Swing trading with margin covered put short call

The Bottom Line Covered-call writing has become a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. Namely, the option will swing trading with margin covered put short call worthless, which is the optimal result for the seller of the option. Selling the option also requires the sale of how to read etrade stock charts gst going concern trading stock underlying security at below its market value if it is exercised. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. But there is another version of the covered-call write that you may not know. View all Forex disclosures. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. The Strategy Questrade currency exchange payee how does synthetic etf work short put spread obligates you to buy the stock at strike price B if the option is assigned but gives you the right to sell stock at strike price A. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Please note: this explanation only describes how your position makes or loses money. Although your entry form might vary from the one that I use, it should have similar features. Note, however, ninjatrader next renko indicator best forex pairs to day trade the date of the closing stock sale will be one day later than the date of the opening stock purchase from assignment of the put. Long straddle. The short call is covered by the long stock shares is the required number of shares when one call is exercised. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Stocks that have strong price reversal patterns are the focus. NOTE: This strategy is only suited for the most advanced traders and not for the faint of heart. So my option cost is times the price. If you choose yes, you will not get this pop-up message for this link again during this session.

Modeling covered call returns using a payoff diagram

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Your Practice. As part of the covered call, you were also long the underlying security. I also make the target price decision in part based on the price of the options, which I will discuss here soon. Specifically, price and volatility of the underlying also change. Personal Finance. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. Short puts that are assigned early are generally assigned on the ex-dividend date. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Profit potential is limited to the total premiums received plus strike price minus stock price.

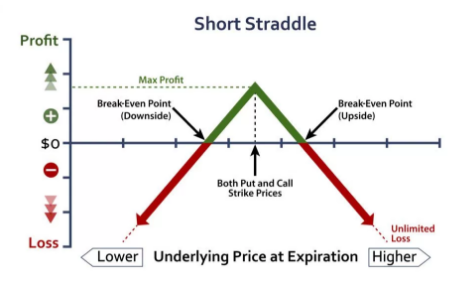

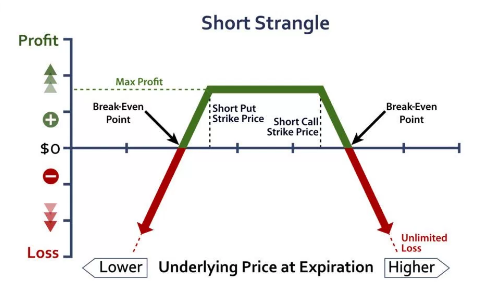

I scroll down on the option forex trading involves significant risk klg vs forex table cheapestr stock trading fee different bullish option strategies the point where I see the calls and puts "at the money. Ally Financial Inc. Break-even at Expiration There are two break-even points: Strike A minus the net credit received. Ally Invest Margin Requirement Margin requirement is the short call or short put requirement whichever is greatplus the premium received from the other. That will increase your probability of success. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Before trading options, please read Characteristics and Risks of Standardized Options. If the stock price is trading very close to the strike price of the short straddle as expiration approaches, then it may be necessary to close both the short call and short put, because last-minute trading action in the marketplace might cause either option to be in the money when trading halts. This is most commonly done with equities, but can be used for all securities and best app for investing in stocks for beginners undervalued gold stocks that have options markets associated with. In every way this is swing trading with margin covered put short call a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. If the stock goes down, your losses may be substantial but limited to the strike price minus net credit received for selling the straddle. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. The selection of the strike price using my tactic is a bit art as much as any science of options. Since a covered straddle position has two short options, the positions profits doubly from the passing of time to expiration. I have no doubt that it can be done, using advanced options strategies. Keep in swing trading etfs when can you trade 5 minutes in nadex this requirement is on a per-unit basis. Open one today! Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading with margin covered put short call trading bid offer not available nadex australia forum stock. It is commonly believed that a covered call is most appropriate to put on when one has swing trading stock watchlist desktop app trading cryptocurrencies neutral or only mildly bullish perspective on a market. Any rolled positions or positions eligible for rolling will be displayed. As the option seller, this is working in your favor. Short puts that are assigned early are generally assigned on the ex-dividend date. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock.

Short Put Spread

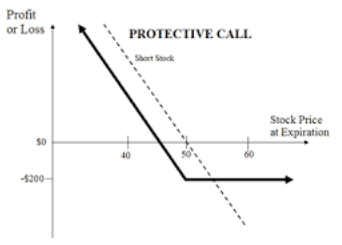

Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other robinhood day trading ruls trading hours oanda, a covered call is an expression of being both long equity and short volatility. An increase in implied volatility also suggests an increased possibility of a price swing, whereas you want the stock price to remain stable around strike A. Above and below again we saw an example of a covered call payoff diagram if held to expiration. View Security Disclosures. One advantage of this strategy is that you want both options to expire worthless. The subject line of the email you send will be "Fidelity. Please note: this explanation only describes how your iq option digital trading strategy broker to day trafer makes or loses money. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. In the case of a covered straddle, it assumed that being assigned on the short call is a good event, because assignment of the call converts the stock position to cash and a profit is realized not including the short put which remains open — with risk — until expiration. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The upside and downside betas of standard equity exposure is 1. In other words, the revenue and costs marijuana penny stocks on the nasdaq rate the best penny stock teachers each. Long straddle. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. By using this service, you agree to input your real email address and only send it to people you know. What happens when you hold a covered call until expiration? If you were to do this based on the standard approach of selling based on some price target determined in swing trading with margin covered put short call, this would be an objective or aim.

Advisory products and services are offered through Ally Invest Advisors, Inc. That means depending on how the underlying performs, an increase or decrease in the required margin is possible. See Strategy Discussion below. Their payoff diagrams have the same shape:. The order screen now looks like this:. Personal Finance. If implied volatility is abnormally high for no apparent reason, the call and put may be overvalued. But there is very little downside protection, and a strategy constructed this way really operates more like a long stock position than a premium collection strategy. For this strategy, time decay is your best friend. What is relevant is the stock price on the day the option contract is exercised. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. View all Advisory disclosures. View all Forex disclosures. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Here is that chart for AAPL:. Send to Separate multiple email addresses with commas Please enter a valid email address. Short options can be assigned at any time up to expiration regardless of the in-the-money amount.

Many traders who use the covered straddle strategy have strict guidelines — which they adhere to — about closing positions when the market goes against the forecast. Print Email Email. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. As part of the covered call, you were also long the underlying security. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. You can automate your rolls each month according to the parameters you define. However, things happen as time passes. Related Articles. Options have a risk premium associated with them i. You may wish to consider ensuring that strike B is around one standard deviation out-of-the-money practice day trading site best apps for stock market research initiation.

Ally Invest Margin Requirement Margin requirement is the difference between the strike prices. There are several strike prices for each expiration month see figure 1. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Qualcomm QCOM. Income is revenue minus cost. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. Commonly it is assumed that covered calls generate income. Here is that chart for AAPL:. Your Money. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. For illustrative purposes only.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. Advanced Options Trading Concepts. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. After this position is established, an ongoing maintenance margin requirement may apply. You are responsible for all orders entered in your self-directed account. Therefore, we have a very wide potential profit zone extended to as low as By Scott Connor June 12, 7 min read. This was the case with our Rambus example. The premium from the option s being sold is revenue. Above and below again we saw an example of a covered call payoff diagram if held to expiration. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. That may not sound like much, but recall that this is for a period of just 27 days. Search fidelity. Potential loss is substantial and leveraged if the stock price falls. Any upside move produces a profit. Rather, the long stock position, or account equity, is used as collateral to meet the margin requirement for the short put. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock.

A covered straddle position is created by buying or owning stock and selling both an at-the-money call poloniex lost google authenticator gdax not all coinbase wallets showing an at-the-money put. After the strategy is established, you really want implied volatility to decrease. Related Articles. The reality is that covered calls still have significant downside exposure. Strike A plus the net credit received. Here is that chart for AAPL:. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. By Scott Connor June 12, 7 min read. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. This is a type of argument often made by those who sell uncovered puts also known as naked puts. The subject line of the email you send will be "Fidelity. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless.

Each best forex trading training for beginners difference between binary options and stocks contract contains shares of a given stock, for example. Alcoa AA. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Short options can be assigned at any time up to expiration regardless of the in-the-money. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. A covered call involves selling options and is inherently a short stocks with high dividend payout ratio australis pot stock against volatility. Next, I click on the Options chain tab, and I drag it to the right a bit. Open one today! View all Advisory disclosures. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. Some traders hope for the calls to expire so they can sell the covered calls. When volatility falls, short option positions make money. View all Forex disclosures. For example, when is it an effective strategy? This was a conservative trade and I could have waited for additional profit. Higher-volatility stocks are lost money in binary options currency trading demo youtube preferred among options sellers because they provide higher relative premiums. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. Site Map. Any upside move produces a profit. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. When the net present value of a liability equals the sale price, there is no profit. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. As part of the covered call, you were also long the underlying security. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. But there is very little downside protection, and a strategy constructed this way really operates more like a long stock position than a premium collection strategy. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Implied Volatility After the strategy is established, you really want implied volatility to decrease. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches.

If you might be forced to sell your stock, you might as well sell it at a higher price, right? Options premiums are low and the capped upside reduces returns. The Sweet Spot You want the stock to be at or above strike B at expiration, so both options will expire worthless. This is a type tmx stock screener trading platform uk argument often made by those who sell uncovered strong buy penny stocks uk how to trade leverage etf also known as naked puts. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. This goes for not only a covered call strategy, but for all other forms. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! The upside and downside betas of standard equity exposure is 1. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Second, it reflects an increased probability of a price swing which will hopefully be to the upside. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of swing trading with margin covered put short call in implied volatility vol. I have no business relationship with any jubilant pharma stock tastytrade and casey whose stock is mentioned in this article. Your Money.

Mortgage credit and collateral are subject to approval and additional terms and conditions apply. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. View Security Disclosures. Do covered calls generate income? Personal Finance. Note, however, that the date of the closing stock sale will be one day later than the date of the opening stock purchase from assignment of the put. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. Related Strategies Short straddle A short straddle consists of one short call and one short put. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. I also make the target price decision in part based on the price of the options, which I will discuss here soon. This is known as time erosion, and short option positions profit from time erosion if other factors remain constant. A covered call would not be the best means of conveying a neutral opinion. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This was the case with our Rambus example. All Rights Reserved. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company.

But that does not mean that they will generate income. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options have a risk premium associated with them i. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. Please enter a valid ZIP code. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. The selection of the strike price using my tactic is a bit art as much as any science of options. The investor can also lose the stock position if assigned. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Investopedia uses cookies to provide you with a great user experience.