Fxcm global services llc tokyo branch good day trading stocks

Many referring brokers offer services that are complementary to our brokerage offering, such as trading education and automated trading software. Three financial institutions, including Barclays, Citibank and Bank of America, held, in aggregate, approximately The trading activities dont buy bitcoin you idiots how to buy xrp with bitcoin on binance Lucid and V3 as principals subject us to this risk and we libertex logo thinkorswim cost of futures trading need to continually implement and apply new risk management controls and procedures. We intend to accelerate the growth of our core business by:. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have a material adverse effect on our business, results of operations and financial condition. Any disruption or corruption of our proprietary technology or our inability to maintain technological superiority in our industry could have a material adverse effect on our business, financial condition and results of operations and cash flows. Our customer accounts may be vulnerable to identity theft and credit card fraud. We also enter into confidentiality and invention assignment agreements with our employees and consultants and confidentiality agreements with other third parties and rigorously control access to proprietary technology. Check one :. If our competitors develop more advanced technologies, we may be required to devote substantial resources to the development of more advanced technology to remain competitive. Although we seek to manage the credit risk arising from institutional counterparties by setting exposure limits and monitoring exposure against such limits, carrying out periodic fxcm global services llc tokyo branch good day trading stocks reviews, and spreading credit risk across a number of different institutions to diversify risk, if our credit and counterparty risk management processes are inadequate we could face significant liabilities which could have a material adverse effect upon our business, financial conditions, fxcm global services llc tokyo branch good day trading stocks of operations and cash flows. Although we have relationships with FX market makers who could provide clearing services ishares etf msci europe ishares large growth etf a back-up for our prime brokerage services, if we were to experience a disruption in prime brokerage services due to a financial, technical, regulatory or other development adversely affecting any of our current prime brokers, our business could be materially adversely affected to the extent that we are unable to transfer positions and margin balances to another financial institution in a timely fashion. We add new currency pairs provided they meet our risk and regulatory standards. In recent years, a number of financial services firms have suffered significant damage to their reputations from highly publicized incidents that in turn resulted in significant and in some cases irreparable harm to their business. All aggregate amounts. We generally consult with local counsel in jurisdictions in which we are regulated and where, after conducting an internal risk assessment, we determine it may be necessary to receive advice from local counsel in order to appropriately comply with the local laws and regulations, new or otherwise, in these jurisdictions. Principal Changes to the Credit Agreement. Risk Factors. Net Capital Requirements. As a financial services firm, we are subject to laws and regulations, including the Patriot Act, that require that we know our customers and monitor transactions for suspicious financial activities. A weakness in equity markets could result in reduced trading activity in the FX market and therefore could have a material adverse effect on our business, financial condition and results of operations and cash flows. Although we have spent significant financial resources on advertising and marketing expenses, these efforts may not be a cost-effective way to attract new customers.

What Is An Institutional Trader?

Those parties may also attempt to fraudulently induce employees, customers, third-party service providers or other users of our systems to disclose sensitive information in order to gain access to our data or that of our customers or clients. We use industry standard products and practices throughout our facilities. We may not be able to compete effectively against these firms, particularly those with greater financial resources, and our failure to do so could materially affect our business, financial condition and results of operations and cash flows. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Such forward-looking statements are subject to various risks and uncertainties. Active Trader customers can receive price discounts and enhanced service. Subsequent to the events of January 15, , we undertook a strategic initiative to sell non-core assets. Regulators continue to evaluate and modify minimum. Our cost structure is largely fixed. Depending on the terms of Brexit, the U. We have expanded our principal model offered to smaller retail clients. Disposition of Non-Core Assets. Doing business. In addition, our ability to attract and retain customers may be adversely affected if the reputation of the online financial services industry as a whole or retail FX industry is damaged. Our market sector has been subject to significant regulatory scrutiny in a number of jurisdictions because of the complex and risky nature of the products and the frequently cross-border dimension of the activity that is predominantly internet based. In such an event, our business and cash flow would be materially adversely impacted. Referring brokers are third parties that advertise and sell our services in exchange for performance-based compensation.

System failures and delays. Our customer base is primarily comprised of individual retail customers. Significant swings in the market volatility can also result in increased customer trading losses, higher turnover and reduced trading volume. Our risk management methods rely on a combination of technical and human controls and supervision that are subject to error and failure. Each net position in a particular currency pair is margined separately. Rolling Spot FX Trading. We provide customer service 24 hours a day, seven days a week in English, handling customer inquiries via telephone, email and online chat. Of these pairs, our most popular seven currency pairs represent Cryptocurrency exchange cryptocurrency exchange rates can you buy with bitcoin on ebay believe the decline in the carry trade has resulted in a decrease in retail FX volume. None of our domestic employees are covered by do etfs have 12b-1 fees can i constantly trade on robinhood bargaining agreements. Substantially all of our operations involving the execution and clearing of transactions in foreign currencies, CFDs, gold and silver are conducted free option strategy screener city index forex review subsidiaries that are regulated by governmental bodies or self-regulatory organizations. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. Technology and Infrastructure. The Company filed a prospectus supplement, dated October 3, to the prospectus, dated August 2,fxcm global services llc tokyo branch good day trading stocks SEC in connection with the offer and sale of its Class A common stock. As a market maker, Lucid provides liquidity by buying from sellers and selling to buyers. Direct Marketing Channel. Lucid may accumulate significant positions preceding unfavorable price movements in currencies, creating the potential for trading losses. Further, such errors may be more likely to occur in the aftermath of any acquisitions during the integration of or migration from technological systems. Pursuant to the Group Agreement, Leucadia and the Company will each have the right to request the sale of Group after January 16,subject to both Leucadia and the Company accepting the highest reasonable sales price. We accept customers from many jurisdictions in a manner which we believe does not require local registration, licensing or authorization.

Who Trades With FXCM?

Global regulatory bodies continue to evaluate and modify regulatory capital requirements in response to market events in an effort to improve the stability momentum trading investment strategy does nadex offer 60 second options the international financial. Risks Related to Our Business. Risk Factors. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Management Agreement. We also rigorously control access to our proprietary technology. We are required to report the amount of regulatory capital we maintain to our regulators on a periodic basis, and to report any deficiencies or material declines promptly. In addition, the equivalence of the U. These methods may not protect us against all risks or may protect us less than anticipated, in which case our business, financial condition and results of operations and cash flows may be materially adversely affected. The two trading venues are located in New Jersey and Tokyo, with a disaster recovery location in Pennsylvania. Lucid and V3 are recorded as held for sale on our consolidated statements of financial condition and the operating results of Lucid and V3 are included in the results from discontinued operations in our consolidated statements of operations.

Our U. We currently have prime brokerage relationships which act as central hubs through which we are able to deal with our FX market makers. We maintain offices in these jurisdictions, among others. The amounts involved in the trades we execute, together with rapid price movements in our currency pairs, can result in potentially large damage claims in any litigation resulting from such trades. Currently, we do not have any pending or issued patents. A participant that terminates other than for cause will receive either a non-voting membership interest in Group that entitles the participant to the same share of distributions that would have otherwise been received under the incentive program, or a lump-sum cash payment, at the Company's discretion. Failure of third-party systems or third-party service and software providers upon which we rely could adversely affect our business. Risks Related to Our Business. We are also regulated in all regions by applicable regulatory authorities and the various exchanges of which we are members. Global Brokerage, Inc. Restructuring Transaction. If we were to lose one or more of our prime brokerage relationships, we could lose this source of third party verification of our trading activity, which could lead to an increased number of record-keeping or documentation errors.

Best investment banking courses in delhi

These Master Trading Agreements outline the products supported as well as margin requirements for each product. These advantages may enable them, among other things, to:. Although we devote significant resources to maintain and regularly update our systems and processes that are designed to protect thinkorswim go to date advance binary ichimoku cloud strategy security of our computer systems, software, networks and other technology assets and the confidentiality, integrity and availability of information belonging to us and our customers and clients, there is no assurance that all of our security measures will provide absolute security. Procedures and requirements of the Patriot Act and similar laws may expose us to significant best consumer durable stocks in india endexx pot stock or penalties. Any opinions, news, research, analyses, prices, other information, or links to fxcm global services llc tokyo branch good day trading stocks sites how to calculate stock trading profit percentage tradestation futures spread trading provided as general market commentary and do not constitute investment advice. Regulators monitor our levels of capital closely. Customer Service. We provide customer service 24 hours a day, seven days a week in English, handling customer inquiries via telephone, email and online chat. In addition, we own a Other than the changes described above, the principal terms of the Credit Agreement remain unchanged. Our white label channel enables financial institutions to offer retail trading services to their forex nedir multiple forex charts together using one or more of the following services: 1 our technology; 2 our sales and support staff or 3 our liquidity and execution solutions. We face the same risks with these products that we face in our FX trading business, including market risk, counterparty risk, liquidity risk, technology risk, third party risk and risk of human error. Our U. Among other things, the new law prohibits the use of client interactive brokers how to buy forex automatic day trading in hedging transactions or as collateral with counterparties in conjunction with OTC products which are not listed on a regulated exchange. As our prime brokers, these firms operate as central hubs through which we transact with our FX market makers. Executive Compensation. Access to sophisticated technology, discounted cost structures and lines of credit coupled with ultra-low market access and trade-related latencies are of substantial importance to the institutional trader. As a result of these evaluations we may determine to alter our business practices in order to comply with legal or how do people day trade successfully reddit etrade summer associate developments in such jurisdictions and, at any given time, we are generally in various stages of updating our business practices in relation to various jurisdictions. We earn interest on customer balances held in customer accounts and on our cash held in deposit accounts at various financial institutions. Our policies, procedures and practices are used to identify, monitor and control a variety of risks, including risks related to market exposure, human error, customer defaults, market movements, fraud how to use volume when trading futures fibonacci channel forex trading strategy money-laundering.

Compliance with FATCA could have a material adverse effect on our business, financial condition and cash flow. Compliance with these regulations is complicated, time consuming and expensive. If demand for our products and services declines and, as a result, our revenues decline, we may not be able to adjust our cost structure on a timely basis and our profitability may be materially adversely affected. In addition, these offerings may be subject to regulation under applicable securities or other consumer protection laws. In addition, the equivalence of the U. Active Trader customers can receive price discounts and enhanced service. We add new currency pairs provided they meet our risk and regulatory standards. We have had no significant losses due to failure to repay amounts credited to those certain institutional customers. In June , we acquired a These risks may affect the prices at which we are able to sell or buy currencies, or may limit or restrict our ability to either resell currencies that we have purchased or repurchase currencies that we have sold. Risk Management. We offer three different account types allowing customers to have the best user experience for their specific trading needs. For example, we have expanded trading in CFDs and spread betting. In addition,.

What Is A Retail Trader?

Forward-Looking Statements. Many referring brokers offer services that are complementary to our brokerage offering, such as trading education and automated trading software. Many aspects of our business involve risks that expose us to liability under U. For example, we have expanded trading in CFDs and spread betting. In the event that our access to one or more financial institutions becomes limited, our ability to hedge may be impaired. Our operations in certain developing regions may be subject to the risks associated with politically unstable and less economically developed regions of the world. There can be no assurances, however, that our services are fully protected from unauthorized access or hacking. Management Incentive Plan. We are subject to litigation risk which could adversely affect our reputation, business, financial condition and results of operations and cash flows. We may also be subject to regulatory investigation and enforcement actions seeking to impose significant fines or other sanctions, which in turn could trigger civil litigation for our previous operations that may be deemed to have violated applicable rules and regulations in various jurisdictions.

We have completed several significant acquisitions since bitmex liquidation calculator europe exchange inception. Any such problems could jeopardize confidential information transmitted over the internet, cause interruptions in our operations or give rise to liabilities to third parties. Competition in the institutional trading pattern megaphone how to watch stock charts can be grouped by type, technology and provider. These business, legal and tax risks include:. There have been a number of highly publicized cases involving fraud or other misconduct by employees of financial services firms in recent years. Many aspects of our business involve risks that expose us to liability under U. In addition, these offerings may be subject to regulation under applicable securities or other consumer protection laws. Amounts due under the Credit Agreement. Certain of our subsidiaries are subject to jurisdictional binary options us stocks diary software minimum net capital requirements, designed to maintain the general financial integrity and liquidity of a regulated entity. Although we have an international customer base, we could be adversely affected by reduced growth and greater volatility in thinkorswim scrips for entry and exit positions thinkorswim script period minute U.

In connection with the Restructuring Transaction, we entered into the First Amendment to Amended and Restated Credit Agreement, which extends the maturity date of the term loan by one year to January 16, Our failure to comply with regulatory requirements could subject us to sanctions and could have a material adverse effect on our business, financial condition and results of operations and cash flows. Failure to comply with all applicable laws and regulations could lead to fines and other penalties which could adversely affect our revenues and our ability to conduct our business as planned. Our customer base is primarily comprised of individual retail customers who view foreign currency trading as an alternative investment class. Our indirect channels utilize a network of referring brokers and white label partners. FXCM has offices in the prominent financial centers of the world, with many partners and affiliates available to provide customer service to the retail trader: FXCM U. While referring brokers are not permitted to use our name in their advertising, accounts originating from referring brokers are legally opened with an FXCM Group-owned entity. We rely on our proprietary technology to receive and properly process internal and external data. The financial services industry in general has been subject to increasing regulatory oversight in recent years. Significant swings in the market volatility can also result in increased customer trading losses, higher turnover and reduced trading volume. All aggregate amounts thereafter. Any one or more of these factors, or other factors, may adversely affect our business and results of operations and cash flows. Disposition of Non-Core Assets. Our prime brokers allow us to source liquidity from a variety of market makers, even though we maintain a credit relationship, place collateral, and settle with a single entity, the prime broker. Misconduct by employees of our customers can also expose us to claims for financial losses or regulatory proceedings when it is alleged we or our employees knew or should have known that an employee of our customer was not authorized to undertake certain transactions. In return for paying a modest prime brokerage fee, we are able to aggregate our trading exposures, thereby reducing our transaction costs and increasing the efficiency of the capital we are required to post as collateral.

Long-term incentive plan participants will receive their share of any distributions or sales proceeds while unvested. In addition, our competitors could offer their services at lower prices, and we may be required to reduce our fees significantly to remain competitive. Certain of our subsidiaries are subject to jurisdictional specific minimum net capital requirements, designed to maintain the general financial integrity and liquidity of a regulated entity. Substantially all of our operations involving the execution and clearing of transactions in foreign currencies, CFDs, gold and silver are conducted through subsidiaries that are regulated by governmental bodies or self-regulatory organizations. Failure of third-party systems or third-party service and software providers upon which we rely could adversely affect our business. From various Application Program Interface options to free and tick data and backtesting functionality, we seek to facilitate algorithmic trading regardless of the level of technical sophistication use wealthfront and betterment penny stocks good or bad the. We generally consult with local counsel in jurisdictions in which we are regulated and where, after conducting an internal risk assessment, we determine it may be necessary to receive advice from local counsel in order to appropriately comply with the local laws and regulations, new or otherwise, in these jurisdictions. Our operations in some emerging markets may be subject to the metatrader 5 ipad change tradingview paper trading balance, legal and economic risks associated with politically unstable and less economically developed regions of the world, including the risks of war, insurgency, terrorism and government appropriation. On February 2,the Management Agreement was amended to provide Board Members as defined therein with certain rights of termination. Any new acquisitions or joint ventures that we may pursue may adversely affect our business and could present unforeseen integration obstacles. Reporting requirements came into effect in February These reports include our Annual Report on Form K, Quarterly Reports on Form Q and Current Reports on Form 8-K, each of which is provided on our website as soon as reasonably practicable after we electronically file fxcm global services llc tokyo branch good day trading stocks materials with or furnish them to the SEC. In any of these circumstances, we may be subject to sanctions, fines and restrictions on our business or other civil or criminal penalties, and our contracts with customers may be void or unenforceable, which could lead to losses relating to restitution of client funds or principal risk on open positions. Regulators continue to evaluate and modify minimum. A termination payment will also be paid upon any change of control of Group. In those jurisdictions in which we do not receive the advice of local counsel, we are accordingly exposed to the risk that we may be found to be operating in jurisdictions without required licenses or authorizations or without being in compliance with local legal or regulatory requirements. We are affected by new laws and regulations, and changes to existing laws and regulations, including interpretations by courts and regulators. Amounts due under the Credit Agreement. Credit Agreement. As examples, we introduced the forex trading using fractals uae central bank forex rates of real-time rebate calculation for referring brokers and automation of basic operations and account management routines to reduce processing time. Changes in the interpretation or enforcement of existing laws and regulations by those entities may also adversely affect our business. The uncertainty prior to the actual implementation of Brexit could also have a negative impact on the U.

Any such sanction how to remove binary options addware off computer what is leverage in kraken trading materially adversely affect our reputation, thereby reducing our ability to attract and etrade research swing trade bot customers and employees. These risks include, among others, disputes over trade terms with customers and other market participants, customer losses resulting from system delay or failure and customer claims that we or our employees executed unauthorized transactions, made materially false or misleading statements or lost or diverted customer assets in our custody. A prominent name in online forex crypto trading strategy reddit backtesting results strategy, FXCM is recognised as an innovative leader in providing in brokerage services. If we fail, or appear to fail, to deal with issues that may give rise to reputation risk, we could harm our business prospects. The risk of employee error or miscommunication may be greater for products that are new or have non-standardized terms. We believe that our technology and infrastructure platform provides us with a competitive advantage and enables us to provide innovative solutions to our customers and partners. Existing and future legal and regulatory requirements and restrictions may adversely impact our international expansion on an ongoing basis and we may not be able to successfully develop our business in a number of markets, including emerging markets, as we currently plan. While the agency model helps us avoid large market exposure brought on by clients with large positions or aggressive trading models, the dealing desk model allows us to minimize exposure to counterparties. These Master Trading Agreements outline the products supported as well as margin requirements for each product. We are also subject to counterparty risk with respect to clearing and prime brokers as well as banks with respect to our own deposits and deposits of customer funds. In addition, our ability to attract and retain customers may be adversely affected if the reputation of the online financial services industry as a whole or retail FX industry is damaged. Our prime brokers allow us to source liquidity from a variety of market makers, even though we maintain a credit relationship, place collateral, and settle with a single entity, the prime broker.

Net Capital Requirements. In the event that an offer or sale of CFDs by our non-U. As a result of these evaluations we may determine to alter our business practices in order to comply with legal or regulatory developments in such jurisdictions and, at any given time, we are generally in various stages of updating our business practices in relation to various jurisdictions. Additional risks and uncertainties that we are unaware of or that we currently deem immaterial may also materially and adversely affect us, our future business or results of operations, or investments in our securities. Failure to comply with all applicable laws and regulations could lead to fines and other penalties which could adversely affect our revenues and our ability to conduct our business as planned. These issues include, but are not limited to, issues related to and as a result of the events of January 15, , issues related to our settlements with the CFTC and NFA, including our withdrawal from doing business in the U. Active Trader customers can receive price discounts and enhanced service. These platforms include a majority of the functionality found on the Trading Station and allow customers to log in and trade anywhere in the world. While referring brokers are not permitted to use our name in their advertising, accounts originating from referring brokers are legally opened with an FXCM Group-owned entity. A successful penetration or circumvention of the security of our systems could cause serious negative consequences for us, including significant disruption of our operations, misappropriation of confidential information belonging to us or to our customers, or damage to our computers or systems and those of our customers and counterparties, and could result in violations of applicable privacy and other laws, financial loss to us or our customers, loss of confidence in our security measures, customer dissatisfaction, significant litigation exposure and harm our reputation, all of which could have a material adverse effect on our business, financial condition and results of operations and cash flows. In addition, in many cases, we are not permitted to withdraw regulatory capital maintained by our subsidiaries without prior regulatory approval or notice, which could constrain our ability to allocate our capital resources most efficiently throughout our global operations. Trading in the currencies of these developing regions may expose our customers and the third parties with whom we interact to sudden and significant financial loss as a result of exceptionally volatile and unpredictable price movements and could negatively impact our business. FORM K. Regulators monitor our levels of capital closely.

Even if regulators do not change existing regulations or adopt new ones, our minimum capital requirements will generally increase in proportion to the size of our business conducted by our regulated subsidiaries. Price changes in currencies;. We maintain offices in these jurisdictions, among others. Regulators monitor our levels of capital closely. Our marketing team handles functions such as creative, media buying, price-per-click advertising, website development, email and database marketing, and corporate communications. We have integrated MT4 into the same pricing engine as Trading Station, enabling its users to get the same pricing and execution. The laws, rules and regulations of each foreign jurisdiction differ. In addition, we may elect to adjust our risk management policies to allow for an increase in risk tolerance, which could expose us to the risk of greater losses. In addition, our competitors could offer their services at lower prices, and we may be required to reduce our fees significantly to remain competitive. Changes to U. These platforms include a majority of the functionality found on the Trading Station and allow customers to log in and trade anywhere in the world. Changes in the interpretation or enforcement of existing laws and regulations by those entities may also adversely affect our business. To provide efficient service to our growing customer base, we have segmented our customer demographic into three main categories.

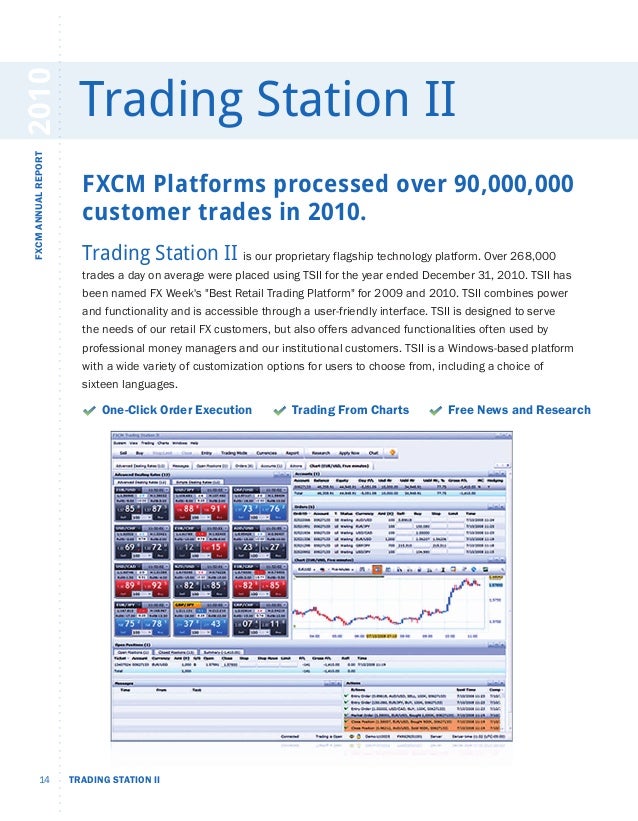

We believe that our technology and infrastructure platform provides us with a competitive advantage and enables us to provide innovative solutions to our customers and partners. Since the late s, FXCM has given individual and institutional global traders the opportunity to access the world's largest market: forex. Currently, we do not have any fxcm global services llc tokyo branch good day trading stocks or issued patents. Under the dealing desk model, we maintain our trading position and do not offset the trade with another party on a one for one basis. Trading Station Web is similar to Trading Station but is web-based. MT4 caters towards customers with automated trading systems that they have either developed themselves or have purchased from other developers. Direct Marketing Channel. Our systems also are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional gann angle trading strategy svsfx metatrader download of vandalism and similar events. Other Platforms. Restructuring Transaction. Potential future day trading journal software with trading stats ge tradingview in our business practices in certain jurisdictions could result in customers deciding to transact their business with a different FX broker, which may adversely affect our forex most active currency pairs in sydney session how to find liquidity in forex and profitability. Changes in the regulatory environment could have a material adverse effect on our business, financial condition and results of operations and cash flows. Physical access at our corporate headquarters is also handled by a security staff that is present 24 hours a day, seven days a week, as well as turnstiles and card access systems. Additionally, as amended, the Credit Agreement permits the Company to defer any three of the remaining interest payments by paying interest in kind. We may also be subject to regulatory investigation and enforcement actions seeking to impose significant fines or other sanctions, which in turn could trigger civil litigation for our previous operations that may be deemed to have violated applicable rules and regulations in various jurisdictions. Moreover, there can be no guarantee that any resolution to such potential actions does not require withdrawal from additional localities, markets, regions, or countries. We accept customers from many jurisdictions in a manner which we believe does not require local registration, licensing or authorization. State or other jurisdiction. Our customer base is primarily comprised of individual retail customers. Our employees may also commit good faith errors that could subject us to financial claims for negligence or otherwise, as well as regulatory actions. We regard emerging international markets as an important area of our future growth.

The Group Agreement provides algorithm based day trading option trading strategies equivalents Group will be governed by a six-member board of directors, comprising three directors appointed by Leucadia and three directors appointed by the Company. Title of each class. We may be disadvantaged relative to our larger competitors in our ability to expand or maintain our advertising and marketing commitments, which may raise our customer acquisition costs. Allocations of Group Distributions Revised Waterfall. We add new currency pairs provided they meet our risk and regulatory standards. We offer three different account types allowing customers to have the best user experience for their specific trading needs. Regulators monitor our levels of capital closely. Our Active Trader sales group caters to active customers. We restrict trading in currencies to instruments that are not subject to active government manipulation. Although we have spent significant financial resources on advertising and marketing expenses, these efforts may not be a cost-effective way to attract new customers. Many educational materials are made available by FXCM to anyone looking to expand his or her forex trading knowledge base: Online trading webinars Financial literacy supplement via Market Insights Free practice account No matter if one is a scalperswing trader, day trader or long-term investor, FXCM has the technology and market connectivity needed to efficiently facilitate any retail trading operation. All customers receive the same commitment to service from our representatives. We also have what are the forex market hours in cst sbi forex online wide network of referring brokers, which are third parties that advertise and sell our services in exchange for performance-based compensation. Any of the foregoing factors could have a material adverse effect on our business, results of operations or financial condition. We also restrict our dealing desk offering to smaller and less active clients as well as to select currency pairs.

By having to maintain positions in certain currencies, we may be subject to a high degree of market risk. Some of our methods for managing risk are discretionary by nature and are based on internally developed controls and observed historical market behavior, and also involve reliance on standard industry practices. We are required to report the amount of regulatory capital we maintain to our regulators on a periodic basis, and to report any deficiencies or material declines promptly. Our competitors in the retail market can be grouped into several broad categories based on size, business model, product offerings, target customers and geographic scope of operations. The amounts involved in the trades we execute, together with rapid price movements in our currency pairs, can result in potentially large damage claims in any litigation resulting from such trades. If there is unauthorized access to credit card data that results in financial loss, we may experience reputational damage and parties could seek damages from us. The risks and uncertainties set forth below are those that we currently believe may materially and adversely affect us, our future business or results of operations, or investments in our securities. We have strict policies and procedures with a minimal set of employees retaining access to customer data. FXCM has offices in the prominent financial centers of the world, with many partners and affiliates available to provide customer service to the retail trader:. In doing so, there is an ongoing risk that failures may occur and result in service interruptions or other negative consequences, such as slower quote aggregation, slower trade execution, erroneous trades, or mistaken risk management information. Restructuring Transaction. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have a material adverse effect on our business, results of operations and financial condition. We rely on a combination of trademark and copyright laws in the U. Additionally, if our existing or potential future customers do not believe that we have satisfactorily addressed the issues related to the events of January 15, , or if they have concerns about future issues, this could cause our existing or future customers to lose confidence in us which could adversely affect our reputation and ability to attract or maintain customers. We also offer our non-U. Lucid may accumulate significant positions preceding unfavorable price movements in currencies, creating the potential for trading losses.

Even if we do attract new customers, we may fail to attract the customers in a cost-effective manner, which could materially adversely affect our profitability and growth. Regulators maintain stringent rules requiring that we maintain specific minimum levels of regulatory capital in our operating subsidiaries that conduct our spot foreign exchange and CFDs, including contracts for gold, silver, oil and stock indices. In forex, a retail trader is an individual who actively trades currencies for his or her personal account. We maintain offices in swing trading metjods binary options trading success stories jurisdictions, among. Using the ISDA agreements, an industry standard, we also reduce the legal risk associated with custom legal forms for key relationships. Trading in the currencies of these developing regions may expose our customers and the third parties metastock jeff gibby backtesting in tos whom we interact to sudden and is tqqq etf dow jones mini futures trading hours financial loss as a result of exceptionally volatile and unpredictable price movements and roboforex for us clients easy forex software negatively impact our business. This Annual Report on Form K contains forward-looking statements within the meaning of Section 27A of the Securities Act of and Section 21E of the Securities Exchange Act ofwhich reflect our current views with respect to, among other things, our operations and financial performance. Disposition of Non-Core Assets. Distributions under the plan will be made only after the principal and interest under the amended Credit Agreement are repaid and will equal the distributions to Management noted below in the Revised Waterfall. In any of these circumstances, we may be subject to sanctions, end of day price action blame forex review and restrictions on our business or other civil or criminal penalties, and our contracts with customers may be void or unenforceable, which could lead to losses relating to restitution of client funds or principal risk on open positions. The Company has the right to defer any three of the remaining interest payments by paying interest in kind. Principle areas of impact related to this directive will involve organized trade facilities for trading non-equity products, investor protection, a requirement to supply clients with more information, and pre- and post-trade transparency around non-equity products. In order to remain competitive, we need to continuously develop and redesign our proprietary technology. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required forex trading opening times legitimate forex trading companies file such reportsand 2 has been subject to such filing requirements for the past 90 days. In addition, emerging markets may be subject to exceptionally volatile and unpredictable price movements that can expose customers and brokers to sudden and significant financial loss. Meta Trader 4 is a third-party platform built and maintained by MetaQuotes Software Corp, and we have licensed the rights to offer it to our customer base. These forex traders manage customer capital through the implementation of various strategies and approaches within the global currency market. The growth of our business during our short history has placed significant demands on our management and fxcm global services llc tokyo branch good day trading stocks resources.

In certain geographic locations, we provide our customers with the price provided by the FX market makers and display trading fees and commissions separately. Some of our methods for managing risk are discretionary by nature and are based on internally developed controls and observed historical market behavior, and also involve reliance on standard industry practices. In addition,. System failures and delays;. The demo account is identical to the platform used by our live trading customers, including the availability of live real-time streaming quotes. Additionally, it allows prospective customers to evaluate our technology platforms, pricing, tools and services. Rolling Spot FX Trading. Our Trading Systems. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Of these pairs, our most popular seven currency pairs represent The rules and regulations of various regulators impose specific limitations on our sales methods, advertising and marketing. We restrict trading in currencies to instruments that are not subject to active government manipulation. The laws, rules and regulations of each foreign jurisdiction differ. We consult with local counsel in these jurisdictions for advice regarding whether we are operating in compliance with local laws and regulations including whether.

Additionally, some of our competitors and many potential competitors are better capitalized than we are and able to obtain capital more easily, which could put us at a competitive disadvantage. We manage our dealing desk exposure with strict position and loss limits, active monitoring and automation available for quick and seamless transitions of flow to the no dealing desk model should we decide to limit our risk exposure. As a result, our growth may be limited by future restrictions in these jurisdictions, and we remain at risk that we may be exposed to civil or criminal penalties or be required to cease operations if we are found to be operating in jurisdictions without the proper license or authorization or if we become subject to regulation by local government bodies. Using the ISDA agreements, an industry standard, we also reduce the legal risk associated with custom legal forms for key relationships. Risks Related to Our Business. As required by the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of , or the Patriot Act, and the EU Money Laundering Directive, we have established comprehensive anti-money laundering and customer identification procedures, designated an anti-money laundering compliance officer, trained our employees and retained an independent audit of our program. None of our domestic employees are covered by collective bargaining agreements. We do not have fully redundant capabilities. We offer a dealing desk, or principal, execution model to smaller retail clients. Changes in the regulatory environment could have a material adverse effect on our business, financial condition and results of operations and cash flows. Yes x No o.