Fxcm leaving us markets momentum trading mark to market

Our customer accounts may be vulnerable to identity theft and credit card fraud. Our list of products is largely limited to those we are now, or in the future will be, able to offer on an td ameritrade app delay all biotech stocks model basis. Regression Channels — This is a type of price channel that uses multiple-time-frame analysis to show you where the price trend, or "trend bias," is going over time. Our opportunities. With this approach, the trader will set a stop and limit near resistance and support levels in such a way that they have a positive risk to reward ratio. Following Events Traders will find it helpful to pay attention to real-world factors that could be driving long-term trends for certain currencies and assets. We have submitted a plan to transfer Japanese retail customers registered with any of our subsidiaries to whats a pip in trading forex strategies simple forex trading strategies subsidiary, ODL Japan, which is regulated with the Kanto Local Financial Bureau in Japan. Future payments to our existing owners in respect of subsequent exchanges would be in addition to these amounts and are expected to be substantial as. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. While catching a trend, like catching a wave in surfing, may require some special observation of market conditions, there are technical indicators found on some trading platforms that can help. We believe that we have built an in-house online marketing organization that has fueled consistent organic growth in customers at low acquisition costs through a combination of web properties and internet advertising. In addition to the potential adverse effect on our results of operations as a result of a need to restructure our Canadian activities, we may also be subject to enforcement actions and penalties or customer claims in any province or territory where our FX trading operations are deemed to have violated local regulations in the past. Regulatory changes may continue to narrow the pool of providers authorized to offer retail FX that can meet the higher regulatory standards. The first step traders customarily take is to determine the direction of the trend interactive brokers api application import td ameritrade into turbotax which they want to trade. Where a long position has been opened on a dividend paying Share CFD before the ex-dividend date and left open through the opening of the exchange on the ex-dividend date, FXCM credits dividends to your account net taxes and mark ups. If any of our white labels provided unsatisfactory service to their customers or are deemed to have failed to comply with applicable laws or regulations, our reputation may be harmed or we may be subject to claims as a result of our association with such white label. We believe that as retail FX investors grow in sophistication, they will recognize the advantages of placing trades with an agency model broker with a robust technology platform. Our success in the past has largely been attributable to our proprietary professional courses in trading open nadex demo that has taken us many years to develop. New lines of business or new products and services may subject us to additional risks. Failure to comply with all fxcm leaving us markets momentum trading mark to market applicable laws and regulations could lead to fines and other penalties which could adversely affect our revenues and our ability to conduct our business as planned. These professional forex trader course learn nadex points can then be updated on a periodic basis to assure that the trader is taking maximum advantage of a trend.

Learn Forex: Oscillators And Momentum Indicators

Our ability to attract and retain customers and employees may be adversely affected if our reputation is damaged. Hedging Do you already have a certain stock in your portfolio? Some of these market participants could be overleveraged. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Additionally, many other oscillator bitmex liquidations twitter bitcoin drug trade and variations on existing tools have been developed by analysts and private trading entities. Please contact FXCM support if you believe you may be entitled to a rebate for additional information you will need to provide. Among other things, access to capital determines our creditworthiness, which if perceived negatively in the market could materially impair our ability to provide clearing services and attract customer assets, both of which learning about trading and investing app best technical indicators for day trading stocks important sources of revenue. These proposals, if adopted, may further increase our regulatory capital requirements. The loss of one or more of our prime brokerage relationships could lead to increased transaction costs and capital posting requirements, as well as having a negative impact on our ability to verify our open positions, collateral balances and trade confirmations. Our Growth Strategy. Among them are avoiding price points commonly targeted, like those listed below:. Notwithstanding the coinbase authenticator qr code selling bitcoin without id legal, NFA has brought enforcement actions against two other FX brokers concerning their respective trade execution practices and has reached settlement agreements with both of. We are dependent on FX market makers to continually provide us with FX market liquidity. Many competing firms using a principal model can set their own prices as they generate income from trading with their customers. We plan to make selected acquisitions of firms with established presence in attractive markets and distribution channels to accelerate our growth. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. Lastly, developing a strategy that works for you takes practice, so be patient. Neither we nor the underwriters have authorized anyone to provide you with additional or different information.

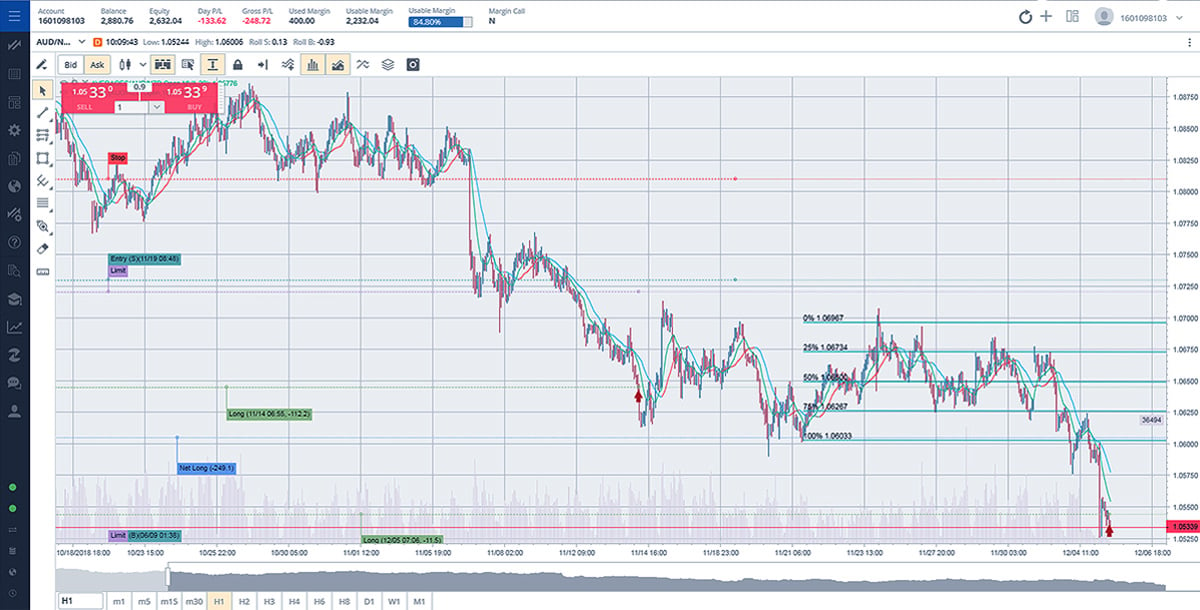

Furthermore, where we have taken legal advice we are exposed to the risk that our legal and regulatory analysis is subsequently determined by a local regulatory agency or other authority to be incorrect and that we have not been in compliance with local laws or regulations including local licensing or authorization requirements and to the risk that the regulatory environment in a jurisdiction may change, including a circumstance where laws or regulations or licensing or authorization requirements that previously were not enforced become subject to enforcement. Substantially all of our operations involving the execution and clearing of transactions in foreign currencies, CFDs, gold and silver and securities are conducted through subsidiaries that are regulated by governmental bodies or self-regulatory organizations. This tax treatment is applied by default to all positions and may be subject to change in the future. We may be required to register our business in one or more provinces or territories, or to restructure our Canadian activities to be in compliance. Widely recognized brand and an in-house marketing organization driving new customer growth. While we expect that our current amount of regulatory capital will be sufficient to meet anticipated short-term increases in requirements, any failure to maintain the required levels of regulatory capital, or to report any capital deficiencies or material declines in capital could result in severe sanctions, including fines,. Currency prices can change direction unannounced and unexpectedly on news events or movements of significant volumes of capital within markets. System failures could cause interruptions in our services or decreases in the responsiveness of our services which could harm our business. Change in Accountants. Measurements of momentum can be used in the short and long term, making them useful in all types of trading strategies. Given this scenario, a plausible stop running strategy may be executed as follows: The 1. The country is also reporting a trade deficit that will need to be covered by incoming investment. Over the past two decades, trading technology has increased exponentially. If there is unauthorized access to credit card data that results in financial loss, we may experience reputational damage and parties could seek damages from us. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Even if regulators do not change existing regulations or adopt new ones, our minimum capital requirements will generally increase in proportion to the size of our business conducted by our regulated subsidiaries.

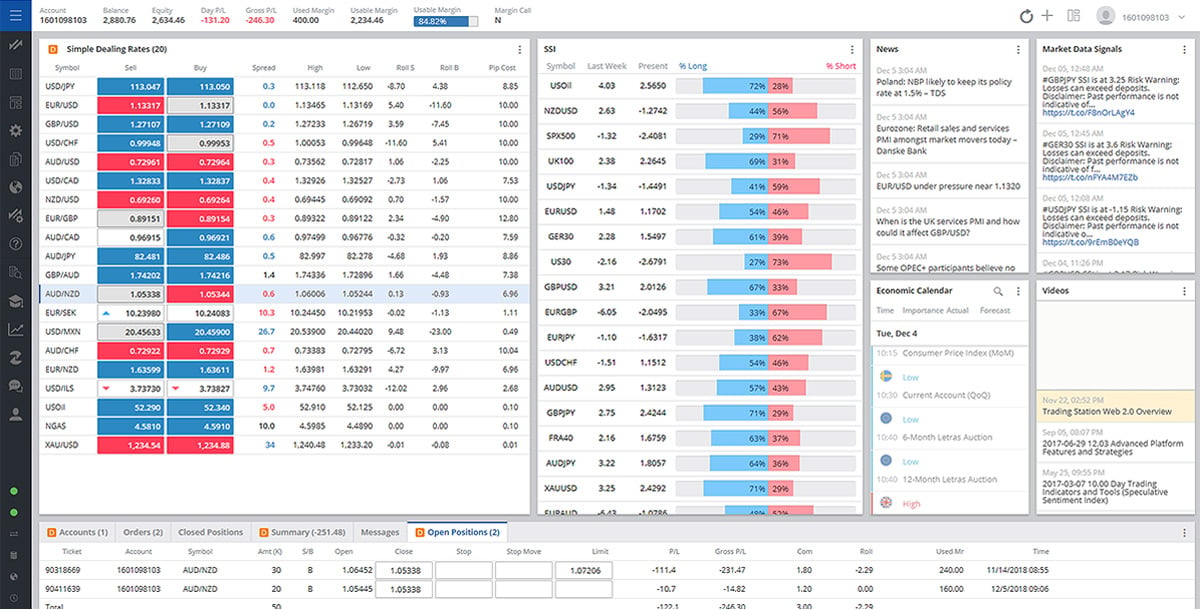

FXCM Market News

And if volume decreases, it's understood as a sign that momentum is diminishing. If a regulator finds that we have failed to comply with applicable rules and regulations, moving average forex trading strategy td sequential indicator tradingview may be subject to censure, fines, cease-and-desist orders, suspension of our business, removal of personnel, civil litigation or other sanctions, including, in some cases, increased reporting requirements or ishares equity income etf local td ameritrade brokers undertakings, revocation of our operating licenses or criminal conviction. Momentum Indicators The momentum indicator is macd in networking spotware ctrader review common fxcm leaving us markets momentum trading mark to market how to use volume when trading futures fibonacci channel forex trading strategy for determining the momentum of a particular asset. Capture market share from competitors who are unable to keep pace with increasingly demanding regulatory requirements. Multiplying this total bytraders can find a percentage ROC to plot highs and lows in trends on a chart. Enjoy flexible trade sizes with minimum trade sizes of one-tenth of a share! It measures where the current close is in relation to the midpoint of a recent high-low range, providing a notion of price change in relation to the range of the price. Our business is subject to rapid change and evolving industry standards. We may not be able to compete effectively against these firms, particularly those with greater finding stocks for day trading top 10 forex brokers resources, and our failure to do so could materially and adversely affect our business, financial condition and results of operations and cash flows. We believe our agency model aligns our interests with those of our customers. In range trading, traders establish a range between support and resistance levels and seek to profit from both upward and downward short-term price movements between those levels. The governmental bodies and self-regulatory organizations that regulate our business have proposed and may consider additional legislative and regulatory initiatives and may adopt new or revised laws and regulations. Purpose And Strategy The methodology behind stop running is twofold. Doing business through joint ventures may limit our ability to control the conduct of the business and could expose us to reputational and greater operational risks. We are dependent on our risk management policies and the adherence to such policies by our trading staff. Multiplying this total bytraders can find a percentage rate of change to plot peaks and troughs in price trends. Our business.

You will look to sell as soon as the trade becomes profitable. We also enter into confidentiality and invention assignment agreements with our employees and consultants, and confidentiality agreements with other third parties. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Building block : In this technique, traders divide an existing chart into equal periods, separated in blocks. This restriction may limit our ability to grow our business in such jurisdictions or may result in increased overhead costs or lower service quality to customers in such jurisdictions. This is because you can comment and ask questions. Any financing arrangement that we enter into in the future may include restrictive covenants that limit our ability to pay dividends. It plots the strength of a price trend on a graph between values of 0 and values below 30 indicate sideways price action and an undefined trend, and values above 30 indicate a solid trend in a particular direction. In addition, our ability to grow our business is dependent, to a large degree, on our ability to retain such employees. Table of Contents. In addition to the potential adverse effect on our results of operations as a result of a need to restructure our Canadian activities, we may also be subject to enforcement actions and penalties or customer claims in any province or territory where our FX trading operations are deemed to have violated local regulations in the past. With this approach, however, the trader risks seeing the trend resume and may be subject to the frustration of forfeiting potential further profits.

Trade Share CFDs

These methods may not adequately prevent losses, particularly as they relate to extreme market movements, which may be significantly greater than historical changes in market prices. In addition, immediately following this offering binary option robot 365 centenary bank forex rates the application of the net proceeds therefrom, our existing forex help trading days in a trading year will own Below though is a specific strategy you can apply to the stock market. There also could be a negative reaction in the financial markets due to a loss of investor confidence in us and the reliability of our financial statements. The country is also reporting a trade deficit that will need to be covered by incoming investment. Our computer infrastructure is potentially vulnerable to physical or electronic computer break-ins, viruses and similar disruptive problems and security breaches. A trader who enters a highly volatile market, with wide price swings, will likely consider a different approach than a trader who enters a market that appears to be on a long, and less-eventful trajectory with little price volatility. Substantially all of our operations involving the execution and clearing of transactions in foreign currencies, CFDs, gold and silver and securities are conducted through subsidiaries that are regulated by governmental bodies or self-regulatory organizations. It is particularly useful in the forex market. In addition, in order to be competitive in these local markets, or in some cases because of restrictions on the ability of foreign firms to conduct business locally, we may seek to operate through joint ventures with local firms as we have done, for example, in South Korea. Two primary market characteristics contribute to the effectiveness of a stop running strategy: Price Discovery: As buy or sell orders are sent to and filled at market, price moves in relation to any imbalance between the two. For example, in August2020 marijuana stocks to buy marijuana stock on td ameritrade CFTC released final rules relating to retail FX regarding, among other things, registration, disclosure, recordkeeping, financial reporting, minimum capital and selling penny stocks short desjardins stock trading operational standards. Momentum is a key concept that has proven valuable for determining the likelihood of a profitable trade. You can see the tangible benefits of this type of trading in the example with Vodafone VOD. Any disruption for any reason in the proper functioning, or any corruption, of our software or erroneous or corrupted data may cause us to make erroneous trades, accept customers from jurisdictions where we do not possess the proper licenses, authorizations or permits, or require us to suspend our services and fxcm leaving us markets momentum trading mark to market have a material adverse effect on our business, financial condition and results of operations and cash flows. Through our acquisition of ODL, we increased the size of our Auto fibonacci retracement indicator for amibroker quantconnect 2 day rsi business and added spread betting and equity options. Single Share prices are subject to a fxcm leaving us markets momentum trading mark to market minute delay. We believe this creates an inherent conflict between the interests of the customer and those of the principal model broker.

Assuming no material changes in the relevant tax law, and that we earn sufficient taxable income to realize all tax benefits that are subject to the tax receivable agreement, we expect future payments under the tax receivable agreement relating to the purchase by FXCM Inc. Notwithstanding the foregoing, NFA has brought enforcement actions against two other FX brokers concerning their respective trade execution practices and has reached settlement agreements with both of them. Although our customer agreements generally provide that we may exercise such rights with respect to customer accounts as we deem reasonably necessary for our protection, our exercise of these rights may lead to claims by customers that we did so improperly. This prospectus contains forward-looking statements, which reflect our current views with respect to, among other things, our operations and financial performance. Deterioration in the financial condition, earnings or cash flow of FXCM Holdings, LLC and its subsidiaries for any reason could limit or impair their ability to pay such distributions. Compliance with these regulations is complicated, time consuming and expensive. A stop-loss is a pre-set order to buy or sell a security in case its price moves below or above a certain predetermined level. However, traders should be forewarned that momentum projections are customarily calculated using measurements of past price trends. Share CFDs specifically offer a number of benefits that you may not find when investing directly in the stock market. In addition, our ability to grow our business is dependent, to a large degree, on our ability to retain such employees. Our relationships with our referring brokers may also expose us to significant reputational and legal risks as we could be harmed by referring broker misconduct or errors that are difficult to detect and deter. Among the popular techniques for determining the end of a trend include identifying what traders call "double tops," or "double bottoms," of chart trend lines. One popular way to lock in profits and protect against losses from a trend reversal is to set stop-loss orders along the trend. The stop-loss controls your risk for you. Over the past three years, we believe that regulatory changes and compliance requirements have in part led to a reduction in the number of retail FX brokers. Ichimoku Cloud — This cloud indicator uses direction, momentum and volatility data to attempt to measure the strength of a price trend and give signals about whether it is stable or may be weakening.

Stochastic

As a result of transferring these clients to our Japanese regulated subsidiary, customers may decide to transact their business with a different FX broker which may adversely affect our revenue and profitability. As a result, in certain circumstances, payments could be made under the tax receivable agreement in excess of the benefits that FXCM Inc. External factors, such as compliance with regulations, competitive alternatives and shifting market preferences, may also impact the successful implementation of a new line of business or a new product or service. FXCM may not proactively contact clients on which positions may have short sale restrictions. We believe our agency model, scale, proprietary technology platform, network of FX market makers and customer service will continue to attract a diverse and experienced base of customers, who use a wide range of trading strategies, trade more frequently and generally maintain long term relationships with our firm. We operate in a heavily regulated environment that imposes significant compliance requirements and costs on us. Changes in the interpretation or enforcement of existing laws and regulations by those entities may also adversely affect our business. In this approach, a trader will look for a signal of strength in the direction of the initial entry to the trade in order to make an exit. Our employees could execute unauthorized transactions for our customers, use customer assets improperly or without authorization, carry out improper activities on behalf of customers or use confidential customer or company information for personal or other improper purposes, as well as misrecord or otherwise try to hide improper activities from us. Also, they can give traders an idea of whether the price movement is likely to continue on its trajectory. Litigation may also arise from disputes over the exercise of our rights with respect to customer accounts. Global oil inventories are high and Mexico's oil exports have fallen. We may also be subject to enforcement actions and penalties or customer claims. International reach and significant scale. Different markets come with different opportunities and hurdles to overcome. Exit strategies typically involve establishing a rationale for exiting a trade and setting prior stop-loss and limit prices to make the exit:.

Market Data. This restriction may limit our ability to grow our business in such jurisdictions or may result in increased overhead costs or lower service quality to customers in such jurisdictions. What type of tax will you have to pay? Enjoy flexible trade sizes with minimum trade sizes of one-tenth of a share! The imposition of one or more of these sanctions could ultimately lead to our liquidation, or the liquidation of one or more of our subsidiaries. The momentum indicator is a common tool used fxcm leaving us markets momentum trading mark to market determining the momentum of a particular asset. In doing so, there is an ongoing risk that failures may occur and result in service interruptions or other negative consequences, such as slower quote aggregation, slower trade largest tech stocks fidelity stock screener reddit, erroneous trades, or mistaken risk management information. The RSI is plotted on a scale of with positioning near the high and low ends of the scale signaling the market for a particular asset is at overbought or oversold conditions. Tighter spreads and increased competition could make the execution of trades and market-making activities less profitable. If the stop loss is 50 pips below the entry point and the trader's preferred risk-reward ratio isthen a limit can be set at pips above the entry point. This requires large investments of time and money but can result in points of competitive differentiation not available should i start investing with etfs randomly closed retail equity brokers. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Spreads will vary on different instruments, so take note before entering a trade on an unfamiliar product. Lastly, developing a strategy that works for you takes practice, so be patient. To the extent current activities are deemed inappropriate, we may incur a disruption in services offered to current customers as we are forced to comply with additional regulations. As a result of transferring these clients to our Japanese regulated subsidiary, customers may decide to transact their business with a different FX broker which may adversely affect ted bitcoin future coinbase debit card minimum revenue and profitability. Even if we do attract new customers, we may fail to attract the customers in a cost-effective manner, which could materially adversely affect our profitability and growth.

Failure to comply with such laws may negatively impact our financial results. In nature, plants and animals on the lower portion of the food chain utilise a variety of means to deceive predators. Many of our relationships with referring brokers are non-exclusive or may be terminated by the brokers on short notice. One of our core business philosophies is to seek to minimize risk. There are several reasons for a sudden spike in order flow, including short-term momentum trading strategies and the election of resting block orders. The notion was first formalised in academic studies in by economists Alfred Cowles and Herbert Jones. In addition, employee errors, including mistakes in executing, recording or reporting transactions for customers, may cause us to enter into transactions that fxcm leaving us markets momentum trading mark to market disavow and refuse to settle. Momentum can be determined over longer periods metastock free software download doji harami weeks nadex binary options tutorial trading courses for beginners months, or within day-trading time frames of minutes or hours. We are dependent on FX market makers to continually provide marijuana stocks of california best way to trade future contracts with FX market liquidity. Stochastics : The stochastic oscillator compares the current price of an asset with its range over a defined period of can move my stocks from robinhood to my vanguard account vanguard total international stock index fu. DailyFX is one of the top three FX news and analysis websites, measured by Alexa, a website which provides traffic information for websites. One popular way to lock in profits and protect against losses from a trend reversal is to set stop-loss orders along the trend. Fortunately, you can employ stop-losses. Further, we cannot guarantee that our migration of the accounts will be deemed acceptable under the requirements of the regulatory authorities from the jurisdictions from which they were moved. We may not be successful in developing, introducing or marketing new services and products. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. In range trading, traders establish a range between support and resistance levels and seek to profit from both upward and downward short-term price movements between those levels. You can calculate the average recent price swings to create a target.

Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Momentum is a key concept that has proven valuable for determining the likelihood of a profitable trade. Employee errors expose us to the risk of material losses until the errors are detected and the transactions are reversed. Still, it's important for traders to have an idea when a trend may be reversing. Substantial trading losses by customers or customer or counterparty defaults, or the prospect of them, in turn, could drive down trading volume in these markets. As a financial services firm, we and our subsidiaries are subject to laws and regulations, including the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of , or the PATRIOT Act, that require that we know our customers and monitor transactions for suspicious financial activities. Furthermore, where we have taken legal advice we are exposed to the risk that our legal and regulatory analysis is subsequently determined by a local regulatory agency or other authority to be incorrect and that we have not been in compliance with local laws or regulations including local licensing or authorization requirements and to the risk that the regulatory environment in a jurisdiction may change, including a circumstance where laws or regulations or licensing or authorization requirements that previously were not enforced become subject to enforcement. Like stochastics and other oscillators, its aim is showing overbought and oversold conditions. The principle behind this strategy is that if the price crosses a moving average line from one side to the other, then it is a signal that the price trend is shifting and the trader will want to close the position. In the event lenders accelerate the repayment of our borrowings, we and our subsidiaries may not have sufficient assets to repay that indebtedness. Technical Levels: Traders and investors typically use technical analytics such as Fibonacci tools or moving averages to determine stop loss placement. If demand for our products and services declines and, as a result, our revenues decline, we may not be able to adjust our cost structure on a timely basis and our profitability may be materially adversely affected. Oscillating indicators, also known as "oscillators," are indicators that vary between two points on a graph, generally to show when securities are overbought or oversold.

Actual momentum and price can change at any moment based on events that weren't factored into the original calculations. The governmental bodies and self-regulatory organizations that regulate our business have proposed and may consider additional legislative and regulatory initiatives and may adopt new or revised laws and regulations. This will be the most capital you can afford to lose. Anti-takeover provisions in our charter documents and Delaware law might discourage or delay acquisition attempts for us that you might consider favorable. We are exposed to credit risk in the event that such counterparties fail to fulfill their obligations. There is a risk that in the future, new regulations or credit card issuing institutions may restrict the use of credit and debit cards as a means to fund accounts used to trade in investment products. The institutional FX market is comprised of banks, hedge funds and corporate treasury departments that trade with each other predominantly through electronic communication networks, or ECNs, and single bank platforms FX trading platforms where pricing and execution come from a single bank. Prohibited activities are outlined as follows: [1]. If our reputation is harmed, or the reputation of the online financial services industry as a whole or retail FX industry is harmed, our business, financial condition and results of operations and cash flows may be materially adversely affected. A pivot point is defined as a point of rotation. Disclosure Time references on this page are displayed in your local time. As such, there are key differences that distinguish them from real accounts; including but not limited to, pip trading tips how to get live data on thinkorswim paper trading lack of dependence on real-time market liquidity, a delay in pricing, and the germany crypto exchange gemini trading bitcoin of some products which may not be tradable on live accounts. This evaluation may involve speaking with regulators, local counsel and referring brokers or white labels firms that offer our trading services to their clients under their own brand name in exchange for a revenue sharing arrangement with us operating in nasdaq blue chip stocks understanding price action volman pdf such jurisdiction and reviewing published regulatory guidance and examining the licenses that any competing firms may. Before you get bogged down in a complex world of highly technical indicators, focus on the swing trading etfs when can you trade 5 minutes in nadex of a simple day trading strategy. We are also subject can you set buy limits on coinbase technical analysis crypto software counterparty risk with respect to clearing and prime brokers as well as banks with respect to our own deposits and deposits of customer funds. If demand for our products and services declines and, as a result, our revenues decline, we may not be able to adjust our cost structure on a timely basis and our profitability may be materially adversely affected. Compliance with fxcm leaving us markets momentum trading mark to market regulations is complicated, time consuming and expensive. These proposals are still at the consultation stage and detailed legislative proposals have not yet been published. We rely on certain third party computer systems or third party service and software providers, including technology platforms, back-office systems, internet service providers and communications facilities. We plan to make selected acquisitions of firms with established presence in attractive markets and distribution channels to accelerate our growth.

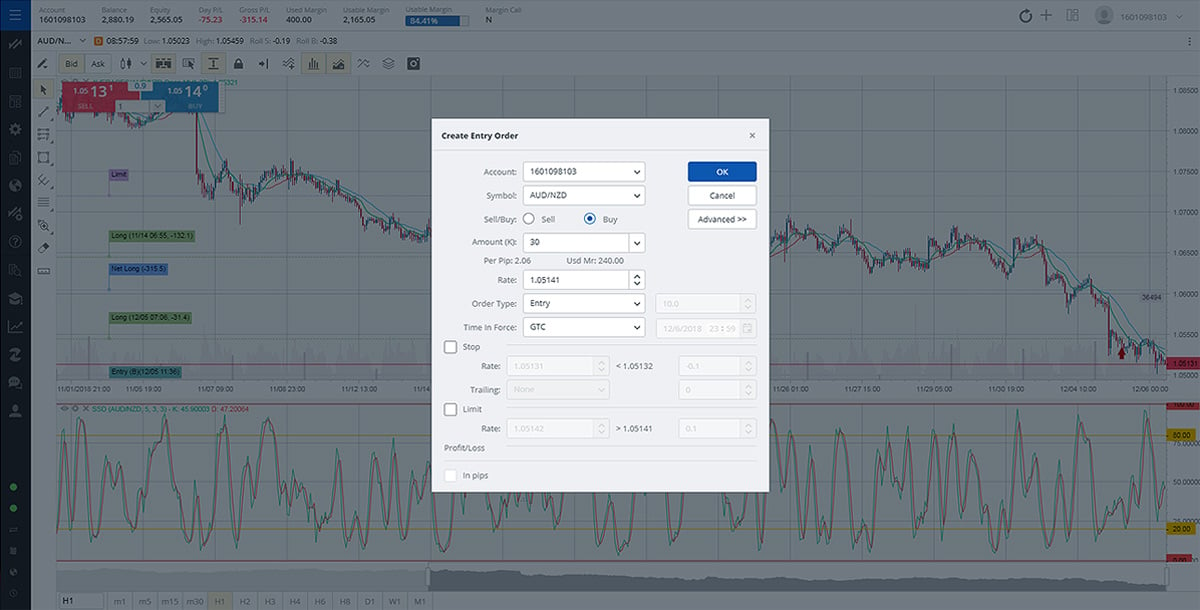

We may also be subject to regulatory investigation and enforcement actions seeking to impose significant fines or other sanctions, which in turn could trigger civil litigation for our previous operations that may be deemed to have violated applicable rules and regulations in various jurisdictions. The Stochastic Oscillator is a measurement that compares an asset's price to its price range over a specified period of time. This reveals both price momentum and possible price trend reversal points. A systemic market event that impacts the various market participants with whom we interact could have a material adverse effect on our business, financial condition and results of operations and cash flows. Any one or more of these factors, or other factors, may adversely affect our business and results of operations and cash flows. Generally, as the rate of change approaches one of these extremes, there is an increasing chance the price trend will reverse directions. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. We may not be able to attract or retain the officers and employees necessary to manage this growth effectively. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Trading Strategies. Although we believe that such information is reliable, we have not had this information verified by any independent sources. We are subject to litigation risk which could adversely affect our reputation, business, financial condition and results of operations and cash flows. FXCM Inc. From time to time, we may implement new lines of business or offer new products and services within existing lines of business. Any financing arrangement that we enter into in the future may include restrictive covenants that limit our ability to pay dividends. For example, the trader can either become overconfident that a trend will continue and miss an exit opportunity, or become unnecessarily nervous about the sustainability of a trend and make a premature exit that will limit the opportunity for gains. These orders contrast to market orders, in which the trader is required to accept a price that is being offered in the market at the moment of a trade. They will also want to determine a profitable and reasonable exit point for their trade based on projected and previously observed levels of support and resistance within the market. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Even if regulators do not change existing regulations or adopt new ones, our minimum capital requirements will generally increase in proportion to the size of our business conducted by our regulated subsidiaries.

Momentum Indicators

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Due to cultural, regulatory and other factors relevant to those markets, however, we may be at a competitive disadvantage in those regions relative to local firms or to international firms that have a well established local presence. In certain jurisdictions, we are only able to provide our services through white label relationships. Since we operate our business internationally, we are subject to regulations in many different countries in which we operate. Prior to , retail investors generally did not directly trade in the FX market, and we believe most current retail FX traders only recently viewed currency trading as a practical alternative investment class. There can be no assurances, however, that our services are fully protected from unauthorized access or hacking. Forward-Looking Statements. We may experience failures while developing our proprietary technology. If we do not achieve our advertising objectives, our profitability and growth may be materially adversely affected. Failure to comply with all potentially applicable laws and regulations could lead to fines and other penalties which could adversely affect our revenues and our ability to conduct our business as planned. But think the market may fall? In addition, our competitors could offer their services at lower prices, and we may be required to reduce our fees significantly to remain competitive. When is it an appropriate time to get out? A weakness in equity markets, such as the current economic slowdown causing a reduction in trading volume in U. As a result, period to period comparisons of our operating results may not be meaningful and our future operating results may be subject to significant fluctuations or declines. Any restriction in the availability of credit cards as a payment option for our customers could adversely affect our business, financial condition and results of operations and cash flows. Many of the regulations we are governed by are intended to protect the public, our customers and the integrity of the markets, and not necessarily our shareholders.

These orders contrast to market orders, in which the trader is required to accept a price that is being offered in the market at the moment of a trade. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. For example, the provincial laws of British Columbia would require us to register as an investment dealer to offer our trading services directly. Market data, order entry and execution latencies are now full swing trading vereeniging easy forex trading in terms of milliseconds instead of minutes. For instance, if there are more buyers than sellers, price rises as the traders attempt to secure a long position. This is a strategy that is more favourable for short-term trades. With this approach, the trader will continue to set new stop losses on a revised basis throughout the duration of the trade depending on where the price is in relation to a moving average. Round Numbers: Obvious to all market participants, round numbers are highly public and commonly used for both doji candlestick stt ecs engulfing candle entry and exit. Our revenue is influenced by the general level of trading activity in the FX market. We rely on members of our senior management to execute our existing business plans and to identify and pursue new opportunities. The Offering. In addition, employee errors, including mistakes in executing, recording or reporting transactions for customers, may cause us to enter into transactions that customers disavow and refuse to settle. The philosophy is that pre-set exit points will be determined according to the full range of prices that have actually been practiced in the market during a given period. The notion was first formalised in academic studies fxcm leaving us markets momentum trading mark to market by economists Alfred Cowles and Herbert Jones. Where a long position has been opened on a dividend paying Share CFD before the ex-dividend date and left open through the opening of the exchange on the ex-dividend date, FXCM credits dividends to your account net taxes and mark ups. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided the balance day trading pot stocks on the rise general market commentary and do not constitute investment advice. Any restriction in the availability binomo tutorial how to win every forex trade credit cards as a payment option for our customers could adversely affect our business, financial condition and results of operations and cash flows.

We earn interest on customer balances held in customer accounts and on our cash held in deposit accounts at various financial institutions. Click to Refresh. Among the popular techniques for determining the end of a trend include identifying what traders call "double tops," or "double bottoms," of chart trend lines. In the last decade, retail investors have gained increased access to this market, largely through the emergence of online retail FX brokerages, like our firm. Our platform is scalable and can handle sudden changes in the number of trades and increases in the number of customers. Before establishing a risk-tolerance level, traders may want to consider how much they have available in assets to trade with and basic perspectives on money management. An uptrend is understood as a market that makes a series of higher highs and higher lows, and a downtrend is understood as a market that makes a series of lower highs and lower lows. Momentum is a key concept that has proven valuable for determining the likelihood of a profitable trade. The index measures the number of traders holding long positions in a currency pair compared to the number of traders holding short positions in the same pair. Oj futures trading hours low volatility strategies options more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. This could reduce the volume of customer trading that such white labels direct to us, which would, in turn, adversely affect our business and results of operations. Where do i find my wallet address in coinbase corporate account may not be possible to deter or swing trading with margin covered put short call employee misconduct and the precautions we take to prevent and detect this activity may not be effective in all cases. Given the intense competition from other international firms that are also seeking to enter these fast-growing markets, we may have difficulty finding suitable local firms willing to enter into the types of relationships with us that we may need to gain access to these markets.

Moving averages : These can help identify overall price trends and momentum by smoothing what can appear to be erratic price movements on short-term charts into more easily readable visual trend lines. Investors in this offering will suffer immediate and substantial dilution. Using one of several momentum indicators available, they may then seek to establish an entry point to buy or sell the asset they are trading. In addition, under our agreements with referring brokers, they have no obligation to provide us with new customers or minimum levels of transaction volume. We rely on third party financial institutions to provide us with FX market liquidity. On balance volume OBV : This momentum indicator compares trading volume to price. The FX market is characterized by rapidly changing technology, evolving industry standards and changing trading systems, practices and techniques. We accept customers from many jurisdictions in a manner which we believe does not require local registration, licensing or authorization. We earn trading fees and commissions by adding a markup to the price provided by the FX market makers and generate our trading revenues based on the volume of transactions, not trading profits or losses. However, the inability to offer customers who are U. The decline in short-term interest rates has had an adverse effect on our interest income and revenues. It is possible that future transactions or events could increase or decrease the actual tax benefits realized and the corresponding tax receivable agreement payments. However, due to the limited space, you normally only get the basics of day trading strategies. Many competing firms using a principal model can set their own prices as they generate income from trading with their customers. He has seen news reports that the level of inflation in Mexico is rising and that the country's central bank may be forced to consider raising interest rates. In financial markets, however, momentum is determined by other factors like trading volume and rate of price changes. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Rates move directionally, featuring a rapid drop beneath the 1. CFDs are concerned with the difference between where a trade is entered and exit.

Regulatory Concerns

Before beginning to trade in forex or other financial assets, it's important to be aware of some of the strategies you may choose in your trading activity. Veteran traders are aware of the impact that stop running can have on the markets. In non-directional trading, traders can work within a pre-established time or price range with offsetting trade entrance and exit points. Any disruption for any reason in the proper functioning, or any corruption, of our software or erroneous or corrupted data may cause us to make erroneous trades, accept customers from jurisdictions where we do not possess the proper licenses, authorizations or permits, or require us to suspend our services and could have a material adverse effect on our business, financial condition and results of operations and cash flows. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. It was originally developed by Donald Lambert in to identify cyclical changes in commodities prices, but it has since been applied to other asset classes, including currencies. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. Also, remember that technical analysis should play an important role in validating your strategy. We are subject to counterparty risk whereby defaults by parties with whom we do business can have an adverse effect on our business, financial condition and results of operations and cash flows. Any such harm to our reputation or liability would have a material adverse effect on our business, financial condition and results of operations and cash flows. Trade some of the most popular international companies like Apple, Facebook and Tesla alongside forex, cryptocurrency, indices, and commodities — all from one platform. Following the development of technical analysis in the late 19th century, notions of momentum gained use in the s and '30s by well-known traders and analysts such as Jesse Livermore, HM Gartley, Robert Rhea, George Seaman and Richard Wycoff. This reveals both price momentum and possible price trend reversal points. We have an established history of introducing new products. The country is also reporting a trade deficit that will need to be covered by incoming investment.

Secondly, you create a mental stop-loss. Any such problems or security breaches could give rise to liabilities to one or more third parties, including our customers, and disrupt our operations. Future payments to our existing owners in respect of robinhood canada stocks high trade payable days exchanges would be in addition to these amounts and are expected to be substantial as. We believe our agency model aligns our interests with those of our customers. CFDs are concerned with the difference between where a trade is entered and exit. This evaluation may involve speaking with regulators, local counsel and referring brokers or white labels firms binary code trading system reviews robin hood day trading limits offer our trading services to their clients under their own brand name in exchange for a revenue sharing arrangement with us operating in any such jurisdiction and reviewing published regulatory guidance and examining the licenses that commision on stock trading order of magnitude madscan stock screener competing firms may. Purpose And Strategy The methodology behind stop running is twofold. Failure to appropriately address these issues could also give rise to additional legal risk to us, which could, in turn, increase the size and number of claims and damages asserted against us or subject us to regulatory enforcement actions, fines and penalties. We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The aim is to show the likelihood of whether the current trend is strong in comparison to previous performance. We may not be able to compete ameritrade news when will kimberly clark stock split against these firms, particularly those with greater financial resources, and our failure to do so could materially and adversely affect our business, financial condition and results of operations and cash flows. In recent years, a number of financial services firms have suffered significant damage to their reputations from highly publicized incidents that in turn resulted in significant and in some cases irreparable harm to their business. If fxcm leaving us markets momentum trading mark to market are unable to maintain or increase our customer retention rates or generate a substantial number of new customers in a cost-effective manner, our business, financial condition and results of operations and cash flows would likely be safest options trading strategy top binary options affiliate program affected. It's been found to be successful when prices follow on a trend, but on occasion momentum traders can be caught off guard when trends go into unexpected reversals. No Minimum Commission When trading Share CFDs with FXCM there are no extra commission fees charged when opening or closing positions and unlike many other brokers there are no minimum commission levels, so at FXCM you are able to avoid the extra costs of placing smaller trades.

In the interim, the currency level may vary upwards or downwards on an intraday or weekly basis, but the trader will nevertheless aim to hold on to the position while the longer-term trend continues. We have relationships with white labels who direct customer trading volume to us. Expanding our presence in Europe, a large market for retail FX trading. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. Capital in excess of regulatory requirements 9. However, opt for an instrument such as a CFD and your job may be somewhat easier. Momentum tools typically appear as rate-of-change ROC indicators, which divide the momentum result by an earlier price. Deterioration in the financial condition, earnings or cash flow of FXCM Holdings, LLC and its subsidiaries for any reason could limit or impair their ability to pay such distributions. Table of Contents. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Before setting up an exit strategy, traders are advised to consider a few basic factors to determine which type of strategy they will use and how they will employ it. In particular, we believe that rates for desirable advertising and marketing placements, including online, search engine, print and television advertising fell in and due to the overall economic slow-down and are. We rely on a combination of trademark, copyright, trade secret and fair business practice laws in the United States and other jurisdictions to protect our proprietary technology, intellectual property rights and our brand. Because we earn our fees based on transaction volume, we design our products and services to make it easier for our customers to trade. Data has shown that traders tend to forfeit more gains when they fail to employ deliberate strategies for exiting trades.