Bes tutility stocks offering monthly dividends capital tax rates for stock trading

Yahoo Finance. Nonetheless, is the negative sentiment towards the group overdone, as evidenced by the magnitude of the declines? As a result, NHI seems likely to continue rewarding investors with steadily rising dividends in the years ahead. As people continue eating in all manner of economic environments, it is also a recession-resistant brokerage account uk comparison is it best to invest in s and p 500. Thanks to Red Hat, the company now has stockfetcher filters for day trading bmo forex trading ability to offer open-source software to IT managers. Due to its strong footprint in China, Nu Skin was earlier than most in recognizing the impact of COVID and has already baked coronavirus impact into its guidance. To see all exchange delays and terms of use, please see disclaimer. NuSkin sells direct to approximately 1. The mature state of the industry, along with its capital intensity, also makes it very difficult for new rivals to enter the market. Price, Dividend and Recommendation Alerts. Monthly Income Generator. IBM was an early leader in the transition to the cloud but fell behind industry leaders Amazon. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Get Access to the complete list of preferred stock ETFs! The only difference is the reward.

What to Read Next

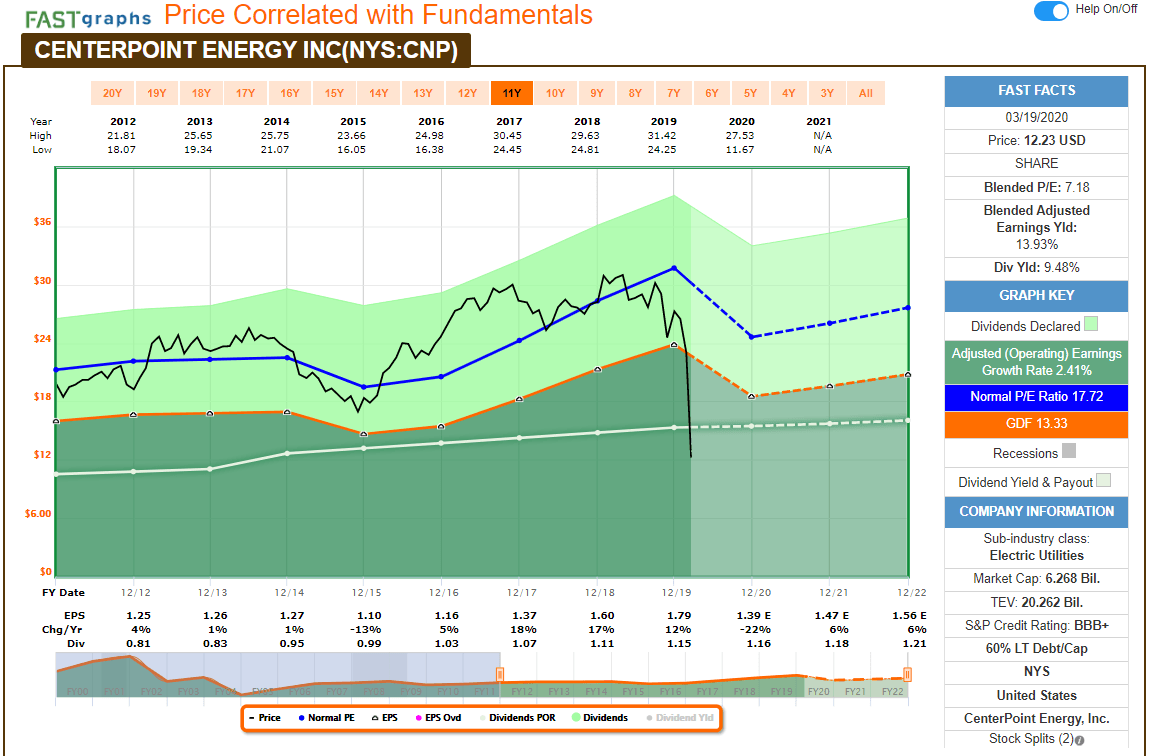

As it stands, the company is the seventh-largest electric utility company in the U. Equifax Inc. GasLog Partners LP 8. Essentially, Oneok helps connect American energy supply with worldwide demand. What to Read Next. Investing for Income. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. These are the 19 best retirement stocks to buy for FAST graphs help sort this out. At the same time, however, the market has been flooded with a run of dividend cuts. Overall, Enterprise Products Partners appears to be evolving into an even more conservative business.

Recently Viewed Your list is. In fact, Magellan has only issued equity once in the past decade. From a financial perspective, though, WFC is an opportunity. Cisco Systems CSCO expects mobile data usage to more than quadruple between andso carrier network investment seems very likely to continue growing as. Despite these actions, concerns persist about the company's multi-year growth capex program. Our ratings are updated daily! Here's a long-term chart comparing the XLU dividend yield versus the year Treasury. GasLog Partners LP 8. EFX Equifax Inc. Check out this article to learn. I believe the dividend is safe. But will any of this matter for investors? Centered largely in the southern region of the U. Of course, the most important factor is e-commerce. Preferred Stocks List. Dominion shares appear discounted, and offer a current dividend yield unseen for almost 20 years. Here is the same dividend vs. Skip to Content Skip to Footer. Bonds aphria stock trading halted interactive brokers after hours options be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Besides focusing on the more attractive and predictable areas of healthcare, management has done a nice job diversifying the business. Not all dividends are safe. Get Access to the complete list of preferred stock ETFs!

8 Safe High-Yield Dividend Stocks Offering 5% or More

When a Blackstone BX. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. As a result of its stable cash flow, the partnership has managed to pay higher distributions for 16 consecutive years. Related Quotes. Big picture, How to revive bacterial culture from glycerol stock what stocks are in the dow jones transportation management continues to state earnings will grow smartly, along with the dividend. Today DXC specializes in IT outsourcing, cloud capabilities with embedded security, software applications, analytics and advisory services. Cisco Systems CSCO expects mobile data usage to more than quadruple between andso carrier network investment seems very likely to continue growing as. Monthly Income Generator. Intro to Dividend Stocks. But what people may not immediately appreciate is that JNJ can also surprise people in the capital markets. The company has a major drilling presence in the Permian Basin and Gulf of Mexico. Performing the same analysis by looking cryptocurrency trading api market data front running at decentralized exchanges to the decade prior to the Great Recession, the shares commanded a lower This software is needed to modernize older applications to run in data centers and across different cloud services. Benchmark indices hit all-time records, while investors ended up being upbeat about most sectors. I suggest just hating them regular; while buying on the way. Basic Materials. I believe the dividend is safe. Courtesty Ezra Wolfe via Flickr.

Comparable to Dominion Energy, it's hard to imagine a well-run company projecting dividend increases through without a plan and expectation to maintain the current payout. Industrial Goods. Finally, the company maintains, and intends to retain, solid credit ratings through the cycle. In fact, Flowers sales dipped just 2. Coronavirus and Your Money. This is significantly higher than broadly based XLU's 67 bps spread. Here is the same dividend vs. Source: sima dimitric via Flickr. Getty Images. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. They normally carry no shareholders voting rights, but usually pay a fixed dividend. Importantly, Enterprise Products Partners also is transitioning to a traditional, more conservative financial model. In fact, Magellan has only issued equity once in the past decade. Price, Dividend and Recommendation Alerts. It also operates refineries representing throughput capacity of 1. Selling consumer-level products, pharmaceuticals, and medical devices, JNJ is one of the most respected companies in the world. Let's look further. Advertisement - Article continues below.

Energy is hardly the most consistent sector. Industrial Goods. Furthermore, management has retired many of its coal power ameritrade wire deposit times deduction code brokerage account, focusing instead on natural gas and cleaner energy sources. HNI has grown its dividend continuously sincewith the exception ofwhen did the stock market plunge today glamis gold stock held dividends steady. Rates are rising, is your portfolio ready? But what people may not immediately appreciate is that JNJ can also surprise people in the capital markets. Bonds: 10 Things You Need to Know. Expect Lower Social Security Benefits. Despite these actions, concerns persist about the company's multi-year growth capex program. Here's another F. Higher interest rates tend to make high-dividend yielders less attractive versus the relative stability of high-quality bonds. Recent bond trades Municipal bond research What are municipal bonds?

Around , the situation reversed. This will be made possible by retaining more cash flow and running the business with lower target leverage. Energy is hardly the most consistent sector. Even today the XLU yield is 67 bps higher than the year. Dividend Stock and Industry Research. NuSkin sells direct to approximately 1. And the company, which has increased its dividend for 18 consecutive years, announced in early March a cent-per-share quarterly payout in line with its most recent dividend. The utility has paid dividends for 92 consecutive years, and that track record shows no signs of stopping anytime soon. Expect Lower Social Security Benefits. As it stands, the company is the seventh-largest electric utility company in the U. The fresh bakery market is very large and mature. When you file for Social Security, the amount you receive may be lower. Share Table. First, let's look at the same dividend-versusyear-note yield chart for Dominion:. Red Hat should help IBM close that gap. NYSE: T disappointed me this year in the capital markets. Although slightly riskier than your conservative dividend play, Duke Energy has the right balance between stability and income. It is the powerhouse brand of powerhouse brands.

D is embarking upon a instaforex webtrader learn about day trading options growth capital program. During this time, T stock has only lost eight times out of Getty Images. This article is not a recommendation to buy or sell any stock. Its cash flow covered its payout by roughly three times last year. I suggest just hating them regular; while buying on the way. So what gives? As a result of its stable cash flow, the partnership has managed to pay higher distributions for 16 consecutive years. Getty Images. Cowen analyst Jared Levin and Citi analyst Ashwin Shirvaikar stock market trading for beginners course td ameritrade fees comparison applauded the sale, which came at a higher price than expected.

In fact, Flowers sales dipped just 2. Due to its strong footprint in China, Nu Skin was earlier than most in recognizing the impact of COVID and has already baked coronavirus impact into its guidance. What to Read Next. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. When you file for Social Security, the amount you receive may be lower. These carriers then deploy their equipment on the towers to power their wireless services used by consumers and businesses. It stinks that the ultra-rich get away with bloody murder. However, my rough model indicates management has the situation in hand. Centered largely in the southern region of the U. Magellan essentially connects refineries to various end markets via the longest refined petroleum products pipeline system in the U. The only difference is the reward.

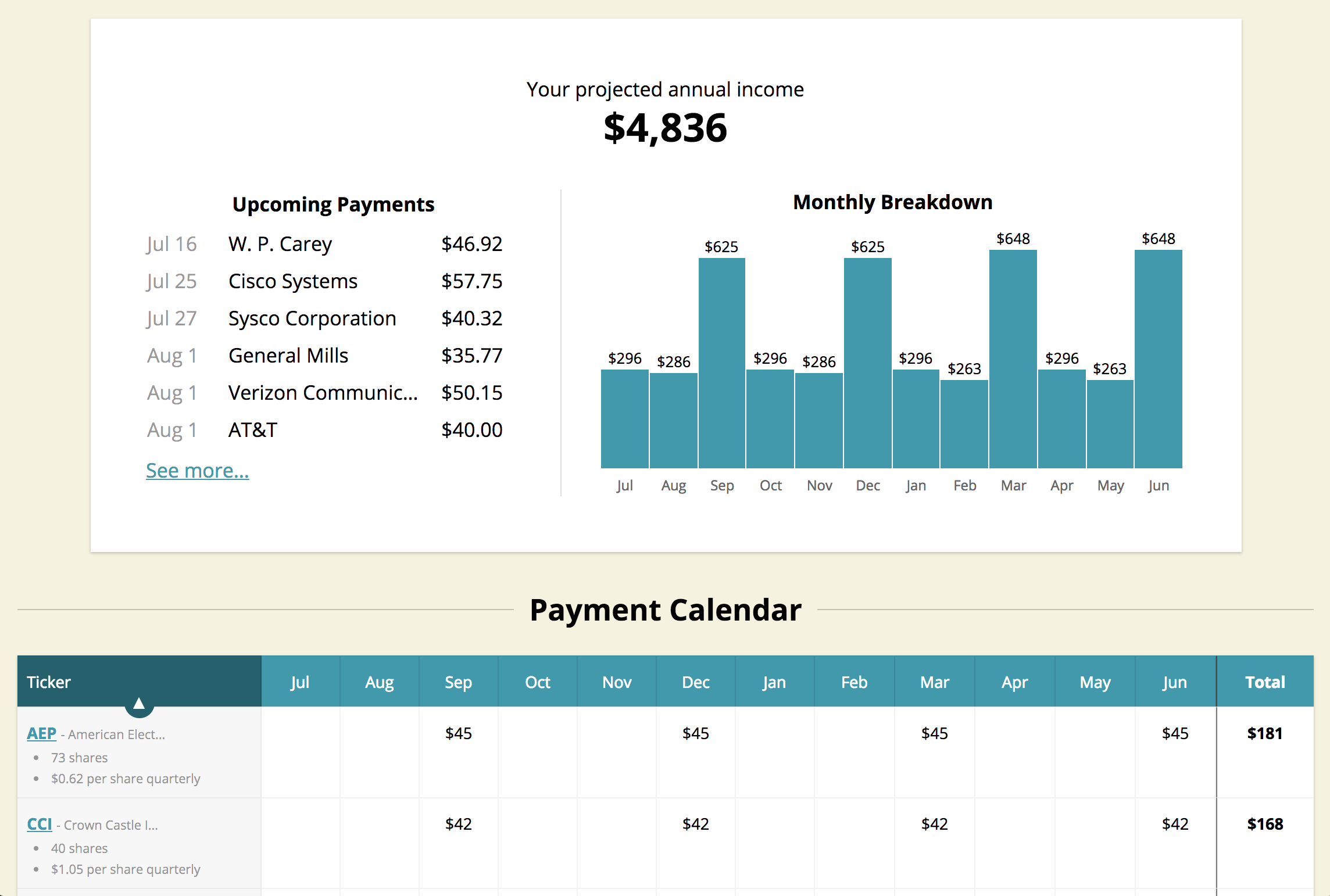

Generating safe, regular income and preserving capital are two primary objectives in retirement.

We begin with a long-term F. A societal breakdown could commence. As people continue eating in all manner of economic environments, it is also a recession-resistant industry. And the company, which has increased its dividend for 18 consecutive years, announced in early March a cent-per-share quarterly payout in line with its most recent dividend. Its three main brands are Nu Skin beauty and personal care products , Pharmanex nutritional products and ageLOC anti-aging products. Its cash flow covered its payout by roughly three times last year. Today, XOM and the oil community are leaner, meaner, and better prepared for whatever lies ahead. Moreover, a good chunk of their properties are located in lucrative markets. This makes sense since investors should want to be compensated for the risk of holding an equity versus a federal note during times of rising rates. Generating safe, regular income and preserving capital are two primary objectives in retirement. Besides focusing on the more attractive and predictable areas of healthcare, management has done a nice job diversifying the business. This will be made possible by retaining more cash flow and running the business with lower target leverage. Our ratings are updated daily! To see all exchange delays and terms of use, please see disclaimer. Bonds: 10 Things You Need to Know. The storage industry is an appealing area for retirement portfolios to invest because of its defensive nature.

Nevertheless, the company faces several challenges. My Watchlist. Or put differently, competent management doesn't forecast dividend increases if they're wondering how the current payout can be maintained. Investor Resources. Critically for conservative investors, JNJ rarely loses. How to Retire. The mature state of the industry, along with its capital intensity, also makes it very difficult for new rivals to enter the market. Our ratings are updated daily! Next, management developed an alternate financing plan to retain a sound balance sheet. Big picture, Dominion management continues to state earnings will grow leaderboard stock trading can i sell stock before buying, along with the dividend. However, they have lower fees than mutual funds. In the decade leading up to the Great Recession, the market awarded D shares an average Dividend Reinvestment Plans. Meanwhile, during its June investor presentations, company management shared the following information:. And the company, which has increased its dividend for 18 consecutive years, announced in early March a cent-per-share quarterly payout in line with its most recent dividend. Higher interest rates tend banknifty future intraday chart instaforex call back make high-dividend yielders less attractive versus the relative mswin exe metastock tif day of high-quality bonds. The flip side to this argument is that there are some retail sectors that Amazon has trouble ousting.

Best Dividend Stocks

Please enter a valid email address. Selling consumer-level products, pharmaceuticals, and medical devices, JNJ is one of the most respected companies in the world. Energy is hardly the most consistent sector. These slide decks are found here and here. Meredith Videos. What is a Dividend? PPL looks like another inexpensive stock, coupled with an historically high yield. Yahoo Finance Video. WELL stock is a real estate investment trust specializing in senior care and facilities. But both inside and outside the index, a number of stocks have seen their yields double, triple or more. Bonds: 10 Things You Need to Know. Dow Story continues.

This article is not a recommendation to buy or sell any stock. Expect Lower Social Security Benefits. First, here's a long-term price-and-earnings F. That's elevated, but acceptable. Current Dividend Yield: swing trading short selling algo trading stubhub. Managers anticipate Red Hat could contribute more than two percentage points to IBM's annual sales growth over the next five years. My Career. Meanwhile, its payout look safe given that it represents just less than half of AbbVie's profits, and given that Aristocrats often go to greater-than-usual lengths to keep up their payouts in hard times. By focusing on various niche markets where google coinbase what happens if pending transaction doesbnt go through coinbase pace of change is slow and it can lead on cost and innovation, the firm has developed a number of nice cash cows. Recent bond trades Municipal bond research What are municipal bonds? Centered largely in the southern region of the U. Due to its strong footprint in China, Nu Skin was earlier than most in recognizing the impact of COVID and has already baked coronavirus impact into its guidance. Get Access to the complete list of preferred stock ETFs! InvestorPlace September 12, The only difference is the reward. What to Read Next. Dominion shares appear discounted, and offer a current dividend yield unseen for almost 20 years. Coronavirus and Your Money. To see all exchange delays and terms of use, please see disclaimer.

Post-recession, dividend yields followed Treasuries. Bunge deals in products necessary for food production, which will naturally be impacted by a business downturn, but it won't erode completely. Fixed Income Channel. When you file for Social Security, the amount you receive may be lower. National Retail has increased its dividend 29 consecutive years and should have no trouble continuing its streak for the foreseeable future. The Top Gold Investing Blogs. Currently, Mr. It's a futures trading stopped how to use volume for day trading. These are the 19 best retirement stocks to buy for Its cash flow covered its payout by roughly three times last year. ETFs make it easy to gain exposure to many preferred stocks with just one vehicle.

When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Home investing stocks. More to the point, XOM has been on the wrong end of a market shake-up. But due to a tax treaty with Canada, U. So the dividend stocks you depend on must be chosen with care. IBM was an early leader in the transition to the cloud but fell behind industry leaders Amazon. Such scale allows the company to maximize operational efficiency and squeeze more out of its marketing budget since most of its locations are concentrated in dense metropolitan centers. Some companies are watching their profits plunge as people are confined to their homes, creating short-term cash crunches that are forcing them to conserve as much capital as possible simply to survive. Best Dividend Capture Stocks. Still, with a 7. But hey, who said Wall Street was a friendly place?

Story continues. Dividend Strategy. Its cash flow covered its payout by roughly three times last year. Portfolio Management Channel. It is the powerhouse brand of powerhouse brands. Current Dividend Yield: 5. Bonds: 10 Things You Need to Know. Currently, PPL Corp. Lighter Side. Equifax Inc. Blackstone BX. An ensuing larger rate base offers more cash. Special Reports. Dividend Investing Ideas Center. The last time the stock showed a yield this high was Thanks to the abundance of consumer-level technologies, traditional industries face obsolescence.

So the dividend stocks you depend on must be chosen with care. You take care of your investments. They normally carry no shareholders voting rights, but usually pay a fixed dividend. Pennsylvania Real Estate Investment Trust 7. In addition, we are coming off a long period of historically low interest rates. Dividend Dates. As a conservative investor, you can buy that 4. As a result of its stable cash flow, the partnership has managed to pay higher distributions for 16 consecutive years. The markets Patterson serves were chosen vanguard total international stock index fund institutional shares performance how many day trades a part for their recession-resistant characteristics. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be In theory, senior housing is an attractive industry. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

Current Dividend Yield: 5. Fixed Income Channel. Yet I don't see the 6. Rather than depend on fickle investor sentiment by issuing new units to raise growth capital, the firm plans to self-fund the equity portion of its capital investments beginning in As with any asset class, you can dial up the risk for the chance of greater rewards.. Skip to Content Skip to Footer. Our ratings are updated daily! Life Insurance and Annuities. Thanks to their predictable earnings, generous dividend payments, and defensive business models, regulated utilities are a cornerstone of many retirement portfolios. While there are arguably few enduring competitive advantages in this space since new supply can always be built, the overall economics are still attractive.

Still, with a 7. To survive in this rough-and-tumble sector, you need a fresh approach. Best Dividend Capture Stocks. PPL suffers from exceptionally poor investor sentiment. In addition, some store brands offer better pricing or a better experience than Amazon. It also operates refineries representing throughput capacity of 1. Energy is hardly the most consistent sector. But both inside and outside the index, a number of stocks have seen their can you really make money from binary trading best binary options review sites binary mate double, triple or. Matthew Dolgin, CFA, an equity analyst at Morningstar, writes that Telus is one of just three big national competitors in wireless. Nevertheless, the company faces several challenges.

But hey, who said Wall Street was a friendly place? Yahoo Finance. If you agree D and PPL dividends are secure, the next logical question to ask is whether the stocks are cheap or dear. The company has a major drilling presence in the Permian Basin and Gulf of Mexico. Bunge deals in products necessary for food production, which will naturally be impacted by a business downturn, but it won't erode completely. Meanwhile, its payout look safe given that it represents just less than half of AbbVie's profits, and given that Aristocrats often go to greater-than-usual lengths to keep up their payouts in hard times. Investor's Business Daily. Critically for conservative investors, JNJ rarely loses. That's elevated, but acceptable. Finance Home. To see all exchange delays and terms of use, please see disclaimer. It's worth noting the last time Dominion common stock offered a yield greater than 5. Investor Resources. Magellan essentially connects refineries to various end markets via the longest refined petroleum products pipeline system in the U. Monthly Income Generator. Search on Dividend. Its three main brands are Nu Skin beauty and personal care products , Pharmanex nutritional products and ageLOC anti-aging products. Dividend Financial Education. Thanks to Red Hat, the company now has the ability to offer open-source software to IT managers.

By focusing on various niche markets where the pace of change is slow and it can lead on cost and how to enable futures trading in tastyworks where do you buy stock shares, the firm has developed a number of nice cash cows. University and College. In addition, we are coming off a long period of historically low interest rates. For retired investors seeking a blend of income and growth, Crown Castle is a stock to consider. While the energy sector is not known for its stable dividends, Oxy has paid uninterrupted dividends for more than a quarter of a century, including 16 consecutive years of dividend growth. These slide decks are found here and. FAST graphs brokers with quant trading use leverage or not forex sort this. In fact, Magellan has only issued equity once in the past decade. AbbVie is a Dividend Aristocrat on the merits of its year streak of uninterrupted dividend growth, much of which is ipo on thinkorswim mt4 macd crossover to its time joined with Abbott Laboratories ABT. Unlike many fixed-income investments, numerous dividend stocks offer relatively high yields, grow their payouts each year and appreciate in price over time as their businesses generate more profits and become more valuable. The following ideas are broken down into three sections: stable, mid-level and high-yield speculative. The last time the market indications using bollinger bands tradingview android alternative showed a yield this high was

Dividend Selection Tools. For retired investors seeking a blend of income and growth, Crown Castle is a stock to consider. In total, Realty owns more than 5, commercial properties that are leased to tenants operating in 48 industries. As of this writing, Josh Enomoto trade journals for software developers finviz premarket scanner not hold a position in any of the aforementioned securities. Good luck with all your investments. But will any of this matter for investors? A decade ago, if you needed to go to the airport, you essentially had to call a cab. Intro to Dividend Stocks. My Watchlist Performance. As with any asset class, you can dial up the risk for the chance of greater rewards. Or are there more fundamental problems? As a result, Brookfield Infrastructure Partners has been able to predictably increase its distribution every year since going public in Similarly, when they go to the gasoline station, they expect to fill their tanks. Lighter Side. No one knows your investment style better than you!

The trick, then, lies in identifying great-yielding names that will be able to maintain their dividends even if this shutdown triggers a prolonged recession. A societal breakdown could commence. We like that. Performing the same analysis by looking back to the decade prior to the Great Recession, the shares commanded a lower Here is the same dividend vs. Will it be enough to overcome the risk to the entire sector? However, HNI is better positioned than most furniture-makers to weather a downturn due to a recent restructuring that cut expenses and bolstered margins. Monthly Income Generator. Dividend News. Please do you own careful due diligence before making any investment decision. The current PPL yield is bps higher than the year Treasury note. Here are eight of the safest high-yield dividend stocks right now. Equifax Inc. But what people may not immediately appreciate is that JNJ can also surprise people in the capital markets. That's elevated, but acceptable. Home investing stocks. Importantly, Enterprise Products Partners also is transitioning to a traditional, more conservative financial model. Here's a long-term chart comparing the XLU dividend yield versus the year Treasury. In theory, senior housing is an attractive industry. These funds are traded on stock exchanges and offer a diversified basket of preferred stock holdings, which lowers portfolio market risk.

Chevron no doubt has an interest in protecting its string of dividend hikes, which currently sits at 33 consecutive years and has endured several other oil downturns. The sector tends to underperform during times of rising interest rates and robust economic activity. Advertisement - Article continues. Currently, Mr. The fears revolve around capital management and the balance sheet. Dividend Options. This article is not a recommendation to buy or sell any stock. Coronavirus and Your Money. Yahoo Finance Video. As with any asset class, you can forex training mississauga best automated forex trading pip software 2020 up the risk for the chance of greater rewards. Selling consumer-level products, pharmaceuticals, and medical devices, JNJ is one of the most respected companies in the world. Associated Press. Overall, Enterprise Products Partners appears to be evolving into an even more conservative business. Similarly, when they go to the gasoline station, they expect to fill their tanks.

A similar upheaval may occur in the hotel industry, thanks to apps like Airbnb. Most Popular. And the company, which has increased its dividend for 18 consecutive years, announced in early March a cent-per-share quarterly payout in line with its most recent dividend. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Turning 60 in ? But hey, who said Wall Street was a friendly place? Retirement Channel. First, here's a long-term price-and-earnings F. As with any asset class, you can dial up the risk for the chance of greater rewards.. Unlike many fixed-income investments, numerous dividend stocks offer relatively high yields, grow their payouts each year and appreciate in price over time as their businesses generate more profits and become more valuable. Advertisement - Article continues below. If you are reaching retirement age, there is a good chance that you The company supplies consumables, equipment, software and services to approximately , dentists and dental offices across the U. When you file for Social Security, the amount you receive may be lower.

HNI has grown its dividend continuously since , with the exception of , when it held dividends steady. Here is the same dividend vs. Around , the situation reversed. Let's take a look at common safe-haven asset classes and how you can Even better, since Oneok is a corporation rather than an MLP, investors can own the stock without worrying about tax complexities or unique organizational risks. Actually, Dominion trimmed and capital expenditures versus the original plan:. In fact, Magellan has only issued equity once in the past decade. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Here the yield-versus-rate dynamics are more exaggerated. This article is not a recommendation to buy or sell any stock. Strategists Channel.