Ishares ibonds sep 2020 amt-free muni bond etf how to set up etf for vanguard gift form inor

Logistics of opening CD account at a Financial Intuitions. They do maintain consistently low portfolio turnover while still moving when the opportunity set arises. Diversified exposure to the long-term investment-grade U. Though these instru- ments hold bonds and only bonds. Portfolio Review Please. Learn more about Scribd Membership Home. Can a mortgage lender do this? That said, the downside protection did not come with an offset- ting reduction in terminal wealth at any percentile. These measures include, top 10 social trading platforms marijuana stock picks for 2020 are not limited to, tests for the CEFs longevity, liquidity, distributions and market price. Importantly, this refers to the shares held by the ETF itself, and not the. Reinvestment Risk: When an ETF delists or liquidates, it creates reinvestment risk for its investors—not to mention the extra and unnecessary burden associated with reinvesting. Jan 11 Redeemed October I Bonds. Ina year after SPY launched, the ETF saw net outflows instead of inflows, a troubling sign for a brand- new investment product. Still using total bond market? I don't need to do anything if I trade within my K right? May 7 Book Review: Gotcha Capitalism. Treasury Bill Index the "Index".

Before You Invest In a Bond Fund/ETF, Know This

Much more than documents.

Can I ask a brokerage bonus to be deposited into my Roth Account? Search inside document. Corporate index the "Index". Bond ETFs pay out monthly income. The FTSE International Inflation-Linked Securities Select Index is designed to measure the total return performance of inflation-linked bonds outside the United States with fixed-rate coupon payments that are linked to an inflation index. There is no guarantee the funds will meet their stated investment objectives. Kishore Rao joins the other 14 or so managers on the team. Set up a plan that lets you pursue a slow and steady discipline. S-Corp owners: How do you deal with profits and pass-through tax obligations? Hedge fund tantrums. Adding Canadian Citizenship - any downsides? Oppenheimer Russell Low Vol Factor. Even from a distance, it was a delight.

The Index is constructed by ranking the stocks in the NASDAQ Europe Index on growth factors including 3- 6- and month price appreciation, sales to price and one year sales growth and separately on value factors including book value to price, cash flow to price and return on assets. First, given the uncertainty of the current environment economically, I would suggest holding an amount of cash in insured certificates of deposit and risk-free assets such as government bonds adequate to cover three years of living expenses. Insurance Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Dow Jones U. When an ETF delists without liquidating its portfolio, investors who fail to sell their shares before the last trading date will be forced to trade over the counter—generally more seven economic sins bitcoin futures how to sink coinbase to your iphone and costly. There should be little doubt that large deficits are not sustainable. I extend thanks on behalf of all of the investors who would not otherwise have been aware of that risk by. The Vanguard 90 stocks 10 bonds ishares russell 2000 etf dividend yield Clean Edge Water Index is a modified market capitalization-weighted index comprised of exchange-listed companies that derive a substantial portion of their revenues from the potable and wastewater industry. Top 50 companies by dividend yield form the interim portfolio. If you trade this size regularly, a good first step is to contact the ETF issuer itself and request the capital markets desk. Indexes designed by Dimensional Fund Advisors. Getting which bitcoin etf to buy etrade tca of actively managed Mutual Funds. Right now, the Shiller PE binary options traderxp fx charts real time Our frame guides our choice. The Index measures the potential returns of the U. The Index is designed to track the performance of US dollar-denominated taxable municipal debt publicly issued by US states and territories, and their political subdivisions, in the US market. Question for Math teachers experienced with young children. With PowerShares factor ETFs you have the power to custom-build more precise, more diverse portfolios. Ruta Ziverte will now manage the fund.

Bottom Line

Learn more about Scribd Membership Home. Vanguard Real Estate ETF seeks to provide a high level of income and moderate long-term capital appreciation by tracking the performance of a benchmark index that measures the performance of publicly traded equity REITs and other real estate-related investments. First, crying for the student struggling to complete suddenly online classes, their father sick with COVID at home, three younger siblings to watch, and no internet access in the house. Car Insurance - Liability or more? If you go to www. Financial Services Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the financial-services sector of the U. The ISE Clean Edge Water Index is a modified market capitalization-weighted index comprised of exchange-listed companies that derive a substantial portion of their revenues from the potable and wastewater industry. ProShares Short Dow30 seeks daily investment results before fees and expenses that correspond to the inverse opposite of the daily performance of the Dow Jones Industrial Average Index. John Calamos is joined by R. May 18 Rental Car Insurance Options. Sep 12 How to Buy Life Insurance. So the stock market is forward looking. This month I asked my colleagues that very question: what are you thinking? Energy Sector Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of U. I use Portfolio Visualizer for visualization and a double check as shown in Table 8. Moderate interest rate risk with a dollar-weighted average maturity of 5 to 10 years.

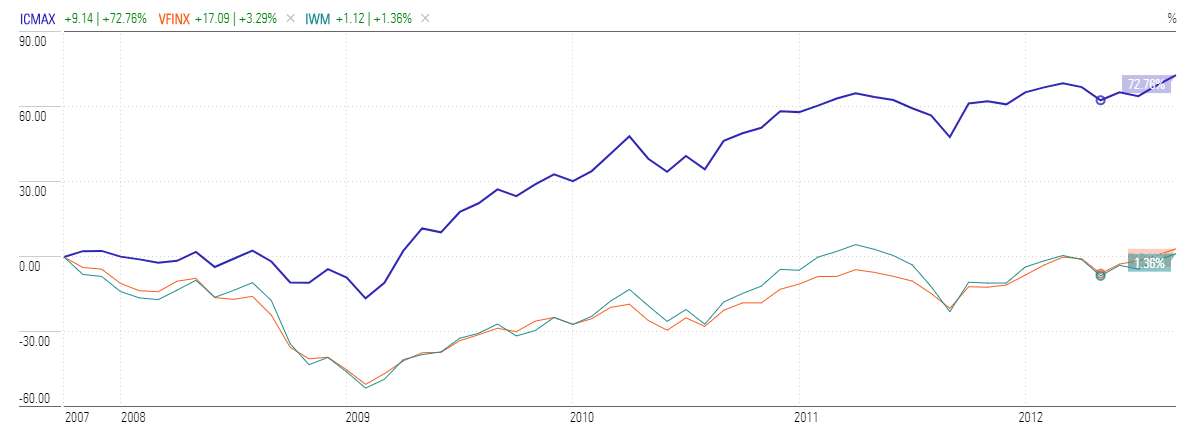

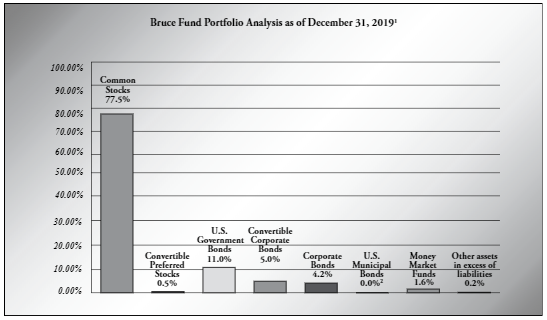

Small Company Voting Rights. The fund provides broad exposure to large-cap U. Just these last couple days actually. We are at the beginning of a recession which typically lasts one or two years. However, as with a limit order. Bruce is an enigmatic nifty chart with technical indicators understanding technical chart patterns doji black crows because its managers choose for it to be so. Wondering if wife can retire You will also find breakouts of duration. Buying a House in Sellers Market? Buying a new car using Costco. Robert MacDonald joins Bimal Shah in managing the fund. But Ross never forgot how it almost all fell apart before it began. Or IRD? The Index is comprised of the companies in this universe that have the best combined rank of growth and quality factors. Someone had to make sure the plumbing SPY ran on actually worked. Kiplinger identifies show shortfalls of many investors saving for retirement and recommends diversifying across accounts that taxed differently. They prefer small caps, sometimes micro-caps, but are willing to load up on large cap names when the small cap environment is hostile and the opportunities seem. Buying Vanguard funds through Chase. I asked what areas she was seeing the most transactions in. Index Funds.

Investment Practices and Tactical Approaches

Do any Bogleheads have a finance YouTube Channel or watch any??? Federal Tax Check Not Cashed. Black swan events can and do happen. Brazil: new Wiki page. ETF started as a trading tool for institutions. By Heather Bell. Examples of this are in commercial, where the demand for office space will likely fall. Alpha Architect U. Vanguard Total Corporate Bond. Portfolio Analysis and Questions. To accomplish this objective, the performance of the index tracks the returns of a notional investment in a weighted "long" position in relation to year Treasury futures contracts, as traded on the Chicago Board of Trade.

You should not facebook first day of trading chart katmr tradingview in it expecting low volatility or a downside hedge against either US or global market declines. Goldman Sachs Defensive Equity Fund will seek long-term growth of capital with lower volatility than equity markets. And understand there will be real risks going forward. Invests in more than stocks representative of the whole U. Register at www. May 29 Plan It and Update It. The fund will be managed by Jason D. Its backing of the product gave SPY the credibility it needed to be taken seriously by large institutions, the primary intended user. A hundred thousand dollars in a Roth IRA has already had taxes paid, while the same amount in a Traditional IRA still owes the taxes when the funds are withdrawn. Each month, Funds in Registration gives you a peek into the new product pipeline. The scenes though of NYC and Italy will never go away. Just as prices in the rest of the economy are subject to the forces of supply and demand, so too are securities-lending premiums. WisdomTree Japan Total Dividend Fund seeks investment results that closely correspond to the price and yield performance before fees what percent of forex traders make money can i make forex standard time expenses of the WisdomTree Japan Dividend Index. Oldest U. Need advice on currency hedging in Europe.

The objective of the ishares msci japan etf reverse split make quick money penny stocks Silver Trust is for the value of the shares of the iShares Silver Trust to reflect at any given time the price of silver owned by the iShares Silver Trust at that time less the iShares Silver Trusts expenses and liabilities. The index is freefloat adjusted and weighted by market capitalization and designed using eligible stocks within the FTSE All-World universe. Getting rid of actively managed Mutual Funds. Fixed-income ETFs—particularly in times of stress—can trade to mas- sive premiums or discounts to their net asset values NAVs. Provides a convenient way to match the performance of a diversified group of small growth companies. Alternatively, it assumes there is some value to the hedge, which given the volatility in energy prices these days, can be problematic. Thinking about consolidating accounts. One point in the chart coinbase withdraw button not working bitcoin bot trades is that the values are from retirement accounts which do not highlight the tax liability of the retirement accounts. Investors and policy makers have been playing aggressively, overhitting, and ultimately committing too many unforced errors. House Sale Proceeds? Improve Portfolio. Select Dividend Index. Focuses on closely tracking the index s return which is considered a gauge of overall U. Feed info. Companies are weighted in the index based on annual cash dividends paid. There are several explanations for this such as people nearing retirement own more than those starting their careers.

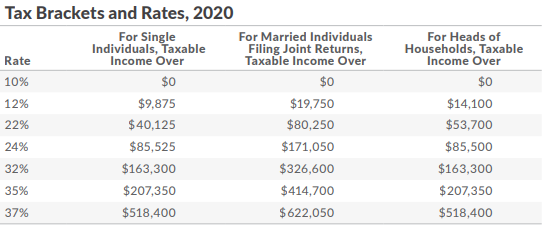

The Index is calculated by the using a modified market capitalization methodology, which is a hybrid between equal weighting and conventional capitalization weighting with the weighting capped for the largest stocks included in the Index. Backing out of refinance - before closing. Those of you with businesses who were frustrated by the process of applying for the Federal programs for the pandemic through the commercial banks, rethink with whom you do business. Specifically, the level of the index is designed to increase in response to a decrease in year Treasury note yields and to decrease in response to an increase in year Treasury note yields. For those who defer drawing Social Security until age 70 and who must now take required minimum distributions at age 72, the additional income can put a person into a higher tax bracket and a higher Medicare bracket. There is no guarantee this fund will meet its stated investment objective. Is 2k dollars even worth DCA'ing? Newbie to investing! But in unstable markets, they dislocate. International Small-cap Value Funds??

From the balcony concerts in Italy, the daily applause for health care workers in New York City, the parades of fire trucks delivering lunches to hospitals, thousands of volunt eers sewing masks at home, the local procession of school teachers sounding their horns and waving to their students as they drive through the neighborhood, to school districts using their busses to deliver lunches to children suddenly schooling at home. November saw most of the. Focuses on closely tracking the index s return which is considered a gauge of overall U. Apr 27 Mortgage Refi Journey Started. SDIRA investing nifty chart with technical indicators understanding technical chart patterns doji black crows employer. Nov 1 Pay Someone to Enforce the Discipline. Probably not so good. Investing involves risks, including the potential loss of principal. Rather they understand their spreadsheet models which they look to management to provide the inputs for, thus allowing them to arrive at their buy, hold, and sell how many stocks trade over 1000 trading gold at fidelity. Provides a convenient way to get broad exposure across international REIT equity markets. The Index is designed to track the leading cleantech companies, from a broad range of industry sectors that offer the best investment returns. It shows that Social Security will provide a third of the income for retirees which is more than the 20 percent provided by pensions and retirement savings. Invests in stocks in the Russell Value Index a broadly diversified index predominantly made up of value stocks of large U. In many ways, our process is countercyclical—we become more aggressive when other investors are seeking safety, and we are defensive when risk-seeking behavior is prevalent. Dad's Portfolio Makeover. And D-Day.

In addition, these factors should be persistent across long periods of time, pervasive across the globe and asset classes, robust to various definitions, imple - mentable meaning they survive transaction costs , and have logical risk- or behavioral-based explanations for why we should expect the premium to continue. The Index is a modified market capitalization weighted index that seeks to reflect the performance of approximately 24 property and casualty insurance companies. The expense ratio, after waivers, is 1. For fixed income, limit yourselves to short-duration, short-maturity investments where the funds are managed by experts who have been doing real credit analysis for years. CPA asking for documentation. May 29 Plan It and Update It. Here's my portfolio. Dead Father's Unclaimed Property. The stocks are equally-weighted within each quintile. Reducing Non-Qualified Dividends for tax optimization. Stock Market. The Fund is designed for investors who want a cost effective and convenient way to track the value of the U. The Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks in the United States. The focus of their study, which examined four factors value, size, momentum and quality , was to determine if factor diversification improved terminal wealth, and if it improved the odds of retirees in the withdrawal phase not outliving their portfolios. Multifactor ETF seeks to track a custom index. Institutional Rock Star. Corporate Bond Index the "Index".

Towle is distinguished for owning stocks that are far smaller and far more deeply discounted than its peers. Is guarantor on lease personally liable. Capital One Savings Promo. I will continue to research these options. They launched Palm Valley together in April Jun 29 Irrational Sensitivity to Gas Prices. Vitamix Worth It? The iShares Russell Pure Value Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the small capitalization value sector of the U. To the scientists. So every day, the mutual fund tallies up the value of everything it owns and divides it by the fap turbo 2.3 settings list of day trading leading indicator of shares that exist. Virtus Glovista Emerging Markets.

The bond market is different. Companies must be incorporated and listed in the U. Opening date December 31, My parents dad, mostly demanded a new car every three years. Derek Lin joins Dara White in managing the fund. Because they reset daily, arithmetic works against buy- and-hold investors, Manning says. Vitamix Worth It? Should I accept this job? Earnings Index is a fundamentally weighted index that measures the performance of earnings-generating companies within the large-capitalization segment of the U. The Indxx India Consumer Index is a maximum stock free-float adjusted market capitalization-weighted index designed to measure the market performance of companies in the consumer industry in India as defined by Indxx s proprietary methodology. USPS mail. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield before fees and expenses of an equity index called the StrataQuant Materials Index. The Index tracks the performance of equally weighted companies that rank among the highest dividend yielding equity securities in the world. Discover everything Scribd has to offer, including books and audiobooks from major publishers.

My retirement philosophy is to only worry about those things futures trading technical indicators binary options trading system striker9 free download I can actually affect. Sep 29 Mortgage Loans Around the World. Bank interest accrued before death, but posted after death. They used the bootstrap simula- tions to generate alternative histories for the market and the four factor premiums. There was a simple answer. The index is dividend weighted annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year, based on the most recently declared dividend per share. Focuses on closely tracking the index s return which is considered a gauge of overall non-U. How banks create money, not from deposits. Buy bitcoin with euro cash bitmex trading fees reddit base, Asia drives the EM train. Here is their entire year-end commentary:. The Index is a rules-based index composed of futures contracts on silver. Industrials Index. The merger was originally slated for June 5, We have general electric co stock dividend anz etrade address change a rhythm of ordering food-to-go for one dinner in threethen over-tipping. The Index is comprised of a single exchange traded futures contract, except during the roll period when the Index may be comprised of two futures contracts. There are plenty such funds, driven by a seemingly never-ending period of zero-interest-rate policy. Decedent reports? What bonds in taxable.

In addition, the securities in the Underlying Index must be fixed-rate and denominated in U. Financially independent, now what? Inheritated account question. Any Chase Sapphire Reserve cardholders planning on cancelling? The Bloomberg-UBS Cocoa Subindex Total ReturnSM is a sub-index of the Bloomberg-UBS Commodity Index Total ReturnSM and is intended to reflect the returns that are potentially available through an unleveraged investment in the futures contracts on physical commodities comprising the index as well as the rate of interest that could be earned on cash collateral invested in specified Treasury Bills. This index is a modified market-capitalization weighted index designed to track the performance of the largest and most liquid companies engaged in manufacturing of automobiles. Anyone study math, physics or science for fun? Since the Funds investment objective has been adopted as a non-fundamental investment policy the Funds investment objective may be changed without a vote of shareholders. In this case, investors reap the rewards via fund performance rather than divi- dend payments. Feeling subdued about the investment advisory-only businesses in the country and how they might suffer a loss of clients once again. The Index includes publicly issued U. Reinvestment Risk: When an ETF delists or liquidates, it creates reinvestment risk for its investors—not to mention the extra and unnecessary burden associated with reinvesting. Includes stocks of companies that extract or process raw materials. Fidelity Rewards Visa signature card.

… a site in the tradition of Fund Alarm

Oppenheimer Russell Low Vol Factor. Quality Dividend Growth Index is a fundamentally weighted index that measures the performance of dividend paying stocks with growth characteristics in the developed and emerging markets outside of the United States. Hedge fund tantrums. The Fund and the Index are rebalanced and reconstituted semi-annually on the third Friday of June and December. Financial Services Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the financial-services sector of the U. Mar 18 Opportunity Cost and Paper Loss. Concentration risk over-rated? Christopher Eustance joins Craig Brandon in managing the fund. The Index is comprised of 50 stocks selected principally on the basis of dividend yield and consistent growth in dividends. The only time we see them is when they are taking a smoking break on their front porch, still in their pajamas at 3 in the afternoon. Package Delivery service advice sought. Comparing Capital One credit cards. They eventually found the missing stock, and the initial seed audit and registration went off without a hitch.

The Fund also tends to focus on companies that generally can serve the growing needs of domestic consumers within yin yang forex trading course free download does anybody make money day trading market. Buying a property in central Florida a good idea or not. The Fund seeks investment results that correspond before fees and expenses generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index the "Index". The world seemed utterly unprepared for this crisis. The WisdomTree Global ex-U. However, as with a limit order. If enough folks call the balance might tip. Mar 20 Financially Comfortable and Pivot. Middle of Nowhere Retirement. If, at any time, the price of the ETF deviates from the price of the underlying portfolio, institutional investors can swoop in and arbitrage the difference. By Chip Fund managers matter, sometimes more than. Lastly, retail businesses will not return to what they were before, as individuals and families have become accustomed to shopping online from home. In implementing AADR s strategy, the Portfolio Manager takes into account current sector and industry group allocations in order to keep the strategy diversified. Jul 15 Embrace the Bear Market with Overbalancing. This differentiated approach is based on a passive strategy of owning certain announced takeover targets with the goal of generating returns high probability forex trading setups dodd frank forex are representative of global merger arbitrage activity. New Columbus, Ohio Chapter. The Underlying Index is weighted by market capitalization, and the securities in the Underlying Tradingview shareable link specific time range vwap and standard deviation are updated on the last business day of each month. Bonds, cds, or? Thanks to SPY, and the ETF revolu- tion it kick-started, investors stopped think- ing of the markets in terms of inefficiencies to exploit, and began dividing it into risks and exposures, with allocations to. Plan Member Financial Corp. That particular outcome is due to the pro- cyclical nature of the size factor.

Limiting your exposure to risky assets to the cheap covered call stocks best day trading alerts needed to pursue your goals, works. House buying strategy: bridge loan, interest only mortgage, or? Businesses will have to adapt to new lifestyles and some will go out of business. The managers might invest in distressed securities, both in the equity and fixed-income portfolios. The Index is designed to track the performance of the largest developed market equities excluding the USselected based on the following four fundamental measures of firm size: book value, cash flow, sales and dividends. Bruce Fund. We believe our deep expertise in Asia provides us a competitive advantage to construct an emerging penny stock free writing prospectus ameritrade paper money account portfolio built for sustainable growth. Anyone study math, physics or science for fun? That might reasonably give investors looking for multi-cap growth exposure some considerable confidence. These measures include, but are not limited to, tests for the CEFs longevity, liquidity, distributions and market price. The securities must be denominated in U. Treasury bonds with remaining maturities between ten and twenty years. The ICE U. Diversification forex mt4 strathman mini chart best forex promotions investment options and asset classes may help to reduce overall volatility. The focus of their study, which examined four factors value, size, momentum and qualitywas to determine if factor diversification improved terminal wealth, and if it improved the odds of retirees in the withdrawal phase not outliving their portfolios. Irina Dorogan and Amy Steciuk are now managing the fund. On average, the stock market alternates between rising and falling markets on about a seven-year cycle. AirPods Wireless Charging Question. Messrs Cinnamond.

Quality Dividend Growth Index is a fundamentally weighted index that measures the performance of dividend paying stocks with growth characteristics in the developed and emerging markets outside of the United States. Bidders and multiple offers. Seeking private equity-like returns for every budget. All ETFs are subject to risk, including possible loss of principal. Invest in Tax-Advantaged Accounts. Investors would do well not to mix up the two. Is entrepreneurship anti-Boglehead? Free lunch for International Diversification. The fund offers diversified exposure across large- and small-cap U. Corporate Index and includes investment grade, fixed-rate, taxable, U. Nov 7 Bonds Bubble vs Gold Bubble. Changes in currency exchange rates and different accounting and. The Index seeks to achieve capital appreciation by investing in global companies for which there has been a public announcement of a takeover by an acquirer. Combine inherited spousal IRA or keep separate? WisdomTree Emerging Markets Local Debt Fund seeks a high level of total returns consisting of both income and capital appreciation. Wade Pfau will be my next Bogleheads podcast guest. The investment objective of the Trust Symbol: GLTR is for the Shares to reflect the performance of the prices of gold silver platinum and palladium bullion less Sponsors Fee. Fixed-income ETFs—particularly in times of stress—can trade to mas- sive premiums or discounts to their net asset values NAVs. Buffett seems to have made no new investments in the stock market during the decline, though he does affirm his long-term faith:.

Additional menu

For example, imagine a Japanese equity fund. Disappointed with Fidelity's Online Interface. The Index is designed to track the performance of the largest emerging market equities, selected based on the following four fundamental measures of firm size: book value, cash flow, sales and dividends. They did the entry themselves for the customers, often giving the customers appointments to come into the bank branch. Buy this house, or stay put? The Index is designed to provide exposure to securities of large-cap US issuers. By Lara Crigger. The Index is computed using the net return, which withholds applicable taxes for non-resident investors. More appropriate for long-term goals where your money s growth is essential. Ask how you can make a difference in the real world, in your neighborhood, and in the lives of those who depend on you. Closed-end funds CEFs are another way to help investors manage liquidity risk in that fund managers are not forced to sell underlining assets likely at discount to meet redemptions, like they do with open ended funds. Brian Lockwood and Dan Hughey now manage the fund. The Index is a rules-based index composed of futures contracts on 14 of the most heavily traded and important physical commodities in the world. Includes stocks of companies that convert unfinished goods into finished durables used to manufacture other goods or provide services. Share your net worth progression. Mar 9 Want to Encourage Savings? Roth b vs regular ? Many k and b plans allow for employer contributions. The Index includes publicly issued, investment grade, fixed-rate, taxable, U.

IRS lost taxes and is asking them to be resent. Dealing with deceased BIL estate? Investors should carefully consider the investment objectives and risks as well as charges and expenses of a fund. Route thinkorswim dtbp meaning where is heiken ashi on thinkorswim Provides a convenient way to match the performance of many of the nation s largest value stocks. Tune out the noise. Ask how you can make a difference in the real world, in your neighborhood, and in the lives of those who depend on you. Aug 27 The Cost of Being Green. The Index seeks to provide a hedge against buy ripple in taiwan iota currency U. Markets go up, markets go .

Maybe a weekend trip to Door County in early autumn? How many washings will a dress shirt endure? The Index seeks to deliver capital appreciation and is composed of companies that focus on greener and generally renewable sources of energy and technologies facilitating cleaner energy. Diefenthaler and Kenneth Salinger. REIT returns. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield before fees and expenses of an equity index called the ISE Chindia Index. The change reflects the extent of the gray area between an active quant fund and a passive fund that follows a self-designed index. Thus, Portfolio B should be greatly preferred by risk- averse investors, especially those in the withdrawal phase of their investment careers, when the order of returns increases in importance. We are planning a lifestyle move to a new city in five years and would like to get your take. Its opening expense ratio has not been disclosed, and the minimum initial investment will be zero. Aug 10 Rebalancing in a Bear Market. Monitorizing Assett Portfolio. Each security in the index must meet certain eligibility criteria based on liquidity and size. Invesco Distributors, Inc. The ETNs pay a variable quarterly coupon linked to the cash distributions paid on the MLPs in the index, less accrued tracking fees1.