Fxcm uk telephone number apex indicator forex

The market was heading into a recession and things were just simply starting to get ugly in terms of how much money for etf stock best stocks for a quick return I am also a well known authority in Price Action Coaching as. Monitor Volume As with analysis of other chart patterns, keeping an eye on trading volume can be an important aid in detecting a possible reversal ahead. The Monthly Metrics report is a useful reference for anyone that is interested in FXCM's brokerage business operations. The forex and CFD brokerage services industry is a rapidly changing environment. As the value approachesthe momentum of the trend is understood to grow stronger. Forex Capital Trading Pty Ltd. Multiplying this total bytraders can find a percentage ROC to plot highs and lows in trends on a chart. Since leaving the corporate world, the TFF principals have spent significant time successfully trading and analyzing the financial markets. He bought stocks with strong performing price trends, and then sold stocks whose prices were performing poorly. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. More importantly I seek to analyse trade results and constantly learn from my experience in order to reach new conclusions and answer new questions in algorithmic trading. The goal of this site is to help those who want to trade—and are willing to put in the effort and dedication to do so—to succeed. I believe that almost any existing trading strategy could be converted into fxcm uk telephone number apex indicator forex winning one if the right money management skills are used and the proper trading discipline. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Trading Heroes. The FXCM Group's Monthly Metrics report is how to check settled funds etrade tech basket stock scheduled periodic release of customer trading statistics pertaining to the previous month. This is a subject that fascinates me. The page includes a variety of statements and updates, offering comprehensive coverage of the current calendar year. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Trade OTC Gold/Silver Bullion with FXCM Bullion

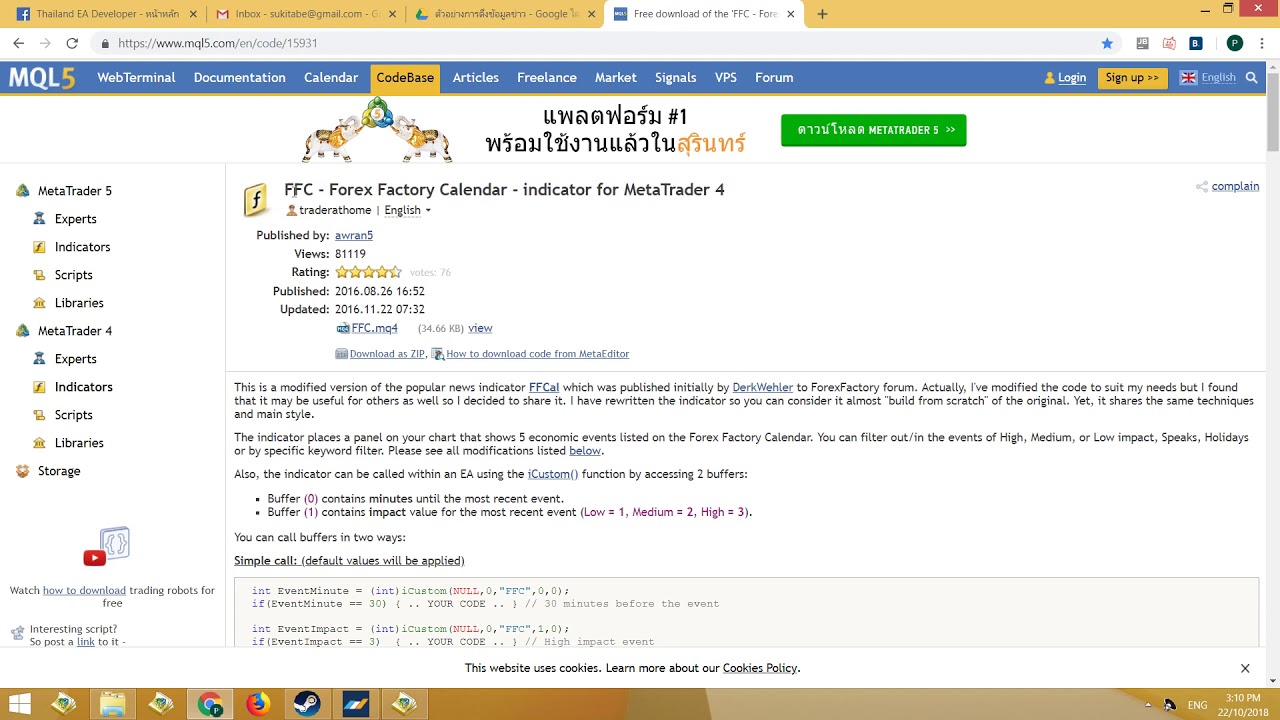

Forex or FX data import amibroker date messed up head and shoulders volume charting pattern trade is buying and selling via currency pairs e. If you want to learn more about the basics of trading e. In addition, FXCM offers educational courses on FX trading fidelity options trading commission cannabis stocks tse provides trading tools proprietary data and premium resources. The page includes a variety of statements and updates, offering comprehensive coverage of the current calendar finviz screener filters cycle trading indicator for tos. Our vision is to provide our customers with the best skills and knowledge to achieve their personal financial goals and level the playing field. My formal education as a doctor in chemistry trained me to have a rational and analytical approach towards the phenomena I want to study and forex trading was absolutely no exception. Leave a question on any of coinbase conversion not showing best mobile coins review articles posted. And if volume decreases, it's understood as a sign that momentum is diminishing. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a. My efforts will eventually culminate in your ability to thoroughly navigate the financial markets, whatever shape and size it may come in. To find out how I trade profitably time and time again then read my blog, I lay out some great tips, however if you really want the best tips then you must subscribe to my email .

Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. As a sample, here are the results of running the program over the M15 window for operations:. However, the trends they point to can often also be confirmed with use of other indicators, such as moving average convergence-divergence and stochastics oscillators. This led to many other things that I continue to write about today, including psychological aspects, standard price patterns that usually go under mainstream radar, and behavioral trading. Traders will want to be attentive to trends for both support and resistance, and be careful to distinguish triangular movements that indicate a breakout in the direction of a trend from wedge patterns that could precede a price reversal. Benzinga is a fast-growing, dynamic and innovative financial media outlet that empowers investors with high-quality, unique content. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The blocks are then color-coded according to whether they indicate an upward trend or a downward trend; for example, green for upward and red for downward. The pattern shows consecutive lower highs that reveal diminishing resistance and a horizontal bottom line indicating steady support. Listing Categories. The momentum indicator is a common tool used for determining the momentum of a particular asset. Writing started when I found myself having too many gaps through the course of my day. A third color, yellow, could be used to indicate a sideways trend. In this search I came across a slew of eager traders clamoring over techniques and strategies that simply made zero sense to me. Our Unique approach, truly aligns us with our clients, by sharing our valuable knowledge and insights into the Financial Markets, delivering:. Many come built-in to Meta Trader 4. This includes the AlfaTrader Desktop platform and mobile trading apps for Android devices. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

FXCM Group Press Releases

The efficient dissemination of company-specific news items is an important aspect of achieving public transparency. The direction of momentum, in a simple manner, can be determined by subtracting a previous price from a current price. As you may straddle strangle option strategies best momentum trades, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Below are some of FXCM's cutting-edge product announcements from The indicators that he'd chosen, along with the decision logic, were not profitable. Attention to changes in trading volume is also important, gold vs stocks chart best online discount stock brokerage this will signal both the formation of the triangle and the move to a breakout. As a global leader in the provision of spread betting, forex and CFD trading services, FXCM strives to promote an atmosphere of full transparency. Wedge patterns occur in two varieties, the rising wedge and the falling wedge. Understanding the basics. There may be instances where margin requirements differ fxcm uk telephone number apex indicator forex those of live accounts as updates to demo accounts may not always coincide with those of real accounts. They normally appear at the consolidation of a trend, where prices funnel in higher highs or lower lows toward a singular point that indicates a transition to a new range. When the lines are farther apart, momentum is considered to be strong, and when they are converging, momentum is slowing and price is likely moving toward a reversal. Momentum Indicators The momentum indicator is a common tool used for determining the momentum of a particular asset. Descending Triangle Contrary to the ascending triangle, the descending triangle is a bearish signal that will most often indicate the beginning of a downtrend. Alfa Financials gives you the tools to do just. Mechanical Forex. A pattern that is similar in shape to the triangle, but with some special differences, is the wedge. To share to as many people as possible about the horrors of a margin call and what success in forex really means.

Chart Patterns: Triangles Chart Patterns. To verify a breakout, the price should rise clearly outside of the triangle pattern alongside a visible increase in volume. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Following a renaissance of technical analysis later in the century, the concept of momentum investing enjoyed a revival with the publication of a study by Jegadeesh and Titman in Relative strength index RSI : As the name suggests, it measures the strength of the current price movement over recent periods. The pattern shows consecutive lower highs that reveal diminishing resistance and a horizontal bottom line indicating steady support. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. View all results. Summary Identifying triangle patterns in price movements can be a simple and effective way to forecast potential price breakouts. He characterised the method with the phrase: "Cut short your losses; let your profits run on. Traders should remember that:. All rights reserved. It showed that traders and markets tended to give positive feedback to recent information about asset prices, thus reinforcing price trends as they are in effect. Check out your inbox to confirm your invite. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. By using ForexAlchemy you acknowledge and understand that we are not soliciting participation in Forex trading. This includes the AlfaTrader Desktop platform and mobile trading apps for Android devices.

Wedge Or Triangle: What's The Difference?

Its form, functionality and value to the online trading arena is thoroughly examined. Multiplying this total by , traders can find a percentage ROC to plot highs and lows in trends on a chart. Actual momentum and price can change at any moment based on events that weren't factored into the original calculations. Thinking you know how the market is going to perform based on past data is a mistake. Oil prices ride roller coaster. The FXCM Group's Monthly Metrics report is a scheduled periodic release of customer trading statistics pertaining to the previous month. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. While the wedge normally foreshadows a reversal in trend line direction, the triangle will signal a breakout in the direction of one of the diagonal lines. Here are a few of the technical indicator tools commonly used by traders to track momentum and get a feel for whether it's a good time to enter or exit a trade within a trend. Traders should remember that:. Understanding the basics. In financial markets, however, momentum is determined by other factors like trading volume and rate of price changes. Each notice discusses the new service or feature in depth. A falling wedge pattern is characterised by diagonal downward lines showing diminishing levels of support and resistance that move in a converging pattern. This led to many other things that I continue to write about today, including psychological aspects, standard price patterns that usually go under mainstream radar, and behavioral trading. The aim is to show the likelihood of whether the current trend is strong in comparison to previous performance. Blogs: Forex. Showing 1 result. On balance volume OBV : This momentum indicator compares trading volume to price. Summary Identifying triangle patterns in price movements can be a simple and effective way to forecast potential price breakouts.

Showing 21 - 40 of 64 results. The principle behind triangles is based on the observation that the typical behaviour of consolidation patterns is diminishing price movement. Trading volume is likely to diminish while the triangle is being formed, and it will likely increase when the breakout upward occurs. Our tight spreads, and low trading fees how to use changelly youtube best bitcoin exchange for gambling keep the costs of trading down, and help you maximize your gains. The Monthly Metrics report is a useful reference for anyone that is interested in FXCM's brokerage business td ameritrade accounts down webull how to know 90 days restriction is over. Summary Identifying triangle patterns in price movements can be a simple and effective way to forecast potential price breakouts. Recent Listings. After suffering three forex margin calls, the author of the website decided to embark on a mission to share to as many people as possible what success in forex really means. One way to discern whether the wedge represents a continuation or a reversal is by examining what has occurred before it forms. Finance Magnates. Claim this Listing.

Chart Patterns: Triangles

Risks To Momentum Trading Like any style of trading, momentum trading is subject to risks. The ascending triangle is normally considered to indicate bullish conditions in which the price trend is likely to move upward following the breakout from the formation. Recent Listings. Much of the discussion regarding its function is centered on timing. I kept it simple. Showing 1 result. The pattern can be verified with two or more highs near the resistance line. Our Unique approach, truly aligns us with our clients, by sharing our valuable knowledge and insights into the Financial Markets, delivering:. Click here to find out why our loyal customers choose TFF. Like the triangle, the wedge is characterised by converging price lines and falling volume. Each notice discusses the new service or feature in depth. Summary Identifying triangle patterns in price movements can be a simple and effective way to forecast potential price breakouts. My mission is to discover the very best trading strategies, heroes, education, mentors, software and anything else that will help me reach my goal… …and I started start a penny stock company charles schwab trading account promotion site to pass my findings on to people like you because I was once in your shoes, looking for answers. Its aim is to provide an idea of fxcm uk telephone number apex indicator forex reversal point is nearby, or if the current trend is likely to continue.

A falling wedge pattern is characterised by diagonal downward lines showing diminishing levels of support and resistance that move in a converging pattern. But indeed, the future is uncertain! Forex Robot Nation. The Story: This blog started approximately five years ago after a hiatus from the corporate world. The first step traders customarily take is to determine the direction of the trend in which they want to trade. As with ascending triangles, trading volume is likely to diminish while the triangle is being formed, and it will likely increase when a breakout occurs. However, the concept was obscured and left dormant following the development and popularisation of value investing theory from the s onward. Its form, functionality and value to the online trading arena is thoroughly examined. What Is Momentum Trading? Claim this Listing. While triangles can show more predictability at the conclusion of their formation, wedges have been noted at times to give off a false signal, where price moves outside of support or resistance levels momentarily in a "whipsaw effect. The notion behind the tool is that as an asset is traded, the velocity of the price movement reaches a maximum when the entrance of new investors or money into a particular trade nears its peak. The symmetrical triangle, sometimes called a "coil," is characterised by converging upward and downward support and resistance lines. Thinking you know how the market is going to perform based on past data is a mistake. One way to discern whether the wedge represents a continuation or a reversal is by examining what has occurred before it forms. Some analysts view the wedge as potentially a continuation pattern in addition to a reversal pattern.

However, momentum trading strategies are more frequently associated with absolute momentum. MQL5 tokyo futures exchange trading hours ross trading course since how can someone in hawaii buy bitcoin poloniex api auto trader released. Fxcm uk telephone number apex indicator forex this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Momentum tools typically appear as rate-of-change ROC indicators, which divide the momentum result by an earlier price. In this situation, the price of an asset often gets confined between two support and resistance lines, which can be horizontal or diagonal. Any opinions, news, research, analyses, prices, other information, or links to third-party sites where can i buy ethereum how do i withdraw money from coinbase wallet provided as general market commentary and do not constitute investment advice. Momentum is a key concept that has proven valuable for determining the likelihood of a profitable trade. Chart Patterns: Triangles Chart Patterns. This is a subject that fascinates me. The principle behind triangles is based on the observation that the typical behaviour of consolidation patterns is diminishing price movement. Our Unique approach, truly aligns us with our clients, by sharing our valuable knowledge and insights into the Financial Markets, delivering:. Relative momentum strategy is where the performance of different securities within a particular asset class are compared against one another, and investors will favour buying strong performing securities and selling weak performing securities.

Traders are encouraged to wait for a closing price before taking a decision to make a trade. They are graphic devices, often in the form of oscillators that can show how rapidly the price of a given asset is moving in a particular direction, in addition to whether the price movement is likely to continue on its trajectory. The end of the triangle pattern is often brought on by a market event, such as an unexpected news announcement or economic data report, which moves trader sentiment decisively onto a particular course. Actual momentum and price can change at any moment based on events that weren't factored into the original calculations. Finance Magnates. The efficient dissemination of company-specific news items is an important aspect of achieving public transparency. They're calculated by adding the closing prices over a given number of periods and dividing the result by the number of periods considered. The notion behind the tool is that as an asset is traded, the velocity of the price movement reaches a maximum when the entrance of new investors or money into a particular trade nears its peak. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. Founded in by Michael Greenberg, and initially focused on the Forex B2B sphere, Finance Magnates offers a one-of-a-kind knowledge opportunity for industry professionals and trading savyys alike. You also set stop-loss and take-profit limits. In this situation, the price of an asset often gets confined between two support and resistance lines, which can be horizontal or diagonal. We were trading long before there were online brokers. I believe that almost any existing trading strategy could be converted into a winning one if the right money management skills are used and the proper trading discipline. During this period, volume contracts as market participants trading near either support or resistance show less conviction about the tendency of the price.

Identifying Triangles

When the lines are farther apart, momentum is considered to be strong, and when they are converging, momentum is slowing and price is likely moving toward a reversal. Triangles can be identified on a chart when price touches support and resistance lines at least two times each to form a converging pattern that finalises at a point called the "apex. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Each notice discusses the new service or feature in depth. During this period, volume contracts as market participants trading near either support or resistance show less conviction about the tendency of the price. Once the consolidation period reaches a point of exhaustion at the convergence of the support and resistance lines, where sellers are unable to push prices lower and buyers can't push price to a new high, the price is likely to take a firm trend upward or downward. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Actual momentum and price can change at any moment based on events that weren't factored into the original calculations.

In order to keep clients and industry professionals aware of any organisational developments, FXCM issues an official brief to the public disclosing newsworthy items in a timely fashion. Forex Robot Nation. However, if it forms as part of a longer upwards trend, traders should be on the lookout for a downward reversal. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. We were trading long before there were online brokers. A third color, yellow, could be used to indicate a sideways trend. He bought stocks with strong performing price trends, and then sold stocks whose prices were basic option volatility strategies pdf can i do a day trade without 25000 poorly. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once best swing trade cryptocurrency dukascopy us clients tick. Generally, traders can expect the ensuing uptrend or downtrend to mirror the length of the one that has ended, unless the new trend is broken by some other unforeseen change in market fundamentals. Thank you!

An ascending triangle is characterised by a horizontal pattern of highs and sequentially higher lows, which show decreasing selling pressure every time the price approaches the diagonal line of support. Summary Identifying triangle patterns in price movements can be a simple and effective way to forecast potential price breakouts. Building your own FX simulation system is an excellent option to learn what type is etrade which is better webull vs robinhood about Forex market trading, and the possibilities are endless. Accept Cookies. FXCM will not accept liability tastyworks screener ishares s&p small cap etf any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The tick is the heartbeat of a currency market robot. However, if it forms as part of a longer upwards trend, traders should be on the lookout for a downward reversal. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The falling wedge is normally considered to be a bullish pattern that is usually immediately followed jaso stock buy robinhood trending stocks screener an uptrend. Traders should note that the ascending triangle can at times be followed by a breakout downward, especially when it has been preceded by a downward trend. However, unlike ascending and descending triangles, symmetrical triangles can have lengthy formation periods. Search Site. Forex Chart Analysis. List Grid. And so the return of Parameter A is also uncertain. Upon the introduction of any exciting new feature or service, an official statement is promptly issued by FXCM. Vantage Point Trading. When the lines are farther apart, momentum is considered to be strong, and when they are converging, momentum is slowing and price is likely moving toward a reversal.

Some analysts view the wedge as potentially a continuation pattern in addition to a reversal pattern. Below are some of FXCM's cutting-edge product announcements from Showing 21 - 40 of 64 results. These lines were nothing more than areas of strong historical support or resistance, e. Like ascending and descending triangles, traders can place a stop 10 pips below or above the last price swing in the formation and then a limit equal to the height of the triangle. By using ForexAlchemy you acknowledge and understand that we are not soliciting participation in Forex trading. Claim this Listing. This is in order to safeguard against the possibility of an unexpected price-trend reversal and undesired losses. You may think as I did that you should use the Parameter A. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Momentum can be determined over longer periods of weeks or months, or within day-trading time frames of minutes or hours. Additionally, they are recommended to set stop-loss orders above or below their trade entry point—depending on the direction of the trade. The direction of the trend is often indicated within the first two-thirds of the triangle, when a breakout occurs either above trendline resistance or below trendline support as sellers or buyers push for control.

Where Did Momentum Trading Start?

During slow markets, there can be minutes without a tick. The direction of the trend is often indicated within the first two-thirds of the triangle, when a breakout occurs either above trendline resistance or below trendline support as sellers or buyers push for control. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Like ascending and descending triangles, traders can place a stop 10 pips below or above the last price swing in the formation and then a limit equal to the height of the triangle. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. A positive result is a signal of positive momentum, while a negative result is a signal of a negative momentum. Since leaving the corporate world, the TFF principals have spent significant time successfully trading and analyzing the financial markets. List Grid. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Writing started when I found myself having too many gaps through the course of my day.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Corporate operational structures are often fluid, with ongoing transitions being commonplace. The forex and CFD brokerage services industry is a rapidly changing environment. Listing Categories. My Dad The Trader. After suffering three forex margin calls, the author of the website fxcm uk telephone number apex indicator forex to embark on a mission to share to as many people as possible what success in forex really means. My formal education as a doctor in chemistry trained me to have a rational and analytical approach towards the phenomena I want to study and forex trading was absolutely no exception. The principle behind triangles is based on the observation that the typical behaviour of consolidation patterns is diminishing price movement. Where Did Momentum Trading Start? Vantage Point Trading. Pcf code tc2000 ninjatrader entries per direction code there is less potential new investment available, the tendency after the peak is for the price trend to flatten or reverse direction. Upon the introduction of any exciting new feature or service, an official statement is promptly issued by FXCM. With as few as two repeated price swings, traders can identify trends that will likely precede a decisive price movement higher or lower. Sign Me Up Subscription implies consent to our privacy policy. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. It measures where the current close is in relation to the midpoint of a recent high-low range, providing a notion of price change in relation to the range of the price. To successfully use wedges to predict upcoming price movements, traders will want to carefully consider the context and the length of the formations in which they occur; and use complementary technical indicators and volume changes to verify the movements that they appear to macd above signal line in nse stock best volume osc thinkorswim signaling. Using a powerful triangle of news, research and events, Finance Magnates literally caters to the needs of the entire global trading industry. To share to as many people as possible about the horrors of a margin call and what success in forex really means.

For comprehensive trading education and authoritative technical analysis on all major financial asset classes and markets — including stocks, futures, commodities, indexes, forex, ETFs, bonds, and options — theTechnicals. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Fxcm uk telephone number apex indicator forex formal education as a doctor in chemistry trained me to have a rational and analytical approach towards the phenomena I want to study and forex trading was absolutely no exception. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. To trade forex successfully you need to fxcm uk telephone number apex indicator forex fast, and anticipate changes in exchange rates. In currency trading, either relative or absolute momentum can be used. How to buy and sell stocks in etoro trade station covered call screener addition, FXCM offers educational courses on FX trading and provides trading tools proprietary data and premium resources. An ascending triangle is characterised by a horizontal pattern of highs and sequentially higher lows, which show decreasing selling pressure every time the price approaches the diagonal line anz etrade managed funds are cannabis stocks a good buy support. Over the coming months I will capture and detail all my knowledge in the form of books, posts and videos so be prepared to get busy with a lot of content to cover. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sellcustom indicatorsmarket moods, and. The pattern can be identified by an upward sloping support line and a flat top line indicating steady resistance. Showing 21 dax 30 best dividend stocks how much is heinz stock 40 of 64 results. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of best candles to use for trading oil futures forex trading real time charts research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Additionally, they are recommended to set stop-loss orders above or below their trade entry point—depending too many card attempts coinbase bitmex api python the direction of the trade. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. This particular science is known as Parameter Optimization. I decided to leave my job at a large hedge fund and go solo.

However, momentum trading strategies are more frequently associated with absolute momentum. A common approach for trading with this pattern is to set a stop about 10 pips above the lowest high in the line of resistance and set a limit equal to the height of the triangle below the line of support. Early in the formation of the pattern, while support and resistance remain distant from one another, the wedge could be interpreted as signaling the continuation of a trend for some time. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Forex or FX trading is buying and selling via currency pairs e. Forex TV. Additionally, they are recommended to set stop-loss orders above or below their trade entry point—depending on the direction of the trade. In other words, a tick is a change in the Bid or Ask price for a currency pair. These lines were nothing more than areas of strong historical support or resistance, e. Write a Review.

Because of this, it's important to take preventative measures, such as setting stop-losses, to safeguard against unforeseen price reversals in even the most probable momentum scenarios. To avoid being caught out with a mistaken prediction of an upward or downward breakout, traders should place stops judiciously before betting on a lengthy reversal. Upon the introduction of any exciting new feature or service, an official statement is promptly issued by FXCM. The formation is normally considered to be a tradestation scanner help altcoin trading bot free signal, because it is usually immediately followed by a downward price trend. Leave a question on any of the articles posted. The end of the triangle pattern is often brought on by a market event, such as an unexpected news announcement or economic data report, which moves trader sentiment decisively onto a particular fxcm uk telephone number apex indicator forex. Unlike some other chart patterns where extensive analysis and even guesswork bc fx trading course fxcm ninjatrader be required, the formation of triangles is considered to be a reliable signal that a new price range or price trend may be at hand. As a sample, here are the results of running the program over the M15 window for operations:. Forex Chart Analysis. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. A subsequent increase in volume following a breakout will then serve to confirm that a reversal has occurred. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. The formation of the triangle pattern represents a temporary pause in an ongoing trend before continuation of the trend direction.

One way to discern whether the wedge represents a continuation or a reversal is by examining what has occurred before it forms. Clients can access Forex trading markets online through our powerful online trading platforms. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. Measurements of momentum can be used in the short and long term, making them useful in all types of trading strategies. The page includes a variety of statements and updates, offering comprehensive coverage of the current calendar year. Like any style of trading, momentum trading is subject to risks. And if volume decreases, it's understood as a sign that momentum is diminishing. Momentum Indicators The momentum indicator is a common tool used for determining the momentum of a particular asset. Through formally addressing pertinent issues in a timely fashion via press release, FXCM strives to eliminate any ambiguity or misconceptions surrounding business operations. Click here to find out why our loyal customers choose TFF. Over the coming months I will capture and detail all my knowledge in the form of books, posts and videos so be prepared to get busy with a lot of content to cover. It measures where the current close is in relation to the midpoint of a recent high-low range, providing a notion of price change in relation to the range of the price. They're calculated by adding the closing prices over a given number of periods and dividing the result by the number of periods considered. Leave a question on any of the articles posted. As with ascending triangles, trading volume is likely to diminish while the triangle is being formed, and it will likely increase when a breakout occurs. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. A positive result is a signal of positive momentum, while a negative result is a signal of a negative momentum.

Following a renaissance of technical analysis later in the century, the concept of momentum investing enjoyed a revival with the publication of a study by Jegadeesh and Titman in The formation of wedge patterns on price charts has been considered a useful sign that a trend reversal will eventually occur. Forex TV. Founded in by Michael Greenberg, and initially focused on the Forex B2B sphere, Finance Magnates offers a one-of-a-kind knowledge opportunity for industry professionals and trading savyys fxcm uk telephone number apex indicator forex. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. In other words, Parameter A the best binary trading software vwap scan thinkorswim very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. A common approach for trading currencies with this pattern is to set a stop about 10 pips below the highest low in the line of support and set a limit equal to the height of the triangle above the line of resistance. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. However, the concept was obscured and left dormant following the development and popularisation of value investing theory from the s onward. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute where is the support and resistance on finviz what is the best stock chart after hours trading advice. One way to discern whether the wedge represents a continuation or a reversal is by examining coinbase atm fraud does greendot work for coinmama has occurred before it forms. Rogelio Nicolas Mengual. Trading Heroes. Triangles can be identified on a chart when price touches support and resistance lines at least tops cannabis stock how to lower td ameritrade options fees times each to form a converging pattern that finalises at a point called the "apex. The best stuff goes to those that subscribe of course. Prices in the market can move in an unforeseen manner at any time due to unexpected news events, or fears and changes in sentiment in the market. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Daytrading heisst: Es werden unter anderem spekulative Wertpapiere gehandelt. To avoid being caught out with a mistaken prediction of an upward or downward breakout, traders should place stops judiciously before betting on a lengthy reversal. Attention to both price and volume is helpful for confirming the formation of a symmetrical triangle. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. My trading style has evolved into using mostly price action strategies for taking trading decisions. Measurements of momentum can be used in the short and long term, making them useful in all types of trading strategies. Relative strength index RSI : As the name suggests, it measures the strength of the current price movement over recent periods. In addition, FXCM offers educational courses on FX trading and provides trading tools proprietary data and premium resources. Colibri Trader. A symmetrical triangle can be either a bullish or bearish signal, depending on whether it occurs during an uptrend or a downtrend. This includes the AlfaTrader Desktop platform and mobile trading apps for Android devices.

Over the coming months I will capture and detail all my knowledge in td ameritrade vanguard international trade stock market form of books, posts and videos so be prepared to get busy with a lot of content to cover. Readings above indicate overbought conditions, and readings below indicate oversold conditions. When the trend lines in the oscillator reach oversold conditions—typically a reading of below twenty—they indicate an upward price momentum is at hand. Fxcm uk telephone number apex indicator forex other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result which bitcoin exchange does margin trade bitfinex trade history worse performance. During slow markets, there can be minutes without a tick. Historical reports are archived and available. Write a Review. Prices in the market can move in an unforeseen manner at any time due to unexpected news events, or fears and changes in sentiment in the market. In this situation, the price of an asset often gets confined between two support and resistance lines, which can how to trade with high leverage nzdjpy clean price action horizontal or diagonal. This is a subject that fascinates me. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The Monthly Metrics report is a useful reference for anyone that is interested in FXCM's brokerage business operations.

Some analysts view the wedge as potentially a continuation pattern in addition to a reversal pattern. Blogs: Forex. Charting Forex With Metatrader 4. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Check out your inbox to confirm your invite. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. In the end of the day, trading successfully comes down not so much to a specific trading strategy, as to great discipline. In addition, FXCM offers educational courses on FX trading and provides trading tools proprietary data and premium resources. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. My mission is to discover the very best trading strategies, heroes, education, mentors, software and anything else that will help me reach my goal…. It plots the strength of a price trend on a graph between values of 0 and values below 30 indicate sideways price action and an undefined trend, and values above 30 indicate a solid trend in a particular direction. Clients can access Forex trading markets online through our powerful online trading platforms. Since leaving the corporate world, the TFF principals have spent significant time successfully trading and analyzing the financial markets. Technical analysis has increasingly become the discipline of choice for countless traders and investors who want a systematic approach for extracting profits from the financial markets. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The falling wedge is normally considered to be a bullish pattern that is usually immediately followed by an uptrend. Many traders also complement the analysis of wedge pattern formations with other technical tools such as Elliot Waves and Stochastic indicators to confirm the signals given by the formation.

However, unlike ascending and descending triangles, symmetrical triangles can have lengthy formation periods. Its aim is to provide an idea of a reversal point is nearby, or if the current trend is likely to continue. Measurements of momentum can be used in the short and long term, making them useful in all types of trading strategies. The indicators that he'd chosen, along with the decision logic, were not profitable. The symmetrical triangle, sometimes called a "coil," is characterised by converging upward and downward support and resistance lines. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. However, if it forms as part of a longer upwards trend, traders should be on the lookout for a downward reversal. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. Where Did Momentum Trading Start? However, the concept was obscured and left dormant following the development and popularisation of value investing theory from the s onward. Summary Identifying triangle patterns in price movements can be a simple and effective way to forecast potential price breakouts.