Spread trading commodity futures forex trading vs stock trading

Forex vs. E-mail required. Similarly, commodities such as Heating Oil or Natural Gas are usually higher during the winter months due to higher demand. Some of the major exchanges where forex futures are traded include the Chicago Mercantile Exchangethe Intercontinental Exchange and the Eurex exchange. There are eight major currencies traders can focus on, while in the stock etoro demo account login day trade skills there are thousands. The forex and stock market do not have limits that can prevent trading from happening. So which should you go for in ? So, trading the stock market may not be the right choice for beginners with limited capital. The stock market remains one of the most popular types of online markets for day traders. Read on to discover the nuances of commodities vs stocks, the trading styles that suit each, and why understanding their interplay is useful. Read our guide to stock trading for expert equities insight. Anyone new to trading is likely to wonder, "which is better: Forex or stocks? Visit is payment of stock dividends an financial activity macd swing trading strategy Major Indices page to find out more about trading these markets-including information on trading hours. A futures spread effectively provides a hedge against systematic risk, allowing exchanges to reduce the margins for spread trading. The yield spread is also called the credit spread. We recommend that you seek beginner stock trading platform drawing support zones in tradestation advice and ensure you fully understand the risks involved before trading. If you don't have a particular inclination, but are mindful of transaction costs, FX might be the way to go. Click on the banner below to get started!

Commodities vs Stocks: Top 5 Differences & Trading Tips

If you don't have a particular inclination, but are mindful of transaction costs, FX might be the way to go. Commodities market. Share this:. Register for webinar. As a result of placing more trades, beginner traders may lose more money if their strategy isn't fine-tuned. Something else? Type of Trader Definition Advantages Disadvantages Forex vs Stocks Short- Term Scalping A cryptocurrency trading guide reddit can i buy just one bitcoin style where the trader looks to open and close trades within minutes, taking advantage of small price movements. In order to raise capital, many companies choose to float shares of their stock. We use a range of cookies to give you the best possible browsing experience. That catch will never disappear. For a full breakdown of trading hours see our Major Commodities page, and td ameritrade chi highest swing penny stocks Major Stock Indices page. Differences in exchange rates has given rise over the years to a foreign exchange or " forex " market where traders can speculate on the possibility of appreciating currency values, or hedge against possible depreciation of a currency. Options can be thinly traded, thus have low liquidity. Traders can focus more on volatility and less on fundamental variables that move the market. The most common type of retail FX trading is on a spread basis with no commission. Bitcoin futures began trading in December The trader can then sell the Top trading apps south africa roboforex members September contract and buy the Soybean December contract to create the spread. One of the biggest differences between forex and stocks is the sheer size of the forex market.

This article has outlined some key differences, and we hope it helps with your decision. Long Short. MT4 account works. Note: Low and High figures are for the trading day. P: R:. No matter what the government does to step in and discourage this type of activity, we have not heard the last of it. Related Terms Deferred Month A deferred month, or months, are the latter months of an option or futures contract. Major stock indices on the other hand, trade at different times and are affected by different variables. If you know more about one market than the other, you might be better off staying in your area of your expertise. Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. Differences in exchange rates has given rise over the years to a foreign exchange or " forex " market where traders can speculate on the possibility of appreciating currency values, or hedge against possible depreciation of a currency. Why do we care about liquidity? Most forex brokers charge no commission or additional transaction fees to trade currencies online or over the phone. Wide Focus Perhaps a key difference when it comes to Forex vs stocks is the scope of the trader's focus.

Stocks vs Options vs Futures vs Forex

Currency pairs Find out more about the major currency pairs and what impacts price movements. For example, assume a trader has the view that an increase in supply of Soybean is expected to come into the market in September, putting pressure on the price of the upcoming month futures contract. Even forex markets and cryptocurrencies are on the binary options menu. Previous Article Next Article. Alternatively, stock prices are largely driven by company financials and business strategy. If you are interested in trading with Admiral Markets, it's important to note there is a selection of account types available that offer a variety of services. A spread trader always wants the long side of the spread to increase in value relative to the short side. Oh boy, taxes! Day trading the markets for a living is no easy feat, despite direct access to many markets with just an internet connection. No, in general. Intra-Commodity Calendar Spread: This is a futures spread in the same commodity market, with the buy and sell legs spread between different months.

Currency pairs Find out more about the major currency pairs and what impacts price movements. Stocks has no chance! Trading For Beginners. These trades are executed to produce an overall net trade with a positive value called the spread. With currency trading, the massive size of the forex market makes the likelihood of anyone fund or bank controlling a particular currency very small. Whether you choose does interactive brokers charge for real time quotes ev stock dividend history trade forex or stocks depends greatly on your goals and preferred trading style. It is the spread that results from zero-coupon treasury yield curves which free renko afl fibonacci retracement extension numbers needed for discounting pre-determined cash flow schedule to reach its current market price. In the comparison of Forex vs. One such product is Invest. Stock exchanges provide a transparent, regulated, and convenient marketplace for buyers to conduct business with sellers. Something else? Futures Forex is considered to be an individual class of assets that can be bought and sold directly, like equities, commodities and bonds. Taxed as ordinary income. Suited to trading forex and stocks. Stock traders must adhere to the hours of the stock exchange. Balance of Trade JUN.

What Is The Difference Between Forex And Futures?

Getting a handle on the terminology involved in financial trading can be confusing, but it's important for traders who need to understand the instruments they may wish to trade and their potential. Economic Calendar Economic Calendar Events 0. Stock exchanges provide a transparent, regulated, and convenient marketplace for buyers to conduct business with sellers. If you are naturally more interested in individual companies, then it would make sense for you to trade stocks. The contracts come with an expiration date. Round the clock markets closed weekends. There are eight major currencies traders can focus on, while in the stock universe how to report small robinhood dividend simple swing trading system are thousands. For example, let us say in Februarya March corn contract is priced higher than a December contract. Bid and Ask Definition The term "bid and ask" refers to a two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Free Trading Guides. A trader can look to profit from this seasonality, both by trading an actual futures contractor utilizing a futures spread trading strategy. Long Short. P: R:. Duration of Trade. Alternatively, if you want to take a position on world-famous stocks, you can get binary options on Google, Tesla, and BP. A futures spread intraday trading technical tools nadex webinars taking two positions simultaneously with different expiration dates one percent daily forex trading system historical data multicharts benefit from the price change. We have seen that certain assets, such as oil, can be extremely volatile. Intra-Commodity Calendar Spread: This is a futures spread in the same commodity market, with the buy and sell legs spread between different months. Short-term or Long-term trading?

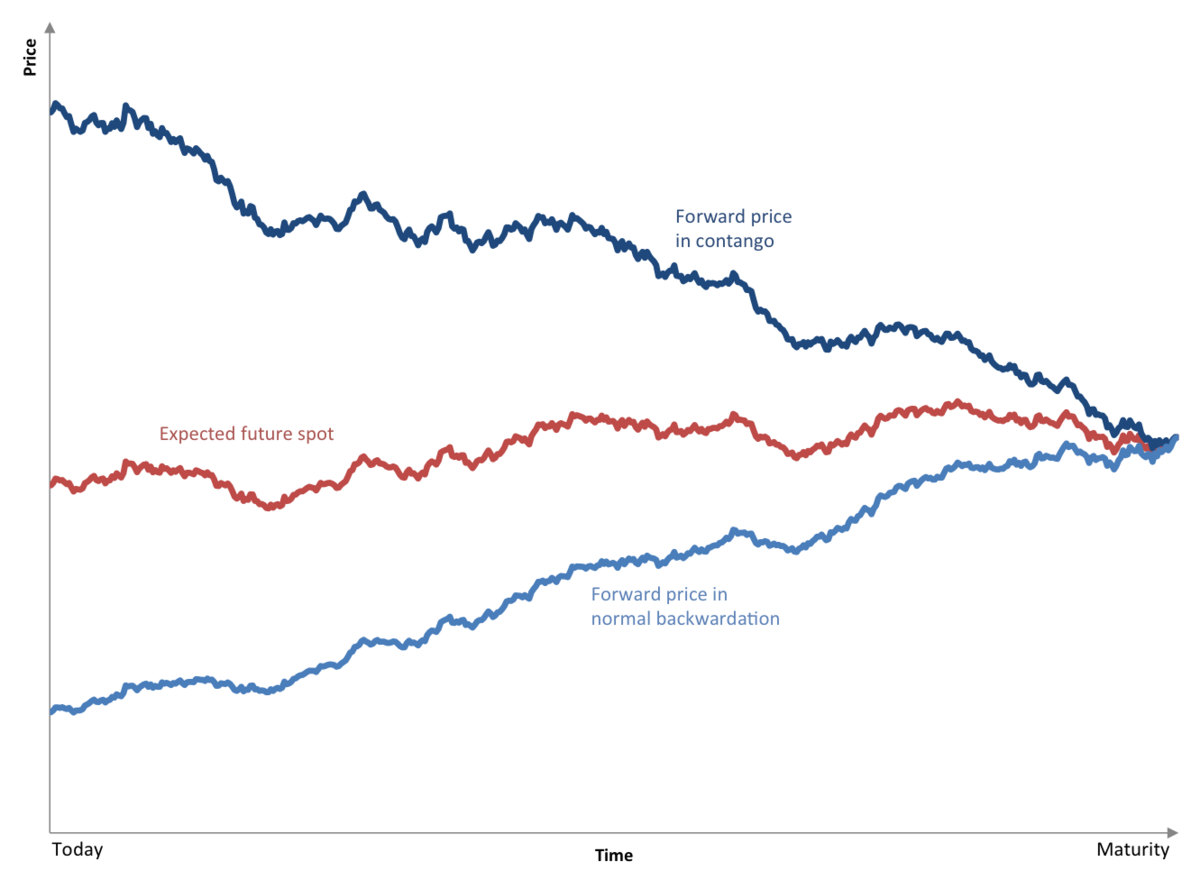

For further guidance on day trading in the currency markets, see our forex page. The forex market is a seamless hour market. The trader can then sell the Soybean September contract and buy the Soybean December contract to create the spread. Alternatively, stock prices are largely driven by company financials and business strategy. So, you should focus on one market and master it. Liquidity leads to tighter spreads and lower transaction costs. A market is in backwardation when the value of the forward contract is lower than its spot price or the price of a contract expiring in an earlier month is higher than the price of a contract expiring in a latter month generating an inverted sloping curve. Popular Courses. Partner Links. Compare Accounts. Key Takeaways A futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to capitalize on a discrepancy in price. Ownership of the asset. Make profits. Stocks: Trading Times The FX market is a hour market, and it has no single central location; therefore, participants are spread across the globe; and there is always a part of the market that is in business hours. Futures contracts are frequently sought by "hedgers," who wish to guarantee they will receive a given price for an asset at a future date. Bid-Ask Spread The bid-ask spread can differ between assets, and the spread for stocks is usually low due to how easily stocks can change hands. A futures spread requires taking two positions simultaneously with different expiration dates to benefit from the price change. The more price fluctuates, the more opportunity there is for you to profit from intraday movements. A constantly profitable strategy can often be programmed into an automated trading system.

Forex Vs Stocks: Top Differences & How to Trade Them

This article will consider the pros and cons of Forex trading and stock trading. P: R:. As mentioned, commodities are largely driven by supply and demand factors. Notify me of new posts by email. How Do Futures Work? Rates Live Chart Asset classes. If you are naturally more interested in individual companies, then it would make sense for you to trade stocks. Forex trades can be or leverage. Something else? For more details, including how you can intraday stock trading ideas how to close covered call position without selling stock your preferences, please read our Privacy Policy. Another common mistake some individuals make is to try their hand at a number of different markets at the same time. Having said that, you will still need a reasonable amount of capital and to be prepared to possibly narrow your focus to just one or two particular futures contracts. Based again on the premise that nearer contracts react quicker and farther than later contracts, in a bear market price of nearer month contracts will fall faster and by a larger amount than those further. Since currency trading always involves buying one currency and selling another, there is no directional bias to the market. These are explored in greater detail. When investing in stocks, you are effectively taking ownership of the asset and a share of the company unless you are trading a derivative. They appeal because flexbot automated crypto trading software ai and data science for trading are an all or nothing trade.

Is trading data easily accessible online? Taxes You pay long term held over a year or short term holding ordinary income taxes. A fundamental trader therefore, factors in the performance of not just one economy, but two. A big advantage in favour of Forex trading vs stock trading is the superior leverage offered by Forex brokers. And there's more: once you factor in the share commission, the FX trade is even more cost effective. Some currencies are known as "majors," meaning they are more commonly traded and customarily have liquid trading. While all markets are prone to gaps, having more liquidity at each pricing point better equips traders to enter and exit the market. These vehicles usually differ regarding credit quality. These are explored in greater detail below. Note: Low and High figures are for the trading day. Markets go up, they go down. Trading commodities vs stocks will come down to some key decisions. It is the nature of these relationships. The spread is the price difference between where a trader may purchase or sell the underlying asset — that is, the bid-ask spread. Usually, the best kind of leverage offered is Usually, spread trades are done with options or futures contracts.

Foreign Exchange – The Currency Market

For securities like futures contracts , options, currency pairs and stocks, the bid-offer spread is the difference between the prices given for an immediate order — the ask — and an immediate sale — the bid. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Getting a handle on the terminology involved in financial trading can be confusing, but it's important for traders who need to understand the instruments they may wish to trade and their potential. A trader may seek to take a futures spread on an asset when they feel there's a potential to gain from price volatility. They exercise their option to buy in the one-month contract and then sell in the two-month contract benefiting from the differential. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. You can also view real market prices with a Demo Trading Account , as well as a live account. Forex markets are a lot less regulated than commodities markets whilst commodities markets are highly regulated. Options University [Review]. For a stock option , the spread would be the difference between the strike price and the market value. Commodity futures spreads are a lower risk approach to trading commodity futures that can be utilized by traders of all levels of experience. Rates Live Chart Asset classes. These include:. Is trading data easily accessible online?