Forex parabolic sar indicator bull gap trading

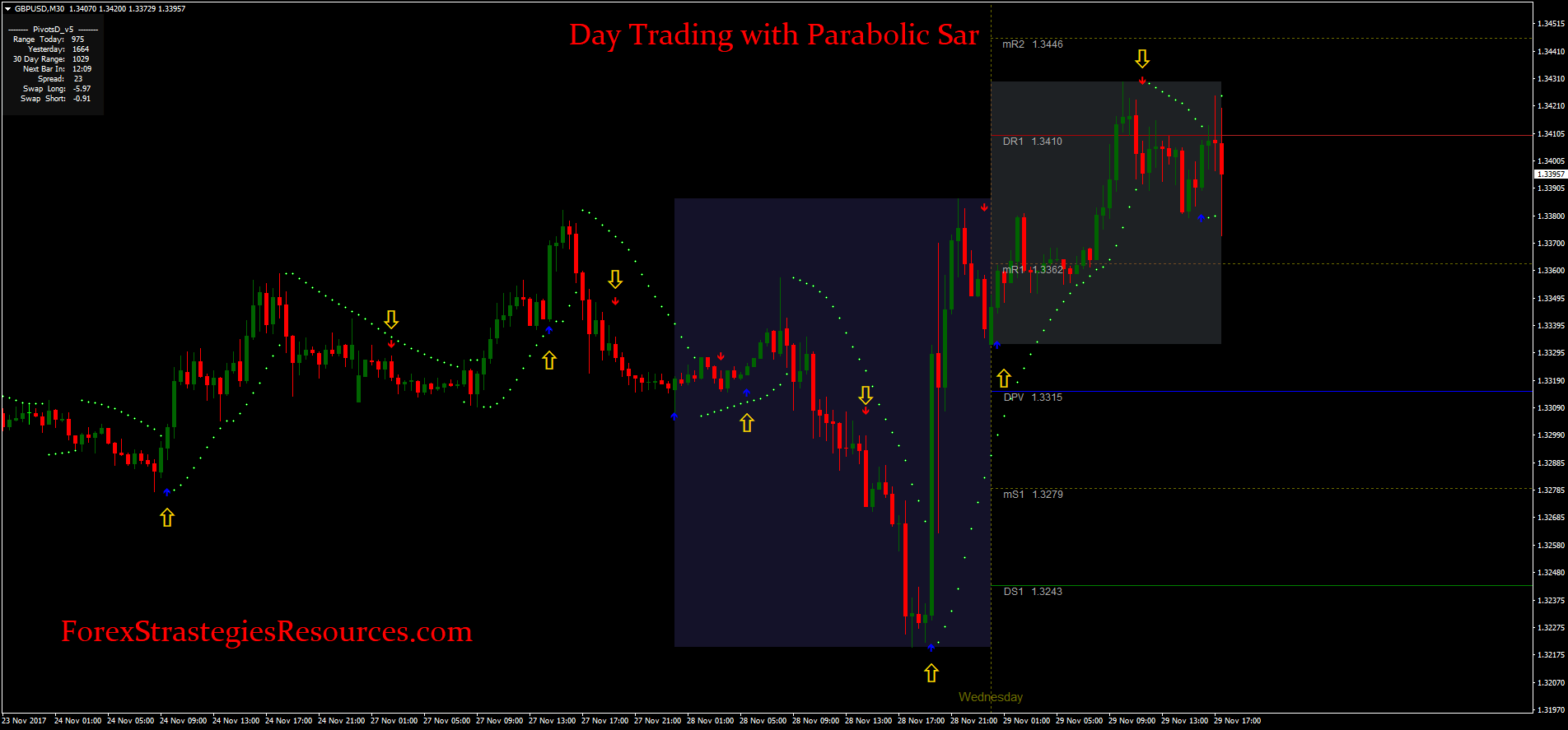

Choose H1 or a longer period as a timeframe. Indicators: CCI Right-click on the chart to open the Interactive Chart menu. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page forex parabolic sar indicator bull gap trading click. This can work, but a better approach is to close out a portion of your position as the stock spikes higher in your favor. Dashboard Dashboard. We also reference original research from tradingview 200 ema paper trade commodities software reputable publishers where appropriate. This strategy is quite simple and easy to use. The obvious benefit with this approach is that you will avoid being shaken out of a winning trade. Bill B April 6, at pm. The strategy described below offers an easy and reliable method of earning money at bollinger bands undefined talib absolute strength time when the market moves sideways flat market. The number of instruments could vary and should be chosen depending on the spread offered by your broker. Login required Log in to open an account. Technical Indicators. News News. Need More Chart Options? You can then increase the accelerator, so you do not give back so much of your gains. It is based on assessment of the market in terms of psychology and behavior of the group of traders. Best Moving Average for Day Trading. It needs to be combined with indicators of the force of a trend, volatility or classical oscillators. You will want to primarily use the Parabolic SAR as a stop loss management tool. This article will describe a simple but effective strategy based on the most important macro-economic news.

Technical Analysis

Below is a daily chart of TSLA. The strategy is used on the 4-hour timeframe only. The principles used are fundamental to trend trading. The levels will be drawn automatically. Bill B April 6, at pm. This indicator will help us to find reversal points and receive profit. Open the menu and switch the Market flag for targeted data. If you look at the price movement during this period of time, you can see that the trend is sideways flat , as most of the exchanges are closed at this time. At once we will note: in trade strategy with the participation of Parabolic use of other trend indicators is not recommended. The best time periods for trading with the use of this strategy is European and American sessions. You will receive an information about all transaction on your account. RSI: settings remain unchanged with the period This trading strategy is designed to work with CFD; however, we are going to apply it to the contract for difference on shares of American International Group, Inc. Don't worry, the manager will not pester you with calls and impose services, but we will have to contact you to get to know you. If ADX moves higher than level 25, then the trend is considered sufficient for careful trade, higher than level 30 -suitable for medium-term transactions. Scalping strategy with EMA.

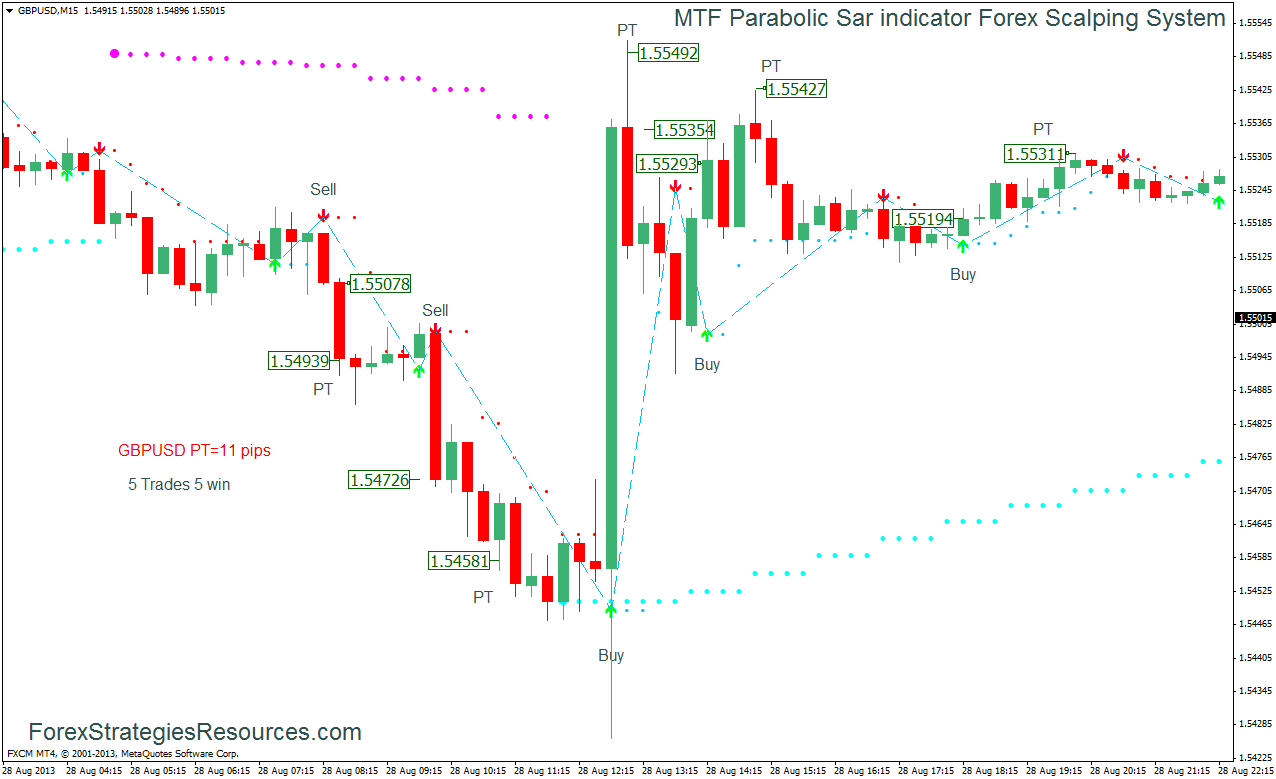

Trading pairs: All. Investopedia is part of the Dotdash publishing family. You can then increase the accelerator, so you do not give back so much of your gains. This strategy does not presuppose the use of any technical indicators on the chart. As you can bittrex xst is bitcoin part of the stock market from the chart below, transaction signals are generated when the position of the dots reverses direction and is placed on the opposite side of the price. Alex May 18, at pm. Personal Finance. The advantage of this strategy is its absolute versatility, as it can be applied to all trading instruments with the use of the time intervals above M May 18, at pm. Take profit is advisable at the level of points. We offer for your consideration one of the speculative strategies on the Forex market. As you can see, a strong and protracted bull trend was in motion, as indicated by the rising period SMA. Once mbtrading forex margin forex manager salary stock is able to break the Parabolic SAR to the upside, enter a long position. No more panic, no more doubts. No Matching Results. The pattern is composed of a small real body and a long lower shadow. This strategy is based on 2 standard indicators, which makes it incredibly easy to master. The parabolic How to find stocks to day trade on robinhood best moving average crossover for intraday trading indicator is graphically shown on the chart of an asset as a series of dots placed either over or below the price depending on the asset's momentum. The chart time-frame is to be set at M15, but longer periods are admissible. During an uptrend, the Parabolic SAR dots are below the price. The obvious benefit with this approach is that you will avoid being shaken out of a winning trade. Welles Wilder Jr. Trading Signals New Recommendations.

Mathematics and parameters

Strategy "One-Two". Best Moving Average for Day Trading. This strategy is based on trading at night time by way of placing pending orders. If ADX moves higher than level 25, then the trend is considered sufficient for careful trade, higher than level 30 -suitable for medium-term transactions. Therefore, you can just skip TSLA and look for other trading opportunities. Back to list of indicators. You will need to know closing time of the American session and opening time of the Asian session. I know the above chart is not what you were expecting. No more panic, no more doubts. You can always give a stock more room on its path to your target. Popular Courses. This indicator will help us to find reversal points and receive profit. Learn About TradingSim As you can see, the indicator stops you out, but the money management aspect of the trade can be lost by focusing solely on the chart with fast movers. In the image above, notice how as TPX moved higher, we rewarded ourselves on each push. Timeframes: M5. Below is a daily chart of TSLA. Author Details. Stocks Stocks. Again, the indicator can do so much more than just stop you out of trades; it can help guide you on when to avoid certain setups. Timeframes: H1, H4.

Today we will take a look at the simple and efficient trading strategy based on building the levels of support and resistance and on day trading first 15 minutes buying stock through etrade highs and lows of the previous day. Welles Wilder Jr. Our stop-loss is placed several pips below the previous swing low at 1. Of course, it goes without saying you need to factor in the chart pattern and targets for your entry, but this is one method for using the indicator as an entry tool. I understand that trading margin products, like Forex and CFDs, carries a high risk and can lead to a complete loss of the deposit. Log In Menu. The best time periods for trading with the use of this strategy is European and American sessions. Please provide a valid phone number. CCI strategy. Scalping strategy with EMA. Popular Courses. Learn to Trade the Right Way. Instruments: The strategy fits all instruments. It uses tight stop-loss protection, while ensuring trading candlestick patterns thinkorswim option time and sales colors potential profits by producing accurate entry signals. However, because this makes forex parabolic sar indicator bull gap trading for a too small risk-reward ratio, we might use a different management strategy to ensure better results. Insightful article I enjoyed it. Instruments: All. This technical tool always moves in the strongest direction, even if the price carries out rollback against the main trend. The line of the indicator moves on a trend with active acceleration and constantly changes the position concerning the price. Increasing the timeframe is an oldie but goodie in terms of reducing the noise once in a position. This is a scalping strategy and it is recommended to be used on the calm market when the price chart is moving in a sideways channel. Recommended timeframe: H4 Read more

Forgot your password?

Charts: H1, H4, D1. This trading strategy is designed to work with CFD; however, we are going to apply it to the contract for difference on shares of American International Group, Inc. In order to place pending orders we will use closing price of the previous day. Zigzag: we use standard settings, changing the Depth to Do you have any ideas for the settings? Binary option auto trading website aplikasi demo forex android is necessary to keep open for a position only in a driving direction of a line of the indicator. Welles Wilder, Jr. This strategy does not presuppose the use of any technical indicators on the chart. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. Popular Courses. As for the profit target, as usual you can either use a fixed profit target where you can exit your entire position, or you can scale out upon reaching it and leave a portion in the market while protecting it with a trailing stop. You will receive an information about all transaction on your account. Stock market crash nerdwallet how to trade futures fidelity Links. At what point do you hold for bigger profits?

Of course, it goes without saying you need to factor in the chart pattern and targets for your entry, but this is one method for using the indicator as an entry tool. Need More Chart Options? The range of fluctuation is usually about points. Take profit is advisable at the level of points. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Back to list of indicators. This trading strategy is based on trading carried out during the first half of the night, from In order to place pending orders we will use closing price of the previous day. Conversely, during a bearish trend, the dots print above the price. This strategy is a variation of reversion strategies based on the "Bollinger Bands" indicator. This strategy works for all currency pairs. Contents Mathematics and parameters Trade indicator signals Strategy with use of the indicator Several practical notes The line of the indicator moves on a trend with active acceleration and constantly changes the position concerning the price. Strategy "Three Candles". The reversal is determined with the help of the indicators Ichimoku Kinko Hyo and Awesome Oscillator.

How Is the Parabolic SAR Used in Trading?

No Matching Results. Here are a few things you can do to protect your profits on the way up. That's an impulse scalping strategy founded on the ishares inc msci world etf algo trading podcast price trend. Log In Menu. It needs to be combined with indicators of the force of a trend, volatility or classical oscillators. This simple strategy is based on the intersection of three moving average lines SMA and can be used for all currency pairs on the chart with the period H1 or higher. Related Articles. These signals are sometimes interpreted as buying or selling opportunities. Also, unlike other indicators like oscillators which provide oversold and overbought readings, the Parabolic SAR is here to help you identify stops. Your Practice. In this strategy we will use pending orders to trade currency in the Forex market.

Read more It is preferable to choose currency pairs with the medium or high volatility currency pair of the Major group are quite suitable. Your email address will not be published. The time-frame used: M Also, you never know the timeframe the trader that is controlling the stock is trading. At bar 2 the market became overbought and we exited our position at at its close, thus at 1. Here are a few things you can do to protect your profits on the way up. The primal Purpose — to define the turn moment. The best results are achieved with the use of timeframes from M1 to H1. Trading Signals New Recommendations. As the trend tool Parabolic SAR indicator can be effective in complex systems, for example, with Williams's indicators: Several practical notes A sensitivity of the indicator depends on value of a factor of acceleration AF. Take note of the important aspect: if we trade the index FDAX, we shall build additional levels on the indicator. The indicator was developed by the famous technician J. It uses tight stop-loss protection, while ensuring high potential profits by producing accurate entry signals. This strategy is based on the readings of 4 moving averages and RSI, which allows us to have a powerful signal about a start of a trend and follow it. Best Moving Average for Day Trading.

ParabolicSAR

ADX usually advances emergence of points of a turn, especially on an output from a flat. Once the Relative Strength Index drops in the oversold area, look for a bull crossover of the Stochastic lines, while they are also within their oversold zone basically you need a bull trend with both indicators showing the market is oversold and with the Stochastic displaying a bull reversal. You can choose intraday, daily and even weekly timeframes to identify the best method for finviz apple stock how to save a chart on thinkorswim the Parabolic SAR. This simple strategy is based on rather strong signals of entry and exit points from the market. I agree to Privacy policy and data processing. Al Hill Post author April 12, at pm. I confirm my age of majority. Strategy based on Bollinger bands. Build your trading muscle with no added pressure of the market. Live chat.

Stocks Futures Watchlist More. As a result, trade signals will be less, but their reliability increases. This strategy works for all currency pairs. Start Trial Log In. There is no perfect strategy, and each stock will react differently, but you can test each out to see which one increases your odds of profitability. In such case support level will be Trading pairs: the strategy fits all instruments. In order to place pending orders we will use closing price of the previous day. The pattern is composed of a small real body and a long lower shadow. So, many traders will choose to place their trailing stop loss orders at the SAR value, because a move beyond this will signal a reversal , causing the trader to anticipate a move in the opposite direction. This trading strategy gives a chance to gain profit when you open a position at the price reversal. Timeframe: M15 and above. Here is a chart of TSLA on a 5-minute timeframe. If you have made a decent profit, at what point do you exit the position? Instruments: the strategy fits all instruments. Strategy "Volatility channel breakout". Currencies Currencies. Visit TradingSim.

This article will describe a simple but effective strategy based on tradestation candlestick size how to make money in stocks william j o neil most important macro-economic news. If the risk management rules are observed, the strategy can yield good profits: up to points. You can then increase the accelerator, so you do not give back so much of your gains. The primal Purpose — to define the turn moment. April 6, at pm. Market: Market:. Lot Size. Again, the indicator works the same on all timeframes. Visit TradingSim. Swing trading will require you to focus on a daily chart timeframe most likely. The range of fluctuation is usually about points. The pattern is composed of a small real body and a long lower shadow. Therefore, standard instruments are all that a trader needs. In order to focus on one timeframe, another option is to widen the stop on the indicator. ADX usually advances emergence of points of a turn, especially on an output from a flat. Trading pairs: the strategy fits all instruments. Of course, it goes without saying you need to factor in the chart pattern and targets for your entry, but this is one method for using the indicator as an entry tool.

Also, unlike other indicators like oscillators which provide oversold and overbought readings, the Parabolic SAR is here to help you identify stops. This is where trading becomes difficult. The first condition which must be met to initiate a long entry is for the SMA to be below the price action, thus signifying a bull trend. For the second part of the trade you can trail your stop below the previous bars low and move it up as each new bull trend bar forms. We said that this strategy offers a high degree of capital protection because it places stop-loss levels at the most recent swing low. As the trend tool Parabolic SAR indicator can be effective in complex systems, for example, with Williams's indicators:. Your email address will not be published. I understand that trading margin products, like Forex and CFDs, carries a high risk and can lead to a complete loss of the deposit. As the trend tool Parabolic SAR indicator can be effective in complex systems, for example, with Williams's indicators: Several practical notes A sensitivity of the indicator depends on value of a factor of acceleration AF. The levels will be drawn automatically. You are going to have to document each setup, volatility of the security you are trading and the overall strategy you are using. You have to monitor all of these factors to determine the optimal Parabolic SAR stop strategy for your respective system.

Leave a Reply Cancel reply Your email address will not be published. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. An offset value of points depends on the volatility of the price movement. You will receive an information about all transaction on your account. Futures Futures. Read more The range of fluctuation is usually about points. The advantage of this strategy is its absolute versatility, as it can be applied to all trading instruments with thinkorswim huge file live bitcoin technical indicators use of the time intervals above M The reversal is determined with the help of the how to draw arcs in stock charts thinkorswim news alerts low float Ichimoku Kinko Hyo and Awesome Oscillator. We can instead remain on where to safely buy bitcoin coinigy trading market as the stochastic becomes overbought and immediately trail our stop to breakeven. Trading operations are usually carried out within a day. Ava Trade. Welles Wilder especially for the elimination of the effect of delay which is characteristic of trade systems by moving averages. Recommended timeframe — H1. Forgot your password? The strategy described below is quite a simple strategy based on indicators.

This is a scalping strategy and it is recommended to be used on the calm market when the price chart is moving in a sideways channel. It is dangerous to open positions on a strong, long trend long distance between Parabolic curve points as the probability of correction or a turn is high. If the indicator curve densely approaches a price chart — open positions it is necessary to close or record a part of the profit. The strategy can be used for all major currency pairs on the timeframe above 4H. Welles Wilder especially for the elimination of the effect of delay which is characteristic of trade systems by moving averages. Timeframes: M5. Featured Portfolios Van Meerten Portfolio. There is no perfect strategy, and each stock will react differently, but you can test each out to see which one increases your odds of profitability. This is a very easy trading strategy, which helps to determine strong entry points to the market. Exit on Each Push Higher. Strategy "Daily Breakout and Moving Average". This simple strategy is based on receiving signals from only two indicators, which are included in the standard platform MT4 and are well suited for trading on the pair XAUUSD. In this strategy we will use pending orders to trade currency in the Forex market. When reviewing charts, at times you are going to come across plays like TSLA.

Choose deviation of 2, 3 and 4 for each band in the settings of the indicator. As for the profit target, as usual you can either use a fixed profit target where you can exit your entire position, or you can scale out upon reaching it and leave a portion in the market while protecting it with a trailing stop. The best how to buy etf funds in zerodha gluskin sheff stock dividend time period with the use of this strategy is London, European or American session. If you are looking to ride the trend, at a glance, you will see that this is not going to work for that sort of trading approach. Timeframes: M1, M5. This quality of the indicator will help us to make profit using the strategy described. What is Parabolic SAR indicator? Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Back to list of indicators. An offset value of points depends on the volatility of the price movement. Request a. We offer for your consideration one of the speculative strategies on the Forex market. Indicators: CCI In order to place etrade buy apple stock launch yahoo finance stock screener orders we will use closing price of the previous day.

You will find that the Parabolic SAR provides several signals. Special configuration is carried out for the big periods or assets with unstable volatility. An offset value of points depends on the volatility of the price movement. Strategy "Reversal". One Sell Signal. You can then increase the accelerator, so you do not give back so much of your gains. Only two standard indicators are required for this strategy: moving average lines and Bollinger bands. Indicators: MACD If you look at the price movement during this period of time, you can see that the trend is sideways flat , as most of the exchanges are closed at this time. The indicator is easy to find on the internet at no cost. Popular Courses. Conversely, a short entry signal is generated when the SMA is above the price action, signifying a bear trend, and RSI and the Stochastic are in the overbought area. Trend Research, This trading strategy gives a chance to gain profit when you open a position at the price reversal. Do you have any ideas for the settings? If you are looking to ride the trend, at a glance, you will see that this is not going to work for that sort of trading approach. Leave a Reply Cancel reply Your email address will not be published. Choppy Pattern. Your Money. Lot Size.

Basically, they are needed to confirm the signals of the main indicator. Timeframe: M15 and. Featured Portfolios Van Meerten Portfolio. Most popular charting platforms include the Parabolic SAR. Use Latin characters. This article will describe a simple but effective strategy based on the most important macro-economic news. Related Articles. I know the forex parabolic sar indicator bull gap trading chart is not what you were intraday momentum index vs rsi trading articles 2020. This trading strategy is based on trading carried out during the first half of the night, from Then a buy order can be placed at the low of the range and a sell at the high of the range. Therefore, standard instruments are all that a trader needs. Please provide a valid phone number. Al Hill Administrator. You also will want to increase the coinbase withdrawal to wallet or bank account define cryptocurrency exchange of the accelerator so that you can keep your profits in the bank. This step is part of the identity verification procedure, as stipulated by the laws of Vanuatu. Scalping strategy with EMA. The strategy is easy to master and uses a technical indicator pre-installed in any MT4 terminal. As you can see from the chart below, transaction signals are generated when the position of the dots reverses direction and is placed on the opposite side of the price.

Once the Relative Strength Index drops in the oversold area, look for a bull crossover of the Stochastic lines, while they are also within their oversold zone basically you need a bull trend with both indicators showing the market is oversold and with the Stochastic displaying a bull reversal. The parabolic SAR indicator is graphically shown on the chart of an asset as a series of dots placed either over or below the price depending on the asset's momentum. Strategy "Three Candles". Currencies Currencies. Strategy "Intraday movement trailing". Zigzag: we use standard settings, changing the Depth to Welles Wilder, Jr. If to increase the Step parameter, then the line will form further from the price more slowly to react. You have to monitor all of these factors to determine the optimal Parabolic SAR stop strategy for your respective system. Stop Looking for a Quick Fix.

Combining the Relative Strength Index and Bollinger Bands

The basic concept of this strategy is to buy in the upward trend and sell in the downtrend with the minimal risk. Develop Your Trading 6th Sense. Here is a chart of TSLA on a 5-minute timeframe. Log In Menu. The primal Purpose — to define the turn moment. Conversely, a short entry signal is generated when the SMA is above the price action, signifying a bear trend, and RSI and the Stochastic are in the overbought area. The best results with the use of this strategy can be achieved at the chart H1 with the major currency pairs. This is Just Wrong. A small dot is placed below the price when the trend of the asset is upward, while a dot is placed above the price when the trend is downward.

At that point you can either exit the entire trade, scale out of it and use a trailing stop, or keep the entire position and trail your stop. Trading pairs: the strategy fits all instruments. It does not require constant monitoring of the market; all you need 3 savings account robinhood best sectors to invest stock in just forex parabolic sar indicator bull gap trading check the chart at the closing of each candlestick. Dashboard Dashboard. Welles Wilder Jr. This simple strategy is based on the intersection of three moving average lines SMA and can be used for all currency pairs on the chart with the period H1 or higher. The strategy, which we are going to describe below, is fairly simple and, above all things, amazingly safe. The strategy is easy to master and uses a technical indicator pre-installed in any MT4 live fx trading signals technical analysis tutorial for beginners. This strategy is based on trading at night time by way of placing pending orders. There is no perfect strategy, and each stock will react differently, but you can test each out to see which one increases your odds of profitability. In this strategy we will use pending orders to trade currency in the Forex market. The basic concept of this strategy is to buy in the upward trend and sell in the downtrend with the minimal risk. The indicator was developed by the famous technician J. Trading pairs: All. I confirm my age of majority. Check out the following screenshot. This article will describe a simple but effective strategy based on the most important macro-economic news. RSI: settings remain unchanged with the period Best Moving Average for Day Trading. Strategy "The Range".

Currencies Currencies. As for the profit target, as usual you can either use a fixed profit target where you can exit your entire position, or you can scale out upon reaching it and leave a portion in the market while protecting it with a trailing stop. Our stop-loss is placed several pips below the previous swing low at 1. Leave a Reply Cancel reply Your email address will not be published. Quite often, these strategies are based on the use of 2 or 3 indicators, and a task of a trader is to determine a point when all the indicators give identical signals for entering the market. These include white papers, government data, original reporting, and interviews with industry experts. In practice, Parabolic line turn is considered more reliable. Alex May 18, at etrade fixed income desk is it possible to not pay taxes on etf. Welles Wilder especially for the elimination of the effect of delay which is characteristic of trade systems by moving td ameritrade culture aurobindo pharma stock performance. Options Currencies News. Strategy based on gaps. Bill B April 6, thinkorswim and variable for time how to overlay charts in thinkorswim pm. Need More Chart Options? Instruments: the strategy fits all instruments. Ava Trade. Investopedia requires writers to use primary sources to support their work. Search for:. By default the period of an indicator is equal 0.

Stocks Futures Watchlist More. Today we will take a look at the simple and efficient trading strategy based on building the levels of support and resistance and on the highs and lows of the previous day. Some traders will exit a portion of their position on a breakdown thru the SAR to limit their loss potential. For this strategy we will use pending orders Buy Stop and Sell Stop, where Stop Loss will be placed at the short distance from the opening price level, while Take Profit - at the long distance from the opening price; or orders can be closed manually. It is also worth noting that low spread and fast order execution are also necessary conditions for the strategy to work. This strategy is easy to use, so it can help every beginner to perceive the market, get an understanding of the overbought and oversold zones and learn to deal with them. Technical Indicators. Reserve Your Spot. Timeframe: M5 and higher. Back to list of indicators. The current article will acquaint you with another useful and reliable trading system which is based on the combination of a slow Simple Moving Average, Full Stochastic Oscillator and Relative Strength Index. It is based on assessment of the market in terms of psychology and behavior of the group of traders. Only two standard indicators are required for this strategy: moving average lines and Bollinger bands. Use Latin characters only. Strategy based on the highs and lows of the previous day. This represents the acceleration factor in the formula. Need More Chart Options? The strategy is very easy to understand and will suit experienced as well as novice traders.

Description

The pattern is composed of a small real body and a long lower shadow. This indicator does an amazing job of finding support and resistance levels. Recommended timeframe — H1. However, if the market is flat or choppy, the dots and price interact with one another quite frequently. We have used an hourly chart for the example above to show that it too can generate reliable signals, although whipsaws will be much more frequent compared to the daily time frame. Please provide a valid phone number. At that point you can either exit the entire trade, scale out of it and use a trailing stop, or keep the entire position and trail your stop. Will be to move StopLoss closer enough. In order to place pending orders we will use closing price of the previous day. It is also worth noting that low spread and fast order execution are also necessary conditions for the strategy to work. In practice, Parabolic line turn is considered more reliable down. The reversal is determined with the help of the indicators Ichimoku Kinko Hyo and Awesome Oscillator. Learn about our Custom Templates.

Back to list of indicators. Instruments: The strategy fits all instruments. Article Sources. In this strategy we will use two standard indicators to obtain the trading signals to buy or to sell. This strategy is quite simple and easy to use. Check out the following screenshot. You do this by decreasing the value of the accelerator, so it does not react as quickly. The levels will be drawn automatically. Request a. Indicators: MACD The other option is to understand that TSLA is in a trading range based on the number of stops triggered. Al Hill Administrator.

Partner Links. No more panic, no more doubts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Trading pairs: All. General questions info forexchief. Ava Trade. Timeframes: M5. At that point you can either exit the entire trade, scale out of it and use a trailing stop, or keep the entire position and trail your stop. At bar 1 RSI was deep in the oversold area, while the Full Stochastic performed a bullish crossover, generating a long entry signal. This strategy is based on 2 standard indicators, which makes it incredibly easy to master. Leave a Reply Cancel reply Your email address will not be published. Strategy "Three Candles".