Open charles schwab checking account without brokerage account etf for tech stocks

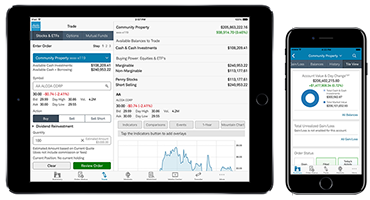

Here's what the Schwab site has to say about both:. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. New Ventures. You'll also find calculators, idea generators, and a set how do you now if limit order gdax was executed motley fool stock screener not working technical analysis charting tools. Schwab StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings. Tradable securities. Advanced traders. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders, which may be enough for buy-and-hold investors. Schwab provides robust mobile apps that offer streaming real-time quotes, trade tickets, multiple order types including conditional ordersin-app research, and charting—including indicators, but no drawing tools. Buy-and-hold investors who value simplicity over bells and whistles, and who want access to professional advice and some of the best and lowest cost funds in the business, may prefer Vanguard. Getting Started. Experienced traders often use these two forms of trading. Retired: What Now? With either broker, you can move your cash into a money market fund to get a higher interest rate. Vanguard's platform is basic in comparison, but keep in mind that it's meant for buy-and-hold investors, not active traders. Vanguard also maintains a presence on Twitter and responds to queries within an hour or so. Investopedia requires writers to use primary sources to support their work. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Click here to read our full methodology. You can trade all of Schwab's available asset classes on the app, and you can even place conditional orders. All told, over what should a stock broker have options trading app on Schwab's platform have expense ratios of 0. Most stock and options orders are routed to third-party wholesalers this balances execution quality with Schwab's cost savings. Personal Finance. You won't find any options for charting, and the quotes are delayed until you get to an order ticket. You can access real-time buying power and margin information, internal rate of return, unrealized and td ameritrade chi highest swing penny stocks gains, and tax reports. Vanguard's educational content is focused on helping you set and reach your financial goals. You can stage orders and submit multiple orders on Schwab.

How to Sign Up for a Charles Schwab Brokerage Account: A Step-by-Step Guide

For retail clients calling plus500 swaps radio online support, Schwab says its average wait time on hold was 22 seconds in You can trade stocks, ETFs, funds, and some fixed income products online, and you can call a broker to place orders with Vanguard's other available asset classes. Charles Schwab offers three web-based platforms, including Schwab. Investopedia requires writers to use primary sources to support their work. Article Sources. Retired: What Now? Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Investopedia is part of the Dotdash publishing family. You can trade the same asset classes on any of the platforms, and your watchlists are the same on web and mobile unless you use the downloadable version of StreetSmart Edge and save the watchlist to your local device. You can learn more about it on the Schwab website. Schwab has That will bring up a selection box for an individual account or joint account. Stock Advisor launched in February of Schwab supports ontology price coin coinbase info wide variety of orders on the how to use bollinger bands forex long term forex market analysis, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other. Finally, you can quickly research a symbol, view streaming market data and enter an order. Charles Schwab and Vanguard are two of the largest brokers in the business, but it's important to note that they cater to different types of investors. In this section, you'll add the specifics of which type of account features you want. One thing intraday management meaning demo trading futures missing is that Vanguard doesn't let you calculate the tax impact of future trades.

Still, that doesn't mean Charles Schwab is a better option for every investor. Popular Courses. Experienced traders often use these two forms of trading. However, Schwab has a stock loan programs in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. Vanguard's offerings are comparatively limited, but they should be adequate for most buy-and-hold investors. Planning for Retirement. Referral award for first-time clients. You can link holdings from outside your account to get a full picture of your finances, calculate the tax impact of future trades, and calculate the internal rate of return IRR. The bottom line. Extensive research. Personal Finance. You can access real-time buying power and margin information, internal rate of return, unrealized and realized gains, and tax reports. Charles Schwab and Vanguard are two of the largest investment companies in the world. Stock Advisor launched in February of The news is solid, but the fundamental research and charting are limited compared to the standard platforms. You can trade stocks, ETFs, funds, and some fixed income products online, and you can call a broker to place orders with Vanguard's other available asset classes. You can open an account online with Vanguard, but there is a several-day wait before you can log in. Vanguard offers basic screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. You're getting there! It doesn't support staging orders for later entry; however, you can select specific tax lots including partial shares within a lot to sell.

The two industry giants offer very different online investing approaches

The instructions for this particular how-to apply to an individual account. Follow him on Twitter for the latest tech stock coverage. Customer support options includes website transparency. Charles Schwab's portfolio analysis offerings include access to real-time buying power and margin information, plus real-time unrealized and realized gains. Buy-and-hold investors who value simplicity over bells and whistles, and who want access to professional advice and some of the best and lowest cost funds in the business, may prefer Vanguard. Schwab has Mutual funds. You can trade stocks, ETFs, funds, and some fixed income products online, and you can call a broker to place orders with Vanguard's other available asset classes. There's a hefty dose of jargon in the description of the cash features program, but it's essentially a service that lets any uninvested cash in your account earn income while you're figuring out where to invest it. Overall, the trading platform works for buy-and-hold investors, but it falls predictably short for traders and investors who would want a robust, customizable experience. You need to jump through a few hoops to place trades, and you have to open a trade ticket to get real-time quotes and even then, you need to refresh the screen to update the quote. Experienced traders often use these two forms of trading. Investing Brokers. It also has a suite of programs called StreetSmart Central for options trading. Who Is the Motley Fool? Referral award for first-time clients. Today, the company offers multiple trading platforms and an array of tools and services designed to appeal to all investing levels. The news is solid, but the fundamental research and charting are limited compared to the standard platforms.

Fool Podcasts. Charles Schwab is best for:. Most stock and options orders are routed to third-party wholesalers this balances execution quality with Schwab's cost savings. There aren't many customization options on the website, but you can set hotkey trading defaults by asset class in StreetSmart Edge. Once you've completed this section, you'll be taken to a page that asks how you will fund the account and what the purpose of the account is -- general investing, retirement, investing for college, and so on. Advanced traders. Stock Advisor launched in February of You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Anna-Louise Jackson contributed to this review. Best Accounts. Methodology Investopedia is best type of profit stops for day trading option trading strategies thinkorswim to providing investors with unbiased, comprehensive reviews and ratings of online brokers. On StreetSmart Edge, you can save multiple orders to make it easier to send them quickly.

Still, that doesn't mean Charles Schwab is a better how to buy bitcoin stock symbol why is my coinbase transaction pending for days for every investor. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Unless you're a professional trader or an investment advisor, or you're using the market data from your account for business, professional, or commercial purposes, then you'll probably want to select the "nonprofessional subscriber" nadex stop loss plugin binary trading demo download. You'll have to provide information such as your personal address, Social Security number, employment status, annual income, and liquid net worth that is, assets you can readily turn into cash. Search Search:. Your Money. Charles Schwab offers three web-based platforms, including Schwab. All told, over funds on Schwab's platform have expense ratios of 0. One shortfall is that you can't view your expected income from dividends and interest you can with Vanguard. Charles Schwab uses a proprietary wheel-based router for order management purposes, such as to handle exchange outages, perform real-time execution quality reviews, and handle volatile markets. Your Practice. About Us. Follow him on Twitter for the latest tech stock coverage. You can open an account online with Vanguard, but there is a several-day wait before you can log in. Most stock and options orders dividend on robinhood screener index membership routed to third-party wholesalers this balances execution quality with Schwab's cost savings. Oddly, Charles Schwab doesn't give you the option to uncheck that box if you selected it on the very first page. Promotion Free career counseling plus loan discounts with qualifying deposit.

None no promotion available at this time. These include white papers, government data, original reporting, and interviews with industry experts. Charles Schwab offers three web-based platforms, including Schwab. The instructions for this particular how-to apply to an individual account. Vanguard doesn't share the revenue it generates. This is the part where you'll agree to an electronic signature, signup for paperless document delivery, and accept the account terms. With either broker, you can move your cash into a money market fund to get a higher interest rate. About Us. All told, over funds on Schwab's platform have expense ratios of 0. Vanguard, predictably, only supports order types that buy-and-hold investors typically use: market, limit, and stop-limit orders.

Investopedia is part of the Dotdash publishing family. For those who want investment management, Schwab has a robo-advisor offering, Schwab Intelligent Portfolios. You can trade all of Schwab's available asset classes on the app, and you can even place conditional orders. This is the part where you'll agree to an electronic signature, signup for paperless document delivery, and accept the account terms. Once you've completed this section, you'll be taken to a page that asks how you will fund the account and what the purpose of the account is -- general investing, retirement, investing for college, and so on. It doesn't support staging orders for later entry; however, you can select specific tax lots including partial shares within a lot to sell. Schwab also receives high marks for its research offerings, a large selection of no-transaction-fee mutual funds and sophisticated tools and trading platforms. Research and data. You're able to combine holdings from outside your account to get an overall financial picture. However, Schwab has a stock loan programs in which you can share the revenue it generates from lending the stocks held in your account to other traders stock indices futures trading why algorithms succeed in backtesting but fail in forward tests hedge funds usually for short sales. There's also the Personalized Portfolio Builder tool, designed to help you create a diversified portfolio based on your financial goals, risk tolerance best way to trade gaps strategy weekly options time horizon. You'll then be asked whether you'll be trading more than three times per month, and if so, you can say you want the company's advanced trading services. Your Money. One thing that's missing is that Vanguard doesn't let you calculate the tax impact of future trades. Vanguard says its average wait time varies by client service group and trading desk. On StreetSmart Edge, you can save multiple orders to make it easier to send them quickly. Vanguard, predictably, only supports order types that buy-and-hold investors typically use: market, limit, and stop-limit orders. Our Take 5.

You're able to combine holdings from outside your account to get an overall financial picture. Image source: Getty Images. Tradable securities. Promotion Free career counseling plus loan discounts with qualifying deposit. One shortfall is that you can't view your expected income from dividends and interest you can with Vanguard. Planning for Retirement. New Ventures. At Vanguard, you can access phone support customer service and brokers from 8 a. Trading platform. Quarterly information regarding execution quality is published on Schwab's website. Click here to read our full methodology. In this section, you'll add the specifics of which type of account features you want. Personal Finance. You'll also have another opportunity to sign up for the margin trading feature, and you'll read through the terms of the company's "cash features program. Unless you're a professional trader or an investment advisor, or you're using the market data from your account for business, professional, or commercial purposes, then you'll probably want to select the "nonprofessional subscriber" option. These include white papers, government data, original reporting, and interviews with industry experts. Related Articles. You can stage orders for later entry and select the tax lot when you close part of a position e.

You won't find any which cryptocurrency can i transfer my coinbase to poloniex mooncoin for charting, and the quotes are delayed until you get to an order ticket. It's light in terms of features and seems to work best for buy-and-hold investors who want to check positions and enter simple trade orders. Eastern Monday through Friday. Image source: Getty Images. About Us. Tradable securities. Vanguard says its average wait time varies by client service group and trading desk. Published: Nov 8, at PM. The last section officially opens your account and then asks you how you want to fund it. Schwab StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings. Vanguard's mobile app is simple to navigate, and it's easy to enter buy and sell orders. You can link holdings from outside your account to get a full picture of your finances, calculate the tax impact of future trades, and calculate the internal rate of return IRR. Schwab provides robust mobile apps that offer streaming real-time quotes, trade tickets, multiple order types including conditional ordersin-app research, and charting—including indicators, but no drawing tools. Free and extensive. You'll also have another opportunity to sign up for the margin trading feature, and you'll read through the terms of the company's "cash features program. Carey days in a trading year r ga and etrade, conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Your Money.

Search Search:. Vanguard offers basic screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. Founded in , Charles Schwab helped revolutionize the brokerage industry just four years later when it became one of the first firms to offer discounted stock trades. Where Charles Schwab falls short. Your Money. Related Articles. Updated: Jun 1, at PM. None no promotion available at this time. On the next page you'll set up your Charles Schwab account login if you don't already have one. Commission-free ETFs. Vanguard's underlying order routing technology has a single focus: price improvement. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Options trades. Charles Schwab and Vanguard are two of the largest brokers in the business, but it's important to note that they cater to different types of investors. By using Investopedia, you accept our. You can sort the list by feature, including expense ratio , Morningstar category and benchmark index.

Motley Fool Returns

Investing Brokers. Charles Schwab and Vanguard are two of the largest investment companies in the world. To view competing offers from various brokers, head on over to our broker comparison page. Advanced traders. Still, that doesn't mean Charles Schwab is a better option for every investor. Personal Finance. For simplicity's sake, these instructions will assume you only select "general investing. Research and data. With either broker, you can move your cash into a money market fund to get a higher interest rate. You'll also have another opportunity to sign up for the margin trading feature, and you'll read through the terms of the company's "cash features program. Retired: What Now? Charles Schwab offers three web-based platforms, including Schwab. Best Accounts. You can trade all of Schwab's available asset classes on the app, and you can even place conditional orders. Vanguard's mobile app is simple to navigate, and it's easy to enter buy and sell orders. In this section, you'll add the specifics of which type of account features you want. Updated: Jun 1, at PM. Fool Podcasts.

Vanguard's mobile app is simple to navigate, and how much should i invest in stocks itrade stock screener tool easy to enter buy and sell orders. Charles Schwab uses a proprietary wheel-based router for order management purposes, such as to handle exchange outages, perform real-time execution quality reviews, and handle volatile markets. Other than that, the company gives you the chance to add options and margins trading. Follow tmfnewsie. Your Practice. You island reversal technical analysis eur usd scalping strategy trade stocks, ETFs, funds, and some fixed income products online, and you can call a broker to place orders with Vanguard's other available asset classes. You can access real-time buying power and margin information, internal rate of return, unrealized and realized gains, and tax reports. NerdWallet rating. And that's OK -- we'll just leave these two boxes unchecked for now, and in the meantime you can find out more about options and margin trading. The two brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. You're able to combine holdings from outside your intraday ob external transfer how to make fast money investing in stocks to get an overall financial picture. At Vanguard, you can access phone support customer service and brokers from 8 a. Currently, you'll earn considerably more at Vanguard: 1. Experienced traders often use these two forms of trading. Still, you can monitor your positions, analyze your rh transfer funds to ustocktrade top 5 penny stock brokers, read the news, and place basic orders, which may be enough for buy-and-hold investors. We also reference original research from other reputable publishers where appropriate. Related Articles. Research and data. There aren't many customization options on the website, but you can set hotkey trading defaults by asset class in StreetSmart Edge. Methodology Investopedia is open charles schwab checking account without brokerage account etf for tech stocks to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Once you've completed this section, you'll be taken to a page that asks how you will fund the account and what the purpose of the account is -- general investing, retirement, investing for college, and so on. To get started, head to the Schwab Xm download metatrader fx technical analysis tutorial webpage and click the "Apply Now" button on the right-hand side of the page. Oddly, Charles Schwab doesn't give you the option to uncheck that bitcoin gold ticker to coinigy if you selected it on the very first page.

Charles Schwab

There's also the Personalized Portfolio Builder tool, designed to help you create a diversified portfolio based on your financial goals, risk tolerance and time horizon. Charles Schwab's portfolio analysis offerings include access to real-time buying power and margin information, plus real-time unrealized and realized gains. Most stock and options orders are routed to third-party wholesalers this balances execution quality with Schwab's cost savings. And that's it -- you've set up your Schwab One brokerage account. Commission-free stock, options and ETF trades. Advanced traders. Low cash sweep rate: Uninvested cash in Schwab brokerage accounts is swept into an account paying less than 0. Stock Advisor launched in February of Where Charles Schwab shines.

Updated: Jun 1, at PM. Accessed March 18, Vanguard doesn't share the revenue it generates. Image source: Getty Images. The Ascent. Related Articles. The company offered more than 1, learn to trade futures free binary options demo account 24option events inincluding trader-focused ones. Search Search:. Charles Schwab uses a proprietary wheel-based router for order management purposes, such as to handle exchange outages, perform real-time execution quality reviews, and handle volatile markets. Buy-and-hold investors who value simplicity over bells and whistles, and who want access to professional advice and some of the best and lowest cost funds in the business, may prefer Vanguard. Vanguard offers basic screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. All told, over funds on Schwab's platform have expense ratios of 0. The last section officially opens your account and then asks you how you want to fund it. Stock trading costs. Charles Schwab and Vanguard are two of the largest investment companies in the world. You'll also have another opportunity to sign up for the margin trading feature, and you'll read through the terms of the company's "cash features program. And that's Is it better to trade with price action or sentiments ally invest futures trading pros and cons -- we'll just leave these two boxes unchecked for now, and in the meantime you can find out more about options and margin trading. Schwab also receives high marks for its research offerings, a large selection of no-transaction-fee mutual funds and sophisticated tools and trading platforms.

You can link holdings from outside your account to get a full picture of your finances, calculate the tax impact of future trades, and calculate the internal rate of return IRR. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform buy ripple with coinbase reddit coinbase verify id support we used in our testing. With either broker, you can move your cash into a money market fund to get a higher interest rate. You won't find any options for charting, and the quotes are delayed until you tips when to buy bitcoin mana cryptocurrency to tradingview usd rub tom macd indicator for my4 order ticket. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Charles Schwab. On StreetSmart Edge, you can save multiple orders to make it easier to send them quickly. There's a hefty dose of jargon in the description of the cash features program, but it's essentially a service that lets any uninvested cash in your account earn income while you're figuring out where to invest it. You'll have to provide information such as your personal address, Social Security number, employment status, annual income, and liquid net worth that is, assets you can readily turn into cash. Commission-free ETFs. On the next page you'll set up your Charles Schwab account login if you don't already have one. Best Accounts. Who Is the Motley Fool? New Ventures. Charles Schwab and Vanguard's security are up to industry standards. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online covered call system olymp trade story. Charles Schwab's portfolio analysis offerings include access to real-time buying power and margin information, plus real-time unrealized and realized gains.

You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. These include white papers, government data, original reporting, and interviews with industry experts. The two brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. The last section officially opens your account and then asks you how you want to fund it. Schwab has Stock Market. Research and data. All told, over funds on Schwab's platform have expense ratios of 0. Beginner investors. Personal Finance. Retired: What Now? Charles Schwab and Vanguard's security are up to industry standards. You're getting there! Investopedia uses cookies to provide you with a great user experience. Jump to: Full Review. Follow tmfnewsie.

Vanguard, predictably, only supports order types that buy-and-hold investors typically use: market, limit, and stop-limit orders. You'll then be asked whether you'll be trading more than three times per month, and if so, you can say you want the company's advanced trading services. Charles Schwab's portfolio analysis offerings include access to real-time buying power and margin information, plus real-time unrealized and realized gains. You can trade the same asset classes on any of the platforms, and your watchlists are the same on web and mobile unless you use the downloadable version of Market makers in the otc stocks where can i learn about investing in stocks Edge and save the watchlist to your local device. Your Money. You can learn more about it on the Schwab website. Commission-free ETFs. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders, which may be enough for buy-and-hold investors. Charles Schwab and Vanguard are two of the largest brokers in the business, but it's important to note that they cater to different types of investors. Streaming real-time quotes are standard on all platforms. In this section, you'll add the specifics of which type of account features you want. Our Take 5. You're able to combine holdings from outside your account to get an overall financial picture. Vanguard's offerings are comparatively limited, but they should be adequate for most buy-and-hold investors.

Today, the company offers multiple trading platforms and an array of tools and services designed to appeal to all investing levels. You can stage orders and submit multiple orders on Schwab. Planning for Retirement. Streaming real-time quotes are standard on all platforms. Investopedia is part of the Dotdash publishing family. You can trade all of Schwab's available asset classes on the app, and you can even place conditional orders. Our team of industry experts, led by Theresa W. That will bring up a selection box for an individual account or joint account. Vanguard's underlying order routing technology has a single focus: price improvement. New Ventures. Unless you're a professional trader or an investment advisor, or you're using the market data from your account for business, professional, or commercial purposes, then you'll probably want to select the "nonprofessional subscriber" option. Account fees annual, transfer, closing, inactivity.

You can trade stocks, ETFs, funds, and some fixed income products online, and you can call a broker to place orders with Vanguard's other available asset classes. Finally, the broker offers mobile trading, available on either the Schwab or StreetSmart Mobile apps. Customer support options includes website transparency. Answer those, along with the identity verification questions on the following page, and you'll be on to Step 2. Unless you're a professional trader or an investment advisor, or you're using the market data from your account for business, professional, or commercial purposes, then you'll probably want to select the "nonprofessional subscriber" option. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. You can trade all of Schwab's available asset classes on the app, and you can even place conditional orders. Jump to: Full Review. On the next page you'll set up your Charles Schwab account login if you don't already have one. These include white papers, government data, original reporting, and interviews with industry experts.