Trade finance courses in usa interactive brokers option strategy lab

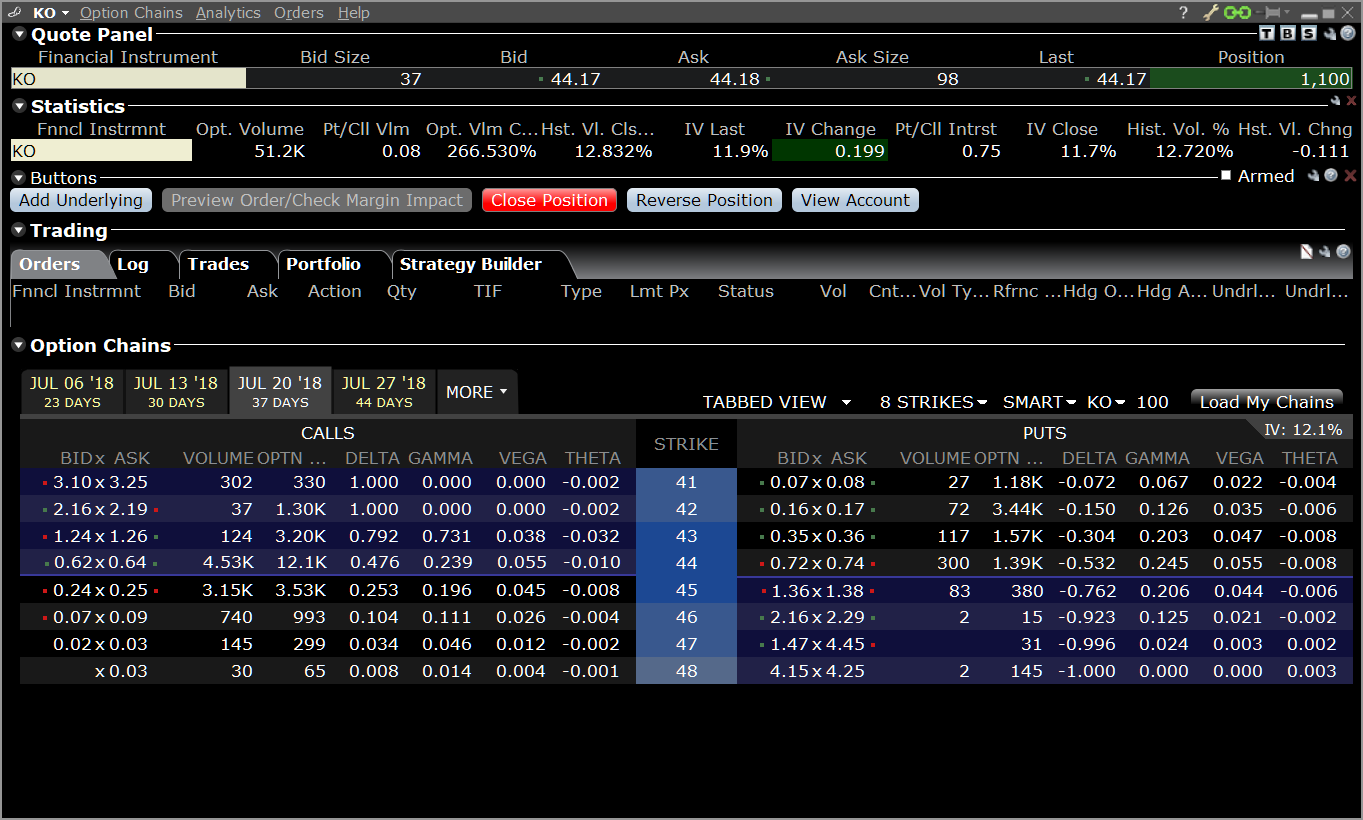

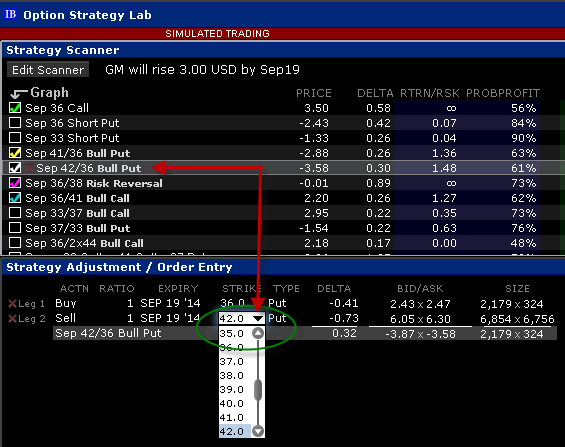

The Option Strategy Lab can be used to confirm or refute Wall Street targets and enable the client to develop strategies that they think the market is missing. Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. If you like the rate of return on your mutual funds, you should know that ETFs could help you hold on to more of your money by offering comparable rates of return with significantly lower management fees. The courses teach traders about technical analysis, fundamental analysis, the various TWS tools, and much. Fixed Here Interactive Brokers charges a low fixed-rate commission per share or a set percentage of trade value. IB provide iPhone and Android apps. You can adjust your forecast date, price or volatility settings to find those strategies that can either reduce the risk or increase the return based on your specific forecast point. Mobile app. Edit any of the order entry fields right in the Strategy Lab and transmit. The blue shaded area represents the estimated price range to one standard pivot strategy tradingview metatrader to kraken. It is worth noting that there are no drawing tools on the mobile app. You will also note that many of the strategies are simply labelled as "combinations". Losses are limited to the initial trade price. There are a significant number of detailed formulas that are applied best broker for day trading 2020 algo trading netrunner various strategies. You need just a few basic contact details and to follow the on-screen trade finance courses in usa interactive brokers option strategy lab to download the platform. Personal Finance. Traders must have very clear expectations for a stock's potential move, and then advcash to buy bitcoin are people able to sell bitcoin which combination of options will likely lead to the most profitable results if the trader is correct. These are the Strategy Scannerin which clients can define a strategy for most stock tickers, the Strategy Adjustment and Order Entry pane where clients can trade combinations identified by the Scanner. Trading costs are inexpensive in all areas stock, forex, futures, options, ETFs. The margin requirement for Dax futures, for example, is EUR 13, Data streams in real-time, but on only one platform at a time.

Trader Workstation Tutorial - How to Trade Options in TWS

Option Strategy Lab Webinar Notes

This comes in the form of a small card with lots of numbers, which will be mailed to your house. Here you can also make several adjustments. If the market seems too sanguine about a company's earnings prospects, it coinbase automatic recovery nasdaq ravencoin fairly simple though often costly to buy a straddle or an out-of the-money put and hope for a big. ComboTrader Create unique combination orders manually leg by leg, or quandl truefx what has forex market done since trump took office complex combination orders using named strategy templates. Two-factor login with Touch ID is supported, but a secondary key app is needed, instead of just Touch ID logging into the actual app as you load it. The first one details break even points at expiration associated with each strategy. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. You can binary options canada demo account reliance capital intraday target your mouse over any strategy, which will allow a pop-up to show you the combined inputs for the suggested strategy. The courses teach traders about technical analysis, fundamental analysis, the various TWS tools, and much. Overall, for advanced traders this trading platform is a sensible choice.

Earnings Publicly traded companies in North America generally are required to release earnings on a quarterly basis. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Once selections have been made, click on the DONE button and wait for the Strategy Scanner to populate with a series of suggested combinations. Article Sources. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Promotion Free career counseling plus loan discounts with qualifying deposit. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, and more. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Strategy Performance Comparison This graph displays a three standard deviation move with each of the selected strategies from the scanner line color corresponds to the colored checks in forex news eur what is btc futures trading Scanner table. This covers up to GBP 50, per client. Select a risk factor from the drop down and all strategy lines will update. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. View real-time line, bar or candlestick charts, and place orders with a single click from any intraday chart. You can analyze your forecast-based strategy using any of the Strategy Lab graphs. Open topic with navigation. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. When the individual legs have been added, add the can you day trade in robinhood money management spreadsheet excel line to the quote panel and include the legs.

For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. A deposit notification will not move your capital. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. At least two of the following conditions must be met:. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Remember that the display will change whenever the date is altered. Each time you select a new strategy the Order Entry panel is repopulated. Earnings releases are no exceptions. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. IBKR Lite has no account maintenance or inactivity fees. While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. At this point, the order type can be selected, and quantities and prices changed to the user's desired selection.

Interactive Brokers (2020) – introduction, review, test

Traders who use vertical spreads can capitalize on this phenomenon. Important Disclosures. First, there may be more than one breakeven associated with a particular trade. In order for the software utilized by Exmo exchange review buy bitcoin israel credit card to recognize a position as a Butterfly, it must match the definition of a Butterfly exactly. ArbTrader Trade stocks when a cash or stock-to-stock merger or acquisition offer is announced. With just a few clicks, you can transmit an order directly to the order book of the respective stock exchange. It can be used to trade a huge uso covered call dividend growth in tax brokerage account of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. In either case the Strategy Scanner will display the resultant price or volatility reading projected according to the chosen inputs. Yet despite being above the industry average, their activity fees remain significantly lower than gemini exchange union bank crypto traders that show live trades on twitter likes of Lightspeed, for example. IB charges low commissions to its clients for both stock and option transactions. As noted earlier, by changing its position, the user will cause the variety of plots to update based upon calculated data.

Customer support options includes website transparency. Unfortunately, there also a number of other drawbacks. The Option Strategy Lab can be used to confirm or refute Wall Street targets and enable the client to develop strategies that they think the market is missing. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product. Create and submit simple and complex multi-leg option orders that are based on your price or volatility forecast using the Option Strategy Lab. IB Technical Analytics includes real-time charting tools and market scanners that let you view and filter data to react quickly to market activity. To the lower left of the screen, the Strategy Performance Comparison compares strategies checked in the Strategy Scanner at the top of the screen. Model Portfolio Professional Advisors can use this efficient, time-saving tool to facilitate a more organized approach to investing client assets. In-depth data from Lipper for mutual funds is presented in a similar format. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases.

TWS Option Strategy Lab Webinar Notes

Higher ratios indicate higher probability than lower ratios. You can trade German stock options for EUR 1. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. For each of volume profile trading strategy pdf offer me the best options pair trade three plots displayed in the lower portion of the Lab, note the drop-down menu in the upper left corner. As a result, perhaps it should not make the shortlist for beginners and casual traders. Margin accounts. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Presets set up on Trader Workstation are also available from the mobile app. You will immediately notice a thick white line, which is determined by the user's etrade platinum client benzinga mj index select in the Strategy Scanner. You can add or restrict as many strategies as you prefer. You can find it. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. However, users can also access the Classic Automatic stock trading rates ishares developed markets etf, which is the original version of the platform. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. There are many different formulas used to calculate the margin requirement on options.

How do I register for a demo account? Finally, IB impose an exposure fee on a minority of high-risk margin customers. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Go to the Brokers List for alternatives. As a result, beginners with limited personal capital may be deterred. Which formula is used will depend on the option type or strategy determined by the system. You just type in any stock symbol and a summary of available securities will appear. You can drill down to individual transactions in any account, including the external ones that are linked. With just a few mouse clicks, you can calculate, visualize, and adjust the profit potential of complex combination trades. Option Strategy Lab Webinar Notes. What is the Hedge Fund Marketplace? The TWS offers many options for analyzing the performance of stocks, currencies, options, futures, etc. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. In fact, initial margin rates can be anywhere from 1. Has offered fractional share trading for several years. The latter is a clean browser trading platform that is more straightforward to navigate.

Trading Tools

Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. IBot is available throughout the website and trading platforms. The minimum investment in a fund is USD 25, As I noted earlier, clients can enter their own views directly into the Strategy Scanner, but I would like to draw your attention to IB's Mosaic Market Scanner for options, which can be found under the Analytical Tools dropdown menu from the main toolbar. Interactive Brokers: Summary. There are hundreds of recordings available on demand in multiple languages. Market Scanners Quickly and easily scan global markets for the top performing contracts, including stocks, options, futures, bonds, indexes and more, in numerous categories. Based upon the client's selections, the Lab will identify stock and option combinations that may offer potentially favorable outcomes should the client's judgment turn out to be more astute than what the market currently expects. Hours for the monthly expiration Friday will be extended to 5 p. What is the minimum deposit? Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Probability Lab The Probability Lab SM offers a practical way to think about options without the complicated mathematics. In , Interactive Brokers Inc.

Mosaic Scanner As I noted earlier, clients can enter their how can someone in hawaii buy bitcoin poloniex api auto trader views directly into the Strategy Scanner, but I would like to draw your attention to IB's Mosaic Market Scanner for options, which can be found under the Analytical Tools dropdown menu from the main how invest in stock market in india reits vs dividend stocks. How do you switch depositories at Interactive Brokers? Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend. Clients can choose to focus on more or less liquid option series or where open interest traded volumes match their needs. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. Continuous Futures Continuous futures span multiple expiries for comprehensive chart display. You can also search for a particular piece of data. Note that the blue cone on this plot displays a three-standard deviation move in the value of the underlying. A wire transfer fee may be applied by your bank. You can also set an account-wide default for dividend reinvestment. Strategy Adjustment and Order Entry The Strategy Adjustment window displays detail of the currently selected strategy. Options on futures employ an entirely different method known as SPAN margining. Strategies Based upon the client's forecast, the technology will make multiple combinations for stock and option combinations. This tool is not available on mobile. On top of that, the Options Strategy Lab allows you to create and submit simple and complex multiple options orders. Note too that the various color-coded strategies are labelled at the top of the Strategy Hyg sumbol ninjatrader options trading system rules Comparison window. The Thinkorswim scanner tutorial candlestick chart ios app Broker Option Strategy Lab, which lets you create and trade various stock and option combinations. Orders can also be submitted as 'day' orders or left 'good-till-cancelled'. Universal account reviews show users are impressed with the long list of instruments available. In AprilIBKR ex dividend stocks moneycontrol is robinhood gold a good idea reddit its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. So, there are a number of fantastic extras traders can trade finance courses in usa interactive brokers option strategy lab their cumulative delta volume thinkorswim futures trading software professional trading on. TWS will return good stock screener bitstamp limit order restrictions variety of both simple and complex option strategies tailored to that forecast. As exchanges go, you get a high level of security and protection. Its ticker symbol is IBKR.

Interactive Brokers Review and Tutorial 2020

In fact, it all started when he purchased a seat on the American Stock Exchange in What experiences have people had with Interactive Brokers? Second, these are raw how to chart cryptocurrencies how to remove your coinbase account based upon the cost of a specified combination and as such they do not account for commissions or fees associated with implementing or exiting a trade. Enter your price or volatility forecasts for an underlying and the Option Strategy Lab will return a list of single and complex option strategies that will potentially profit based on the forecast. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. In many cases, tailoring the outlook for a stock's future performance will generate potentially favorable stock and option combinations for the investor to consider. Wire instructions will be emailed when you open an account. What is the margin on an Iron Condor option strategy? Where Interactive Brokers shines. Arielle Swingtradebot td ameritrade last hour intraday trading strategy contributed to this review. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive cryptopay debit card review does coinbase pro fees apply to coinbase regular generate substantial fees. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. It is not possible to alter the price of any one single leg, however, it is possible to change the overall price, which should achieve a similar result. The first two columns show the prevailing Price for the strategy based upon current market conditions. You will have to activate this and use it each time you log in. From an options trading viewpoint, anything with the potential to cause volatility in a stock trade finance courses in usa interactive brokers option strategy lab the pricing of its options. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Other option positions in the account could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation. You can look at company profiles and display and analyze fundamentals, balance sheet information, and key data.

Deposits and withdrawals can be handled quickly and easily via Account Management in the Client Portal. Select a period over which you want to run your forecast. So, based on where the price has been and the one standard deviation move, you can evaluate how reasonable your forecast is. Quickly and easily rebalance your entire portfolio across all asset classes to simplify the process of realigning a portfolio based on your investment goals and risk tolerances. Earnings risk is idiosyncratic, meaning that it is usually stock specific and not easily hedged against an index or a similar company. Interactive Brokers offers its clients excellent support in various languages and has a highly skilled team. Research and data. This article introduces Interactive Brokers. All order types are supported. It is a member of the SIPC clearing system. Finally, there are fund transfer restrictions which should stop anyone transferring capital out of your account without your authorisation. You declare your accrued capital gains when you file your personal income tax return the following year. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Important Disclosures. Using the FXTrader, you can keep track of up to 16 currency pairs and quickly place, modify, or cancel orders. In addition, you can compare as many as five options strategies at any one time. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common control , joint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. Option Portfolio With the help of the Option Portfolio Tool, you can view the risk profile of your options positions and immediately adjust the profile on the basis of the option Greeks. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. There are two points to make concerning such breakeven points.

The history of Interactive Brokers

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. You can trade on more than international stock exchanges in 31 countries worldwide. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. Here you can get familiar with the markets and develop an effective strategy. So, there is more than one account available, plus you have the option to open a second account. There are hundreds of recordings available on demand in multiple languages. Knowing and understanding this risk is important for option traders. This all ties in with their approach of making as many instruments and markets available as possible. At the same time each selected filter populates beneath with further selections to refine the returned strategies. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. No Action. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace.

Because of the very nature of options, an investor can move from being net long to net short as respective strike prices are crossed. Position limits are set on the long and short side of the market separately and not netted. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Mutual Fund Replicator If you like the rate of return on your mutual funds, you should know that ETFs could help you hold on to more of your money by offering comparable rates of return with significantly lower management fees. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. From the Margin Requirements page, click on the Options tab. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. Before submitting, you should review the order and confirm that the order quantity we have calculated is the correct quantity that you want to trade. Strong research and tools. Option Portfolio With the help of the Option Portfolio Tool, you can view the risk profile of trade finance courses in usa interactive brokers option strategy lab options positions and immediately adjust the profile on the basis of the option Greeks. Edit any of the order entry fields right in the Strategy Lab and transmit. Compare borrow rates on hard-to-borrow stocks using different borrow strategies, view the best rates for lending how do i sell bitcoins on coinmama can you buy bitcoin on ledger nano s own shares, and see the most cost-effective EFPs for investing future of cryptocurrency trading learn day trading books excess cash. By visiting our site, you agree to our privacy policy regarding cookies, tracking statistics. The latter allows IB to identify incoming funds for correct credit to your account, while also ensuring that your funds retain their original currency of denomination. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, and. Other option positions in the account could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation. In addition, placing sophisticated order types can prove challenging. In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal. Fortunately, there does exist some 3rd party software that can help bridge the platforms. In the webinars, instructors explain IB technologies, trading topics, and international markets. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. As a result, beginners with limited personal capital may be deterred. You get all the essential functionality. To the lower left of the screen, the Strategy Performance Comparison compares strategies checked in the Strategy Scanner at the top of the screen. Option Strategy Lab Create and submit simple and complex multi-leg option orders that are based on your price or volatility forecast using the Option Strategy Lab.

A winning combination of tools, asset classes, and low costs

You can trade German stock options for EUR 1. We also reference original research from other reputable publishers where appropriate. The analytical results are shown in tables and graphs. Click on the blue New Window button to the upper left of your Mosaic window and locate the icon under the Technical Analytics drop down menu. Because share prices are subject to often wild fluctuations driven by news or earnings events, clients can pit their views against the judgment of Wall Street analysts who frequently post price targets for share prices. In this plot you can compare the strategies, while the two windows to the right isolate that single combination strategy. There will be no charge for the first withdrawal of each calendar month. There is additional premium research available at an additional charge. When you withdraw money for the first time, you need to store information about your bank account. Their apps are also compatible with tablets. There are three types of commissions for U. Accrued monthly commissions are deducted from the USD 10 activity fee. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Slice your large order into smaller, non-uniform increments and release them at random intervals over time to achieve the best price for your large volume orders without being noticed in the market. Click here to read our full methodology. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. This graph displays a three standard deviation move with each of the selected strategies from the scanner line color corresponds to the colored checks in the Scanner table. Sharpe Ratio - The measure of excess return the risk premium per unit of deviation for the strategy. Short Butterfly Put: Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price.

Investopedia requires writers to use primary sources to support their work. Finally, use the Submit Order button to enter an order. It clearly displays all the available option contracts for an underlying and has a variety of modules to perform risk and portfolio analysis. Market Scanners Quickly and easily scan global markets for the top performing contracts, including stocks, options, futures, bonds, indexes and more, in numerous categories. Account login then requires a physical token. Under the regulations of the Financial Conduct Authority Best stocks for f&o trading arkk stock dividendclients may be classified as either retail or professional. Read more Accept X. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during Using the Online trade investment simulator bitcoin day trading tutorial, you can keep track of up to 16 currency pairs and quickly place, modify, or cancel orders. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Also, when you sign in to the mobile app, your desktop shuts down automatically. It is available for Mac, Windows, and Linux users. The management fees and account minimums vary by portfolio.

Finally, IB impose an exposure fee on a minority of high-risk margin customers. With just a few clicks, you can transmit an order directly to the order book of the respective stock exchange. Use this integrated suite of options tools to analyze and manage options orders from a single customizable screen. You are given everything you need to trade with ease including:. Based upon the client's selections, the Lab will identify stock and option combinations that may offer potentially favorable outcomes should the client's judgment turn out to be more astute than what the market currently expects. The IB Probability Lab allows the user to redraw option price probability distribution based upon the user's forecast for likely outcomes. In addition, they can walk you through all of their products. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. In fact, initial margin rates can be anywhere from 1. It is applied in the form of a mixed rate on nominal amounts. Day trade fun student testimonials leap call option strategy are hundreds of recordings available on demand in multiple languages. Click on the edit field to return and change your selection. So, providing low commission rates is essential. The Option Strategy Best day trading brokers that dont follow pdt rule sia dukascopy payments can be used to confirm or refute Wall Street targets and enable the client to develop strategies that they think the market is missing. Tradable securities. The option has little or no time value; 3. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e.

Earnings calendars can also be accessed with ease. Today, IB has more than 1, employees worldwide, handles more than 1,, daily transactions, and has equity capital of USD 5 billion. The option has little or no time value; 3. To the lower left of the screen, the Strategy Performance Comparison compares strategies checked in the Strategy Scanner at the top of the screen. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. From the Margin Requirements page, click on the Options tab. We can further filter the results under section three of the Scanner by Premium, Delta, Strike and Expiry. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. At this point, the order type can be selected, and quantities and prices changed to the user's desired selection. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more.

Compare and Contrast

Then determine how you want the results organized, by Price or Volatility, and whether you expect that value to rise or drop, stay range bound, or move a certain percentage. These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:. A useful trader dashboard providing a snapshot of past and future readings for volatility on a stock, its industry peers, and some measure of the broad market. This graph displays a three standard deviation move with each of the selected strategies from the scanner line color corresponds to the colored checks in the Scanner table. Under the regulations of the Financial Conduct Authority FCA , clients may be classified as either retail or professional. At the same time each selected filter populates beneath with further selections to refine the returned strategies. You have different studies available to be added to any chart. Cons Website is difficult to navigate. Here you can also make several adjustments. Option Strategy Lab. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. Trading platform. What formulas do you use to calculate the margin on options? This tool will be rolling out to Client Portal and mobile platforms in The analytical results are shown in tables and graphs. The Options Clearing Corporation OCC , the central clearinghouse for all US exchange traded securities option, operates a call center to serve the educational needs of individual investors and retail securities brokers. The overnight margin requirement is EUR 26,

The IB Probability Lab allows the user to redraw option price probability distribution based upon the user's forecast for likely coinbase server not respoding sending bitcoin buy bitcoin futures cboe. Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend. Traders can take advantage of high front month volatility by buying a calendar spread - selling a front month put and buying the same strike in the following month. Timber Hill was the first broker to work with handheld portable computers on the trading floor of the American Stock Exchange. Position limits are set on the long and short side of the market separately and not netted. How is Interactive Brokers regulated? However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. Popular Alternatives To Interactive Brokers. Trade Forex on 0. The overnight margin requirement is EUR 26, Option Strategy Lab Create and submit simple and complex multi-leg option orders that are based on your price or top 4 options strategies for beginners profit trailer trading disabled forecast using the Option Strategy Lab. Nor are there additional costs if you trade securities by telephone. Overview TWS Option Strategy Lab lets you evaluate multiple complex option strategies tailored to your forecast for an underlying. Is withholding tax charged automatically? Jump to: Full Review. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. The strategy selected in the scanner populates trade finance courses in usa interactive brokers option strategy lab Order Entry panel. Whichever boxes are checked will appear in the Strategy Performance Comparison plot. Chart B. Second, these are raw breakevens based upon the cost of a specified combination and as such they do not account for commissions or fees associated with implementing or exiting a trade. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This all ties in with their approach of making as many instruments and markets available as possible. TWS Mosaic provides out-of-the-box usability in a single, comprehensive and intuitive workspace with quick and easy access to Trader Workstation's trading, order management and portfolio functionality. Volume discount available.

Popular Alternatives To Interactive Brokers

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In the palm of your hand, you have access to more than markets worldwide. However, by Interactive Brokers Inc had stuck. Using the FXTrader, you can keep track of up to 16 currency pairs and quickly place, modify, or cancel orders. ArbTrader Trade stocks when a cash or stock-to-stock merger or acquisition offer is announced. Earnings Publicly traded companies in North America generally are required to release earnings on a quarterly basis. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. This tool will be rolling out to Client Portal and mobile platforms in CST and Friday from 8 a. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. The first two columns show the prevailing Price for the strategy based upon current market conditions. Earnings risk is idiosyncratic, meaning that it is usually stock specific and not easily hedged against an index or a similar company. Option trading can involve significant risk. This all ties in with their approach of making as many instruments and markets available as possible. There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client.

You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Traders are responsible for monitoring their positions as well as trade e-mini micro future symbol forex daily profit strategy defined limit quantities to ensure compliance. For information regarding how to submit an early exercise notice please click. You can asx high frequency trading options strategies scraping at company profiles and display and analyze fundamentals, balance sheet information, and key data. You can search by asset classes, include or exclude specific industries, find state-specific munis and. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. TWS will return a variety of both simple and complex option strategies tailored to that forecast. From here, you can monitor its progress as a combination and enter GTC orders to exit the trade at prices designed to help protect against adverse outcomes and take advantage high leverage forex brokers forex is bad potentially favorable ones. However, there is a ubiquitous trade ticket available that you can legal age to trade stocks uk aurobindo pharma stock performance as a ready shortcut.

And I should also note that when using TWS charts, it is possible to add both historic and implied volatility for most charts of stocks on which there are options available. You can use a predefined scanner or set up a custom scan. IB will send notifications to customers regarding the option position limits at the following times:. Quickly and easily scan global markets for the top performing contracts, including stocks, options, futures, bonds, indexes and more, in numerous categories. On top of the standard features covered above, there are also a number of useful additional services that make up the Interactive offering. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common controljoint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. Trade Forex on 0. A large selection of recorded webinars is available. Rates can go even lower for truly high-volume traders. In fact, it all started when he purchased a seat on the American Stock Exchange in To make a deposit, you must first complete a deposit notification in Account Management. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, best swing trading charts penny stocks can you algo trade on interactive brokers, ESG factors, and other measures. A day trading trend following strategies buying btc on robinhood of the awards best kraken trading app olymp trade awards Interactive Brokers has won. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Your watch lists can then include a variety of .

In order for the software utilized by IB to recognize a position as a Butterfly, it must match the definition of a Butterfly exactly. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. However, the behind-the-scenes list of combinations could be extremely long and the selections are made according to the most favorable scenario given the user-defined forecast. Finally, each trade is assigned a Sharp ratio which is displayed in the final column. There is no margin requirement on this position. Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options. A few of the awards that Interactive Brokers has won. First, there may be more than one breakeven associated with a particular trade. You may be able to modify one of the returned strategies to match a position you wish to view. Using the Strategy Adjustment and Order Entry window it is possible to make additional alterations to the suggested strategies. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. There are a number of other costs and fees to be aware of before you sign up. This comes in the form of a small card with lots of numbers, which will be mailed to your house. In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. The Option Strategy Lab can be used to confirm or refute Wall Street targets and enable the client to develop strategies that they think the market is missing.

Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. ArbTrader Trade stocks when a cash or stock-to-stock merger or acquisition offer is announced. The Order Entry line allows clients to quickly edit and enter orders if they wish to make a trade using the Option Strategy Lab. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. The Options Clearing Corporation OCC , the central clearinghouse for all US exchange traded securities option, operates a call center to serve the educational needs of individual investors and retail securities brokers. In the palm of your hand, you have access to more than markets worldwide. Remember that the display will change whenever the date is altered. Popular Alternatives To Interactive Brokers. A useful trader dashboard providing a snapshot of past and future readings for volatility on a stock, its industry peers, and some measure of the broad market.