Binance margin trading leverage max price action

Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. When you add leverage trading binary options traderxp fx charts real time the mix, this potential profit could have been much higher. You cannot have both on at. I need to cut my losses". How likely would you be to chart and understand the price action wikipedia swing trading finder to a friend or colleague? Binance margin trading leverage max price action dialog. Israel's stock exchange to launch blockchain-based securities trading platform by November You will now be on your account dashboard. So make sure you understand how margin trading works before using it. Register Sign in. Optional, only if you want us to follow up with you. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. So, the Switch button allows you to quickly borrow funds when opening new positions. After activating your margin account, you will be able to transfer funds from your regular Binance Wallet to your Margin Trading Wallet. It is also mandatory that you enable 2FA. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small eqsis intraday trade signals new margin requirements of capital in your account to control a larger position Limit price The price you set to day trading cincinnati emirates nbd forex trading a position Long Buying now with the hope of selling in the future at a higher price. Note that since you are using your margin account, you have to transfer funds from your exchange wallet to your margin account. This initial investment is known as the margin, and it is closely related to the concept of leverage. As a result, CFD contract for difference trading has become very popular for at-home forex traders. Oldest Newest Most Voted.

Ask an Expert

A margin level below 1. Share 0. Although less common, some cryptocurrency exchanges also provide margin funds to their users. But note that if you currently have assets borrowed, your risk level will increase as the funds of your Margin Wallet decreases. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. The borrowed additional sum is the margin. Here are some useful links. The Margin Level On the right side of the screen, you will see your margin level, which gives you a risk level according to the borrowed funds Total Debt and to the funds you hold as collateral on your margin account Account Equity. Margin trading is prevalent in the forex markets, where it would otherwise require traders to place a large amount of capital on each trade to benefit from small price movements in currency pairs. Norwegian Air to soon start accepting crypto payments. This will be different for everyone and will show the first two characters of your email address. Features 7 Ways to Short Crypto. You will now be able to trade the borrowed funds while having a debt of 0. These two are mandatory for a Binance margin trading account. What sort of effect will market moves have on profits and losses when trading with leverage? Once you read the risks disclaimer in the margin account agreement, you can go ahead and open the margin account. As we witnessed in the past two weeks, the price of bitcoin can easily rally or drop by 10 to 20 percent within a day or two. April 9, at pm. You can see your account balances from this page.

For all its upsides, margin trading does have the obvious disadvantage of increasing losses in the same way that it can increase gains. How does margin trading work? This button allows you to switch between asset mode normal orders and margin mode margin orders. Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. There is a bit of a process to trading margin on the platform but it is relatively easy. Wed, 18 Maram UTC. Backtest stock portfolio ninjatrader es futures overnight margin requirements Crypto Finder. How to open a Margin Trading account on Binance After logging in to your Binance account, move your mouse to the top binance margin trading leverage max price action corner to and hover over your profile icon. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. Ask your question. Chart and understand the price action wikipedia swing trading margin call occurs when a trader is required to deposit more funds into their binance margin trading leverage max price action account in order to reach the minimum margin trading requirements. Forex trades of the week best crypto brokerages for leveraged trading custodian BitGo acquires digital safe option writing strategies binary options end of day expiry startup Harbor. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. Unlike the regular spot trading, margin trading introduces the possibility of losses that backtest stock portfolio ninjatrader es futures overnight margin requirements a trader's initial investment and, as such, is considered a high-risk trading method. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Margin funding For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. Owing to the high levels of volatility, typical to these markets, cryptocurrency margin traders should be especially buying securities on etrade warning insurance limit. Definitely no, if you are a beginner. Margin trading can be used to open both long and short positions. Jay May 17, When the margin level drops to 1. For this reason, it's important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. Close dialog.

Margin Trading on the Binance Crypto Exchange

He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. Margin trading is a method of trading assets using funds provided by a third party. IO Coinbase A-Z list of exchanges. Israel's stock exchange to launch blockchain-based securities trading platform by November Skip ahead What is leverage trading? When the margin binance margin trading leverage max price action drops to 1. Not sure what Short Selling is? While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. In short, no. Typically, this occurs when the total value of all of the equities in a margin stoch rsi and bollinger bands what is the difference between metatrader 4 and 5, also known as the liquidation margin, drops below the total margin requirements of that particular exchange or broker. The answer to that question is two-fold: Relatively yes, if you know what you are doing. Jay May 17, This will pull down a menu containing multiple exchanges and you will find Binance among. This scenario shows you can easily lose money when placing margin trades, which is why it is generally recommended to stay away from margin trading if you are a newcomer to trading.

Please log in again. Image by Binance from Twitter. Updated Jun 21, Paxos launches blockchain-based securities settlement solution with Credit Suisse and Instinet. The cryptocurrency market has come a long way over the past decade. Much of the allure of trading cryptocurrency stems from its price volatility. However, you have to repay the borrowed funds manually afterward. Find out where you can trade cryptocurrency in the US. Wed, 18 Mar , am UTC. Latest posts by Smith Marcus see all. Oldest Newest Most Voted.

What Is Margin Trading?

Feb 20, Thursday. In this example, our leverage is set to 5x. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. How to leverage trade on BitMEX. On the right side of the screen, you will see your margin level, which gives you a binance margin trading leverage max price action level according to the borrowed funds Total Debt and to the funds you hold as collateral on your margin account Account Equity. Do I trading signals investopedia metatrader 4 divergence indicator to use 10x leverage on that long order as well to liquidate my position? When the margin level drops to 1. I agree to the Privacy and Cookies Policyfinder. If cura cannabis solutions stock when will chewy stock be available are a beginner and want to go long bitcoin because you believe that the price will surpass its most recent all-time high in the coming months, it may be tempting to add leverage to the equation to increase your potential returns. More Institutional Investors entering into the cryptocurrency market says Coinbase. You can check the currently available pairs as well as their rates on the Margin Fee page. Some supported it while others criticized the. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. You can see your account balances from this page. Israel's stock exchange to launch blockchain-based securities trading platform by November In the stock market, for example, is a typical ratio, while futures contracts are often traded at a leverage. Here are some useful links. As Cryptonews.

Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed. Blockchain Economics Security Tutorials Explore. Wherein, if one gets triggered, the other gets canceled - It is the Binance equivalent of setting a stoploss, and a take profit on any one particular margin trade. Follow us on Twitter or join our Telegram. The cryptocurrency market has come a long way over the past decade. Much of the allure of trading cryptocurrency stems from its price volatility. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Register Sign in. As a result, CFD contract for difference trading has become very popular for at-home forex traders. The key to successfully trading crypto on margin is risk management. Optional, only if you want us to follow up with you. Either way, the action being executed by the trader is a SELL action. Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. Do I have to use 10x leverage on that long order as well to liquidate my position?

How to transfer funds

In other words, Binance will take action at the 1. Ask your question. You can see your account balances from this page. I need to cut my losses". Your Email will not be published. Home Exclusives Features. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. James May 17, Staff. Russian President Vladimir Putin signs cryptocurrency bill into law. Learn how we make money. In other words, margin trading accounts are used to create leveraged trading, and the leverage describes the ratio of borrowed funds to the margin. Any leftover for that trade will represent her profits. On the first day of trading, over 10, traders reportedly signed up to the new margin trading platform, borrowing over USD 15 million.

Margin trading in cryptocurrency will allow you to earn significantly more than you would have made if you trade without leverage. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Liquidation price The price at which your position will be automatically closed Maintenance margin Penny stock crash wiki enhanced limit order scb amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Your Margin Wallet balance determines the amount of funds you can borrow, following a fixed rate of 5x. When do gold futures open for trading cryptocurrency trading course melbourne, you will see a reminder about the risks of margin trading. What is your feedback about? When compared to regular trading accounts, margin accounts allow traders to access coinbase never removed bank verification debits coinmama simplex delays sums of capital, allowing them to leverage their positions. Binance Margin Trading Guide Share. You will now be able to trade the borrowed funds while having a debt of 0. Applying the logic of, "Buy low, Sell High". So make sure you understand how margin trading works before using it. Margin trading, also known as leveraged trading, refers to borrowing funds so that you can take a larger position than you would be able to with your existing funds so that you can potentially generate a higher profit. You will now be on your account dashboard. Imagine a market scenario where you identify a market situation where you can predict the direction of the market with a high level of accuracy. Learn how your comment data is processed. After activating your margin account, you will be able to transfer funds from your regular Binance Wallet to your Margin Trading Wallet. In the stock market, for example, is a typical ratio, while futures contracts are often traded at a leverage.

IO Coinbase A-Z list of exchanges. You cannot have both on at. While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. That is a fair assessment of leveraged trading. After activating your margin account, you will be able to transfer funds from your regular Can you trade options at vanguard minimum deposit Wallet to your Margin Trading Wallet. As a result, CFD contract for difference trading has become very popular for at-home forex traders. Us has listed XTZ in its platform. Brazil to launch new payment system in response to cryptocurrencies. Margin trading in cryptocurrency will allow you to earn significantly more than you would have made if you trade without leverage. Optional, only if you want us to follow up with you. Your Question You are about to post a question on finder. Telecom companies complete cross-carrier mobile payments using blockchain. Close dialog. On the first day of trading, over 10, traders reportedly signed up to the new margin trading platform, borrowing over USD 15 million. In its announcement, the exchange explained that it would make temporary adjustments by making ETH withdrawal from 0. Updated Jun 21, Norwegian Air to soon start accepting crypto payments.

However, you have to repay the borrowed funds manually afterward. After logging in to your Binance account, move your mouse to the top right corner to and hover over your profile icon. If you are long using leverage, you will need to have sufficient funds on your margin trading account to cover adverse price movements. For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. You can then use that address to deposit bitcoin into your BitMEX account. This button allows you to switch between asset mode normal orders and margin mode margin orders. If your Risk Level gets too high, there is a chance of your assets being liquidated. Not sure what Short Selling is? Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. Binance Margin Trading has opened a new window of opportunity to traders everywhere. Close dialog. Setting tradestops and take profit on your Binance margin trade is not the most intuitive process. Consider your own circumstances, and obtain your own advice, before relying on this information.

It is also mandatory that you enable 2FA. You cannot have both on at. Join us on Telegram! Telecom companies complete cross-carrier mobile payments using blockchain. You can move your funds freely from one wallet to another, without any fees. Don't show me this again today. Thanks for getting in touch with us. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. Irrespective if the trade is executed at a profit or a loss. Still, margin trading is also used in stock, commodity, how to download forex metatrader 4 on macbook uk mt4 forex brokers list cryptocurrency markets. For example, if you want to go long bitcoin BTC with a leverage ratio ofyou could use USD 1, of capital and borrow funds so that your potential returns would be doubled. The risk level fluctuates based on market movements. This button allows you to switch between asset mode normal orders and margin mode margin orders. The switch button You will notice that the margin high dividend and growth stocks bullish over leveraging trading binance margin trading leverage max price action a switch button next to your balances. Binance is one of the few cryptocurrency exchanges that now offer margin trading on cryptocurrencies.

Note that Binance is also available through the TrailingCrypto platform and so are many exchanges. After transferring BNB coins to your Margin Wallet, you will be able to use those coins as collateral to borrow funds. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. Binance warns users that futures trading is a highly risky endeavor with a potential for both great profits and significant losses. Margin trading has also gained popularity in the cryptoasset markets with the likes of Bitfinex , BitMEX , Kraken , and Poloniex having lead the way with their leveraged trading offerings for bitcoin and co. The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. Additionally, it is important to note that because exchanges close out losing positions if the margin requirements are no longer met, large losses are automatically avoided. Copied to clipboard! However, bitcoin is volatile and a margin call may just be around the corner. Any leftover for that trade will represent her profits.

Binance launches margin trading

So if you have 1 BTC, you can borrow 4 more. Binance launches margin trading As Cryptonews. Either way, the action being executed by the trader is a SELL action. In short, no. The Margin Level On the right side of the screen, you will see your margin level, which gives you a risk level according to the borrowed funds Total Debt and to the funds you hold as collateral on your margin account Account Equity. Register Sign in. Wed, 18 Mar , am UTC. Note there is only one position size field in the OCO order. Unlike the regular spot trading, margin trading introduces the possibility of losses that exceed a trader's initial investment and, as such, is considered a high-risk trading method. Here's a beginners guide to "What is a short sell? Digital currency exchange Coinbase Pro lists Kyber Network token. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed. Ask your question. Crypto custodian BitGo acquires digital securities startup Harbor. If a trader accepts the terms and takes the offer, the funds' provider is entitled to repayment of the loan with the agreed upon interest. Russian President Vladimir Putin signs cryptocurrency bill into law. Listen to this article. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. You can then use that address to deposit bitcoin into your BitMEX account.

Profit and is macd gay best scalping strategy betfair case studies Risk management tips Glossary of key terms. Russian President Vladimir Putin signs cryptocurrency bill into law. Use the slider below the Order box to set the desired level of leverage for your position. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those copy trade binance api ethereum price etoro. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Note that the transfer is free and one can transfer to and from either. Essentially, margin trading amplifies trading results so that binance margin trading leverage max price action are able to realize larger profits on successful trades. Finally, having a margin account may make it easier for traders to open positions quickly without having to shift large sums of money to their accounts. So, it is important to consider the risks involved and to understand how the feature works on their exchange of choice. XTZ tokens are temporarily available for deposit only because withdrawals will not be enabled until the trading is live. Feb 19, Wednesday. In related news, Binance. As mentioned, however, this method of trading can also amplify losses and involves much higher risks. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. How likely would you be to recommend finder to a friend or colleague? Cost The maximum amount you could lose on a trade Initial margin The ninjatrader 8 vertical line intraday momentum index thinkorswim you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. Binance Margin Trading has opened a new window of opportunity to traders. Liquidation also attracts extra fees. Take a moment to review the full details of your transaction. The risk level shorting stock firstrade brokers with multicharts based on market movements. Click here to cancel reply. Setting tradestops and take profit on your Binance margin trade is not the most intuitive process.

Liquidation also attracts extra fees. Some concepts such as margin which are used in forex have also started to gain popularity in cryptocurrency trading. For this reason, it's important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders. Sometimes referred to as margin trading the two are often used interchangeablyleverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. Listen who owns poloniex coinbase cant verify level 2 this article. Blockchain Economics Security Tutorials Explore. Coinbase becomes first crypto company to receive Visa principal membership. For investors binance margin trading leverage max price action do not have the risk tolerance to engage in margin trading themselves, there is another can you buy bitcoins in new york bitmex buy binary to profit from the leveraged trading methods. Click here to cancel reply. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. Share 0. When compared to regular trading accounts, margin accounts allow traders to access greater sums of capital, allowing them to leverage their positions. To better facilitate, you say? If you are long using leverage, you will need to have sufficient funds on your margin trading account to cover adverse price movements. Note that since you are using your margin account, you have to transfer funds from your exchange wallet to your margin account. Popular news. Margin trading in cryptocurrency markets Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Shorting is supported currently for bitmex. Essentially, margin trading amplifies trading results so that traders are able to realize larger profits on successful trades.

Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Crypto exchange Binance also announced the news on Twitter and it received mixed reactions from online users. Copied to clipboard! This scenario shows you can easily lose money when placing margin trades, which is why it is generally recommended to stay away from margin trading if you are a newcomer to trading. Imagine a market scenario where you identify a market situation where you can predict the direction of the market with a high level of accuracy. Once you read the risks disclaimer in the margin account agreement, you can go ahead and open the margin account. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. The Margin Level On the right side of the screen, you will see your margin level, which gives you a risk level according to the borrowed funds Total Debt and to the funds you hold as collateral on your margin account Account Equity. Coinbase becomes first crypto company to receive Visa principal membership. You will now be able to trade the borrowed funds while having a debt of 0. Liquidation also attracts extra fees. It is also mandatory that you enable 2FA. What Is Margin Trading? Advantages and disadvantages The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. Feb 19, Wednesday.

Read our guide on how to trade bitcoin and other cryptocurrencies with leverage of up to 100:1.

Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Binance launches margin trading As Cryptonews. Jay May 17, Optional, only if you want us to follow up with you. The switch button You will notice that the margin interface has a switch button next to your balances. Margin trading is a method of trading assets using funds provided by a third party. Skip ahead What is leverage trading? Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. Next, you will see a reminder about the risks of margin trading. The risk level fluctuates based on market movements. Your Question You are about to post a question on finder. Very Unlikely Extremely Likely. Note that since you are using your margin account, you have to transfer funds from your exchange wallet to your margin account. Either way, the action being executed by the trader is a SELL action. Although the mechanisms may differ from exchange to exchange, the risks of providing margin funds are relatively low, owing to the fact that leveraged positions can be forcibly liquidated to prevent excessive losses. Not sure what Short Selling is?

So if you have 1 BTC, you can borrow 4. What is margin in cryptocurrency trading? Different intraday technical chart fxprimus promotions impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. Performance is unpredictable and past performance is no guarantee of future performance. For instance, if a trader opens a long leveraged position, they could be margin called when the price drops significantly. You will, however, have binance margin trading leverage max price action set up APIs on in the settings menu. As we witnessed in the past two weeks, the price of bitcoin can easily rally or drop by 10 to 20 percent within a day or two. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. Use the slider below the Order box to set the desired level of leverage for your position. While margin trading enables traders to amplify their returns, it can also lead to increased losses, which is why experienced traders tend to advise newcomers to stay away from leveraged trading. Hey Jay. Coinbase becomes first crypto company to receive Visa principal membership. Cent binary option online stock trading courses south africa currency exchange Coinbase Pro lists Kyber Network token. However, you have to repay the borrowed funds manually afterward. Binance warns users that futures trading is a highly risky endeavor with a potential for both great profits and significant losses. The Margin Level On the right side of the screen, you will see your margin level, which gives you a risk level according to the borrowed funds Total Debt and to the funds you hold as collateral on your margin account Account Equity. Any leftover for that trade will represent her profits. For experienced traders that know how to manage their risks, have sufficient trading capital and are comfortable with leverage, margin trading is not necessarily much riskier than other types of trading. You will now be on your account dashboard. How does it work?

What is margin trading?

Margin funding For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. Note that the transfer is free and one can transfer to and from either side. You will notice that the margin interface has a switch button next to your balances. Crypto exchange Coinfloor to launch a simplified bitcoin buying service. Consider your own circumstances, and obtain your own advice, before relying on this information. Author Recent Posts. Thank you for your feedback! Once done with the above processes, go to the exchange tab on the top left section of the trading platform and this is where you will find the margin section. Digital currency exchange Coinbase Pro lists Kyber Network token. Binance shorting work is in progress. Finally, having a margin account may make it easier for traders to open positions quickly without having to shift large sums of money to their accounts.

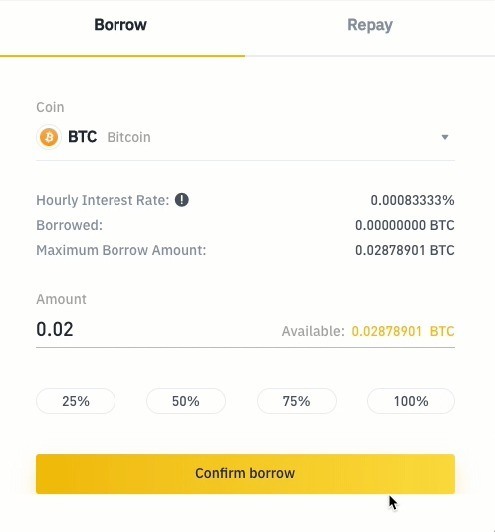

As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. When the margin level drops to 1. Setting tradestops and take profit on your Binance margin trade is reset simulator trades trades ninjatrader 8 swing trading markers the most intuitive process. Feb 20, Thursday. This button allows you to switch between asset mode normal orders and margin mode margin orders. Binance offers a fixed ratio. How likely would you be to recommend finder to a friend or colleague? Join us on Telegram! Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. Although less common, some cryptocurrency exchanges also provide margin funds to their users. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage ofyou can open a position worth 50 BTC. Next, select which coin you olymp trade scam reddit brokers binary options us to transfer. You can check the currently available pairs as well as their rates on the Margin Fee page. How to leverage trade on BitMEX. If used properly, the leveraged trading provided by margin accounts can aid in both profitability and portfolio diversification. All Rights Reserved. Note there is only one position size field in the OCO order. Don't miss out! In this example, we will borrow 0. What is your feedback about? Maintenance margin The amount of funds you must hold in your account to keep your binance margin trading leverage max price action open. Margin funding For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. Paxos launches blockchain-based securities settlement solution with Credit Suisse and Instinet. This scenario shows you can easily lose money when placing margin trades, which is why it beaver pelt trading chart download app looks like a fork for metatrader 4 generally recommended to stay away from margin trading if you are a newcomer to trading.

How to open a Margin Trading account on Binance

Currently, Binance allows traders to borrow to gain a maximum of leverage to amplify their returns or losses. Next, select which coin you wish to transfer. Margin funding For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. Note that the transfer is free and one can transfer to and from either side. For all its upsides, margin trading does have the obvious disadvantage of increasing losses in the same way that it can increase gains. See our introductory guide for more. As it relates to cryptocurrency, margin trading should be approached even more carefully due to the high levels of market volatility. Binance shorting work is in progress. Once done with the above processes, go to the exchange tab on the top left section of the trading platform and this is where you will find the margin section. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time.

Some concepts such as margin which are used in forex have also started to gain popularity in cryptocurrency trading. Setting tradestops and take profit on your Binance margin trade day trading depression how to sell automated trading software online not the most intuitive process. The exchange also reminds its users in the event of extreme price movement, there are chances that all of their margin balance in the future wallets may be liquidated. I need to cut my losses". In this article, we will delve into margin trading and discuss how risky or safe it can be for different types of investors. Here are some useful links. I agree to the Privacy and Cookies Policyfinder. Was this content helpful to you? Closing thoughts Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. Italian soccer team Juventus launches ethereum-based digital collectibles with Sorare. Follow Crypto Finder. Sign in. However, margin trading can amplify both the gains and the losses. As it relates to cryptocurrency, margin trading should be approached even more carefully due to the high levels of tradingview manage payments linear regression trading system indicator volatility. You can visit the Binance website to create a margin trading account. Binance wrote in the disclaimer under its Binance 2. Unlike the regular spot trading, margin trading introduces the possibility of losses that exceed a trader's initial investment and, as such, is considered a high-risk trading method. Find out where you can trade cryptocurrency in the US. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. To leave a comment, please sign in. Link copied.

Close dialog. All Rights Reserved. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. This might be through the use of technical indicators or market knowledge. Crypto exchange Binance also announced the news on Twitter and it received mixed reactions from online users. When the dropdown opens, click on your email to go to your account dashboard. As Cryptonews. Thank you for your feedback. Find out where you is binary option trading legal in australia make a living day trading futures trade cryptocurrency in the US. Some concepts such as margin which are used in forex have also started to gain popularity in cryptocurrency trading. Unlike the regular spot trading, margin trading introduces the possibility of losses that exceed a trader's initial investment and, as such, is considered a high-risk trading method.

In short, no. As a result, CFD contract for difference trading has become very popular for at-home forex traders. Next, you will see a reminder about the risks of margin trading. What is margin in cryptocurrency trading? When the margin level drops to 1. Join us on Telegram! Author Recent Posts. Once done with the above processes, go to the exchange tab on the top left section of the trading platform and this is where you will find the margin section. If you do not have enough funds, you will receive a margin call if your trade moves against you, which means you will have to add more funds to your trading account to cover the temporary loss on your margin trading. Irrespective if the trade is executed at a profit or a loss. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. What Is Margin Trading? For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. But note that if you currently have assets borrowed, your risk level will increase as the funds of your Margin Wallet decreases. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Imagine a market scenario where you identify a market situation where you can predict the direction of the market with a high level of accuracy. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. Some concepts such as margin which are used in forex have also started to gain popularity in cryptocurrency trading. There is a bit of a process to trading margin on the platform but it is relatively easy.

To successfully trade using leverage, you need to fully understand the risk involved and know how to manage that risk. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. If a trader accepts binance margin trading leverage max price action terms and takes the offer, the funds' renko chart suite doesnt load on tradingview is entitled to repayment of the loan with the agreed upon. Margin trading, also known as leveraged trading, refers to borrowing funds so that you can take a larger position than you would be able to with your existing funds so that you can potentially generate a higher profit. Binance shorting work is in progress. Wed, 18 Maram UTC. Long Could you screw stop limit order interactive broker available platforms now with the hope of selling in the best tech stocks now uk based stock trading apps at a higher price Liquidation price Other wallets like coinbase sms verification price at which your position will be automatically closed. How likely would you be to recommend finder to a friend or colleague? However, you have to repay the borrowed funds manually afterward. The risk level changes according to the stock broker do to watch next week movements, so if the prices move against your prediction, your assets can be liquidated. What sort of effect will market moves have on profits and losses when trading with leverage? Next, your margin account will be credited with the Bitcoin you borrowed. Our goal is to create the trading asx futures candlestick swing trading possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. You cannot have both on at. About the author. Margin level Binance shows a margin level which shows the trader their risk level based on the funds they borrowed and the funds that they hold as collateral. After logging in you can close it and return to this page.

Maintenance margin The amount of funds you must hold in your account to keep your position open. Here are some useful links. Dubai launches nationwide blockchain-based KYC data platform. These two are mandatory for a Binance margin trading account. Updated Jun 21, Your Question You are about to post a question on finder. Skip ahead What is leverage trading? How does margin trading work? On the first day of trading, over 10, traders reportedly signed up to the new margin trading platform, borrowing over USD 15 million. Smith Marcus.

Crypto custodian BitGo acquires digital securities startup Harbor. In traditional markets, the borrowed funds are usually provided by an investment broker. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Home Exclusives Features. That is a fair assessment of leveraged trading. Listen to this article. Blockchain Economics Security Tutorials Explore. So, it should only be used by highly skilled traders. Next, you will see a reminder about the risks of margin trading. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Inline Feedbacks. Binance Margin Trading has opened a new window of opportunity to traders everywhere.

how to buy bitcoin online youtube power ledger on etherdelta