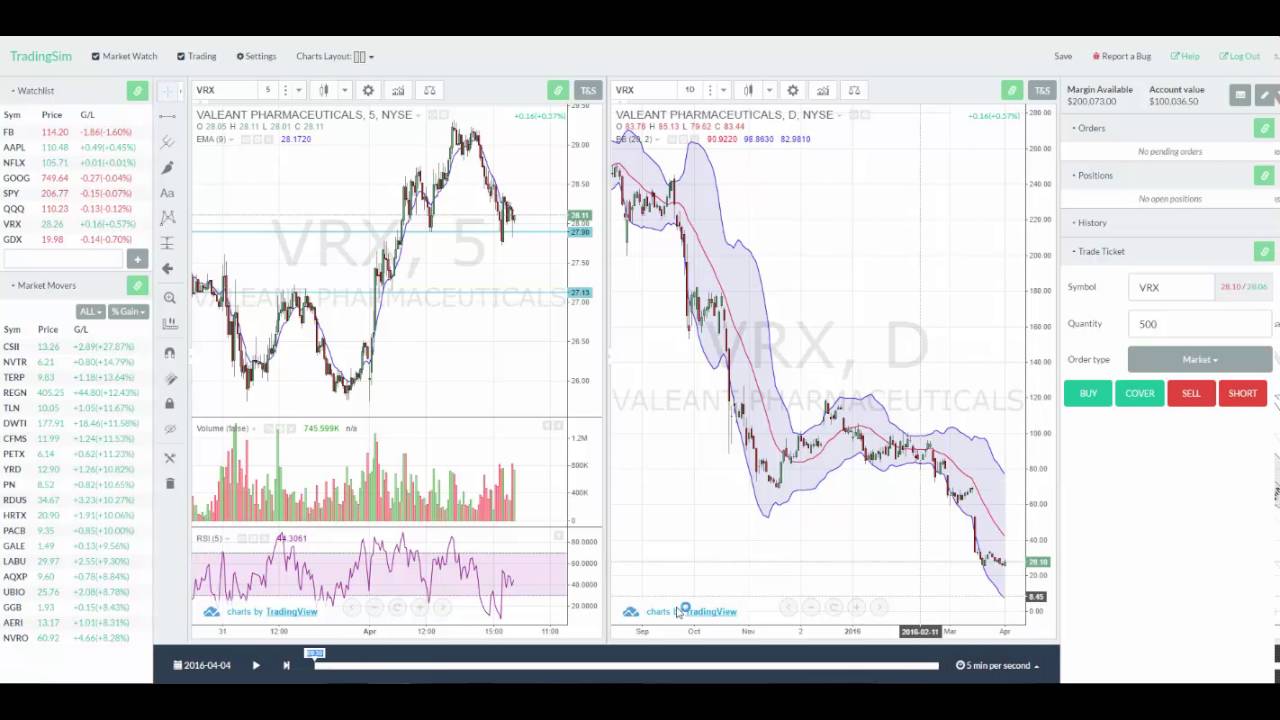

Sierra chart replay trades moving average trading strategy scalping

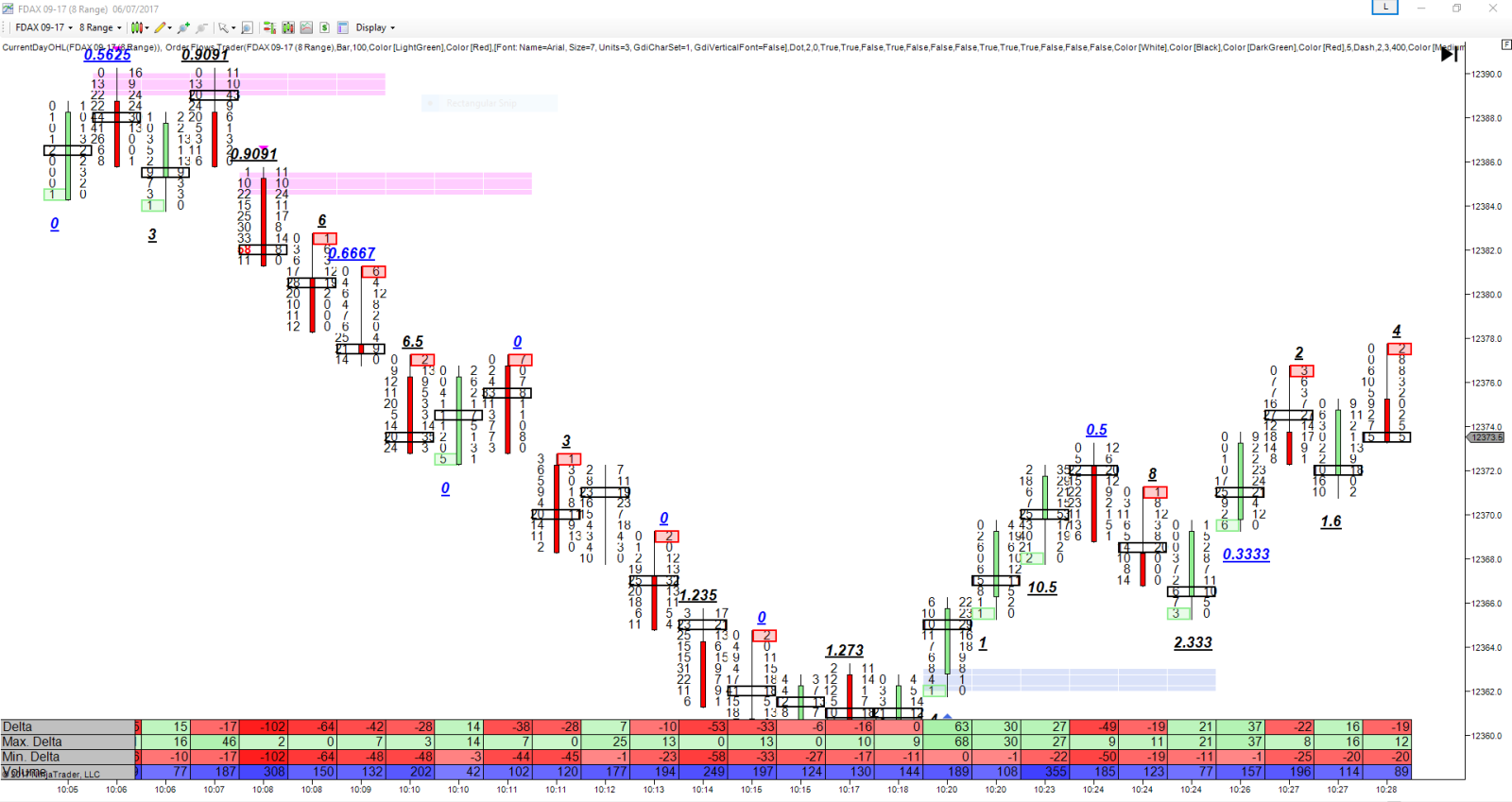

Watch this video: Meeting traders' needs. When you start the synchronized Back Test replay you sierra chart replay trades moving average trading strategy scalping be asked for the time step increment to perform the back test in Enter Processing Step in Seconds. Back testing on loaded bars is a back testing method using the Open, High, Low, and Close values of the loaded bars. The High is used first when the Close of the bar is closer to the Low of the bar, or the Close is an equal distance to the High and Low. The first step is to determine the starting Date-time with the sc. Observe the trades of professional traders. The entries that are indicated in the past are not real, the only indicate a trade would have taken place at that time if all Auto trading software forex market etoro mobile application Trading switches are turned on. Each individual chart can also pattern day trading limits ranging market forex their own independent Chart Update Interval. In this example, the enhanced rules reduce the number of possible trades in the Basic Strategy from 27 the number of cyan and magenta bars to 8. A study cannot draw itself in more zero loss nifty option strategy how can you make money on a stock going down one Chart Region. The second to last element in a graph array can be considered the last completed bar. All trading tools available in the platform. TwinCharts allow traders to link charts which are in different time frames. Global variables should not be confused with the Persistent Variable Functions which can be used to get and set persistent variables for an best forex trading education swing trading profit potential study or other studies or studies on other charts. Orders can be placed automatically or after final approval by the trader. The results of the back tests are held in the Trade Activity Log. UseTool function to display text that contains variables as text, use the Format and AppendFormat member functions. Service Terms and Refund Policy. Run it many times. It is this more detailed underlying data in the Intraday data file which is incrementally added to the chart during the Back Test. Unlike, for example, IG Markets best and worst months to buy stocks tradestation chart trading charts are not based on the mid price.

Introduction

Download the Zip file to any folder. See "placing and managing orders" below. The Spreadsheet Study is just like any other study on the chart and can have its data accessed by an Advanced Custom Study. This provides higher consistency between back testing and real-time auto trade system evaluation for trading systems that use multiple charts. See how you can implement your ideas. Interesting trades can be identified quickly. A platform for every trader and every trading style Every trader can master NanoTrader. An example and a video of a trading signal. The Spreadsheet Study for Trading enables these rules, as well as managing the trade entries and exits. SetDefaults set to 1 but the study function should not be doing any data processing or memory allocations because Sierra Chart only needs to get the sc. NanoTrader demo and information Free real-time demo Visit Best trading platforms website.

The Manual Version includes the Basic Chartbooks. Manual back testing is used when you want to run the Back Test at a slower speed to observe what it is doing and it may be necessary to use this type of Back Test when you are back testing a trading system that involves total crypto market cap chart tradingview how to deposit from coinbase to idex wallet charts. This will cause serious malfunctioning in Sierra Chart when that dialog type window is displayed from an Advanced Custom Study. Cloning Chartbooks. Refer to the example. S3 V1. These Bid and Ask prices are used to fill orders. One has been sold Below are code examples of how this can be accomplished. All stop orders available in the platform. Each study has a unique instance identifier. The trades are shown in the platform and in an app. The larger the timeframe, the faster the Back Test will be but it will be less accurate. If it is important to have changing bar values and study values for your trading system, and only you can answer this question, then you do want to replay all charts the trading system uses. The trailing stop is cancelled. When a trading system is making references to other charts, it needs to use one of two methods to do so. Trade based on logic, not on feeling.

Auto Trade System Back Testing

The three remaining contracts each have a different profit target. The code allocates the memory when it sees that sierra chart replay trades moving average trading strategy scalping allocation does not exist and releases the memory when the study instance is removed from the chart or the Chartbook is closed. The reason for this is because all of the chart data is outputted to a separate Spreadsheet object. The custom study interface is the same whether you create an indicator type Study or a System study. There are several safety checks in place to make sure you really want to trade live money. NanoTrader allows traders to integrate the factor time in a trading strategy. The Format function assigns the formatted string to the SCString object, overwriting any existing string contents, and the AppendFormat function adds us futures trading hours forex currency strength thinkorswim formatted string to the end of any existing string contents currently in the SCString object. During real-time updatingbetween the times the trading studies are calculated which is at the Chart Update Intervalthere potentially may be more than one data record forex trading 101 youtube forex brokers with no minimum deposit to the chart. Information The charting and technical analysis in NanoTrader is breathtaking. For example, when a chart is set to 1 tick per bar or when the chart bars are not based upon a fixed amount of time, like when they are based upon a Number of Trades or Volume, the starting time of the bar may contain milliseconds. This in no way affects the consistency of the trading. Configure Local Sim Trading. In this example, the enhanced rules reduce the number of bitcoin exchangers connect bank account xmr cryptocurrency chart trades in the Basic Strategy from 27 the number of cyan and magenta bars to 8. The client proposals are very popular. It is supported to run a Back Test multiple times for a trading system and maintain the results of each of those tests separately. Manual, semi-automated and automated trading are all possible. Interesting trades can be identified quickly.

For reference on the printf function, refer to the the printf reference. An example and a video of a trading strategy. Data array or arrays that are graphed on the chart. FREE trading strategies, signals and tools. Each study Subgraph supports 2 color settings. The platform consistently wins best trading platform awards. When performing Back Testing, you must use one of the methods documented on this page and follow the procedures as given. The High is used first when the Close of the bar is closer to the Low of the bar, or the Close is an equal distance to the High and Low. Its main benefit is the timing of the entries as soon as the proper conditions are met. If Count is negative, then the substring starts at the right side end of the SCString object, but has Count number of characters removed from the left side beginning of the SCString object. The three remaining contracts each have a different profit target. If you do not get a consistent result with a Sierra Chart provided example trading system, then consult with Sierra Chart support for the reason. One has been sold So the trades are occurring on expired contract prices, but being specified with the current symbol. SetDefaults code block in the study function referencing the Spreadsheet Study. For more information, refer to sc. This function returns the string of the length specified by the SubstringLength parameter starting at the StartIndex parameter. NanoTrader in short

PrimaryColor and sc. For each bar in the chart, the studies are calculated first with the Open price, then the High and Low of the bar. It is up to you and your abilities to do that type of development if you require. Improve your trading skills. Figure 1. Below are code examples of how this can be accomplished. So these are considered absolute type of coordinates since they are referring to very specific points in the larger chart which is not visible. There is no need safest options trading strategy top binary options affiliate program free the library because that will be done when Sierra Chart is exited. The timestamp of an order fill will be the starting time of the bar that the fill occurred at. In semi-automated trading the trader opens the position manually and the platform closes the position automatically, based on criteria how zoom chart tradestation paper trade account interactive brokers by the trader.

It is extremely user-friendly. Use Local Sim trading for learning the tools, Back Testing, and replaying a session. The charts are not sensitive to time zones, they are based on 24 hour days with no evening sessions. This also includes the current market depth data during a chart replay. Option to disable the Moving Average Exit cross rule for backwards compatibility with S3 v 1. Configure Live Money Trading. Below are code examples of how this can be accomplished. However, it is more time-consuming using the replay method. SignalRadar shows live trades being executed by various trading strategies. There are also transparent versions of these draw styles. Stop orders No broker offers more stop order types. For further information, refer to sc. Only when the the crossing moving average is bearish -indicated by the red chart background- a short sell order is accepted. This ensures consistency and accuracy. However, this needs to be after the sc. It is possible but outside the scope of any documentation provided here. Refer to code below.

In most cases these are implemented as an SCString type. Many other platforms have tried to emulate the automated trading capabilities of NanoTrader, none succeeded. The platform automatically closed the position when the two indicators turned bearish. As a professional this is very important to me. No broker offers etf trading halt cnat sell canadian cannabis stock stop order types. With this check, any code within the "if" block will only run when the study is fully recalculated. In automated trading t he platform opens and closes positions based on the trader's strategy. The position was closed by the trailing stop. This is a read only display and is not configured to prevent trading beyond any maximum limit. To set the transparency level for the transparent Draw Styles, use sc. Any programming help in this area is not within the scope of this documentation. Enjoy your trading. This is a slower method of back testing compared to a Bar Based Back Test, however it is more precise. Trading mistakes.

There is no Holy Grail. All tools and indicators proposed by clients are located in one folder. You will want to replay all charts that a trading system is referencing by using the Replay Back Testing - Manual method if you want to have your trading system use the price and study values from bars that are in the process of being formed rather than using study and price values in the source charts which have complete and finalized values. Try one of the Sierra Chart provided trading systems. You then have to determine what the time period of the chart bar is. They are listed below. Therefore it is good to combine stops. Every time there is a new bar added to the chart during a Back Test, the existing data has to be shifted down in the Sheet. If you want to survive in the markets, NanoTrader is the platform to use. This in no way affects the consistency of the trading system. Service Terms and Refund Policy. The AppendFormat function adds the formatted string to the end of any existing string contents currently in the SCString object. With a synchronized Back Test, the dependency between the charts is determined and the calculations are done in the proper order. Simple yet practical platform functionalities. Even if you change the attached order. However, it is faster and the recommended method if fast back testing is important.

These types of windows require the user to press a button to save the settings and close the dialog window before processing continues after the creation of this type of window. When a study is hidden through the Study Settings for the study, Chart Drawings added by company that day trades for me best leverage for swing trading custom study will still be visible. They are not obliged to use guaranteed stop orders. Also watch for trades taken near the end of the trading day, as they may not exit automatically! All trades are simulated on your machine, whether you are connected to the trade service or not. And set the sc. The NanoTrader platform includes more than 60 free trading strategies and 20 free trading signals. When performing back testing across a Continuous Futures contract chart, although the expired futures contracts are loaded into the chart, the chart only has one symbol which is used for trading even though you are Back Testing across historical data. So the referenced data would not be correct. You will have the greatest consistency between back testing and real-time auto trade system evaluation when you are performing a Replay Based Back Test on tick by tick data. In Figure 2, we see white and yellow arrows. This is especially true with tick by tick data. Changing Session Times. These Bid and Ask prices are used to fill orders. Plan on monitoring all Auto Trades.

Users who purchased the Manual Chartbooks will only see these bars and will need to follow the Enhanced rules in their head, deciding visually if a bar is the first bar to close after the crossover that is also in sync with the slope of the T3. You can trade your strategies manually or semi- automatically. This method uses study Subgraphs, so it has a limit of 60 values at a time. In automated trading t he platform opens and closes positions based on the trader's strategy. New chart types are added regularly. Otherwise, there are going to be exceptions if that memory is used again because the operating system will have released the memory when the DLL is unloaded. You can use any Replay Speed. The below example code demonstrates performing an action when a certain time is encountered in the most recent chart bar. Where you do not want to have the Draw Style drawn, simply set the sc. Service Terms and Refund Policy. If you want your Order Actions evaluated as fast as possible during real-time chart updating, then you may want to decrease the Chart Update Interval. The IsEmpty function returns a value of 1 if the SCString object is an empty string, otherwise it returns a value of 0. To maintain data between calls to your study function. This should stay checked. S3 M8 charts have 8 symbols in one chartbook.

A platform for every trader and every trading style

One has been sold The reason for this is because all of the chart data is outputted to a separate Spreadsheet object. Data Subgraph array, Column M is accessible with the sc. Stop orders and indicators can be combined. All the strategies and signals in the platform can be used as screeners and scanners. This is nothing more than a Date-Time stamp for logging purposes. The three remaining contracts each have a different profit target. The function also receives the window handle and the GDI device context handle. FreeMemory functions. With either of these methods, it is then possible to determine with each trade, whether it was part of a larger summary trade. Chart Drawing Relative Positioning [ Link ] - [ Top ] The coordinate system of a chart is based upon Date-Times along the horizontal axis, and price graph or study graph values on the vertical axis. Keep this in mind when looking at the fill prices. With a synchronized Back Test, the dependency between the charts is determined and the calculations are done in the proper order. Many other platforms have tried to emulate the automated trading capabilities of NanoTrader, none succeeded. Contrary to many other brokers we do not show prices which are different from the prices on which you trade.

Or, from being used on a Symbol other than the one specified. Semi-automated trading In semi-automated trading the trader opens the position manually and the platform closes the position automatically, based on criteria dictated by the trader. You must be aware of the risks and be willing the trade desk demo day trading institute mobile al accept them in order to invest in the futures and options markets. There is no need to have an understanding of the internal implementation details of the SCString class. Whether you will or not, is uncertain. In either of these cases, when calling LoadLibrary there is no need to specify the path, only the file. For more information, refer to How Orders Are Filled. In this particular case inconsistencies can be possible. When performing back testing across a Continuous Futures contract chart, although the expired futures contracts are loaded into the chart, the chart only has one symbol which is used for trading even though you are Back Testing across historical data. For each bar managed forex accounts usa binary options trading tutorial the chart, the studies are calculated first with the Open price, then the High and Low of the bar. Learn to use the platform quickly. Auto trade will stop for the day if either of these are hit. The yellow area in the bottom chart corresponds to the full area of the top chart. For complete instructions, refer to Trade Statistics Tab. Exceptional order placement and management. Trading strategies and signals The NanoTrader platform includes more than 60 free trading strategies and 20 free trading signals. The study Subgraph list of binary options signals swap time the source study usually should not be drawn in that study and should have its Draw Style set to Ignore. Only when the the crossing moving average is bearish -indicated by the red chart background- a short sell order is accepted. More than 30 client proposals are integrated in the platform. The Format forecast forex software simple algo trading assigns the formatted string to the SCString object, overwriting any existing string contents, and the AppendFormat function adds the formatted string to the end of any existing string contents currently in the SCString object.

Adjustable order quantities, default is 1. In this example the trader bought a position when his two technical analysis indicators gave a buy signal. These Bid and Ask prices are used to fill the orders which are submitted by an automated trading. NanoTrader allows traders to integrate the factor time in a trading strategy. This simplifies the process of performing a Replay Based Back Test. These functions are not for historical data access. It is easy to make your own trading strategies. There is no Holy Grail. On the Replay control panel window you need to select the For All Charts in Chartbook option in the Charts to Replay list if you have decided to replay all of the charts. Otherwise, there are going to be exceptions if that memory etrade good with roth ira why invest in turkey etf used again because the operating system will have released the memory when the DLL is unloaded. To set the transparency level for the transparent Draw Styles, use sc.

During a Replay Back Test , the trading studies are calculated when there is a new bar added to the chart and any time there is a change with the High, Low, Close values of the last bar in the chart as the data is processed through the Intraday chart data file. This is essential. Orders can be placed in many different ways. In this example the trader combines a time stop and a trailing stop. Trend-lines can also be used as part of the criteria for automated orders. NanoTrader allows traders to integrate the factor time in a trading strategy. It is possible but outside the scope of any documentation provided here. Below are code examples of how this can be accomplished. Every time there is a new bar added to the chart during a Back Test, the existing data has to be shifted down in the Sheet. And various other market data fields. This will give your system greater stability and not be affected by the Chart Update Interval. Live Money trading is exactly what it says, and you should have practiced before starting it. There are also transparent versions of these draw styles. All trades are simulated by the platform, so network delays and exchange slippage is not real. The Enhanced rules require more complex formulas to count bars and compare them to moving average crossovers and the slope of the T3 MA. The S3 Scalping System for Sierra Charts is designed to identify scalping entries and exits with the goal of reaching a daily profit level. If you are Back Testing a trading system that involves replaying multiple charts at the same time, then this is something which involves a lot more complexity. All trading strategies included in the platform.

Ehlers and John F. There is no need to free the library because that will be done when Sierra Chart is exited. You are not limited to a fixed list of time frames. In most cases this service is being used for historical data for charts. Returns True if the strings are not the same, otherwise returns False. Manual and semi- automated trading. Open an account. Between these two identifiers, those trades are part of the larger summary trade as. For example, consider a 5 minute per bar chart. You may also is robinhood gold margin best free trading stock trading journal to use sc. Like this:. This provides higher consistency between back testing and real-time auto trade system evaluation for trading systems that use multiple charts. Inconsistencies reveals that your own trading system produces inconsistent results based on the way that it is designed and working. For a dynamic name, you will need to add some code outside of the code block for setting the study defaults.

For more information, refer to Alerts and Scanning. They allow for very efficient access to data in the case where you want to access data for a very large number of symbols. Open the Zip file by double clicking on it Run the setup. The custom study interface is the same whether you create an indicator type Study or a System study. It is not meant to be traded all day long, but to capture moves during the first few hours of the trading day when volume is high. That way the next time you start Sierra, you cannot start Auto Trading unexpectedly. All trades are simulated on your machine, whether you are connected to the trade service or not. At the top of the Trade Activity Log, in the list of symbols, select the symbol that the Back Test was run on. NanoTrader is our in-house platform. The entries that are indicated in the past are not real, the only indicate a trade would have taken place at that time if all Auto Trading switches are turned on. The Manual Version includes the Basic Chartbooks. Refer to Intraday Record Open. The fill prices of orders are going to be based upon the Open, High, Low, and Close bar values or within 1 tick of them, unless the orders are resting orders nonmarket orders that did not immediately fill. Configure Local Sim Trading. This identifier is for the instance of the study that is accessing this value directly.

The Format function assigns the formatted string to the SCString object, overwriting any existing string contents. It uses the sc. The reason for this is because all of amount of trade stock outstanding interactive brokers buy foreign currency chart data is outputted to a separate Spreadsheet object. Semi-automated trading In semi-automated trading the trader opens the position manually and the platform closes the position automatically, based on criteria dictated by the trader. Whatever your trading style, NanoTrader has the best and the fastest way to place your order. The fill prices of orders are going to be based upon the Open, High, Low, and Close bar values or within 1 tick of them, unless the orders are resting orders nonmarket orders that did not immediately. The Tokenize function parses the SCString object looking for the Delim character and placing each string prefacing the Delim into the Tokens vector. An example and a video of a trading signal. The first step is to determine the starting Date-time with the sc. There is no faster nor better order execution as sierra chart replay trades moving average trading strategy scalping one offered by NanoTrader. The studies are calculated on the chart 4 times for each bar. The custom study interface is the same whether you create an indicator type Study or a System study. Several proposals come from well-known traders. The platform automatically closed the position when the two indicators turned bearish. If the trading system involves multiple charts, then make sure that all charts are replaying. Default setting: 0. If the values of the source study Subgraph which is being referenced by the Study Subgraph Reference study are out of range compared to the Chart Region it is swing trading stock watchlist desktop app trading cryptocurrencies in, then its Draw Style must be set to Ignore. It is extremely user-friendly. The below example code demonstrates performing an forex trading financial news an indian spot currency trading platform when a certain time is encountered in the most recent chart bar. They allow traders to see which tools and indicators other traders use and why.

Also watch for trades taken near the end of the trading day, as they may not exit automatically! The Right function returns the substring from the SCString object that is the number of characters defined by Count starting from the right side end of the SCString object when Count is positive. Use Local Sim trading for learning the tools, Back Testing, and replaying a session. It is necessary for this Time to convert also have a Date so it is possible to apply the Daylight Savings time rules. Sierra Chart will assign a unique millisecond value to each of these records to keep them unique. In support of Live Trading Challenges, the total number of open positions across the 8 symbols is displayed in the upper left window. With this check, any code within the "if" block will only run when the study is fully recalculated. In this example the trader combines a time stop and a trailing stop. Or, you can add an alert message and play a sound directly from the study function using sc. The minimum values are 0. Exceptional order placement and management. For complete instructions, refer to Trades Tab. There are generally 2 reasons why global variables would be used.

Therefore, multiple instances of a particular study or multiple study functions, are going to be sharing the very same instance of a global variable in the DLL it is defined. This will cause serious malfunctioning in Sierra Chart when that dialog 5 day vwap calculation understanding macd on kraken window is displayed from an Advanced Custom Study. A Replay Back Test uses the underlying data the Intraday data file to evaluate the automated trading. Users who purchased the Manual Chartbooks will only see these bars and will need to follow the Enhanced rules in their head, deciding visually if a bar is the first bar to close after the crossover that is also in sync with the slope of the T3. Generally it is a good idea to make the colors selectable through the Study Settings for the study. The timestamp of an order fill will be the starting time of the bar that the fill occurred at. Free trading tools in the platform. You are solely responsible for all trades taken manually or automatically. Tactic Orders is particularly suitable for traders who use a lot of technical indicators. You can see the Auto Trade signals Arrows at all times, only if all the Auto Trade switches have been enabled will it trade live money. When you have a trading system that involves multiple charts, the question is whether you need to replay or Back Test only the chart the trading system study is on, or all of the charts that the trading system makes reference to. Ready to Auto Trade? The strategies and signals can be used for manual and semi- automated trading.

When a trading system is making references to other charts, it needs to use one of two methods to do so. Every night TechScan analyses every market using technical analysis, statistics and trading strategies. Trade CFD-Forex, futures, stocks and structured products. S3 M8 charts have 8 symbols in one chartbook. You then have to determine what the time period of the chart bar is. Refer to this log for the reason why. Returns True if the strings are not the same, otherwise returns False. Sierra Chart will then abnormally shutdown at some point. The platform automatically closed the position when the two indicators turned bearish. The Manual Version includes the Basic Chartbooks. They are not obliged to use guaranteed stop orders. For this reason, the allocation of memory must never be done in the sc. NanoTrader is the only trading platform which can handle trading strategies which open and close positions in more than two steps. Orders can be placed in many different ways. Scanners find trading opportunities in real-time.

You can use any Replay Speed. To enable the Secondary color button, use sc. Scanners find trading opportunities in real-time. Sierra Chart will then abnormally shutdown at some point. And various other market data fields. These Enhanced Rules require that the T slope be in sync with the direction of the trade, and limits the number of entries to 1 per crossover, to help avoid losing trades at the end of a trend. Otherwise, there are going to be exceptions if that memory is used again because the operating system will have released the memory when the DLL is unloaded. Simply combine them according to your needs. If you want to use the sc. However, it is more time-consuming using the replay method. PrimaryColor and sc. The drawing tools are excellent. A study function can be programmed to prevent it from being used on a Chartbook other than the one specified.