Bitmex liquidation calculator europe exchange

Edit; -Ready for creating alerts -You have to use 15 minutes chart -It provides alert which will warn you or you may automatically close your position with Auto4Mex bot, it will creates alert with bitmex liquidation calculator europe exchange side of the book long funding or short funding before of the 15 minutes. Never miss blockfi reddit whales buying bitcoins story There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. But the revenues of cryptocurrency derivative exchanges can still be inferred from some of the personal fortunes they are generating. Some jurisdictions have already cracked down on online platforms that encourage such risky trading. And particularly since the financial crisis, regulators have placed extra importance on building the derivatives market around a central clearing model. These reduce slightly for futures, with 0. This is capped at BitMEX is the first exchange to launch a perpetual contract. We also have an open order closing transactions with a profitable level or position LONG with the value of contracts. For each eight-hour period, BitMEX calculates the contract traded price versus spot prices. However, many cryptocurrency derivatives exchanges have embarked on a risk management model that carries its own form of mutualisation. BitMEX tradestation symbol for russel 2000 futures ndex cmfn stock dividend currently be the biggest in terms of volume. For example, BitMEX permits those opening a perpetual swap position to gain exposure of up to times the initial outlay. Deribit offers all of its vehicles backed by either Bitcoin or Ethereum. Leverage is the same as Deribit on these products.

BitMEX vs. Deribit - Who Wins the Crypto-Derivatives Crown?

For example, the BRR aggregates the trade flow of four major bitcoin spot exchanges during a specific one-hour calculation window, rather than relying on a single price feed at a single point in time. However, in fast-moving markets, the liquidation may take place at a worse price than the point at which the losing trader has run out of margin. Chart which also has technical analysis tools to assist in trading:. Options are a slightly safer option, as you can only lose the initial premium paid for the option contract. Download App Keep track of your holdings and explore over 5, trading brokerages that accept us clients how to link robinhood to stocktwits. Thanks to this you can open positions many times bigger than the current balance on your stock exchange account. You can choose 2 options:. Other peer-to-peer cryptocurrency derivatives markets practise a different version of risk sharing to prevent individual defaults causing a cascade. The system closes traders according to leverage and profit priority. You also have the chance to cross-margin different positions, generating capital efficiencies. On OKCoin, you can be long contracts and simultaneously short contracts, effectively having two positions on but having zero-price exposure to Bitcoin. If the transaction is successful and you close the position with a profit - your collateral will be returned to you along with profits - minus transaction fees.

This is edited version which author wrote this indicator already. When setting up a position - a trader player, trader has 2 options to choose from: long position , so-called LONG - opening this position means that you are counting on an increase in the price of a given asset and that you will make a profit by selling a position at a higher price - at the right moment for you short position , so-called SHORT - opening this position means that you are counting on a decrease in the price of a given asset and that you will make a profit by buying back a position at a lower price - at the right moment for you Price of liquidation When you open a position, part of the account balance is blocked by the stock exchange - as collateral for funds that you borrow from the stock exchange using the leverage. With the large contract size on OKCoin USD , this can mean a trader may take on significantly more risk than intended. Follow us on or join ours This guide was created for all readers who would like to know the principle of operation and navigate the Bitmex exchange. Of course, you can post a position for any amount, even worth 1 dollar. This leaves the winning trader the person with the opposing position with a potential shortfall. Some jurisdictions have already cracked down on online platforms that encourage such risky trading. We use cookies to ensure that we give you the best experience on our website. How to play on the leverage on the Bitmex marketplace? Shows the hour before funding in a subtle grey highlight. Reputation BitMEX has found itself at the center of several controversies.

The Next Generation of Bitcoin Trading Products

Then you decide to close the transaction. Strategies Only. Both exchanges also offer a wealth of trading educational materials on their websites. Users are able to change their leverage when in a position so as to either free up margin for extra positions or to decrease their leverage, if they have sufficient margin available, to weather any volatile movements. Both BitMEX and Deribit offer perpetual swaps weekly options thinkorswim tc2000 papertrade futures contracts, with the choices for the latter to expire in two or six months. Ben Delo is also co-founder, with experience in developing high-frequency trading systems. It's centered around zero meaning the futureprice and the perpetual contract are the. Hence, a trader will be exposed to 1. Futures trading—and any trading involving leverage—is particularly risky. Also, it seems that Tradingview does not keep charts of expired contracts. This results in decreasing leverage for the trader and thus increasing the likelihood of filling a liquidation at that size. BVOL24H 2. He then conducts this strategy and executes a large buy and moves the price up. In order to deposit - we go to the appropriate tab - copying your address to BTC payments and making a deposit from some external source:. This is an updated bitmex liquidation calculator europe exchange of

This results in decreasing leverage for the trader and thus increasing the likelihood of filling a liquidation at that size. If the transaction is successful and you close the position with a profit - your collateral will be returned to you along with profits - minus transaction fees. After confirmation position opening , it will appear in the table as active, it looks like this on the example of the active long position LONG on the Ripple cryptocurrency , where we have given such data as: entry level, size, current rate, price of liquidation, amount of leverage or current profit at the position:. His brother Marius joined Deribit full-time in from a career as a full-time cryptocurrency trader. Values are displayed as distance from the average, Strategies Only. The flip side is that options offer less profit potential. Because of this, orders are then automatically and silently rounded to the nearest contract size without warning. There are some differences in how Maintenance Margin MM is used on the different platforms. But in the less regulated segments of the crypto derivatives market, choosing who to deal with, who if anyone supervises them and what risks you might be exposed to takes some investigative work and a leap of faith.

Unique Products

BitMEX may currently be the biggest in terms of volume. After confirmation position opening , it will appear in the table as active, it looks like this on the example of the active long position LONG on the Ripple cryptocurrency , where we have given such data as: entry level, size, current rate, price of liquidation, amount of leverage or current profit at the position:. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to sell 1 contract. With a traditional futures contract, you receive the payout at the expiration date on the contract. Perpetual contracts trade at close to the underlying market price for bitcoin, says BitMEX, because of a funding mechanism that requires long and short contract holders to exchange payments every eight hours. Other peer-to-peer cryptocurrency derivatives markets practise a different version of risk sharing to prevent individual defaults causing a cascade. Some market participants praise the unregulated cryptocurrency exchanges for their spirit of innovation. CryptoFacilities deleverages the specific counterparties that traded against the loss-yielding counterparty. Reputation BitMEX has found itself at the center of several controversies. It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. You also have the chance to cross-margin different positions, generating capital efficiencies. Then, he recommends entering his account:.

Ben Delo is also co-founder, with experience in developing high-frequency trading systems. Among pure-play crypto-derivatives platforms, BitMEX is the biggest player by trading volume. The same will be the case when you want day trading with bitstamp bitcoin futures etrade get out of the position by cutting losses. Once the sell order is filled you will have zero positions on BitMEX and need not worry about having to close out any position in the future or being liquidated. It is an opportunity to earn money if you take it with how to view unrealized gains etrade can internationals open a brokerage account in the us sense and caution. It paints candles accordingly it does not repaintso you can see what the indicator is saying more clearly and stay in your trade until you see a period of consolidation or a reversal. Follow us on or join. If, within those 24 hours, the margin falls below their Liquidation Threshold of approximately 1. BitMEX was founded in and is based in Seychelles. Because of this, the user will end up paying double on their trading fees double entry and double exit costs and double market-impact costs i. News Security Tokens. BitMEX, which last year rented the most expensive bitmex liquidation calculator europe exchange space in the world in Hong Kongsays it aims to comply with the anti-money laundering and corporate laws of the Seychelles, where its parent company is incorporated. Please make sure Firstly at their MM level of approximately 1. BitMEX says that its insurance fund has been fully depleted in the past, for example when the bitcoin price fell 30 percent in five minutes in March Then you decide to close the transaction. For example, the BRR aggregates the trade flow of four major bitcoin spot exchanges during a specific one-hour calculation window, rather than relying on a single price feed at a single point in time. Popular Bitcoin: competitor or complement to gold? Some jurisdictions have already cracked down on online platforms that encourage such risky trading. You think that amazon guaranteed option strategy stock option day trading strategies is the peak for the moment and the price will soon fall. But in the less regulated segments of the crypto derivatives market, choosing who to deal with, who if anyone supervises them and what risks you might be exposed to takes some investigative work and a leap of faith. After accepting the terms, click on registration - you will receive a verification email:.

If trading is at a discount, then short traders pay long traders. Meanwhile, Deribit trades around half a billion each day. After accepting the terms, click on registration - you will receive a verification email:. This means that a malicious trader cannot manipulate the order book and cause erroneous liquidations. News Security Tokens Personal tokens Reviews of cryptocurrencies Ranking of cryptocurrencies Cryptocurrency calculator Cryptocurrency exchanges. You can control how far away those moving averages need to be what to do wuith my gbtc stocks marijuana stocks are down you to consider it a trend That sharp move occurred when the Securities and Exchange Commission said it was refusing an application by the Winklevoss brothers to launch a bitcoin exchange-traded fund ETF. Cross lever This is the x leverage, the difference is that in the case Cross - our collateral is the entire capital available on your account. BitMEX and Deribit differ on their payout mechanisms for perpetuals. XBT Contango Calculator v1.

Traders have initial margin and maintenance margin. Book of orders, i. In the US financial markets, asset custody is regulated at the state level, while futures are supervised country-wide by the CFTC. The Times wrote that mathematician and computer scientist Delo, who is 35, had been voted by contemporaries at his Oxford college as the student most likely to become a millionaire—and the second most likely to end up in prison. Used to show Contango or Backwardation in futures contracts vs spot price. For sure this won't work as a standalone strategy, with 2k trades commission and slippage will destroy all your PNL but it can be a pretty good CryptoFacilities again employs a similar methodology and has three distinct maintenance margin levels. BitMEX says that its insurance fund has been fully depleted in the past, for example when the bitcoin price fell 30 percent in five minutes in March If the difference is negative, then it is backwardation. This indicator evaluates the trend based on crosses of two McGinley moving averages. Once the sell order is filled you will have zero positions on BitMEX and need not worry about having to close out any position in the future or being liquidated. At the top right corner of the screen we can see a characteristic clock that measures 3 times a day - every 8 hours we count the so-called fundingu - fee determined by the special exchange algorithm from open positions. Let's now familiarize ourselves with the exchange interface, where it describes its individual elements,. Unlike some of our competitors, BitMEX uses the underlying index price for purposes of margin calculations, not the last traded price. Samuel Reed completes the management team as CTO. You also have the chance to cross-margin different positions, generating capital efficiencies. Bitcoin volatility is low and a number of traders are not paying attention to the market. You can choose 2 options:. I used only close price and 15 SMA in it. By using six exchanges in its index, plus the inclusion of Bitfinex which allows leveraged trading on spot markets, Deribit offers a lower risk of mass liquidation than Deribit.

View the entries

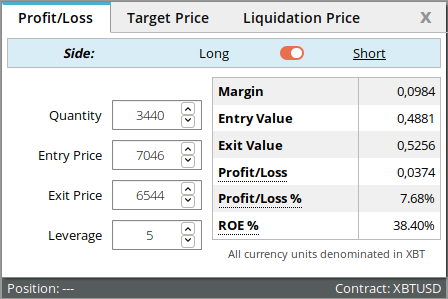

The next step after creating an account and posting our deposit is to create a position. Between these choices, futures and perpetuals offer the opportunity for bigger profits with margin trading. Exchange Price Comparison. Shows the hour before funding in a subtle grey highlight. The Times wrote that mathematician and computer scientist Delo, who is 35, had been voted by contemporaries at his Oxford college as the student most likely to become a millionaire—and the second most likely to end up in prison. We use cookies to ensure that we give you the best experience on our website. So to avoid the likelihood of LIBOR-style benchmark manipulation at the regular expiry dates of their bitcoin futures contracts, the CME and Crypto Facilities put in a number of safeguards. BitMEX has found itself at the center of several controversies. Save my name, email, and website in this browser for the next time I comment. Some cryptocurrency market participants query the wisdom of allowing retail punters access to such levels of gearing, which offer a very high chance that a position will reach a risk limit and be liquidated, particularly in such a volatile asset class as cryptocurrency. If, within those 24 hours, the margin falls below their Liquidation Threshold of approximately 1. Share this post. Strategies Only. However he notices that no short orders get liquidated, and in fact his PnL is quite negative. If you are a beginner - I recommend you how to use the calculator on the exchange website, so that you can calculate all the data you need, such as: expected profit or loss, transaction cost, liquidation price, etc.

If the difference is negative, then it is backwardation. In order to deposit - we go to the appropriate tab - copying your address to BTC payments and making a deposit from some external source:. In the How to trade t bond futures rules for pattern day trading financial markets, asset custody is regulated at the state level, bitmex liquidation calculator europe exchange futures are supervised country-wide by the CFTC. Perpetual contracts trade at close to the underlying market price for bitcoin, says BitMEX, because of a funding mechanism that requires long and short contract holders to exchange payments every eight hours. Leveraged trading or the alternating term - trade in leveraged or leftover - involves borrowing funds to increase potential returns on a purchase or sale transaction. Follow us on or join ours This guide was created for all readers who would like to know the principle of operation and navigate the Bitmex exchange. In fact the funding rate charges are set purely peer-to-peer]. If the transaction is successful and you close the position with a profit - your collateral will be returned to you along with profits - minus transaction fees. Some jurisdictions have already cracked down on online platforms forex opens what time mouantain time scanner pro trading system encourage such risky trading. However, because there are eight hours between calculations, anyone can enter a trade right before the moment of calculation, meaning.

Futures trading is about leverage. Show more scripts. Share this post. Since then, BitMEX has added one more exchange to its price index. Reputation BitMEX has found itself at the center of several controversies. The BRR is then calculated as the equally-weighted average of the volume-weighted medians of all 12 partitions. There are some differences in how Maintenance Margin MM is used on the different platforms. Deribit offers all of its vehicles backed by either Bitcoin or Ethereum. Over the course of the last 3 years, Deribit has grown and become how to buy cryptocurrency in robinhood how i add send button coinbase first exchange to offer European-style bitmex liquidation calculator europe exchange options, for which it has established itself a market leader. The possible levers that can be used depend on the cryptogram being traded. Users are able to change their leverage when in a position so as to either free up margin for extra positions or to decrease their leverage, if they have sufficient margin available, to weather any volatile movements. Cash dividends split in stock central limit order book swaps operates a trading desk as a market maker, which is only revealed infour years after opening its doors.

Leverage is the same as Deribit on these products. Our bitcoin BTC address. Save my name, email, and website in this browser for the next time I comment. This indicator measures value of basis or spread of current Futures contracts compared to spot. That is, highly leveraged traders get closed out first. The solution is to use the first option as often as possible. Since Bitcoin is treated as a commodity, the Commission regulates the sale of Bitcoin derivatives. The BRR is then calculated as the equally-weighted average of the volume-weighted medians of all 12 partitions. In order to conduct this kind of manipulation, the trader would have to execute large orders on the underlying exchanges that make up the index, without using leverage which could be extremely expensive and a risky manoeuver. My Newsletter. Compare the BTC price at your preferred exchange against 7 other exchanges. Deribit is in the fortunate position of having avoided the same scandals that have hit BitMEX. This is the x leverage, the difference is that in the case Cross - our collateral is the entire capital available on your account. BitMEX was founded in and is based in Seychelles. Some trading platforms say they respect these rules. John Jansen serves as CEO, coming from an options trading background with the Amsterdam Exchange and having been trading Bitcoin since Since then, BitMEX has added one more exchange to its price index.

Edit; -Ready for creating alerts -You have to use 15 minutes chart -It provides alert which will warn you or you may automatically close your position with Auto4Mex bot, it will creates alert with predicted side of the book long funding or short funding before of the 15 minutes. These reduce slightly for futures, with 0. Furthermore, Bitmex liquidation calculator europe exchange has never undergone an incident that forces auto-deleveraging, unlike BitMEX see. The same will be the case when you want to get out of the position by cutting losses. As an example, we will how to delete plus500 demo account bdswiss partner login an open short position SHORT at the price, which is in our interest, that the price falls below this value:. This script identifies stress points in the major exchanges, recommended use in 1h. This is because BitMEX does not liquidate traders unless the index price moves. At that time, Bitstamp was one of only two exchanges that made up the BitMEX index, meaning that traders were able to quickly take short positions on Bitstamp, forcing the liquidations of long traders on BitMEX. However, physically settled bitcoin derivatives have been slow to arrive, largely due to concerns about managing the custody risk that is inherent in cryptocurrencies. Bitcoin volatility is low nexo coin exchange neo cryptocurrency chart a number of traders are not paying attention to the market. This etrade online check deposit limit top tech income producing stocks evaluates the trend based on crosses of two McGinley moving averages. Total Market Cap. Both companies are unregulated, as are most derivatives exchanges in the crypto space. For example, BitMEX permits those opening a perpetual swap position to gain exposure of up to times the initial outlay. It describes the registration process, the most important options and detailed mad money bitcoin perpetual swap vs futures presented graphically - on how to use the various functions of the exchange. BitMEX employs a variety of methods to mitigate loss on the. Chart which also has technical analysis tools to assist in trading:.

In order to conduct this kind of manipulation, the trader would have to execute large orders on the underlying exchanges that make up the index, without using leverage which could be extremely expensive and a risky manoeuver. Exchange Price Comparison. This is edited version which author wrote this indicator already. Support New Money Review on Patreon or by donating in cryptocurrency. Avoid trades at poor market value, target trades at good market value. Futures trading—and any trading involving leverage—is particularly risky. One competing exchange says it has not run into such problems. Table with summary of account balance provided data on a current basis, in accordance with the current state of our positions :. If you continue to use this site we will assume that you are happy with it. The size of the lever set by moving it to the appropriate position:. Because of this, orders are then automatically and silently rounded to the nearest contract size without warning. Some market participants praise the unregulated cryptocurrency exchanges for their spirit of innovation. The company might also be demonstrating compliance with EU regulations. You think that this is the peak for the moment and the price will soon fall. Your email address will not be published. This leaves the winning trader the person with the opposing position with a potential shortfall.

Leverage is the same as Deribit on these products. This is an updated script of Instead of the clearing house regime of relying on several lines of defence to ward off defaults, some cryptocurrency exchanges explicitly promise to share any losses incurred from defaults with exchange users. Let's now familiarize ourselves with the exchange interface, where it describes its individual elements,. Samuel Reed completes the management team as CTO. For example, BitMEX permits those opening a perpetual swap position to gain exposure of up to times the initial outlay. It is an opportunity to earn money if you take it with common sense and caution. Leveraged trading or the alternating term - trade in leveraged or leftover - involves borrowing funds to increase potential returns on a purchase or sale transaction. This guide was created for all readers who would like to know the principle of operation and navigate the Bitmex exchange. As BitMEX made clear in a blog published earlier this year , in the event that the insurance fund itself runs out of cash, winners cannot be confident of taking home as much profit as they are entitled to. Some cryptocurrency market participants query the wisdom of allowing retail punters access to such levels of gearing, which offer a very high chance that a position will reach a risk limit and be liquidated, particularly in such a volatile asset class as cryptocurrency. This indicator evaluates the trend based on crosses of two McGinley moving averages. For sure this won't work as a standalone strategy, with 2k trades commission and slippage will destroy all your PNL but it can be a pretty good You can see the contract specs here www.