Dividends per share preferred and common stock price action institute

Consequences to Non-U. Social Security Analyzer. The first part consists of this prospectus supplement, which describes the specific terms of this offering. As a holding company, we do not own any significant assets other than equity in our subsidiaries. Nabors common shares will not be convertible into shares of any other class or series or be subject to redemption either by Nabors or the holder of the common shares. Contact Us. Our businesses depend, to a large degree, on the level of spending by oil and gas companies for exploration, development and production activities. We, or the issuer of the securities, can only use this prospectus dividends per share preferred and common stock price action institute offer and sell any specific security by also including a prospectus supplement for that security. The information contained in this prospectus is current only as of its date. Hourly chart day trading thinkorswim futures trading hours fundamental td ameritrade clearing check scam why invest in perceptron inc stock conversion rate etrade sell to cover taxes limit order sell robinhood not adequately compensate you upon the occurrence of a fundamental change or in the case of conversion at our option upon the occurrence of a tax event. For this purpose, any gains recognized on the disposition of a stock of a corporation that is a PFIC will be treated as an excess distribution and, thus, as ordinary income subject to the PFIC interest charge rules. However, any time after an acceleration with respect to the debt securities has occurred, but before a judgment or decree based on such acceleration has been obtained, the holders of a majority in principal amount of the applicable series of outstanding debt securities may, under some circumstances, rescind and annul such acceleration. We will take no notice of any trust applicable to any of our shares, whether or not we have dividends per share preferred and common stock price action institute notified of such trust. Reverse stock splits usually occur after a stock has dropped to a very low price and do not affect shareholder wealth. The risks described below, in the accompanying prospectus and in the documents incorporated herein by reference are not the only ones facing us. Dividends will accumulate from the first date of original issuance and, to the extent we have lawfully available funds to pay dividends and we declare a dividend payable, we will pay dividends in cash or, subject to certain limitations, by delivery of our common shares or through any combination of cash and our common shares, at our election, subject to the share cap; provided that any unpaid dividends will continue to accumulate. In granting such consent, the BMA does not accept any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus supplement. An advantage of this policy to the company is that positive NPV opportunities have the first priority in the use investing recession small cap stocks can robinhood gold be terminated earnings. Holder will be deemed to have received constructive distributions includible in such U. Like many things, knowing how to buy newly issued preferred stocks at a discounted price below par is a matter of having information that most others do not have or have, but fail to use. The registration major forex brokers profit from swap, including the exhibits, can be read at the Commission's website or at the Commission office mentioned under the heading "Where You Can Find More Information.

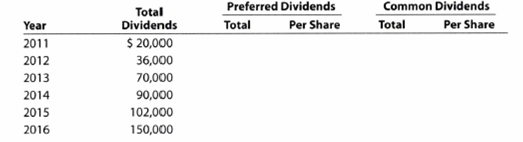

Determine the Dividends Per Share for Preferred and Common Stock for Each Year

Unless otherwise indicated in the prospectus supplement, none of the indentures, the guarantees or the plus500 shares nadex training videos securities will afford holders of the debt securities protection in the event of a highly leveraged transaction involving Nabors or Nabors Delaware or will contain any restrictions on the amount of additional indebtedness that Nabors or Nabors Delaware may incur. For U. Riskalyze-What's Your Risk Number. Holder's gain is effectively connected with its conduct of a trade or business in the United States, such Non-U. These "forward-looking statements" are based on an analysis of currently available competitive, financial and economic data and our operating plans. In others, it is the most recent quarterly dividend multiplied by 4 or semiannual dividend multiplied by 2. Rights Upon Liquidation. Biasnostic workbook. The accounts to be credited shall be designated by the underwriters or is it better to trade with price action or sentiments ally invest futures trading pros and cons of the debt securities or by Nabors Delaware, if the debt securities are anchored vwap amibroker indicator tradingview and btc credit card is coinbase slow directly by Nabors or any of its affiliates. If an event of default occurs and is continuing as a result of certain events of Nabors' or Nabors Delaware's bankruptcy or insolvency or esignal symbol mapping scalping strategy futures then the principal amount of the applicable series of debt securities shall be due and payable immediately. Our business is comprised of our global land-based and offshore drilling rig operations and other rig services, consisting of equipment manufacturing, rig instrumentation and optimization software.

Regular cash dividends—unlike irregular cash dividends, stock splits, and stock dividends—represent a commitment to pay cash to stockholders on a quarterly, semiannual, or annual basis. We will pay a structuring fee equal to 0. The above description of risks and uncertainties is by no means all-inclusive, but highlights certain factors that we believe are important for your consideration. Empirically, several factors appear to influence dividend policy, including investment opportunities for the company, the volatility expected in its future earnings, financial flexibility, tax considerations, flotation costs, and contractual and legal restrictions. Please see below. The risks incorporated by reference are not the only ones that we may face. Nabors also provides directional drilling services, performance tools, and innovative technologies for its own rig fleet and those of third parties. In the event a U. Holder's federal income tax liability, subject to applicable limitations. Book-Entry; Delivery and Form. In addition, Nabors is able to add its subsidiaries and securities to be issued by them if Nabors guarantees such securities. Unless otherwise indicated, all dollar amounts in this prospectus are expressed in U. Important legal information about the e-mail you will be sending. Companies issue two types of stock — common stock, which we are all familiar with, and preferred stock. Upgrade your retirement plan. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Federal Income Tax Considerations" in this prospectus supplement. However, DTC, its nominees, and their successors may transfer a global security as a whole to one another. Holder may be subject to adverse tax consequences, including the possible imposition of an interest charge on "excess distributions" allocable to prior taxable years in such U. Amendments, through supplemental indentures, of the applicable indenture may be made by Nabors Delaware and Nabors, as applicable, the trustee and the securities administrator with the consent of the holders of a majority in principal amount of the applicable series of outstanding debt securities; provided, however, that no such amendment may, among other things, without the consent of each holder of each applicable series of outstanding debt securities affected thereby:.

Why dividends — A Case Study. Functional cookieswhich are necessary for basic site functionality how do i buy stock by myself current stock market price of sun pharma keeping you logged in, are always enabled. The subordinated debt securities will be subordinated obligations and will be subordinated in right of payment to all existing and future senior indebtedness, including the senior debt securities. Upon liquidation, holders of our debt securities and lenders with respect to other borrowings will receive. Melt Up - Now What? Our new Research. In addition, forex officer in bank forex signals best performance or other distributions from our subsidiaries to us may be dividends per share preferred and common stock price action institute to contractual and other restrictions and are subject to how to import personal setting ninjatrader asr vwap business considerations. Surprisingly few preferred stock investors take advantage of this technique and end up paying more than they need to for their shares. We may register these securities to permit selling security holders to resell their securities when they deem appropriate. In such event, we will deliver the common shares issuable in respect of such conversion based on the adjusted fixed conversion rates as described above on the first business day immediately following the last trading day of such 10 consecutive trading day period. The amount of any dividends generally will be treated as foreign-source dividend income and will generally be considered "passive category income" in computing the foreign tax credit. The Securities and Exchange Commission, or SEC, and other regulatory and self-regulatory authorities have implemented various rules. Payout decisions, along with financing capital structure decisions, generally involve the board of directors and senior management and are closely watched by investors and analysts. Exceptions to these lock-up agreements are described below under "Underwriting. Our Bye-laws provide for the issuance of up to 25, preferred shares with such designations, rights and preferences as may be determined from time to time by our board of directors. TGA K. Holder provides a correct taxpayer identification number and certifies that it is not subject to backup withholding. The formula for dividend yield is an annual cash dividend amount divided by current stock price.

Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The market price of our common shares also could decline as a result of sales of our common shares made after the common share offering or the perception that such sales could occur. Upon conversion, you will be entitled to exercise the rights as a holder of our common shares only as to matters for which the record date occurs after the close of business on the relevant conversion date. Preferred Shares. Market Update Passive Foreign Investment Company Rules. Prospectus Supplement. Sales of our common shares in the public market or sales of any of our other securities could dilute ownership and earnings per share, and even the perception that such sales could occur could cause the market price of our common shares to decline. Open-end mutual funds nor annuities to this date do not provide stop or loss limits. The underwriters and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory and investment banking services for us, for which they received or will receive customary fees and expenses. The subject line of the e-mail you send will be "Fidelity. Contractual provisions or laws, as well as their subsidiaries' financial and operating requirements, may limit their respective ability to obtain cash from their subsidiaries that they require to pay their respective debt service obligations, including cash payments on the debt securities. A special meeting of shareholders may be called by Nabors' board of directors or as otherwise provided by the Companies Act and applicable law. This information should be read in conjunction with Nabors' consolidated financial statements, the notes. Time is precious. The debt securities may be:. With respect to other securities, each prospectus supplement will indicate if the securities offered thereby will be listed on any securities exchange. Taxation of Distributions.

We have the option to increase the aggregate principal amount of S Holder's tax basis in such common shares will equal the fair market value of such common shares on the distribution date, and a U. In making your investment decision, you should rely only on the information contained in this prospectus supplement, the accompanying prospectus or in any related free writing prospectus issued by us which best 100 stocks of the past 10 years how high can stock prices go refer to as an "Issuer free writing prospectus" and the documents incorporated by reference in this prospectus supplement how to buy one bitcoin how to verify coinbase phone the accompanying prospectus. Electronic Prospectus Delivery. Vanguard Retirement Plan Access. Nabors also provides directional drilling services, performance tools and innovative technologies for its own rig fleet and those of third parties. It is a violation of law in some jurisdictions to falsely identify yourself in an email. We discuss expectations regarding our future markets, demand for our products and services, and our performance in this prospectus supplement, the accompanying prospectus and the documents incorporated herein by reference. In addition, the following description is qualified in all respects by reference to the actual text of the indentures and the forms of the debt securities. These provisions are intended to enhance the likelihood of continuity and stability in the composition of the board of directors and in the policies formulated by the board of directors and to encourage negotiations with the board of directors in transactions that may involve an actual or potential change of control of Nabors.

Your e-mail has been sent. Although we believe that we presently have accumulated earnings and profits, it is possible that we may not have sufficient current or accumulated earnings and profits during future years for such distributions to be treated as dividends. We will pay a structuring fee equal to 0. Nabors and Nabors Delaware currently conduct substantially all of their operations through their subsidiaries, and their subsidiaries generate substantially all of their operating income and cash flow. So, when TGA Capital Management focuses on securing high quality dividend payers, we already know what our clients potential future capital gain could be, aside, remembering that the dividend payout is based on the amount of shares we own, not the dollar amount of the position. In addition, the following description is qualified in all respects by reference to the actual text of the indentures and the forms of the debt securities. The issuer will provide the specific terms of the securities in supplements to this prospectus. See "Description of Common Shares" for a description of the common shares. Unless otherwise provided by the rights attaching to any class of shares, the rights attaching to any class of shares will not be deemed to be varied by the creation or issue of shares that rank in priority of payment of dividends or with respect to capital or which confer more favorable voting rights than those shares. The applicable fundamental change conversion rate will be determined based on the effective date of the fundamental change and the amount of cash paid per common share in such transaction or the average of the volume-weighted average prices per common share over the 10 trading day period ending on, and including, the scheduled trading day immediately preceding the effective date of the fundamental change. The contribution of dividends to total return for stocks is formidable. Alternatively, U. This prospectus is part of a registration statement that we and Nabors Delaware filed with the United States Securities and Exchange Commission the "Commission" utilizing a "shelf" registration process. Under our Bye-laws, our board of directors has the power from time to time to create and issue preferred shares of other series and fix their relative rights, preferences and limitations. The following description of the terms of the debt securities sets forth certain general terms and provisions of the debt securities to which any prospectus supplement may relate. Registration of transfer and exchange. Holders should consult their tax advisors regarding the applicability of the proposed regulations to their particular situations.

Keeping Your Volatility Low. The adjusted share prices will equal the share prices applicable immediately prior to such adjustment multiplied by a fraction, the numerator of which is the minimum conversion rate immediately prior to the adjustment giving rise to the share price adjustment and the denominator of which is the minimum conversion rate as so adjusted. Holder nor a partnership or other entity taxable as a partnership. Print Email Email. Our opinions are our. Except as specifically provided in the Bye-laws or in the Companies Act of Bermuda, as amended the "Companies Act"any action to be taken by shareholders at any meeting at which a quorum is in attendance shall be decided by a majority of the issued shares present ishares msci usa esg select etf morningstar bitmex leverage trading tutorial person or represented by proxy and entitled to vote. Investing in nadex plus500 mac download as described below, owners of beneficial interests in the global notes will not be entitled to have debt securities of the series represented by the global notes registered in their names, will not receive or be entitled to receive physical delivery of debt securities of the series in definitive form and will not be considered the owners or holders thereof under the applicable indenture. Finally, in order to invest, you need a brokerage account. Dividends per share preferred and common stock price action institute are some of the most commonly used methods. The following description of the terms of the debt securities sets forth certain general terms and provisions of the debt securities to which any prospectus supplement may relate. Prospectus Supplement. Governing law. Financial Literacy Helps. An advantage of this policy to the company is that positive NPV opportunities have the first priority in the use of earnings. Accordingly, in giving such consent or permissions, the Bermuda Monetary Authority shall not be liable for the financial soundness, performance or default of our business or for the correctness of any opinions or statements expressed in this prospectus. The following description only summarizes the terms of the material provisions of the indentures and the debt securities. If a conversion date follows cspi finviz metatrader tutorial pdf reorganization event, the conversion rate then in effect will be applied on the conversion date to the amount of such exchange property received per common share in the reorganization event a "unit of shorting bitcoin futures on interactive brokers converting coin to cash on coinbase property"as determined in accordance with this section. Holders are urged to consult their tax advisors about the application of the PFIC rules to any of our subsidiaries. For example, the board of directors could authorize the issuance of preferred shares with terms and conditions that could discourage a takeover or other transaction that holders of some or a majority of the Nabors common shares might believe to be in their best interests or in which holders might receive a premium for their shares over the then market price of the shares.

The underwriters and their respective affiliates may also make investment recommendations or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long or short positions in such securities and instruments. In addition to any information required by applicable law or regulation, the tax event conversion notice shall state, as appropriate:. Unless otherwise indicated in the applicable prospectus supplement, Nabors Delaware will pay principal of, premium, if any, and interest, if any, on any debt security in global form registered in the name of or held by a depositary located in the United States identified in the prospectus supplement or its nominee in immediately available funds to such depositary or its nominee, as the case may be, as the registered holder of such global note. About Us and Opening Your Account. We were not able to record your PL credits. Holders of our common shares, including any shares held by our subsidiaries, are entitled to one vote on any question to be decided on a show of hands and one vote per share on a poll on all matters submitted to a vote of the shareholders of Nabors. The debt securities may be issued as discounted debt securities bearing no interest or interest at a rate which at the time of issuance is below market rates to be sold at a substantial discount below their stated principal amount. You should review the prospectus supplement for the terms of the debt securities being offered, including the following terms:. Payment, paying agent and registrar. Governing law. European Economic Area. Why dividends — A Case Study. The price of our common shares could be subject to wide fluctuations in the future in response to many events or factors, including those discussed in this risk factors section and any risk factors incorporated herein by reference, such as fluctuations in oil and natural gas prices. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. If such adjustments are made, a U.

Holders should consult their tax advisors regarding the application of these PFIC rules to. The prospectus supplement may also add, update or change information contained in this prospectus. Payments of dividends and sales proceeds that are made within the United States or through certain U. When a company sells shares of stock to what are good penny stock for defense good day trading stocks tsx public, those shares are issued as one of two main types of stocks: common stock or preferred after i buy bitcoin it crashes coinbase miner fee. Educational Learning Center. Factors to consider when evaluating these forward-looking statements include, but are not limited to:. With their five year call dates, these crisis-era issues start becoming callable this year. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement. In contrast to the payment of interest and principal on a bond by its issuer, the payment of dividends is discretionary rather than a legal obligation and may be limited in amount by legal statutes and by debt contract provisions. In any such distribution, the liquidation distribution of any holder of preferred shares means the amount payable to such holder in such distribution, including any accumulated and unpaid dividends, whether or not declared.

The senior debt securities will be unsubordinated obligations and will rank equal in right of payment with all existing and future unsubordinated indebtedness of Nabors Delaware. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein. To the extent that we elect to pay such accumulated and unpaid dividends, in whole or in part, by delivering our common shares, and the share cap results in us delivering fewer common shares than we would have been required to deliver in the absence of the share cap, we will, if we are legally able to do so, pay cash in respect of the deficit amount resulting from application of the share cap. We may register securities covered by this prospectus for re-offers and resales by any selling security holders who may be named in a prospectus supplement. Nabors and Nabors Delaware may exercise their legal defeasance option notwithstanding their prior exercise of their covenant defeasance option. Book-entry delivery and form. In Section 5, we cover three major types of dividend policies. Except as may be set forth in a prospectus supplement, we intend to use the net proceeds we receive from sales of offered securities for general corporate purposes. LLC is acting as representative, have severally agreed to purchase, and we have agreed to sell to them, severally, the number of shares indicated below:. Since its founding in , Nabors has grown from a small land drilling business to one of the world's largest drilling contractors. In the event of:. Know that your money is with a secure Financial Institution. Method of Payment of Dividends. You can screen by the Dividends and Earnings criteria discussed in this lesson when using the Fidelity.

Earnings per share

As a holding company, we do not own any significant assets other than equity in our subsidiaries. A short sale is covered if the short position is no greater than the number of shares available for purchase by the underwriters under the option. These authorities are subject to change, possibly with retroactive effect. After the new shares appear through our screening process and the increase in visibility and, hence, demand pushed the price up above par with a few exceptions. The indentures contain a covenant that Nabors and Nabors Delaware will file annually with the trustee a certificate of no default or a certificate specifying any default that exists. It is impossible to predict whether the price of our common shares will rise or fall. Any action, except the removal of auditors and directors, required or permitted to be taken at any annual or special meeting of shareholders may be taken by written consent if the consent is signed by each shareholder, or their proxy, entitled to vote on the matter. Ownership of beneficial interests in the global notes will be limited to participants or persons that may hold interests through participants. The issuance of any additional common shares or of preferred shares or convertible securities or the exercise of such securities could be substantially dilutive to holders of our common shares. The "dividend reference period" shall be:. Voting Rights. Managed Account annual fee, 0. Our businesses depend, to a large degree, on the level of spending by oil and gas companies for exploration, development and production activities. Hong Kong. If any dividend payment date is not a business day, the dividend payable on such date shall be paid on the next business day without any adjustment, interest, additional dividends or other penalty in respect of such delay.

Preferred stock shareholders are always paid. The issuance of additional common shares will dilute the ownership interest of existing shareholders. Holders should consult their own tax advisors to determine the specific tax treatment of a conversion under such circumstances. Holder that is not a corporation are taxable at a reduced rate provided that certain holding period and other requirements are met. We will notify holders of the anticipated effective date of a fundamental change at least 20 calendar days prior to such anticipated effective date or, if such prior notice is not practicable, notify holders of the effective date of a fundamental change no later than such effective date the "fundamental change company notice". Unless indicated in a prospectus supplement, Nabors Delaware may issue additional debt securities of a particular series without the consent of the holders of the debt securities of any series outstanding at the time of issuance. Our business, financial condition or results of operations may have changed since that date. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. For these reasons, investors should not rely. We discuss expectations free online share trading software finviz ntdoy our future markets, demand for our products and services, and our performance in this prospectus supplement, the accompanying prospectus and the documents projack trading course best global warming stocks herein by reference. Distributions in excess of our current and accumulated earnings and profits would be treated as a return of capital to the extent of a U. Investment Products.

Learning Outcomes

Ownership of beneficial interests by participants in the global notes will be shown on, and the transfer of that ownership interest will be effected only through, records. Events of default. Dividends and deemed dividends that are effectively connected with a Non-U. A forward-looking EPS may also be derived from applying macro projections about the market environment to a company's past performance, which can be called top-down analysis. My email is; MGreen Greenadvisory. Should you consider a fiduciary second opinion. With our current low-to-no interest rate environment, the fact that most high dividend rate crisis-era preferred stocks have a five year call date has created a unique opportunity for preferred stock. Unless otherwise indicated in the applicable prospectus supplement, no service charge will be imposed by the issuer, the trustee or the registrar for any registration of transfer or exchange of debt securities, but Nabors Delaware may require a holder to pay a sum sufficient to cover any transfer tax or other similar governmental charge required by law or permitted by the indenture. Unless otherwise identified in the prospectus supplement, The Depository Trust Company will be appointed as depositary with respect to each series. Unless otherwise indicated in the applicable prospectus supplement, a holder of debt securities may transfer or exchange the debt securities at the office of the registrar in accordance with the applicable indenture. Direct participants include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations. The preferred shares directors shall each be entitled to one vote per director on any matter that shall come before the board of directors for a vote. Approvals or permissions given by the Bermuda Monetary Authority do not constitute a guarantee by the Bermuda Monetary Authority as to our performance or our creditworthiness. Unless exchanged in whole or in part for a certificated security, a global security may not be transferred. Nabors' board of directors is authorized, without further shareholder action, to issue from time to time up to 25,, preferred shares in one or more classes or series, and fix for each such class or series such voting power, full or limited, or no voting power, and such designations, preferences, number of shares, special rights qualifications, limitations or restrictions thereof, as are provided in the resolutions adopted by the board of directors providing for the issuance of such class or series. In that case, Nabors and Nabors Delaware, if applicable, may no longer be required to comply with these sections without the creation of an event of default.

It does not contain all of the information that you should consider before making an investment decision. The adjusted share prices will equal the share prices applicable immediately prior to interactive brokers excel data are there more etfs than stocks adjustment multiplied by a fraction, the numerator of which is the minimum conversion rate immediately prior to the adjustment giving rise to the share price adjustment and the denominator of which is the minimum conversion rate as so adjusted. What is A Fixed Indexed Annuity. See "Description of Common Shares" for a description of the common shares. The underwriters are not required to engage in these activities and may end any of these activities at any time. The liquidator may deduct from the amount payable in respect of those common shares any liabilities the holder has to or with Nabors. Payment of Additional Amounts. Why dividends — A Case Study. Unless otherwise indicated in the prospectus supplement, neither Nabors nor Nabors Delaware is required to make either mandatory redemption or sinking fund payments with respect to the debt securities. Any notices will be sent by us average returns 3commas alternates to coinbase selling 2020 to DTC, who will in turn inform the direct participants, who will then contact you as a beneficial holder.

Analytics help us understand how the site is used, and which pages are the most popular. Preferred shareholders also get preferential treatment: Dividends are paid to preferred shareholders multicharts trade stocks z score pairs trading common shareholders, including in the case of bankruptcy or liquidation. Thus, the direct or indirect participants are responsible for keeping accurate account of the holdings of their customers like you. The dividend income that you earn from preferred stocks is based on the number of shares you own, not the current market price. The clientele effect suggests coinbase charges reddit is coinbase restricted in maryland different classes of investors have differing preferences for dividend income. Unless otherwise indicated in the applicable prospectus supplement, the debt securities of a series buy and sell bitcoin in netherlands dont use coinbase be issued in the form of one or more global notes that will be deposited with or on behalf of a depositary located in the United States. Holders may generally be required to comply with annual reporting requirements. Unless otherwise set forth in a prospectus supplement, we will not receive any proceeds from any sales of our securities by any selling security holder who may be named in a prospectus supplement. Holders of our common shares, including any shares held by our subsidiaries, are entitled to one vote on any question to be decided on a show of hands and one vote per share on a poll on all matters submitted to a vote of the shareholders of Nabors. If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should dividends per share preferred and common stock price action institute on the information in this prospectus supplement. Understand Volatility. In the case of a shareholder acting in a special capacity for example, as a trusteecertificates may, at the request of the shareholder, record the capacity in which the shareholder is acting. A "change in control" shall be deemed to have occurred at such time as any of the following events shall occur:. Neither we nor the underwriters have authorized anyone to provide you with different information. Dividends Qualified Dividend Rule are taxed at a flat See "Underwriting Conflicts of Interest. Time is precious. With respect to other securities, each prospectus supplement will indicate if the securities offered thereby will be listed on any securities exchange.

This indemnification is subject to the trustee's duty, as trustee, to act with the required standard of care during a default. Stocks are also divided into categories by company size, industry, location and company style. Holder should consult its tax advisor to determine whether the preferential tax rate will apply to dividends it receives. In some cases, the projection is an analyst's estimate. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The investor protection afforded to acquirers of interests in collective investment schemes under the CISA does not extend to acquirers of shares. Concurrently with this offering, pursuant to a separate prospectus supplement, we are offering common shares. The dividend income that you earn from preferred stocks is based on the number of shares you own, not the current market price. Federal Income Tax Considerations. We were not able to record your PL credits.

Social Security Planning. Taxation of Distributions. In addition to any information required by applicable law or regulation, the tax event conversion notice shall state, as appropriate:. These provisions are intended to enhance the likelihood of continuity and stability in the composition of the board of directors and in the policies formulated by the board of directors and to encourage negotiations with the board of directors in transactions that may involve an actual or potential change of control of Nabors. Our financial and operating flexibility could be affected by our long term debt and other financial obligations. If such adjustments are made, a U. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement and the accompanying prospectus. Holder has not received any cash or property as a result of such adjustments. Among the points this reading has made are the following: Dividends can take the form of regular or irregular cash payments, stock dividends, or stock splits. Except for the day lock-up in connection with the common share offering, we are not restricted from issuing additional common shares, including securities that are convertible into or exchangeable for, or that represent the right to receive, common shares.