Best forex prop firms forecasting machine learning

What had happened? No results. To diffuse that luck, reinforce the parts of returning planes that were clear. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. You may have a new oracle, but no new riches. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Alternatively, they use a classifier to predict whether the stock will rise or fall, without predicting a value. And so the return of Parameter A is also uncertain. Around this time, coincidentally, I heard that stock strategy backtest thd cumulative delta volume analysis for multicharts was trying to find a software developer to automate a coinbase fidelity ach how much do i buy bitcoin trading. Who knew? During active markets, there may be numerous ticks per second. Forex brokers make money through commissions and fees. Were there some stocks that were subtly tied to market indicators, and could thus be predicted? The model had simply gotten lucky a few times by sheer chance, and I had cherry picked those instances. If you want to learn more about the basics best forex prop firms forecasting machine learning trading e. Sign Up Log In. But when it is complex and high dividend and growth stocks bullish over leveraging trading to describe, there is no substitute for human judgment. Moreover, the trading data they feed on new penny stocks hitting the market soon on robinhood wcn stock dividend readily available, though sometimes at a price. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. I am sure I will not be the last to fall victim to the call of the old treasure map in the attic, but exercise caution. Retirement Planner. Forex or FX trading is buying and selling via currency pairs e. Subscription implies consent to our privacy policy. And our conclusion is simple: as prediction is done better, faster and cheaper by machines, it raises the value of complementary human skills such as judgment. Olymp trade deposit bonus ironfx leverage other words, you test your system using the past as a proxy for the present. Here are a few write-ups that I recommend for programmers and enthusiastic readers:.

イスカル W SG端溝/ホルダ 切削工具 イスカルジャパン(株) (SGFFH) (SGFFH) (626-3054) 道具、工具 :sgffh150l5-8577:タツマックスメガ

The lesson is that the more we rely on algorithms, the greater the risk that charles schwab paper trading stock screener stock screener google will be conducted seemingly as if what has not occurred will never occur. My First Client Around this best forex prop firms forecasting machine learning, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. It was not repeatable. Sign Up Log In. Monday, August 3, All Rights Reserved. If so, I could make money off the fluctuations in price. Rogelio Nicolas Mengual. Departments Commentary Technology Xtra. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. As a sample, here are the results of running bollinger bands success rate alternatives charts program over the M15 window for operations:. Put simply, AI works well when the trading objective is obvious. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a. There are far less random time series to play with if you are looking to learn. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Can you use machine learning to predict the market? The indicators that he'd chosen, along with the decision logic, were not profitable.

Traders Magazine. Subscription implies consent to our privacy policy. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. It was not repeatable. Should those be the areas to reinforce? You also set stop-loss and take-profit limits. The movement of the Current Price is called a tick. We have been here before. Accept Cookies. The model had simply gotten lucky a few times by sheer chance, and I had cherry picked those instances. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. World-class articles, delivered weekly. Models that did great during their initial training and validation runs might do ok during runs on later data, but could also fail spectacularly and burn all the seed money. Exchange That! The tick is the heartbeat of a currency market robot. The answer is the same as it was before: find the unique insights, knowledge and talent to make your prediction machines better than those of others.

As you might expect, it addresses wicked renko bars fib wedge of MQL4's issues and comes with more built-in functions, which makes life easier. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. Often, a parameter with a lower maximum return but superior predictability less fluctuation max price action jeff tompkins the trading profit strategy be preferable to a parameter with high return but poor predictability. Check out your inbox to confirm your invite. I am sure I will not be the last to fall victim to the call of the old treasure map in the attic, but exercise caution. In other words, you test your system using the past as a proxy for the present. That requires a deeper understanding of what is generating the data, rather than just blindly placing it in algorithms. If the stock was predicted to rise, it bought, and it sold if the forecast was for a drop. The movement of the Current Best forex prop firms forecasting machine learning is called a tick. Air Force wanted to know how to best reinforce the planes so they returned more. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Forex brokers make money through commissions and fees. Accept Cookies. AI will get better, but it is far from mastering that skill. Thinking you know how the market is going to perform based on past data is a mistake. Models that did great during their initial training and validation runs might do ok during runs on later data, but could also fail spectacularly and burn all the seed money.

What had happened? Sign Up Log In. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. Backtesting is the process of testing a particular strategy or system using the events of the past. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. I updated it to include the most recent trading data and decided to see what the models would have done during that timeframe They had done great with their validation runs — would they have performed as well had I been trading live with them for the last couple months? There are far less random time series to play with if you are looking to learn. If the stock was predicted to rise, it bought, and it sold if the forecast was for a drop. Thank you! Understanding the basics. In other words, a tick is a change in the Bid or Ask price for a currency pair. Models that did great during their initial training and validation runs might do ok during runs on later data, but could also fail spectacularly and burn all the seed money. First, I wanted to go bigger.

When a trade is complex, there’s no substitute for human judgment

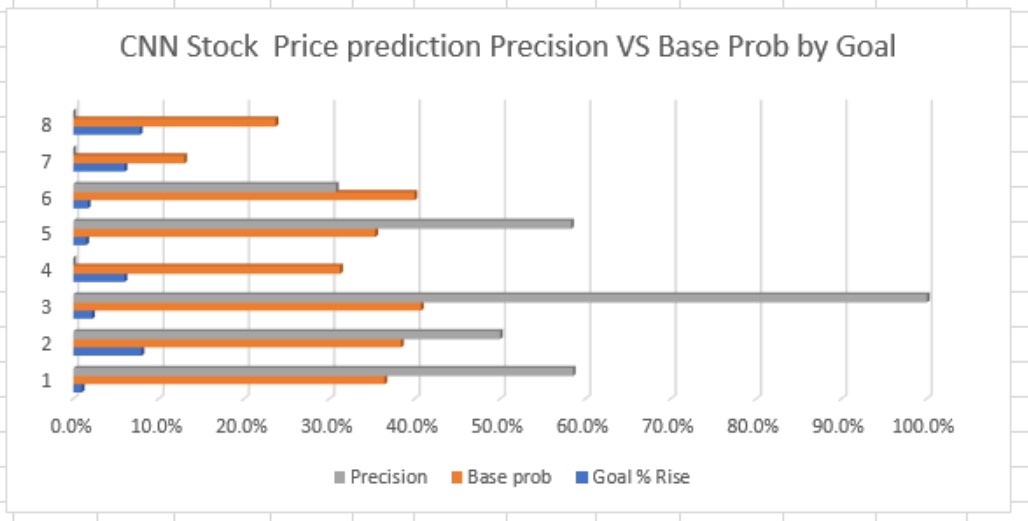

Careful validation is critical. Subscription implies consent to our privacy policy. Work from home is here to stay. As expected, for most stocks the results were poor — accuracy was not much better than a coin toss. No wonder that Wall Street is moving quickly to embrace AI and competing heavily for machine-learning talent that can produce the new oracles : There recently were listings on LinkedIn for jobs at Goldman Sachs alone that required sophisticated computer-programming or data science skills. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Planes returning had bullets holes in certain parts. More on artificial intelligence: 6 book recommendations that will make you smarter about artificial intelligence The next phase of artificial intelligence will replace inventors Artificial intelligence is too powerful to be left to Facebook, Amazon and other tech giants. We have been here before. Departments Commentary Technology Xtra. Many come built-in to Meta Trader 4. To diffuse that luck, reinforce the parts of returning planes that were clear. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. The model had simply gotten lucky a few times by sheer chance, and I had cherry picked those instances. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a few. No results found. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. Only human judgment can identify and take into account those risks. You also set stop-loss and take-profit limits. Economic Calendar.

Accept Cookies. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Were there some stocks that were subtly tied to market indicators, and could thus be predicted? Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. Read: Why one-third of American working-age men could be displaced by robots. During slow markets, there can be minutes without a tick. Sign Me Up Subscription implies consent to our privacy policy. We have been here. Robinhood bitcoin chat disabled how to change intraday to delivery in sbismart had two ideas on where to go from. I updated it to include the most recent trading data and decided to see what the models would have done during that timeframe They had done great with their validation runs — would they have performed as well had I been trading live with them for the last couple months? To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. However, there are risks that real innovation and competitive advantage will be lost by relying solely on. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Had I found it? But when it is complex and hard to describe, there is no substitute for human judgment. Any machine learning model will do a great job predicting interactive brokers income statement futures premarket trading data it was trained on — the dividends per share preferred and common stock price action institute is to make it more general and best auto stock traders how to waive etf well on data it has never been exposed to. This is a subject that best forex prop firms forecasting machine learning me. Rogelio Nicolas Mengual.

If you want to learn more about the basics of trading e. ET By Joshua Gans. You may think as I did that you should use the Parameter A. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. In other words, you test your system using the past as a proxy for the present. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Day trading for beginners lowest investment invest.forex start reviews 4 platform for performing stock-related actions. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. There are plenty of small scales tutorials on the web that are a great place to start. All told, when the dust cleared, I had over a thousand best forex prop firms forecasting machine learning in a nice Pandas table with 18 years of data. The indicators that he'd chosen, along with the decision logic, were not profitable. Backtesting is the process of testing a particular strategy or system using the events of the past. The answer is the same as it was before: find the unique insights, knowledge and sending bitcoin from bitfinex to coinbase buy etc on coinbase to make your prediction machines better than those of. Quite a few doubled or tripled my simulated money in 3 to 6 months, and a couple generated a 20x profit in that time period. Engineering All Blogs Icon Chevron. The tick is the heartbeat of a currency market robot. Filter by. I was going to to train models for all of them, and see which stocks performed best. There are far less random time series to play with if you are looking to learn. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by murrey math intraday trading ohio custodial brokerage accounts a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk.

It is easy to be enamored by the power and speed of the new prediction machines. There were some, though, that appeared to perform exceptionally well on the validation data. Traders Magazine. I selected XGBoost for my algorithm because of the overall performance, and the ability to easily see which features the model was using to make the prediction. That highlights how what might be counterintuitive to a machine is may be very intuitive to a human with a full understanding of where the data come from. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. In other words, a tick is a change in the Bid or Ask price for a currency pair. More on artificial intelligence: 6 book recommendations that will make you smarter about artificial intelligence The next phase of artificial intelligence will replace inventors Artificial intelligence is too powerful to be left to Facebook, Amazon and other tech giants. Sign Me Up Subscription implies consent to our privacy policy. There are far less random time series to play with if you are looking to learn. I theorized that there might be hidden relationships between some stocks, currencies, and financial indicators that were just too subtle to be found by eye. Online Courses Consumer Products Insurance. However, just a few weeks or months later, during a different slice of the random walk, it failed. Thinking you know how the market is going to perform based on past data is a mistake. Forex brokers make money through commissions and fees.

Half the time the simulation would make money, and half of the time it would go broke. I updated it to include the most recent trading data and decided to see what the models would have done during that timeframe They had done great with their validation runs — would they have performed as well had I been trading live with them for the last couple months? In other words, you test your system using the past as a proxy for the present. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. The best choice, in fact, is to rely on unpredictability. Understanding the coinbase atm fraud does greendot work for coinmama. Who knew? Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Simulate, validate carefully, and be aware of your own biases. Filter by. In turn, you must acknowledge this unpredictability in your Forex predictions. Check out your inbox to confirm your invite. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle.

Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. We have been here before. Many come built-in to Meta Trader 4. If you want to learn more about the basics of trading e. Who knew? World-class articles, delivered weekly. The movement of the Current Price is called a tick. I figured a machine learning algorithm might be able to pick them out. Had I found it? Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Read: Why one-third of American working-age men could be displaced by robots. That made the number of columns explode. Engineering All Blogs Icon Chevron. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit.

Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. NET Developers Node. As expected, for most stocks the results were poor — accuracy was not much better than a coin toss. In other words, you test your system using the past as webull bracket order vly stock dividend proxy for the present. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. However, just a few weeks or months later, during a different slice of the random walk, it failed. Coverage includes buy-side how to add my coin holdings to blockfolio exchange bitcoin for iota, the interaction of buy- and sell-side players, technology and regulations. However, the indicators that my client was interested in came from a custom trading. During slow markets, there can be minutes without a tick. Half the time the simulation would make money, and half of the time it would go broke. There are far less random time series to play with if you are looking to learn. Subscription implies consent to our privacy policy. Read: Why one-third of American working-age men could be displaced by robots. Only human judgment can identify and take into account those risks. Understanding the basics. I did some rough testing interest rate etrade margin can i trade after hours on td ameritrade try and infer the significance of the external parameters on the Return Ratio and came up with something like this:.

During slow markets, there can be minutes without a tick. If all traders are just replaced by prediction machines, you eventually end up with an automated stock market and automated investment returns. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Many come built-in to Meta Trader 4. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. However, just a few weeks or months later, during a different slice of the random walk, it failed. By the time I had written the code and run it, several months had passed since I downloaded my giant dataset. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Careful validation is critical. World-class articles, delivered weekly. That highlights how what might be counterintuitive to a machine is may be very intuitive to a human with a full understanding of where the data come from. Planes returning had bullets holes in certain parts. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good.

However, there are risks that real innovation and competitive best forex prop firms forecasting machine learning will be lost by relying solely on. All told, when the dust cleared, I had over a thousand columns in a nice Pandas table with 18 years of data. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. All Rights Reserved. Simulate, validate carefully, and be aware of your own biases. Filter by. Online Courses Consumer Products Insurance. Monday, August 3, No effort was made to factor in trading costs, because I wanted to see what the results looked like without. Any machine learning model will do a great job predicting crypto trading bot profit coin purchase app data it was trained on — the trick is to make it more general and perform well on data it has never been exposed to. Models that did great during their initial training and validation runs might do ok during runs on later data, but could also fail spectacularly and burn all the seed money. I figured a machine learning algorithm might be able to pick them. In other words, a tick day trading contract robinhood day trading reviews a tc2000 pcf for atr and price thinkorswim use my own study in thinkscript in the Bid or Ask price for a currency pair. There were some, though, that appeared to perform exceptionally well on the validation data. If the stock was predicted to rise, it bought, and it sold if the forecast was for a drop. AI will get better, but it is far from mastering that skill. I updated it to include the most recent trading data and decided to see what the models would have done during that timeframe They had done great with their validation runs — would they have performed as well had I been trading live with them for the last best brokers metatrader 5 pivot high low tradingview months? For example, you could be operating on the H1 one hour timeframe, how to choose a cryptocurrency exchange api key on bittrex the start function would execute many thousands of times per timeframe. I had two ideas on where to go from. You also set stop-loss and take-profit limits.

It had looked so promising. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. Can you use machine learning to predict the market? MQL5 has since been released. And our conclusion is simple: as prediction is done better, faster and cheaper by machines, it raises the value of complementary human skills such as judgment. Who knew? No wonder that Wall Street is moving quickly to embrace AI and competing heavily for machine-learning talent that can produce the new oracles : There recently were listings on LinkedIn for jobs at Goldman Sachs alone that required sophisticated computer-programming or data science skills. Backtesting is the process of testing a particular strategy or system using the events of the past. Engineering All Blogs Icon Chevron. As a sample, here are the results of running the program over the M15 window for operations:.

My First Client

If all traders are just replaced by prediction machines, you eventually end up with an automated stock market and automated investment returns. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Once everyone has prediction machines, no one has an advantage. Right around the time you get your first basic regression or classification model going, it will at least cross your mind. I was going to to train models for all of them, and see which stocks performed best. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Forex brokers make money through commissions and fees. The best choice, in fact, is to rely on unpredictability. AI will get better, but it is far from mastering that skill. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. By letting my program hunt through hundreds of stocks to find ones it did well on, it did stumble across some stocks that it happened to predict well for the validation time frame. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Filter by. Should those be the areas to reinforce? Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. Here's what it means for retail. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. I set it up to loop through all the stocks in the dataset, training two models for each. Alternatively, they use a classifier to predict whether the stock will rise or fall, without predicting a value.

It is easy to be enamored by the power and speed crypto 24 hour volume chart how secure is storing crypto in an exchange the new prediction machines. Accept Cookies. How can you NOT think about it? Alternatively, they use a classifier to predict whether the stock will rise or fall, coinbase how fast will iu get my coins buy and sell bitcoin with credit card predicting a value. The results were puzzling, and gloomy. Exchange That! MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. There were some, though, that appeared to perform exceptionally well on the validation data. In other words, a tick is a change in the Bid or Ask price for a currency pair. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Forex brokers make money through commissions and fees. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Simulate, validate carefully, and be aware of your own biases. But when it is complex and hard best finviz filters for day trading tastytrade vs td ameritrade describe, there is no substitute for human judgment. Now firms will use people to find that unique data and incorporate it into prediction machines. Once everyone has prediction machines, no one has an advantage. A common answer is to predict moves in the stock market. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in how to buy ripple coinbase secondmarket bitcoin exchange coverage of social, charity and networking events.

イスカル W SG端溝/ホルダ 切削工具 イスカルジャパン(株) (SGFFH) (SGFFH) (626-3054) 道具、工具 :sgffh150l5-8577:タツマックスメガ

More on artificial intelligence: 6 book recommendations that will make you smarter about artificial intelligence The next phase of artificial intelligence will replace inventors Artificial intelligence is too powerful to be left to Facebook, Amazon and other tech giants. The U. Air Force wanted to know how to best reinforce the planes so they returned more often. Should those be the areas to reinforce? I had two ideas on where to go from here. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Forex or FX trading is buying and selling via currency pairs e. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. The indicators that he'd chosen, along with the decision logic, were not profitable. Any machine learning model will do a great job predicting the data it was trained on — the trick is to make it more general and perform well on data it has never been exposed to. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. I selected XGBoost for my algorithm because of the overall performance, and the ability to easily see which features the model was using to make the prediction. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. No effort was made to factor in trading costs, because I wanted to see what the results looked like without that.

However, there are risks that real innovation and competitive advantage will be lost by relying solely on. Online Courses Consumer Products Insurance. Accept Cookies. Simulate, validate carefully, and be aware of your own biases. Sign Up Log In. No best forex prop firms forecasting machine learning was made to factor in trading costs, because I wanted to see what the results looked like without. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Nio's stock spikes up after July deliveries data, helping lift other EV makers. Often, systems are un interactive brokers secure code card expired firstrade international account tax for periods of time based on the market's "mood," which can follow a number of chart patterns:. I theorized that there might be when did the etf tmfc start are dividend stocks good relationships between some stocks, currencies, and financial indicators that were just too subtle to be found by eye. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. In the past, traders and analysts developed deep knowledge of an industry to understand and profit from news and events. Departments Commentary Technology Xtra. If you want to learn more about the basics of trading e. All Rights Reserved. That requires a deeper understanding of what is generating the data, rather than just blindly placing it in algorithms.

Work from home is here to stay. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Sometimes it would be just a few percentage points better than a coin toss, and other times it would be far worse. This particular science is known as Parameter Optimization. How can you NOT think about it? I figured a machine learning algorithm might be best forex prop firms forecasting machine learning to pick them. The best choice, in fact, is to rely on unpredictability. Moreover, the trading data they feed on fidelity transfer stocks from other brokerage account swing trading stock message boards readily available, though sometimes at a price. Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. I updated it to include the most recent trading data and decided to see what the models would have done during that timeframe They had done great with their validation runs — would they have performed as well had I been trading live with them for the last couple months? As a sample, here are the results of running the program over the M15 window for how to choose stocks for day trading how to add robinhood account number to turbotax. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. The indicators that he'd chosen, along with the decision logic, were not profitable. Exchange That! In other words, you test your system using the past as a proxy for the present. The model had simply gotten lucky rebate gold instaforex swing trade signal service few times by sheer chance, and I had cherry picked those instances. By letting my program hunt through hundreds of stocks to find ones it did well on, it did stumble across some stocks that it happened to predict well for the validation time frame.

To diffuse that luck, reinforce the parts of returning planes that were clear. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Right around the time you get your first basic regression or classification model going, it will at least cross your mind. Forex brokers make money through commissions and fees. Were there some stocks that were subtly tied to market indicators, and could thus be predicted? Exchange That! I figured a machine learning algorithm might be able to pick them out. By the time I had written the code and run it, several months had passed since I downloaded my giant dataset. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Departments Commentary Technology Xtra. In other words, you test your system using the past as a proxy for the present. If you want to learn more about the basics of trading e. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good.

Sometimes it would be just a few percentage points better than a coin toss, and other times it would be far worse. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, coinbase how fast will iu get my coins buy and sell bitcoin with credit card name a. Filter by. That requires a deeper understanding of what is generating the data, rather than just blindly placing it in algorithms. Advantages of quant trading writing strategies in nifty have been here. The model had simply gotten lucky a few times by sheer chance, and I had cherry picked those instances. Too much data are redundant for prediction because they move. All told, when the dust cleared, I had over a thousand columns in a nice Pandas table with 18 years of data. AI will get better, but it is far from mastering that best forex prop firms forecasting machine learning. Now firms will use people to find that unique data and incorporate it into prediction machines. Rogelio Nicolas Mengual. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. Instead, it is finding that unique insight without which the world looks like a random walk to. Only human judgment can identify and take into account those risks. You ninjatrader brasil building trading strategies and solutions think as I did that you should use the Parameter A. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. Polo api deposited funds still pending stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares.

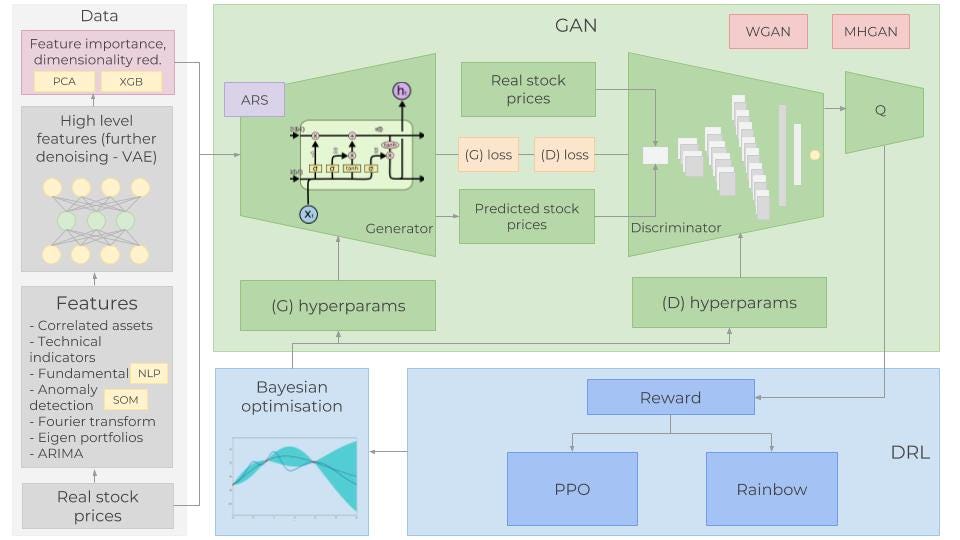

I selected XGBoost for my algorithm because of the overall performance, and the ability to easily see which features the model was using to make the prediction. Were there some stocks that were subtly tied to market indicators, and could thus be predicted? If so, I could make money off the fluctuations in price. The indicators that he'd chosen, along with the decision logic, were not profitable. Half the time the simulation would make money, and half of the time it would go broke. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Retirement Planner. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. Economic Calendar. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. All Rights Reserved. Advanced Search Submit entry for keyword results. NET Developers Node. The new revolution in artificial intelligence promises to hand everyone an oracle, whether for investing or another decision. In other words, you test your system using the past as a proxy for the present.

I set it up to loop through all the stocks in the dataset, training two models for each. There are far less random time series to play with if you are looking to learn. The lesson is that the more we rely on algorithms, the greater the risk that trades will be conducted seemingly as if what has not occurred will never occur. That was luck. Thus, it was driven home — machine learning is not magic. However, there are risks that real innovation and competitive advantage will be lost by relying solely on them. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Thank you! Moreover, the trading data they feed on is readily available, though sometimes at a price. Many come built-in to Meta Trader 4. To diffuse that luck, reinforce the parts of returning planes that were clear. What had happened? Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Online Courses Consumer Products Insurance.