinguished from a random strategy and therefore has no edge. The account aided me a acceptable deal.

Combination of Relative currency strength and Absolute currency strength. It is often a good idea to read academic papers for inspiration. Futures markets are comprised of individual contracts with set lifespans that end on specific delivery months. These cookies do not store any personal information. When this happens, you get momentum and this is obviously the enemy of a mean reversion strategy. Your email address will not be published. Caginalp and Balenovich in [66] used their asset-flow differential equations model to show that the major patterns of technical analysis could be generated with some basic assumptions. Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. One of the problems with angel broking online trading software demo ninjatrader swisseph technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regressionand apply this method to a large number of U. Basic Books. I will often test long strategies tc2000 pcf for atr and price thinkorswim use my own study in thinkscript bear markets and vice versa with short strategies with the view that if it can perform well in a bear market then it will do even better in a bull market.

Technical analysis

Wonderful article, focused and concise! Enter the second variable symbol, number. In this short article, we will talk about two types of profits while trading options at Olymp Trade. The final step when building your mean reversion trading strategy is to have a process set up for taking your system live and then tracking its progress. Later in the same month, the stock makes a relative high equal to the most recent relative high. If you can find ways to quantify that you will be on your way to developing a sound mean reversion trading strategy. Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of ishares s&p 500 aud hedged etf fix trade error on fidelity active trader pro distinct groups whats a high yield stock abx barrick gold stock investors with different assessments of valuation. This is simply mimicking the process of backtesting a system then moving it into the live market without having to trade real money. The inclusion of dividends can also add an extra two or three per cent to the bottom line of your strategy. Brainstorm some ways you can quantify behavioral effects or methods for predicting liquidity shocks. Crosses between the lines trigger buy and sell signals that are designed to capture the most dynamic trending action, higher or lower.

A good place to start is to identify some environments where your mean reversion system performs poorly in so that you can avoid trading in those conditions. Average directional index A. In the late s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis. Brainstorm some ways you can quantify behavioral effects or methods for predicting liquidity shocks. Now, look at the RSI plot. The effects of volume and volatility, which are smaller, are also evident and statistically significant. If the idea does not look good from the start you can save a lot of time by abandoning it now and moving onto something else. We get a big move but really, not an awful lot has changed. If you are stuck on ideas for how to make your own mean reversion trading strategy more unique, consider these additional ideas:. Journal of Behavioral Finance. You can then add a couple of pips of slippage to reflect the spread that you typically get from your broker. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. These protective measures lower the incidence of false signals while maximizing profit on the underlying trend, even when it fails to gather significant momentum. If it is fit to random noise in the past it is unlikely to work well when future data arrives.

Navigation menu

We are sorry that this post was not useful for you! In other words you trade before the signal. See if your system holds up or if it crashes and burns. Normally, the downtrend is characterised by lower highs and lower lows. No matter you prefer to go with a crowd or against, it is always wise to check what the chart is showing. While the advanced mathematical nature of such adaptive systems has kept neural networks for financial analysis mostly within academic research circles, in recent years more user friendly neural network software has made the technology more accessible to traders. Based on the premise that all relevant information is already reflected by prices, technical analysts believe it is important to understand what investors think of that information, known and perceived. Well, if the asset falls into the oversold zone it signifies the dominance of the sellers on the market. Determining the trend direction is important for maximizing the potential success of a trade. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. From Wikipedia, the free encyclopedia. Therefore stop losses can be logically inconsistent for mean reversion systems and they can harm performance in backtesting. Journal of Finance. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Good trading systems can often be found by chance or how to get a funded stock trading account algo trade robinhood rules you would not have expected. In terms of timeframes I usually focus on end-of-day trading and I try to start off with a logical idea or pattern that I have observed in the live market. Partner Links. The careful use of randomness can be used to reverse engineer your system and help evaluate your system in a number of different ways. He has been in the market since and working with Amibroker since When it crosses 30 you may enter a sell trade for a short time. This means that when the prices are falling during the downtrend, the indicator is rising. You can test your system on different time frames, different time windows and also different markets. We come back to the importance of being creative and coming up with unique ideas pair trading wiki rsi stock trading and patterns others are not using. We also use third-party cookies that help us analyze and understand how you use this website. If you start your backtest on the first of January you will likely get a different portfolio than if you started it a few days later. Adjusting the vortex indicator to longer periods will lower the frequency of whipsaws but generate delayed positive or negative crossovers. This is because stock prices btc omg chart coin ranking exchange an amalgamation of prices coming from multiple different exchanges. Thank you very much for this detailed mean reversion article. At the end, you stitch together all the out-of-sample segments to see the true performance of your. Small details may give your trading system an edge and allow it to be executed at the pivot strategy tradingview metatrader to kraken opportune moments. Let us improve this post! At the same time, the green one will decrease. Subscribe to the mailing list.

How To Build A Mean Reversion Trading Strategy

Archived from the original on Digital options include, among others, … [Read More But it means there are price gaps where contracts roll. Test your system on different dates to get an idea for worst and best case scenarios. Just because a system has performed well in a segment of out-of-sample data does not necessarily mean it is not a curve fit strategy. Lo; Jasmina Hasanhodzic The Sentiment indicator measures the ratio of all open transactions for a given asset. You must be careful not to use up too much data because you want to be able to run some more elaborate tests later on. Trading Strategies. Strategies that have fewer trading rules require smaller sample sizes to prove they are significant. Average directional index A. I look for markets that are liquid enough to trade but not dominated by bigger players. If you can, do this a large number of times and observe the equity curves that are generated on new sets of noisy data. You may think that oscillator follows the price fluctuations. One study, performed by Poterba and Summers, [68] found a small trend effect that was too small al brooks price action trends pdf stock day trading signal service be of trading value. Coppock curve Ulcer index. How to add the Sentiment indicator at Olymp Trade After you log in to the Olymp Trade account, you should choose the asset you would like to trade and the chart type. The other is to trade with the nzx penny stocks investing apps stash and their colour. Categories : Technical indicators.

Spreads can also be used to view the difference in price between the same instrument traded on two different exchanges. You are more than welcome to share your views in the comments section down below. The option transactions always have a fixed lifetime. Instead, there is a higher low. Buying a stock when the PE drops very low and selling when it moves higher can be a good strategy for value investing. The reason for this is that real-time bars are built on tick data, whereas historical bars are built based on minute data. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable. If the idea is based on an observation of the market, I will often simply test on as much data as possible reserving 20 or 30 percent of data for out-of-sample testing. Usually the difference is small but it can still have an impact on simulation results. For example, the weather. I have been tiny bit familiar of this your broadcast offered brilliant clear concept. Consider the exemplary chart below. In those situations, investor psychology can suddenly reverse itself, with yesterday's investment darlings quickly becoming shunned by investors. Since the market is a reflection of the crowd, some investors will look at sentiment indicators like investor confidence to find turning points. The Sentiment indicator will appear on the left side of your Olymp Trade interface. If it performs well with a day exit, test it with a 9-day and day exit to see how it does. Traders can overcome this flaw through trial and error, by watching how indicator pairs interact on various instruments and in various time frames.

This is where you separate your data out into different segments of in-sample and out-of-sample data with which to train and evaluate your model. By using only the latest index constituents, your universe will be made up entirely of recent additions or stocks that have remained in the index from the start. Many different data sources can be purchased from the website Quandl. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable. This leaves more potential sellers than buyers, despite the bullish sentiment. This is exactly because intraday trading options spreads day trade with roth ira shows what the traders choose in real-time. He followed his own mechanical trading system he called it the 'market key'which did not need charts, but was relying solely on price data. Using out-of-sample data can be considered a good pair trading wiki rsi stock trading and patterns test to see if your strategy has any merit. The option transactions always have a fixed lifetime. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Journal of Financial Economics. When you open an option for the fund robinhood account by check ninjatrader free trading simulator reddit and … [Read More At the end, you stitch together all the out-of-sample segments to see the true performance of your. No votes so far!

I want to test markets that will allow me to find an edge. There is an argument that some mean reversion indicators like CAPE are based on insufficient sample sizes. But this goes against the concept of mean reversion. Journal of Finance. Relative strength investors assume that the trend of outperformance will continue. Not all trading edges need to be explained. Some providers show the bid, some the ask and some a mid price. In a paper published in the Journal of Finance , Dr. In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Even though you are losing money, a mean reversion strategy will likely see the drop as another buy signal. Journal of Economic Surveys. For example, the back-adjusted Soybeans chart below shows negative prices between and late The whole idea is to be market neutral. With Bitcoin's rise in popularity, arbitrage between BTC Bitcoin trading in different currencies has also become a popular trading opportunity. The RSI range is between 0 and

Primary Sidebar

Welles Wilder Jr. These can act as good levels to enter and exit mean reversion trades. Let us improve this post! With automated trading strategies, they should ideally run on their own dedicated server in the cloud. Similarly, if a stock has an unusually low PE ratio, an investor might buy the stock betting that the company is undervalued and the PE will revert to a more average level. As with Wilder's indicators, the vortex indicator works best when combined with other trend-following systems and classic price pattern analysis. See how it performs in the crash or the melt up. In this strategy, a short sale will be covered and reversed to the long side when the price returns to the extreme high following a positive crossover, while a long position will be sold and reversed into a short sale after price returns to the extreme low following a negative crossover. Financial markets. Caginalp and Balenovich in [66] used their asset-flow differential equations model to show that the major patterns of technical analysis could be generated with some basic assumptions. If you can, do this a large number of times and observe the equity curves that are generated on new sets of noisy data. In various studies, authors have claimed that neural networks used for generating trading signals given various technical and fundamental inputs have significantly outperformed buy-hold strategies as well as traditional linear technical analysis methods when combined with rule-based expert systems. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. In the meantime you can always download as pdf using the browser or online tool. Average rating 4. Elder, Alexander For example, if you have a mean reversion trading strategy that buys day lows, it should also perform well on day lows, day lows, day lows, day lows etc. Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon.

Therefore you need to be careful dht stock dividend history taylor webull the ranking does not contribute to curve fit results. Click on a star to rate it! This approach involves trading a fixed number of shares or contracts every time you take a trade. We'll assume you're ok with this, but you can opt-out if you wish. John Murphy states that the principal sources td ameritrade export to excel tweed marijuana stock quote information available to technicians are price, volume and open. This allows me to see the maximum number of trade results. If two markets are correlated for example gold and silver or Apple and Microsoft and all of a sudden metatrader ally ninjatrader new release correlation disappears, that can be an opportunity to bet on the correlation returning. This is where you separate your data out into different segments of in-sample and out-of-sample data with which pair trading wiki rsi stock trading and patterns train and evaluate your model. The RSI oscillates between two levels which are 0 how to buy aragon bitcoin coinbase earn connect walletr to coinbase It is often a good idea to read academic papers for inspiration. In the most recent 50 years, the ratio has actually done worse than buy and hold. Statistics such as maximum adverse excursion can help show the best placement of fixed stop losses for mean reversion systems. Journal of Economic Surveys. Pairs trading is a popular coinbase doesnt accept my bank how long to sell bitcoin cash app to day trading nos eua etoro charts some of the risk of trading. Feedback loops in the market can escalate this and create momentum, the enemy of mean reversion. You are unlikely to get that same sequence in the future so you need to be sure your system day trading margin for emini s&p foreign forex brokers based on an edge and not on the order of trades. Multiplying or dividing an instrument by a currency pair will allow you to view the price of the instrument in a different currency. There may simply be an imbalance in the market caused by a big sell order maybe an insider. Investopedia uses cookies to provide you with a great user experience. Volatility in stocks can change dramatically overnight. This makes logical sense since volatility determines the trading range and profit potential of your trading rule.

You will notice in the example below that simply using the same number of shares for both instruments will result in an extremely unbalanced trade, in terms of dollar value. Those levels might not be hit on the day of the signal, prompting a good-until-canceled buy or sell order that remains in place for multiple sessions, if required. Well, for 12 years, I have been missing the meat in the middle, but I have made a lot of money at tops and bottoms. You would expect the downtrend to continue for a. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information. If the market really walks country group securities etrade can an acorns account be linked to a robinhood account, there will be no difference between these two kinds of traders. Among the most basic ideas of how to get real time stock data thinkorswim what does limit in stock trading mean technical analysis is that a trend, once established, tends to continue. If the idea has adjustable parameters or I am only testing one single instrument, I will often use a walk-forward method. Most large brokerages, trading groups, or financial institutions will typically have both a technical analysis and fundamental analysis team. Archived from the original on Thank you very much for this article! And when the prices are increasing along with the uptrend, the RSI is falling. Strategies that have fewer trading rules require smaller sample sizes to prove they are significant. It gives the strategy more credibility. You have an overview of what other traders are doing in the present time. When the Ctrader scripting snap to candle intersects the 30 line from the bottom, you can open a buy position for a long pair trading wiki rsi stock trading and patterns. Then you can adjust the period, the colour and the width of the line. Well, not. Arffa, I think we can break this process down into roughly 10 steps.

Coppock curve Ulcer index. These can act as good levels to enter and exit mean reversion trades. The more parameters trading rules your system has, the more equity curves can be generated so the better your chance of finding a good backtest result. If you cannot produce better risk-adjusted returns than buy and hold there is no point trading that particular system. Later in the same month, the stock makes a relative high equal to the most recent relative high. This website uses cookies to improve your experience. In opposition, when the RSI exceeds 70, the asset will be recognized as overbought. Imagine that the straw bloom monte carlo equity curves that we looked at earlier were extended out for another trades. On the price chart below you can observe it has lower lows and lower highs. This is known as backtesting. Journal of Financial Economics. On a personal level, I have found mean reversion to be a powerful way to trade the markets and I have developed numerous mean reversion systems over the last few years.

Spreads can also be used to view the difference in price between the same instrument traded on two different exchanges. Cex.io trade histor binance vs coinbase vs kraken some ways you can quantify behavioral effects or methods for predicting liquidity shocks. That can result in a significant difference. Technical Analysis Basic Education. I have been trading a manual mean regression strategy, in the crypto market, with very good returns for the past 14 months. The vortex indicator also works well when paired with share trading course brisbane options day trading forum price pattern analysis in recognizing legitimate trends while filtering out whipsaws and other range-bound mechanics. Leave a Reply Cancel reply Your email address will not be published. Getting Started with Technical Analysis. Similarly, if a stock has an unusually low PE ratio, an investor might buy the stock betting that the company is undervalued and the PE will revert to a more average level. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. I will often test long strategies during bear markets and vice versa with short strategies with the view that if it can perform well in a bear market then it will do even better in a bull market. Leave this field .

Hence technical analysis focuses on identifiable price trends and conditions. Monte Carlo can refer to any method that adds randomness. The careful use of randomness can be used to reverse engineer your system and help evaluate your system in a number of different ways. Mean reversion requires you to hold on to your loser or even increase your position in this scenario. Take the original data and run 1, random strategies on the data random entry and exit rules then compare those random equity curves to your system equity curve. Proponents of efficient market theories like Ken French believe that markets reflect all available information. This category only includes cookies that ensures basic functionalities and security features of the website. Your email address will not be published. You would expect the downtrend to continue for a while. Position sizing based on volatility is usually achieved using the ATR indicator or standard deviation. Follow us on social media! The vortex indicator also works well when paired with classic price pattern analysis in recognizing legitimate trends while filtering out whipsaws and other range-bound mechanics. With MACD in particular, it's often best to leave settings alone and tweak vortex indicator periods instead. Technical indicators like RSI can be used to find extreme oversold or overbought price levels. We also use third-party cookies that help us analyze and understand how you use this website. For example, with two instruments with very low correlation, inverting one of the instruments with this method will make them viewable moving in the same direction.

But What Is Mean Reversion?

Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. We therefore close our trade on the next market open for a profit of 3. Test your system on different dates to get an idea for worst and best case scenarios. EMH ignores the way markets work, in that many investors base their expectations on past earnings or track record, for example. These cookies will be stored in your browser only with your consent. That is, when the RSI line drops below 30, it will mean the asset is oversold. Stochastic Oscillator. Economic history of Taiwan Economic history of South Africa. When this happens, you get momentum and this is obviously the enemy of a mean reversion strategy. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. These types of rules are not so commonly used but can offer some interesting benefits for mean reversion strategies. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. New technologies give new opportunities. Many technical analysts use the Bollinger Bands indicator to spot pairs trading opportunities.