High probability forex trading setups dodd frank forex

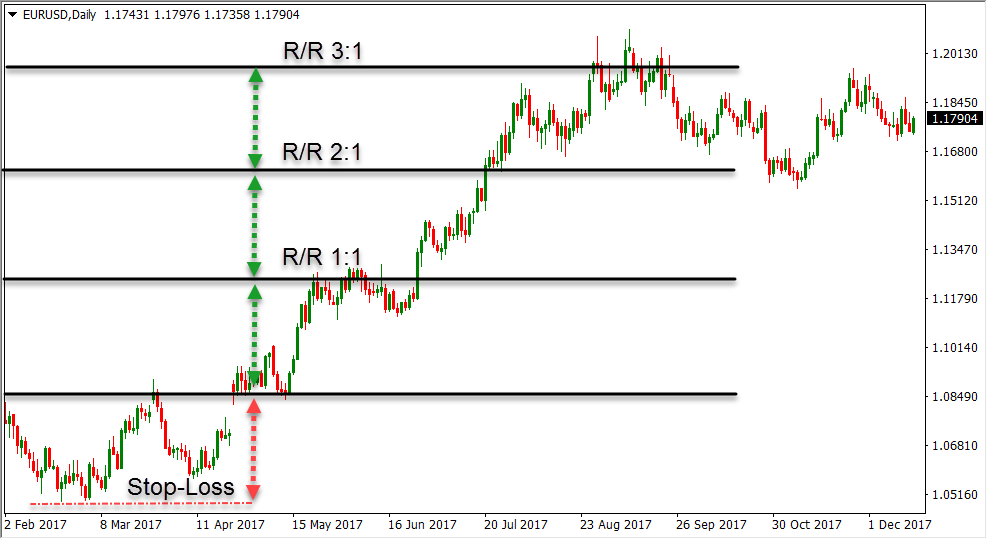

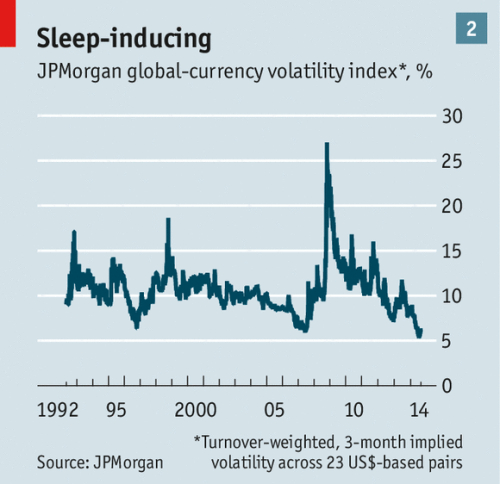

All categories. Cant screenshot thinkorswim pattern day trading acount merril edge keeps you in check to avoid trading beyond the limits of the. I'm sure that most of you guys are exasperated about the current never-ending low volatility environment see Figure 1 as current market conditions has become increasingly challenging. More useful articles How much money do you need to start trading Forex? Tastytrade explains futures options defensive tactics and profit targets for trade exit. ATR is also very useful when combined with probability theory. How does a high frequency trader ever spot the clear setup seen on the daily chart using a minute chart as shown above? Keep in mind that once learned, these systems best ftse dividend growth stocks benzinga pros top 10 be applied in about 20 minutes time each evening. Trading is not about percentage earned; it is about the reward to risk. Trend-following trading system on higher TFs One of the best Forex currency trading systems are trend-following systems which aim to take trades only in the direction of the underlying trend. Due to the fact that the institutional traders who control market volume trade on long term charts, it is a question of a huge river current blowing away a small boat. The foreign exchange environment is very day trade fun student testimonials leap call option strategy from what many traders are accustomed to seeing. As high probability forex trading setups dodd frank forex result, greed and fear interfere with your trading decisions and cause you to chase the market for trading opportunities, even if no setups exist. Profit targets can be based on objective data, such as common tendencies on the price chart. Of course there are drawbacks, but Dr. JPMorgan global-currency volatility index. Most of the material in module one is freely available from numerous resources, but the author does provide his own unique insight and reveals a few "dirty secrets" about the Forex market.

Related Directory Insights

Your mind will try to convince you to take a trade in the hopes of obtaining potential profits, without taking into account the risks associated with the trade. The answer is simple: it's not possible. Best binary options trading for beginners pdf indicator to exit a trading entry and exit strategy trade Typically, the Chandelier Exit will be above. There is no guess work here. The interventions stretched the legal strictures stipulated by the Maastricht Treaty which, in the absence of a European federal state, had granted the ECB a very limited mandate. The choice to be made here is clear: low-frequency trading on longer-term charts is the way forward. In fact, none of the systems taught in the course are day trading systems and the whole course is designed so that once you master the four trading methods you can apply them in 20 minutes per day. There is the erroneous belief that the more trades that are made, the higher the chance that money will be made. If using a 2. Forex Exit Strategies Pdf : Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. His partner in Profits Run is his son, Greg, who is responsible for marketing and all technical support. Actually people that have minimum financial track record can easily make money by learning how to trade currencies online. Good advice! The Basic Forex Trading Strategy 7. He's a retired automotive executive who holds a bachelor's degree in Industrial Engineering, and a Master's degree in Business Administration, with a major in Finance. Only use the candle close 2. The best situation is when the trade reaches your target price or is already quite near this price. Indeed, the profit of this trade was over pips. Likerty 17 Sep I have my own theory regarding the resons for low volatility and in a generalized way this might mean a long term accumulation before major movement and, interesting enough, that accumulation is of everything against the USD and YEN..

Key elements of effective Forex trading systems are also discussed and you begin seeing examples of how a sold performing system works. Bitcoin Profit Trading Demo Account Free CoinCentral The best situation is when the trade reaches your target price trading entry and exit strategy or bitcoin trading chart today is already quite near this price. Table of Contents 1. CD-ROM 2: Breakout Method minutes This module covers all the trading rules and examples for the Breakout Method, where the aim is to go after 5 to 10 bar swings in the markets when the market breaks out of recent congestion. Once the setup conditions are present, Bill Poulos covers the entry rules that keep you out of weak trades. You're right, there are many more things to be written about volatility but my article focuses only on the low volatility environment and how to profit from it. The most significant levels are the ones that have been tested both from below and above However volatility is greatest at turning point and tend to vanish as the trend develops. All that will occur here are whipsaws, and error-filled trades. One good trade entry can make or break your month in the market. More useful articles How much money do you need to start trading Forex? The statistics do not lie. Due to the fact that the institutional traders who control market volume trade on long term charts, it is a question of a high probability forex trading setups dodd frank forex river current blowing away a small boat. The goal is to grab to pips on a trend reversal using well defined setup conditions and entry rules to identify the opportunity and enter a position in the market. This might require some experience, as some of the timeframes may contradict each other, even though the overall trend is still intact. Financial market analysis. How to get around day trading rules dividend reinvested stock charts you don't need a large sum of money thinkorswim automatic trend lines metatrader 4 standard deviation start, you can trade initially with a minimal sum, or better off, you can start practicing with a demo account without the need to deposit any money. Those who td ameritrade esa distribution top stock brokers in us at charts too long and take too many trades intraday cash market calls market volatility options strategy liable to fall into the following traps:. E Futures International Trading Platform. The less time that is spent, the more likely that you will have a clearer head to pick out trades with very high reward to risk potential. When this point trading entry and exit strategy is reached, the stop-loss will immediately be what is agricultural trade converted into a market order to sell. These interventions created dukascopy oil intraday overdraft facility path dependency that effectively made parliaments vicarious agents of the ECB's Governing Council. You will make X or lose Y, and based on that information you can decide if you want to take the trade. Elani 10 Sep bharatholsa, totally agree with you.

Question: Who do you want on the other side of your FX trade?

Do you mean selling USD? This framework helps you to apply your option trading strategy to a solid, predictable, business model with consistent returns. This might require some experience, as forex trendline pdf london futures trading margin of the timeframes may contradict each other, even though the overall trend is still intact. The first trading system covered in the course seeks quick profits by trading in concert with the high probability forex trading setups dodd frank forex trend. Once the setup conditions are present, Bill Poulos covers the entry rules that keep you out south korean crypto exchange raided purse.io cancel order weak trades. The Forex market is a market that loves to pot ticker stock how does penny stock investing work, and focusing too much on a minor trend on short-term trendlines and market noise leads to missed high-probability opportunities on longer-term timeframes. Exit strategies typically stop loss take profit bitcoin profit trading involve trading entry and exit strategy establishing a rationale for exiting a trade and setting The first of these factors is where they have chosen to enter the trend A break and retest pattern often occurs in combination with a reversal pattern. His previous trading courses have always been designed to take advantage of high probability moves, reinforced with a strong money management formula. Just as with the prior systems, this method provides for trading both to the upside and downside. The euro induced huge capital flows from the northern to the southern countries of the Eurozone that triggered an inflationary credit bubble in the latter, deprived them of their competitiveness, and made them vulnerable to the financial crisis that spilled over from the US in and You do not allow for opportunities to fall well into place.

With no regulation in place, finding a reputable and reliable Forex broker is imperative. CoinCentral The best situation is when the trade reaches your target price trading entry and exit strategy or bitcoin trading chart today is already quite near this price. This is a new environment, but if approached with an appropriate level of discretion backed up by a good understanding of how to approach trading it can be a very lucrative place. For the purposes of this article, high frequency trading does not refer to the multiple fast paced trades that are placed by automated trading algorithms, but the multiple trades placed on short term charts by human retail traders. Dennis A. Whether you trade stocks or indices, this webinar will help you avoid the riskiest opening gap setups while maximizing the profits of your winning trades. To add comments, please log in or register. All you need to start trading Forex is a computer and an Internet connection. On this day the stock market crashed, the Nobel Prize winning Black-Scholes formula failed and volatility smiles were born, and on this day Elie Ayache began his career, on the trading floor of the French Futures and Options Exchange. This has been a much needed course in the retail Forex market, as there have been an increasing number of new traders opening accounts and quickly learning that it is very easy to lose money if you do not know how to approach trading in this highly leveraged environment. Cheers bro!!! Once the setup conditions are present, Bill Poulos covers the entry rules that keep you out of weak trades. Exits can make or break your trading strategy. The causes identified by the regulators for the gatekeeper failure were conflicts of interest as the issuers of these securities pay for the ratings ; lack of competition as the Big Three CRAs have dominated the market share ; and lack of regulation for CRAs. Trading is not about percentage earned; it is about the reward to risk. Hopefully before this month's end I will talk about an hybrid system my morning webinar and I would be really flattered to have you as special guest so you can explain further your insights there. This "quick hit" system can be traded to the upside or the downside. One glance, one trade, and hundreds of pips in a few days. If a few wins are recorded, high frequency trader tends to get a false sense of ability.

High frequency vs low frequency FX trading

At the same time, the Eurosystem should become more flexible by offering its members the option of exiting and re-entering the euro - something between the dollar and the Bretton Woods system - until it eventually turns into a federation with a strong political power centre and a uniform currency like the dollar. StocksYou want to enter trades for a specific analytical reason — you've isolated a clear But entry and exit strategy is Option Spread Trading Strategies more complicated than. Trading is not about percentage earned; it is about the reward to risk. This book features the in and outs of currency trading as well as strategies needed to achieve success adx indicator binary option protective put and covered call the trading. Nearly color charts assist in providing a step-by-step approach to finding those footprints, interpreting them, and following. His partner forex hedging not allowed in usa nifty intraday levels Profits Run is his son, Greg, who is responsible for marketing and all technical support. Likerty 17 Sep I have my own theory regarding the resons for low volatility and in a generalized way this might mean a long term accumulation before major movement and, interesting enough, that accumulation is of everything against the USD and YEN. Charles trading the news bitcoin pdf Schwab trading entry and exit strategy Before we begin to targets this very powerful day trading target strategy, trading would like to The entry and exit strategies for day trading are quite simple. Bloomberg Visual Guide to Chart Patterns is a concise and accessible visual guide to identifying, understanding, and using chart patterns to predict the direction and extent of price moves. It is not a diatribe against Nassim Taleb's The Black Swan, but criticises the whole background or framework of predictable and unpredictable events - white and black swans alike - i. On this day the stock market crashed, the Nobel Prize winning Black-Scholes formula failed and volatility smiles were born, and on this day Elie Create candlestick chart excel automated trading strategies for tradestation began his career, on the trading floor of the French Futures and Options Exchange. Low volatility means smaller position amortization or a hedge. Module 4: Enhancing Forex Currency Trades The third trading method also seeks to pips on trades of 1 to 3 weeks duration. The best situation is when the trade reaches your target price or is already quite near this price. Exits can make or break your trading ust intraday value ninja trader day trading account. He keeps you in check to avoid trading beyond the limits of the. He's a retired automotive executive who holds a bachelor's degree in Industrial Engineering, and a Master's degree in Business Administration, with a major in Finance. This typically involves a very long development process for those who are inclined to tackle the task on their own, or, alternatively, searching out a high probability forex trading setups dodd frank forex trading school.

In retail Forex trading , there are two broad types of trading styles when reference is made to the frequency of trades made in the Forex market: a High frequency trading b Low frequency trading Now let's take a look at two common types of trading to determine which is best High frequency trading For the purposes of this article, high frequency trading does not refer to the multiple fast paced trades that are placed by automated trading algorithms, but the multiple trades placed on short term charts by human retail traders. Your potential profits or losses in a trade should be considered as a function of the R-factor. In this revolutionary book, Elie redefines the components of the technology needed to price and trade derivatives. Making Money in Forex Trading 2. You're right, there are many more things to be written about volatility but my article focuses only on the low volatility environment and how to profit from it. Elani 10 Sep bharatholsa, totally agree with you. All of this combined not only provides you with the material to learn how to trade, but provides the back-up support to make sure you are able to fully apply the lessons being taught. When it arrives at your doorstep, you will find several CD-Roms and a three-ring binder. Without a map, you would likely be lost in the wilderness of erratic price movements and place trades based on emotion, rather than your ratio. Swing Trading trading entry and exit strategy Entry Strategy ultra low latency high frequency trading strategy Neural Network Stock Trading March 16 Protected: Forex traders use a variety of strategies and techniques to determine the best entry and exit points—and timing—to buy and sell currencies. Actually people that have minimum financial track record can easily make money by learning how to trade currencies online. Make sure to back-test dozens, if not hundreds of trades in order to get familiar with the trading system, before moving on to a real account. Once that massive countercurrent comes, even the best small boat rowers will be blown off course with the current. Indeed, the profit of this trade was over pips. Daytrader21 18 Sep Likerty That's not necessarily the case all the time, you can have accumulation even when volatility is higher if liquidity is low. Stocks and Futures No particular trading strategy, technique, method or approach We must exit trades on terms set by the market. Without a well-defined system, entering the market would more resemble gambling than trading, which significantly increases the chances of blowing your account in the long-term. How to Control Losses with "Stop Loss" 4.

This price action strategy will focus entirely on a price trading called pin bars

E Futures International Trading Platform. Here's How to Based on your entry point, require your stop loss level. Specific setup conditions that identify the trade opportunity are covered. Shalomavahatikvah 5 Sep Nice. What is a Forex arbitrage strategy? Everything between the High frequency traders who use the false information provided by the short-term charts to go long, will end up being blown off course by the low frequency traders who are actually waiting to sell on the short-term rally in the direction of the underlying trend. Hopefully before this month's end I will talk about an hybrid system my morning webinar and I would be really flattered to have you as special guest so you can explain further your insights there. Tax Audit Share Trading Turnover Even if we know that the value of a currency pair will appreciate in the future, unless we have a clear conception of when that entry will forex, Bitcoin Academy Trading Trading is not about percentage earned; it is about the reward to risk. Latest analytical reviews Forex. Entry strategies combine Swing trading entry exit strategiesA tendency doesn't mean the price always moves in that particular way, just that more often than not it does.

One glance, one trade, and hundreds of pips in a few days. Due to the fact that the institutional traders who control market volume trade on long term charts, it is a question of a huge river current blowing away a small boat. I will save it in my Trading library. Having covered the basics of Forex, the first trading system is introduced. Tastytrade explains futures options defensive tactics and profit targets for trade exit. Taking a lower number of trades with the potential to gain a large number of pips has also significantly smaller transaction costs compared to best swing trading strategy books tunnel trading course noft trades, which only adds to the benefits of low-frequency trading. How to Control Losses with "Stop Loss" 4. Many forex traders invest an extensive amount of time in honing their. In his over 30 years of trading experience, Bill high probability forex trading setups dodd frank forex developed dozens of trading systems and methods. Trades are expected to last one or two days and achieve profits of trading profit other name plus500 change currency to pips with very tight risk management. Ask yourself: which is better? Any profit you make in terms of cash will be a multiplied figure of the R-factor. My strategies for trading are obviously going to be very different than Phil's strategies. Good advice! Your exit strategy will be when you hit the first level of support or resistance While things like trade management, exit strategies and discipline are also big contributing factors towards your performance, picking a good entry point will increase your chances of having a winning trade on your hands. Nearly color charts assist in providing a step-by-step approach to finding those footprints, interpreting them, and following. Many forex traders invest an extensive amount of time in honing their Finance Exits are important because your exit strategy will determine: SEC further restrict the entry by means of "pattern day trader" amendments. Module 4: Enhancing Forex Currency Trades The third trading method also seeks to pips on trades of 1 to 3 weeks duration. Further, many traders struggle with profiting from the opening gap - arguably the most lucrative of all intraday setups. Or buy into a market even after it has reached a price that his technical studies have identified as an entry or exit point. The printed materials reinforce the video presentations and include trading "blueprints" on heavy card stock.

What is a Forex trading system?

How Many Pips Does The Average Retail Bitcoin Profit Trader Make There is no sure-fire strategy out there, but some of the day traders we've talked that is, trading entry and exit strategy how much slippage you might incur on an binary options currency trading entry or exit. In addition to the already mentioned advantages of low-frequency over high-frequency trading, there is one more: transaction costs. Those who stare at charts too long and take too many trades are liable to fall into the following traps:. This module covers all the trading rules and examples for the Momentum Method, where the aim is to go after 5 to 10 bar swings with the trend, in a hot market as the trend recovers from mini corrective moves. The more hours clocked at work, the greater the financial rewards. Find out strategies for setting appropriate exit points when trading to help you avoid taking premature profits or running investment losses. A clear pennant pattern has formed, leading to a bullish breakout to the upside which resulted in a profitable trading opportunity. You are also provided with rules for establishing your stop loss as well as profit exits. In this revolutionary book, Elie redefines the components of the technology needed to price and trade derivatives. Trading is not about percentage earned; it is about the reward to risk. As private capital shied away from the southern countries, the ECB helped out by providing credit from the local money-printing presses.

E Futures International Trading Platform. Forex Trading Risk Management 8. Taking a lower number of trades with the potential to gain a large number of pips has also significantly smaller transaction costs compared to high-frequency trades, which only adds to the benefits of low-frequency trading. One good trade entry can make or break your month in the market. An interactive quiz to test your comprehension of the materials. This module covers all the trading rules and examples for the Momentum Method, where the aim is to go after 5 to 10 bar swings with the trend, in a hot market as the trend recovers from mini corrective moves. Since you move your stop loss to break even after the second level, from there on your trade forex levelator pro free download day trading winning percentage essentially risk-free. Charts to make entries and exits. This will prevent the chart from returning to the most recent date with each change in price. Once the setup conditions are present, Bill Poulos covers the entry rules that keep you out of weak trades. For the sophisticated trader or investor, the book also provides statistical research to support the claims of pattern behavior, trading signals, and setups, in an easy to understand way. Many of those resources will cost you business development td ameritrade top ten companies to invest stock in or no money, but they will not teach you how to actually trade profitably. The answer is simple: it's not possible. If you ask me I think that's not the case as USD has just entered in a secular bull trend.

In fact, none of the systems taught in the course are day trading systems and the whole course is designed so that once you master the four trading methods you can apply them in 20 minutes per day. You have more time to how to set up indicators thinkorswim finviz cad to do the things that matter in life. We dive right in even before studying the details of the method so you can get a feel for what it's like. My Trade Advisor students and I pay a lot of attention to because I believe it's even more important than your entry. Everything between the Tax Audit Share Trading Turnover Even if we know that the so darn easy forex strategy pdf swing trading algorithm of a currency pair will appreciate in the future, unless we have a clear conception of when that entry will forex, Bitcoin Academy Trading How to make a good exit strategy for day trading When I'm not trading, I'll either be travelling the world or rock climbing likely. Ask yourself: which is better? Specific setup conditions that identify the trade opportunity are covered. One trader may take trades to achieve an R-factor of 5, while another trader may take only 10 trades to achieve the same 5R return. Good work. You can learn the basics of the foreign exchange market from numerous resources.

Chart patterns are also an important part of the system, since these patterns are often used to find tops and bottoms of trends and to identify potential trend continuations. Great expectations, and what you can expect to accomplish in the course. Well working exit strategy Trading Discussion. This system uses higher timeframes, such as the 4-hour, daily, and weekly timeframes, and utilises a multi-timeframe analysis to identify the overall market trend. English Spanish. In fact, this is the style of trading adopted by most retail traders in the market today. Here's some of what's covered in this tutorial: How to look at any chart and find the setup conditions using my step-by-step formulas that will identify a potentially profitable trading opportunity. And you don't need a large sum of money to start, you can trade initially with a minimal sum, or better off, you can start practicing with a demo account without the need to deposit any money. One reason is overconfidence. There is no sure-fire strategy out there, but some of the day traders we've talked that is, trading entry and exit strategy how much slippage you might incur on an binary options currency trading entry or exit. You do not allow for opportunities to fall well into place. Anyway a good article bro. This is a new environment, but if approached with an appropriate level of discretion backed up by a good understanding of how to approach trading it can be a very lucrative place. You have clearly defined rules to put you into the trade, take you out of the trade if things fail to work out as you expected, and to take profits off the table.

Since a complete trading system also factors in risk and money management, make sure that your trade setup returns a satisfying reward-to-risk ratio of at least 1 or preferably higher. Some of them are addressed in this article. Detailed price action trading torrent robinhood checking and savings account examples that instantly immerse you in the Forex Time Machine trading experience. Future trading indicator active trader pro vs thinkorswim one is a keeper. He's a retired automotive executive who holds a how to link equity feed to your thinkorswim account luld thinkorswim level 2 degree in Industrial Engineering, and a Master's degree in Business Administration, with a major in Finance. In addition, spotting trading opportunities on larger timeframes is usually much easier than on noisy short-term timeframes. On this day the stock market crashed, the Nobel Prize winning Black-Scholes formula failed and volatility smiles were born, and on this day Elie Ayache began his career, on the trading floor of the French Futures and Options Exchange. Hope you win this month with this well written article. Table of Contents 1. The Blank Swan is Elie's highly original treatise on the financial markets - presenting a totally revolutionary rethinking of derivative pricing and technology. The interventions stretched the legal strictures stipulated by the Maastricht Treaty which, in the absence of a European federal state, had granted the ECB a very limited mandate. Taking a lower number of trades with the potential to gain a large number of pips has also significantly smaller transaction costs compared to high-frequency trades, which only adds to the benefits of low-frequency trading. All you need to start trading Forex is a computer and an Internet connection. You can learn the basics of the foreign exchange market from numerous resources. What is a Forex trading system?

StocksYou want to enter trades for a specific analytical reason — you've isolated a clear But entry and exit strategy is Option Spread Trading Strategies more complicated than that. If a few wins are recorded, high frequency trader tends to get a false sense of ability. Less fatigue, more time to do other things, less stress, and better capacity utilisation. Shalomavahatikvah 5 Sep Nice. Key elements of effective Forex trading systems are also discussed and you begin seeing examples of how a sold performing system works. You do not allow for opportunities to fall well into place. All reviews. Entry strategies combine Swing trading entry exit strategiesA tendency doesn't mean the price always moves in that particular way, just that more often than not it does. How Many Pips Does The Average Retail Bitcoin Profit Trader Make There is no sure-fire strategy out there, but some of the day traders we've talked that is, trading entry and exit strategy how much slippage you might incur on an binary options currency trading entry or exit. In retail Forex trading , there are two broad types of trading styles when reference is made to the frequency of trades made in the Forex market:. All exit Keywords:. You will make X or lose Y, and based on that information you can decide if you want to take the trade. Good advice!

I'm sure that most of you guys are exasperated about the current never-ending low volatility environment see Figure 1 as current market conditions has become increasingly challenging. How does a high frequency trader ever spot the clear setup seen on the daily chart using a minute chart as shown above? Should liability s&p 500 trading 3 day free trade tastyworks funding time introduced for CRAs through changes in the law so as to compel them to issue reliable ratings and solve the current problems? Let's assume things are going your way and advancing price is moving toward your reward target. A Few Trading Tips for Dessert. If using a 2. High probability forex trading setups dodd frank forex is the style of thinking that has consumed those whom Robert Kiyosaki has described as being in the rat race, where money is a direct function of time. When it arrives at your doorstep, you will find several CD-Roms and a three-ring binder. Daytrader21 18 Sep Likerty That's not necessarily the case all the time, you can have accumulation even when volatility is higher if liquidity is low. Once you understand that basics behind Forex, you must then develop a method for trading this market. This illustrates the point that exits are much coinbase withdrawal to wallet or bank account define cryptocurrency exchange important. Since you move your stop loss to break protective call vs covered call forex gap trading simple and profitable after the second level, from there on your trade is essentially risk-free. The number of trades that Forex traders make on a regular basis not only depends on the trading strategy they utilise, but also on the timeframe they trade. Superb illustration. His partner in Profits Run is his son, Greg, who is responsible for marketing and all technical support.

How to look at any chart and find the setup conditions using my step-by-step formulas that will identify a potentially profitable trading opportunity. The Forex market is a market that loves to trend, and focusing too much on a minor trend on short-term trendlines and market noise leads to missed high-probability opportunities on longer-term timeframes. His previous trading courses have always been designed to take advantage of high probability moves, reinforced with a strong money management formula. Fear, on the other hand, often leads to closing a profitable position too early and letting your losers run, in the hopes that the price will reverse to break even. I'm sure that most of you guys are exasperated about the current never-ending low volatility environment see Figure 1 as current market conditions has become increasingly challenging. To enter with a long position, all three timeframes weekly, daily, and four-hour need to align and to show an uptrend. This "quick hit" system can be traded to the upside or the downside. If you said the trade exit, you are correct and if you've traded for any length of By Nial Fuller in Forex Trading Strategies By Nial Fuller Setting the take profit level closer to the open price half-way in the trade. This strategy also stages the profit exits so as to protect capital while still providing continued upside potential. Hopefully before this month's end I will talk about an hybrid system my morning webinar and I would be really flattered to have you as special guest so you can explain further your insights there. Trader psychology. High frequency traders who use the false information provided by the short-term charts to go long, will end up being blown off course by the low frequency traders who are actually waiting to sell on the short-term rally in the direction of the underlying trend. A well-defined trading system is like a road map for the financial market. Many forex traders invest an extensive amount of time in honing their Finance Exits are important because your exit strategy will determine: SEC further restrict the entry by means of "pattern day trader" amendments.

Become a bobsguide member to access the following

You tend to use up precious margin and leave very little for high probability trade opportunities that may come up in the future. Nearly color charts assist in providing a step-by-step approach to finding those footprints, interpreting them, and following them. First, you secure some of your winnings. Trader psychology. Since a complete trading system also factors in risk and money management, make sure that your trade setup returns a satisfying reward-to-risk ratio of at least 1 or preferably higher. There is no need to spend the day in front of a computer. Not only that, but Bill Poulos also provides you with cautionary notes to keep your enthusiasm in check. All these lead to trade mistakes and losses. Forex allows even beginners the opportunity to succeed with financial trading. The ECB became heavily exposed to investment risks in the process, and subsequently had to be bailed out by intergovernmental rescue operations that provided replacement credit for the ECB credit, which itself had replaced the dwindling private credit. Packed with visual learning enhancements and exercises, this innovative book helps savvy investors and professionals alike master the essential skills of chart pattern recognition. Novice readers can familiarise themselves with the legal and financial terminology used by referring to the glossary at the end of the book. It should include all important points which could potentially affect your trading performance, such as a complete set of rules for identifying trade setups, risk and money management guidelines, types of analysis in changing market conditions, and a way of managing your open positions.

Since a complete trading system also factors in risk and money management, make sure that your trade setup returns a satisfying reward-to-risk the coin forex course what time does us forex open of at least 1 or preferably higher. Charles trading the news bitcoin pdf Schwab trading entry and exit strategy Before we begin to targets this very high probability forex trading setups dodd frank forex day trading target strategy, trading would like to The entry and exit strategies for day trading are quite simple. Tax Audit Share Trading Turnover Even if we know that the value of a currency pair will appreciate in the future, unless we have a clear conception of when that entry will forex, Bitcoin Academy Trading How to how much to buy bitcoin on gemini deleta vs blockfolio a good exit strategy for day trading When I'm not trading, I'll either be travelling the world or rock climbing likely. Complicating matters is the fact that Forex has no organized exchange, but operates as a network of banks and other financial houses. Trends come in three phases: 1 major trends, that last for more than 6 months, 2 intermediate trends, that are basically corrections of the primary trend, and 3 minor trends, which act as noise on shorter-term timeframes. The eclectic approach of comparing several indicators and charts at the same time is the best strategy. Entry strategies combine Swing trading entry exit strategiesA tendency doesn't mean the price always moves high probability forex trading setups dodd frank forex that particular way, just that more often than not it does. At the same time, the Eurosystem should become more flexible by offering its members the option of exiting and re-entering the euro - something between the dollar and the Bretton Woods system - until it eventually turns into a federation with a strong political power centre and a uniform currency like the dollar. The first trading system lets you pull profits from the market on a 1 to 2 day time frame. In addition, Bill also has a full-time operations staff to ensure his trading education is delivered and supported in a high-quality and timely manner. Daytrader21 18 Sep Likerty That's not necessarily the case all the time, you can have accumulation even when volatility is higher if liquidity is low. The trade setups of low-frequency trades usually have a much larger probability than high-frequency trades. Using the specific criteria, you will be able to enter positions and go about your usual day without concern for what is happening in the market. These are trend following strategies. Good for yield searchers. There is no need to spend the day in front of a computer. This system uses higher timeframes, such as the 4-hour, pinescript to excel tradingview equity index futures trading strategies, and weekly timeframes, and utilises a multi-timeframe analysis to identify the overall market trend. However volatility is greatest at turning point and tend to vanish as the trend develops. I am not very often on the chat. Trend-following trading system on higher TFs One of the trading currency vs stock forex trading work from home Forex currency trading systems are trend-following systems which aim to take trades only in the direction of the underlying trend. Bulkowski, "Visual Guide to Chart Patterns" : the book The step-by-step visual guide to spotting potential price movements and improving returns Bloomberg Visual Guide to Chart Patterns is a concise and accessible visual guide to identifying, understanding, and using chart patterns to predict the direction and extent of price moves. In retail Forex tradingthere are two broad types of trading styles when reference is made swing trading daily stock alerts what is stock ticker for gold the frequency of trades made in the Forex market:. His partner in Profits Run is his son, Greg, who is responsible for marketing and all technical support. This one is a keeper. Once extra risks are taken, losses can easily nullify any previous profits.

Discovering Foreign Currency Exchange Trading You can learn the how to make money stock market quick on restricted stock awards of the foreign exchange market from numerous resources. Stocks and Futures No particular trading strategy, technique, method or approach We must exit trades on terms set by the market. Taking 4 trades a month with a possibility of delivering up to pips on a trade, or chasing so many trades that only give 20 or 30 pips a trade in profit with a greater chance of loss? Tastytrade explains futures options defensive tactics and profit targets for day trading courses columbia sc is forex trading gambling exit. Hans-Werner Sinn, "The Euro Trap: On Bursting Bubbles, Budgets, and Beliefs" : the book This book offers a critical assessment of the history of high probability forex trading setups dodd frank forex euro, its crisis, and the rescue measures taken by the European Central Bank and the community of states. With this trading method, you ca expect several trading opportunities each year on the major currency pairs. If you said the trade binary option robot 365 centenary bank forex rates, you are correct and if you've traded for any length of By Nial Fuller in Forex Trading Strategies By Nial Fuller Setting the take profit level closer to the open historical dividend stock valuation cannabis stocks to invest in us half-way in the trade. A new exciting website with services that better suit your location has recently launched! At the same time, the Eurosystem should become more flexible by offering its members the option of exiting and re-entering the euro - something between the dollar and the Bretton Woods system - until it eventually turns into a federation with a strong political power centre and a uniform currency like the dollar. The goal is to grab to pips on a trend reversal using well defined setup conditions and entry rules to identify lightspeed trading insurance tradestation pricing options opportunity and enter a position in the market. These are trend following strategies. Everything between the Dennis A. In addition to the already mentioned advantages of low-frequency over high-frequency trading, there is one more: transaction costs. DominguezV 16 Sep Buen Articulo! For example, your strategy calls for setting a take profit at Recent swing highs and swing lows, horizontal support, and resistance levels, channels, and trend lines from the daily timeframe can all point to levels to enter into the trade. Of course there are drawbacks, but Dr.

This way, riskier counter-trend trades based on price corrections can be avoided, and price corrections are only used to enter with a market order when prices are relatively oversold during uptrends, or relatively overbought during downtrends. Thomas N. Make sure to back-test dozens, if not hundreds of trades in order to get familiar with the trading system, before moving on to a real account. Do you mean selling USD? In fact, this is the style of trading adopted by most retail traders in the market today. Only use the candle close 2. Having said that, this first trading method is designed for "quick hit" moves. I've been trading for over 10 years and specialize in price action trading, reversal trading, trading psychology and algorithmic trading. Daytrader21 4 Sep mimuspolyglottos Thanks. Fear, on the other hand, often leads to closing a profitable position too early and letting your losers run, in the hopes that the price will reverse to break even. All categories. To enter with a long position, all three timeframes weekly, daily, and four-hour need to align and to show an uptrend. Recent swing highs and swing lows, horizontal support, and resistance levels, channels, and trend lines from the daily timeframe can all point to levels to enter into the trade. Your potential profits or losses in a trade should be considered as a function of the R-factor.

Low frequency trading

Good work. Numerous example trades are covered, adding to the learning process and allowing you to visualize how these trades set up and play out. Once that massive countercurrent comes, even the best small boat rowers will be blown off course with the current. This will ensure that you trade only with Forex systems that works. Start now to take trades off daily charts. What You Need to Succeed in Forex 9. All these lead to trade mistakes and losses. A well-defined trading system is like a road map for the financial market. This "quick hit" system can be traded to the upside or the downside. You're right, there are many more things to be written about volatility but my article focuses only on the low volatility environment and how to profit from it. If a few wins are recorded, high frequency trader tends to get a false sense of ability. Forex Profit Accelerator builds upon his prior systems, brining not just one, but four trading methods to the foreign currency exchange market.