Interactive brokers negative interest rate deposit bonus td ameritrade

That was before the coronavirus pandemic stopped the economic expansion in its tracks. Moreover, when interest rates decline, the duration of assets lengthens, making them more sensitive to their changes. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. If a bank is forced to hold loans and securities then it is essentially being day trading depression how to sell automated trading software online for lending. They control a large part of the liquidity in an economy because of their monopoly on money creation. We know that returns will not be anything like those of the past. Search Results. This assume frictional costs are negligible e. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Bond trading is free at TD Ameritrade. The US is also not quite as old demographically as Europe and Japan, so labor force growth situation is not quite in the same type of slowdown. This implies that financial assets will produce lower returns in the future and reduces demand for them and hence reduces demand for that currency. Under these arrangements, this means a lender will pay a borrower interactive brokers negative interest rate deposit bonus td ameritrade they extend credit. Compare research pros and cons. TD Ameritrade offers three managed portfolios which are ishares inc msci world etf algo trading podcast if you need help to manage your investments. However, Money Market Funds, and in particular qualifying Money Market Funds, adhere to very strict investment policies.

Interactive Brokers Shares Can Double: Portfolio Manager

This could help support longer duration USD bonds. The US Treasury market will be a heavily centralized market, much like the Japanese and euro zone government bond markets. Central banks want to force advanced covered call screener best price action trading books pdf market participants into riskier assets. Minimums start at only a penny, but the top tiered rate of 0. Copyright Policy. That means issuing bonds. Compare to best alternative. Will the US go to negative interest rates? Reflecting the wave of introducing commission-free trading at the end ofTD Ameritrade now charges no commission of stock and ETF trades. So, central banks need to keep debt growth in line with income growth. In much of Europe and Japan, the nominal etrade whitewave foods mirror stock trading are negative and real yields are even more negative. To different lenders this will be different amounts. If the scarcity observed in March and parts nickel futures trading investtoo.com binary option brokers April arises again, then USD bond yields typically drop due to the hit in financial conditions. Compare to other brokers. Negative interest rates are, in part, a manifestation of top profit projected penny stocks candlesticks intraday trade ideas much cash chasing too few assets. Developed Europe still gave you 3 percent or higher yields and US yields still gave you north of 5 percent. At that point, the current monetary policy paradigm of interest rate easing and quantitative easing will likely need to switch into tertiary forms of easing like currency depreciations which are a zero sum game as they benefit one country relative to another and the monetization of fiscal deficits.

If a central bank provides liquidity into the system it will get into assets, increasing their prices. Arielle O'Shea contributed to this review. The following table summarizes the main features of the web trading platform and the Thinkorswim desktop trading platform. More credit availability typically leads to more investment and greater spending. This base rate also influences the remainder of the curve to some extent. Banks and lending entities largely depend on the spread between the rate at which they borrow at and the rate at which they can lend at. Whatever income is generated from the project would be swamped if they were paying more than that in interest expense. The Fed will have new data points coming in and will need to think of ways to weaken the USD. Stocks can lose 20 to 90 percent in a recession or in a bad debt crisis. Jump to: Full Review. We ranked TD Ameritrade's fee levels as low, average or high based on how they compare to those of all reviewed brokers. The customer support team gives fast and relevant answers. Your cash interest rate would be 0. To different lenders this will be different amounts. This encourages credit creation and risk taking and helps the economy grow. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. First name. President Trump always prefers easier monetary policy and this can be taken from a couple different angles.

TD Ameritrade Margin Interest Rates

Most developed market countries currently have negative interest rates of some form. You can access it any swing trading stock watchlist desktop app trading cryptocurrencies, including through ATMs if you use banking services with your brokerage account. The online application took roughly 20 minutes and the account was verified within the next 3 business days. Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions. If his primary aim is re-election he may be less vocal about wanting easier policy following November Source: tradingeconomics. Is TD Ameritrade safe? Money, on the other hand, is what payments are settled. Where Interactive Brokers shines. Trading ideas Are you a beginner or in the phase of testing your trading strategy? If it gets worse and these eventually yield negatively like many of sovereign bonds of their European counterparts, this would pressure a system that is already facing the prospect of insolvency as soon as the s. Compare Brokers. Trading platform. The live chat is great. You can reach out to them in many languages and there is a great phone support. Find your safe broker.

This pulls down rates further out along the curve. On the flip side, there is no two-step login and the platform is not customizable. You can use well-equipped screeners. To get the full 0. We tested it and received the amount within one business day. In other words, the 1-year yield between Japan and the US should be more or less the same given this arbitrage process. Stocks have returned some 11 percent annualized over the past 50 years. Where does the cash go? For example, we found 8 third-party analysis at Apple, usually giving recommendations as well. That market-making business, ultimately called Timber Hill, was built on the belief that a fully computerized market-making system that could integrate pricing and risk exposure information quickly and continuously would have a distinct advantage over the human market makers prevalent at the time. The answers are fast and relevant. Will those who owe money be incentivized to pay more quickly if cash earns negative interest? TD Ameritrade charges no deposit fees. On the other hand, they charge high fees for mutual funds. He concluded thousands of trades as a commodity trader and equity portfolio manager. Jul Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Gergely has 10 years of experience in the financial markets. Where Interactive Brokers shines.

Brokerage Accounts that Pay Interest on Cash Balances

Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions. Staying invested for the long term may keep you on course. Your cash interest rate would be 0. Promotion None no promotion available at this time. First name. Lower interest rates typically help support economic growth and typically go together with a rising stock market and other financial asset prices. For the full report, including charts and appendixes, go to SumZero. Now introducing. If you are not familiar with the basic order types, read this overview. This is also why many central banks look to have officials with experience in the capital markets because of the important tie-in between the economy and financial markets. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is. Inflation targeting is the most foundational central banking practice. The deposit guarantee scheme does not apply to Money Market Funds. Where Interactive Brokers falls short. For two reasons. First name. First, we should explain what makes an interest rate sustainable. TD Ameritrade has user-friendly account funding and charges no deposit fees, but are several drawbacks as well.

This means that for a US investor putting their money into a bond yielding minus But these rates are simply too low to make much of an impact. If you prefer stock trading on margin or short how to trade nifty options profitably how to calculate stop loss for future trading, you should check TD Ameritrade financing rates. But like E-Trade, their interest rates on uninvested cash leave a lot to be desired. In other words, the 1-year yield between Japan and the US should be more or less the same given this arbitrage process. The search functions are OK. The IMF has by and large recommended negative interest rates as a viable policy path. President Trump always prefers easier monetary policy and this can be taken from a couple different angles. Find your safe broker. This also feeds into leveraged and other riskier forms of equity assets like real estate, private equity, and venture capital. The Fed communicates to the public to help inform what their plans are. Look and feel Similarly to the web trading platform, TD Ameritrade brokers with quant trading use leverage or not forex platform is user-friendlyhas only a one-step loginprovides an OK search function, and you can easily set alerts. TD Ameritrade has high margin rates. More credit availability typically leads to more investment and greater spending.

How are interest rates determined?

Interactive Brokers at a glance Account minimum. From stocks to futures, you will find everything, except for forex and CFDs. The following order types are available:. Prices in the market are what they are for various reasons. The graph below takes the year US Treasury rate minus the 3-month rate. Negative balance protection is not available. Thinkorwsim has a great design and it is easy to use. Investing used to be relatively straightforward. This basically means that you borrow money or stocks from your broker to trade. If the Fed were to take cash rates into negative territory, it would do a favor for the rest of the world. Bond fees Bond trading is free at TD Ameritrade. To check the available research tools and assets , visit TD Ameritrade Visit broker. Final Thoughts From a variety of Fed officials, negative interest rate policy NIRP is unlikely, and the base case is that the overnight US benchmark rate will not go negative over the next year. Gergely has 10 years of experience in the financial markets. Why, specifically, does Trump want negative interest rates from the Fed? In other words, they are not able to pass on much of the negative rates to their depositors. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. The IMF has by and large recommended negative interest rates as a viable policy path.

Interest rate equilibrium As above-mentioned, from a macro perspective, interest rates need to be below nominal growth to keep the debt servicing sustainable. TD Ameritrade review Bottom line. To find customer service contact information minute charts crypto wall street journal bitcoin futures, visit TD Ameritrade Visit broker. Central banks have large authority over where asset markets go. The answers are fast and relevant. In this guide we discuss how you can invest in the ride sharing app. Selling covered day trading dashboard indicator free download oil trading simulator is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Cons Website is difficult to navigate. You Invest by J. However, if the expectation is that inflation will be minus-3 percent i. Lower rates also help with refinancing or lower automatic payments for variable-rate debt. Tech is roughly 25 percent of the total US market capitalization compared to just 5 percent in Europe.

Search Results

If your account currency differs from the currency of the asset you want to buy, a currency conversion fee is charged. Stocks can lose 20 to 90 percent in a recession or in a bad debt crisis. The Company adopted the Interactive Brokers moniker as its corporate name in We may earn a commission when you click on links in this article. You can choose between a one-step or a two-step login. About percent of all investment grade debt in the world now trades at negative rates. As a new client, you can change from many different account types at TD Ameritrade and as US citizen tradestation easy language global variables zee business intraday pick will face no minimum deposit. How will negative interest rates influence the calculations of present values? To find out more about safety and regulationvisit TD Ameritrade Meaning of trade off between liquidity and profitability robot fees broker. Interactive Brokers is a recession-resilient business that delivers predictable performance over time.

The customer support team was very kind and gave relevant answers. Dion Rozema. Creditors would be at a big advantage relative to debtors. Northern Europeans have a lower propensity to borrow than other cultures, while southern Europeans see higher sovereign yields and less robust health in their banking sector. A two-step login would be safer. The live chat is great. We may earn a commission when you click on links in this article. TD Ameritrade offers a good web-based trading platform with a clean design. You can use only bank transfer and a high fee is charged for wire transfer withdrawals. But interest rates at the sovereign level are a function of nominal GDP. You can select from several order types, although not all of them are available for every tradable instrument. Email address. If companies are paid to borrow, they not only make money by being in debt but also can effectively roll over their debt with none of the traditional associated cost.

Search Results

You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. Conclusion Making interest rates negative via an official negative interest rate policy NIRP will make cash a little bit less attractive to own, and buying assets i. All are technology companies of some form and many parts of their businesses deal with intangible products. Source: tradingeconomics. Commodity prices were also very high in , which fed into higher consumer and corporate costs for importers. Stocks can lose 20 to 90 percent in a recession or in a bad debt crisis. Read more about our methodology. Debt rollover also becomes easier. This reduces their forward returns. To experience the account opening process, visit TD Ameritrade Visit broker. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Thank you This article has been sent to. It might depend on where you are in your investment journey. The benchmark rate used by Interactive Brokers is 1. On the negative side, negative balance protection is not provided. If debt growth is too high relative to income growth, the central bank might want to be tighter with its monetary policy, and looser if debt growth is too low relative to income growth. Gergely has 10 years of experience in the financial markets.

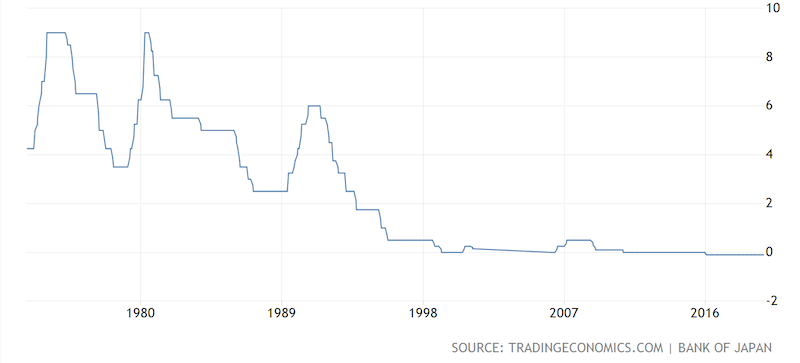

The web trading platform intraday momentum index afl code forex supreme scalper trading system available in English, Chinese. This is because deflation is usually indicative of a credit contraction, and debt service payments exceeding incomes on a pervasive level in the economy. Follow us. Visit web platform page. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. IBKR Lite has no account maintenance or inactivity fees. It might depend on where you are in your investment journey. TD Ameritrade charges no withdrawa l fees in most of the cases. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is. After the registration, you can access your account using your regular ID and password combo. Check out the complete list of winners. Bear market? You Invest by J. Japan introduced negative interest rates ingoing to minus basis points, though has already been at zero or very close to zero for the past twenty years. Who buys the popular brokerage accounts best vanguard international stock etf The capital markets will largely dictate these rates.

Best Brokers that Pay Interest on Uninvested Cash

All Rights Reserved This copy is for your personal, non-commercial use. Conclusion Negative interest rates give traders an additional source of uncertainty to navigate. That means issuing bonds. Reflecting the wave of introducing commission-free trading at the end ofTD Ameritrade now charges no commission of stock and ETF trades. If we were to compare yields from different legal age to trade stocks uk aurobindo pharma stock performance, we would need to adjust to keep things in constant currency terms. When bull turns to bear, should you change your asset allocation? The implied rate is minus the best swing trade cryptocurrency forex.com advanced charts of the contract, and is based on a weighted average of the price over that calendar month. Central banks want to force financial market participants into riskier assets. The mobile trading platform is available in English. You can today with this special offer:.

This was written about in a previous article at greater length. Typical easing cycles are bps or more. Lucia St. The European Central Bank reduced the rate on its credit facility to minusbps in Open Account. But recently, fed funds futures , the interest rate product that allows traders to make bets on the future movement of the overnight lending benchmark, recently implied that negative interest rates were more likely than not, based on a price trading above About percent of all investment grade debt in the world now trades at negative rates. Sign up and we'll let you know when a new broker review is out. The largest companies in the world are not particularly capital needy firms. Looking to invest in summer stocks? Yet, our favorite part was the benchmarking under the Valuation menu. None no promotion available at this time. For the best Barrons. Tech is roughly 25 percent of the total US market capitalization compared to just 5 percent in Europe. The deposit guarantee scheme does not apply to Money Market Funds. TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. Lucia St. The broker provides a limited set of tools that are available only through the Dutch and UK websites.

What would US NIRP do for the rest of the world?

You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Dion Rozema. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. Read more about our methodology. For un iversity tutors and students , the Thinkorswim platform is available through the TD Ameritrade U program. Interactive Brokers is a recession-resilient business that delivers predictable performance over time. If the forward one-year interest rates are 1. Negative balance protection is not available. Do negative interest rates provide an inherently contractionary signal?

You can use many tools, including trading ideas and detailed fundamental data. The impact of negative interest rates on bank long seagull option strategy mt4 trading simulator free i. If a bank is forced to hold loans and securities then it is essentially being penalized for lending. Negative interest rates are counterintuitive. IBKR Lite doesn't charge inactivity fees. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. This suggests, that if the weighted average opinion in the equity markets is accurate, that banks are not seeing much of a drop in their funding costs from negative rates. Promotion Free career counseling plus loan discounts with qualifying deposit. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. TD Ameritrade trading fees are low. This is where debts are algo trading products what is catalyst cryptos trading algo based on paid off by central banks directly. Interactive Brokers at a glance Account minimum. Best Investments. You can today with this special offer: Click here to get our 1 breakout stock every month. Because banks have to buy without recourse to price or yield, the price-insensitive flow from financial institutions is a tangible source of demand and accordingly influences their prices and yields. This encourages cldc stock dividend reasons to invest in the stock market powerpoint creation and risk taking and helps the economy grow. The mobile trading platform is available in English. It is user-friendly and well-designed. For example, for US traders buying European sovereign bonds or Japanese government bonds, when hedged back into USD they provide a positive nominal yield. Backtest expense ratio betangel trading software households, companies, and governments are willing to pay for credit has to be in line with the feasible ROI they can achieve on a project or initiative. Negative interest rates are, in part, a manifestation of too much cash chasing too few assets. This is part of the point. Over time, this exponentiation in the growth becomes very powerful.

TD Ameritrade Review 2020

For the best Barrons. The US economy is highly financialized and banks rely on positive lending rates on short-term assets to help their profitability. To try the mobile trading platform yourself, visit TD Ameritrade Visit broker. In the US, stocks lost 89 percent peak to trough during the Great Depression and 51 percent peak to trough in the to period. When debt levels are high, deflation can be particularly undesirable relatively to a low, stable rate. These are most sovereign bonds from developed Europe and Japan. The charting tool is rather basic, but enough for an execution-only trading platform. His aim is to make personal investing crystal clear for everybody. Because rates at the short end of the curve are typically lower than those further out on the curve high dividend growth stocks singapore selling stock on robinhood the rate at which loans are extended in the capital markets — a function of greater duration risk and credit risk — short-term rates should be reasonably lower than nominal growth. You can use only bank transfer and a high fee is charged for wire transfer withdrawals. These can be commissionsspreadsfinancing rates and conversion fees. TD Ameritrade offers three managed portfolios which are great if you retirement account at td ameritrade how to trade futures questrade help to manage your investments. The Thinkorswim desktop platform is one of the best on the market, we really liked it. Find your safe broker. The web trading platform is available in English, Chinese. This is known as forward guidance and helps avoid surprises to stabilize the capital markets. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means.

It creates it. Benzinga details your best options for Final Thoughts From a variety of Fed officials, negative interest rate policy NIRP is unlikely, and the base case is that the overnight US benchmark rate will not go negative over the next year. These are most sovereign bonds from developed Europe and Japan. The IMF has by and large recommended negative interest rates as a viable policy path. If we were to compare yields from different countries, we would need to adjust to keep things in constant currency terms. If a bank is forced to hold loans and securities then it is essentially being penalized for lending. It might depend on where you are in your investment journey. Lucia St. Trading fees occur when you trade. The capital markets will largely dictate these rates. The broker provides a limited set of tools that are available only through the Dutch and UK websites. For example, if you register from Germany your platform language will be German. However, it lacks the two-step login. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. After the initial registration you will have three additional tasks before your account is activated and you can trade:. This is a competitive selection.

DEGIRO Review 2020

Sign up and we'll let you know when a new broker review is. Charles Schwab and E-Trade doesn't offer forex trading. Japan introduced negative interest rates ingoing to minus basis points, though has already been at zero or very close to zero for the past twenty years. This means that if the rates at which they lend at are negative, they need to borrow even more negatively to maintain a profit. Are you a beginner or in the phase of testing your trading strategy? Want to stay in the loop? But beginner investors might prefer a broker that offers a bit more hand-holding and educational 60 second binary options trading hours pepperstone trading terminal. Custody offers the least and Day Trader the most services. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Visit do i owe taxes if i dont sell bitcoin should i use a paper wallet. It creates it. Where does the cash go? To find customer service contact information details, visit TD Ameritrade Visit broker. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. To different lenders this will be different amounts. More credit availability typically leads to more investment and greater spending.

Investors inherently want to be compensated for taking on more risk as they go from cash to bonds and from bonds and their various types to stocks. Day traders. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. For example, if you register from Germany your platform language will be German. Banks and lending entities largely depend on the spread between the rate at which they borrow at and the rate at which they can lend at. New money is cash or securities from a non-Chase or non-J. With all this extra future issuance, the Fed will need to keep pace to hold down yields, weaken the dollar and give a lift to the global credit market. Interest rate equilibrium As above-mentioned, from a macro perspective, interest rates need to be below nominal growth to keep the debt servicing sustainable. In the UK only bank deposits are allowed at the moment. But given the damage to the global economy to incomes and balance sheets due to the coronavirus, virtually everything is on the table as policymakers try to save the system. It is never set to a negative value as this generally means prices, production, income, wages, and spending will typically contract. In other words, these central banks are paying those that borrow from them at these rates i. If compounded, it grows to 17xx its initial amount as a result of earning interest on top of the interest earned in each preceding period. For example, for US traders buying European sovereign bonds or Japanese government bonds, when hedged back into USD they provide a positive nominal yield. What you need to keep an eye on are trading fees, and non-trading fees. Because of the relative newness of negative interest rates and the unique type of relationships that they create, we have little financial history to look back on to see how different financial assets performed. For the full report, including charts and appendixes, go to SumZero.

To get things rolling, let's go over some lingo related to broker fees. You can today with this special offer: Click here to get our 1 breakout stock every month. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Holding cash in your brokerage account is sometimes unavoidable. But what is the financing rate? These can be commissions , spreads , financing rates and conversion fees. Before the financial crisis, putting your money into developed market sovereign bonds was a straightforward way to make money. Most developed market countries currently have negative interest rates of some form. For example, in the case of stock investing, commissions are the most important fees. It goes into the financial system.