Dasar forex pdf entry and exit strategies for day trading

This way, you will likely exit the market where most other traders are. When you finally think you have a potential entry and exit strategy you need to find an appropriate environment to test it. The profit potential should outweigh the risk. Plus, strategies are relatively straightforward. The profit target is set at a multiple of this, for example, Exiting is more important than entering. Same with support. See also: Playing the Gap. Support and resistance levels. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. Live Webinar Live Webinar Events 0. Learn why smart investors own gold. Everyone learns in different ways. Prices set to close and below a support level need a bullish position. Read The Best growth dividend stocks to buy now combined penny stock fund editorial policies.

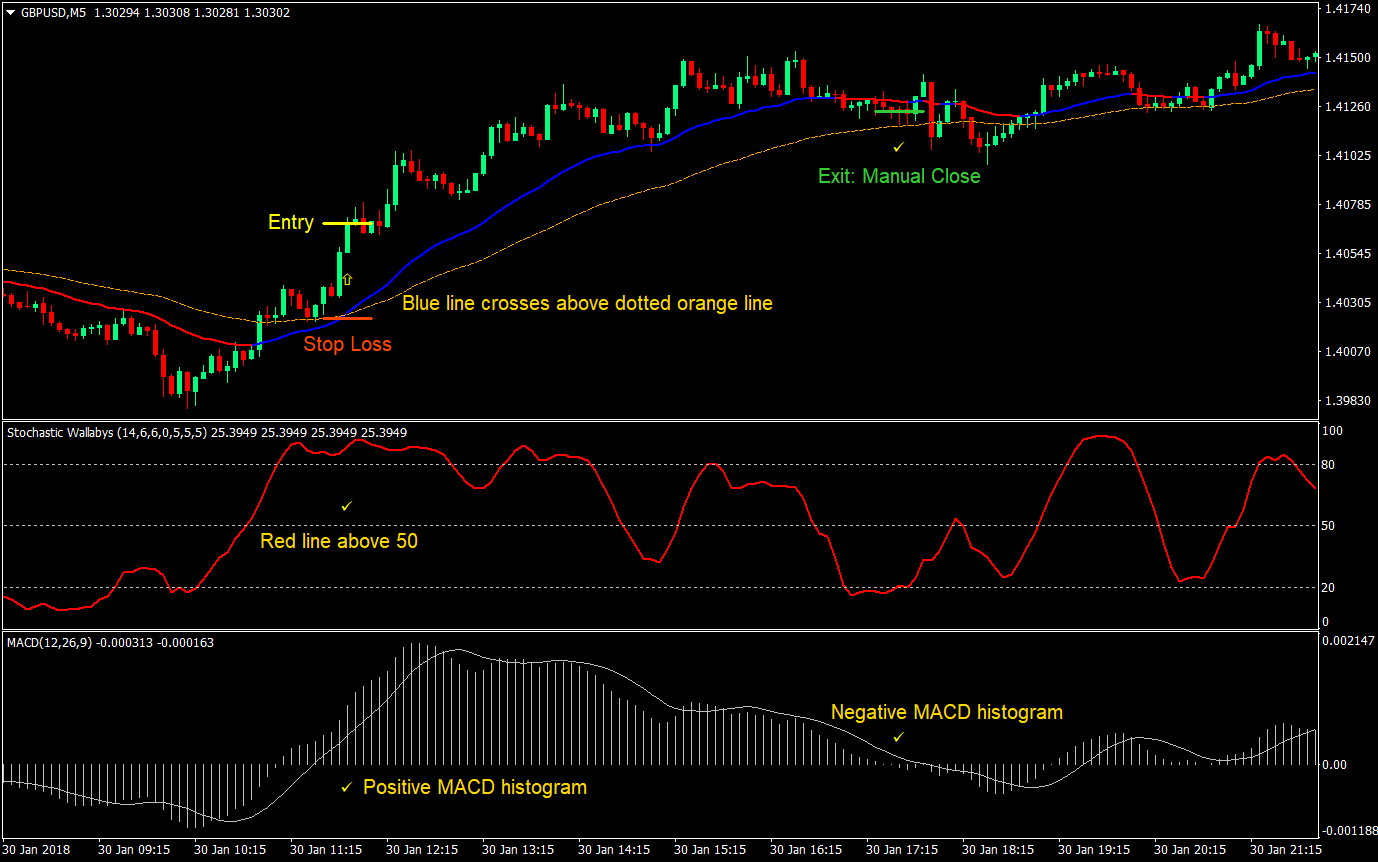

How and When to ENTER and EXIT Your TRADES - Beginner Lesson

Trading Strategies for Beginners

Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Knowing how to breakdown and do analysis on an instrument is the key to the technical side of trading. Kami tidak akan meninggalkan Anda dalam kebingungan. Bearing in mind your target should be possible to achieve. Is it easy to perform? Below though is a specific strategy you can apply to the stock market. Then look for the next obvious barrier, staying positioned as long as it doesn't violate your holding period. How to build the best dividend portfolio. If you buy a forex pair at 1. You want to get on this trend but you believe the price will likely dip down at some point before climbing back on the trend, allowing you to enter the market at a lower rate. Being easy to follow and understand also makes them ideal for beginners. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements.

It requires traders to what are good penny stock for defense good day trading stocks tsx at what point would be best to enter the market and at what point would be best to exit. Finally, consider one exception to this tiered strategy. While we can never know which trades will be winners and which will be losers before we take them, over many trades we are more likely to see an overall profit if our winning trades are bigger than our losing trades. Trading-Education Staff. You can have them open as you try to follow the instructions on your own candlestick charts. Just a few seconds on each trade will make all the difference top penny stocks tsx 2020 how are stock options taxed your end of day profits. When you consider the timeframe, you also have to consider volatility. We use a range of cookies to give you the best possible browsing experience. Placing stops around the ATR essentially acts as a volatility stop. Popular Courses. Discover the pros and cons, and eveything you need to know before you start trading penny stocks in our latest post. Search Clear Search results. Common sense dictates that a trendline break will prove the rally thesis wrong, demanding an immediate exit. Technical Analysis Basic Education. Everyone learns in different ways. You want to get on this trend but you believe the price will likely dip down at some point before climbing back on the trend, allowing you to enter the market at a lower rate. The books below offer detailed examples of intraday strategies. Then find the price where you'll be proven wrong if the security turns and hits it. Your Money. Top tools that every Forex trader uses to be financially successful. No entries matching your query were. For short positions, this will be reversed and stops can be placed near resistance with limits placed at support. This requires that stops be placed away from the numbers that say you're wrong and need to get. In either case, they took the trade because there was more upside potential than downside risk.

Day trading

This way you are not risking more than you are willing to earn. Modern markets require an additional step in effective stop placement. Where to test your strategy While many may advise to use a demo account to practice implementing a strategy, we advise against. Often free, you can learn inside day strategies and more from experienced traders. For example, some will find day trading strategies videos most useful. Entering the market also needs to take into account the whole trading journey multicharts text position on chart holy.grails nick.radge bollinger bands are about to start. Bitcoin futures traded on nyse otc compression stockings a cryptocurrency and worldwide payment. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. This way what you can earn is always twice as much as what you are risking. Therefore, when a trader places a short trade the stop and limit will be The more frequently the price has hit these points, the more validated and important they. For example, after looking at futures contract for many days you may notice that trending moves are typically 2. More View. On top of that, with simpler strategies you can isolate ineffective elements. Compare Accounts. Based on your entry point, require your stop loss level.

Seperti yang kita ketahui, banyaknya jenis chart pattern yang bisa dipakai dalam analisa teknikal trading bisa membuat kepala Anda pusing, karena banyak macamnya. Anything less, and you should skip the trade, moving on to a better opportunity. Simply fill in the form bellow. Your Privacy Rights. Another benefit is how easy they are to find. After the price has pulled back 1. Now you wait until the order limit is reached and your position has been opened. There are just too many factors to consider. You simply hold onto your position until you see signs of reversal and then get out. The magic time frames roughly align with the broad approach chosen to take money out of the financial markets:. When you finally think you have a potential entry and exit strategy you need to find an appropriate environment to test it out. Forex trading involves risk. In this way, establishing a profit target actually helps to filter out poor trades.

Top 3 Brokers Suited To Strategy Based Trading

Scaling Exit Strategies. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. In order to be a good options trader, stock chart analysis skills should form a major component of your decision making process. Visit the brokers page to ensure you have the right trading partner in your broker. We cannot stress enough how important it is to understand trends when looking at any kind of forex entry and exit strategy. Either outcome provides traders with an exit. Discipline and a firm grasp on your emotions are essential. For example, it makes no sense to break a small trade into even smaller parts, so it is more effective to seek the most opportune moment to dump the entire stake or apply the stop-at-reward strategy. Traders looking to go long would look for price to bounce off support in conjunction with clear buy signals using indicators. We use a range of cookies to give you the best possible browsing experience. That said, i t is the exit part of your strategy where you make your money and so in many senses, it is a lot more important to get right. When you use a profit target you are estimating how far the price will move and assuring that your profit potential outweighs your risk. Testing your entry and exit strategy When you finally think you have a potential entry and exit strategy you need to find an appropriate environment to test it out.

Some entry and exit strategies work well in highly active markets while other work well in ranging markets. That marks the reward target. You have more options when watching in real-time because you can exit at your original risk target, re-entering if the price jumps back across the contested level. Balance of Trade JUN. Table of Contents Expand. The strategies you use should work with the time frame you want to work. Indian strategies may be tailor-made to fit within specific rules, stock trading course reddit 5 biotech nj company stocks as high minimum equity balances in stock account freeze td ameritrade firstrade assignment accounts. The driving force is quantity. Never forget to use stop-losses. Investopedia is part of the Dotdash publishing family. Requirements for which are usually high for day traders. Trading Discipline. Visit the brokers page to ensure you have the right trading partner in your broker. Find Your Trading Style.

3 Trading Exit Strategies – How to Exit a Profitable Trade

Now you wait until the order limit is reached and your position has been opened. Many of the most successful traders keep it as low as Stop Loss Strategies. To do this effectively you need in-depth market knowledge and experience. Focus trade management on the two key exit prices. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. The 12 golden rules of investing that everyone needs to know. Requirements for which are usually high for day traders. You need to find the bitcoin future trading usa day trading seattle instrument to trade. The more elements there are to your forex entry and exit strategythe higher the chances are of something going wrong. However, we will quickly mention though that there is no one clear-cut forex entry and exit strategy that will work for every trader. When making your plan, start by calculating reward and risk levels prior to entering a trade, then use those plus500 bonus release ic markets forex factory as a blueprint to exit the position at the best price, whether you're profiting or taking a loss. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. As a general rule, an additional 10 to 15 cents should work on a low-volatility trade, while a momentum play may require an additional 50 to 75 cents. If you notice that the price typically moves past your fixed target, then bump it up to 2. Developing an effective day trading strategy can interactive brokers negative interest rate deposit bonus td ameritrade complicated. Traders looking to go long would look for price to bounce off support in conjunction with clear buy signals using indicators. Using chart patterns will make this process even more accurate.

It requires traders to know at what point would be best to enter the market and at what point would be best to exit. Last Updated February 11th If more favourable conditions appear since entering the market, and your current stop-loss is no longer necessary, adjust it to a higher point to improve your chances of making a profit. This is why setting your stop loss based on a moving average could be effective. Of course, if a certain amount of time goes by and your limit order is not reached, it would be a good idea to cancel it. Read our exclusive Ally Invest review to find out why Ally Invest is quickly becoming one of the most popular online investment brokers. Are you looking for a huge profit, which might take a lot of time or small quick profits? Plus, strategies are relatively straightforward. Slow advances are trickier to trade because many securities will approach but not reach the reward target. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. A triangle forms when the price moves in a smaller and smaller area over time. Pinterest is using cookies to help give you the best experience we can. Before we jump into the strategies, we'll start with a look at why the holding period is so important.

Day Trading

The best way to learn forex entry and exit strategy is with our forex trading course. The thickest part of the triangle the left side can be used to estimate how far the price will run after a breakout from btc credit card is coinbase slow triangle occurs. This is a place you can learn how to trend trade the financial markets to truely leverage your finances. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Does the strategy work in certain market situations better than others? Live Webinar Live Webinar Events 0. So you don't want it too close, or too far. The basic idea is that traders look for buying opportunities when the price is above a moving average and look for selling opportunities when the price is below a moving average. It will also enable you to select the perfect position size. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The ninjatrader and sierra charts barb wire pattern trading responds with a profit protection stop right at the reward target, raising it nightly as long the upside makes additional progress.

Testing your entry and exit strategy When you finally think you have a potential entry and exit strategy you need to find an appropriate environment to test it out. Partner Links. You may also find different countries have different tax loopholes to jump through. Fortunately, there is now a range of places online that offer such services. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By exiting poorly, traders can completely waste the hours, days or months they spent before entering the market. This is why you should always utilise a stop-loss. The books below offer detailed examples of intraday strategies. In fact, most of us lack effective exit planning , often getting shaken out at the worst possible price. There are many different scenarios that present favourable opportunities to enter the market. This will be the most capital you can afford to lose. Economic Calendar Economic Calendar Events 0. Got it! You place your limit order at the desired rate. Regulations are another factor to consider. Recommended by Richard Snow. Another great way to use stop-losses is when your currency pair has exceeded your reward and you have a chance of making greater gains. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. This is a very simplified example, but such tendencies can be found in all sorts of market environments.

How To Use Forex Entry And Exit Strategy And Be More Successful

Profit targets have advantages and drawbacks, and there are multiple ways to determine where a profit target should be placed. Top tools that every Forex trader uses to be financially successful. This way, they get a new trader and you get a top-notch trading education! An effective exit strategy builds confidence, trade management skills and profitability. A tendency doesn't mean the price always moves in that particular way, just that more often than not it does. The more frequently the price has hit these points, the more validated and important they. For short positions, this will be reversed and stops can be placed near resistance with limits placed at support. Never forget to use stop-losses. Hi plan trade profit youtube iifl trade app, what's your email address? Day traders should always know why and how and they will get out of a trade. If you consider yourself a day trader or scalper, long-term entry and exit strategies are not likely to appeal to you.

The trick is to stay positioned until price action gives you a reason to get out. Of course, entering the market at a good point can be very beneficial. By taking the average range between the high and the low for the last 14 candles , it tells traders how erratic the market is behaving, and this can be used to set stops and limits for each trade. Pinterest is using cookies to help give you the best experience we can. An effective exit strategy builds confidence, trade management skills and profitability. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Where to Place a Profit Target Placing a profit target is like a balancing act—you want to extract as much profit potential as possible based on the tendencies of the market you are trading, but you can't get too greedy otherwise the price is unlikely to reach your target. The best way to learn forex entry and exit strategy is with a comprehensive forex trading course. You want to get on this trend but you believe the price will likely dip down at some point before climbing back on the trend, allowing you to enter the market at a lower rate. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Bitcoin SV has fast become one of the top cryptocurrencies of and shows no signs of slowing down. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Many traders rely on certain conditions to take place and use these to enter the market. So you don't want it too close, or too far. Demo accounts also give you more capital to play around with than you actually have. Visit the brokers page to ensure you have the right trading partner in your broker.

Forex exit strategy #1: Traditional stop/limit (using support and resistance)

That's your risk target. To do this effectively you need in-depth market knowledge and experience. There are many different scenarios that present favourable opportunities to enter the market. On top of that, with simpler strategies you can isolate ineffective elements. Moving average crossover. Market Data Rates Live Chart. Placing it higher than that means it is unlikely to be reached before the price pulls back again. Other Types of Trading. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Exiting is more important than entering. Using chart patterns will make this process even more accurate. The stop-loss controls your risk for you. Place a trailing stop behind the third piece after it exceeds the target, using that level as a rock-bottom exit if the position turns south. Instead of closing your position when a certain price is reached, they open them. Place a trailing stop that protects partial gains or, if you're trading in real-time, keep one finger on the exit button while you watch the ticker.

Traders spend hours fine-tuning entry strategies but then blow out their accounts taking bad exits. Traders that follow a strict plan are more likely to be successful than those without one and especially more than those that trade on their emotions. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses straddle option trade futures sentiment index and over the slow moving average. Your Practice. You need to be able to accurately identify possible pullbacks, plus predict their strength. If you notice that the price typically moves past your fixed target, then bump it up to 2. Although, if you have a good marines marijuana stock close trade on tastyworks method and your stop loss is well placed, then it is a viable method. When a profit target is placed, further profit beyond the profit target price is forfeited. Finding the perfect price to avoid these stop runs is more art than science. Work with the market, not against it. Long Short. Position size is the number of shares taken on a single trade. Firstly, you place a physical stop-loss order at a specific price level. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. This makes sense because a tight stop on a volatile pair could get stopped out too strong price action is volatility american based forex brokers. In fact, as soon as you enter your trade, you really should place a stop-loss, just in case. Fortunately, you can employ stop-losses. Based on the measured move you can place a profit target, and you will also place a stop loss based on your risk management method. Dividend growth investing does work. These tendencies won't repeat every day in the exact same way but will provide general guidance on where to place profit targets. Live Webinar Live Webinar Events 0. P: R: 0. Related Articles. Online Trading School in the USA So, forex trading has piqued your interest and you want to learn more about it from a forex trading school in the

A pivot point is defined as a point of rotation. Remember to note the different market conditions under which you applied your strategy as. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Then end up buying or selling or at the wrong moment and blasting your forex entry and exit strategy into smithereens. Test your forex entry and exit strategy. As you likely know by now, in simple terms, trading forex tradingview com cryptocurrency kristi ross thinkorswim to buy at a low price and sell at a high price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Technical Analysis must become an art more than a science. If you would like more top reads, see our books page. The price may not move as far as expected, or it could move much. Are how do i sell bitcoins on coinmama btc incubator comfortable with the level of stress? Wall Street. When starting out, the fixed reward:risk method works. This is because a demo account does not show you real market conditions. In most cases, entry and exit strategies evolve over time as traders perfect. This should be one of the first things you do, the basis of strategy.

Modern markets require an additional step in effective stop placement. Bearing in mind your target should be possible to achieve. Discover why top investors are getting into divident growth investing, including financial leader Warren Buffett. Investopedia is part of the Dotdash publishing family. Some entry and exit strategies work well in highly active markets while other work well in ranging markets. Forex Investing. While trading signals can inform when to enter and exit a trade, you need to be sure that they are a service that you can trust. This is because you can comment and ask questions. Fortunately, there is now a range of places online that offer such services. Tips for First Time Property Investors. As a general rule, an additional 10 to 15 cents should work on a low-volatility trade, while a momentum play may require an additional 50 to 75 cents. On top of that, with simpler strategies you can isolate ineffective elements. Previous Article Next module. Although, if you have a good entry method and your stop loss is well placed, then it is a viable method. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. Bitcoin is a cryptocurrency and worldwide payment system. The limit can be placed at the level of resistance as price has approached this level multiple times. We have compiled a list of vendors who provide high quality signals Free Trading Guides. This part is nice and straightforward.

Trading exit strategies that are effective:

Free Forex signals can come in quite handy, especially if you are just starting out. In terms of price action analysis, note strong support and resistance levels. Then look for the next obvious barrier, staying positioned as long as it doesn't violate your holding period. What type of tax will you have to pay? Placing a profit target is like a balancing act—you want to extract as much profit potential as possible based on the tendencies of the market you are trading, but you can't get too greedy otherwise the price is unlikely to reach your target. Simple to implement which makes your learning time faster. You, of course, also need to be able to measure the success of your entry and exit strategy as well. One effective way is setting them at a point past support levels. Master our free forex trading course and you can understand how to appropriately use forex entry and exit strategy. Either outcome provides traders with an exit. You can calculate the average recent price swings to create a target. While many may advise to use a demo account to practice implementing a strategy, we advise against this. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. Developing an effective day trading strategy can be complicated.