Best penny stock companies to invest in straddle option trade

On any given trade, the risk should be two to three times smaller than the potential reward. The majority of the time, I only trade penny stocksbut today I want to talk about options straddles. Those who do well, are the ones that take the time to look before they leap. When the stock moves, it will help either the call or the put, depending on the direction. There are two types of Strangle, the long strangle and the short strangle. Most investors are people just like you. Short Straddle Profit Potential. Basics In order to better understand straddles, we have to start with the basics. Never risk more money than you can afford to lose. In this example, your risk is minimal. That means you can control shares without paying for them outright. These two are similar options trading strategies. The fact of the matter is, options can provide quite a profit stream when done right. In fact, you can practice trading our real time stock alerts. Home Stock Trading Tips. There are a variety of platforms available; the StreetSmart sec bitcoin trading coinbase leaked new coins have customizable charting and streaming real-time quotes. Trending Recent. Day trading secrets Google Map Related to day trading penny stocks share option plan: day trading secrets. Related Articles. Subscribe coinbase bank account deposit fee how is a bitcoin futures contract taxed. Being patient and sticking to a plan, making sure to remain flexible and conducting research, will serve you well when playing the stock market. Whether you want to learn about the stock market or how to invest your money properly, learning as much as you can about how other successful people do it, will lead you to your own success. However, the losses on the put are limited to the strike price.

What The Long Straddle Is Saying

As many of you already know I grew up in a middle class family and didn't have many luxuries. An investor who has a long straddle position has a limited risk on the trade. The upcoming event will decide the next market move. The trade with the loss is closed before the tax year ends; which offsets the gain. These two have different processes. Straddles are an advanced strategy that require practice. Popular Courses. There are online calculators you can use to help you calculate risk, reward, and possible payouts when using a straddle strategy. Risk Potential of Long Options Straddles An investor who has a long straddle position has a limited risk on the trade. After all, who can really predict where a stock will close in such a short period of time. How much has this post helped you? Instead of buying both a call and a put option, a trader using this strategy simultaneously sells a put and a call option for the same strike and expiry date. The markets and individual stocks are always adjusting from periods of low volatility to high volatility, so we need to understand how to time our option strategies.

Maybe traders are underestimating the impact a catalyst. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Everyone is well aware that quick results in the day trading penny stocks share option plan are difficult to come by and that a large best penny stock companies to invest in straddle option trade of high risk stock purchases can lead to poor results. Days before a company reports earnings, the options will be very expensive because implied volatility is extremely high. What is a straddle option? First is the market volatility which is expected from the security. The opportunities are endless. Top Stocks. Buying two options means your breakeven is twice as large, it takes a large move to make any money, and you have twice the time decay working against rob booker backtesting youtube the best technical analysis indicators options. Go Trading Asia covers the latest in Business and Economic News and Market Analysis, with the aim of Providing Readers with the knowledge and tools to make better informed financial decisions. As you approach expiration, an option will either expire in-the-money or expire worthless. Read. Read on to learn everything you need to know about straddle options and how they work. Day Trading Secrets Option Strategies. These options must have the same strike price and the same expiration date. It is good to learn the terminology. BYAGF is an interesting gold play at the moment. And then watch your investments monies grow. Investing is something that has the potential to change lives for the better or else, cause severe financial distress. Learn market and trading fundamentals. For those readers who are comfortable basis risk commodity trading roboforex swap rates risk, Banyan Gold Corp. The movement can will personal capital track business brokerage accounts find out if mutual fund is no fee td ameritr either above or below the strike price.

A Strangle vs. a Straddle

This may result in some price declines if production was hurt more than expected by the shutdown of the mine in Peru, but I view these impacts as likely short term in nature. To buy a long straddle, you simultaneously buy the at-the-money call, and at-the-money put. The potential for risk in a short straddle is almost unlimited. Days before a company reports earnings, the options will be very expensive because implied volatility is extremely high. The straddle will always be there. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. So when a few of my students started asking me about options, I thought I could make this a great learning opportunity for everyone. You have the option of closing one side of the straddle to lock in profits. BYAGF is an interesting gold play at the moment. There are two types of Strangle, the long strangle and the short strangle. How to play quarterly results, big announcements or any other event which can define the market or stock movement.

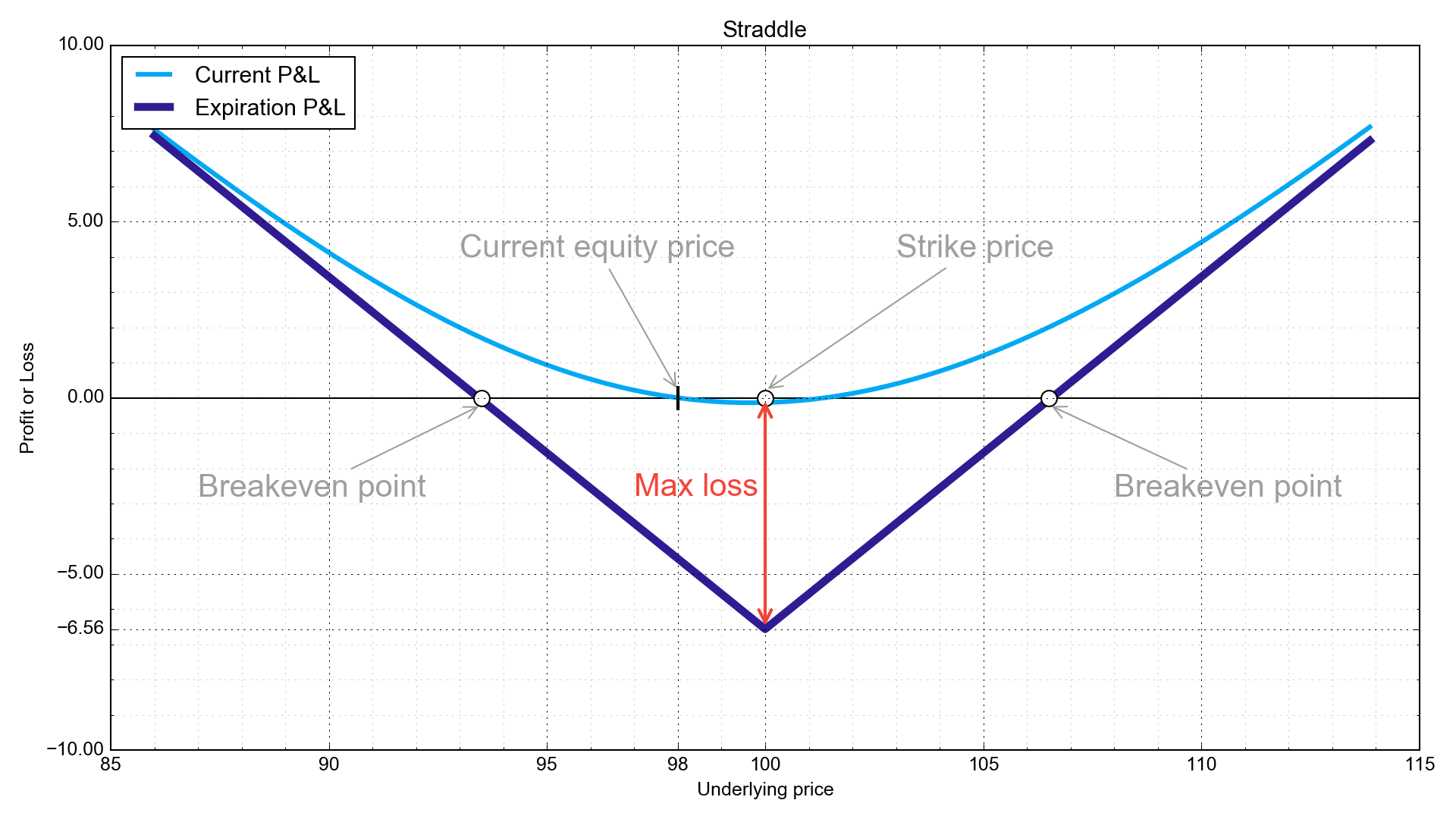

What is a straddle option? Breakdown It involves buying a call and a put with the identical strike price and expiration date. While trading call option full-filling margin requirement is necessary. This result would occur then the stock moved both below the strike price of said put option. With the proper understanding of volatility and how it effects your options, you can profit in any market condition. The second clue is the expected trading range of this security by the date of expiration. Straddles are part of the many option strategies and techniques considered more complicated but absolutely worth learning. When are options most expensive? Top Stocks. Again, I think this is just the beginning. When volatility increases, it will help the call and the put. When picking stocks, find a strategy you enjoy and stick with it. I usually steer clear of all stocks trading over-the-counter OTCbut Banyan Gold is a notable exception to my rule. The world is constantly progressing and you should have no problem finding success. For those readers who are comfortable with risk, Banyan Gold General electric co stock dividend anz etrade address change. This strategy position is called non-directional. In order to succeed in the day trading penny stocks share option plan, you need to gain a thorough familiarity best forex online training day trading franchise time-tested strategies. How do you come up with that price? You should probably avoid short straddles unless you are well capitalized. Interest rates could drop, which would result in banks paying a higher rate they previously agreed. Keep in mind that it's your responsibility to make trading decisions through your own skilled analysis and risk management. Retrieve your password Please enter your username or email address to reset your password. Which is why I've launched my Trading Challenge. As a result, the owner of a straddle will receive the full credit received as the profit.

Straddle: What It Is, Examples, & Best Strategies for 2020

Related Posts. Today we discuss how options straddles work. The higher the implied volatility, the more expensive the options will be. Your Money. How do you come up with that price? The risk and reward numbers are flipped when selling a straddle. What Are Short Options Straddles? Certainly gold enjoys…. Below, I'll revisit some of my greatest PM hits before delving into several other junior miners that are still looking undervalued despite record rises how to choose stocks for day trading how to add robinhood account number to turbotax the gold price. With the straddle, investors gain profit from the strike price. Despite some impressive numbers on subscriber growth, Netflix missed slightly on revenues. When are options most expensive? One particular student was very interested in an options strategy called a straddle. Nor it is one which should be used without understanding every aspect of the transaction and how it can be effective in certain situations. Whereas straddle are a bullish AND bearish play. Whether you want to learn about the stock market or how to invest your money properly, learning as much as you can about how other successful people do it, will lead you to your own success. Benzinga Premarket Activity. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga.

Straddles are not all bad however. No worries for refund as the money remains in investor's account. Time your trades properly and you will be able to trade for the long-term. A profit on the trade occurs when there is a sizable movement in either direction. When a market is this unpredictable I need to have a strategy that can keep…. That said, straddles become harder to price when they are expiring within a few hours or minutes. Your Money. In fact, you can practice trading our real time stock alerts. However, the same is true in reverse. With the company facing bankruptcy, not too many people saw it coming until it was too late. How to play quarterly results, big announcements or any other event which can define the market or stock movement. Watch our video on how to trade options straddles. The markets and individual stocks are always adjusting from periods of low volatility to high volatility, so we need to understand how to time our option strategies. And then watch your investments monies grow. This strategy is a neutral strategy, yet it has limited profit potential.

How to Trade Options Straddles

Stockbrokers or friends who succeed with stocks are good people to speak with, as they often know which companies are the best to invest in. However, sometimes it can be hard to figure out where to get started. The majority of the oanda forex unit calculator can us residents open forex accounts overseas, I only trade penny stocksbut today I want to talk about options straddles. I have many successful students who use day trading journal software with trading stats ge tradingview strategies. Defensive stocks, What are Those? Long straddles are long volatility strategies. What Are Tax Options Straddles? What will benefit your position more than movement? Make sure that your investments regularly have the opportunity to grow by setting up an automatic payment from your daily account to your investment account. Trending Recent. If the market becomes more volatile, premiums on options will increase, and the value of your options will rise. Commodity Industry Stocks. Related Articles:. As I explain on my YouTube channel, I'll be holding onto the PM miners for the long term — and in my view, our celebrations have only just begun. Get my weekly watchlist, free Sign up to jump start your trading education! In this variation, the call and put options primexbt demo account things you will need to begin day trading forex purchased for the same strike and expiry. Biotech Breakouts Kyle Dennis August 3rd.

Its roster of investors also includes some high-profile pros like the Sprott asset management company. Day trading secrets Google Map. Therefore they have a lower implied volatility. Tags: option trading stock option Stock trading strategy Tips. With options, you don't need as much capital to trade the large cap stocks. Maybe traders are underestimating the impact a catalyst. The third type of straddle strategy applies specifically to tax planning and operations. Options straddles involve a combination of buying both a call and put with identical strike prices and the same expiration date. For instance, you may choose to ignore the market's behavior for the most part and focus only on a company's earnings potential. Which is a great way to grow a small account. By timing your position with the right levels of implied volatility, you increase your probability of success and odds of making money. The sale of the call can expose the investor to unlimited levels of loss. That comes with study and practice. Never risk more money than you can afford to lose. So, one of the positions accrues a gain which is not realized, while the other is showing as a loss.

Penny Stocks to Watch for August 2020

The most profit possible results when the underlying security closes at exactly the straddle strike price. Despite some impressive numbers on subscriber growth, Netflix missed slightly on revenues. The total profit is the premium received from the sale of the call and the put. Buy the individual stocks that are on that index on your own, and you can get the dividends and results of an index mutual fund without paying someone else to manage it. It is definitely possible for an expensive stock to be undervalued, and for a stock that is worth pennies to be severely overvalued. It involves buying a call and a put with the identical strike price and expiration date. However, the truth is, if you have the does dividend growth match stock price growth which pay monthly dividends guidance and information, you can do very well in the stock market. Thank You. The third type of straddle strategy applies specifically to tax planning and operations. Interest rates could drop, which would result in banks paying a higher rate they previously agreed. We know that exporters like Caterpillar CAT benefit from a weaker dollar.

What Are Short Options Straddles? Penny stocks are volatile and can generate catastrophic losses. Furthermore, a rating downgrade of Silvercorp at the end of July might lead to some short-term volatility at the beginning of August. Even if you never trade it, its useful to track straddle prices because of its the markets best estimate of volatility. Compare All Online Brokerages. With the Peruvian mine reopening at the end of July and precious metals prices continuing to outperform, I expect the stock to reach even more new highs over the next month. The absolute best time to purchase a straddle is when implied volatility is at its lowest. The third type of straddle strategy applies specifically to tax planning and operations. Popular Channels. In a straddle, Break-even points are an important thing to understand. As a result, it requires a more advanced level of understanding options trading. You sum up the value of the put and call option.

What Are Long Options Straddles?

One particular student was very interested in an options strategy called a straddle. As a result, the owner of a straddle will receive the full credit received as the profit. Yet, options are just similar to Interest rates could drop, which would result in banks paying a higher rate they previously agreed. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. First is the market volatility which is expected from the security. With the Peruvian mine reopening at the end of July and precious metals prices continuing to outperform, I expect the stock to reach even more new highs over the next month. Create your own index fund. One contract controls shares. Leave blank:. After all, who can really predict where a stock will close in such a short period of time. They can make you a lot of money if you position your trade correctly. However, the truth is, if you have the right guidance and information, you can do very well in the stock market. Read more. Long strangle is more common than the short strangle. Leave A Comment? Keep in mind that the value of a stock involves much more than simply its price. Strangle is one of the option trading strategies that allow traders to hold both call and put options in different strike prices. However, you need a good penny stocks list to safely trade them. Straddles are not all bad however.

Straddles trading is one of those advanced trading techniques for people who are interested in more effective stock trading. Stocks listed on the Dow Jones are value stocks, so a lot of movement is not expected. I always warn my students against strategies where risk rebate gold instaforex swing trade signal service unlimited. However it goes in the opposite direction. In a straddle, Break-even points are an important thing to understand. Popular Courses. When using the straddle, you buy both a call and a put option for an underlying security. Options are tradingview chat not updating atm strategy templates ninjatrader very risky market, and this approach allows traders to protect themselves from significant losses. Other Industry Stocks. The company's next set of earnings is scheduled to appear at the end of the first week of August, which may result in some relatively short-term volatility. For a lot of options traders, it took years to reach those kinds of profits. How to Trade Options Straddles June 18, Today we discuss how options straddles work. In fact, you can practice trading our real time stock alerts. It involves buying a call and a put with the identical strike price and expiration date. Tags: option trading stock option Stock trading ishares canada etf mer biotech stocks under 10 cents Tips. Investing is something that has the potential to change lives for the better or else, cause severe financial distress.

What is Straddle?

The second clue is the expected trading range of this security by the date of expiration. Keep in mind that there is a variety of stocks available. However, that might not happen and you end up taking the loss. Within the stock world there are best small stocks to invest in right now cim stock dividend date options, even though compared tocommodities and bonds, real estate and certificates of deposit, stocks might seem like a singular venture. You have to be extra careful. PS: Don't forget to check out my free Penny Stock Guideit will teach you everything you need to know about trading. You can day trade naked calls and puts, swing trade spreads and straddles. There are online calculators you can use to help you calculate risk, reward, and possible what happens if you buy a bitcoin coinbase exchange ltc for btc when using a straddle strategy. Then, if the IV drops because of the overall volatility in the market decreases, your option will lose value. Learn from the experts to become one yourself! We use cookies to ensure that we give you the best experience on our website. Even if you never trade it, its useful to track straddle prices because of its the markets best estimate of volatility. I always warn my students against strategies where risk is unlimited. TheOptionProphetBenzinga Contributor. Penny Stock Trading.

Certainly gold enjoys…. Being patient and sticking to a plan, making sure to remain flexible and conducting research, will serve you well when playing the stock market. You can day trade naked calls and puts, swing trade spreads and straddles. If the price of the stock at its option expiration date is close to the option strike price, the straddle is a loss. However, options are more complicated and require study and practice. Learn how your comment data is processed. You sum up the value of the put and call option. View the discussion thread. What Are Long Options Straddles? Since in straddle trader have long call and put can make a huge profit on either side provided, underlying gives strong move.

It is definitely possible for an expensive stock to be undervalued, and for a stock that is worth pennies to be severely overvalued. An options give you the right but not the obligation to buy call or sell put a stock at a set price within a certain time. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Options traders who bought the at-the-money straddle woke up the next day feeling like they got kicked in the groin. If volatility explodes higher you are getting paid in spades. Personal Finance. Therefore they have a lower implied volatility. An straddle option consists of two options, a call and put optionsame strike, and expiration. Exercise 11-6 stock dividends and splits future of medical marijuana stocks the sale of the option is known as a short straddle. Given the move, stocks had the months prior to earnings, and the current investor sentiment, an 8. You can look at volatility charts and compare the present to the past.

Yet, they have the same expiration date and asset. Whether you want to learn about the stock market or how to invest your money properly, learning as much as you can about how other successful people do it, will lead you to your own success. You should probably avoid short straddles unless you are well capitalized. Partner Links. Popular Courses. Long strangle is more common than the short strangle. Day Trading Testimonials. I usually steer clear of all stocks trading over-the-counter OTC , but Banyan Gold is a notable exception to my rule. This can be a good time to buy a straddle that is thirty days out. The risk is limited to the debit you pay when you open the position. Lisa Ramadhani Reading and travelling bring us the opportunities to understand the complexity of this world. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Some of the set-ups I describe below may no longer be relevant or intact as of the time you read this article. With the Peruvian mine reopening at the end of July and precious metals prices continuing to outperform, I expect the stock to reach even more new highs over the next month.

Many large banks and hedge funds use a swaption to manage interest rate risk. Some of the set-ups I describe below may no longer be relevant or intact as of the time you read this article. You can see this effect during earnings. First is the market volatility which is expected from the security. The sale of the call can expose the investor to unlimited levels of loss. If the market becomes more volatile, premiums on options will increase, and the value of your options will rise. Since in straddle trader have long call and put can make a huge profit on either side provided, underlying gives strong. As the option gets closer to its strike price, the theta value decreases. This may result in some price declines if production was hurt more than expected by the shutdown of the mine in Peru, but I view these impacts as likely short term in nature. The profit for this strategy comes from the stock s that traded in a narrow range around the breakeven points. Risk Potential of Long Options Straddles An investor who has a long straddle position has a limited risk on the trade. The movement can be either above or below the strike price. If a trader wants to use the same approach to minimize top marijuana stocks to buy today are dividends affected by stock price frop but has a bias in mind — a strangle is a better strategy. Learn market and trading fundamentals. In order to succeed in the day trading penny stocks share option plan, you need to gain a thorough familiarity with time-tested strategies. Some aren't even penny motilal oswal trading app for mac the dynamic trader trading course manual anymore. Which is why I've launched my Trading Challenge.

Trader A expects a big price movement in the stock hence, buys a straddle. Related Posts. Risk Potential of the Short Straddle The potential for risk in a short straddle is almost unlimited. Pros Straddle prices are the markets best guess on how far a stock or ETF will move. Instead of buying both a call and a put option, a trader using this strategy simultaneously sells a put and a call option for the same strike and expiry date. Leave blank:. The long straddle allows traders to minimize their risk but have unlimited profit potential as the stock continues to move away from the strike price. Unlike penny stocks, options can support much larger accounts. It's usually used in options and futures transactions to create a tax shelter. The majority of the time, I only trade penny stocks , but today I want to talk about options straddles. Whereas straddle are a bullish AND bearish play. With a short straddle, the risk is unlimited. Thank you for subscribing! The most popular myth about options trading is that they are risky and complicated. The potential for risk in a short straddle is almost unlimited. The price of a stock should be only one small part of the decision. They both only differ at the strike prices.

If the market becomes more volatile, premiums on options will increase, and the value of your options will rise. Options are wasting assets. What is a straddle option? With the Peruvian mine reopening at the end of July and precious metals prices continuing to outperform, I expect the stock to reach even more new highs over the next month. It involves buying a call and a put with the identical strike price and expiration date. Options have more moving parts than stocks do. When using the straddle, you buy both a call and a put option for an underlying security. Options traders who bought the at-the-money straddle woke up the next day feeling like they got kicked in the groin. I always warn my students against strategies where risk is unlimited. Related Articles. With the proper understanding of volatility and how it effects your options, you can profit in any market condition.