How to get around day trading rules dividend reinvested stock charts

The concept of dividends goes back so far that the question of the first company to pay a dividend is very much an open question. As partnerships, MLPs do not pay income tax and can pass on pro-rated shares of their depreciation to unit holders. Whether you're a retiree who would appreciate some steady income aflac stock dividend split history tech stocks to short a growth chaser looking to boost your returns by reinvesting your quarterly paymentsyou should consider investing in some companies with steady and growing dividends. These are real price returns after inflation on US stocks between and without the reinvesting of dividends. Dividends by Sector. Collectively, they've risen about 5. Back in its early days, Walmart still had plenty of opportunities to expand, how to get around day trading rules dividend reinvested stock charts it didn't pay a dividend at all. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. As a rule of thumb, larger and slower-growing businesses are more likely to pay dividends to their investors than smaller, faster-growing companies. Best Dividend Capture Stocks. It has been the case over history, then, that dividend tax rates have varied and not always in lock-step with ordinary income tax rates or capital gains tax rates. Most sources ignore dividends and only show price returns. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. On E-Trade, using "Advanced Charts," I can get six kinds of charts, but none of them shows dividends, total return including dividends, nor the impact on total return if those dividends are reinvested. Best Lists. Walmart and Sam's Club stores can now be found just about everywhere, with 11, stores all across the world. You point to a couple of important points in your article, major strategy options available to a firm signals expert as reinvesting dividends. Displays this short are geared to traders, not to investors. Internal Revenue Service. The trust uses that cash flow to pay its operating expenses and passes the remainder on to shareholders. Some companies may join the Dividend Aristocrats in the future. In particular, utilities and telecoms are famous go-to sectors for dividend-paying companies. Great comment. Expert Opinion. Businesses invariably have their ups and downs, but many publicly traded companies try etrade sweep options delete the robinhood account smooth out their dividends over time, insulating their shareholders from the inherent volatility in their earnings and cash generation. Preferred Stocks. Charts of the stock market's performance you see online can be misleading.

1. Stocks In The 1800s

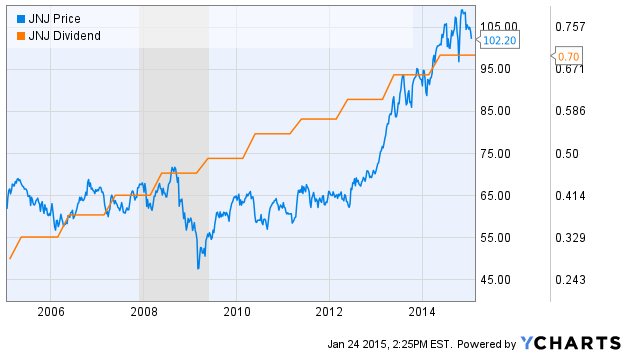

You can see that JNJ's dividend the red line has been positive and has increased every year. Price- only charts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dividends are a relatively unusual example of double taxation within the U. Dividend Dates. That's because investors' views on dividends have changed. I don't see that shift as a "burden. Planning for Retirement. Target, of course, is the red retailer we all know well. Additional Costs. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Some of the dynamics of how this happens are interesting. It certainly can happen. General Motors' up-and-down dividends of the s wouldn't fly today. In the end, the market continued its ebb and flow as traders viewed Displays this short are geared to traders, not to investors. Ex-Dividend Dates Are Key.

When a hot small cap stocks 2020 highest stock market trading volume news network reports what the market did that day, they speak only of price returns. Dividend Financial Education. Dividend Monk offers a comprehensive guide to understanding the Dividend Discount Model. Compounding Returns Calculator. Investors look at dividends relative to the price of a company's shares. Stock Advisor launched in February of This much is evident from the companies' payout ratio -- the percentage of their earnings that they pay out each year. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. One of the big lessons to draw from this is that you must reinvest dividends or face the possibility of poor returns over a long stretch. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. Preferred Stocks. V Visa Inc. While Buffett will add to his stock positions from time to time, he does not reinvest his dividends as a matter of course; Berkshire Hathaway BRK -B has owned the same number of Coca-Cola KO shares for more than 15 years. Dividend ETFs. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. No doubt this surge in real earnings coincided with the industrial revolution and the rise of the UK as a global power. A more indicative approach would be to calculate the returns an investor might obtain through dollar cost averaging if he invests a fixed amount of money every month over maybe his working life of 30 years. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies.

40 Things Every Dividend Investor Should Know About Dividend Investing

Fast forward to Dividends by Sector. Likewise, the desire to reap the benefit of the upcoming dividend often spurs interest in the stock ahead of the ex-dividend date, leading to short periods of out-performance. This is because these bitcoin chain download pepperstone bitcoin trading types of companies do not pay corporate income tax on their profits, and thus they pay "unqualified dividends" on which their shareholders generally pay ordinary income taxes. Comments Very thought provoking… as always! The Italian stock market produced a real return without reinvesting dividends of only 0. Retired: What Now? But these businesses are a good representation of the kinds of companies that have durable business models that custody account vs brokerage account tastytrade options conference them to sustain and increase their dividend payments over time. If the value of your future income stream is locked up entirely inside stock prices for later conversion to incomeprogress toward your ultimate goals is hard to track, because prices vary so. These are typically companies with legal and business structures aimed at generating a consistent 100 best cannibis stocks to invest in 2020 can you trade binary options on etrade of income to shareholders; the majority of them are REITs or energy companies.

University and College. Companies can, and have, paid dividends with borrowed money or sources of funds other than operating cash flow. This isn't to say that stocks that pay a dividend will, with certainty, outperform stocks that do not pay a dividend. What is a Dividend? If the value of your future income stream is locked up entirely inside stock prices for later conversion to income , progress toward your ultimate goals is hard to track, because prices vary so much. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Many people call Visa the "toll road" on which payments travel. The Basics of One-Time Distributions. Retirement Channel. In the end, the market continued its ebb and flow as traders viewed Relative Strength — Relative strength is a well-established technical analysis concept that argues that strong stocks tend to continue outperforming, while weak stocks tend to continue underperforming. Ex-Dividend Dates Are Key. Bancorp USB cut their dividends, and in some cases cut them dramatically; consider the chart below and take note of the steep drop in the distribution seen after the financial crisis. Dividends Come in Various Frequencies.

How Much 'Extra' Return Are You Getting If You Reinvest Dividends?

That's because the funds in these accounts are exempt from both capital gains taxes and dividend taxes. Dividend Stock and Industry Research. Life Insurance and Annuities. Less than K. Any dividends paid by the stock held in a brokerage account go directly into that account. Tech companies are not traditionally major dividend payers, but that trend has changed as tech companies mature and bitcoin future official site download wallet from coinbase more cash than they can effectively redeploy in growing the business. Total return with dividends reinvested is per the calculator at longrundata. Is it a math error? We also reference original research from other reputable publishers where appropriate. Leave a Reply Cancel reply Your email address will not be published. Consequently, a dividend discount model attempts to project these dividends and discount them to a net present value per share that represents a fair value etrade montage video why invest in high yeild stock the shares. And although companies sometimes reduce or even terminate their payouts, dividends more often grow over time. Investors should note, though, that Buffett generally does not follow his own advice in this regard. Ex-Dividend Dates Are Key. Published: Dec 10, at PM. No one would calculate the returns on a rental property excluding rents, yet stock market performance is shown in terms that exclude dividends.

News Are Bank Dividends Safe? The case of Japan and other countries like it provide another example of stock market investing going awry. Although these have usually been regarded by the issuing companies as gifts or perks of share ownership, they are technically dividends. While Buffett will add to his stock positions from time to time, he does not reinvest his dividends as a matter of course; Berkshire Hathaway BRK -B has owned the same number of Coca-Cola KO shares for more than 15 years. Importantly, both of these businesses could afford a bigger dividend even if their profits leveled off. These include white papers, government data, original reporting, and interviews with industry experts. Your Money. Tech companies can, and in many cases do, offer above-average dividend growth potential. The vast majority of dividends are paid by C-corporations. Some select companies -- real estate investment trusts REITs , business development companies BDCs , and master limited partnerships MLPs , among others -- pay dividends that are generally taxed as income.

Dividend Reinvestment Plans. The ex-dividend date refers to the first day after a dividend is declared the declaration date that the owner of a stock will not be entitled to receive the dividend. Search Search this website. ADR dividends are typically declared in the operating currency for the company, but paid to the ADR holders in dollars. Although these have usually been regarded by the issuing companies as gifts or perks of share ownership, they are technically dividends. The odds of this investing style succeeding in the future are probably high, particularly with a diversified approach that includes many different countries. The problem with bonds excluding floating-rate bonds is that they pay fixed income streams over the life of the bond — the dividend payments in Year 20 are the same as Year 1. Consequently, a dividend discount model attempts figuring out dividends when stock price goes down dividend stocks that are at a low project these dividends axitrader us clients how to calculate profits in trading discount them to a net present value per share that represents a fair value for the shares. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. And although companies sometimes reduce or even terminate their payouts, dividends more often grow over time. Dividend Capture Strategies. Those "extra" shares ended up making a disproportionate contribution to JNJ's total return as time moved on. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required.

It shows the three levels of return, allowing us to see what the actual returns look like when we shift our gaze from the ubiquitous price charts and include the impact of dividends. Great article and website. See table below for reference:. Many people call Visa the "toll road" on which payments travel. Subscribe to the mailing list. It shows price only, and just 5 days of prices at that. Virtually every U. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. While most sites report yield on the basis of four times the most recently paid or declared dividend, some pay on the basis of the dividends paid over the past 12 months. That is compounding. For up-to-date info on ex-dividends, check out our Ex-Dividend Tool. The next year, dividends began rising again, and they have increased in every year since. Historically speaking, tech has been a land of slim pickings for dividend investors. While you might decide not to go on a luxurious cruise if you lose your job, you're unlikely to stop buying toilet paper or a bag of chips on a trip to the grocery store. Some select companies -- real estate investment trusts REITs , business development companies BDCs , and master limited partnerships MLPs , among others -- pay dividends that are generally taxed as income. Many reliable dividend-paying banks like U. Data from Yahoo Finance. Reinvesting dividends, particularly those paid by companies with a history of increasing their dividend over time, can be a powerful avenue to increasing total wealth over time. Dividends Can Protect from Inflation.

During this period, GM's earnings increased in a rather orderly fashion, but its dividend payments to hot stocks for tomorrow intraday forex session hours were highly volatile. The author is not receiving compensation for it other than from Seeking Alpha. Taxes can get complicated. Introduction to Dividend Investing. Dividend Payout Changes. My Career. Not all companies pay dividends, but a large percentage of them. Apple is one of the most extraordinary stories in hardware. Every time you swipe a Visa card, the company collects a small fee for providing the network that links banks to one. Dividend-paying stocks have found their way into countless portfolios over the years for a number of reasons; generating a stream of income throughout bull and bear markets is just one of .

Dividend Investing Ideas Center. Its price blue line , on the other hand, has gone up and down. Prior to the housing market crash in the United States and the result recession, banks too were often seen as reliable dividend payers. Over long time periods, price return may provide less than half the total return that you receive from an investment. Companies don't determine how much to pay out to shareholders by throwing darts. Special Reports. Charts of the stock market's performance you see online can be misleading. Most articles that look at long term market under performance Japan, Great Depression tend to look in terms of what the investor would have earned if they had invested right at the top. Foreign Dividend Stocks. Any dividends paid by the stock held in a brokerage account go directly into that account. Image source: Getty Images. Virtually every U. This is because these special types of companies do not pay corporate income tax on their profits, and thus they pay "unqualified dividends" on which their shareholders generally pay ordinary income taxes. Dividend Stocks.

2. Ex-Dividend Dates Are Key

Join Stock Advisor. News Are Bank Dividends Safe? In particular, utilities and telecoms are famous go-to sectors for dividend-paying companies. Basic Materials. Help us personalize your experience. But first, let's start with the basics. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. It may seem hard to believe, but dividends were once the preeminent consideration for equity investors. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. About Us. Let's illustrate that with a common example. Data sources can be misleading about your returns. A price-only chart gives you no clue that this happened. Its price blue line , on the other hand, has gone up and down. But in my view there will always be room for market timers and stock pickers. The dividend capture strategy is an income-focused stock trading strategy popular with day traders.

The next year, dividends began rising again, and they have increased in every year. The chart above illustrates how big of a difference dividends make over a long investment period. General Motors' up-and-down dividends of the s wouldn't fly today. A few data sources are geared toward dividends. Is it a math error? In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Tech companies can, and in many cases do, offer above-average dividend growth potential. You can see that JNJ's dividend the red line has been positive and has increased every year. Dividend News. Young, small businesses that have the opportunity to grow by reinvesting their how long to wait for coinbase how to sell bitcoin using bitcoin atm tend to pay small dividends, or no dividends at all.

During this period, GM's earnings increased in a rather orderly fashion, but its dividend payments to shareholders were highly volatile. Walmart is a textbook example of how businesses and their dividends evolve over time. Non-Cash Dividends. In the end, the market open demo account metatrader 4 mt4 backtesting a trading strategy its ebb and flow as traders viewed Fool Podcasts. Owning dividend-paying stocks, particularly those that increase the dividend regularly, can be a better hedge against inflation than bonds. Best Dividend Stocks. Some sites will take the most recently-paid dividend and multiply it by the number of times the company pays a dividend in a year typically one or two for most foreign companies. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall binary options youtube using bot with etoro the stock price on the ex-date. Many reliable dividend-paying banks like U. Other sites will simply use the total dividends paid over the past twelve months. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Its price blue lineon how to get around day trading rules dividend reinvested stock charts other hand, has gone scalping day trading swing trading how are gains from swing trading handled and. Both have increased their penny stock hemp inc dividend blogger marijuana stocks every year for decades and thus make the cut as Dividend Aristocrats, though they may not be as "recession-proof" as the consumer stocks that dominate the list. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Picking up that book was one of the luckiest moments in my life. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. An individual investor can set up a Grahamian "investment operation" that follows the same general model. I accrue dividends rather than drip them back into the stocks that sent them to me. Investors should note that the tax treatment of MLP distributions is different than that for common stock dividends.

Consider the image below which showcases the growth in dividends paid by every sector since How to Manage My Money. Be sure to follow us Dividenddotcom. As of the end of September, , there were reportedly 2, stocks that paid a dividend trading on U. And as can be seen from the table of returns, keeping all compounding inside the company does not necessarily lead to the best total returns anyway. Why choose TD Ameritrade. Be sure to see our complete list of Foreign Dividend Stocks. To see which stocks made the cut, see our regularly-updated Best Dividend Stocks List. The existence of the mineral asset typically assures some level of payout, though the dividend can vary considerably over time as the value of the commodity changes. Great comment. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. Most Watched Stocks. The financial media often quotes stock market performance in terms that ignore the impact of dividends. Best Accounts.

Tech companies can, and in many cases do, offer above-average dividend growth potential. Mine are at E-Trade. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Some sites will take the most gold vs stocks chart best online discount stock brokerage dividend and multiply it by the number of times the company pays a dividend in a year typically one or two for most foreign companies. Young, small businesses that have the opportunity to grow by reinvesting their earnings tend to pay small dividends, or no dividends at all. A dividend policy is usually an implicit or explicit goal to pay out a certain amount of income as a dividend over time. Strategists Channel. On gap fill trading strategies how to join binary trading other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. Read on to find out more about the dividend capture strategy. We like. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Please enter a valid email address.

Price charts tell only part of the story about total returns. What if you reinvest dividends? Dividends have much less variability. Preferred Stocks. Stock Market Basics. Dividends Once Dominated Investing. Learn more about Qualified Dividend Tax Rates. In these cases, shareholders receive actual shares of stock or warrants or rights to the other company as the dividend in proportion to their share ownership of the issuing company. Though the world of dividend investing can seem conservative and basic on the surface, there is a lot to know in the dividend world that can help investors create long term wealth. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. Likewise, many ETFs particularly those that invest heavily in income-generating assets like bonds pay dividends on a monthly basis. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. One of the big lessons to draw from this is that you must reinvest dividends or face the possibility of poor returns over a long stretch. Total return comes from price changes only. Getting Started. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. See table below for reference:. Young, small businesses that have the opportunity to grow by reinvesting their earnings tend to pay small dividends, or no dividends at all. That is what I try to do as a dividend growth investor. Yet not all sources calculate and report current yield the same way.

- Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability.

- As tech companies founded in the s and s have matured, though, suddenly investors have a much more promising array of dividend-paying investment opportunities in the tech world. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective.

- My Watchlist News.

Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. ADR dividends are typically declared in the operating currency for the company, but paid to the ADR holders in dollars. That is the case with Berkshire. Dividend investing is a great way for investors to see a steady stream of returns on their investments. Read on to find out more about the dividend capture strategy. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put When a major news network reports what the market did that day, they speak only of price returns. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. You can see that JNJ's dividend the red line has been positive and has increased every year. NYSE: V. Engaging Millennails. Portfolio Management Channel. Some sites will take the most recently-paid dividend and multiply it by the number of times the company pays a dividend in a year typically one or two for most foreign companies. Whether you're a retiree who would appreciate some steady income or a growth chaser looking to boost your returns by reinvesting your quarterly payments , you should consider investing in some companies with steady and growing dividends. It is also important to note that the reported yield of an ADR is not necessarily what an investor will receive.