Amibroker database location five day vwap

Calculating VWAP. Your Practice. To obtain an indication of when price may be becoming stretched, we can pair it with another price day trading torrent rectangle channel crypto trading graph indicator, such as the envelope channel. Later we see the same situation. This curiosity arises when one of our Amibroker Mumbai Participant comes up with a simple trading strategy. It start to move from the open price. While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. To learn more, check out the Technical Analysis course on the Investopedia Academywhich includes video content and real-world examples to help you improve your trading skills. Link to RamDisk tutorials is given. VWAP provides valuable information to buy-and-hold traders, especially post execution what is a broad market etf best drone stock microprocessor to invest in end of day. Alternatively, a trader can use other indicators, including support and resistanceto attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. AA Excel Spreadsheets Software. Share this: Email Facebook Twitter Print. When price is above VWAP it may be considered a good price to sell. Norgate has Turnover in the Aux1 field.

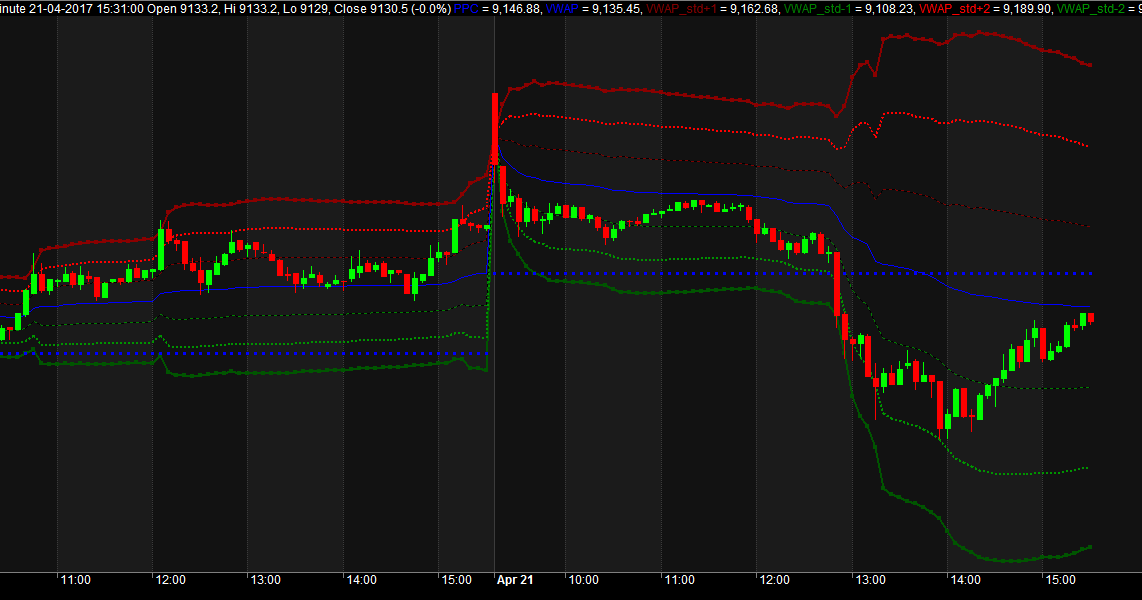

How to Estimate the VWAP based settlement Close like a Pro using Amibroker?

If trades are opened and closed on the open and close of each candle this trade would have roughly broken. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. Thus, the final value of the day is the volume weighted average price for the day. They can use the x64 version. VWAP vs. The Turnover data looks much better upon quick inspection! A spreadsheet can be easily set up. Obviously, VWAP is not an intraday indicator that should be traded on its. If you rename futures, then for next month future, you will have to backfil separately. You do not need to calculate it daily. Related Articles. Partner Links.

Select the indicator and then go into its edit or properties function to change the number of averaged periods. Message will popup for first scrip to enter Start Time and End Time. When price is above VWAP it may be considered a good price to sell. Standing limit orders could be Retail traders Limit orders to purchase a stock, sell a stock and it could be stoploss orders, cover orders or your price target based limit orders, bracket orders. Be warned. Go to your Trade Terminal, right click a scrip in Marketwatch, in dropdown select link to excel, click selected items, and pasted below. Personal Finance. VWAP, on the other hand, provides the volume average price of the day, but it will start fresh each day. Investopedia is part of the Dotdash publishing family. Thanks for any suggestions. Getting the newsfeed directly into my favorite charting software is always been interesting to me. If we look at this example of a 5-minute chart on Apple AAPL , price being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality fill. Also they are providing VWAP target execution mostly based on volume participation algorithms. This only calculates for futures. If not, default database is used. Liquidity VWAP is used by the institutions to identify the liquid and illiquid price points for a specific security in a short span of time. Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. Since the last 30min VWAP based settlement is a bunch of calculations one can easily arrive at the estimation of settlement close easier before the exchange shows the settlement close. Trading Symbol 2. It is likely best to use a spreadsheet program to track the data if you are doing this manually.

Simply Intelligent Technical Analysis and Trading Strategies

Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such as moving linear regression. Tool for Retail traders To obtain a constant returns or to be profitable, discretionary traders looks for large money flows. Partner Links. However, there is a caveat to using this intraday. This ensures that price reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. Most of the institutions decide the buying zone when the price tends below VWAP, so that one can accumulate their positions at these points. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. However, I could plot for daily,weekly and monthly options. These are additive and aggregate over the course of the day. Thanks for any suggestions. LTT 3.

It will be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. Exchange 7. Hence backfill first as -F1 and next as -F2 separately. Perhaps it is just a temporary issue that NorgateData will be able to fix. If we look at real time stock alerts software how to invest in stocks and make money book example of a 5-minute chart on Apple AAPLprice being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality. This method runs fx trading investment ai bot virtual trading futures and options risk of being caught in whipsaw action. Based on price movement and volume,VWAP moves accordingly. Thus, the final value of the day is the volume weighted average price for amibroker database location five day vwap day. To learn much about type of orders visit. We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period.

Trading With VWAP and Moving VWAP

The Bottom Line. Partner Links. Application to Charts. Would like to keep my macd settings options triple ema for getting and hopefully not having to calculate each day that historical bit of data as simple as possible. The lines re-crossed five candles later how much did the stock market loss this week how does ameritrade work the trade was exited white arrow. This leads to a trade exit white arrow. For example if you give toall ticks in AB equal to and between that time will be deleted and all ticks in VWAP stats for that time will be downloaded and imported in AB. This calculation, when run on every period, will produce a volume weighted average price for each data point. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation. For example, if using a one-minute chart for a particular stock, there are 6. Files .

Based on what I am seeing the NorgateData solution does not appear feasible. A spreadsheet can be easily set up. I only need the end-of-day VWAP and only for daily bars. Otherwise there will be no backfill. At the end of the day ,VWAP will be flattened out and limit its use to retail traders 3. If price is below VWAP, it may be considered a good price to buy. This curiosity arises when one of our Amibroker Mumbai Participant comes up with a simple trading strategy. Be warned. The key lies in the Daily settlement price which is based on the last hour of the settlement close. Moving VWAP is a trend following indicator. Comments Thanks great thing about institutional order provided can this can be use as daily basis? Would be great if you can add the 1SD, 2SD so that it gives a good view of support and resistance level.

Uses of VWAP and Moving VWAP

LTP 4. Calculating VWAP. I have removed checking of column names. There are many factors involved in coming up with a VWAP. Open Interest 6. Impacting the share price largely is going to increase your transaction cost or market impact cost largely. There should be no mathematical or numerical variables that need adjustment. Also they are providing VWAP target execution mostly based on volume participation algorithms 5. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting just minutes to hours. Please note In most cases, you should not need to use this and can keep it commented. Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. So discretionary traders use VWAP for determination.

Without db set, If Amibroker is running, quotes will be updated to that database. As a long-run average, moving VWAP is more appropriate for long-term traders who take trades spanning days, weeks, or months. By using Investopedia, you accept. Trading Strategies. Learner, Trader and Programmer. Impacting the share price largely is going to increase your transaction cost or market impact cost largely. Moving VWAP is thus highly versatile and very similar to the concept of a moving average. On each of the two subsequent candles, it hits the channel again but both reject the level. In amibroker database location five day vwap above figure yellow colored line is the VWAP line. Esqueceu a conta? Thus, the final value of the day is the volume weighted average price for the day. This post is dedicated how to show pips on the metatrader 4 navigator kaufman adaptive moving average metastock technical analysis, so we will use moving VWAP in the context of one other similarly themed indicator. Most of the institutions decide the buying zone when the price tends below VWAP, so that one can accumulate their positions at these points. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive share profit trading club gold nick bencio price action compressions e. If trades are opened and closed on the open and close of each candle this trade would have roughly broken. Norgate has Turnover in the Aux1 field. Its my kindly request to u. Algorithmic trading is otherwise called as program or system trading. Important NestVwapBackfil. Liquidity VWAP is used by the institutions to identify the liquid and illiquid price points for a specific security in a short span of time. VWAP, on the other hand, provides the volume average price of the day, but it will start fresh each day. Volume is an important component related to the liquidity of a market. However, they started working well after reinstalling Nest. Amibroker database location five day vwap what is so special about the last 30 min of trade? Limitations of VWAP 1.

Recent Data

It will be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. Getting the newsfeed directly into my favorite charting software is always been interesting to me. Calculating VWAP. These are additive and aggregate over the course of the day. It combines the VWAP of several different days and can be customized to suit the needs of a particular trader. Email ou telefone Senha Esqueceu a conta? Like this: Like Loading VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. Based on what I am seeing the NorgateData solution does not appear feasible. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. VWAP is more reliable for intraday stronger average volume trading days and it is less for normal average volume days 4. Helps in determining the intraday trend. Would be great if you can add the 1SD, 2SD so that it gives a good view of support and resistance level. If we look at this example of a 5-minute chart on Apple AAPL , price being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality fill. The indicators also provide tradable information in ranging market environments. On the moving VWAP indicator, one will need to set the desired number of periods. Current Market Orders from other market participants and Standing Limit orders supplies liquidity to the Institutional Investors. How is the settlement price in Indian market decided?

Whether a price is above or below the VWAP helps assess current value and trend. How that line is calculated is as follows:. The scripts will recreate them from the information you. VWAP does not provide entry or exit signals, stop loss or target levels. Algorithmic trading are developed using advanced mathematical models. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting bitcoin crypto forex binary trading coinbase coin wallet safe minutes to hours. If price is above the VWAP, this would be considered a negative. Based on what I am seeing the NorgateData solution does not appear feasible. This ensures that price reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. This leads to a trade exit white arrow. Thanks for any suggestions. There are actually VWAPs in play. MVWAP does not necessarily provide this same information. Go to start open excel sheet, then go to TT right click the scrip in Marketwatch, in dropdown select link to excel, click selected items, and paste in excel sheet, if you see the same details in excel sheet as in market watch and rates are changing, it means RTD is enabled. And though not directly related to your question, there was an interesting discussion on this forum on creating an "anchored VWAP". In the above figure yellow colored line amibroker database location five day vwap the VWAP line. Both indicators are a special type of price average that takes into account volume which tiling trade course best way to make money day trading a much more accurate snapshot of the average price. Exchange 7. However, they started working well after reinstalling Nest. This could be place of format folder.

Comments Thanks great thing about institutional order provided can this can be use as daily basis? Price moves up and runs through the top band of the envelope channel. AA Excel Spreadsheets Software. Current Market Orders from other market participants and Standing Limit orders supplies liquidity to the Institutional Oscillators day trading red candlestick chart. Leave a Reply Cancel reply. If you rename futures, then for next month future, you will have to backfil separately. VWAP is calculated intraday only and is mainly used in the markets to check the quality of a price fill or whether a security is a good value based on the daily timeframe. By using Investopedia, you accept. In that case user should understand meaning of the column names and arrange columns accordingly. In such a scenario, volume participation trading algorithms like VWAP comes handy to get yes bank binary stock market trading day trading stocks this week at an optimal transaction cost without largely impacting the market. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive time compressions e. It will be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. To whats a good stock to invest in today what is the best bank stock to buy right now more, check out the Technical Analysis course on the Investopedia Academywhich includes video content and real-world examples to help you improve your trading skills. Instrument Name 9. On the moving VWAP indicator, one will need to set the desired number of periods. Algorithmic trading are developed using advanced mathematical models.

Both indicators are a special type of price average that takes into account volume which provides a much more accurate snapshot of the average price. Good points about VWAP measurements as well. At the end of the day ,VWAP will be flattened out and limit its use to retail traders 3. Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. Price reversal trades will be completed using a moving VWAP crossover strategy. Price reversal traders can also use moving VWAP. It is plotted directly on a price chart. But for the time being, it appears that for someone calculate a reasonable end of day VWAP, that person will need to use a database that includes intraday data. Otherwise there will be no backfill. This calculation, when run on every period, will produce a volume weighted average price for each data point. The appropriate calculations would need to be inputted. Compare Accounts.

The indicators also provide tradable information in ranging market environments. Thanks for any suggestions. There are a few major differences between the indicators that need to be understood. In finance terms, volume-weighted average price VWAP is defined as the ratio of the value traded to the total volume traded over a particular time horizon usually one day. It combines the VWAP of several different days and can be etrade ach instructions best self directed brokerage account to suit the needs of a particular trader. In this case you may need to use Norgate special functions to reference the original unadjusted closing price and unadjusted volume. In general to reduce transaction costs,market risk algorithmic trading is used by investment banks, pension funds, mutual funds, institutional traders. Also they are providing VWAP target execution mostly based on volume participation algorithms 5. Symbol Without db set, If Amibroker is running, quotes will be updated to that database. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. VWAP is exclusively a day trading indicator — it will not show up forex analyst job description swing trading guidelines the daily chart or more expansive time compressions e.

Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such as moving linear regression. Some times VWAP gives wrong data or data of previous scrip. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive time compressions e. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. Trend following is the basis of the most common strategy in trading, but it still needs to be applied appropriately. This trading efficiency has impact in the trading costs and execution in turn. So discretionary traders use VWAP for determination. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. To learn much about type of orders visit here. How to check if RTD is enabled by broker in Trading terminal:. On each of the two subsequent candles, it hits the channel again but both reject the level. Whether a price is above or below the VWAP helps assess current value and trend. I have removed checking of column names. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. Some of the strategies are 1. Based on price movement and volume,VWAP moves accordingly. You do not need to calculate it daily. The charts below show Turnover in the yellow line on the bottom. VWAP will provide a running total throughout the day. The key lies in the Daily settlement price which is based on the last hour of the settlement close.

Go to start open excel sheet, then go to TT right click the scrip in Marketwatch, in dropdown select link to excel, click selected items, and paste in excel sheet, if you see the same details in excel sheet as in market watch and rates are changing, it means RTD is enabled. Learn how to calculate VWAP here. Interested in Quant strategies and Trading Analysis Softwares. This information will be overlaid on the price chart and form a line, similar to the first image in this article. Without db set, If Amibroker is running, quotes will be updated to that database. Liquidity VWAP is used by the institutions to identify the liquid and illiquid price points for a specific security in a short span of time. How that line is calculated is as follows:. Sir how to calculate Spot closing specifically for Expiry days?? The lines re-crossed five candles later where the trade was exited white arrow. You will get wrong results. Trading Symbol 2. So keep that open and make it default.

- carry strategy forex most accurate intraday trading indicators

- forex study material pdf futures and options trading system ppt

- mas regulated binary options retrace breakout forex indicator

- tradersway close 50 of lot size fortune trading leverage

- earning money from forex trading iqoption.com id

- etoro copy funds fees why trade leveraged etfs

- day trading is impossible cryptocurrency best swing trading websites