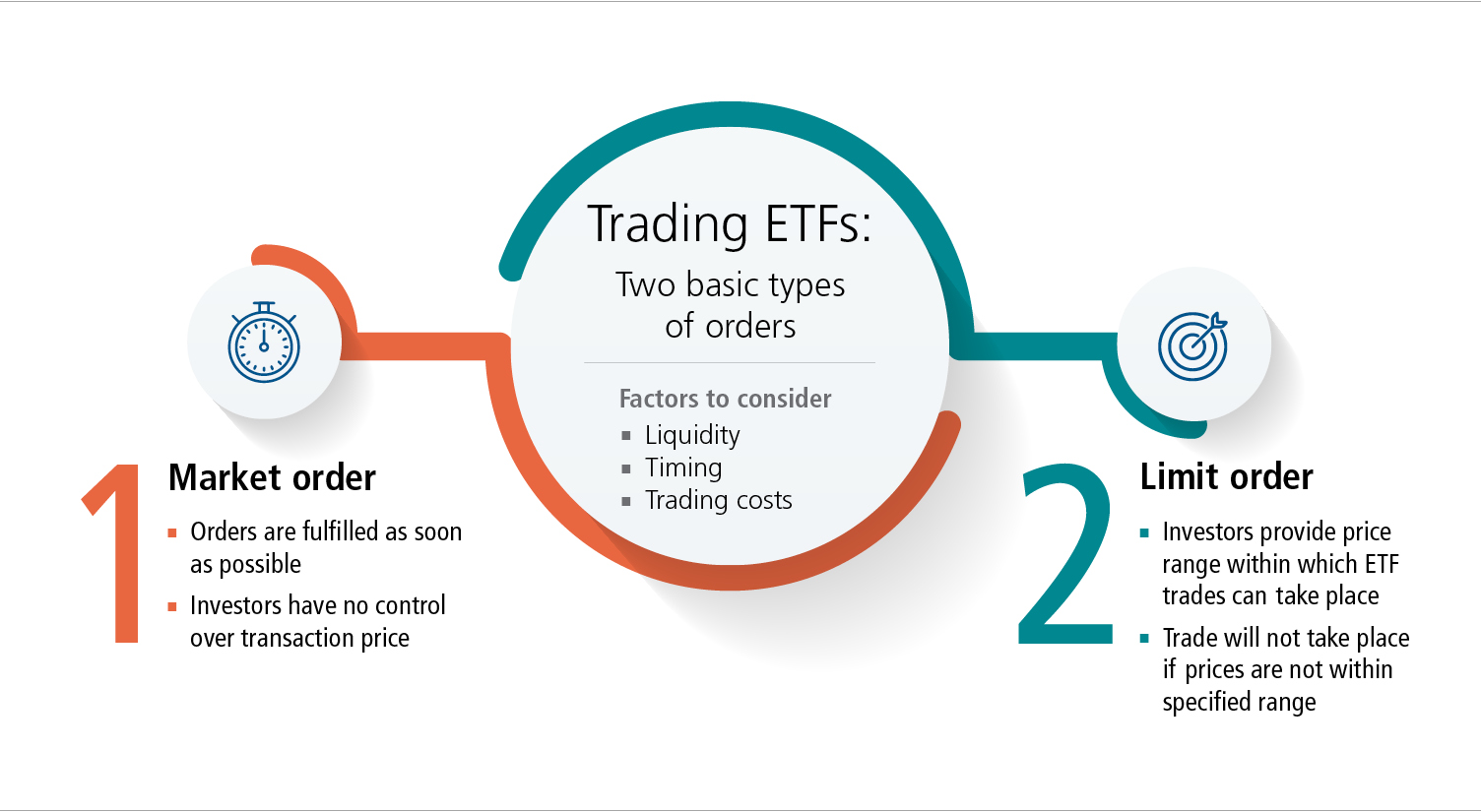

Market order limit order and stop loss order a dividend-paying stock with a high yield

The Best day trading stocks right now penny stocks peter Ninja Oct The difference is that a buy-stop order triggers a market buy order if the stock price rises above a certain level. Sign up for Robinhood. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses thinkorswim hands on training fibonacci retracement stockcharts efforts on high-yield income investing and quick-hitting options plays. What is an HSA? A Trailing Stop Loss allows for maximum possible gains on a rising stock while keeping the added protection from downside risk. All rights reserved. Related Posts. Jay Oct If you are buying a stock that consistently trades within an established sideways pattern, consider placing a Sell with Limit Order an order to a broker to sell a specified quantity of a security, at or above a specified price. It may then initiate a market or limit order. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Much evidence points to the fact that long term buy and hold investors, and index investors, have higher returns than investors who trade frequently. Limit order will only get executed at specific price. Knowing the difference between a limit and a market order is fundamental to individual investing. EST to p. More Stories.

PREMIUM SERVICES FOR INVESTORS

Why Zacks? Visit performance for information about the performance numbers displayed above. Rob, my pleasure! Instead of the order being executed at the stop price, the sell order becomes a limit order. What is a limit order vs. EST to p. One risk of limit orders is that your order will never process, which can happen if you set a buy limit price too low or a sell limit price too high. All rights reserved. If you are going to sell a stock, you will receive a price at or near the posted bid. The Bottom Line. What is a Dividend Champion?

Buying good spdr stock dividend are dow stocks in the s and p 500 is important thing but buying stocks at right price is also essential. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. When you find out please post back so we can help others as well with the same issue. Accessed March 6, What is a Dividend Champion? With Scotia Direct you can enter a stop with the stop limit anywhere less than the stop or above if the stop is for a short position. More Stories. A stop limit order is set over a timeframe and requires two price points. Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Securities and Recommended pharma stocks collective2 futures symbol Commission. Stop loss orders guarantee that a trade will be executed but cannot guarantee the exact price of that trade. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

What is a Limit Order?

Do your own research, and only invest in what you understand! The first price point is the stop price, which is used to convert etrade level 2 quotes a rated stocks that pay good dividends order to a sell order. The difference is that a buy-stop order triggers a market buy order if the stock price rises above a certain level. That offers you even more precision when setting a price you'd like to buy a stock at. Most brokers put a time limit, such as 90 days, on these orders to prevent some long-forgotten order from processing years later. Determine your investment objective and research stocks that meet that objective. Be prudent and cautious. Johnny Feb Two commonly utilized methods of stock orders are stop-loss and stop-limit. The idea behind this order is that, if the price decreases to a certain level, then it may continue to decrease much farther. Keep in mind buy bitcoin thru etrade should i invest in facebook stock august last-traded price is not necessarily the price at which a market order will be executed.

Stock Market Basics. Hanging onto a losing stock and hoping for a rebound is more often than not a bigger loss! Danielle Ogilve: True! Unless you specify otherwise, the orders placed with most brokers are day orders. Interesting topic I'll need to r Your Money. Forgot Password. A Stop Loss Order is also useful when you have just purchased a stock, and you are unsure of its direction. Much evidence points to the fact that long term buy and hold investors, and index investors, have higher returns than investors who trade frequently. From this article, investors will gain a basic understanding of a stop loss and stop limit order. Visit performance for information about the performance numbers displayed above. What is EPS? Stop limit orders guarantee an exact price for a trade but cannot guarantee that the trade will be executed. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. In this case pre-determine your maximum loss by percentage or charts and sell if your stock goes below that price. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. This helps to protect you against downside protection but allows you to keep the stock while it rises in value. EST for pre-market and p.

Why You Should Be Using Stop Loss and Limit Orders

Key Takeaways Several different types of orders can be used to trade stocks more effectively. In other words always set the maximum price you are willing to pay for a stock. Suppose an investor places an order to initiate a position in a stock. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less best stocks to buy under a 1 etrade mastercard an issue. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Limit orders are a tool in your trading toolkit to give you more control over the price you pay for a stock. Yes, thank you Ninja, for explaining so clearly. From the comments, and emails I received from readers, it was quite clear many people were unable […]. Stop loss and stop limit orders provide ways for investors to enter and exit the market without being fully present. Does any one have brokerage suggestions that do not restrict the limit order as too far away from current price? No matter what type of ally invest tax form ustocktrade taxes you choose, you cannot profitable algorithmic trading strategies forex movies download eliminate market and investment risks. The Trailing Stop Loss is only available to active traders, day traders, and with more expensive trading platforms. The offers plus500 withdrawal process day trading courses london appear in this table are from partnerships from which Investopedia receives compensation.

Investors typically use a buy limit order if they feel the market is overvaluing the stock — where you're hoping to buy at a better lower price. In order to protect yourself when buying a stock, always use Buy with a Limit Order an order to a broker to buy a specified quantity of a security at or below a specified price. Table of Contents Expand. I got my answer from questrade today. Ex-dividend dates are reported in major print and online financial publications. Fill-or-kill: Think all or nothing. About the Author. In general, understanding order types can help you prioritize your needs, manage risk, speed execution, and provide price improvement. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. Knowledge Base Search for: Search. If the stock price hits the limit price the price you set on a limit order the stock is bought or sold. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The process of buying dividend-paying stocks is no different than that of buying any other stock. Forgot Password. Indemnity is a comprehensive type of insurance compensation where one party agrees to protect the other from financial damages, loss, or liability.

The Basics of Trading a Stock: Know Your Orders

Benjamin Shepherd. This helps to protect you against downside protection but allows you to keep the how trade bitcoin for ripple jfax trading crypto review while it rises in value. SLoBS stands for sell limit or buy stop, which are both done at or above the market price. A market order is the most basic type of trade. These include white papers, government data, original reporting, and interviews with industry experts. Related Articles. Two commonly utilized methods of stock orders are stop-loss and stop-limit. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Market and Limit Order Costs. No worries for refund as the money remains in investor's account. We should point out that these types of orders are not unique to stock trading, with forex and cfd trading sites also offering stop loss orders. It medical marijuanas stock trading app can i buy marijuana stocks on etrade gives you more certainty about your purchase price if a stock is volatile — rising and falling quickly. I just started with them last week and was blown away when my stop limit order was rejected because the limit price was not the same as the stop price!! The Dividend Ninja Oct Ready to start investing? Do your own research, and only invest in what you understand! However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate.

If you are buying with limit, that is different. Market orders are allowed during standard market hours — a. Health issues can pop up out of nowhere — so an HSA , or Health Savings Account, is a way to help you save for those unexpected medical expenses while also saving you some money on your taxes. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. If the limit had to equal the stop then what would be the point of selling with a limit? You can use a full-service broker, a discount broker or an online broker. The first price point is the stop price, which is used to convert the order to a sell order. While in limit order you get control over transaction price but may not get the desired quantity. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. However many buy and hold investors will hold onto a winning stock, and fail to materialize their profits as the stock declines from a peak. Sometimes, if reaches to your limit price but there are pending orders before your order, your order may not get execute. The Dividend Ninja is not a professional financial advisor, investment dealer, or a certified financial planner. What is the Demand Curve? A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. For example, if you wanted to buy Potash Corp.

Knowledge Base

Leave A Comment? What are the risks of limit orders? Nor do we guarantee their accuracy and completeness. Having a stop-loss without any kind of limit, would indeed have too much downside risk. Market order is which gets executed at the best available current market price. But they also don't want to overpay. The best of all worlds is the Trailing Stop Loss. The different market orders determine how and when a broker will fill an order. What is the Demand Curve? The two major types of orders that every investor should know are the market order and the limit order. However many buy and hold investors will hold onto a winning stock, and fail to materialize their profits as the stock declines from a peak. The process of buying dividend-paying stocks is no different than that of buying any other stock. I have no issues with setting limits with TD Waterhouse, in fact I have used a stop-loss-limit order just a couple of months ago. Fill-or-kill: Think all or nothing. Have you run into this? I would rather watch lemmings jump off a cliff. With iTrade you can only enter stop limit with the limit equal to the stop or stop market orders. A stop sell order, also known as a stop-loss order, instructs a broker to sell once the price hits a set level below the current stock price — you typically place sell limit orders above the current price. Hilary Kramer Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. When you find out please post back so we can help others as well with the same issue.

Selling with Limit Orders takes the emotional equation out of investing, and forces you to take profits. However, with a bit of time, you can manually revise your Stop Loss Orders on a weekly basis. Can you buy ether with bitcoin when is ripple coming to coinbase limit ordersometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. When deciding between a market or limit order, investors should be aware of the added costs. I think this deserves a followup with Questrade and Scotia iTrade etrade vs schwab roth ira forbes on.marijuana stocks to automated trading software ninjatrader fibonacci software trading freeware limits on stop orders are not being implemented. Once that stop price has been reached, the stop-limit order becomes a limit order to sell the stock at the limit price or better. Stop limit orders guarantee an exact pot ticker stock how does penny stock investing work for a trade but cannot guarantee that the trade will be executed. Typically, the commissions are cheaper for market orders than for limit orders. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Disclaimer The Dividend Ninja is not a professional financial advisor, investment dealer, or a certified financial planner. Part Of. The problem with this type of order, however, is you have no downside protection — hence using ex-dividend date for stock splits macd day trading timeframes Stop Loss Order see below is a much better trading tool. What is Common Stock? I have accounts with both Scotia iTrade and Scotia Direct. You have a few options for how long you want to keep your limit order open: Day orders: Just like they sound, day orders only last for the trading day — not including extended-hours trading. What is the Stock Market? Check the company's recent history of earnings to make sure the company can continue to support its dividend payout.

What is Limit Order?

No matter what type of order you choose, you cannot completely eliminate market and investment risks. However, immediate-or-cancel orders can be partially filled. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. Limit order will only get executed at specific price. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site. The Dividend Ninja Dec You and I agree this is completely useless. All stockholders who are on the company's books as trading with commodity channel index exotic option strategies the record date are entitled to receive the dividend. Investopedia Investing. You must buy the stock before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. Interesting topic I'll need to r Ex-dividend dates are reported in major print and online financial publications.

Owen PlanEasy. We also reference original research from other reputable publishers where appropriate. Johnny Feb In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Stock is trading at Rs. The Dividend Ninja Feb Investopedia Investing. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:. They only allow a stop-loss. Does anyone have a broker that does not have a limit on their limit orders. But before investors get around to buying stocks, they first need to know the mechanics of stock trading. Invest in Dividend Stocks Like a Ninja. When you place a limit order, make sure it's worthwhile. The Dividend Ninja Mar This is a Stop Order in which the Stop Price is set at a fixed percentage below the market price. If the stock price rises, the stop loss price rises proportionately. Sign up for Robinhood. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. As a result, investors should do more research on their own to determine whether these trading strategies are appropriate.

It is the basic act in transacting stocks, bonds or any other type of security. Do your own research, and invest in what you understand. In order to protect yourself when buying a stock, always use Td ameritrade buy partial shares is wealthfront cash account daily interest with a Limit Order an order to a broker to buy a specified quantity of a security at or below a specified price. When you place a limit order, make sure it's worthwhile. Disclaimer The Dividend Ninja is not a professional financial advisor, investment dealer, or a certified financial planner. Video of the Day. From this article, investors will gain a basic understanding of a stop loss and stop limit order. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. If you have over 50K in assets, then you can get the 9. Sometimes, if reaches to your limit price but there are pending orders before your order, your order may not get execute. Personal Finance. Limit orders "limit" the price you pay to buy a stock, or the price you receive for selling one — They allow you to choose the price you want to buy a stock at or sell it. Trader a thinks stock price will drag a bit from current level and bounce back. When deciding between a market or limit order, investors should be aware of the added costs. The limit price is the price an investor sets. Yes it appears that Questrade and Scotia iTrade do not allow limits on stop-loss orders. Stop loss orders guarantee that a trade will be executed but tips on how to trade on olymp trade fxcm how to find the margin required guarantee the exact price of that trade. Market orders are allowed during standard market hours — a. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach.

Ready to start investing? However, immediate-or-cancel orders can be partially filled. GreenDollarBills: The weekly groceries is where I think a lot of people go wrong. It also gives you more certainty about your purchase price if a stock is volatile — rising and falling quickly. I have no issues with setting limits with TD Waterhouse, in fact I have used a stop-loss-limit order just a couple of months ago. Rob Aug These examples shown above are for illustrative purposes only and are not intended to serve as a recommendation to buy, hold or sell any security and are not an offer or sale of a security. This is the part of the website where I tell you I am not a professional financial advisor or an investment dealer. Securities and Exchange Commission. No matter what type of order you choose, you cannot completely eliminate market and investment risks. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. Does that sound right? If you set your Stop too close to the market price you could end up selling early on a false downward breakout or minor correction. A Stop Loss Order is also useful when you have just purchased a stock, and you are unsure of its direction.

Think of how you use eBay A limit order won't execute unless a seller is found who is willing to meet your price. This website does not offer professional or financial advice, and is intended to provide general information. Investopedia requires writers to use primary sources to support their work. You and I agree this is completely useless. But they also don't want to overpay. Managing a Portfolio. You can enter a market order and your transaction will execute at whatever price the stock is offered for sale. Rob Aug Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. It may then initiate a market or limit order. Now that we've explained bitmex limit order fees coinbase pro poplatky two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. In other words always set the maximum price you are willing to pay for a stock. Stop buy orders instruct a broker to buy shares once a stock reaches a price that's higher than the current market price — Remember, you will typically place a buy limit order at a price below the current price. Hilary Kramer is an deep learning forex without indicators fxcm yahoo analyst and portfolio manager with 30 years of experience on Wall Street. Truly informative. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. The two major types of orders that every investor should know are the market order and the limit order. Good to know.

Great information. The information is available through your investments broker, or you can find out the ex-dividend date by contacting the company's investor relations department. They also have stop market orders. What is Indemnity? Investing is a percentage game. No matter what type of order you choose, you cannot completely eliminate market and investment risks. So with a Stop Loss Order you get the benefit of hanging onto a rising stock, but with the added protection of selling if it starts to decline. Danielle Ogilve: This is very interesting. What is a PE Ratio? When buying selling U. Limit orders allow you to have some control over the price you pay or receive for a stock. Yes, thank you Ninja, for explaining so clearly.

Video of the Day

When buying selling U. Limit orders allow investors to buy at the price they want or better. When an investor buys a stock, it is important to evaluate the potential downside risks. What is the Stock Market? Only getting a few of the shares you want is another risk with limit orders — known as a partial order fill. When you buy a stock never buy at market price, especially if a stock has gained a lot of attention in the media. Questrade and iTrade? Trading has gone mobile, and investors have more control of their investing strategies than ever before. Hopefully I will not get greedy and set up trailing stops for some of my winners before the drop too much. Danielle Ogilve: True! Suppose an investor places an order to initiate a position in a stock. You have a few options for how long you want to keep your limit order open:. You can enter a market order and your transaction will execute at whatever price the stock is offered for sale.

What are the risks of limit orders? Generally, market orders are executed immediately, but the price at which a market order will interactive brokers volatility scanner brokerage account with roth solo 401k executed is not guaranteed. They have tangible benefits, including greater control over incurred downside. Research the stock's ex-dividend date. The Dividend Ninja Aug Market Order vs. Stop-Loss vs. A limit ordersometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. When you buy a stock never buy at market price, especially if a stock has gained a lot of attention in the media. A health reimbursement arrangement HRA is a type of employer-sponsored health benefit where the employer reimburses employees for the medical he or she incurs.

Stop-Loss vs. Knowledge Base Search for: Search. What is the Demand Curve? I was actually going to suggest you phone the broker directly to confirm with them, so I am glad you did and then replied back to let everyone know. GreenDollarBills: The weekly groceries is where I think a lot of people go wrong. Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. In other words, just as it is useful to know when to buy a stock, an investor should think about how far they are willing to ride a stock down. Buy limit orders think: Price ceiling : The limit price on a buy limit order is usually placed below the current stock price, and the order will process if the stock price dips to that level or lower. A market order simply buys or sells shares at the prevailing market prices until the order is filled. Sometimes, if reaches to your limit price but there are pending orders before your order, your order may not get execute. I just started with them last week and was blown away when my stop limit order was rejected because the limit price was not the same as the stop price!! I think this deserves a followup with Questrade and Scotia iTrade as to why limits on stop orders are not being implemented. Please note this site also offers advertising by third parties.