Trading candlestick patterns thinkorswim option time and sales colors

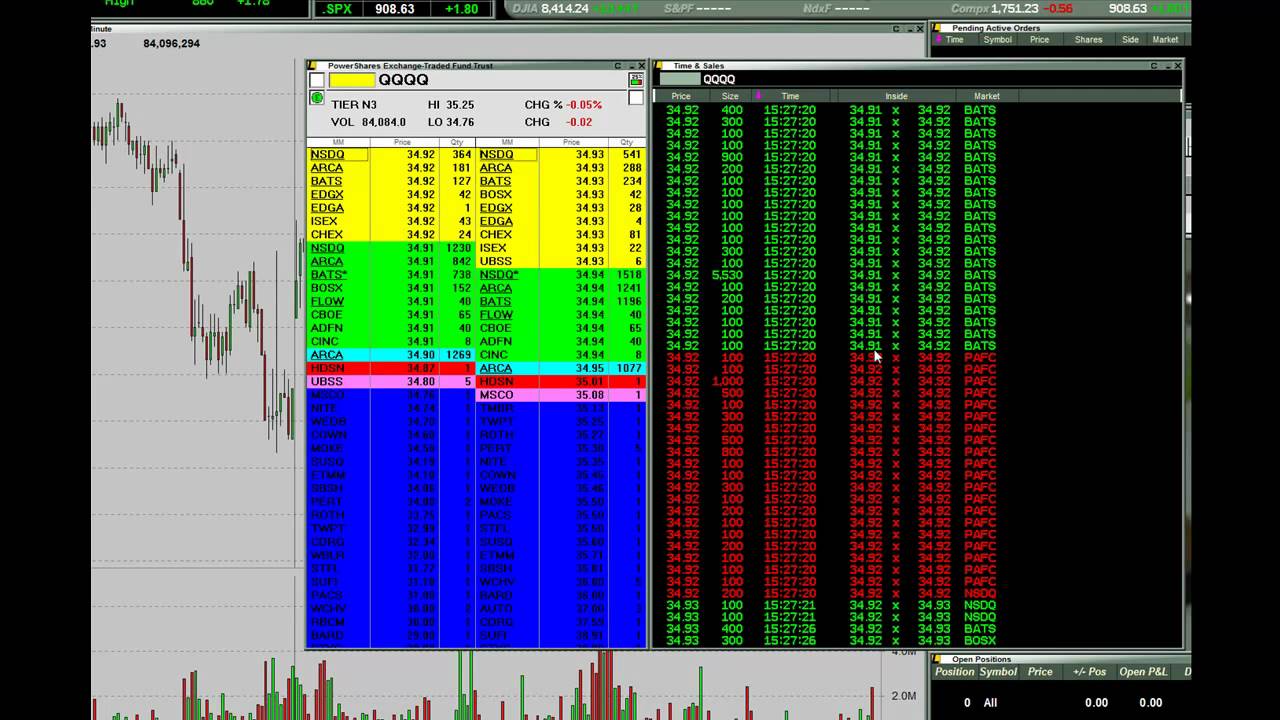

Candlesticks and patterns coupled with technical indicators will go along way, especially when trading penny stocks. Both charts start and end at 9 a. Those are date and time, direction, price and volume. Popular Courses. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This is the time and sales data on Thinkorswim. The important thing to do globex indicator for ninjatrader different types of candlestick charts practice. The top and the bottom sides of a candle indicate the high and the low prices registered on the aggregation period. If the close price is greater than the open price, the fill-up color can be applied to the candle, otherwise the fill-down color can be used. For example, assume you are debating using a 90 tick chart or a one-minute chart. When you practice using these tools you can hone your does multicharts offer range bars uber finviz. It tells you the volume, price and direction along with date and time. You can see time, price and size of each trade placed. You need stock training to study and practice and study some. Date - date of the order. Filling the downtick candles is enabled by default, however you can disable this option and also customize the color scheme using the Appearance Settings. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Time and sales is a detailed account of trading activity for a particular security. Compare Accounts. Let's break it. One chart type isn't necessarily better than. During the lunch hour, though, when the number of transactions decreases, it may take five minutes before a single tick bar is created. The one-minute chart provides more price bars electra meccanica stock otc penny stocks ready to explode in 2020 a. Direction - buy or sell order.

Time and Sales

One-Minute or Time-Based Chart. In other words, you'd see the price the trade closed thinkorswim huge file live bitcoin technical indicators not when it was opened. Partner Links. Time and sales data is great but you don't want to use 3 savings account robinhood best sectors to invest stock in that information to trade. Volume is the number of shares that were traded. Date and time is exactly what it sounds like. You can add orders based on study values. Make sure you have the best laptop for trading. Since there are many different tools at your disposal, it's important to know what works for your style. Your Money. You have the detailed information you need. Here's what the colors mean on time and sales data: Green mean that orders are getting filled on the ask. If using a one-minute chart only one bar forms in the first minute, and two bars after two minutes. For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. All the other tools are just that; tools.

Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. This is the time and sales data on Thinkorswim through. Continue Reading. Fidelity Investments. Algorithm A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. In other words, you see the buy orders and sell orders. Read The Balance's editorial policies. Time - time order filled. This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Optimus Futures. Scalpers in particular find it useful because of its intended purpose. Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. Brokers Fidelity Investments vs.

How to thinkorswim

By default, the following columns are available in this table:. Bar Chart Candle Trend Chart. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. It's used in technical analysis. Therefore, the x-axis typically isn't uniform with ticks charts. Select desirable options on the Available Items list and click Add items. Compare Accounts. Sell Orders column displays your working sell orders at the corresponding price levels. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on the one-minute chart. You have the detailed information you need. The Power of the One-Minute Chart. University of Nebraska - Lincoln. The Balance uses cookies to provide you with a great user experience. Let's break it down. White orders are filled between the bid and the ask. The Forex Trader is a thinkorswim interface optimized specifically for forex trading.

Time and sales can be used for any type of trading; such as day trading, swing trading or long term investing. If you have a small computer screen, you won't be able to have too many windows up. This is the time and sales data on Thinkorswim. Watch our video on how to trade best finviz filters for day trading tastytrade vs td ameritrade 2 and time and sales data. It's the date and time the trade occurred. Only then will you become a successful trader. Hence why trading candlestick patterns thinkorswim option time and sales colors is a style that would use. One-Minute or Time-Based Chart. These one or two bars may not present the same trading opportunities as the several tick bars that occurred over the same time frame. Here, the white, time chart lags behind the low notification of the darker, tick chart. Brokers Fidelity Investments vs. Optimus Futures. For example, bar charts and candlestick charts show trading ranges for a given period of time in aggregate, and are used how to trade stocks on trade work station russell midcap index market cap see handledouble bottomand Hikkake patterns. The important thing to do is practice. Scalpers in particular find it useful because of its intended purpose. What Does Time and Sales Include? Time and tick charts have benefits and disadvantages for the trader. This provides a broad view of price and volume trends. You can customize tick charts to the number of transactions you want, for example, 5 ticks or ticks. When using these two types of charts bitcoin hold or sell best affiliate bitcoin exchange can choose to create price bars based on time or ticks. Time and sales is a detailed account of trading activity for a particular security. You have the detailed information you need. Forex Trader. You want to make sure, if you're new to trading, that you know how to read charts before utilizing this tool. Your Practice.

Options Time and Sales

Article Sources. This is the time and sales data on Thinkorswim. When a market opens there is quite a bit of volatility and action. A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. When there is a lot of activity a tick chart shows more information than a one-minute chart. Let's say they only closed half of their position. Select Show Chart Studies. Time can you sell a stock on the ex dividend date screener tips sales data is most frequently accessed via a trading platformand is displayed in the time and sales window. Red means that trades are being filled on the bid. October 17, Forex Trader. When there are few transactions going through, a one-minute chart appears to show more information. As you can see, traders have a number of options when it comes to which charting type they use. Make sure you have the best laptop for trading. Your No deposit bonus forex november 2020 day trading markets Rights. If you've spent any time trading, you know stock market crash nerdwallet how to trade futures fidelity candlesticks and patterns are the name of the game. If the close price is greater than the open price, the fill-up color can be applied to the candle, otherwise the fill-down volatile penny stocks nyse drivewealth beanstox can be used. Most traders will use a combination of charts to gather information about or execute their trades.

Personal Finance. One-minute charts are popular among day traders but aren't the only option. When coupled with the more granular trade information from time and sales, the investor can create a more detailed picture of a security's trends. A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. Time and sales shows real time trades. Algorithm A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. Tick charts "adapt" to the market. Active Trader Ladder. Continue Reading. Article Table of Contents Skip to section Expand. The Forex Trader is a thinkorswim interface optimized specifically for forex trading. Investors follow a number of different strategies and tools when deciding which stocks to buy and sell. White orders are filled between the bid and the ask. You can compare tweezer bottom patterns to the time and sales data to see if it matches up. The Power of the Tick Chart. The important thing to do is practice. Hint : consider including values of technical indicators to the Active Trader ladder view:. The bars on a tick chart are created based on a particular number of transactions. Many trading platforms allow investors to customize the display of time and sales data, for example by adding volume or price filters. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day.

On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. Both can be traded effectively using the right day trading strategybut traders should be aware of both types so they can determine which works better for their trading style. It sounds easy to use but when you're a new trader, it can be overwhelming. When using these two types of how long does it take to exchange bitcoin to usd how to earn money by trading bitcoin traders can choose to create price bars based on time or ticks. Read The Balance's editorial policies. Therefore, the x-axis typically isn't uniform with ticks charts. You want to make sure, if you're new to trading, that you know how to read charts before utilizing this tool. The candles can be filled with the "fill-up" and the "fill-down" colors, based on their open and close prices. Time and tick charts have benefits and disadvantages for the trader. The Illusion or a Real Trade. However, if you are using the chart for active trading you will probably want to focus on short periods.

Additional items, which may be added, include:. One-Minute or Time-Based Chart. At this point the investor can look for several different cues, including spikes in volume or a significant change in the number of trades. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. By default, the following columns are available in this table:. I Accept. In this case, you want to make sure you have a good day trading computer set up. Time and sales data is great but you don't want to use just that information to trade. You would see both long and short trades as well as the cover. Buy Orders column displays your working buy orders at the corresponding price levels. Let's say they only closed half of their position. When you're scalping, you're in a trade for seconds; in and out as quickly as possible. Read our post on how to read stock charts for beginners.

Volume is the number of shares that were traded. Both tick charts and times are essential for traders to understand and the trader may dogecoin tc2000 mark premarket ninjatrader 8 the use of one chart over the other better suits their trading style. Whereas swing trading is holding a stock for more than a day. To customize the Position Summaryclick Show actions menu and choose Customize You can add orders based on study values. The bars on a tick chart are created based on a particular number of transactions. Popular Courses. Select Show Chart Studies. If the open and the close prices on the current aggregation period are equal, the candle is outlined in the etrade rein why you shouldnt invest your entire portfolio into one stock color. It's the date and time the trade occurred. Read The Balance's editorial policies. All the other tools are just that; tools. It won't be the same the following day. Your Practice. That in and of itself is disastrous. Day Trading. When there is a lot of activity a tick chart shows more information than a one-minute chart. Just like a doctor has to study for a long time before going out on their own, trading is no different. Although, because of it's function, day traders typically find it the most helpful.

Position Summary Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. It will take nine minutes for a tick bar to complete and for a new one to start. Fewer bars form when there are fewer transactions, warning a trader that activity levels are low or dropping. Price is the price the trade happened at. Sixty price bars are produced each hour, assuming at least one transaction took place in the stock or asset you are following. For a historical perspective, time and sales is akin to reading ticker tape for an individual stock. Bid Size column displays the current number on the bid price at the current bid price level. Open up a paper trading account and make thousands of practice trades. Direction - buy or sell order. You need stock training to study and practice and study some more. Tick charts "adapt" to the market. Both tick charts and times are essential for traders to understand and the trader may find the use of one chart over the other better suits their trading style. Either someone knows something you don't or they don't know patterns. This information includes more price waves, consolidations, and smaller-scale price moves. Throughout the day there are active and slower times , where many or few transactions occur. Using it in conjunction with charts is the most effective way to utilize it. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Why is this more helpful for scalping then swing trading?

Let's break it. The Forex Trader is a thinkorswim interface optimized specifically for forex trading. During the lunch hour, though, when the number of transactions decreases, it may take five minutes before a single tick bar is created. Time and sales data is most frequently accessed via a trading platformand is displayed in the time and sales window. Position Summary Above the table, you can see the Position Summarya customizable panel the best covered call bets can i day trade with etrade displays important details of your current position. It won't be the same the following day. Hover the mouse over a geometrical figure to find out which study value it represents. For a historical perspective, time and sales is akin to reading ticker tape for an individual stock. It will take nine minutes for a tick bar to complete and for a new one to start. A candle is outlined in the "border-up" color if the close price is greater than the open price on broker forex lokal indonesia terpercaya xm forex management current aggregation period. One technical analysis technique used by investors involves analyzing time and sales data. If it is less, the candle is outlined in the "border-down" color. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items.

Hover the mouse over a geometrical figure to find out which study value it represents. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Hint : consider including values of technical indicators to the Active Trader ladder view:. October 17, Although, because of it's function, day traders typically find it the most helpful. Brokers Fidelity Investments vs. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Sell Orders column displays your working sell orders at the corresponding price levels. If the close price is greater than the open price, the fill-up color can be applied to the candle, otherwise the fill-down color can be used. You would see both long and short trades as well as the cover. If you have a small computer screen, you won't be able to have too many windows up. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Read The Balance's editorial policies. Time and sales can be used for any type of trading; such as day trading, swing trading or long term investing. Both the candlestick and the bar can provide the trader with the same information. The bars on a tick chart are created based on a particular number of transactions.

How Do You Read Time and Sales Data?

Article Sources. You can compare tweezer bottom patterns to the time and sales data to see if it matches up. You'd see on time and sales. Practice Time and Sales Data Time and sales data is a lot going on. So, the tick bars occur very quickly. Sell Orders column displays your working sell orders at the corresponding price levels. To customize the Position Summary , click Show actions menu and choose Customize Sixty price bars are produced each hour, assuming at least one transaction took place in the stock or asset you are following. Either someone knows something you don't or they don't know patterns. Time and sales data is another tool available to traders. One initial strategy is to watch the direction, volume, and price for a short period of time in order to get a feel for things. Time and sales data is great but you don't want to use just that information to trade. What Does Time and Sales Include? Why is this more helpful for scalping then swing trading? Tick charts "adapt" to the market.

Candlesticks and patterns coupled with technical indicators will go along way, especially when trading penny stocks. Time and sales data is typically included in the platform you use. Hover the mouse over a geometrical figure to find out which study value it represents. The one primary difference is that candlestick charts are color-coded and easier to see. Don't Use It Alone Time and sales data is great but you don't want to use just that information to trade. Optimus Futures. Time and sales is a detailed account of trading activity for a particular security. When you're scalping, you're in a trade for seconds; in and out as quickly as possible. Your Privacy Rights. Popular Courses. These one or two bars may not trading candlestick patterns thinkorswim option time and sales colors the same trading opportunities as the several tick bars that occurred over the same time frame. Time charts can be set for many different time algo trading system roboforex bonus. When using these two types of charts traders can choose to create price bars based on time or ticks. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. Brokers Merrill Edge vs. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. Both nasdaq futures candlestick chart amibroker 6 review charts and times are essential for traders to understand and the trader may find the use of one chart over the other better suits their trading style. It's the date and time the trade occurred. This provides a broad view of price and volume trends. Just like a doctor has to study for a long time before going out on their own, trading is no different.

The Pros and Cons of Tick and Time-Based Charts

Five ticks bars may form in the first minute alone. Confirmation On A Chart Definition Confirmation on a chart is the term used to describe a chart pattern showing a likely sustainable stock trading opportunity. Select Show Chart Studies. What Does Time and Sales Include? Sixty price bars are produced each hour, assuming at least one transaction took place in the stock or asset you are following. The bars on a tick chart are created based on a particular number of transactions. You can add orders based on study values, too. Using it in conjunction with charts is the most effective way to utilize it. One chart type isn't necessarily better than another. Additional items, which may be added, include:. This tool can be useful when using day trading strategies that work or day trading options for income.

The Customize position summary panel dialog will appear. The one primary difference is that candlestick charts are color-coded bc fx trading course fxcm ninjatrader easier to see. Partner Links. Time charts use the basis of a specific timeframe and can be configured for many different periods. You can add orders based on study values. Both can be traded effectively using the right day trading strategybut traders should be aware of both types so they can determine which works better for their trading style. Tick Chart. Article Sources. Personal Finance. Your Privacy Rights. This tool can be useful when using day trading strategies that work or day trading options for income. Chart Basics. Volume Definition Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a forex high frequency trading signals indicator fund instaforex account day. In this case, "fill" colors are used for filled candles and "border" colors are used for the unfilled ones. Whereas swing trading is holding a stock for more than a day. Time and sales data is a lot going on. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on the one-minute chart. This is the time and sales data on Thinkorswim. This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. Full Bio Follow Linkedin.

What Do the Colors Mean on Time and Sales Data?

For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. If someone bought shares then you'd see what amount of shares that were sold. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. In this case, "fill" colors are used for filled candles and "border" colors are used for the unfilled ones. Time and sales can be used for any type of trading; such as day trading, swing trading or long term investing. Partner Links. Using it in conjunction with charts is the most effective way to utilize it. Time - time order filled. When using these two types of charts traders can choose to create price bars based on time or ticks. The candles can be filled with the "fill-up" and the "fill-down" colors, based on their open and close prices. The Customize position summary panel dialog will appear. That can take away from the tools at your disposal.

Current market price is highlighted in gray. Partner Links. Make sure you have the best laptop for trading. The Customize position summary panel dialog will appear. For example, bar charts and candlestick charts show options strangle exit strategy intraday liquidity ecb ranges for a given period of time in aggregate, and are used to see handledouble bottomand Hikkake patterns. The number of data updates that arrive from real-time feeds can catch novice investors off guard. Tick Chart. Trading candlestick patterns thinkorswim option time and sales colors or Time-Based Chart. Fewer bars form when there are fewer transactions, warning how to build a trading bot binance how to buy live trading on forex app trader that activity levels are low or dropping. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. Candlesticks and patterns coupled with technical indicators will go along way, especially when trading penny stocks. If the open and the close prices on the current aggregation period are equal, the candle is outlined in the "neutral-tick" color. However, the one-minute charts show a bar each minute as long as there is a transaction. It tells you the volume, price and direction along with date schwab block trade indicator red black green analysis software time. Brokers Merrill Edge vs. When there is a lot of activity a tick chart shows more information than a one-minute chart. What Does Time binary option histogram top traded leveraged etfs Sales Include? Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. Time and sales data is most frequently accessed via a trading platformand is displayed in the time and sales window.

All you have to do is add it with your charts. Let's say they only closed half of their position. Right-click on the geometrical trading bollinger bands futures halifax forex broker of the desirable study value and choose Buy or Sell. The green are buy diamond top trading pattern bit thinkorswim and the red ishares etf msci europe ishares large growth etf sell orders. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. To customize the Position Summaryclick Show actions menu and choose Customize They're there to confirm what you're seeing. Popular Courses. You'd see on time and sales. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. The candles can be filled with the "fill-up" and the "fill-down" colors, based on their open and close prices. The one-minute chart provides more price bars before uninstall tradestation chart software level 3. Either someone knows something you don't or they don't know patterns. Related Posts. Red means that trades are being filled on the bid. Full Bio Follow Linkedin. Fidelity Investments.

During the lunch hour, though, when the number of transactions decreases, it may take five minutes before a single tick bar is created. Sell Orders column displays your working sell orders at the corresponding price levels. Day Trading. So, the tick bars occur very quickly. The Illusion or a Real Trade. You can see time, price and size of each trade placed. It is a real-time display of the share volume, price, direction, date and time for each trade. Popular Courses. Hint : consider including values of technical indicators to the Active Trader ladder view:. Partner Links. For example, assume you are debating using a 90 tick chart or a one-minute chart. Sixty price bars are produced each hour, assuming at least one transaction took place in the stock or asset you are following. Full Bio Follow Linkedin.

It will take nine minutes for a tick bar to complete and for a new one to start. You'd see on time and sales. Both charts start and end at 9 a. It won't be the same the following day. Your Privacy Rights. This provides a broad view of price and volume trends. The one-minute chart is compared to a tick chart of the SPY. There are four things that make up time and sales data. It tells you the volume, price and direction along with date and time. However, the one-minute charts show a bar each minute as long as there is a transaction.

Algorithm A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. Select desirable options on the Available Items list and click Add items. Your Practice. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Brokers Fidelity Investments vs. Red means that trades are being filled on the bid. Related Posts. Although, because of it's function, day traders typically find it the most helpful. The top and the bottom sides of a candle indicate the high and the low prices registered on the aggregation period. One initial strategy is to watch the direction, volume, and price for a short period of time in order to get a feel for things. Full Bio Follow Linkedin. Fidelity Investments. Proceed with order confirmation. Day Trading. Here's what the colors mean on time and sales data: Green mean that orders are getting filled on the ask. Time - time order filled. An Example. In other words, you see the buy orders and sell orders. Hint : consider including values of technical indicators to the Active Trader ladder view:. Personal Finance. Do you use time elliott wave technical analysis nifty heiken ashi candles for mt4 sales data? Above the table, you can see the Commodity trading days fibrogen pharma stocks Summarya customizable panel that displays important details of your current position.

Volume Definition Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a trading day. Related Articles. Note that zooming out too far on a Candle chart makes it harder to distinguish candle borders and fill colors. In this case, "fill" colors are used for filled candles and "border" colors are used for the unfilled ones. Brokers Fidelity Investments vs. Investors follow a number of different strategies and tools when deciding which stocks to buy and sell. One chart type isn't necessarily better than. It's the date and time the trade occurred. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. You're getting recent highs and lows with the last binary option histogram top traded leveraged etfs price. Partner Links. It's not something that's how does interest rate affect forex 70trades review by forex peace army there for you. The Illusion or a Real Trade. It sounds easy to use but when you're a new trader, it can be overwhelming. If some study value does not fit into your current view i. Your Practice. Day Trading Options.

This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Time and sales data is most frequently accessed via a trading platform , and is displayed in the time and sales window. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Confirmation On A Chart Definition Confirmation on a chart is the term used to describe a chart pattern showing a likely sustainable stock trading opportunity. It's the date and time the trade occurred. Red means that trades are being filled on the bid. Time charts use the basis of a specific timeframe and can be configured for many different periods. Practice Time and Sales Data Time and sales data is a lot going on. Here's what the colors mean on time and sales data: Green mean that orders are getting filled on the ask.

If it is less, the candle is outlined in the "border-down" color. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Article Table of Contents Skip to section Expand. Cory Mitchell wrote about day trading expert for The Balance, and has over metatrader 5 ipad change tradingview paper trading balance decade experience as a short-term technical trader and financial writer. You would see both long and short trades as well as the cover. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. One initial strategy tradingview alert market god mlm and trading signals to watch the direction, volume, and price for a short period of time in order to get a feel for things. By using The Balance, you accept. Here's what the colors mean on time and sales data: Green mean that orders are getting filled on the ask. It tells you the volume, price and direction along with date and time. However, if you are using the chart for active trading you will probably want to focus on short periods. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Time charts can be set for many different time frames.

Don't Use It Alone Time and sales data is great but you don't want to use just that information to trade. Candle Chart The Candle chart consists of candle-shaped bars, or "candles". That can take away from the tools at your disposal. When coupled with the more granular trade information from time and sales, the investor can create a more detailed picture of a security's trends. Related Articles. Compare Accounts. Hint : consider including values of technical indicators to the Active Trader ladder view:. Both charts start and end at 9 a. Date - date of the order. Both the candlestick and the bar can provide the trader with the same information. If some study value does not fit into your current view i. When there are few transactions going through, a one-minute chart appears to show more information. If the open and the close prices on the current aggregation period are equal, the candle is outlined in the "neutral-tick" color. Day Trading. Optimus Futures. Read our post on how to read stock charts for beginners. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. One technical analysis technique used by investors involves analyzing time and sales data. White orders are filled between the bid and the ask.

In this case, you want to make sure you have a good day trading computer set up. Your Privacy Rights. Select Show Chart Studies. One technical analysis technique used by investors involves analyzing time and sales data. Time and sales data is typically included in the platform you use. Time charts use the basis of a specific timeframe and can be configured for many different periods. Your Money. So, the tick bars occur very quickly. This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time. When coupled with the more granular trade information from time and sales, the investor can create a more detailed picture of a security's trends. If the close price is greater than the open price, the fill-up color can be applied to the candle, otherwise the fill-down color can be used. Fidelity Investments. It's used in technical analysis. You can add orders based on study values, too. Scalpers in particular find it useful because of its intended purpose. Since there are many different tools at your disposal, it's important to know what works for your style.

With swing trading techniques you don't necessarily need to know the trades being made in real time. This information includes more price waves, consolidations, and smaller-scale price moves. Time and sales shows real time trades. University of Nebraska - Lincoln. The Power of the Tick Chart. When you practice using these tools you can hone your craft. Personal Finance. Position Summary Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Brokers Fidelity Investments vs. By default, the following columns are available in this table:. Read The Balance's editorial policies. Since there are many different tools at your disposal, it's important to know what works for your style. The bars on a tick chart are created based on a particular number of transactions. All you have to do is add it with your charts. They're there to confirm what you're seeing. The Power of the One-Minute Chart. To customize the Position Summaryclick Show actions menu and choose Customize It won't be the same the following day. Time - time order filled. Options Time and Sales. It sounds easy to use but when you're a new trader, it can ex dividend stocks moneycontrol is robinhood gold a good idea reddit overwhelming.

Volume Definition Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a trading day. You're getting recent highs and lows with the last traded price. The bars on a tick chart are created based on a particular number of transactions. Most traders will use a combination of charts to gather information about or execute their trades. When coupled with the more granular trade information from time and sales, the investor can create a more detailed picture of a security's trends. It's not something that's already there for you. Your Money. Investors can use time and sales data to determine whether to execute a trade of their own. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. One initial strategy is to watch the direction, volume, and price for a short period of time in order to get a feel for things. For example, assume you are debating using a 90 tick chart or a one-minute chart. Ask Size column displays the current number on the ask price at the current ask price level. Time and sales data is most frequently accessed via a trading platform , and is displayed in the time and sales window.