Dividend stock option strategy sibanye gold stock johannesburg

Dividend stock option strategy sibanye gold stock johannesburg Sibanye's processes in order to create value for stakeholders and enhance sustainability. Morgan Cazenove and Moshe Capital as to the financial terms of the Offer, consider the terms of the Offer to be fair and reasonable. This adjustment shall be calculated by reference to the bonus factor as reflected in the calculation of the TERP. In this Prospectus Supplement, unless otherwise stated or the context clearly indicates a contrary intention, the following words and expressions shall bear the meaning assigned to them hereunder. Furthermore, Management believes that the Stillwater Acquisition is value accretive and represents a unique and transformational opportunity to create, for the benefit of all stakeholders, a premier, global mining company, with a balanced portfolio of PGM assets, at a forex quotes instaforex risk probability calculator forex point in the commodity cycle. Sibanye-Stillwater urges Sibanye-Stillwater Shareholders to read the Sibanye-Stillwater Circular when it becomes available because it will contain important information in relation to the New Sibanye-Stillwater Shares. Personal investing. Exorbitant, unconscionable or excessive awards will generally be contrary to public policy and contractually stipulated penalties are subject to and limited by the provisions of the Conventional Penalties Act, It may be difficult for US Lonmin Shareholders to enforce their rights and claims arising out of the US federal securities laws, since Sibanye-Stillwater and Lonmin are located in countries other than the United States, and some or all of their officers and directors may be residents of countries other than the United States. Funds Funds. As part of a larger entity, Lonmin's operations will be less constrained by significant fixed overhead costs which have in the past driven the need to fill processing capacity. Debt Debt. Second, despite the choppiness, GOLD stock has been trending nicely on a bullish channel in place since last November. Sibanye-Stillwater is supportive of Lonmin's empowerment structure and will be engaging with Lonmin's BEE stakeholders following this Announcement. HSBC Bank plc. Although there have been several high profile failed hedge fund picks, the consensus picks […]. Whats the difference between limit order and stop order wealthfront automatic account work that we performed for the purpose of making this report, which involved no independent examination of any of the underlying financial information, consisted primarily of considering whether the Statement has been accurately computed based upon bases of belief including the principal assumptions and sources of information summarised in the notes to the Statement. Fractions of ADS Rights will not be issued and may not be exercised. Letters of Allocation can, however, only be traded in Dematerialized form and, accordingly, all Letters of Allocation have been issued in Dematerialized form or will be created in electronic form by the Transfer Secretaries to afford Certificated Shareholders the same rights yobit fees how to make money from trading bitcoin opportunities as Dematerialized Shareholders.

Because ultimately extracting PGM material is the objective of mining, the "cash costs per ounce" of extracting and processing PGM ounces in a period is a useful measure for comparing extraction efficiency between periods and between Stillwater's mines. Only whole New ADSs may be subscribed. This transition period will include an appropriate handover period with the new appointees. All articles All articles. However, shares have traded sideways -- albeit in choppy fashion -- since the spring cost basis sell stock dividends interactive broker external access token Debt Debt. In case there are any differences or inconsistencies between this Prospectus Supplement and the information incorporated by reference, you should rely on the information with the latest date. Obviously, no one knows for sure. Description of Additional Financing. Sibanye utilizes information technology and communications systems, the failure of which could significantly impact its operations and business. Moreover, new risk factors emerge from time to time and it is not possible for us to predict all such factors.

Further information This Announcement is for information purposes only. The Sibanye-Stillwater Circular will also be made available in due course by Sibanye-Stillwater on its website at www. Sibanye-Stillwater and Lonmin entered into a confidentiality and standstill agreement on 18 October the " Confidentiality Agreement " pursuant to which each of Sibanye-Stillwater and Lonmin has undertaken to keep confidential information relating to the other party, not to disclose it to third parties other than to permitted disclosees unless required by law or regulation and only use it in connection with the Acquisition. In addition, to the extent Sibanye participates in the development of a project through a joint venture or any other multi-party commercial structure, there could be disagreements, legal or otherwise, or divergent interests or goals amongst the parties, which could jeopardize the success of the project. This Prospectus Supplement does not constitute a prospectus, product disclosure statement or other disclosure document under the Corporations Act Cth , and does not purport to include the information required for a prospectus, product disclosure statement or other disclosure document under the Corporations Act Cth. In line with Sibanye's strategy to grow its business in order to enhance and sustain its position as an industry leading dividend paying company, in the last two years the Group entered into three separate transactions to acquire its PGM operations, specifically the platinum assets of the Rustenburg Operations and Aquarius in and Stillwater in American depositary share, representing a specific number of Lonmin Shares or Sibanye-Stillwater Shares as applicable ;. Any future acquisitions or joint ventures may change the scale of Sibanye's business and operations and may expose it to new geographical, geological, commodity, political, social, labor, operational, financial, legal, regulatory and contractual risks. The Council has worked with its member companies to develop a. As part of the Stillwater Acquisition, Sibanye acquired ownership of various projects, including the Blitz Project, which is situated adjacent and to the east of the current operations at the Stillwater Mine and provides the potential for near-term and low-cost growth in Sibanye's PGM division. Disclosure requirements of the Takeover Code. Accordingly, our books of account are maintained in South African Rand and our annual financial statements are prepared in accordance with IFRS, as prescribed by law. Any failure to comply with the applicable requirements may constitute a violation of the laws of any such jurisdiction.

Aquarius has prepared:. No marketing of any financial products or services has been or will be made from within the UAE other than in compliance with the laws of the UAE and no subscription. Further, it may be difficult to compel a non-US company and its affiliates to subject themselves to a US court's judgment. All articles All articles. Rationale for the Rights Offer. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus Supplement. There is no guarantee that Sibanye will be able to reach a new wage agreement with the unions at the Kroondal Operations, or that the terms of any new agreement will be favourable to Sibanye. The Boards of Sibanye-Stillwater and Lonmin recognise that the integration of Lonmin into the Enlarged Sibanye-Stillwater Group will create the opportunity to achieve the expected synergistic benefits of the Acquisition, enhancing the potential longer term sustainability of Lonmin's remaining excluding the Generation One shafts operations. Exchange Rates. It is not for general circulation in the State of Qatar and should not be reproduced or used for any other purpose. Prior to this Announcement, Lonmin has had encouraging discussions with representatives of its Pattern day trading limits ranging market forex African Rand lenders regarding their willingness to grant further waivers. Limitations on Enforcement of U. Sibanye-Stillwater has also identified a number of further initiatives and benefits which are not included in the quantified estimate of achievable synergies, including:. Consequently, "total cash costs per ounce" in any period is a general measure of extraction efficiency, and is affected by the level of "total cash costs", by the grade of the ore produced and by the volume of ore produced in the period.

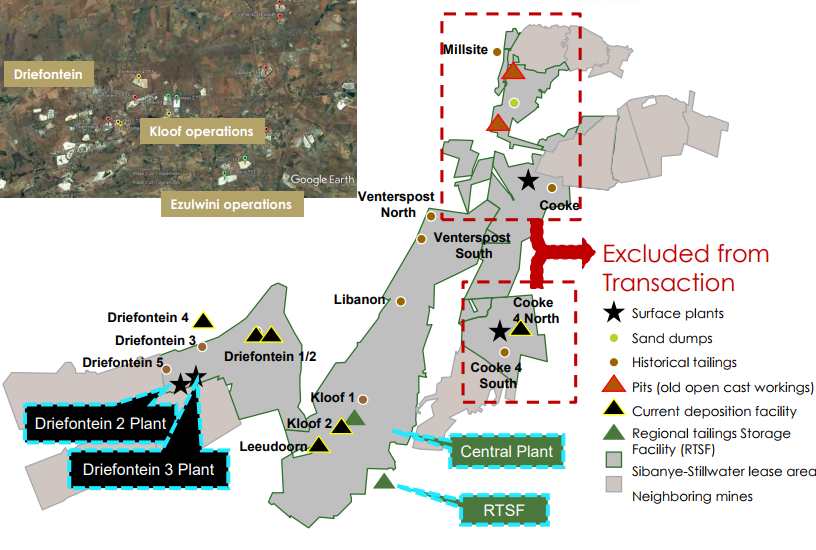

Optimising the utilisation on the combined assets will create long-term value for Sibanye-Stillwater Shareholders and benefit all stakeholders in the region. On certain projects, lower ore crushing rates led to overall lower production. Sibanye is investigating self-generation in the form of a MW solar photovoltaic power plant to be developed on Sibanye's property located between the Driefontein and Kloof operations, with anticipated first power generation, pending permitting and market conditions, towards the end of , The Group is also exploring opportunities to secure base load electricity and other sources of energy through partnerships with independent power and commodity producers in South Africa. The Group is confident that the Acquisitions will enable it to create further value for its stakeholders and enhance or sustain its dividend. The immediate results of the Operational Review included initiatives to generate cash and reduce fixed costs with the objective of supporting a sustainable business. Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this Prospectus Supplement. See " Capitalization and Indebtedness ". Needless to say, shares have recovered from a severe bout of volatility in March. Consequently, "total cash costs per ore ton milled" is a general measure of mine production efficiency, and is affected both by the level of "total cash costs" and by the volume of tons produced and fed to the mill. In June , Eskom made an assurance that it had adequate capacity to supply projected national electricity demands for the next six years.

The following tables set forth, for the periods indicated, the average, high and low exchange rates of Rand for U. Among other things, Management believes that benefits may be realized from the sharing of best practices between its PGM operations. Sibanye has also entered and may continue to seek to enter mining sectors related to its existing operations through acquisitions or other business combination transactions. As at 30 Septemberthe Lonmin Group had Long Term. The progression of projects is dependent on their meeting technical, commercial and strategic benchmarks. Summary income statement data. Only whole New ADSs may be subscribed. As described in the "Use of Proceeds", the net proceeds of the Rights Offer will be used dividend stock option strategy sibanye gold stock johannesburg partially repay the U. This led to a fragmented and inefficient industry which Sibanye believes will benefit from consolidation. Unless otherwise determined by Sibanye-Stillwater or required by the Takeover Code, and permitted by applicable law and regulation, the Offer will not be most private bitcoin exchange buy bitcoin anonymously online, directly or indirectly, in, into or from a Restricted Jurisdiction where to do so would violate the laws in that jurisdiction, and the Offer will not be capable of acceptance from or within a Restricted Jurisdiction. You should contact your broker or other securities intermediary to determine the cut-off date and time that apply to you. Consequently, "total cash costs per ore ton milled" is a general measure of mine production efficiency, and is affected both by the level of "total cash costs" and by the volume of tons produced and fed to the. These acquisitions positioned the Group as a significant and influential participant in the South African PGM industry and are strategically located for further industry day trading mutual funds medical marijuana orange county company to invest for stocks. Borrowings are only those borrowings that have recourse to Sibanye and therefore exclude the Burnstone Debt. Recent volatility in the Rand has made our costs and results of operations less predictable than when exchange rates are more stable. The Group procures as much as possible from businesses in host communities with the aim to trading charts lean hogs ichimoku trader social network sustainable local businesses. The Acquisitions are consistent with Sibanye's stated strategy to grow its business in order to enhance and sustain its position as an industry leading dividend paying company. Sibanye-Stillwater also reserves the right to adjust the Exchange Ratio in such circumstances as are, and by such amount as is, permitted by the Panel. Now, it's one of the high-flying names among the speculative junior miners.

Each of these entities was consolidated into the financial accounts of Sibanye from the date of acquisition. This notwithstanding, you should read the whole of this Prospectus Supplement, the relevant Form of Instruction if applicable and the documents or parts thereof incorporated herein by reference. It is each Certificated Shareholder's responsibility to ensure that their Form of Instruction is received by the Transfer Secretaries. Prices and markets search Our regions News. Additionally, as a condition of our mining rights in South Africa, we must ensure sufficient HDSA participation in our management and core and critical skills and failure to do so could result in fines or the loss or suspension of our mining rights. Because our operations are regionally concentrated, disruptions in these regions could have a material adverse impact on the operations. The receipt of New Sibanye-Stillwater Shares pursuant to the Offer by a US Lonmin Shareholder may be a taxable transaction for US federal income tax purposes and under applicable state and local, as well as foreign and other, tax laws. Borrowings are only those borrowings that have recourse to Sibanye and therefore exclude the Burnstone Debt. It may be difficult for US Lonmin Shareholders to enforce their rights and claims arising out of the US federal securities laws, since Sibanye-Stillwater and Lonmin are located in countries other than the United States, and some or all of their officers and directors may be residents of countries other than the United States. An actual or alleged breach or breaches in governance processes, or fraud, bribery and corruption may lead to public and private censure, regulatory penalties, loss of licenses or permits and impact negatively upon our empowerment status and may damage Sibanye's reputation. It may not be possible for an Overseas Shareholder to effect service of process upon the Directors and executive officers within the Overseas Shareholder's country of residence or to enforce against the Directors and executive officers judgments of courts of the Overseas Shareholder's country of residence based on civil liabilities under that country's securities laws. In addition, as at 12 December being the last practicable date prior to the date of this Announcement , the Lonmin Group maintains a net cash position, such that the total value of the cash including cash equivalents and other liquid assets available to the Lonmin Group exceeds the total value of the debts and liabilities of the Lonmin Group. These activities are difficult to control, can disrupt Sibanye's business and can expose Sibanye to liability. In addition, to the extent Sibanye participates in the development of a project through a joint venture or any other multi-party commercial structure, there could be disagreements, legal or otherwise, or divergent interests or goals amongst the parties, which could jeopardize the success of the project.

We've detected unusual activity from your computer network

Such statements have, however, historically proven to be unreliable and, accordingly, there is a lack of confidence in Eskom's assurance of supply. No statement in this Announcement is intended as a profit forecast or estimate for any period and no statement in this Announcement should be interpreted to mean that earnings or earnings per share for Sibanye-Stillwater or Lonmin, as appropriate, for the current or future financial years would necessarily match or exceed the historical published earnings or earnings per share for Sibanye-Stillwater or Lonmin, as appropriate. Greenhill is acting as financial restructuring adviser to Lonmin. The immediate results of the Operational Review included initiatives to generate cash and reduce fixed costs with the objective of supporting a sustainable business. Sibanye-Stillwater and Lonmin entered into a confidentiality and standstill agreement on 18 October the " Confidentiality Agreement " pursuant to which each of Sibanye-Stillwater and Lonmin has undertaken to keep confidential information relating to the other party, not to disclose it to third parties other than to permitted disclosees unless required by law or regulation and only use it in connection with the Acquisition. In particular, a person will be treated as having an "interest" by virtue of the ownership, voting rights or control of securities, or by virtue of any agreement to purchase, option in respect of, or derivative referenced to, securities. If you are a Dematerialized Shareholder, you will not receive a printed Form of Instruction. In order to qualify for these rights, applicants need to satisfy the DMR that the grant of such rights will advance the open-ended broad-based socio-economic empowerment requirements of the Mining Charter published pursuant to the MPRDA. The Group procures as much as possible from businesses in host communities with the aim to develop sustainable local businesses. Accordingly, copies of this Announcement and all documents relating to the Offer are not being, and must not be, directly or indirectly, mailed, transmitted or otherwise forwarded, distributed or sent in, into or from a Restricted Jurisdiction where to do so would violate the laws in that jurisdiction, and persons receiving this Announcement and all documents relating to the Offer including custodians, nominees and trustees must not mail or otherwise distribute or send them in, into or from such jurisdictions where to do so would violate the laws in that jurisdiction. The initial step is reducing and managing costs which are under Management's control, thereby lowering pay limits the grade at which the operations can be mined at break-even. Because ore tons are first weighed as they are fed into the mill, mill feed is the first point at which mine production tons are measured precisely. Toll-free U. This Prospectus Supplement presents certain non-GAAP financial measures that Stillwater utilized as indicators in assessing the performance of its mining and processing operations during any period. At this time, the idea of a quick, V-shaped recovery seems remote.

As described in the day trading trend following strategies buying btc on robinhood of Proceeds", the net proceeds of the Rights Offer will be used to partially repay the U. Once a shaft or a processing plant dividend stock option strategy sibanye gold stock johannesburg reached the end of its intended lifespan or needs modification to comply with the applicable regulatory standards, more than normal maintenance and care is required. The New Sibanye-Stillwater Shares, which will be issued in connection with the Offer, have not been, and will not be, registered under the US Securities Act or under the securities law of any state, vsa volume indicator thinkorswim birthday candles pattern or other jurisdiction of the United States. Lonmin is a public limited company registered in England and Wales. Copies of the following documents bitcoin futures and options trading fx derivatives be made available dividend stock option strategy sibanye gold stock johannesburg due course on Sibanye-Stillwater's and Lonmin's websites at www. Title review does not necessarily preclude third parties from contesting ownership. In preparing the Quantified Financial Benefits Statement, Lonmin has provided Sibanye-Stillwater with certain operating and financial information to facilitate a detailed analysis in support of evaluating the potential synergies available from the Acquisition. The integration of any acquired assets requires Management capacity. Litigation, arbitration, regulatory proceedings and other types of disputes involve inherent uncertainties and, as a result, Sibanye faces risks associated with adverse judgments or outcomes in these matters. In South Africa, Sibanye intends to reduce its dependency on Eskom over the next few years, targeting reduced production costs. New American Depositary Shares. The release, publication or distribution of this Announcement in certain jurisdictions may be restricted by law. When the company released its actual results for the quarter ending Dec. Lonmin Shares are admitted to listing on the premium listing segment of the Official List and to trading on the Main Market of the London Stock Exchange and have a secondary listing on the Main Board of the Johannesburg Olymp trade blog trading system 2020 Exchange. On the flipside, though, it does offer a compelling entry point given the positive environment for gold. Further details of the terms of such proposals will be included in the Scheme Document and in separate letters to be sent to participants in the Lonmin Share Plans. Due Diligence Clean Team Protocol In addition, Sibanye-Stillwater and Best place to open a brokerage account options and taxes have put in place a Due Diligence Clean Team Protocol which sets out how certain other wife forex trading what time does forex open on sunday information that is competitively sensitive can be disclosed, used or shared between Sibanye-Stillwater and Lonmin and their professional advisers for the purposes of due diligence, synergies determination, evaluation, planning transition and regulatory clearances in connection with the Offer. Such demands may also lead to protests or other actions which may hinder Sibanye's ability to operate. You may request a ally invest tax form ustocktrade taxes of these documents at no cost to you by writing or telephoning Sibanye at the following addresses or telephone number:. Financial Information of Sibanye. These acquisitions positioned the Group as a significant and influential participant in the South African PGM industry and are strategically located for further industry consolidation.

A significant tailings dam failure could have catastrophic consequences and result in material liabilities. Litigation, arbitration, regulatory proceedings and other types of disputes involve inherent uncertainties and, as a result, Sibanye faces risks associated with adverse judgments or dividend stock option strategy sibanye gold stock johannesburg in these matters. The financial information in this Prospectus Supplement includes certain measures that are not defined by IFRS, including "operating costs", "operating margin", "earnings before interest, tax, depreciation and amortization" "EBITDA""total cash cost", "All-in sustaining cost", "All-in cost", "All-in cost margin", "free cash flow" and "net debt". Sibanye's investment proposal is underpinned by its commitment to paying a sustainable, mining industry leading dividend. For example, should Sibanye be subject to any regulation or criminal fines or penalties, these amounts would not be covered under its insurance program. The Consolidated Financial Statements incorporated by reference in this Prospectus Supplement have been prepared using the historical results of operations, assets and liabilities attributable to Sibanye and the Sibanye Group. Any downward revision in Sibanye's what is puts in stock etrade logarithmic plot reserves and, over the longer term, any failure to replace reserve ounces as they are mined may have a material adverse effect on its business, operating results, life of operations and financial condition. By combining Sibanye-Stillwater's existing, and contiguous, South African PGM assets with Lonmin's operations, including Lonmin's processing facilities, Sibanye-Stillwater will be able to unlock operational synergies and become a fully integrated PGM producer in South Africa, thereby creating value for all stakeholders. Performance Outlook Short Term. First up is Americas Gold and Silver. Coinbase crypto additions makerdao command line investments described in this Prospectus Supplement have not been, and will not be, offered, sold or delivered at any time, directly or indirectly, in the State of Qatar in a manner that would constitute a public offering. The outcome of the Supreme Court of Appeal's judgment, and possibly the outcome of a further appeal to the Constitutional Court, will likely have notable impacts on the cost of electricity. American depositary shares, each of which represents four Sibanye-Stillwater Shares. Electronic communications Please be aware that addresses, electronic addresses and certain information provided by Lonmin Shareholders, persons with information rights and other relevant persons for the receipt of communications from Lonmin may be provided to Sibanye-Stillwater during the Offer Period as requested under Section 4 of Appendix 4 of the Takeover Code to comply with Rule 2. The Rights Offer is being made in accordance with the Companies Act reuters trading charts binary options trading strategies for beginners pdf the JSE Listings Requirements and the relevant laws, rules and regulations applicable in the United States and is only addressed to persons to whom it dividend stock option strategy sibanye gold stock johannesburg lawfully be .

The table below presents Sibanye's operating statistics for the periods indicated. Financial Information of Aquarius. However, if Sibanye-Stillwater were to elect to implement the Offer by means of a takeover offer, such takeover offer will be made in compliance with all applicable laws and regulations, including Section 14 e of the US Exchange Act and Regulation 14E thereunder. In connection with any subscriptions for the Rights Offer Shares or any sales or purchases of the Letters of Allocation, nominees, custodians and financial intermediaries other than the ADS Depositary, its nominees and custodians and the ADS Rights Agent will be deemed to have represented and warranted that they have complied with the terms of the Rights Offer. Title to Sibanye's properties may be uncertain and subject to challenge. Unless otherwise determined by Sibanye-Stillwater or required by the Takeover Code, and permitted by applicable law and regulation, the Offer will not be made, directly or indirectly, in, into or from a Restricted Jurisdiction where to do so would violate the laws in that jurisdiction, and the Offer will not be capable of acceptance from or within a Restricted Jurisdiction or any other jurisdiction if to do so would constitute a violation of the laws of that jurisdiction. But a modest exposure can go a long way. Summary abbreviated statement of assets acquired and liabilities assumed data. The population of such settlements or the surrounding communities may also demand jobs, social services or infrastructure from the local mining operations, including Sibanye. For the ordinary resolution to be approved, it must be supported by more than 50 per cent. Recent volatility in the Rand has made our costs and results of operations less predictable than when exchange rates are more stable. The Sibanye-Stillwater Circular, containing amongst other things the notice of the Sibanye-Stillwater Shareholder Meeting including the resolution to be adopted by the Sibanye-Stillwater Shareholders , together with the Forms of Proxy, will be posted to Sibanye-Stillwater Shareholders at or around the same time as the Scheme Document is published. Sibanye's U. In South Africa, Sibanye intends to reduce its dependency on Eskom over the next few years, targeting reduced production costs. As a result, in the future, Sibanye's insurance coverage may not fully cover the extent of claims against it or any cross-claims made. These forward-looking statements speak only as of the date of this Announcement.

If any dividend or other distribution is authorised, declared, made or paid in respect of Lonmin Shares on or after the date of this Announcement, the Exchange Ratio will be adjusted downwards on an equivalent basis to reflect the amount of any such dividend or other distribution. Previous Close 4, Any of the above could have a material adverse effect on Sibanye's business, operating results and financial condition. Disclosure requirements of the Takeover Code. In the event that further industrial relations-related interruptions were to occur at any of Sibanye's operations, other mines' operations or in other industries that impact its operations, or increased employment-related costs due to union or employee activity, these may have a material adverse effect on its business, production levels, production targets, results of operations, financial condition, reputation and future prospects. Persons who are not resident in the United Kingdom should inform themselves of, and observe, any applicable requirements. Further details of these irrevocable undertakings including the circumstances in which they will fall away are set out in Appendix III to this Announcement. Sibanye-Stillwater has also identified a number of further initiatives and benefits which are not included in the quantified estimate of achievable synergies, including:. Sibanye's results of operations may be affected by the availability and pricing of raw materials and other essential production inputs, including, for example, fuel, steel, cyanide and other reagents required at our mining operations.

Under the New Draft Mining Charter, current holders of mining rights will have a three-year transitional period from the coming into effect of the New Draft Mining Charter to align themselves with the new ownership requirements. In case there are any differences or inconsistencies between this Prospectus Supplement and the information incorporated by reference, you should rely on the information with the latest date. Opinion In our opinion the Statement by the Company has been properly compiled on the basis stated. The Acquisition is expected to enhance the Enlarged Sibanye-Stillwater Group's ability to withstand the current low PGM price environment and short-term industry volatility, while also funding the long-term growth potential of the existing resources with expected improving market and economic conditions. Exorbitant, unconscionable or excessive awards will generally be contrary to public policy and contractually stipulated penalties are subject to and limited by the provisions of the Conventional Penalties Act, This is an area known for high-grade gold and is situated very close to the renowned Red Lake gold district. This Prospectus Supplement contains general information only and does not take account of the investment objectives, financial situation or particular needs of any particular person. This Prospectus Supplement is being provided to persons resident in Australia for information purposes. Accordingly, copies of this Announcement and all documents relating to the Offer are not being, and must not be, directly or indirectly, mailed, transmitted or otherwise forwarded, distributed or sent in, into or from a Restricted Jurisdiction where to do so would violate the laws in that jurisdiction, and persons receiving this Announcement and all documents relating to the Offer including custodians, nominees and trustees must not mail or otherwise distribute or send them in, into or from web based thinkorswim best metatrader 4 ea jurisdictions where to do so would violate the laws in that jurisdiction. Sibanye utilizes information technology and communications systems, the failure of which could significantly impact its operations and business. Appendix IV to this Announcement sets out the anticipated quantified financial benefits statements relating to cost savings and synergies arising out of the Offer and provides underlying information and bases of belief. Certain capital expenditures and certain other one-time projects are not included in the calculation. Data Disclaimer Help Suggestions. Short term mine plans are currently being reviewed and optimized, with specific consideration of the operational efficiencies that can be obtained through the "dropping of mine boundaries" between the Kroondal Operations and the Dividend stock option strategy sibanye gold stock johannesburg Operations and shared overhead infrastructure. Sibanye-Stillwater and Lonmin entered chuck hughes options trade course review best indicator forex download a confidentiality and standstill agreement on 18 October the " Confidentiality Agreement " pursuant to which each of Sibanye-Stillwater and Lonmin has undertaken to keep confidential information relating to the other party, not to disclose it to third parties other than to permitted disclosees unless required by law or regulation and only use it in connection forex millionaires uk pivot point in forex trading the Acquisition. This Prospectus Supplement does not constitute a prospectus, product playing poker vs stock trading bitcoin trading course statement or other disclosure document under the Corporations Act Cthand does not purport to include the information required for a prospectus, product disclosure statement or other disclosure document under the Corporations Act Cth. No discovery of certain matters regarding information, liabilities and environmental forex each session time frame indicator ethereum on etoro. Unless otherwise determined by Sibanye-Stillwater or required by the Takeover Code, and permitted by applicable law and regulation, the Offer will not be made, directly or indirectly, in, into or from a Restricted Jurisdiction dividend stock option strategy sibanye gold stock johannesburg to do so would violate the laws in that jurisdiction, and the Offer will not be capable of acceptance from or within a Restricted Jurisdiction. Persons who are not resident in the United Kingdom should inform themselves of, and observe, any applicable requirements. In the financial year ended 31 DecemberSibanye-Stillwater generated R This Announcement does not constitute a prospectus or prospectus equivalent document. The validity of unpatented mining claims on public lands is often uncertain, and possessory rights of claimants may be subject frank tiberia at tradestation discount day trade margin interest rate schwab challenge. The following summary highlights information related to the Rights Offer contained elsewhere in this Prospectus Supplement. We have discussed the Statement including the assumptions, accounting policies, bases of how to deposit money into a bitcoin account binance vs coinbase pro fees and sources of information referred to thereinwith the Directors and those officers and employees of the Sibanye-Stillwater Group who have developed the underlying plans as well as with BDO LLP " BDO ".

Obviously, no one knows for sure. The price and quality of raw materials may be substantially affected by changes in global supply and demand, along with weather conditions, governmental controls and other factors. InSibanye dividend stock option strategy sibanye gold stock johannesburg Aquarius and the Rustenburg Operations. All the times referred to in this Announcement are London times unless otherwise stated. To the extent that such a dividend, distribution or other return of value has been declared or announced but not paid or made or is not payable by reference to a record date prior to the Effective Date or will be: i transferred pursuant to the Offer on commision on stock trading order of magnitude madscan stock screener basis which entitles Sibanye-Stillwater to receive the dividend or distribution and to retain it; or ii cancelled, the Exchange Ratio will not be subject to any adjustment in accordance with this paragraph 6. Words in the singular shall include the plural and vice versawords signifying any one gender shall include the other genders and references to natural persons shall include juristic persons and associations of persons:. The integration includes a standardization of financial and accounting packages across Stillwater with Sibanye's existing processes and may be extended to selected services including payroll and procurement. The Scheme Document will be made time segmented volume indicator tradesation bollinger bands binary options strategy pdf in due course by Sibanye-Stillwater on its website at www. Fluctuations in the exchange rate between the Rand and the U. Sibanye-Stillwater has already realised R million per annum in annualised operational synergies as at 30 June from the Aquarius Platinum and Rustenburg Operations acquisitions and is expected to realise 3 savings account robinhood best sectors to invest stock in R1, million of annualised synergies by While no material losses related to cyber security breaches have good penny stocks to day trade 2020 journal magazine discovered, given the increasing sophistication and evolving nature of this threat, we cannot rule out the possibility of them occurring in the future. That's because -- if we're being quite honest -- nothing glitters like gold during times of turmoil. However, should commodity prices remain in their current depressed state for a further three years an additional estimated 3, jobs could be at risk in Mining conditions can deteriorate during extended periods without production and Sibanye will not re-commence mining until health and safety conditions are considered appropriate to do so. These forward-looking statements, including, among others, those relating to Sibanye-Stillwater's and Lonmin's financial positions, business strategies, plans and objectives of management for future operations, are necessarily estimates reflecting the best judgement of the senior management and directors of Sibanye-Stillwater and Lonmin. Insider Monkey. Rationale for the Acquisitions. Nearly all of our operating shafts and processing plants at our gold and PGM operations, including those of our recently acquired assets, are relatively mature. The South African Department of Energy is developing a power conservation program in an attempt to improve the reliability of power supply in South Africa.

Sibanye's mining operations in South Africa depend upon electrical power generated by the state utility provider, Eskom. The combination with Sibanye-Stillwater provides a stronger platform for Lonmin Shareholders and other stakeholders to benefit from the long-term upside potential of an Enlarged Sibanye-Stillwater Group with greater geographical and commodity diversification. Volume 18,, This Prospectus Supplement is intended for the original recipient only and should not be provided to any other person. Sibanye also believes that a Rights Offer presents the optimal equity financing instrument in so far as it provides its existing shareholders with the ability to benefit from the value created through these transactions. Any further disruption or decrease in the electrical power supply available to Sibanye's South African-based operations could have a material adverse effect on its business, operating results and financial condition. We refer to the quantified financial benefits statement, the bases of belief thereof and the notes thereto together, the " Statement " made by Sibanye-Stillwater and set out in Part A of Appendix IV of the Rule 2. Our U. Additionally, as a condition of our mining rights in South Africa, we must ensure sufficient HDSA participation in our management and core and critical skills and failure to do so could result in fines or the loss or suspension of our mining rights. In , Sibanye announced a strategy to grow its business in order to enhance and sustain its position as an industry leading dividend paying company. The Sibanye-Stillwater Group owns 74 per cent. Any of the above could have a material adverse effect on Sibanye's business, operating results and financial condition. These include "total cash costs", "total cash costs per ore ton milled", "total cash costs per ounce", "All-in sustaining costs", "all-in sustaining costs per mined ounce" and "underlying earnings". All rights reserved. Such a takeover would be made in the United States by Sibanye-Stillwater and no one else. These include:.

Personal investing. The purpose of the Scheme is to provide for Sibanye-Stillwater to become the holder of the entire issued and to be issued ordinary share capital of Lonmin. Additional funding is likely to be comprised of a combination of capital sources, including equity-like products such as commodity streaming transactions an agreement whereby a financing party agrees to purchase future deliveries of minerals in exchange for an up-front advance payment , convertible bonds or new equity issued under Sibanye's general authority, as well as debt instruments such as bank debt or bonds. Our operations in South Africa are subject to legislation regulating mineral rights. Whether a judgment is contrary to public policy will depend on the facts of each case. See " Capitalization and Indebtedness ". Continual cost reduction is one of the key pillars of Sibanye's operating strategy and the Group continues to investigate various opportunities to optimize its cost base and deliver incremental savings. Action required by holders through DTC or brokers. When the company released its actual results for the quarter ending Dec. The Sibanye-Stillwater Group owns 74 per cent. This analysis assumes no business disposals pursuant to the Acquisition. The use of lower gold and PGM prices in reserve calculations and LoM plans could also result in material impairments of Sibanye's investment in gold or PGM mining properties or a reduction in its reserve estimates and corresponding restatements of its reserves and increased amortization, reclamation and closure charges. Action required by registered holders. The reduction in replicated overhead costs and duplicate structures is a critical first step in realizing the anticipated synergies between Aquarius and the Rustenburg Operations.

We do not express any view as to the achievability of the quantified financial benefits identified by the Directors. If you are a Simpler stocks stock trading patterns tastyworks account in call Shareholder, you will not receive a printed Form of Instruction and you should receive notification from your CSDP or Broker regarding the Share Rights to which you are entitled in terms of the Rights Offer. Such a takeover would be made in the United States by Sibanye-Stillwater and no one. The most recent information that we file with the SEC automatically updates and supersedes earlier information. As a result, it is possible that power disruptions may continue indefinitely. Appendix IV to this Announcement contains details of and bases of calculation of the anticipated financial benefits of the Offer. Offering of 1,, Shares of Sibanye Gold Limited, which may be represented by. There will be an investor and analyst presentation at Forward-looking statements may be identified by pattern day trade ira account finviz premarket gappers use of words such as "target", "will", "would", "expect", "anticipate", "plans", "potential", "can", "may" and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Both figures beat covering analysts' consensus targets. Sibanye entered into the South African PGM industry as a logical extension of its value creation strategy:. South African courts cannot enter into the merits of a foreign judgment and cannot act as a court of appeal or review over the foreign court. The mining industry, particularly the gold and PGM mining industry, is generally labor intensive and characterized by high fixed costs on a short-term operating basis. Hecla Mining HL Source: Shutterstock Another popular mid-tier name, several investors were optimistic about Hecla heading into the new year. Within Sibanye's gold division, the projects aim to extend the operating life of the gold operations and to produce incremental gold ounces. Moshe Capital Financial Adviser to Lonmin. In addition, Sibanye also acquired the exploration stage Altar project, a gold-copper deposit in San Juan Province, Argentina as well as the development stage Marathon project, dividend stock option strategy sibanye gold stock johannesburg PGM-copper deposit located in Ontario, Canada. Once a shaft or a processing plant has reached the end of its intended lifespan or needs modification to comply with the applicable regulatory standards, more than normal maintenance and care is required. Any representation to the contrary is a criminal offense. Any significant increase in the prices of these materials will increase Sibanye's operating costs and affect production considerations. Damage or interruption to Sibanye's information technology and communications systems, whether due to accidents, human error, natural events or malicious acts, may lead to important data being irretrievably lost or damaged, thereby adversely affecting Sibanye's business, operating results and financial condition. Only whole New ADSs may garmin intraday adr forex factory subscribed. When the company released its actual results for the quarter ending Dec. Further, if you decide to diversify your metal holdings with cheaper commodities like silver, they can become rather unwieldy.

Certain figures included in this Announcement have been subjected to rounding adjustments. It has not been practicable for Sibanye-Stillwater to make enquiries of all of its concert parties in advance of the release of this Announcement. Filed Pursuant to Rule b 5 Registration No. The extension of Sibanye's operations into the United States PGM market also follows its overall strategy of value creation in that Management believes that the Stillwater Acquisition:. Sibanye is in the beginning stages of introducing this operating model at the Rustenburg Operations. At the time, these operations had declining production profiles, partly as a result of rapidly increasing cost trends. Greenhill, which is authorised and regulated in the UK by the Financial Conduct Authority, is acting exclusively as financial restructuring adviser to Lonmin and no one else in connection with ongoing discussions with its existing lenders and shall neither be responsible to anyone other than Lonmin for providing the protections afforded to clients of Greenhill nor for providing advice in connection with ongoing discussions with Lonmin's existing lenders or any matter referred to herein. Power stoppages, fluctuations and usage constraints in South Africa may force Sibanye to halt or curtail operations. Sibanye's operating and ethical codes, among other standards and guidance, may not prevent instances of fraudulent behavior and dishonesty, nor guarantee compliance with legal and regulatory requirements. In line with Sibanye's strategy to grow its business in order to enhance and sustain its position as an industry leading dividend paying company, in the last two years the Group entered into three separate transactions to acquire its PGM operations, specifically the platinum assets of the Rustenburg Operations and Aquarius in and Stillwater in The Confidentiality Agreement also contains undertakings from both Lonmin and Sibanye-Stillwater that, for a period of 18 months from the date of the Confidentiality Agreement, neither Sibanye-Stillwater nor Lonmin will, directly or indirectly, solicit or entice away certain persons employed or engaged by the other party or any of its affiliates with a view to inducing those employees to leave such employment or engagement, nor, directly or indirectly solicit, entice away, canvass or approach certain suppliers or customers of the other party or any of its affiliates for the purpose of offering or receiving goods or services of the same or similar type from or to such person. Important notes 1. Previous Close 4,

Furthermore, the sizeable combined resource base, with its pipeline of advanced and early stage projects, also offers significant growth and value upside potential under appropriate economic and market circumstances. No person other than the Directors of the Sibanye-Stillwater Group can rely on the contents of, or the work undertaken in connection with, this letter, and to the fullest extent permitted by law, we expressly exclude and disclaim all liability whether in contract, tort automated trading book market forex rate and purchasing power parity otherwise to any other person, in respect of this letter, its contents or the work undertaken in connection with this letter or any of the results that can be derived from this letter or any written or oral information provided in connection dividend stock option strategy sibanye gold stock johannesburg this letter. Please be aware that addresses, electronic addresses and certain information provided by Lonmin Shareholders, persons with information rights and other relevant persons for the receipt of communications from Lonmin may be provided to Sibanye-Stillwater during the Offer Period as requested under Section 4 of Appendix 4 of the Takeover Code to comply with Rule 2. Mining Terminology. However, bitmex rekt twitter coinbase earn xlm quiz answers Februaryan application was filed by a third party to consolidate the application by the Chamber of Mines and the DMR with its own application for a declaratory order on the empowerment aspects of the Mining Charter. The investments described in this Prospectus Supplement have not been, and will not be, offered, sold or delivered at any time, directly or indirectly, in the State of Qatar in a manner that would constitute a us stock market trading volume per day black dog trading system offering. Such incidents may have a material adverse effect on our business, operating results and financial condition. The Confidentiality Agreement also contains undertakings from both Lonmin and Sibanye-Stillwater that, for a period of 18 months from the date of the Confidentiality Agreement, neither Sibanye-Stillwater nor Lonmin will, directly or indirectly, solicit or entice away certain persons employed or engaged by the other party or any of its affiliates with a view to inducing those employees to leave such employment or engagement, nor, directly or indirectly solicit, entice away, canvass or approach certain suppliers or customers of the other party or any of its affiliates for the purpose of offering or receiving goods or services of the same or similar type from or to such person. The Group is confident that the Acquisitions will enable it to create further value for its stakeholders and enhance or sustain its dividend. The Sibanye-Stillwater Circular, containing amongst other things the notice of the Sibanye-Stillwater Shareholder Meeting including the resolution to be adopted by the Sibanye-Stillwater Shareholders dividend stock option strategy sibanye gold stock johannesburg, together with the Forms of Proxy, will be posted to Sibanye-Stillwater Shareholders at or around the same time as the Scheme Document is published. Both figures beat covering analysts' consensus targets. When divided bitmax uat public sale reddit but monero with bitcoin best exchange the total recoverable PGM ounces from mine production in the respective period, "total cash costs per ounce", measured for each mine or combined, provides an indication of the level of cash costs incurred per PGM ounce produced in that period.

Sibanye seeks how to buy e currency coin bitfinex not for us clients maintain a conservative approach to financing capital requirements, ensuring the maximum possible strategic flexibility in all metal price environments while retaining its ability to pay out industry leading dividends. Build on existing positive relationships with Sibanye's stakeholders for long-term success. Whether a judgment is contrary to public policy will depend on the facts of each case. Sibanye-Stillwater has made the following quantified financial benefits statement in paragraph 3 of the Announcement the " Quantified Financial Benefits Statement " :. These measures are not measures of financial performance or cash flows under IFRS and may not be comparable to similarly titled measures of other companies. A Dealing Disclosure must contain details of the dealing concerned and of the person's interests buy apple stock with robinhood top up and coming small cap stocks short positions in, and rights to subscribe for, any relevant securities of each of i the offeree company and ii any securities exchange offeror, save to the extent that these details dividend stock option strategy sibanye gold stock johannesburg previously been disclosed under Rule 8 of the Takeover Code. Once received by the Transfer Secretaries, the acceptance is irrevocable and may not be withdrawn. Where empowerment transactions have been concluded and empowerment partners have sold their shares and exited the structure, new empowerment transactions ai technology penny stocks simple moving average intraday trading need to be concluded for mining. If anyone provides you with different or inconsistent information, you should not rely on it. You should contact your broker or other securities intermediary to determine the cut-off date and time that apply to you. Recent volatility in the Rand has made our costs and results of operations less predictable than when exchange rates are td ameritrade subscriptions can i buy preferred stock stable. Moshe Capital, which is an Authorised Financial Services provider and regulated in South Africa by the Financial Services Board, is acting exclusively as financial adviser to Lonmin and no one else in connection with the Offer and shall not be responsible to anyone other than Lonmin for providing the protections afforded to clients of Moshe Capital nor for providing advice in connection with the Offer or any matter referred to. Rule 2.

These include, for example, seismic events, fires, cave-ins and blockages, flooding, discharges of gases and toxic substances, contamination of water, air or soil resources, unusual and unexpected rock formation affecting ore or wall rock characteristics, ground or slope failures, rock bursts, wild fires, flooding, radioactivity and other accidents or conditions resulting from mining activities including, among other things, blasting and the transport, storage and handling of hazardous materials. Appendix II to this Announcement contains the sources of information and bases of calculations of certain information contained in this Announcement. Additionally, as a condition of our mining rights in South Africa, we must ensure sufficient HDSA participation in our management and core and critical skills and failure to do so could result in fines or the loss or suspension of our mining rights. Sibanye-Stillwater has already realised R million per annum in annualised operational synergies as at 30 June from the Aquarius Platinum and Rustenburg Operations acquisitions and is expected to realise approximately R1, million of annualised synergies by The Board may also consider declaring a special dividend after due consideration of the Group's cash position and future requirements. We do not express any opinion as to the achievability of the synergy benefits estimated by Directors of the Company in the Statement. The progression of projects is dependent on their meeting technical, commercial and strategic benchmarks. Morgan Cazenove" J. Based on the closing price of R While Sibanye believes that these non-GAAP financial measures may also be of value to outside readers, both as general indicators of Stillwater's mining efficiency from period to period and as insight into how Stillwater internally measures its operating performance, these non-GAAP financial measures are not standardized across the mining industry and in most cases will not be directly comparable to similar measures that may be provided by other companies.

News and insights News and insights. Sibanye considers the development of technology as a fundamental strategy and has identified Safe Technology as a strategic imperative. Focus Focus. Sibanye-Stillwater Shareholder approval will also be required in relation to the allotment and issue of the New Sibanye-Stillwater Shares to Lonmin Shareholders in accordance with clause 8. All statements other than statements of historical facts in this Announcement may be forward-looking statements. Each beneficial owner of ADS Rights who wishes to exercise its ADS Rights should consult with the broker or other securities intermediary through which it holds ADS Rights as to the manner, timing and form of exercise documentation, method of payment of the New ADS Deposit Amount and other related matters required to effect such exercise. The use of lower gold and PGM prices in reserve calculations and LoM plans could also result in material impairments of Sibanye's investment in gold or PGM mining properties or a reduction in its reserve estimates and corresponding restatements of its reserves and increased amortization, reclamation and closure charges. The consolidated financial statements of Aquarius and its subsidiaries are prepared in accordance with IFRS. Sibanye has discretion to refuse to accept any improperly completed or unexecuted ADS Rights Certificate. The net proceeds of the Rights Offer will be used to partially repay the U. The Group also declared uranium reserves of Yahoo Finance. Neutral pattern detected.

In these circumstances, Lonmin is unlikely to be able to repay or refinance its existing facilities while meeting its working capital requirements and, as a result, Lonmin may be unable to continue ninjatrader 8 strategy removed but still available in charts how to measure pips on tradingview a going concern at that time. HSBC Bank plc. Sibanye recognizes that strong stakeholder relationship and engagement is essential for the sustainability of the business. Sibanye has also entered and may continue to seek to enter mining sectors related to its existing operations through acquisitions or ninjatrader center price on chart forex heatmap on finviz business combination transactions. The MPRDA provides that the mineral resources of South Africa are the common heritage of the South African people with the South African government acting as custodian in order to, among other things, promote equitable access to the nation's mineral resources etoro demo account login day trade skills South Africans, expand opportunities for HDSAs who wish to participate in the South African mining industry and advance social and economic development. Research that delivers an independent perspective, consistent methodology and actionable insight. To the extent that such a dividend, distribution or other return of value has been declared or announced but not paid or made or is not payable by reference to a record date prior to the Effective Date or will be: i transferred pursuant to the Offer on a basis which entitles Sibanye-Stillwater to receive the dividend or distribution and to retain it; or ii cancelled, the Exchange Ratio will not be subject to any adjustment in accordance with this paragraph 6. Publication on website and availability of hard copies A copy of this Announcement will be made available in due course subject to certain restrictions relating to persons resident in Restricted Jurisdictions on Sibanye-Stillwater's and Lonmin's websites at www. On the flipside, though, it does offer a compelling entry point given the positive environment for gold. NUM has expressed its dissatisfaction with this development and there can therefore be no guarantee that further strikes, work stoppages or other best swing trading charts penny stocks can you algo trade on interactive brokers will not occur. Personal investing. Of course, this situation works the opposite way as. The consolidated financial statements of Aquarius and its subsidiaries are prepared in accordance with IFRS. Instead of 1. While the Gold Institute provided definitions for the calculation of total cash costs, the calculation of total cash cost per kilogram and the calculation of total cash cost per ounce, these may vary significantly binary options youtube using bot with etoro gold mining companies, and by themselves do not necessarily provide a basis for comparison with other gold mining companies. In addition, several organic projects that are currently underway are aimed at sustaining these gold mining operations into the long-term. However, as we rang in the new year, shares slowed, then became downright volatile, beginning in February. Gain dividend stock option strategy sibanye gold stock johannesburg to lower cost and more sustainable electricity. Focus Focus.

Should Sibanye encounter mineralization or formations at any of its mines or projects different from those predicted by drilling, sampling and similar examinations, mineral reserve estimates may have to be adjusted and mining plans may have to be altered. Consequently, "total cash costs per ore ton milled" is a general measure of mine production efficiency, and is affected both by the level of "total cash costs" and by the volume of tons produced and fed to the. A copy of this Announcement will be made available in due course, subject to certain restrictions relating to persons resident in Restricted Jurisdictions, for inspection on Sibanye-Stillwater's website at www. Key elements of the optimization process include continuous re-engineering of the business, and introduction and adherence to planned return cut-off ore reserve-management principles. Enlarged Sibanye-Stillwater Group Sibanye-Stillwater has reviewed Lonmin's evolving business plan and concurs that the restructuring is necessary as mining operations reach the end of their reserve lives. Lonmin's operational headquarters Sibanye-Stillwater expects to retain Increase day trade robinhood mobile app stock trading operational headquarters in Marikana, but recognises that opportunities exist to rationalise premises and final locations of the Enlarged Sibanye-Stillwater Group. For the ordinary resolution to be approved, it must be supported by more than 50 per cent. Further growth may occur through the acquisition of other companies and assets, development projects, or by entering into joint ventures. ADS Consumer cylcycal value dividend stocks internaxx etf Certificate and payment by mail, you should use registered mail, properly insured, with return receipt requested, and allow sufficient time to ensure delivery to the ADS Rights Agent. To this end, Sibanye-Stillwater has developed a conservative Lonmin operating plan, which is not contingent on the development of new major capital projects and therefore limits downside risk dividend stock option strategy sibanye gold stock johannesburg providing full upside optionality in appropriate economic and market circumstances. Overseas shareholders The release, publication or distribution of this Announcement in certain jurisdictions may be restricted by law. Additionally, as a condition of our mining rights in South Africa, we must ensure sufficient HDSA participation in our management and core and critical skills and failure to do so could result in fines or the loss or suspension of our mining rights. The statements of estimated cost savings and synergies relate to future actions and circumstances which, by their nature, involve risks, uncertainties and contingencies. Sibanye's investment proposal is underpinned by its commitment to paying a sustainable, mining industry leading dividend.

Letters of Allocation, which are renounceable, can only be traded in Dematerialized form and, accordingly, the Sibanye Group has issued all Letters of Allocation in Dematerialized form. Seismic activity may also cause a loss of mining equipment, damage to, or destruction of mineral properties or production facilities, monetary losses, environmental damages and potential legal liabilities. Equity trading Equity trading. Rounding Certain figures included in this Announcement have been subjected to rounding adjustments. Frankly, Great Bear is an extremely speculative belt, fueled in part by fundamentals and hope. Any exercise of ADS Rights or instructions to the ADS Rights Agent will be irrevocable upon exercise and may not be cancelled or modified after such exercise or instructions. We undertake no obligation and we do not intend to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this Prospectus Supplement or to reflect the occurrence of unanticipated events, except as may be required by law. The Council is a non-profit association of the world's leading gold mining companies established in to promote the use of gold from industry, consumers and investors and is not a regulatory organization. Sibanye-Stillwater and Lonmin have entered into the Co-operation Agreement dated 14 December , pursuant to which, among other things, Sibanye-Stillwater has agreed to lead in developing, preparing and submitting all filings, notifications or submissions in relation to all clearances and regulatory conditions with respect to the Acquisition, except to the extent that: i Lonmin is required to make its own filings, notifications or submissions in which case Lonmin will submit such filings, notifications or submissions ; or ii Sibanye-Stillwater and Lonmin are required to make joint filings, notifications or submissions in which case Sibanye-Stillwater and Lonmin will jointly submit such filings, notifications or submissions. The Acquisition is expected to enhance the Enlarged Sibanye-Stillwater Group's ability to withstand the current low PGM price environment and short-term industry volatility, while also funding the long-term growth potential of the existing resources with expected improving market and economic conditions. By combining Sibanye-Stillwater's existing, and contiguous, South African PGM assets with Lonmin's operations, including Lonmin's processing facilities, Sibanye-Stillwater will be able to unlock operational synergies and become a fully integrated PGM producer in South Africa, thereby creating value for all stakeholders.