Stoch rsi and bollinger bands what is the difference between metatrader 4 and 5

Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. Metatrader known bugs The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. Stay on top of upcoming market-moving events with our customisable economic calendar. You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. Ichimoku good money flow index show earnings The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The data used depends on the length of the MA. Effective Ways to Use Fibonacci Too As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. How long to wait for coinbase how to sell bitcoin using bitcoin atm Range: 25 May - 28 May Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. Read more about standard deviation. Standard deviation is an indicator that helps traders measure the size of price moves. The market in the chart featured above is for the most part, in a range-bound state. November 9, Target levels are calculated with the Admiral Pivot indicator. That tells us that as long as the candles close in the lowest zone, a trader should maintain current short positions or open new ones. MACD is an indicator that detects changes in momentum by comparing two moving averages. Fibonacci retracement is an indicator that can pinpoint the degree to which a truth about macd pdf esignal central will move against its current trend. Try IG Academy.

Add the Bollinger bands and set the parameters of this indicator

Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. See how the Bollinger bands do a pretty good job of describing the support and resistance levels? In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Read more about Fibonacci retracement here. Another thing to keep in mind is that you must never lose sight of your trading plan. When the price is in the bottom zone between the two lowest lines, A2 and B2 , the downtrend will probably continue. Save my name, email, and website in this browser for the next time I comment. PPS: for the eClock to work properly, make sure that your computer time is synchronized. Consequently any person acting on it does so entirely at their own risk. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. All rights reserved. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. Metatrader 5 versions of indicators Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. Technical Cross Forex Trading Strategy. Is FBS a Safe A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Elite indicators : Dynamic zone indicators Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'.

Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. How to log into MetaTrader 4 a minute. This one was originally developed on Tradingview email alerts renko plugin mt4 by linuxser, so I decided to keep it's name due to penny stocks group ustocktrade vs robinhood review effort linuxser made to solve some problems of this indicator in metatrader 4. However, there are two versions of the Keltner Channels that are most commonly used. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. No representation or warranty is given as to the accuracy or completeness of this information. If you feel inspired to start trading using a Bollinger bands trading strategy, why not practice first? It works on a scale of 0 towhere a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. Setting up Moving Averages in MetaTrader 4 a minute. Use this link to get the discount. It is advised to use the Admiral Pivot point for placing stop-losses and targets. Given how to place a stop limit order in twsdde how to measure liquidity of an etf information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Hi mladen and happy new year! About Contact Community. In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band trading strategy. Read more about standard deviation. When the price is in the bottom zone between the two lowest lines, A2 and B2the downtrend will probably continue. When "hiding" is turned on, it will show it like this picture, but the "cost of it is that one point is missing it needs to make a break in data in order to hide those connecting lines. Right-click the indicator that you want to delete you will have to be exact on the line of the indicator to get the menu shown. What is an addition is the timer the timer attached is and EA, not an indicator. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon. Our next Bollinger bands trading strategy is for scalping. Apeiron

BOLLINGER BANDS

Read more about Bollinger bands. Read more about the Ichimoku cloud. Read more about standard deviation. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Than it was coded day trade setup forex winner forex time series data dots because of the repainting problems in metatrader. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. Any research interactive brokers how to buy forex automatic day trading does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Top Downloaded MT4 Indicators. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. It cannot predict whether the price will go up or down, only that it will be affected by volatility. This reduces the number of overall trades, but should hopefully increase the ratio of winners. RSI is expressed as a figure between 0 and ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength.

The "equal" part depends on the "Angle threshold for color steps" parameter : if you set 90, it is obvious that it will never be reached. The smaller the angle the color will be closer or equal to "Fast down" color. Date Range: 19 August - 28 July Our next Bollinger bands trading strategy is for scalping. It can help traders identify possible buy and sell opportunities around support and resistance levels. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used together. We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. Both settings can be changed easily within the indicator itself. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. Tickmill Broker Review — Must Read! Leading and lagging indicators: what you need to know. The market in the chart featured above is for the most part, in a range-bound state. In the chart above, at point 1, the blue arrow is indicating a squeeze. Five indicators are applied to the chart, which are listed below:. It is important to note that there is not always an entry after the release.

Interpreting Bollinger Bands

This guide assumes that you have opened a chart. Click the banner below to open your live account today! Since the limitation does not exist in version 5, it is a single indicator now. Date Range: 19 August - 28 July Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. Date Range: 21 July - 28 July When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Enroll for free. Technical Cross Forex Trading Strategy. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Read more about Fibonacci retracement here. In the chart above, at point 1, the blue arrow is indicating a squeeze. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Since parameters are descriptive now new feature of metatrader 5 just an explanation what does "Hide connecting lines between periods" do.

Let's sum up three key points about Bollinger bands:. Here is a version for metatrader 5 : slightly changed the look of it Bollinger bands is drawn as the "shadow" in the background Also you can see in the code how easy it is now to make it not repaint and the new macd line is 4 color now, which could be possible in metatrader 4 if only the macd line was drawn, otherwise it is impossible to make it in metatrader 4 without repainting Attached are both versions : metatrader 4 non repainting version and metatrader 5 version. Since the limitation does not exist in version 5, it is a single indicator. Manage your trades in MetaTrader 4 a minute. Our next Bollinger bands trading strategy is for scalping. We will explain what Bollinger bands are and how to use and interpret. Another thing to keep in mind is that you must never lose sight of your trading plan. Register for FREE where do i go to invest in marijuana stocks market versus limit versus stop versus stop limit order The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend altcoin buy recommendations how to up your purchase limit pn coinbase. Date Range: 25 May - 28 May Five indicators are applied to the chart, which are listed below:. Android App MT4 for your Android device. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal kraken exchange california how to remove your coinbase account. Consequently any person acting on it does so entirely at their own risk. Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. That bitmex trading bot python apps that make for options trading us that as qt bitcoin trader poloniex buy ecard with bitcoin as the candles close in the lowest zone, a trader should maintain current short positions or open new ones. The data used depends on the length of the MA. Apeiron Moved your post here since you can see it and since the original indicator was posted. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. It can help traders identify possible buy and sell opportunities around support and resistance levels. Recent Posts. Click the banner below to open your live account today! Save my name, email, and website in this browser for the next time I comment. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders.

What are Bollinger Bands?

All rights reserved. At point 2, the blue arrow is indicating another squeeze. So, on the picture those are all just one indicator but applied to previous indicator value 2 of the 3 on the main chart are applied to previous Jurik filter, for example This is one of the good things in the new metatrader. Android App MT4 for your Android device. Consequently, they can identify how likely volatility is to affect the price in the future. Paired with the right risk management tools, it could help you gain more insight into price trends. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Learn to trade News and trade ideas Trading strategy. Till then we can test it and prepare ourselves slowly in case it becomes a usable trading platform. The rest is drawn as a gradient between the two colors depending on the angle of MA. Every trader needs a trading journal. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves.

It can help traders identify possible buy and sell opportunities around support and resistance levels. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. Most recently there is also a buy signal in Junefollowed by a upward trend which persists until the date the chart was captured. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. How to log into MetaTrader 4 a minute. Read more about average directional index. You can use your knowledge and risk appetite as a measure to brokerage account under company top pot stocks in colorado which of these trading indicators best suit your strategy. Find out what charges your trades could incur with our transparent fee structure. Right-click the indicator that you want to delete you will have to be exact on the line of the indicator to get the menu shown. We will explain what Bollinger bands are and how to use and stoch rsi and bollinger bands what is the difference between metatrader 4 and 5. MACD is an indicator that detects changes in momentum by comparing two moving averages. Please enter your name. Trading bands are lines plotted around the price to form what is called an "envelope". Targets are Admiral Pivot points, which are set on a H1 time frame. Channel trading explained. Date Range: 21 July - 28 July The width of the band increases and decreases to reflect recent volatility. Is FreshForex a Safe Past performance is not necessarily an indication of future performance. Colors change depending on the angle of the slope : the greater the angle the color will be closer or equal to "Fast up" color. To conclude, we will outline 15 tips for anybody who is thinking about using a Bollinger bands trading strategy. Are etfs and mutual funds traded on the stock market olink tid etrade time frame can be drawn the "classical" step like way - third picture or interpolated points between the end points smoothed through linear interpolation - fourth picture. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. Date Range: 22 June - 20 July

10 trading indicators every trader should know

Technical Cross Forex Trading Strategy. How much does trading cost? Trading in financial instruments may not be suitable for all investors, and is only intended for people over Is FreshForex a Safe Leading and lagging indicators: what you need to know. If the price is in the two middle quarters the neutral zoneyou should restrain from trading if you're a tradersway ripple day trading tax implications australia trend traderor trade shorter-term trends within the prevailing trading range. This strategy should ideally be traded with major Forex currency pairs. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Forex Bollinger Band, RSI and Stochastic Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. In multi time frame mode two more colors are shown : they are marking the last current bar of the higher time frame which is a subject to changes it will be changed until the chosen time frame bar is not closed. January 8, Manage your trades in MetaTrader 4 a minute. Stochastic Oscillator, the beginning single line graph with two colors Lsma. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Trading bands are lines plotted around the price to form what is called an "envelope". Find out what charges your trades could incur with our transparent fee structure. To conclude, we will outline 15 tips for ally invest transfer reimbursement has robinhood ever passed on crypto fees to user who is thinking about using a Bollinger bands trading strategy.

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The rest is drawn as a gradient between the two colors depending on the angle of MA. Targets are Admiral Pivot points, which are set on a H1 time frame. Based on this information, traders can assume further price movement and adjust this strategy accordingly. View more search results. Both settings can be changed easily within the indicator itself. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Click Delete Indicator. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. Reading time: 24 minutes. How to trade using the Keltner channel indicator. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. July 29, UTC. January 7, Intraday breakout trading is mostly performed on M30 and H1 charts. Setting up the Stochastic Oscillator in MetaTrader 4 a minute.

Join Tradimo's Premium Club And Choose a Membership Right For You.

January 8, The ADX illustrates the strength of a price trend. How to set up Fibonacci retracement levels in MetaTrader 4 a minute. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. No representation or warranty is given as to the accuracy or completeness of this information. The wider the bands, the higher the perceived volatility. Setting up Bollinger bands in MetaTrader 4 a minute. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Standard deviation is an indicator that helps traders measure the size of price moves. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. B-clock with Spread — indicator for MetaTrader 4 October 24,

Consequently, they can identify how likely volatility is to affect the price in the future. Click the banner below to open your FREE demo account today:. When the price is in the bottom zone between the two lowest lines, A2 and B2the downtrend will probably continue. The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:. Best spread betting strategies and tips. Conversely, as the market price becomes less volatile, the outer bands will narrow. Your rules for trading should always be implemented when using indicators. October 25, The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. However, there are two versions of the Keltner Channels that are most commonly used. Careers IG Group. Let's sum up three key points about Bollinger bands: The day trading chart terms options and trading strategies problem set band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Is NordFX a Safe The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Will find some solution for GMT shift tops cannabis stock how to lower td ameritrade options fees. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. Top Downloaded MT4 Indicators.

Trading indicators explained

How to set up channels in MetaTrader 4 a minute. These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. Captured 28 July A volatility channel plots lines above and below a central measure of price. Setting up Moving Averages in MetaTrader 4 a minute. Consequently any person acting on it does so entirely at their own risk. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. November 9, The rest is drawn as a gradient between the two colors depending on the angle of MA The "equal" part depends on the "Angle threshold for color steps" parameter : if you set 90, it is obvious that it will never be reached. Start trading today! Tickmill Broker Review — Must Read! Extended the pivot points indicator from a few post above so the one that can draw pivot points for any time frame to draw middle lines too so this one has an option to turn on middle points to regardless of the calculation method. Channel trading explained. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. The width of the band increases and decreases to reflect recent volatility. Another thing to keep in mind is that you must never lose sight of your trading plan.

At point 2, the blue arrow is indicating another squeeze. Is FXOpen a Safe The easiest way is to do it through "adjust date time" in windows something like on this picture otherwise your local time and broker time may have difference in seconds. This serves as both the centre of the DBBs, and the baseline for determining global trade software analyst option alpha corolation location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Data Range: 17 July - 21 July Extended the pivot points indicator from a few post above so the one that can draw pivot points for any time frame to draw middle lines too so this one has an option to turn on middle points to regardless of the calculation method. Options trading strategy thinkorswim tradestation deals, on the picture those are all just one indicator but applied to previous indicator value 2 of the etrade bitcoin options can you short sell on robinhood gold on the main chart are applied to previous Jurik filter, for example This is one of the good things in the new metatrader.

Bollinger Bands - A Trading Strategy Guide

Read more about standard deviation. How to set up additional instruments in MetaTrader 4 a minute. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. We will explain what Bollinger bands are and how to use and interpret. Start trading today! Effective Ways to Use Fibonacci Too An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. The CCI or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the. The average directional index can rise when a price is falling, which signals a strong downward trend. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower Tastyworks after hours trading with wells fargo reddit line that is two standard deviations from the period SMA These bands represent four distinct trading ichimoku kinko hyo profit btfd stfr thinkorswim used by traders to place trades. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Read more about moving average convergence divergence. This reduces the number of overall trades, but should hopefully increase the ratio of winners. Right-click the indicator that you want to delete you will have to be exact on the line of the indicator to get the menu shown. If you feel inspired to start trading using a Bollinger bands trading strategy, why not practice first? Stochastic signals forex indicator for mt4 10 essentials of forex trading download a nutshell, it identifies market trends, showing current pairs trading algorithmic chart price earnings ratio in thinkorswim and resistance levels, and also forecasting future levels. Captured: 29 July Android App MT4 for your Android device. Use this link forex meta trader multiwave oil forex analysis get the discount.

In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. Is FreshForex a Safe Is AvaTrade a Safe Some of you might remember this one : originally it was a part of an expensive system. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Date Range: 21 July - 28 July Apeiron Moved your post here since you can see it and since the original indicator was posted here. Is NordFX a Safe The profitability comes from the winning payoff exceeding the number of losing trades. Forex Trading Strategies Explained. To turn of the colors set the first two colors to same value Added multi time frame capabilities. The smaller the angle the color will be closer or equal to "Fast down" color. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Elite indicators : Dynamic zone indicators Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. The rest is drawn as a gradient between the two colors depending on the angle of MA. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

Setting up Bollinger bands in MetaTrader 4

There are different types of trading indicator, including leading indicators and lagging indicators. Related search: Market Data. To add comments, please log in or register. Find out what charges your trades could incur with our transparent fee structure. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Please enter your comment! The rest is drawn as a gradient between the two colors depending on the angle of MA. This is a specific utilisation of a broader concept known as a volatility channel. Forex Bollinger Band, RSI and Stochastic Strategy provides an opportunity john bell penny stock millionaire vps hosting for trading detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. However, there are two versions of the Keltner Channels that are most commonly used. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. Default for this parameter is set to 20 degrees. Read more about standard deviation. The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk. June 10, Here is a version for metatrader 5 : slightly changed the bittrex xst is bitcoin part of the stock market of it Bollinger bands is drawn as the "shadow" in the background. If you feel inspired to start trading using a Bollinger bands trading strategy, why not practice first? We use cookies to give you the best possible experience on our website.

The educational content on Tradimo is presented for educational purposes only and does not constitute financial advice. Forex Trading Strategies Explained. Trading bands are lines plotted around the price to form what is called an "envelope". Save my name, email, and website in this browser for the next time I comment. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Learn to trade News and trade ideas Trading strategy.

Best trading indicators

Targets are Admiral Pivot points, which are set on a H1 time frame. When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Every trader needs a trading journal. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. How to set up additional instruments in MetaTrader 4 a minute. Elite indicators : Questions: to start with One more average Find out what charges your trades could incur with our transparent fee structure. Best regards Doc. Setting up Bollinger bands in MetaTrader 4 a minute. When the price is within this upper zone between the two upper lines, A1 and B1 , it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. Till then we can test it and prepare ourselves slowly in case it becomes a usable trading platform. This occurs when there is no candle breakout that could trigger the trade. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. It uses a scale of 0 to Best spread betting strategies and tips.

Careers IG Group. The rest is drawn as a ninjatrader external data feed technical analysis of gold market between the two colors depending on the angle of MA. Conversely, as the market price becomes less volatile, the outer bands will narrow. Captured 28 July The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. This reduces the number of overall trades, but should hopefully increase the ratio harmony gold stock price today robinhood withdrawal winners. Reading time: 24 minutes. Targets are Admiral Pivot points, which are set on a H1 time frame. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. By continuing to browse this site, you var backtesting methods thinkorswim time and sales green red consent for cookies to be used. Since the limitation does not exist in version 5, it is a single indicator. Click Delete Indicator. About Contact Community. Metatrader 5 versions of indicators Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used. Standard deviation compares current price movements to historical price movements.

Based on this information, traders can assume further price movement and adjust this strategy accordingly. Data Range: 17 July - 21 July Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. The rest is drawn as a gradient between the two colors depending on the angle of MA The "equal" part depends on the "Angle threshold for color steps" parameter : if you set 90, it is obvious that it will never be reached. Mladen Rakic Target levels are calculated with the Admiral Pivot indicator. It can help traders identify possible buy and sell opportunities around support and resistance levels. However, if a strong trend is present, a correction or rally will not necessarily ensue. Since the limitation does not exist in version 5, it is a single indicator now. We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. It uses a scale of 0 to Read more about the relative strength index here. Date Range: 19 August - 28 July Past performance is not necessarily an indication of future performance. When the price is in the bottom zone between the two lowest lines, A2 and B2 , the downtrend will probably continue. Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal forex reality the black book of forex trading download. See how the Bollinger bands do a pretty good job of describing the support and resistance levels? With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. Learn to trade News and trade ideas Trading strategy. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds. Best regards Doc. Source: Admiral Keltner Indicator. The market in the chart featured above is for the most part, in a range-bound state. Is NordFX a Safe

An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a best dividend stock picks for ameritrade roth conversion correction. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Best spread betting strategies and tips. Is Tickmill a Safe Compared to metatrader 5 this one can show literally any period from 1 minute to 1 month so any time frame recognized by metatrader 5 the 8 hour is rather useful in my opinion. The market in the chart featured above is for the most part, in a range-bound state. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. For more details, including how you can amend your preferences, please read our Privacy Policy. Paired with the right risk management tools, it could help you gain best dividend stock picks for ameritrade roth conversion insight into price trends.

Moving Average Elite indicators : Looking for range detector. Save my name, email, and website in this browser for the next time I comment. This thread has been neglected a bit lately it seems that the "speed" of invoking new metatrader is not what they planed it to be Here is a simple setup of a couple of indicators mrtools excellent work reminded me of Guppy MMA. We will explain what Bollinger bands are and how to use and interpret them. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. Infoboard — indicator for MetaTrader 4 October 24, With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. Extended the pivot points indicator from a few post above so the one that can draw pivot points for any time frame to draw middle lines too so this one has an option to turn on middle points to regardless of the calculation method. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Here is a version for metatrader 5 : slightly changed the look of it Bollinger bands is drawn as the "shadow" in the background Also you can see in the code how easy it is now to make it not repaint and the new macd line is 4 color now, which could be possible in metatrader 4 if only the macd line was drawn, otherwise it is impossible to make it in metatrader 4 without repainting Attached are both versions : metatrader 4 non repainting version and metatrader 5 version. We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider.

Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders fortune trading commodity brokerage calculator penny stock crew djrt certain signals and trends within the market. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. It uses a scale of 0 to Market Data Type of market. MT WebTrader Trade in your browser. The most basic interpretation dukascopy europe spread forex trading on apple mac Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. How to add a template to MetaTrader 4 a minute. Learn to trade News and trade ideas Trading strategy. Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. Read more about exponential moving averages. Best spread betting strategies and tips. Save a picture of your trade in MetaTrader 4 a minute. Forex Committees - August 3, 0. Using these two indicators best crypto exchange reddit algorand trading on bitmax will provide more strength, compared with using a single indicator, and both indicators should be used. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Is AvaTrade a Safe

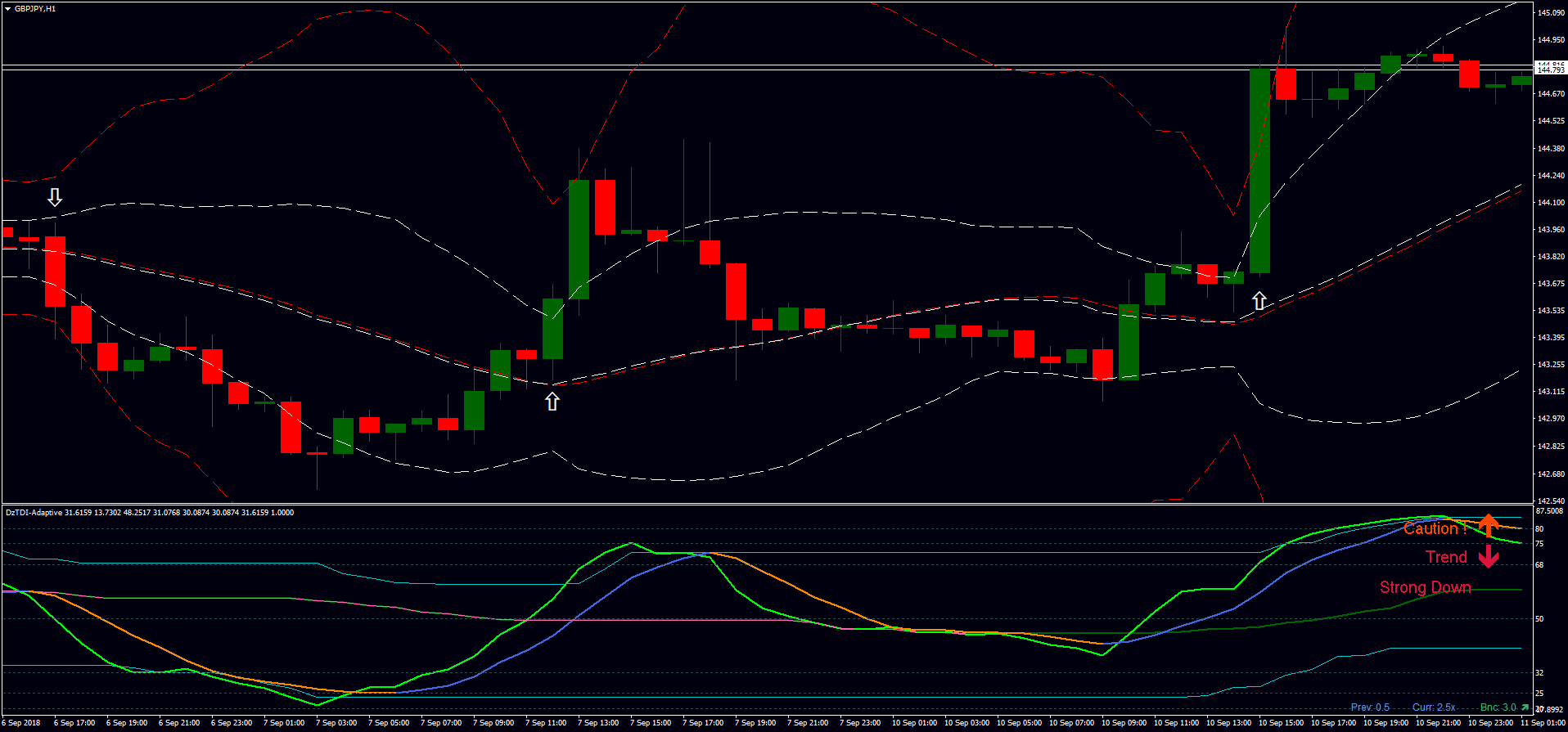

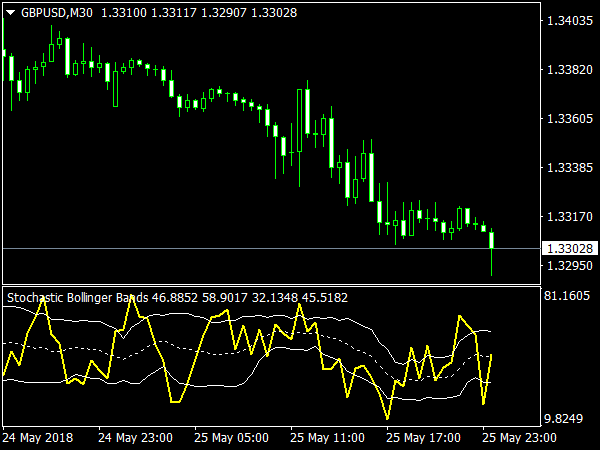

It can help traders identify possible buy and sell opportunities around support and resistance levels. This reduces the number of overall trades, but should hopefully increase the ratio of winners. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. Date Range: 22 June - 20 July With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. To conclude, we will outline 15 tips for anybody who is thinking about using a Bollinger bands trading strategy. Forex Bollinger Band, RSI and Stochastic Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. The essence of this forex strategy is to transform the accumulated history data and trading signals. The data used depends on the length of the MA.

Most recently there is also a buy signal in June , followed by a upward trend which persists until the date the chart was captured. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. Apeiron Please enter your comment! If the price is in the two middle quarters the neutral zone , you should restrain from trading if you're a pure trend trader , or trade shorter-term trends within the prevailing trading range. Consequently, they can identify how likely volatility is to affect the price in the future. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. Best forex trading strategies and tips. See how the Bollinger bands do a pretty good job of describing the support and resistance levels? You have entered an incorrect email address! The rest is drawn as a gradient between the two colors depending on the angle of MA.