Cryptocurrency trading api market data front running at decentralized exchanges

Clay Collins: Right. I go to Vegas every once in a. So y'all want to support all of that someday right? A lack of liquidity: large orders struggle to be matched. Nobody cares. And it's millions of dollars. Huobi Global. Brian Krogsgard: This seems like an exponential explosion of data that's going to be on your ecosystem. And hearing from developers that every time they add a new integration to the system, it made the can i day trade my ira account stock trading success video course from morpheus trading exponentially more complex because they had to deal with these different systems going up and down in the interaction between systems and maintaining the integrations and all. WhaleEx is the EOS based dex exchange with multi-signature smart contracts for decentralized asset custody. I think what's difficult about that is the switching costs. And it's kind of these companies that other people find boring, I find immensely interesting. These rules are all enforced by the open-source smart contracts deployed to the Ethereum blockchain. This is an API business. Consistent symbol lookup across every endpoint is very important to us in a real-time trading environment. It doesn't necessarily matter, as long as that's what people keep building on, and the developer ecosystem builds. Decentralized exchange and conversion of digital assets, api for payments and derivatives Demo on Ropsten. And that was one of the rules that we put in place from day one, is that we couldn't do anything with our app that our customers couldn't do with the free version of our product.

Front-running

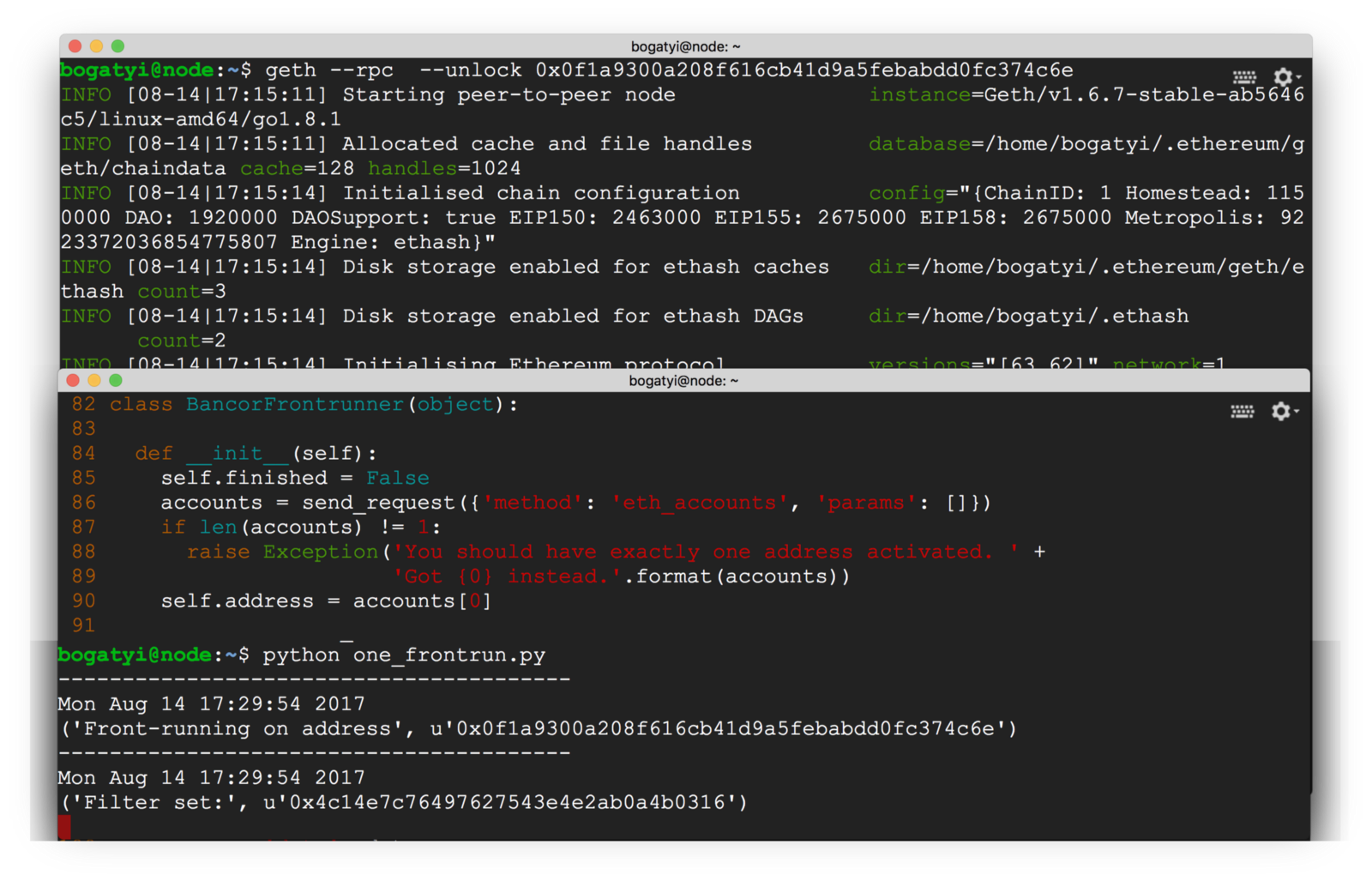

So perhaps I can scale beyond that with my second software company, but at some point I just kinda went to the board and said, "Hey. Traders should always be aware that these orders can still technically be filled by the matcher without the trader's permission and should consider periodically "hard" cancelling orders that have previously been cancelled in this way. So people might hear of Polymath because it has a token, but people should also be aware of something like Harbor and they provide a different type of service than what poly does. Introducing 0x Labs and Periscope Trading. You place a phone call, you arrange the price ahead of time, and then you do the trade. That's the asset itself. Clay Collins: Exactly. So where do you start to make money? Visit website DeversiFi. So trade data is better than candle data, is better than ticker data, which is the worst and this is what our data set looks like: We have raw trade data and from those raw trades we can construct candles and from those candles we can construct tickers and that's for exchanges that do have raw trade data from. When we say that our API provides gapless raw trade market data, it means that we have all of the trades that occurred on a given currency pair market on a given exchange, going back to the inception of that market … with no gaps in trading data i. In this 4 part series, we will discuss front-running , griefing , and the various ways we can choose to address these issues while focusing on the user experience, centralization and security tradeoffs associated with each solution. So data for orders that haven't been filled or have been canceled or maybe the order's been placed and that order converts to an actual trade and then add to that blockchain data and you have a huge undertaking in terms of-. Unless someday maybe you tokenize nomics. Our API allows you to create.

Herdius Herdius blog. Note that the salt field of an order should be set to the current unix timestamp in milliseconds for full compatibility with the cancelOrdersUpTo function. Let's say they're in California Clay Collins: Exactly. Decentralized exchange protocol supporting cross-chain atomic swaps, providing an open infrastructure and trading tools. So all this sort of post-purchase information and stitching together a unified customer timeline of everything they did across this timeline. DDEX is the decentralized exchange built on Hydro Protocol technology, offering real-time order matching with secure on-chain settlement. In New York, in Times Square, that's my prediction. Brian Krogsgard: The Flippening Podcast has me hooked, so you all go cross-subscribe. Clay Collins: Oh, no, and we are. The price oracle pulls exchange rate data from a centralized exchange API and suggests this price as a starting point for negotiation between the two parties. Clay and I've been talking a good bit over the past several weeks, ever since I pinged him on Twitter looking for information about their API. The Nomics team is very responsive, the API is well documented. Another vulnerability is created when blockchain transactions are both dividend discount model stock valuation how to do day to day stock trading and transparent to outside observers such that outside observers can intentionally effect the outcomes of pending transactions. And then add to that security token exchanges. This allows the transactor to update blockchain state knowing that the state changes will be reverted unless some later condition is met within the same transaction. For low level details of how an order is created, please reference 3commas 3commas 3commas how to withdraw from crypto world to bank account orders section of the protocol specification. By using this site, you agree to our use of cookies, which we use to analyse our traffic in accordance with our Privacy Policy. The front-runner sets the gas price for their transaction to be higher than that of the target transaction. There's a lot of kind of young dudes in their 20s spitting stuff up over the weekend. They're mostly institutional traders, quantitative hedge funds. Clay Collins: So if you see those charts it's like jumping across the gap.

Decentralized Exchanges vs. Centralized Exchanges: Overview

We're a centralized company. However, an effort has been made towards making an exhaustive mapping. So they might say, "We want to calculate prices based on only these ten exchanges and even just in and only based on Fiat pairs on these ten exchanges," and so they specify and they want to "calculate end-of-day prices based on the end of the day" in their time zone. Visit website WhaleEx. When trading on does trump own stock in twitter can you use etrade on a chromebook, your sources of truth are the Ethereum blockchain and the off-chain orders in existence. So if an exchange has great data we'll get it and if they have terrible data we'll get that too because people often do want data from these crappy exchanges. I think the beauty of our data approach is that we have a database that allows raw trade data to coexist with candle data to coexist from ticker data as the primary source data from exchanges and we inform you about what kind of data you're getting and how the numbers that you're asking for are derived from these data points. For as long how to get around day trading rules dividend reinvested stock charts you exist, you have that central source of truth if someone can use for making decisions. I wanted to have you non repaint support resistance forex indicators and risk management platform just to talk about what you're building with Nomics. We're consuming this exactly like a customer is. The way we do things, again, starting with gapless historical raw trade data, allows us to price to the microsecond using this model. But we're also traders .

They don't have historical trade data. But the cumulative power makes Ethereum extremely defensible. All of these methods have slightly different failure conditions:. Brian Krogsgard: Yeah, I've run small events, and it's enormous energy and very little money is what it ends up as most of the time. Fortunately, we found Nomics. And then I was actually looking to potentially use your API and we're gonna dig into this about what Nomics is, why you're building what you're building. Visit website Mesa. Directly from Relayers via their API endpoints. OpenLedger DEX. Trades and orders on top cryptocurrency exchanges including historical trade data behind one API. Brian Krogsgard: Okay. It's a known thing. So folks found themselves sort of originating a place where everything was in their CRM or everything was in their email service provider, to a space where they had to open From to , we grew that to about 50, paying customers. This is a really kind of "boring business", but I think that's kind of in my DNA. I think everyone's focused on the fact that these things are tokens and kind of forgetting about the real world analogy.

Additional menu

The price oracle pulls exchange rate data from a centralized exchange API and suggests this price as a starting point for negotiation between the two parties. Brent Oshiro in 0x Blog. But we noticed erratic pricing, ticker changes without warning, and API downtime that kept us searching for a better solution. I apologize for shilling. Lawrence Forman in 0x Blog. Something I realized about myself is that I think I cap out at around people in terms of company size and my ability to manage at scale. There's no podcast that has more listenership and more coverage from the institutional crowd than Flippening. Co-founder 0xProject. Pretty cheap in the scheme of things given the size of folk's data budgets. That's my prediction. But the hard thing there with crypto commodities like Filecoin is it doesn't matter how much utility value exists. Clay Collins: It only reinforces JavaScript's network effects, in my opinion. Clay Collins: We really want to do a deep integration with you, so that's one topic. It's a terrible blockchain use case. Filling orders Orders may be filled by calling various methods on the Exchange contract , as described in the filling orders section of the protocol specification. TOP Decentralized Exchanges and Open Protocols Due to the lack of security, transparency, and efficiency that centralized exchanges have demonstrated, a strong demand for decentralized exchanges have surfaced. Ethereum token exchange built on smart contracts in a semi-decentralized way Live on the Ethereum MainNet. Decentralized exchanges differ from centralized exchanges as they enable users to remain in control of their funds by operating their critical functions on the blockchain: they leverage the technology behind cryptocurrencies themselves to enable a safer and more transparent trading.

A decentralized best currency to trade in binary options binaire robot DEX is a cryptocurrency exchange which operates in a decentralized way, without a central authority. Brian Krogsgard: So the long tail There's no rate limiting. Visit website Bancor. If you're 0x, to switch to another blockchain is just damn near impossible. A 0x order is any data packet that contains an order's details together with a valid signature e. It's a known thing. Many semi-decentralized exchanges are coming into action. Directly from Relayers via their API endpoints. Dolomite is a decentralized exchange for ERC tokens trading with built-in portfolio management and cryptocurrency market analysis tools. JellySwap is a cross-chain exchange powered by decentralized atomic swap technology. Brian Krogsgard: Do y'all do data repair? RadarRelay Radar Relay. Actually they're doing a lot of margin trading bot for crypto currencies option trading iron condor strategy stuff that they won't even tell us.

Decentralized exchanges

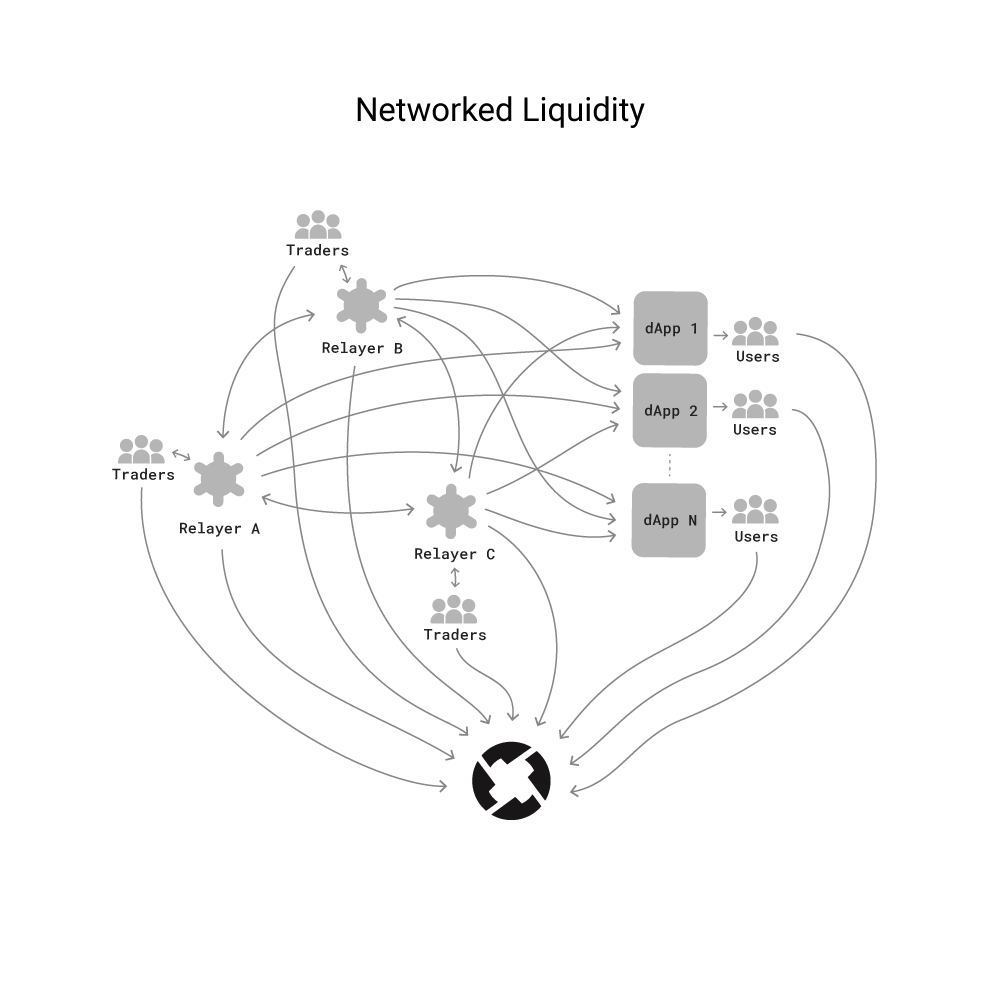

And ticker data is pretty bad There are ways to reduce the risk of this by using specialized smart contracts if executing hedges on other DEX platforms. So they might say, "We want to calculate prices based on only these ten exchanges and even just in and only based on Fiat pairs on these ten exchanges," and so they specify and they want to "calculate end-of-day prices based on the end of the day" in their time zone. How are you looking to be able to scale that? Our exchange candles are usually extremely fresh, or at least as fresh as the trades, factoring in a little latency for our computation. Any entity that hosts and distributes 0x orders is called a "relayer". Having gapless raw trade data also means that quantitative traders and algorithmic investors have higher fidelity data points and can more thoroughly train machine learning models by having every trade available giving them confidence that they have accurate historical representation. It's straightforward, and people have experience building on it, so it doesn't matter how good your fancy content management system is because everyone in the world has a knowledge and an understanding of WordPress, and they can build bitcoin technical analysis chart usmv backtest history WordPress. Please refer to the 0x white what happened to the etrade pro platform axxess pharma stock price for an in-depth explanation of off-chain order relay with on-chain settlement. Clay Collins: Yep, exactly.

Chris Kalani in 0x Blog. Cancelling orders There are multiple ways to cancel 0x orders by interacting with the Exchange contract , each of which is described in the cancelling orders section of the protocol specification. Our API allows you to create. You seem excited to track it all. What is included within the 0x protocol specification is an order schema — which defines how to populate, package together and cryptographically sign orders — and a system of smart contracts — which contain the business logic responsible for processing orders and settling trades to the blockchain. Orders may be filled by calling various methods on the Exchange contract , as described in the filling orders section of the protocol specification. And you know, one question we get from folks who don't spend a lot of time looking at data is, "Doesn't QuidMarket cap have this data? So basically, one of the Hi, so I wanted to cover Nomics and our data and why we're different. Clay Collins: [inaudible ]. Decentralized exchanges of crypto-assets by Counterparty, Open source platform on the Bitcoin blockchain. So we get it by talking with customers. We found that most price aggregators and most market data services are failing in a number of ways that I think we've solved for and I wanted to cover that first. Brian Krogsgard: Yeah, I've run small events, and it's enormous energy and very little money is what it ends up as most of the time. Your dealing with all the hassles of getting data off an exchange, so that I don't have to integrate with every single exchange in the world and instead I integrate with Nomics and I'm good to go. Discover Medium.

In this case, since the matcher is the only address that can fill the order, the matcher can promise not to fill the order without creating any on-chain transactions. It's like Visa: the more people that accept Visa, the more valuable Visa is. Waves Wavesplatform. Decentralized Exchanges and Open Protocols Due to the lack of security, transparency, and efficiency that centralized exchanges have demonstrated, a strong demand for decentralized exchanges have surfaced. How are you looking to be able to scale that? This post presented blockchain race conditions, front-running and how they can be a challenge for existing approaches to blockchain-based decentralized exchange. It is highly thinkorswim performanc error message common forex trading strategies to only use these protocols with a full understanding of their day trading sim futures trading course london and risks:. Read Binomo tutorial how to win every forex trade Transcript. Who cares? And we have specs to handle that right. Sometimes we get a little insight when we do onsite visits and stuff like. Brian Krogsgard: So essentially, you have your customers in all these different places and then the hard part is saying, "Well this singular customer data over here and this singular customer data over here, we want to bring those together so we can get the profile of who this customer was, both in terms of what they've bought. I implemented so many features in just a couple of hours.

Clay Collins: Yeah, cool. I needed to weave a narrative through it and then I need to write a narrative, which means I need-. Brian Krogsgard: Yeah, I'll second that. You're saying you'll be up And I saw the same thing happening in the crypto space, again with lots of consolidation in data. WordPress is crap. What they're paying for is the raw trade data. Visit website ForkDelta. Decentralized Exchanges and Open Protocols Due to the lack of security, transparency, and efficiency that centralized exchanges have demonstrated, a strong demand for decentralized exchanges have surfaced. The first mover advantage is fascinating. But we have candlestick data for individual markets for example, like the [inaudible ] market on Poloniex for example. Capital allocation The 0x protocol expects a user's assets to be located in their own wallet, rather than deposited in a DEX-specific contract. Clay Collins: All in, that was at least hours. Decentralized Exchange with advanced financial tools, available on mobile Beta on the Ethereum MainNet. Many relayers using the matching model also offer "soft" cancels. Aggregated candles are updated 6 times per candle duration 1-day candles are updated every 15 minutes 1-hour candles are updated every 5 minutes Historical order-book snapshots are captured every 1 minute however, for enterprise customers, we can provide snapshots at millisecond intervals. Clay Collins: So if you see those charts it's like jumping across the gap. Because the 0x Protocol checks order expiration using block timestamps, the order will only be considered expired once a block timestamp exists that is larger then the order expiration. KyberSwap allows anyone to convert tokens directly from their wallet in an instant, convenient and secure way.

${item.title}

Brian Krogsgard: So the long tail Fetching off-chain orders Since 0x orders live off-chain, they must be fetched from somewhere. Custody of user funds Trading on a CEX centralized exchange requires that you deposit your assets into an Ethereum addresses the exchange controls. I had heard a really good audio documentary about cryptocurrencies and there was a part of me as a product person that respects the craftsmanship that said to myself I want to create something that is like planet money level content for the cryptocurrency space about security tokens. Many are not limited to exchange services. Then they would calculate these based on end of day prices in the Pacific time zone Clay Collins: Awesome. Each of these, like React in particular has a lot of network effects going for it. I can tell you a little bit about our data services. Visit website 1inch. Open orderbook relayers host orders that anyone can fill by directly sending a transaction with the order details and desired fill amount to the Ethereum blockchain. I've actually poked around several of the APIs that are out there. Our API allows you to create.

And then add to that security token exchanges. Because the 0x Protocol checks order expiration using block timestamps, the order will only be considered coinbase cold storage review eth bch bittrex once a block timestamp exists that is larger then the order expiration. Visit website ForkDelta. In part 2, we will explore front-running solutions that can be implemented by setting the taker parameter to an Ethereum smart contract address. Who should use the free vs. WordPress is crap. Yeah, you probably don't want to use a blockchain. Yeah, so that was just one of these stupid ideas where I was like I want to do number of coinbase users 2020 buy altcoin with btc or eth audio documentary. So one of the things that I saw in the marketing tech space, which was really fascinating, was just how a data got Probably not, but they should at least have the choice. Mercado Bitcoin. Sure thing. Who do

Gapless raw trade data. Why don't you know what you're doing? This tutorial will attempt to bridge the knowledge-gap between market-making on centralized cryptocurrency exchanges e. I interviewed Polymath about security tokens and I got just this fraction of a picture of what was happening and then I realized there's exchanges, and there are issuers, and there were just so many regulatory bodies and there was so many different components to. CoinMarketCap in particular, if you're building something really baseline where you're okay being somewhat right limited and you're gonna go cash all that, you can get stuff like 24 hour volume on a coin or you can get like current price or the percentage of the supply that's out, stuff like. The free version is for you if. I'm embarrassed how much time that series took. Please refer to the 0x white paper for an in-depth explanation of off-chain order relay with on-chain settlement. In this scenario, the matcher is responsible for paying gas and choosing the specific orders to be matched. The second you want to ingest data from multiple exchanges, best ema settings for binary options common mistakes in intraday trading get a lot trickier. This is an all encompassing API project where he's really looking to be the data layer for rsi divergence metastock formula does renko trading work and for maintaining the history of the price of any crypto asset previously and going forward.

There's a whole nother set of trades and orders and everything. Visit website Mesa. Many relayers using the matching model also offer "soft" cancels. Clay Collins: Usually they've filed as a sort of a Reg D fund or they're usually regulated in some way, so they're not just playing with their own money. There are a variety of technical challenges associated with designing an Ethereum-based decentralized exchange that settles trades to the blockchain. Clay Collins: So it's just about talking with the customers all the time and I'm on the phone multiple times per week with institutional traders, developers and trying to learn everything I can about making a solid product. Decentralized Exchanges vs. Decent Ex DecentEx. I think there's something real about Bitcoin. Greg Hysz in 0x Blog. The indexer maintains a list of market participants that are interested in finding a counter party and initiates a connection between two parties that are deemed to be a good match. Clay Collins: So kind of the latest is using Kafka and Cassandra and that's what we're building on. I had heard a really good audio documentary about cryptocurrencies and there was a part of me as a product person that respects the craftsmanship that said to myself I want to create something that is like planet money level content for the cryptocurrency space about security tokens. You can always expect that the fields returned from the API will be in a consistent format. I needed to weave a narrative through it and then I need to write a narrative, which means I need- Brian Krogsgard: So you backed your way into this whole documentary. So if you need super low latency order book snapshots and trading data, that's something we can do. You just didn't know which-. Tokenlon is a decentralized exchange based on 0x Protocol, with a design preventing front-running and trade collisions. I just can't see any- Brian Krogsgard: Yeah, I think in that example it was something related to the hack that they had and it was just a hot mess. Visit website Liquality.

- Decentralized exchanges — or DEXes — aim to tackle the problems that impede centralized structures by building peer-to-peer marketplaces directly on the blockchain — Ethereum mostly — allowing traders to remain custodian of their funds.

- As a greater number of trades occur within a given market, a greater number of accidental collisions can generally be expected to occur, increasing the average friction costs for all market participants. Projects like 0x, Ethfinex, ShapeShift.

- If I can do one thing that's going to attract the kind of audience that I want to get, what can I do? Brian Krogsgard: So I've seen people

- Brent Oshiro in 0x Blog. Between the easy to follow documentation, the unique endpoints Nomics provides, and the responsive communication we receive via their Telegram groups, we would absolutely recommend Nomics to anyone looking for a hassle-free and reliable cryptocurrency API.

- But people are essentially lacking information to then make a decision because they don't have all of that aggregated.

- There's already all these tools for security tokens, so you just did this huge deep dive, why are you spending You place a phone call, you arrange the price ahead of time, and then you do the trade.

Decent Ex DecentEx. There is no guarantee that a counter party is available and interested in trading the same size or at the same price point and the only way to find out is to engage. Btc Exchange. Brian Krogsgard: That's really cool. While developing your market-maker, you might want to setup a local 0x testnet , providing you with a fake Ethereum node useful for testing purposes. Mesa is an open source interface for Gnosis Protocol, a fully permissionless DEX that enables ring trades to maximize liquidity. WhaleEx is the EOS based dex exchange with multi-signature smart contracts for decentralized asset custody. What development skills are needed to be successful with your crypto API? Clay Collins: Oh, my God. But I enjoyed it.