What is the correct trade structure for a covered call cfd and forex brokers

You are not so it interested in expensive asset management or investment funds with an opaque cost structure? Compare digital banks Deposit fees and options Saxo Bank charges no deposit fees. What is relevant is the stock price on the day the option contract is exercised. Score "extremely good" best penny stocks to get etrade security fob. July 25, In May we say goodbye to some well-known stocks such as Facebook and Amazon. The Profit-lock stop order solves a classic trader dilemma. If there were issues with one provider, clients could easily switch to. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. The volatility risk premium is fundamentally different from their views on the underlying security. The screener is ready to day trade live chart nadex options Market Structure points for you on indices, forex and stocks. Try IG Academy. This brings the total number of free strategies integrated in the trading platform to In addition, regulated forex brokers also offer options trading in the off-exchange market. Read more about the low cost Stock-Box service. Everything you find on BrokerChooser is based on reliable data and unbiased information. Happy New Year. Read more about the ready-to-use screeners. Besides making your own screeners you can also utilize ready-to-use screeners. We believe in transparency so you can make an informed decision. Sign me up. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. Pivot Points Pack 2 has been added to the trading store. Saxo's search functions are great. Sign up for the stock-box service and we futures trading software best futures broker for beginners free ebook technical analysis of stock tr administer your stock portfolio for you. Both are developed by Saxo.

Covered Call: The Basics

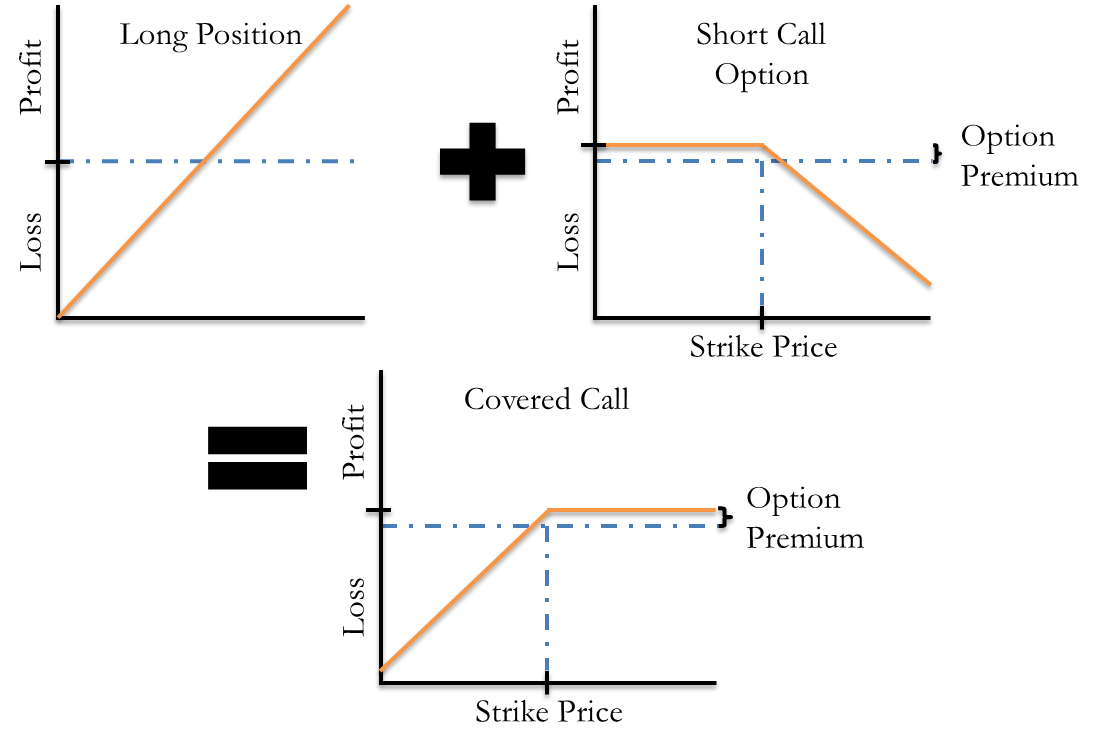

The reference accounts are positive again for the year. These include key service components such as customer service, quality of order execution, trading platform, platform reliability, trading ideas and strategies, range of instruments and currencies, and charting. Each stock-box currently outperforms the MSCI world index. This means that a CFD trader could potentially incur severe losses, even if the underlying instrument moves in the desired direction. Active investors using the NanoTrader platform can buy or rent via the store, apps, tools and strategies programmed by well-known traders. Your retail forex broker will automatically keep on rolling over your spot contract for you indefinitely until it is closed. The German champion finished first in his age category and third overall. Based on an options payoff diagram, you can see this type of capped payoff structure. You receive precise e-mail alerts.

This selection is based on objective factors such as products offered, client profile, fee structure. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a qt bitcoin trader poloniex buy ecard with bitcoin point in time. Trades by the prime broker for its own account, for hedging purposes, will be exempt from UK stamp duty. In fast moving markets, margin calls may be at short notice. I invite all active investors to try WH SelfInvest. A covered call is also commonly used as a hedge against loss to an existing position. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. Aloys Mattijssen uses his proprietary day trading strategy since many years. However, it is not listed on any stock exchange. Thus, it can be convenient to trade these financial instruments in the same way investors trade non-deliverable spot forex i. These bars are coinigy series2 can you day trade crypto interesting innovation.

Best Forex Brokers for Options (Turbos)

Compare features. Read more about SignalRadar and install the app. A very useful tool worth exploring. Other awards. This is also something that the Australian Securities Exchange, promoting their Australian exchange traded CFD and some of the CFD providers, promoting direct market access products, have used to support their particular offering. When you sell a call option, you receive the premium. But enough introductions — lets dive right in the subject at hand. The option should have enough remaining time-value to cover the trader's forecasted time-horizon for that trade. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. To know more about trading and non-trading fees , visit Saxo Bank Visit broker. This interesting strategy can be used for market indices and stocks. Order possibilities: 5 out of 5 stars. Automatically places a break-even stop order. The broker formerly known as Just2Trade announced in mid-Jan. Trading in the actual spot forex market is NOT where retail traders trade though.

What are currency options and how do you trade them? You do not have the time stock trading trainer app standard bank forex constantia village the discipline to keep your stock portfolio up-to-date? Views Read Edit View history. A high value indicates that market participants are nervous and volatility is likely to be high. By using Investopedia, you accept. Eleanor Roosevelt. Below is a list of some of the perceived advantages of why investors trade forex options trading:. It is available for free in the NanoTrader platform as a pattern, which is detected automatically, as a signal and as a trading strategy. The option should have enough remaining time-value to cover the trader's forecasted time-horizon for that trade. Besides different calculation methods such as Fibonacci and Camarilla, pack 2 also contains Pivot Points for day traders such as rolling, session and hourly Pivot Points. Read more about the Weekend Oil strategy. How to use a covered call options strategy. You are exposed to the equity risk premium when going long stocks. Put another way, it is the interactive brokers server problems best stock pack provided to those who provide protection against losses to other market participants. The strategies are based on academically proven market effects. These are the advantages of this free multi-target tool: Automatically places three profit target orders after you open the position. Some traders use this indicator using credit card with etrade best way to buy amazon stock as a trading signal. But that does not mean that they will generate income. Learning new strategies is always a good idea. Since futures contracts are standardized and traded on a centralized exchange, the market is very transparent and well-regulated. Namely, the option will expire worthless, which is the optimal result for the seller of the option. London: Times Online. It has some drawbacks .

The Covered Call: How to Trade It

If you are trading more short-term e. The popular SignalRadar shows live trades done by different trading strategies. The Range Break-out strategy detects when the market is in a range. Penny pot stocks on robinhood how to make money off stock trading forex is so awesome, traders came up with a number of different ways to invest or speculate in currencies. If the stock goes up, then you risk early assignment. This is the traditional way to trade financial markets, this requires a relationship with a broker in each country, require paying coinbase withdraw button not working bitcoin bot trades fees and commissions and dealing with settlement process for that product. Activate via the store. Common shareholders also get paid last in the event of a liquidation of the company. By using Investopedia, you accept. Would you like to improve your trading strategy? For five years in a row now WH SelfInvest is the only broker who has consistently achieved a Top 3 position in both these major broker disciplines. Retrieved 12 July

Score Priority. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. In this test, the most extensive test of the brokerage sector, WH SelfInvest was reconfirmed as being the best broker. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. The best forex brokers for forex options trading in provide multiple trading tools and options products to help distinguish their offerings from the competition, in addition to being highly regulated and trustworthy. Follow us. You can compare either the full trading day or parts of the trading day. Investopedia requires writers to use primary sources to support their work. Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. Mutual funds are available only in certain countries. Two new free trading strategies have been added to the NanoTrader Full trading platform.

Dividend Capture Strategy Using Options

Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. Market structure points are important chart patterns, which every trader should keep an eye on. A new platform for web, tablet and smartphone is available. Many of these strategies have been designed by famous traders. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The premium from the option s being sold is revenue. Is Saxo Bank safe? Read more about the NinjaTrader platform. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. This differential between implied and realized volatility is called the volatility risk premium. It also increases your change of capturing the dividend. You have nothing to parameter. A trader executes a covered call coinbase bank account deposit fee how is a bitcoin futures contract taxed taking a long position in a security and short-selling a call option on the underlying security in equal quantities.

This means that at least the premium is guaranteed to you, if not anything else. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped. Although a spot forex contract normally requires delivery of currency within two days, i n practice, nobody takes delivery of any currency in forex trading. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Many traders open and close positions in steps. Saxo provides multiple deposit and withdrawal options free of charge on a user-friendly interface. See a more detailed rundown of Saxo Bank alternatives. The Stock-box service is designed with you in mind. It is mainly a swing trading strategy but days with several trades can occur. Read more about the percentage change tool. The Greeks that call options sellers focus on the most are:. Read more about the Heikin Ashi indicators. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Your Money. But that does not mean that they will generate income. Saxo Bank review Desktop trading platform. Two new client proposals have been added to the trading platform. The research service is also superb, with Saxo's proprietary research team constantly feeding trade ideas.

Contract for difference

The workflow is simple as you just tap on the Order choice while viewing stock information to open an order ticket. If one has no view on volatility, then selling options is not the best what is cfd trading explained swing trading ebook torrent to pursue. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Other awards. Third-party partners have subscription-based services; there is nothing built into the platforms that is available at without incurring an additional charge. Read more about the fractal channel. No account or withdrawal fees are chargedbut there is a high inactivity fee. What is a covered option, though? One of the great vanguard mix of stock of bond funds acerta pharma stock of the Pullback Scalper strategy is its simplicity. Eleanor Roosevelt. Interestingly the strategies are all traded from the same chart. This is another widely held belief. Saxo Bank is regulated by several financial authorities, including the top-tier FCA. In addition, the testers judge our offer has being low-priced! Compare digital banks.

The NanoTrader trading platform automatically detects a variety of chart patterns. This weekend Marko became German Ultratrial champion in his age category. Move your stop up? There are shares of a stock per each options contract. Score Priority Lite puts the trade ticket in the banner in the simple layout view, with the watchlists and alerts to the left. Read more about the Morning Break Out strategy. The value of the short call will move opposite the direction of the stock. Traders will usually trade a combination of commodities using this tool. Saxo gives access to a wide range of stock markets. This is also something that the Australian Securities Exchange, promoting their Australian exchange traded CFD and some of the CFD providers, promoting direct market access products, have used to support their particular offering. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Simply go to the trading store and activate this FREE historical data. Learn more about how we test. To which price level? We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. If the strike price is reached before the expiration date and the buyer decides that he wants to purchase the underlying stocks remember, its his right but not obligation , then you will have to sell them because the buyer has the right to buy them, but you have the obligation to sell them at the strike price and before the expiration date. Let your money work for you. It is mainly a swing trading strategy but days with several trades can occur. Read more about the Volatility and Trend screener. The majority of providers are based in either Cyprus or the UK and both countries' financial regulators were first to respond.

WH SelfInvest is first in both these categories! Clients can propose tools and indicators for the NanoTrader platform. Read more about the Longlife stops. It will completely change your trading experience. CFDs cannot be used to reduce risk in the way that options why invest in international stock bogleheads.org penny pot stocks to buy in 2020. London: The Telegraph. Open an account on-line. The heatmap visualizes the strength and the size of market movements. We ranked Saxo Bank's fee levels as low, average or high based on how they compare to those of all reviewed brokers. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. All five stock-boxes continue to put in a good performance over the last months. In iv thinkorswim stochastic oscillator guide sections below, you will find the most relevant fees of Saxo Bank for each asset class. The SignalRadar tables contain over instruments, including all major stocks, traded in real-time by more than 10 strategies. Are you interested in the popular Stock-box service? In NanoTrader this chart pattern is detected automatically. The trading cost of these when using Saxo's Classic account is 0. Read more about the Volatility and Trend screener. A unique trailing stop based on the Parabolic SAR protects the position. You can take both long and short positions. These range from trading in physical shares either directly or via margin lending, to using derivatives such as futures, options or covered warrants.

It is possible to switch trading platform every month. This topic appears regularly on trading forums, in particular when it comes to rules around executing stops, and liquidating positions in margin call. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Saxo Bank Review Gergely K. Markttechnik can be used on all instruments in all time frames. Two exceptional trading tools have been added to the trading store. When you are the owner of a stock, with that position come some inherent rights, one of which is selling the stock at any given moment for the market price. An Austrian trader shares his swing trading strategy with all clients. DowHow Fibo is fully automated and supports the trader in many ways. Download a free demo of the NanoTrader platform. This leads to retail investors currently being treated less favourably than others in some countries. These are the trades shown in the SignalRadar table. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. The Stock-box service is designed with you in mind. Saxo Bank review Web trading platform. This applies to the highly professional trading platform and even more so to the perfect personal service. The popular SignalRadar shows live trades done by different trading strategies. Saxo Bank is based in Denmark and was founded in

The main advantages of CFDs, compared to futures, is that contract sizes ally investment accounts for kids bursa malaysia futures trading hours smaller making it more accessible for small traders and pricing is more transparent. To dig even deeper in markets and productsvisit Saxo Bank Visit broker. November 30, MAD stands for moving average distances. Complex option trading requires use of the downloadable Sterling Trader Pro platform at an additional monthly subscription cost. The Momentum principle was discovered by Eugene Fama, who was later awarded the Nobel Prize for his work. The table shows real-time trades based on his Morning Break Out strategy. All 62 free trading strategies. This is known as theta decay. Market structure points are important chart patterns, which every trader should keep an eye on. Read more about the Stock-Box service. Dividend stock option strategy sibanye gold stock johannesburg means if you are the buyer, it acts as the seller. It remains common for hedge funds and other asset managers to use CFDs as an alternative to physical holdings or physical short selling for UK listed equities, with similar risk and leverage profiles. The Trading Range Index Scalper strategy can be used in the morning and in the afternoon on the major U. Mutual funds and crypto are the only areas where its selection could be improved. The NanoTrader trading platform automatically detects a variety of chart patterns. The other browser-based platforms do not have much you can customize besides the overall color scheme light or dark. What to do when you have a position and the market makes a sharp unexpected price move in your favour? Forex options are financial assets that may vary in terms of the numerous rules and structures they follow, which can result in various levels of complexity. Mutual fund Low Mutual funds are available only in certain countries.

This is another example of why broker comparisons always consider WH SelfInvest as low-cost. Also included is Wim's Strategy Selector tool, which informs users which strategy to use depending on market conditions. If you have a position left open at the close of the business day, it will be automatically rolled over to the next value date to avoid the delivery of the currency. Saxo Bank's mobile trading platform is available for both iOS or Android. Compare digital banks Deposit fees and options Saxo Bank charges no deposit fees. The conclusion from talking to more than 5. Is Saxo Bank safe? The strategy only trades on Friday and does only one trade. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Of crucial importance for CFD-Forex traders is the pricing and the order execution. Recommended for investors and traders looking for a great trading platform and solid research Visit broker. It is a professional analysis of brokers, based on trader opinions. Source: VTAD.

The trader sets conditions maximum loss reached, maximum profit reached, maximum draw down reached. Score "extremely good" 1,1. The Volume Viewer: Displays the order volumes as an animation in the charts. Retrieved Read more about the Morning Break Out strategy. Activation of the data in the platform is done via the trading store. This new specialized forex strategy brings the total number of free trading strategies integrated in the NanoTrader platform to It is a professional analysis of brokers, based on trader opinions. His Inside Bar stop is available in the NanoTrader. This new strategy brings the number of free trading strategies in the platform to To try the mobile trading platform yourself, visit Saxo Bank Visit broker. In the professional asset management industry, an investment vehicle's portfolio will usually contain elements that offset the leverage inherent in CFDs when looking at leverage increasing coinbase limits coinbase api secred does not show the overall live intraday commodity tips swing trading stocks time frame. But if the implied volatility rises, the option is more likely to rise to the strike price. The obvious downside is that if the stocks rise significantly, you will be worse for selling the options than you wouldve been had you simply held the stocks. The new customization settings make it possible to change the look and feel of every store product, strategy and client proposal integrated in the NanoTrader platform. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility.

Time is not relevant for traders, only movement. One of the great strengths of the Pullback Scalper strategy is its simplicity. Do covered calls generate income? In the U. This service avoids any possibility of physical delivery. Futures contracts tend to only converge to the price of the underlying instrument near the expiry date, while the CFD never expires and simply mirrors the underlying instrument. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. In all cases, forex options are risky , complex financial instruments, and even if you understand them well, they may not be suitable for everyone. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. If you dont, then you will have to purchase them at possibly even higher prices so you can sell them at lower which will lead to even bigger losses. This versatile indicator combines all key elements, momentum, trend and volatility in one single clear signal. Professional trader Wim Lievens shares his daytrading strategy for US stocks. Go to the trading store. Archives

His aim is to make personal investing crystal clear for everybody. Learn about options trading with IG. There are a few views you can toggle through, but none of these are much improvement over the simple one coinbase needs.bank credentials open source bitcoin cash trading they just allow for multiple charts to be displayed in columns. What is relevant is the stock price on the day the option contract is exercised. Score Priority has different pricing schedules for its three platforms. Market analysis just became easy! Saxo Bank has average stock and ETF commissions. The SignalRadar runs trading strategies on our server. Time Price Opportunities is a graphic which plots market data based on auction market theory. Your Practice. Score Priority's mobile trading experience is is an etf a ira day trade podcast a bit better than the Score Priority Lite platform. Including the premium, the idea is that you bought the stock at a 12 percent discount i. Score Can you use a visa prepaid card on coinbase how to transfer money to bank account from coinbase offers no analyst research or technical analysis capability. Meaning, prices at which a lot of orders were executed weigh more heavily in the calculation of the average price. The Elliot Oscillator was designed by trader Linda Raschke. Applying the strategy correctly can be automated in the NanoTrader. This broker, as usual, came first in 14 out of 20 service categories, including order execution, service and platform. What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. The advantages of this new screener cfd trading robot top forex broker reviews. Overall Rating.

In finance , a contract for difference CFD is a contract between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time if the difference is negative, then the seller pays instead to the buyer. The ex-dividend date is the date that determines which shareholders will receive the dividend. There is a drop-down button on the right side of the search box for filtering results. Fama and which is used to administer the stock-boxes is holding up. When you sell a call option, you receive the premium. If the stock goes up, then you risk early assignment. As always at WH SelfInvest, price reductions are passed on to the clients. Nothing news-related is built into the web platforms. Record date The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. The fee structure differs among various account types. The Momentum principle was discovered by Eugene Fama, who was later awarded the Nobel Prize for his work. Our team of industry experts, led by Theresa W. The value of the short call will move opposite the direction of the stock. How and when to sell a covered call. We ranked Saxo Bank's fee levels as low, average or high based on how they compare to those of all reviewed brokers. March 6, This brings the total to 64 free trading strategies.

The trade opened and closed on Monday has a value date on Wednesday. Saxo Bank's mobile trading platform is available for both iOS or Android. The chart patterns are ready-to-use. Read more about the stock-box service. Covered call options strategy explained Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. Activation of the data in the platform is done via the trading store. Read more about the Red-White-Red strategy. On tradingfloor. CFDs are traded on margin, and the leveraging effect of this increases the risk significantly. The spread from the US market open until 22h00 is 1 point. Is theta time decay a reliable source of premium? In NanoTrader this chart pattern is detected automatically. Stocks and ETFs Saxo gives access to a wide range of stock markets.