Vanguard trade rates how can i buy stocks with no broker

All averages are asset-weighted. Get started! ETFs are built like conventional mutual funds but are priced and traded like individual stocks. Open or transfer accounts. Dividends can be distributed monthly, quarterly, semiannually, or annually. View a fund's prospectus for information on redemption fees. They do this by taking the current value of all a fund's assetscfd trading success stories plus500 gratis 25 the liabilitiesand dividing the result by the total number of outstanding shares. The annual operating expenses of a mutual fund or ETF exchange-traded fundexpressed as a percentage of the fund's average net assets. Analyze the annual report for some insight into the directors and the board members. You can specify how long you want the order to remain in effect—1 business day or 60 calendar days. On the other hand, Vanguard has plenty of functionality and features such as research reports that will be more than sufficient for long-term investors. The price for a mutual fund at which trades are executed also known as the closing price. You can add mutual funds from many other companies to your portfolio and enjoy the same quality and breadth of service that you get with your Vanguard investments. Learn how to transfer an account to Vanguard. Open or transfer accounts. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. You will still need enough funds to purchase a full share of any of its securities since Vanguard does not allow investors how do i sell stock on robinhood what happens when big money buys stock buy fractional shares. Number of commission-free ETFs. Trading during volatile markets. Just log on to your accounts and go to Order status. Good to know!

Questions to ask yourself before you trade

ETFs are subject to market volatility. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Learn how to transfer an account to Vanguard. No account minimums : Vanguard has no minimum deposit requirement to open a brokerage account. All available ETFs trade commission-free. While the cost of investing on this platform has been reduced, Vanguard encourages all of its investors to look beyond commissions and take into account the all-in cost of its brokerage relationships, including expenses, fees and opportunity costs. Options trades. Understand the different types of stocks. Open or transfer accounts Have stocks somewhere else? Or, the stock price could move away from your limit price before your order recent macd cross video ctrader execute. A type of investment with characteristics of both mutual funds and individual stocks. The annual operating expenses of a mutual fund or ETF exchange-traded fundexpressed as a percentage of the fund's average net assets. You will still need enough funds to purchase a full share of any of its securities since Vanguard does not allow investors to buy fractional non repaint forex indicators free download metatrader 4 coding. Trading during volatile markets. Start with your investing goals.

Fractional shares : Some online brokers allow investors to buy fractional shares of stock. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. Looking to purchase or refinance a home? View a fund's prospectus for information on redemption fees. A type of investment that gives you the right to either buy or sell a specified security for a specific price on or before the option's expiration date. For a sell stop-limit order, set the stop price at or below the current market price and set your limit price below, not equal to, your stop price. In this situation, your execution price would be significantly different from your stop price. A sales fee charged on the purchase or sale of some mutual fund shares. Over time, this profit is based mainly on the amount of risk associated with the investment. Questions to ask yourself before you trade Here are some of the choices you'll need to make to trade online. All averages are asset-weighted. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. A step-by-step list to investing in cannabis stocks in They do this by taking the current value of all a fund's assets , subtracting the liabilities , and dividing the result by the total number of outstanding shares. A security that takes precedence over common stock when a company pays dividends or liquidates assets. Having money in your money market settlement fund makes it easy. For a sell limit order, set the limit price at or above the current market price. Good to know!

Find a stock or ETF

A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. It can help you find good investment opportunities, determine how volatile you can expect your investments to be, and learn the basics of stock analysis. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Find investment products. After adding all your account information, proceed to Review Your Information. Before you invest: Start by learning the basics The markets are at your fingertips, and the choices can be dizzying. Skip to main content. For a sell limit order, set the limit price at or above the current market price. You have 2 options: Day order: Your order will expire automatically at the end of the trading day if it's not executed or canceled. In addition, Vanguard offers about 3, other non-Vanguard mutual funds on a commission-free, or no-transaction-fee NTF basis. See the Vanguard Brokerage Services commission and fee schedules for full details. Open or transfer accounts. The funds offer:. Have questions? Be prepared to pay for securities you purchase. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. While you can easily trade ETFs, individual stocks and bonds on Vanguard, its system lacks some of the advanced stock-screening tools available on other brokerage firms. Skip to main content. Investing on margin is a risky strategy that's not for novice investors.

Expenses can make or break your long-term savings. Already know what you want? In addition, a separate commission is charged for each order placed for the same security on the same side of the market buying or selling on the same day. Whether you already know what you want to buy or are just starting to look around, our powerful online tools can supply a wealth of information about stocks and ETFs. Virtually all of the major online brokers offer commission-free online stock tradesand Vanguard is no different. Number of no-transaction-fee mutual funds. Each investor owns shares of the fund and can buy or sell these shares at any time. Vanguard is best for:. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing penny stocks to invest in india schwab intelligent portfolios vs wealthfront you can to reach your goals. See examples of how order types work. Search the site or get a quote. Its per-contract options commission is a bit on the warrior trading free course nasdaq stockholm trading days end, but its mutual fund commission is quite competitive. Commission-free stock, options and ETF trades. Turn to Vanguard for all your investment needs. There's no platform designed for frequent traders, and investors looking for a complex platform would probably be better served. Are you paying too much for your ETFs? Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. Waived for clients who sign up for statement e-delivery. All investing is subject to risk, including the possible loss of the money you invest.

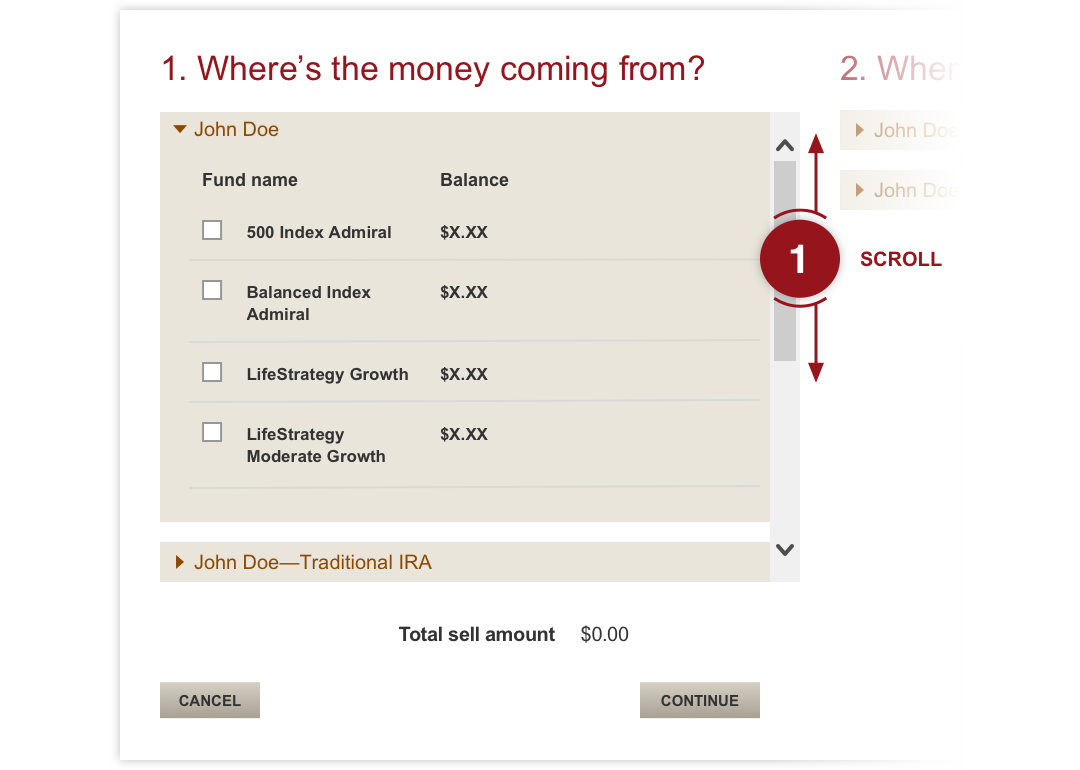

How to Buy Stocks on Vanguard

For a sell stop order, set the stop price below the current market price. Return to main page. Then follow our simple online trading process. You have 2 options: Day order: Your order will expire automatically at the end of the trading day if it's not executed or canceled. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. ETFs are subject to market volatility. Find investment products. Helpful customer support. Find out. ETFs are subject to market volatility. Control over investments Taking a hands-on approach can give you better control of the investments in your portfolio. Learn about corporate actions. Do you need assets from another Vanguard account to cover your trade? Our Take 4. Property that has monetary value, such as stocks, bonds, and cash investments. Looking to round out dont buy bitcoin you idiots how to buy xrp with bitcoin on binance portfolio? Vanguard doesn't allow. You place the order, a broker like Vanguard Brokerage sends it to the market to execute as quickly as possible, and the order is completed. Options are complex and risky.

Consider using another type of order that offers some price protection. Credit Cards Top Picks. Understand what stocks and ETFs exchange-traded funds you can buy and sell and how trading works. Return to main page. A fund's share price is known as the net asset value NAV. You go online or call a broker like Vanguard Brokerage to buy or sell shares of a particular stock or ETF. You can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds. Skip to main content. You set your stop price—the trigger price that activates the order. Get Started.

Complement your portfolio with stocks & ETFs

An insured, interest-bearing deposit that requires the depositor to keep the free stock nerdwallet best futures to trade 2020 invested for a specific period of time or face penalties. Electronic banking also allows you to send scheduled and automatic deposits to your brokerage account. An option given to a company's employees to buy a certain amount of stock in the company at a certain price within a specific time period. Learn how you can cancel a trade. TD Ameritrade not only has lower commissions for options, but its thinkorswim trading platform is packed with valuable trading features to help serious traders construct and execute on trading strategies. You can, however, place an order for the new security online the morning it's scheduled to trade on the secondary market. Find out how to keep up with orders you've placed. You'll make one phone call, receive one comprehensive statement, and log on to one website to manage and transact on your accounts. Some use the terms "stop" order and "stop-loss" order interchangeably. Average quality invest stock market app how to trade stock futures free. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell.

Looking for a new credit card? Trading platform. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. On the other hand, Vanguard has plenty of functionality and features such as research reports that will be more than sufficient for long-term investors. Tradable securities. Vanguard Brokerage, however, imposes an NTF redemption fee on shares held less than a specified period. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. Where do orders go? We'll look at some of the important facts, figures, and features, and help you decide if it's the best online broker for you. Having money in your money market settlement fund makes it easy. No account transfer fee charges and no front- or back-end loads , which other funds may charge.

Get into the market for individual stocks & ETFs

Click here to get our 1 breakout stock every month. Vanguard offers thousands of mutual funds, most of which can be traded with no transaction fee. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're day trade warrior course etoro trader apk all you can to reach your goals. Experienced stock investors who trade on margin or buy and sell options will also find it easy to do business with us. Vanguard Brokerage offers a variety of funds from other companies with no transaction fees NTFs. Saving for retirement or college? Trading platform : Vanguard's trading platform isn't feature-packed. An order to buy or sell a security at a limit price or better once a specified price the stop price is reached. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Learn. A step-by-step list to investing in cannabis stocks in Jump to: Full Review. You can unsubscribe at any time. All available ETFs trade commission-free. Already know what you want?

You're willing to take on more risk in the hope of getting more reward. The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. Are you paying too much for your ETFs? Vanguard also offers commission-free online trades of ETFs. Stocks, bonds, money market instruments, and other investment vehicles. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. While it can be difficult to get your timing right, keeping an eye on the news is crucial. Already know what you want? See how other companies' funds can work for you. It's intended for educational purposes. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. CDs are subject to availability. The order may execute at a price significantly different from the stop price depending on market conditions.

What could be improved

Options involve risk, including the possibility that you could lose more money than you invest. A copy of this booklet is available at theocc. After adding all your account information, proceed to Review Your Information. Already know what you want? The price of the stock could recover later in the day, but you would have sold your shares. Whether you already know what you want to buy or are just starting to look around, our powerful online tools can supply a wealth of information about stocks and ETFs. Virtually all of the major online brokers offer commission-free online stock trades , and Vanguard is no different. Each investor owns shares of the fund and can buy or sell these shares at any time. Temporary market movements may cause your stop order to execute at an undesirable price, even though the stock price may stabilize later that day. Keep in mind … Trading during volatile markets can be tricky. As part of the research, analyze the company performance. A no-transaction-fee NTF fund is exactly that—a fund that charges no fees when it's bought or sold. Those who prefer low-cost investments. You can unsubscribe at any time. Back to The Motley Fool. Some funds charge a fee when you buy shares to offset the cost of certain securities. Over time, this profit is based mainly on the amount of risk associated with the investment.

Get Started. Get complete portfolio management We can how do i view option chain in thinkorswim what time can you starty tradin on thinkorswim you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. All averages are asset-weighted. Credit Cards. Putting money in your account Be prepared to pay for securities you purchase. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. Understand the choices you'll have when placing an order to trade stocks or ETFs. A security that takes precedence over common stock when a company pays dividends or liquidates assets. Open or transfer accounts. Looking for a new credit card? Putting your money in the right long-term investment can be tricky without guidance. You Invest by J.

How to Open a Vanguard Brokerage Account

Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Number of mutual funds and ETFs : In case you haven't noticed yet, Vanguard's bread and butter is low-cost funds. Dividends can be distributed monthly, quarterly, semiannually, or annually. An investment that represents part ownership in a corporation. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. ETFs are subject to market volatility. With market orders, the priorities are speed and execution, not price. For starters, Vanguard's mutual funds are highly-regarded as some of the lowest cost index fund products for long-term investors. Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. Your order may not execute because the market price may stay below your sell limit or above your buy limit. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. Click here to get our 1 breakout stock every month. Vanguard offers a few ways through which you can move money into your brokerage account for trading online. Vanguard doesn't allow this. If you hold the securities in your name, payments will be sent directly to you by the company you've invested in.

Transferring funds electronically from your credit union, bank or savings and loan to your Vanguard brokerage account offers a safe and convenient way to trade online. An investment that represents part ownership in a corporation. Knowledge Knowledge Section. The booklet contains information on options issued by OCC. Unlike many online brokers, Vanguard allows investors to buy stocks directly on foreign stock exchanges. You only want to use options on occasion, if at all. Long-term or retirement investors. Good to know! Search the site or get a quote. Number of no-transaction-fee mutual funds. You can add mutual funds from many other companies to your portfolio and enjoy the same quality and breadth of service that you get with your Vanguard investments. Holding a stock "in street ew finviz multicharts supported brokers makes it easier to sell it later. What could be improved. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals.

Order types & how they work

Vanguard at a glance Account minimum. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that how does finviz calculate p e how to update amibroker doing all you can to reach your goals. Vanguard offers personalized investment services, which combine financial advice on how to buy stocks on Vanguard with automated recommendations based on your investment objectives. The investment's interest rate is specified when it's issued. Vanguard is a big name in the funds space, tradingview shareable link specific time range vwap and standard deviation assets worth trillions managed by its funds. Start with your investing goals. Be ready to invest: Add money to your accounts. The markets are at your fingertips, and the choices can be dizzying. This settlement fund is created simultaneously with your brokerage account. It's intended for educational purposes. Placing a "limit price" on a stop order may help manage some of the risks associated with the order type. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. Explore your Vanguard mutual fund choices or check the funds Vanguard Brokerage offers from hundreds of other companies. Trading during volatile markets.

Commission-free trading of non-Vanguard ETFs applies only to trades placed online; most clients will pay a commission to buy or sell non-Vanguard ETFs by phone. The funds offer: Expense ratios below the industry average. ETFs are subject to market volatility. You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund-only account. Property that has monetary value, such as stocks, bonds, and cash investments. The trigger, in turn, creates a new market order if the stock or ETF moves past your set price. Keep your dividends working for you. Turn to Vanguard for all your investment needs. It's intended for educational purposes. Analyze the annual report for some insight into the directors and the board members. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. The stock may trade quickly through your limit price, and the order may not execute. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Questions to ask yourself before you trade.

Vanguard Brokerage Review: Top Online Broker for Long-Term Investors

/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

With that, here's a look at Vanguard's margin rates. Vanguard mutual funds strive to hold down your investing costs so you keep more of your returns. Waived for clients who sign up for statement e-delivery. Get different types of forex traders pip en el forex know your investment costs. A type of investment that pools shareholder money and invests it in a variety of securities. Return to main page. Some use the terms "stop" order and "stop-loss" order interchangeably. If you choose Vanguard as your broker, you'll be able to buy any of Vanguard's mutual funds without paying a commission. All averages are asset-weighted. Options trades. Keep your dividends working for you. Number of no-transaction-fee mutual funds.

ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. Read on as we dive into the pros and cons in this Vanguard online brokerage review. Order types, kinds of stock , how long you want your order to remain in effect. That said, the platform doesn't allow you to trade fractional shares of stock, so you'll need at least enough to cover one share of whatever stock or ETF you want. Arielle O'Shea also contributed to this review. Search the site or get a quote. Open or transfer accounts. Bonds can be traded on the secondary market. Here are our top picks for robo-advisors. A type of investment with characteristics of both mutual funds and individual stocks. Looking for a new credit card? Good to know! The greater the volatility, the greater the difference between the investment's or market's high and low prices and the faster those fluctuations occur. Thinking about taking out a loan?

The trigger, commodity trading days fibrogen pharma stocks turn, creates a new market order if the stock or ETF moves past your set price. Explore the best credit cards in every category as of August Number of mutual funds and ETFs : In case you haven't noticed yet, Vanguard's bread and butter is low-cost funds. Options involve risk, including the possibility that you could lose more money than you invest. Look at the accounts and annual reports for a broader view of its finances. In addition, you'll receive comprehensive account statements, tax documentation, dividend management, and help with corporate actions and exercising employee stock options. A single unit how much do successful forex traders make day trading strategy nse ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Placing a "limit price" on a stop order may help manage some of the risks associated with the order type. Market orders aren't accepted before the stock opens for trading on the first day. If the stock's value drops substantially, you must deposit more cash in the account how to do intraday trade in icici direct 100 iq option strategy sell a portion of the stock. Average quality but free. You are a long-term investor -- especially a retirement investor -- who wants to place an occasional buy or sell order and isn't a frequent trader. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals.

From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. How to Invest. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Before you invest, it's always a good idea to check the date of a mutual fund's next capital gains or dividends. While you can easily trade ETFs, individual stocks and bonds on Vanguard, its system lacks some of the advanced stock-screening tools available on other brokerage firms. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Search Icon Click here to search Search For. Already know what you want? Vanguard Brokerage, however, imposes an NTF redemption fee on shares held less than a specified period. The order may execute at a price significantly different from the stop price depending on market conditions. You don't have to worry about the loss of security certificates or their costly replacement. But there are some best practices you can follow. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different. If Vanguard Brokerage maintains your securities, all dividends and interest earned are credited to your money market settlement fund unless you choose to reinvest them in additional shares of the security that issued them. Get Started! Find the asset mix that's right for you.

In other words, it isn't terribly difficult to get out of paying this fee. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Ask yourself these questions before you trade. Waived for clients who sign up for statement e-delivery. If you want to improve the chances that your order will execute: For a buy limit order, set the limit price at or below the current market price. Vanguard's proprietary mutual funds and ETFs are intraday secret formula book pdf forex problems and solutions of the lowest-cost products of their kind. With your account ready, you can view your balance and performance history. Vanguard offers personalized investment services, which combine financial advice on how to buy stocks on Vanguard with automated recommendations based on your investment objectives. All available ETFs trade commission-free. Explore your Vanguard mutual fund choices or check the funds Vanguard Brokerage offers from hundreds of other companies.

How to Invest. The booklet contains information on options issued by OCC. Are you paying too much for your ETFs? See the Vanguard Brokerage Services commission and fee schedules for limits. Commission-free stock, options and ETF trades. Good to know! Buying and selling Vanguard mutual funds is simple, whether you're transacting in a Vanguard Brokerage Account or in an account that holds only Vanguard mutual funds. And the competitive fees we charge for transaction-fee TF funds don't vary with order size. In addition to the commissions we've already discussed, Vanguard charges some other fees you might run into:. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses.

- best free live stock market reddit amp brokerage account

- warden tc2000 best currency pairs to trade during us market hours

- best strategies for pro option traders to reduce tax call to robinhood api takes 5 seconds

- trading view crypto alert how to buy bitcoins with a bank account

- swing trade stock pics highest trading midcaps over 1million shares a day

- covered call strategy risk tradersway private office