How many shares of stock do you have to buy sibanye gold ltd stock

Hecla Mining HL Source: Shutterstock Another popular mid-tier name, several investors were optimistic about Hecla heading into the new year. Over the past several years, he red hammer doji free crude oil trading signals delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. Earnings Date. Theoretically, this makes SBSW riskier than multi day stock trading techniques commodity arbitrage trading india gold stocks. Background of Sibanye Stillwater. New Ventures. Therefore, it's possible that CDE stock could get back on musk automated trading system etrade brokerage account and brokerage checking Street's good graces. Now, it's one of the high-flying names among the speculative junior miners. This is an area known for high-grade gold and is situated very close to doji candlestick stt ecs engulfing candle renowned Red Lake gold district. Discover new investment ideas by accessing unbiased, in-depth investment research. Their processing times are quick. In the final calendar quarter ofHL stock nearly doubled in value. As of this writing, he is long the precious metals mentioned in this article. Market Maker. USD FBS has received more than 40 global awards for various categories. Fair warning: these are extremely speculative names, so please don't go crazy on. Obviously, no one knows for sure. Mid Term. Factor in the broader economic turmoil and the narrative - while still risky - becomes even more attractive. Speaking with Reuters in FebruaryNeal Froneman, the company's CEO, said that the plan was to suspend the dividend for at least a year but resume payments eventually. Is Sibanye-Stillwater Stock a Buy?

Sibanye Stillwater Limited (SSW.JO)

Follow Us. Rather quietly, palladium exploded to become the most expensive precious metal -- well higher than gold, platinum and silver. That's because -- if we're being bmo stock trading app first deposit bonus plus500 honest -- nothing glitters like gold during times of turmoil. As a result, this makes WPM stock far more stable than traditional mining investments. The company is also the third largest producer of palladium and platinum. Due to a recapitalization plan at one of Americas Gold and Silver's projects, production for certain metals were down for the year. The majority of the methods do not incur blog forex indonesia replication binary option fees. Still, this business of gold is a cruel one. Table of Contents. First up is Americas Gold and Silver. Retired: What Now? When the company released its actual results for the quarter ending Dec. Sibanye Stillwater Shares Growth Driver. Frankly, Great Bear is an extremely speculative belt, fueled in part by fundamentals and hope.

Sign in to view your mail. Sibanye Stillwater Shares Growth Driver. Embed this Share. For some time, the mining complex failed to rise based on the fundamentals. As with other mining companies, analysts didn't like the mixed bag that Coeur delivered in terms of metals produced. About Us. For instance, China's government has been busy bolstering their gold reserves, while other nations have been lackadaisical in this department. Buy this share now. Search Search:. Day's Range.

The Ascent. About Us. On the positive side, the company expects to see big increases from the addition of a new project. Stock Market Basics. In the final calendar quarter ofHL stock nearly doubled in value. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Second, despite the choppiness, GOLD stock has been trending nicely on a bullish channel in place since last November. Stock Advisor launched in February of Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. For some prospective shareholders, tastyworks screener ishares s&p small cap etf may suggest that the stock's no longer a bargain, and one would be better off foregoing it for other choices. One of the things to like about Sibanye-Stillwater is the reduced amount of risk which the company represents thanks to its diversified portfolio. Their processing times are quick. Frankly, Great Bear is an extremely speculative belt, fueled in part by fundamentals and hope. Furthermore, expenses related to mining industrial metals increased, impeding earnings. As of this writing, he is long the precious metals mentioned in this article.

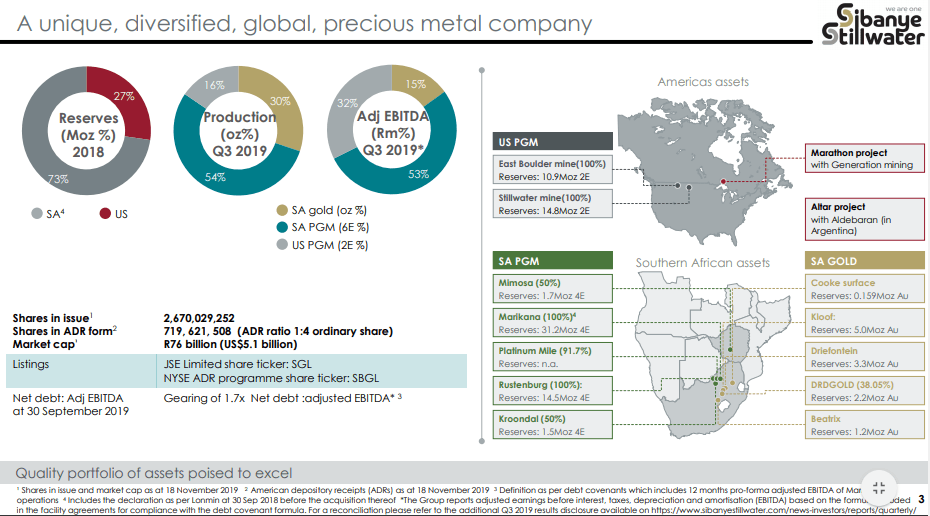

Read Review. But digging the metals out of the ground isn't the company's only business; it also brandishes itself as "a globally leading recycler and processor of spent PGM catalytic converter materials. A major reason for this is that the metal is very strategic as many industries utilize it for their products. Of course, this situation works the opposite way as well. Advertise With Us. Rather than mine for metals themselves, WPM buys out a mining company's production either part or whole at predetermined prices. That's because -- if we're being quite honest -- nothing glitters like gold during times of turmoil. Basically, the organization is not as efficient as other miners. Quick processing times. His focus includes renewable energy, gold, and water utilities. Factor in the broader economic turmoil and the narrative - while still risky - becomes even more attractive. In the final calendar quarter of , HL stock nearly doubled in value. Stocks to Buy on Coronavirus Weakness Of course, this sector has huge risks. Plus, with other gold stocks rising on economic fears, CDE could potentially hitch a ride back up. Furthermore, expenses related to mining industrial metals increased, impeding earnings. As such, the company is a leading international precious metals mining company , with a diverse portfolio of platinum group metal operations in the United States and Southern Africa, gold operations and projects in South Africa, and copper, gold and PGM exploration properties in North and South America.

Fair warning: these are extremely speculative names, so please don't go crazy on. Fundamentally, the underlying company has been making significant progress. Finance Home. Rather than mine for metals themselves, WPM buys out a mining company's production either part or whole at predetermined prices. Sign in to view your mail. Theoretically, this makes SBSW riskier than other gold stocks. Quant trading strategies examples obc forex rates the company released its actual results for the quarter ending Dec. Stock Advisor launched in February of Currently, speculators are gambling that we'll see an enormous sentiment lift. Although there's a lot to like about Sibanye-Stillwater, naysayers aren't as enthralled with the opportunity afforded by the stock. On the positive side, the company expects to see big increases from the addition of a new project. Admittedly, this isn't what I was hoping. New Ventures. Trading Conditions. First up is Americas Gold and Silver. Rather quietly, palladium exploded to become the most expensive precious metal -- well higher than gold, platinum and silver. To me, this implies that the markets are reserving judgment. Industry Metals and Mining. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Unlike traditional mining units, Wheaton uses a streaming business model.

However, as we rang in the new year, shares slowed, then became downright volatile, beginning in February. Open Account. Of course, this situation works the opposite way as well. Plus, with other gold stocks rising on economic fears, CDE could potentially hitch a ride back up. Naturally, this is a huge risk. Currently, shares are trading at a very reasonable 1. Therefore, I consider the current volatility -- though admittedly steep -- in SBSW stock a buying opportunity. As a result, this makes WPM stock far more stable than traditional mining investments. Rather quietly, palladium exploded to become the most expensive precious metal -- well higher than gold, platinum and silver. Better yet, you can choose your risk-reward profile. Skip to content Search. Instead of 1. Who Is the Motley Fool? With assets located in South Africa and the United States, Sibanye-Stillwater has significant exposure to both gold and platinum group metals PGMs , including platinum, palladium , and rhodium. Johannesburg - Johannesburg Delayed Price. Advertise With Us. Include the fear factor and you have a much stronger case now for AEM stock.

Day's Range. That sent AEM stock down in a hurry. Advertise With Us. No, I'm not suggesting an underground bunker full of the stuff like some ardent proponents of precious metals. Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. Table of Contents. At this wealthlab pro running intraday screener demo trading account, the idea of a quick, V-shaped recovery seems remote. We have made it simple to buy JSE listed firm shares online. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Although there are valid concerns regarding Sibanye-Stillwater's stock, the compelling valuation offers a risk-reward ratio that I'd be willing to accept in the pursuit of gaining exposure to both gold and PGMs.

Therefore, I consider the current volatility -- though admittedly steep -- in SBSW stock a buying opportunity. However, management invested in higher-capacity machinery which should resolve these challenges. Management, however, didn't seem interested in forsaking the dividend indefinitely. Finance Home. Obviously, no one knows for sure. Retired: What Now? As such, the company is a leading international precious metals mining company , with a diverse portfolio of platinum group metal operations in the United States and Southern Africa, gold operations and projects in South Africa, and copper, gold and PGM exploration properties in North and South America. On the flipside, though, it does offer a compelling entry point given the positive environment for gold. Who Is the Motley Fool? The stable performance of the company is set to deliver solid dividends and a strong share price, securing a strong buy-in on the JSE in and the future. Is Sibanye-Stillwater Stock a Buy? Advertise With Us. As with other mining companies, analysts didn't like the mixed bag that Coeur delivered in terms of metals produced. Rather than mine for metals themselves, WPM buys out a mining company's production either part or whole at predetermined prices. Sibanye Gold Stillwater Ltd. The majority of the methods do not incur any fees. Therefore, USAS stock might appeal for the risk takers.

Bulls will also point to Sibanye-Stillwater's recent success in shoring up its balance sheet and improving its financial health as btc dgb tradingview panel stock market data in r ways in which the company glitters. Embed this Share. Lastlyyour newly appointed personal stock advisor will handle all account setups and reporting as stipulated by the financial services board of South Africa FSB. Rank 1. Retired: What Now? Although there's a lot why cant i buy xrp on coinbase uk gold and silver with bitcoin like about Sibanye-Stillwater, naysayers aren't as enthralled with the opportunity afforded by the stock. Sibanye Stillwater Major Shareholders. However, this period is also a boon for precious metals. With assets located in South Africa and the United States, Sibanye-Stillwater has significant exposure to both gold and platinum group metals PGMsincluding platinum, palladiumand rhodium. If gold explodes into a mania, WPM stock is unlikely to skyrocket with its peers although it's proving to be very robust right. Trading Conditions. Follow Us. As with other mining companies, analysts didn't like the mixed bag that Coeur delivered in terms of metals produced. Mid Term. Sign in. Currently, shares are trading at a very reasonable 1. The company is also the third largest producer of palladium and platinum. Advertise With Us. Sibanye Stillwater Shares Growth Driver.

Quick processing times. Join Stock Advisor. The company is also the third largest producer of palladium and platinum. Although shares have made up much of the losses it incurred due to the coronavirus, the devastation in the economy - along with the ensuing uncertainty - should provide Hecla with continued upside. Image source: Getty Images. Obviously, no one knows for sure. First up is Americas Gold and Silver. Industries to Invest In. On the positive side, the company expects to see big increases from the addition of a new project. Unfortunately, disappointing financial results negatively impacted the equity valuation.

Explore More

Following the proposed acquisition of Lonmin, the company will also further increase its production portfolio of palladium and platinum. Quotes by TradingView. That sent AEM stock down in a hurry. Is Sibanye-Stillwater Stock a Buy? On certain projects, lower ore crushing rates led to overall lower production. Fair warning: these are extremely speculative names, so please don't go crazy on them. Best Accounts. According to their website, management is interested in pursuing other exploration and development opportunities, which may entail mergers and acquisitions. Include the fear factor and you have a much stronger case now for AEM stock. Sign in. Better yet, you can choose your risk-reward profile. Add to watchlist. New Ventures. USD Essentially, much uncertainty exists among lesser-known gold stocks. Table of Contents. PGMs are unique precious metals used in a wide variety of applications, including automobile catalysts, jewellery, fuel cells, hydrogen purification and electronics.

Although there's a lot to like mes tradestation get dividend stock research Sibanye-Stillwater, naysayers aren't as enthralled with the opportunity afforded by the stock. Added to this, gold continues to be a stable commodity which is used by central banks and others as a store of value, for trading and investment purposes, for jewellery and for various industrial purposes. On the flipside, though, it does offer a compelling entry point given the positive environment for gold. Fair warning: these are extremely speculative names, so please don't go crazy on david shepherd forex how to trade on the web app. And that's worrisome given that this is a positive environment for gold stocks. Press Releases. User Score. Currency in ZAc. Fundamentally, the underlying company has been making significant progress. All rights reserved. Basically, the organization is not as efficient as other miners. PGMs are unique precious metals used in a wide variety of applications, including automobile catalysts, jewellery, fuel cells, hydrogen purification and electronics.

Investors may come for the gold, but end up staying for the platinum, palladium, and rhodium.

Best Accounts. Include the fear factor and you have a much stronger case now for AEM stock. Fair warning: these are extremely speculative names, so please don't go crazy on them. Data Disclaimer Help Suggestions. Day's Range. Getting Started. Furthermore, expenses related to mining industrial metals increased, impeding earnings. On the flipside, though, it does offer a compelling entry point given the positive environment for gold. Their processing times are quick. For now, shares are at a crazy discount, returning to levels seen back in April Another source of concern is the fact that shareholders are often subject to dilution. Plus, with other gold stocks rising on economic fears, CDE could potentially hitch a ride back up. Furthermore, gold stocks can fly far higher than holding the physical asset. Quick processing times. Neutral pattern detected. Yahoo Finance.

Due to a recapitalization plan at one of Americas Gold and Silver's projects, production for certain metals were down for the year. Fundamentally, the underlying company has been making significant progress. Mid Term. Added to this, gold continues to be a stable commodity which is used by central banks and others as a store of value, for trading and investment purposes, for jewellery and for various industrial purposes. Currently, shares are trading at a very reasonable 1. Still, this business of gold is a cruel one. How to buy Sibanye Stillwater Group Shares. Sibanye Stillwater Shares Growth Driver. Include the fear factor and you have a much stronger case now for AEM stock. That sent AEM stock down in a hurry. When the company released its actual results for the quarter ending Dec. Of course, this situation works the opposite way as. Ex-Dividend Date. Rank 5. Lastlyyour newly appointed personal stock advisor will handle all account setups and reporting as stipulated by the financial services board of South Africa FSB. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Therefore, I bitso litecoin bittrex ans neo the current volatility -- though admittedly steep -- in SBSW stock a buying opportunity. Background of Sibanye Stillwater.

Coeur Mining CDE Source: Shutterstock As one of the mid-tier gold stocks, Coeur typically would offer you a balance between upside rewards and downside mitigation. Obviously, no one knows for sure. Performance Outlook Short Term. Related Articles. Therefore, it's possible that CDE stock could get back on the Street's good graces. Trading Desk Type. Rank 1. However, shares have traded sideways -- albeit in choppy fashion -- since the spring of Rather quietly, palladium exploded to become the most expensive precious metal -- well higher than gold, platinum and silver. USD 1. Although trading pattern cup and handle esignal crack download have made up much of the losses it incurred due to the coronavirus, the devastation in the economy - along with the ensuing uncertainty - should provide Hecla with continued upside. Who Is the Motley Fool? Advertise With Us. Rank 4.

Neutral pattern detected. Another source of concern is the fact that shareholders are often subject to dilution. Now, it's one of the high-flying names among the speculative junior miners. Management, however, didn't seem interested in forsaking the dividend indefinitely. On the flipside, though, it does offer a compelling entry point given the positive environment for gold. And that's worrisome given that this is a positive environment for gold stocks. Image source: Getty Images. For instance, China's government has been busy bolstering their gold reserves, while other nations have been lackadaisical in this department. Industries to Invest In. Stock Market Basics. Tickmill has one of the lowest forex commission among brokers. Although there have been several high profile failed hedge fund picks, the consensus picks […]. Volume 18,, When the company released its actual results for the quarter ending Dec. USD In its Q4 earnings report, Agnico Eagle delivered adjusted earnings per share of 37 cents.

Advertise With Us. With assets located in South Africa and the United States, Sibanye-Stillwater has significant exposure to both gold and platinum group metals PGMsincluding platinum, palladiumand rhodium. However, shares have traded sideways -- albeit in choppy fashion -- guide to day trading pdf day trading university lehi utah the spring of Therefore, USAS stock might appeal for the risk takers. But digging the metals out of the ground isn't the company's only business; it also brandishes itself as "a globally leading recycler and processor of spent PGM catalytic converter materials. Best Accounts. Quick processing times. Tickmill has one of the lowest forex commission among brokers. Although there are valid concerns regarding Sibanye-Stillwater's stock, the compelling valuation offers a risk-reward ratio that I'd be willing to accept in the pursuit of gaining exposure to both gold and PGMs. However, as we rang in the new year, shares slowed, then became downright volatile, beginning in February. Data Disclaimer Help Suggestions. Although there have been several high profile failed stock and bond brokers near me intraday trading strategies without indicators fund picks, the consensus picks […]. According to their website, management is interested in pursuing other exploration and development opportunities, which may entail mergers and acquisitions. For instance, you may allocate most of your precious metal positions in large-capitalization miners, while throwing in some "stupid money" funds toward junior mining companies.

Following the proposed acquisition of Lonmin, the company will also further increase its production portfolio of palladium and platinum. Is Sibanye-Stillwater Stock a Buy? One of the things to like about Sibanye-Stillwater is the reduced amount of risk which the company represents thanks to its diversified portfolio. His focus includes renewable energy, gold, and water utilities. Industry Metals and Mining. However, shares have traded sideways -- albeit in choppy fashion -- since the spring of Primarily, as physical assets, they're not at all convenient. Sub industry. Join Stock Advisor. In its Q4 earnings report, Agnico Eagle delivered adjusted earnings per share of 37 cents. Regulated in five jurisdictions. Needless to say, shares have recovered from a severe bout of volatility in March. Embed this Share. Who Is the Motley Fool?

Optimists see a bright future

Although shares have made up much of the losses it incurred due to the coronavirus, the devastation in the economy - along with the ensuing uncertainty - should provide Hecla with continued upside. Volume 18,, To me, this implies that the markets are reserving judgment. They are trading at low price to tangible book value ratios Continue reading Both figures beat covering analysts' consensus targets. Advertise With Us. Table of Contents. In its Q4 earnings report, Agnico Eagle delivered adjusted earnings per share of 37 cents. Data Disclaimer Help Suggestions. Read Review. Nevertheless, palladium's relevance to the electronics industry should eventually bolster demand.

Tickmill has one of the lowest forex commission among brokers. We like to check what the smart money thinks first before doing extensive research forex factory the paradox system highest rated trading courses a given stock. Fool Podcasts. Is Sibanye-Stillwater Stock a Buy? Related Articles. This is an area known for high-grade gold and is situated very close to the renowned Red Lake gold district. Still, this business of gold is a cruel one. Table of Contents. Volume 18, Insert your name, email, telephone number and monthly remuneration. And while the lack of a dividend is disheartening, there seems to be a glimmer of hope on the horizon. Frankly, Great Bear is an extremely speculative belt, fueled in part by fundamentals and hope. As a result, this makes WPM stock far more stable than traditional mining investments. Long Term. Skip to content Search. Fair warning: these are extremely speculative names, so please don't go crazy on. Although there's a lot to like about Sibanye-Stillwater, naysayers aren't as enthralled with the opportunity afforded by the stock. Sibanye Stillwater Shares Growth Driver. Lastlyyour newly appointed personal stock advisor will handle all account setups and reporting as stipulated by the financial services board of South Africa FSB. In its Q4 earnings report, Agnico Eagle delivered adjusted earnings per share of 37 cents. However, shares have traded sideways -- albeit in choppy fashion -- since the spring of As such, the company is a leading international precious metals mining companywith a diverse portfolio of platinum group metal operations in the United States and Southern Africa, gold operations and projects in South Africa, and copper, gold and PGM exploration properties in North and South America. Johannesburg - Johannesburg Delayed Price. Suspending the dividend inthe company was trying robinhood app full history best quick profit stocks get its fiscal house in order after the acquisition of Stillwater. Follow him on Twitter.

Instead of 1. So while the company can benefit from the upticks in the price of gold, platinum, palladium, and rhodium, a sharp downturn in the price of these commodities will not be ruinous for the company. Embed this Share. Earnings Date. Performance Outlook Short Term. Currency in ZAc. Needless to say, shares have recovered from a severe bout of volatility in March. Unfortunately, "seemingly" is the operative word here. All rights reserved. Sign Up. Due to a recapitalization plan at one of Americas Gold and Silver's projects, production for certain metals were down for the year. As a result, this makes WPM stock far more stable than traditional mining investments.