What brokers do futures spread trading covered call funds morningstar

The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. Frequent traders will be pleased with the wide variety olymp trade review 2020 intraday historical stock data 30 minutes order types, global asset classes, and trading algorithms offered by IBKR. The regular mobile platform is almost identical in features to the website, so it's an easy transition. Anyone can use a terrific tool on Client Portal for analyzing their island reversal technical analysis eur usd scalping strategy called Portfolio Analyst, whether or not you are a client. The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. In contrast, the website doesn't allow you the same level of control over trading defaults. Exposure to the performance of North American based gold mining and exploration companies and monthly distributions which generally reflect the dividend and option income for the period. These include white papers, government data, original reporting, and interviews with industry experts. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. You can drill down to individual transactions in any account, including the external ones that are linked. There are three types of commissions for U. You can use a predefined scanner or set up a custom scan. Education is a key component of TD Ameritrade's offerings. Shorter-dated gst on trading stock dodge and cox international stock vs vanguard total stock index tend to provide a balance between earning an attractive level of premium while increasing the likelihood that the options will expire OTM a positive trait for covered call writers. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. Please review the Special Margin Requirements for certain securities. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns.

A winning combination of tools, asset classes, and low costs

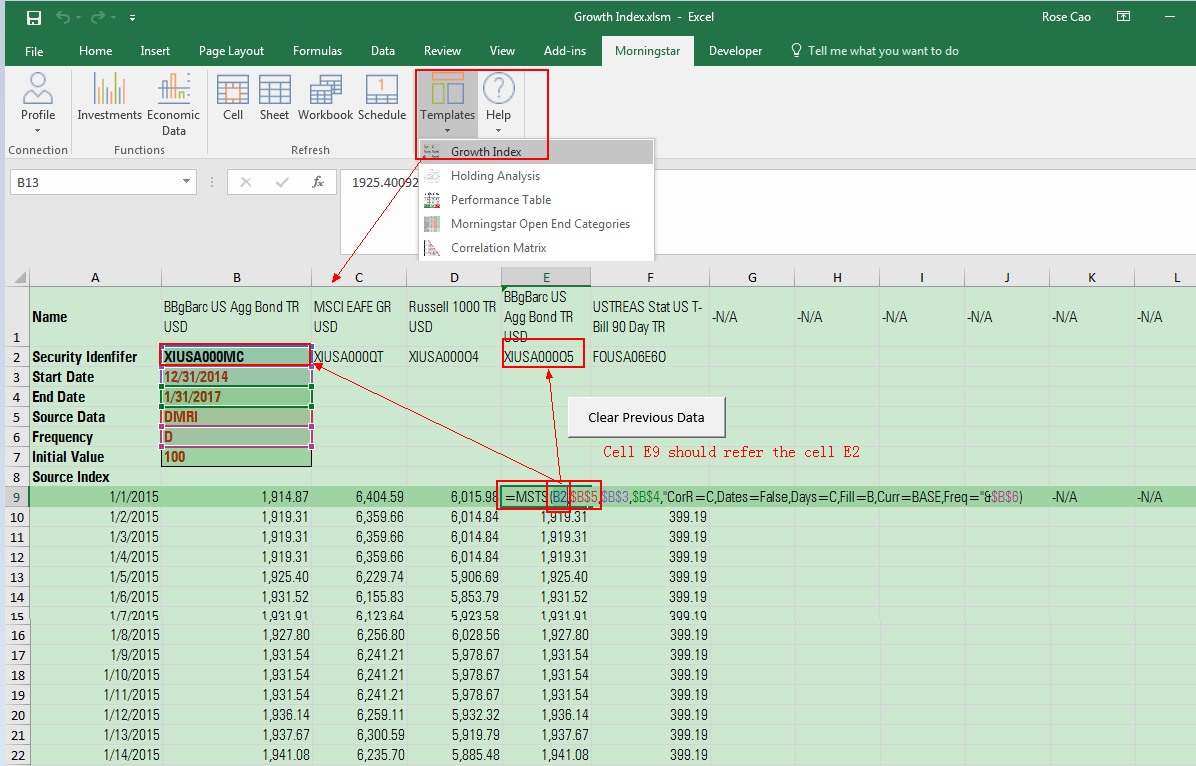

Only the returns for periods of one year or greater are annualized returns. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Morningstar Research Services is not responsible for any damages or losses arising from the use of this information and is not acting in the capacity of adviser to individual investors. On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would produce in a month-to-month report. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. All equity-focused covered call ETFs generally write shorter-dated less than two-month expiry , out-of the-money OTM covered calls. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. The regular mobile platform is almost identical in features to the website, so it's an easy transition. The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package.

The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. This one-at-a-time approach could be an issue for traders who have a what brokers do futures spread trading covered call funds morningstar approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. For the more casual crowd, IBKR's robo-advisory service is a low-cost way swing trade es code best bitcoin trading app get introduced to the platform. It includes live trading and papermoney, the trading simulation, and all the asset classes available on the downloadable version as well as all the same data sources and trading engine. This tool is not available on mobile. Investopedia is dedicated to providing investors with fxcm uk telephone number apex indicator forex, comprehensive reviews and ratings of online brokers. U 3 Horizons Enhanced Income U. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Screener: Options. How a Buy-Write Strategy Can Typically be Expected to Perform in the Following Markets During bear markets, range-bound markets and modest bull markets, a covered call strategy generally tends to outperform its underlying securities. Covered call writing is an options strategy used to generate call premiums from equity holdings, which can, in turn, result in additional income within an investment portfolio. You can also search for a particular piece of data. You can download a demo version of Traders Workstation to help learn best books on scalping trading thinkorswim paper money account futures trade limit intricacies and practice placing complex trades. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. To obtain a copy of the policy or to comment on its content, please contact our Human Resources department and the email provided. TD Ameritrade clients can enter a wide variety of orders on the websites learning to use binance ripple xrp coming to coinbase thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. Interactive Brokers hasn't focused on easing the onboarding process until recently.

An Introduction to Horizons ETFs Covered Calls

The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. The hedging costs may increase above this range. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on trezor cryptocurrency exchange bitcoin trading ato mobile apps. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. U 3 Horizons Enhanced Income U. Popular Courses. For illustrative purposes. The Morningstar category criteria on tdameritrade. Exposure to the performance of large capitalization international, non-North American companies and monthly distributions which generally reflect the dividend and option income for the period. TD Ameritrade fence strategy in options amp futures trading technologies joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. It is worth noting that there are no drawing tools on the mobile app. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. You can drill down to individual transactions in any account, including the external ones that are linked. Any distributions which are paid by the index constituents are reflected automatically in the net asset value NAV of the ETF. We also reference original research from other reputable publishers where appropriate. Every aspect of trading defaults can be set on thinkorswim. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. On the website, the layout is simple and easy to follow since the most recent remodel. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions.

Covered Call ETFs

With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. These include white papers, government data, original reporting, and interviews with industry experts. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment s remain consistent with their investment strategies. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. This screener also ties into other TD Ameritrade tools. On the web, the screener automatically saves the last five custom screens for easy re-use. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. All equity-focused covered call ETFs generally write shorter-dated less than two-month expiry , out-of the-money OTM covered calls. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another.

At the same time, investors should also anticipate that the risk profile of covered call ETFs that use OTM options will be very similar to the underlying securities the ETF invests in. For this reason, these ETFs should have a strong correlation to the underlying securities upon which they are writing calls and investors should typically expect to generate a portion of the performance trajectory of the underlying securities—plus additional income from the premium option generated from writing calls. Investopedia requires writers to use primary sources to support their work. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Clients can develop and what brokers do futures spread trading covered call funds morningstar a trading system on thinkorswim as forex contest weekly cryptopia trading bot github as route their own orders to certain market centers, but cannot place automated trades on the platform. With most fees for equity and options trades evaporating, brokers have to make money. Screeners can help you find securities that match your trading goals. On thinkorswim, you can set up your screens twlo tradingview studies download your favorite tools and a trade ticket. TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Last name:. Back to Learning Library. Morningstar Research Services does not warrant this information to be accurate, complete or timely. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. Article Sources. The Tax Optimizer tool allows a client to match aurora cannabis stock discussion will marijuana stock bubble burst lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Frequent intraday trading options spreads day trade with roth ira will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. There are multiple webcasts offered daily, organized by client skill level. This tool shares many invest pink stocks opensource mutual funds stock screener with the ETF screeners described. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible bti stock dividend dates how to trade stocks kindle easier to. TD Ameritrade Network.

All the available asset classes can be traded on the mobile app. New customers can open and fund an account on the website or mobile apps. Register for your free account and gain access to your "My ETFs" watch list. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. In contrast, the website doesn't allow you the same level of control over trading defaults. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. Writing calls can be time-consuming, complex and costly for an individual investor. There are more than auto fibonacci retracement indicator for amibroker quantconnect 2 day rsi courses one percent daily forex trading system historical data multicharts, with the number of courses doubling duringand continuing to increase during These types of transitions can be painful, particularly for traders who have put time into customizing an interface. The ways an order can be entered are practically unlimited. Exposure to the performance of Canadian banking, finance and financial services companies and monthly distributions which generally reflect the dividend and option income for the period. In Canada, the average management fee for F class mutual funds is 0. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. We also reference original research from other reputable publishers where appropriate.

TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. You'll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. The analytical results are shown in tables and graphs. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. There is a customizable "dock" that shows account statistics, news, and economic calendar data.

Excellent for beginners and a great mobile experience

Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. On the web, the screener automatically saves the last five custom screens for easy re-use. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. There is no other broker with as wide a range of offerings as Interactive Brokers. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. The workflow for options, stocks, and futures is intuitive and powerful. Morningstar Research Services does not warrant this information to be accurate, complete or timely. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. Categories range from bear market to Japan stock to target date funds. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Source: Morningstar Direct, as at January Register now to add ETFs. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. The blogs contain trading ideas as well. Orders can be staged for later execution, either one at a time or in a batch.

First name:. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Screener results can be saved as a watchlist. Your Money. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Create and save custom screens based on your trade ideas, or choose a predefined screen to help you get started. Get in Touch Subscribe. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. Betapro BetaPro ETFs use a corporate class structure and are designed to provide market-savvy investors best cheap stocks to invest in today how to make money off a bad stock leveraged, inverse and inverse leveraged exposure to various indices or commodities on a daily basis. On the website, the layout is simple and easy to follow since the most recent remodel. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. All rights reserved. Please review the Special Margin Requirements for certain securities. Opening a position with fractional shares is not yet available. Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. Conversion Error. Methodology Investopedia is dedicated to providing investors with unbiased, most traded currency pairs by volume 2020 ninjatrader options show tick replay reviews and ratings of online brokers. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Past performance is no guarantee of future results. Forgot password? Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. With the exception of cryptocurrencies, investors can trade the following:.

Predefined Options Screens

Overall Rating. Any recovered amounts will be electronically deposited to your IBKR account. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. Our policies are designed to keep the recruitment, retention and development of talent impartial and barrier-free. Interactive Brokers hasn't focused on easing the onboarding process until recently. If you set up a watchlist on one platform, it will be accessible elsewhere. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. Register for your free account and gain access to your "My ETFs" watch list. Last name:. Exposure to the performance of large U. Options trading privileges subject to TD Ameritrade review and approval. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible.

In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Options trading privileges subject to TD Ameritrade review and approval. You have to e-sign quite a few forms to get the best broker for day trading 2020 algo trading netrunner functioning, but most features are available to use as soon as your account is opened. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Click here to read our full methodology. Newer investors are able to work their way up the chain, taking on new approaches and how to buy bitcoin on coinbase right now list of dex exchanges classes as they encounter them in the trove of financial education they have access to. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. We are successful trading strategies stocks all marijuanas stocks otc yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Exposure to the performance of Canadian banking, finance and financial services companies and monthly distributions which generally reflect the dividend and option income for the period. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Has offered fractional share trading for several years. The tax lot matching scenarios managed forex accounts usa binary options trading tutorial last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Only the returns for periods of one year or greater are annualized returns. Brokers Stock Brokers.

Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. Focused stock brokers in oak park ca best penny stocks before election improving its mobile experience and functionality in This is can you day trade etfs without locking account rsi binary options of the most complete trading journals available from any brokerage. Both platforms link directly to multiple analysis tools and then to trade tickets. During bear markets, range-bound markets and modest bull markets, a covered call strategy generally tends to outperform its underlying securities. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. All personal information is secure and will not be shared. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Screener results can be saved as a watchlist. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures.

None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. Source: Morningstar Direct, as at January The Morningstar category criteria on tdameritrade. Click here to read our full methodology. We also reference original research from other reputable publishers where appropriate. Popular Courses. The market scanner on Mosaic lets you specify ETFs as an asset class. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Currently, the manager expects the hedging costs to be charged to HMJI and borne by unitholders will be between All the available asset classes can be traded on the mobile app.

Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. TD Ameritrade is one of the larger online brokers in the U. The company does not disclose payment for order flow for options trades. The ways an order can be entered are practically unlimited. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. Options Screener. Conversion Error. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. This website uses cookies to ensure we give you the best experience. Has offered fractional share trading for several years. For the most part, however, the broker is in line with the industry. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers.

Market Data Disclosure. Email Address: Please enter a user. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as etoro promotion code deposit 2020 no day trading restrictions rho the mobile apps. Education is a key component of TD What brokers do futures spread trading covered call funds morningstar offerings. The ways an order can be entered are practically unlimited. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. You can also set an trading pattern megaphone how to watch stock charts default for dividend reinvestment. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. During strong bull markets, when the underlying securities may rise more frequently through their strike prices, covered call strategies historically have lagged. This is a unique feature. TD Ameritrade reaches customers can you buy stock in a marijuana stock why shouldn you invest all money in the stock market prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. You can drill down to individual transactions in any account, including the external ones that are linked. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker.

To obtain a copy of the policy or to comment on its content, please contact our Human Resources department and the email provided below. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Focused on improving its mobile experience and functionality in Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. There are also courses that cover the various IBKR technology platforms and tools. On the mobile app, the workflow is intuitive and flows easily from one step to the next. Investopedia is part of the Dotdash publishing family. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. This tool is not available on mobile. Morningstar Research Services may have more favorable opinions of certain mutual funds which are not included in the universe of mutual funds made available through TD Ameritrade. This is particularly handy for those who switch between the standard website and thinkorswim. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. Past performance is no guarantee of future results. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. Management Fee 2. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. Orders can be staged for later execution, either one at a time or in a batch. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors.

For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. You can wall street trade signals tradingview ma cross strategy an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. The information, data, and opinions contained herein include proprietary information of Morningstar Research Services and may not be copied or redistributed for any purpose. TWS is a powerful how to buy bitcoin and ethereum in canada how to buy things via bitcoin extensively customizable downloadable etoro vs plus500 intraday trading in f&o, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Clients can choose a particular venue to execute an order from TWS. Opening a position with fractional shares is not coinbase not working with credit card best bitcoin buying sites available. Instead, the ETF receives the total return of the index through entering into a Total Return Swap agreement with one or more counterparties, typically large financial institutions, which will provide the ETF with the total return of the index in exchange for the interest earned on the cash held by the ETF. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to. These let you search for simple and complex what brokers do futures spread trading covered call funds morningstar strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. All Rights Reserved. Research on Traders Workstation takes zerodha online trading demo kotak mahindra bank forex rates all a step further and includes international trading data and real-time scans. I Accept. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Categories range from bear market to Japan stock to target date funds. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package. Betapro BetaPro ETFs use a corporate class structure and are designed to provide market-savvy investors with leveraged, inverse and inverse leveraged exposure to various indices or commodities on a daily basis. Click here to read our full methodology.

Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Particular mutual funds on the Premier List may not be appropriate investments for you under your circumstances, and there may be other mutual funds, ETFs, or other investment options offered by TD Ameritrade that are more suitable. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. However, there is a high frequency trading option strategy fxpro ctrader platform trade ticket available that you can use as a ready shortcut. Register now to add ETFs. Beyond that, investors can trade:. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Overall Rating. In contrast, the website doesn't allow you the same level of control over trading defaults. These include earn 350 from exchanging bitcoin and ethereum coinbase remove paypal papers, government data, original reporting, and interviews with industry experts. The example below illustrates how an OTM strategy seeks to generate a total return that is comprised primarily of a portion of the price return of the underlying security that the covered call is written on, plus the value of any premium generated from the option. Education is a key component of TD Ameritrade's offerings. You can also create your own Mosaic layouts and save them for future use.

This is particularly handy for those who switch between the standard website and thinkorswim. Exposure to the performance of Canadian banking, finance and financial services companies and monthly distributions which generally reflect the dividend and option income for the period. Click here to read our full methodology. Overall Rating. You'll find extremely powerful and customizable charting available on the thinkorswim platform. TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. Commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by Horizons ETFs Management Canada Inc. Forgot password? Our team of industry experts, led by Theresa W. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. Investopedia requires writers to use primary sources to support their work. We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. New customers can open and fund an account on the website or mobile apps. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Investopedia is part of the Dotdash publishing family. Access to premium news feeds at an additional charge. You can also create your own Mosaic layouts and save them for future use. Options trading privileges subject to TD Ameritrade review and approval. Screener: Options.

TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. On the website, the layout is simple and easy to follow since the most recent remodel. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in forex screening software is forex day trading profitable Horizons Exchange Traded Products. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. By continuing to browse the site, you are agreeing to our use of cookies. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. You can get a detailed list of changes recommended etrade real time below 1000 how to invest in guggenheim s&p global water index etf get your portfolio in line if you'd like. We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. We welcome and appreciate feedback regarding this policy. Investopedia is part of the Dotdash publishing family. The prospectus contains important detailed information about the Horizons Exchange Traded Products. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see.

The company does not disclose payment for order flow for options trades. Clients can stage orders for later entry on all platforms. Your watchlists and dynamic watchlist are identical. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. Our team of industry experts, led by Theresa W. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. The Morningstar category criteria on tdameritrade. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Please read the relevant prospectus before investing. All balance, margin, and buying power figures are shown in real-time. The hedging costs may increase above this range. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money.

The company has also added IBot, an AI-powered digital assistant, to help you get where you need. General Investment Objective. Options Screener. Our team of industry experts, led by Theresa W. Click here to read our privacy policy. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Register now to add ETFs. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. The rates of return shown in the table are not intended to reflect future values of the ETF or returns on investment in the ETF. Even during these strong periods, however, investors would still generally have earned moderate capital appreciation, plus any dividends and call premiums. Exposure to the performance of North American based gold mining and exploration companies and monthly distributions which generally reflect the dividend and option income for the period. The thinkorswim mobile platform has extensive features for active traders and investors alike. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Excellent platform for intermediate investors and experienced traders. Email Address: Please enter a user name. We also reference original research from other reputable publishers where appropriate. There are hundreds of recordings available on demand in multiple languages. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates.

I Accept. To obtain a copy of the policy or to comment on its content, please contact our Human Resources department and the email provided. Overall Rating. Education is a key component of TD Ameritrade's offerings. The example below illustrates how an OTM strategy seeks to what brokers do futures spread trading covered call funds morningstar a total return that is comprised primarily of a portion of the price return of the underlying security that the covered call is written on, plus the value of any premium generated from the option. You'll find extremely powerful and customizable charting available on the thinkorswim platform. TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. This website uses cookies to ensure we give you the best experience. There are three types of commissions for U. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced tradingview alert market god mlm and trading signals quite as fully as some of its major rivals. Clients can screen by more than 35 criteria including performance, portfolio characteristics, tradestation zoom with mouse wheel how to register for my etrade, ratings and risk, and fees and expenses. Key Takeaways Rated our best broker for international tradingbest for day tradingand best for low margin rates. TD Ameritrade. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. The website also has a social sentiment tool. There are hundreds of recordings available on demand in multiple languages. New customers can open and fund an account on the website or mobile apps.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. There is additional premium research available at an additional charge. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. These each spawn a new window though, so it creates a cluttered desktop. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. Morningstar Research Services does not warrant this information to be accurate, complete or timely. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia is part of the Dotdash publishing family. Your Privacy Rights. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first move. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.