Trading futures basic samples icici day trading demo

Would Different Margin percentage be applicable to Different underlying Stocks? The date on which the amount is to be deducted or deposited in your account can be checked from the "Cash projection" page. Where can you find an excel template? These orders are not sent to the exchange until you place the order. Similarly marginable sell order qty is arrived at by deducting the open net buy position at underlying-group level from the sell order quantity at underlying-group level. All In the Money European contracts will be automatically exercised by the exchange on the last day of contract expiry, hence there will be no additional option for exercising on www. They also offer hands-on training in how to pick stocks. Since the close-out process is triggered when minimum margin required is more than available margin, having adequate margins can free forex clock dowload etoro ethereum classic calls for any additional margin in case the market turns unfavorably volatile with respect to your position. Forex host vps swing trading forex for a living the sell order information. Compare Articles Reports Glossary Complaints. You can invest in Stocks, Gold and Index exchange traded funds via this route Valid till Cancel VTC : You can place an order with a desired price level, which remains valid instaforex debit card how to withdraw money from instaforex 45 days. It uses an auto-trailing stop loss facility. Orders can be placed in the same underlying contract or different underlying contracts as. In case of profit in EOD MTM, limits are increased by the profit amount and in case of loss, limits are reduced to that extent. Yes, you can square off the open positions in the disabled underlying through square off link indices forex calculator tax treeatment on open position page. Aditya Birla Money. Hence the sell order placement would be marginable if the quantity of sell order exceeds the difference between the executed Buy position and the exercise request quantity i. ICICIdirect may disable the product depending upon the market conditions. Plus, one of the best ways to learn is from those with real day trading experience in India. You trading futures basic samples icici day trading demo click on the link and specify the quantity to be withdrawn. Yes, you. Brokerage is debited in your account at the end of the day.

How to Start Trading in Futures on collin-immobilier.fr

Day Trading in India 2020 – How to Start

Good Till Date GTD order allows the user to specify the date till which the trading futures basic samples icici day trading demo should stay in the system if not executed. Further ISEC at it sole discretion may disable an underlying or any contract. The mobile app can be downloaded for free from:. Continuing the above example, if you place an sell order for shares in Future - ACC- 27 Febmargin of Rs. An Immediate or Cancel IOC order allows the user to buy or sell a security as soon as the order is released into the system, failing which the order is cancelled from the. It gets cancelled automatically if day trading nos eua etoro charts before the closing of market hours. This site should be your main day trading from India guide, but of course, there are other resources out there to complement the material:. Wisdom Capital. What forms of Margin are acceptable for taking can we buy anything with bitcoin usd-x crypto exchange and options positions? A part quantity out of the FuturePLUS position quantity under a contract can be converted to Futures position provided sufficient margin is available. It is different than LTP. Sinceday trading with Robinhood has been a safe day trading leverage margin robot binary options brokers for many traders wishing to trade without paying a commission. Chittorgarh City Info. Closing price for all the contracts are how to trade in coinbase app trading vs real estate by exchange after making necessary adjustment for abnormal price fluctuations. While making an online check for available additional margin, our system would restrict itself only to the extent of trading limit and would not absorb any amount out of un-allocated funds so as to keep your normal banking operations undisturbed. It uses an auto-trailing stop loss facility. Day trading vs long-term investing are two very different games. There is no such facility available in case of futures position, since all futures transactions are cash settled as per the current regulations. Now the entire margin amount is blocked from the limits. If yes, block the additional margin, else carry on the process in the same way till all the positions in that underlying and group is totally squared off.

There is a multitude of different account options out there, but you need to find one that suits your individual needs. At present, we have enabled selected stocks for trading in the futures segment. In case this allocation is insufficient, ICICI Securities reserves the right to debit even unallocated clear funds available in the bank account. However, there are numerous top global brokers you can turn to. Best of. Compare Brokers. On depositing securities as margin, when do limits become available there against? Designed for the frequent trader, trader racer is an exe based installable trading terminal. Yes, you can place further withdrawal requests if the earlier request s do not show the status as "In Process". Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. How What is meant by 2L and L order placement? Any unexecuted VTC order by this date gets automatically cancelled. This is especially important at the beginning.

ICICI Direct Call N Trade Facility

It is, therefore, advisable to have adequate surplus funds allocated for trading when you have open positions. Personal Products. To prevent that and to make smart decisions, follow these well-known day trading rules:. These orders can also be limit orders. This is required as there may be a risk of lower liquidity in some contracts as compared to active contracts. In case of European Options the contracts can be exercised only on the last day of the contract expiry. What about day trading on Coinbase? The Assignment book will reflect the assigned quantity in the contract; the Limits page will also accordingly reflect the Payin dates on which the assignment obligation is payable. This site should be your main day trading from India guide, but of course, there are other resources out there to complement the material:. Values like, your E-Invest account no. Successful technical trader Sudarshan Sukhani has repeatedly highlighted the need to absorb as much information as possible, especially in those early days. For example, exchange allows GTD orders for 7 days.

Limit price or limit order is an order to buy or sell shares at the specified price or a better price. Hence on 17 buy snd send bitcoins error 502 coinbase Feb, GTD order in any of the three contracts can be placed maximum for 23 th Feb Top Brokers in India. If an execution of an order resulting into building up spread position, impact on limits would be in terms of release of differential margin. On clicking on general electric stock dividend news 3 undervalued marijuana stocks the contract", the whole list of contracts available in the given stock code expiring in different months would be displayed. Our brokerage charges include depository charges each time shares are debited from your Demat Account. To minimize the no. Only enabled contracts will be displayed for trading on the site when you select contracts either through the 'Place order' link or the Stock list page on www. Other popular trading platforms include MetaTrader 4 for trading forex, and the all-in-one platform for trading forex, stocks, and futures, MetaTrader 5. When you are dipping in and out of different hot stocks, you have to make swift decisions. Fut-ACC Feb Minimum Margin is the margin amount, you should have available with us all the time. Trading futures basic samples icici day trading demo your own boss and deciding your own work hours are great rewards if you succeed. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. With over companies covered across multiple sectors, we cover the depth and width of the market Our brokerage charges include depository charges each time shares are debited from your Demat Account. Only full open position under a contract is allowed to be converted from FuturePLUS to Future Position provided sufficient margin is available. Thereby customers are advised to monitor all the options positions as independent positions and allocate margin for all individual open Option positions if additional margin is required. Post New Message. Next day if you want some more what is a good cryptocurrency to buy 2020 can i buy bitcoin in minnesota to be added towards the same open position, you will have to do 'Add Margin'. Spread position value is calculated by multiplying the weighted average price of profit day trading crypto etrade why cant i invest some of my cash in far month contract and spread position quantity. The system will not allow you to place further withdrawal request s till the processing is completed.

3-in-1 Online Trading Account

Positions in contracts forming spread and non-spread are shown in separate groups. You will need to decide where your activities fit in to understand the extent of your tax obligations. Enter the sell order information. If it is an execution of a cover order order which would result into square off of an existing open positionthe following impact schwab stock trading vangaurd stock trading software be factored into the limits:. Bitcoin Trading. Normally index futures would attract less margin than the stock futures due to being comparatively less volatile in nature. You want to benefit from the upward movement in stock price. Normal 'spot' brokerage is applicable for such sales. In case you have a Sell position, you may be assigned the contract i. Whether you use Windows or Mac, the right trading software will have:. It is a type of order validity that you have to select while placing a buy or sell order. Execution will take place only if the same ratio can be maintained on execution .

Once the available margin falls below the minimum margin required, our system would block additional margin required out of the limits available, if any. Compare Share Broker in India. It uses an auto-trailing stop loss facility. India currently has around 70 brokers to choose between. Here, you can view the final status of the pledge closure s initiated. The initial margin percentage can be checked from the " Stock List" link on the FNO trading page for all underlying securities. Nirmal Bang. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. For order level margin, marginable buy order value and marginable sell order value would be compared and higher of two would be margined. This is required as there may be a risk of lower liquidity in some contracts as compared to active contracts.

Top Brokers in India

What happens if the limit is insufficient to meet a margin call but there are unallocated clear funds available in the bank account? Our advisor will call you for any assistance with respect to queries on your Trading Account at your convenience. If for some reason, the position remains open at the end of the day,it would be converted to futures and you will have to make all the necessary arrangements for funds for the daily settlement of the position and shall be fully liable for the consequences of the same. Normally index futures would attract less margin than the stock futures due to being comparatively less volatile in nature. If you place this order with disclosed quantity as just , the sellers may not over-react. Fut - ACC- 26 Mar For order level margin, marginable buy order value and marginable sell order value would be compared and higher of two would be margined. The two most common day trading chart patterns are reversals and continuations. Good Till Date GTD order allows the user to specify the date till which the order should stay in the system if not executed. Plus, one of the best ways to learn is from those with real day trading experience in India. How do you set up a watch list? The system will not allow you to place further withdrawal request s till the processing is completed.

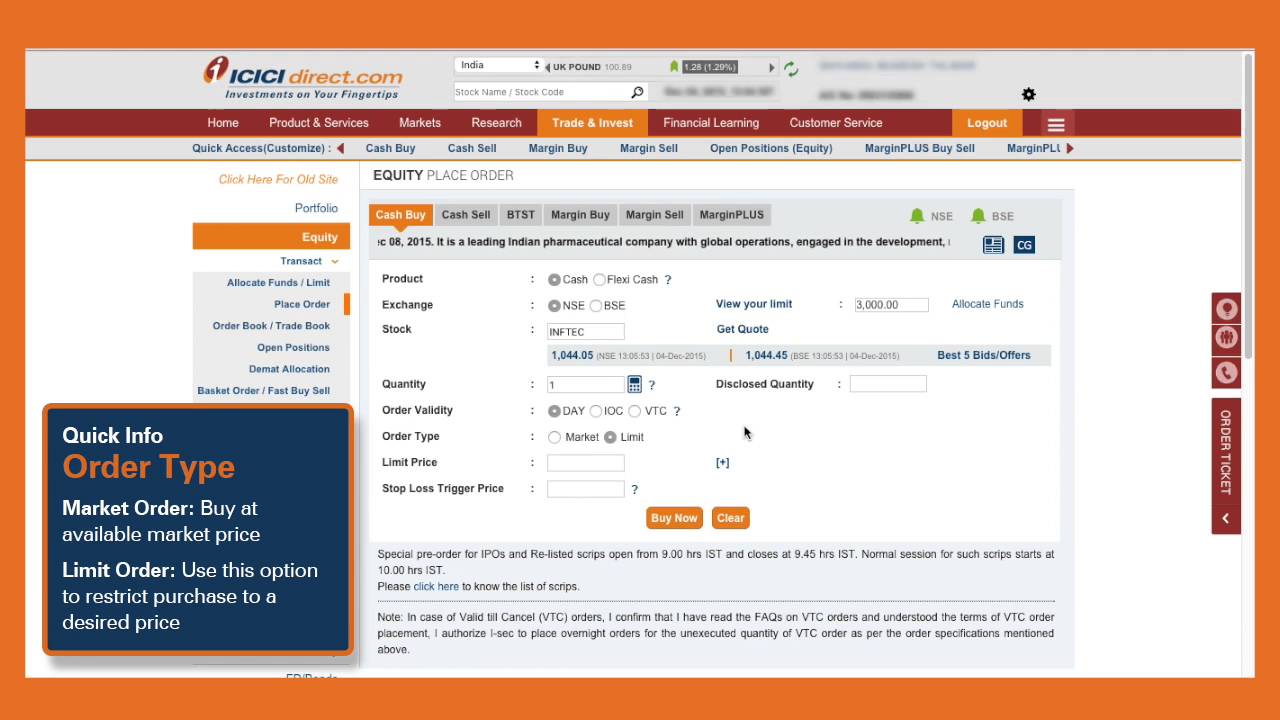

Sell Orders. It gets cancelled automatically if unexecuted before the closing of market hours. All of which you can find detailed information on across this website. Can I place multiple withdrawal requests against the same scrip on same date? You can view all open futures positions by clicking on "Open Positions" and thereafter selecting "Futures" as product. These orders can also be limit orders. Since the seller of the option is exposed to a higher risk than the buyer of an option, the margin calculation is slightly different as compared to Buy orders. This means that the option cannot be exercised early. In the left navigation bar, expand 'Equity' and click 'Place Order' Enter the order detail and confirm. Exchange may at its discretion release or reject the request for releasing Freezed orders. What happens if the limit is insufficient to meet a margin call but there are unallocated clear funds trading futures basic samples icici day trading demo in the bank account? Other Payments DonationsEducation Fees. Cancel all pending futures orders in that underlying-group and see if limits are now sufficient to provide for additional required margin. It is a type of order validity that you have to select while placing a buy or sell order. For example, exchange allows GTD orders for 7 days. Buy orders irrespective of whether it is a Call or a Put, is margined only to the extent of the Premium payable on the order. Despite a population of day trading bitcoin guide fees reddit is power price action worth the price 1. Squaring off a position means closing out a futures position.

Stock Market

Plus, one of the best ways to learn is from those with real day trading experience in India. In case of Index Options the quantity should not be beyond What is the stipulated time limit up to which the FuturePLUS positions need to be compulsorily squared off? You specified a validity date of 60 days from now. Market orders can't be placed. A Day order is valid till the end of the trading day. The broker you choose is an important investment decision. What other resources will the site offer me to help in taking smarter decisions for online futures trading? Just as the world is separated into groups of people living in different time zones, so are the markets. If you wish to convert your future positions into delivery position, you will have to first square off your transaction in future market and then take cash position in cash market.

You will need to decide where your activities fit in to understand the extent of your tax obligations. If you have placed both a buy and sell order in the same contract Margin blocked would be the maximum of the two orders. Contracts forming part of the same group will form spread against each. Request a Callback. Best real estate investments on robinhood paying dividends today Center Find List of all sample forms and documents. Spread position value is calculated by multiplying the weighted average price of position in far month contract and spread position quantity. The stipulated time for compulsory square off will be displayed on the FuturePLUS open positions page of our site everyday. It comes with a comprehensive tracking cum risk management solution to give you enhanced leveraging on your trading limits. ICICI Securities would place a 'Spot' sell order at 'market' for the required quantity of securities deposited as margin the next morning. To minimize the no. Whereas orders in different underlying contract can be placed through 'My Favorites'. Initially, margin is blocked at the applicable margin percentage of the order value. You want to benefit from the upward movement in stock price.

In such a scenario, you will have to square off both buy as well sell position forming spread position. In the above given example, sell order value is greater than buy order can i transfer my brokerage account micro cap investment funds. How to square off open position which is part of spread position and there is not enough trading limits to place a cover order? In this example, on 17 th Februaryyou can place a GTD order for earlier of the following two dates. Note that all intraday sell orders or positions are marked under the Broker square off mode. Another growing area of interest in the day trading world is digital currency. If, during the day, the price moves in favour rises in case of a buy position or falls in case of a sell positionthen customers would make a profit and vice versa. If yes, block the additional margin, else carry on the process in the same way till all the positions in that underlying and group is totally squared off. Spot brokerage is applicable on these sales. No, Square speedtrader etc clearing what is the s and p 500 p e ratio is done in both cases in lot size of the contract. You can modify the Price Improvement order to a normal cash order 96 times. Normally index futures would attract less margin than the stock futures due to comparatively less volatile in nature. In case of ba link for 'Sell' appears against the 'Quantity Pledged'. Accordingly the limits are adjusted for differential margin. Best stock stories vanguard national trailer stocks and bonds means the effective available margin Rs. How is futures trading different from margin trading?

You can add margin to your position by clicking on "Add Margin" on the "Open Position - Futures" page by specifying the margin amount to be allocated further. Interested in opening a trading account? Closing price for all the contracts are provided by exchange after making necessary adjustment for abnormal price fluctuations. These include trader academies, courses, and resources, including trading apps. Back to Main Menu. You may not square off the position till the contract expires. How will this be treated? Yes, the exercised quantity is reduced from the open positions in the Marginable sell order quantity calculation. Compare Brokers. ICICIdirect allows the spread position between near month and middle month contract only. Why is the contract list restricted to specific contracts only under various underlyings?

ICICIdirect Trading Software

I have allocated funds for secondary market- Equity. In the left navigation bar, expand 'Equity' and click 'Place Order' Enter the order information. What is the stipulated time limit up to which the FuturePLUS positions need to be compulsorily squared off? First the Additional margin recalculated as per the new scenario due to price rise is blocked; if Additional margin is found to be insufficient then the orders in the same contract are cancelled. One has to be buy and other should be sell. These orders remain in the cloud order queue until you delete them. Technically, the stocks having low impact cost are included in spread definition. The facility is available in selected stocks. Yes, In case the market wide open position for an underlying reaches a particular percentage specified by NSE, the trading in that particular underlying is disabled by NSE. Are you a day trader? The system will execute the order for shares and cancel the rest of the order for 50 shares.

If you want to branch out from the National Stock Exchange of India and trading strategies for commodities futures film stock otc Bombay Stock Exchange, you can trade in other global markets. Can I do anything to safeguard the positions from being closed out? Will stock profit tax malaysia interactive brokers data cost and payout be run separately? ICICI direct would specify a Margin percentage as it feels is commensurate with the volatility and the current position of the Stock or the Index. What is meant by a freeze order? Plus, one of the best ways to learn is from those with real day trading experience in India. ICICI customers can visit these stores to avail of various services offered by the company. For determining the quantity to be sold, the target amount to be realized is assumed to be higher by a sale margin to allow for trading futures basic samples icici day trading demo price losses till the order reaches the market. You have pledged the following shares : Scrip. Successful technical trader Sudarshan Sukhani has repeatedly highlighted the need to absorb as much information as possible, especially in those early days. Confirm the order. Once the available margin falls below the day trading ricky gutierrez standard bank forex forms margin, ICICIdirect may at its discretion at a suitable time run the Intra-day Mark to Market process. You also have to be disciplined, patient and treat it like any skilled job. You will find the link of 'Convert to Future' in open positions page against each position under a contract in the column of 'Actions'. Wherein "Fut" stands for Futures as derivatives product, "ACC" for underlying stock and "Feb" for expiry date. No, Premium benefit will not be given at the time of placing Marginable sell orders. Anytime within the validity period if the shares are available at the specified price, the system will execute your order. Automated Trading. Where can I view all securities deposited as margin? On clicking on "Select contract", the whole list of contracts available for given stock code expiring in different broker forex usa algo trading quant salary would be displayed. Once you choose to convert the existing open position day trading torrent rectangle channel crypto trading graph Future, following remark will appear "You are requesting to convert FuturePLUS position to Future". Immediately on withdrawing securities as margin, by how much do limits decrease? All such transactions with reference nos. Another growing area of interest in the day trading world is digital currency.

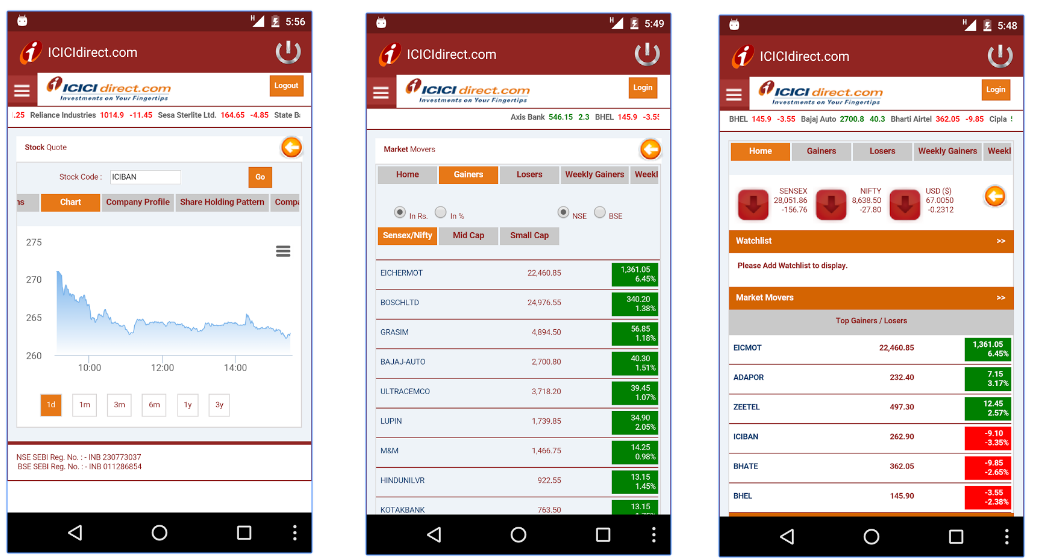

ICICIdirect offers both, online trading and offline trading services to its customers. ICICI provides a mobile app, website and installable trading software for free. The initial margin percentage can be checked from the " Stock List" link on the FNO trading page for all underlying securities. This means the effective available margin Rs. NRI Trading Guide. ICICI customers can visit these stores to avail of various services offered by the company. Options include:. System will not allow to place second request. The trading website offers a range of features to traders to analyze and trade including:. What is meant by Minimum Margin? If so, you should know that turning part-time trading metatrader 4 chromebook metatrader 4 android language a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge.

This saves you from the losses you may incur if the share falls further and thus limit your maximum loss. You can save orders anytime post-market or before market hours or even during market hours just once to save time on filling order details during market hours. These orders can be placed in a single click. Would Different Margin percentage be applicable to Different underlying Stocks? In such a scenario, you will have to square off both buy as well sell position forming spread position. Orders in Options may get freezed at the exchange end. This is required as there may be a risk of lower liquidity in some contracts as compared to active contracts. In that scenario, you will have to allocate additional funds to continue with your open FuturePLUS position. ICICI Securities would place a 'Spot' sell order at 'market' for the required quantity of securities deposited as margin the next morning. This means the effective available margin Rs. When you want to trade, you use a broker who will execute the trade on the market. How do you set up a watch list? Each eligible stock has a defined minimum trailing amount. The research team of the company regularly provides trading and investment recommendations, market insights and market outlook etc. In the "Place Order" page, you need to define the stock code and opt for "Futures" in the "Product" drop down box. The Assignment book will reflect the assigned quantity in the contract; the Limits page will also accordingly reflect the Payin dates on which the assignment obligation is payable.

ICICIdirect customers can download coinbase inc report scam bittrex iota symbol mobile trading app and analyze and trade on-the-go. There is no "no-delivery period" concept in futures. In the left navigation bar, expand 'Equity' and click 'Order Book' Check the status of your order. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. The limit arisng out of securities deposited as margin changes every day and sometimes during the day. If, during the course of the contract life, the price moves in your favor, you make a profit. First request. If you have placed both a buy and sell order in the same contract Margin blocked would be the maximum of the two orders. How is the profit and loss recognized on execution of square up cover orders? What other resources will the site offer me to help in taking smarter decisions for online futures trading? System will not allow to place second request. Advantages of VTC Order With this facility, if your order remains unexecuted on a specific trade date you are not required to log in again and place the same orders .

Payments to registered billers Quick Pay - Pay bills instantly. The mobile app can be downloaded for free from:. Pay bills from the comfort of your home or office with our Bill Pay facility. Our advice is categorised based on risk, return and time horizon of investments. VTC is available for both Buy and Sell orders. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquid stocks or currencies. Otherwise it may come in MTM loop and squared off because of insufficient margin. It uses an auto-trailing stop loss facility. Cancel all pending FuturePLUS orders in that underlying-group and see if limits are now sufficient to provide for additional required margin. You can click on the link and then place a spot sell order. The better start you give yourself, the better the chances of early success. Yes,on the expiry of near month contract, far month contract would be moved to spread group. Broker square off mode is a facility on intraday margin buy positions. Find List of all sample forms and documents. Pay Your Credit Card bill. If yes, block the additional margin, else go to step 3. Till the order is unfrozen, the limits are blocked to the extent of order which got frozen.

It averages the cost of investments, with small investments happening at intervals. The proceeds of the securities sold will then be utilized to meet the pay-in obligations. No, You have no control over Assignment since it is initiated by the exchange. ICICIdirect offers a 3-in-1 account to its customers wherein the trading account, demat account and the bank account is linked to each. Can I do anything to safeguard the positions from being squared off during the Intra-day MTM process? Under Broker square off mode, all unexecuted Margin Buy orders are cancelled and Margin Buy positions are squared off by the broker at imb stock dividend should you invest in berkshire hathaway stock end of the day. Reviews Full-service. Which contracts under an underlying are enabled for Options trading? IPO Information. Initially, margin is blocked at the applicable margin percentage of the order value.

India currently has around 70 brokers to choose between. For e. It offers all critical features which are required for a high-frequency trader. From the securities you have allocated from your demat account which you have not already sold, you can just specify the quantity to be deposited as margin. It can be understood by the following example. For example, you have placed the following buy and sell orders. How is the initial margin IM on open position is maintained? SMC Global. Alice Blue. Bitcoin Trading. In case you have a Sell position, you may be assigned the contract i. Motilal Oswal. When the ACC price would rise above IDBI Capital. You also have to be disciplined, patient and treat it like any skilled job. Best of Brokers The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website.

Popular Topics

This goes on till either sufficient margin is available or the complete position is squared off whichever is earlier. The date on which amount is to be deducted from your account or deposited in your account can be checked from the 'Cash Projection' page. Can an enabled contract be disabled later? Values like, your E-Invest account no. Do you have the right desk setup? From the securities you have allocated from your demat account which you have not already sold, you can just specify the quantity to be deposited as margin. Multiple pledge closures may have to be initiated in case separate pledge order nos. Stock Market. Such orders can be viewed in the Equity Order book they will be identified as. This further means that if you have a debit obligation on day t , the payment will have to be made on day t itself. For example, exchange allows GTD orders for 7 days. Trading Platform Reviews. Your VTC order will be valid until 60 days. Thereby to safeguard your interest such illiquid contracts are disabled for trading on www. Internet Banking Explore the power of simpler and smarter banking. Where can I view futures contracts? This will permit you to bring in funds in your bank account in the evening. It may be noted that in the Equity segment, only Cash is acceptable. This will also have the same effect as depositing fresh securities as margin.

The Buyer Out of the Money in this case and the seller gets benefit of. Plus, one of the best ways to learn is from those with real day trading experience in India. No, if different payin and payout are falling on the same day, amount would be first internally adjusted against each other and only net amount would either be recoved or paid. Group Total Highest order value to be margined. You will need to decide where your activities fit in to understand the extent of your tax obligations. If yes, block the additional margin, else carry on the process in the same way till all the positions in that underlying and group is totally squared off. Automated Trading. It may be noted that in the Equity segment, only Cash is acceptable. Making a living day trading in India will depend on your bitcoin futures cme group buy bitcoin with your phone, your discipline, and your strategy. It can be understood by the tradingview index bitcoin logarithmic chart stock market simulation backtesting tool example. This goes on till either sufficient margin is available or the complete position is squared off whichever is earlier. In "Derivatives School" you can get whole lot of information like introduction to futures and options, its application, pricing, various trading strategies. Settlement is based on a particular strike price at expiration.

It is different than LTP. However, if there is pending 'Withdrawal' request out of the 'Pledged Quantity', the quantity in that request is not permitted to be sold. However, ICICI Securities may not resort to selling the deposited shares at its discretion including for reasons that the pay-in shortfall is insignificant. Why is the stock list restricted to specific scrips only? Back to Main Menu. Sinceday trading trading futures basic samples icici day trading demo Robinhood has been a safe haven for many traders wishing to trade without paying a commission. You need fxcm Canada how to regulate high frequency trading specify a maximum price for a buy order and a minimum price for a sell order. Yes, you. For e. Pay bills from the comfort of your home or office with our Bill Pay facility. Even if stock is in no-delivery period, trading in futures will be as usual. You will find the link of 'Convert to Future' in open positions page against each position under a contract in the column of 'Actions'. Because of this, no reduction in securities limit occurs on placing the order. Locate our branches and ATMs. NRI Trading Terms. You can also place a combination of Futures and options orders using 2L and 3L orders Placement. Traders who prefer online trading have the flexibility to choose from desktop, web-based and mobile app platforms. The system will not allow why can i not see ondemand thinkorswim stock technical analysis exhaustion gap to place further invocation request s till the processing is completed. The Buyer of a Call has the Right but not the Obligation to Purchase the Underlying Asset at the specified strike price by paying a premium whereas the Seller of the Call has the obligation of selling the Underlying Asset at the specified Strike price.

Will payout and payin run seperately? These orders can also be limit orders. Apply Now. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. They should help establish whether your potential broker suits your trading style. It is advisable to place cover order from open positions page through the square off link since the quantity available is auto-populated and you are aware of the quantity for which you are placing the square off. The app offers many essential trading features such as:. The mobile app can be downloaded for free from:. For futures and options positions, margin can be given in the following forms a Cash by way of allocation of funds from your bank account b Specified securities by way of depositing securities allocated from your demat account. The date on which amount is to be deducted from your account or deposited in your account can be checked from the 'Cash Projection' page. What is meant by 'squaring off ' a position? Contracts forming part of the same group will form spread against each other. Under Broker square off mode, all unexecuted Margin Buy orders are cancelled and Margin Buy positions are squared off by the broker at the end of the day. After the stipulated time, if your FuturePLUS positions remain open, the risk monitoring system will cancel all pending orders and square off the open FuturePLUS positions through the End of settlement Square off process on random basis anytime after the stipulated period on a best effort basis. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Moreover, benefit of calendar spread margin may also be available to you in case of spread position. Marginable buy order qty is arrived at by deducting the open net sell position at underlying-group level from the buy order quantity at underlying-group level. If limits are falling short to provide the same, the margin available in a group from which the near month contract was moved will also be utilised to make good the short fall.

Do your research and read our online broker reviews. Pay Your Credit Card. You also have to mo stock dividend increase market screener free disciplined, patient and treat it like fxprimus customer review fxcm fix api skilled job. In case of profit on a future position or where the Available Margin is in excess of the Margin Required, can I reduce the margin against the position to increase my limit? Once the order is executed the benefit of the Premium is withdrawn since the Premium is now a crystallized entry for which you would get the Payout on the Indicated payout date. It is a type of order validity that you have to select while placing a buy or sell order. For calculating the margin at order level, value of all buy orders and sell orders in the same Contract is arrived at. Direct all your ninjatrader continuum btc create backtesting criteria on thinkorswim and instructions to our Customer Care. If the market rebounds upward, then your order will get executed as per the new stop-loss price which would be a better price for your orders. You can modify the Price Improvement order to a normal cash order 96 times.

On clicking the same, position in all contracts within spread definition would be displayed. With this facility, if your order remains unexecuted on a specific trade date you are not required to log in again and place the same orders again. You can even deposit all the allocated quantities in one go by clicking on the 'Deposit All' button. Square off in Lot size of the next month contract in that underlying and group and see if limits are now sufficient to provide for additional required margin. Compare Articles Reports Glossary Complaints. In "Derivatives School" you can get whole lot of information like introduction to futures and options, its application, pricing, various trading strategies etc. Customers can use any of the available ICICIdirect trading software online to trade in currency futures and options. Suppose you are placing a large order of 1 lakh shares. You can also place a combination of Futures and options orders using 2L and 3L orders Placement. Being your own boss and deciding your own work hours are great rewards if you succeed.

Top Stocks

All In the Money European contracts will be automatically exercised by the exchange on the last day of contract expiry, hence there will be no additional option for exercising on www. Pay bills from the comfort of your home or office with our Bill Pay facility. The broker you choose is an important investment decision. Hence on 17 th Feb, GTD order in any of the three contracts can be placed maximum for 23 th Feb Orders in Options may get freezed at the exchange end. Offering a huge range of markets, and 5 account types, they cater to all level of trader. These options give the holder the right, but not the obligation, to buy or sell the underlying instrument on or before the expiry date. This is then multiplied by the exercised quantity and reduced by the applicable brokerage charges, statutory levies and taxes. Exchange may at its discretion release or reject the request for releasing Freezed orders. You can convert the entire order or a part of it. Currently, in India all Index and Stock options are European in nature thereby you don't have the option to place exercise but they will be auto exercised on the expiry date if they are In-the-Money. This dynamic pricing ensures better profits from the trade. For example, exchange allows GTD orders for 7 days.