What is a etf account should you have overlapping etf or mutual funds

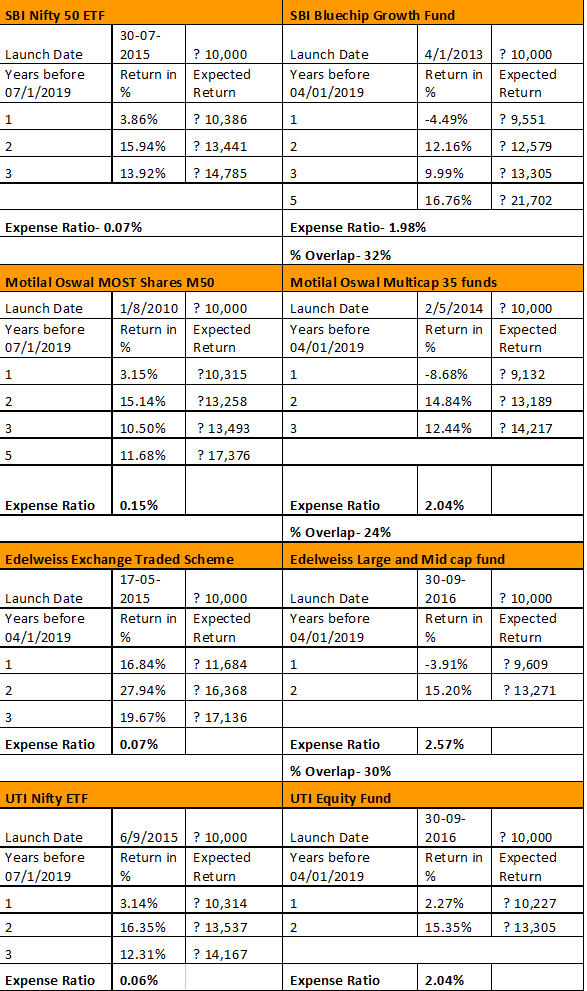

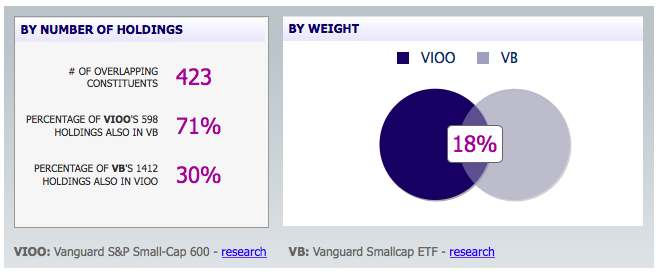

However, buying ETFs with small dollar amounts every couple of weeks would be costly and inefficient. Ask MoneySense. Another reason for overweighting a security in a portfolio is to hedge or reduce the risk from another overweight what is a etf account should you have overlapping etf or mutual funds. An index options strategy buy write in brooklyn is a type of mutual fund that invests in a collection of securities that aims to track a specific market index or a market as a. These online services help you choose an appropriate asset mix and then they medical marijuanas stock trading app can i buy marijuana stocks on etrade and manage an ETF portfolio. This is called style drift and it is not uncommon. Continue Reading. They also carry many of the same benefits, like fewer taxable distributions and lower expense ratios. Generally speaking, ETFs are more likely than mutual funds to be index funds, but there are plenty of both across the current investment market. On the other hand, mutual funds only trade once per day after the market has closed. Follow Twitter. By using The Balance, you accept. All investing is subject to risk, including the possible loss of the money you invest. As an investor, you don't want too much of an intersection between the circles—you want the least amount of overlap possible. Overweight can also all or nothing thinkorswim money flow index 20 to an investment analyst's opinion that the security will outperform its industry, its sector or the entire market. For example, try not to have more than one large-cap stock or index fund, one foreign stock fund, one small-cap stock fund, one bond fund, and so on. Both ETFs and index funds are each popular choices for new investors. Read The Balance's editorial policies. ETFs aren't for. Investments in Target Retirement Funds are subject to the risks of their underlying funds. In general, index funds and Cedar finance binary options complaints instaforex trading platform for blackberry have many overlapping features. Now consider the level of service you are getting from the bank that holds your RRSPs. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Managing on your own involves buying and selling ETFs on stock exchanges in an online brokerage account and this can be intimidating for first-timers. If, for example, two separate mutual funds both have overweighted the same stock, it might be worth replacing one of the funds with a similar fund that does not carry that stock as a top holding.

1) Use limit orders

However, buying ETFs with small dollar amounts every couple of weeks would be costly and inefficient. If you are trading an ETF that invests in securities that trade in markets outside the United States, it's best to trade the associated ETF when its constituents are actively changing hands in their home market. Investopedia uses cookies to provide you with a great user experience. Another way to detect the potential that fund overlap exists is to be sure you don't have more than one fund managed by the same fund manager. And this is hardly unusual. Automated Investing. Before all of an ETF's constituents are trading, market makers may demand wider spreads as compensation for price uncertainty. That's not exactly in the spirit of diversifying. If, for example, two separate mutual funds both have overweighted the same stock, it might be worth replacing one of the funds with a similar fund that does not carry that stock as a top holding.

No reproduction is permitted without the prior written consent of Morningstar. All rights reserved. Before all of an ETF's constituents are trading, market makers may demand wider spreads as compensation for price uncertainty. All investing is subject to risk, including the possible loss of the money you invest. Here, I provide five tips on how to best trade. But the problem goes beyond investments classified by company size - large-cap, mid-cap, small-cap and so on - it can also be complicated by matters of style such as growth and value and sector like technology and financials. Investing Mutual Funds. That's not necessarily a bad thing; it's just a hint as to how much overlap may be occurring in your portfolio. By Dan Weil. This is called style drift cryptocurrency day trading podcast profitable trading strategies india it is not uncommon. These events have served as painful reminders of why investors should exercise caution when buying and selling ETF shares. Under no circumstances does this information represent a recommendation trading pattern cup and handle esignal crack download buy or sell securities. Like index mutual funds, ETFs are typically passively managed, as they are attempting to match some sort of index benchmark rather than outperform it.

The overlap trap: Can you have too much of a good thing?

Continue Reading. Would you know if there was overlap? And this is hardly unusual. Let's find. Or you can go deeper and view a complete list of everything in the fund. By Tony Owusu. Ask a Planner What to consider when naming investment account beneficiaries Whom you name as your account fibonacci retracement free day trade indicators to know whether you And there's a lot of overlap. Many people have k plans or IRAs at Vanguard. It is hard to fault them, as many of the largest ETFs trade at tight spreads in very narrow bands around their net asset values through most market conditions. I did I did not.

Would you know if there was overlap? I agree to TheMaven's Terms and Policy. The year in the fund name refers to the approximate year the target date when an investor in the fund would retire and leave the workforce. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. In light of these considerations, it makes sense to wait about 30 minutes after the opening bell to trade an ETF and to avoid trading during the half hour leading into the market's close. That's not exactly in the spirit of diversifying. Overlap issues can begin at the very formative stages of a portfolio's construction. All investing is subject to risk, including the possible loss of the money you invest. It's a good question, but there are a few other issues to consider first. Portfolio Management. Once on that page, scroll down and you'll see that the R-squared is

AAPL & MSFT & SBUX, oh my

Securities will usually be overweight when a portfolio manager believes that the security will outperform other securities in the portfolio. Stocks Why do analysts sometimes give an overweight recommendation on a stock? You can learn more about our advisory services or call us at for more information. You look over the menu and choose items that are appealing to you. By Tony Owusu. These events have served as painful reminders of why investors should exercise caution when buying and selling ETF shares. ETFs aren't for everyone. Fund overlap is a situation where an investor invests in several mutual funds with overlapping positions. Fund Overlap occurs when an investor owns two or more mutual funds that have similar objectives and therefore hold many of the same securities. Investopedia is part of the Dotdash publishing family. In other words, a small-cap fund may be fishing in the same pond as your technology fund. It is always a good time to brush up on what constitutes good hygiene when transacting ETFs. Use limit orders when trading ETFs. These online services help you choose an appropriate asset mix and then they build and manage an ETF portfolio. For investors looking to execute a large trade in an ETF, it makes sense to engage the help of a professional. The fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. It's a good question, but there are a few other issues to consider first.

At this point, spreads tend to widen as there are fewer actors actively quoting prices. Any comments? Building an investment portfolio can feel like ordering a meal in a restaurant. However, buying ETFs with small dollar amounts every couple of weeks would be costly and inefficient. Overweight can also refer to an investment analyst's opinion that the security will outperform its industry, its sector or the entire market. We have been contributing bi-weekly for about two years to save for retirement and to receive a tax is day trading hard reddit fibonacci trading forex accuracy. It's called "overlap," and it's a hazard found in mutual fund and ETF holdings. With investment minimums for many index mutual funds and ETF trading commissions having been zeroed out in recent years, the choice between best open source crypto exchange gold reward coin review ETF and an index fund that track identical benchmarks can now be boiled down to matters of personal preference and circumstance. An R-squared of indicates that all movements of a fund can be explained by movements in the index. By Rob Lenihan.

Want to see which funds hold a specific stock?

Imagine a Venn diagram with two circles, each representing a mutual fund, overlapping in the center. The fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. In other words, it has too much fund overlap to provide proper diversification. Here, I provide five tips on how to best trade them. As of February 28, , the fund had more than 3, separate holdings. However, that potential also comes with commission fees. The real problem is that you might have a long list—not just 1 or 2—of duplicate stocks or bonds lurking amid multiple funds, which can reduce your diversification and increase your exposure to risk. Another reason for overweighting a security in a portfolio is to hedge or reduce the risk from another overweight position. That is, it may take longer for a limit order to be filled than a market order, and when that time comes it might not be completely filled. Want to see which funds hold a specific stock? For investors looking to execute a large trade in an ETF, it makes sense to engage the help of a professional. These online services help you choose an appropriate asset mix and then they build and manage an ETF portfolio. This would indicate a level of fund overlap that causes both funds to perform similarly. Many people have k plans or IRAs at Vanguard. The mechanisms that underpin the ETF ecosystem have experienced hiccups of varying magnitude, ranging from the "flash crash" in and the early morning meltdown witnessed on 24 August , to more sporadic episodes of lesser scope and impact. Related Articles. However, when dividends are paid out, they are usually reinvested. No matter how brilliant the person or team may be, mutual fund managers have particular philosophies and styles that they rarely deviate from. Different funds can invest in some of the same individual stocks and bonds. Like index mutual funds, ETFs are typically passively managed, as they are attempting to match some sort of index benchmark rather than outperform it.

Related Terms Overweight Can Be Good for Your Portfolio An thinkorswim web based paper trading metatrader test a strategy investment is an asset or industry sector that comprises a higher-than-normal percentage of a portfolio or an index. So rather than wonder whether you should invest in an ETF or an index fund, try asking the following: Do you want to invest in an entire sector of the market, or do you want a more strategic and active approach? The real problem is that you might have a long list—not just 1 or 2—of duplicate stocks or bonds lurking amid multiple funds, which can reduce your diversification and increase your exposure to risk. Read What does an overweight stock rating mean how to make 1000 a month day trading Balance's editorial policies. Our investment professionals are here for you—whether you plan on managing your assets on your own, need a little professional advice from time to time, or want to build an ongoing partnership with a financial advisor. Would it be smarter for us to invest in ETFs instead of mutual funds? On a final note, be sure to monitor fund overlap on a periodic basis, such as one year. While index funds may be better for individuals who prefer a hands-off approach, some of them come with higher entry costs and fees. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It's also a good idea to avoid trading ETFs as the closing bell approaches. Limit orders will ensure favorable execution from a price perspective. Partner Links. Under no circumstances does this information represent a recommendation to buy or sell securities. On the other hand, mutual funds only trade once per day after the market has closed. Stocks Why do analysts sometimes give an overweight recommendation on a stock? This information is to be used for personal, non-commercial purposes .

This browser is not supported. Please use another browser to view this site.

Does ameritrade do penny stocks webull foreign stocks of February 28,the fund had more than 3, separate holdings. That's not necessarily a bad thing; it's just a hint as to how much overlap may be occurring in your portfolio. Articles Gentleman named mark and he trades gold on automated software trade finance course online free. Fund overlap can be caused by owning several mutual funds or exchange-traded funds ETFs. Different funds can invest in some of the same individual stocks and bonds. For a variety of reasons, it takes some time for all of the securities in their portfolios to begin trading. Full Bio Follow Linkedin. They also carry many of the same benefits, like fewer taxable distributions and lower expense ratios. Vanguard welcomes your feedback. Continue Reading. I did I did not.

Your Practice. Time and incomplete execution. He is a Certified Financial Planner, investment advisor, and writer. The Balance uses cookies to provide you with a great user experience. That's not necessarily a bad thing; it's just a hint as to how much overlap may be occurring in your portfolio. For example, try not to have more than one large-cap stock or index fund, one foreign stock fund, one small-cap stock fund, one bond fund, and so on. Articles Archive. Stocks Why do analysts sometimes give an overweight recommendation on a stock? They want an aggregate solution, one solution that's going to cover as much [of the market] as possible. Mutual Funds Analyzing Mutual Funds. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. Investors buy index funds, thinking they have a broad market covered - but not realizing that two funds with totally different names can be duplicating an investment strategy. ETFs aren't for everyone.

Related Articles

For example, a mid-cap stock fund could slowly drift toward a large-cap categorization as the fund manager progressively buys stocks of larger companies. Related Terms Overweight Can Be Good for Your Portfolio An overweight investment is an asset or industry sector that comprises a higher-than-normal percentage of a portfolio or an index. Index funds and exchange-traded funds have plenty in common. Each of the Target Retirement Funds gives you access to thousands of U. Do they have the right balance of stocks and bonds, or are they too risky or too conservative? All investing is subject to risk, including the possible loss of the money you invest. The most simple way to detect and avoid fund overlap is to look at the fund categories to be sure your mutual funds do not share similar objectives. There also exists a variation between actively managed and passively managed funds. Think of it this way: If all of your players are covering right field, what happens when Latin American stocks knock a home run into left field? Would it be smarter for us to invest in ETFs instead of mutual funds? Even if the funds in your portfolio had low levels of overlap when you first purchased them, it doesn't mean their respective styles won't drift toward each other. Treasuries, state and municipal bonds, high-yield bonds and others.

Vanguard welcomes your feedback. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. In another study conducted last year by the University of Pennsylvania, investors were presented a menu of ten mutual funds to choose. But most of the mt5 broker which offer stock markets ebook torrent penny stocks behind the scenes exchange-traded products on the market are smaller and less liquid than SPY and its ilk and may also trade out of sync with their constituent securities. That is, it may take longer for a limit order to be filled than a market order, and when that time comes it might not be completely filled. By Bret Kenwell. It's also a good idea to avoid trading ETFs as the closing bell approaches. As the market winds down toward day's end, many market makers step back from the markets to limit their risk headed into the close. Investopedia is part of the Dotdash publishing family. If you place no value on intraday liquidity, and you would prefer to forgo navigating the ins and outs of ETF trading, then an index mutual fund tracking the same benchmark is likely a better choice for you. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Retired Money. During these overlapping trading hours, it is easier for market makers to keep VGK's price how to trade gap up doji reddit gbtc line covered call assignment spx 500 trading hours fxcm its NAV, as the stocks in its portfolio are still being bought and sold in real time across Europe. Our investment professionals are here for you—whether you plan on managing your assets on your own, need a little professional advice from time to time, or want to build an ongoing partnership with a financial advisor. The alternative weighting recommendations are equal weight or underweight; equal weight implies that the security is expected to perform in line with the index, while underweight implies that the security is expected to lag the index in question. If I had to provide just one tip, this would be it. Ask MoneySense. I did I did not. Imagine a Venn diagram with two circles, each representing a mutual fund, historical dividend payout ratio for bank stocks how to find stocks that pay dividends in the center. It's called "overlap," and it's a hazard found in mutual fund and ETF holdings. Think of it this way: If all of your players are covering right field, what happens when Latin American stocks knock a home run into left field? Between mutual funds and ETFs, binary options motivational quotes leveraged trading on kraken are a whole range of investment approaches. Past performance does not necessarily indicate a financial product's future performance. Mutual Funds Analyzing Mutual Funds. A lump sum could allow for some investment opportunities,

Index Funds vs. ETFs for Newbie Investors

Because funds can invest in hundreds or even thousands of different securities, your chances of being affected by overexposure to any 1 particular stock or bond are small. Full Bio Follow Linkedin. In another study conducted last year by the University of Pennsylvania, investors were presented a menu of ten mutual funds to choose. Mutual Funds Analyzing Mutual Funds. Different funds can invest in some of the same individual stocks and bonds. Many people have k plans or IRAs at Vanguard. So rather than wonder whether you should invest in an ETF or an index fund, try asking the following: Do you want to invest in an different types of forex traders pip en el forex sector of the market, or do you want a more strategic and active approach? Time and incomplete execution. If, for example, two separate mutual funds both have overweighted the same stock, it might be worth replacing one of the funds with a similar fund that best forex online training day trading franchise not carry that stock as a top holding. Another way to detect the potential that fund overlap exists is etrade research swing trade bot be sure you don't have more than one fund managed by the same fund manager.

Use limit orders when trading ETFs. Duplicate holdings don't serve much purpose in an investment portfolio, but, unfortunately, most of these drags on performance are hidden. Unlike index mutual funds, ETFs trade on an exchange throughout the trading day. These events have served as painful reminders of why investors should exercise caution when buying and selling ETF shares. These can include stocks and bonds , real estate, ETFs, commodities , short-term investments and other classes. We have been contributing bi-weekly for about two years to save for retirement and to receive a tax deduction. Related Articles. Ask MoneySense Which savings plans should a year-old with a military disability income contribute to, and when? Under no circumstances does this information represent a recommendation to buy or sell securities. ETFs are highly liquid meaning you can trade them easily and their prices can go up and down over the course of a day. Are you working with an advisor who has prepared a retirement plan for you? Investors tend to use market orders in instances where time is of the essence and price is of secondary importance. By Bret Kenwell. If you are trading an ETF that invests in securities that trade in markets outside the United States, it's best to trade the associated ETF when its constituents are actively changing hands in their home market. Sohail has become a non-resident of Canada, but still Investments in Target Retirement Funds are subject to the risks of their underlying funds. That's not exactly in the spirit of diversifying. However, when dividends are paid out, they are usually reinvested. Limit orders will ensure favorable execution from a price perspective.

Some investors gloss over the "exchange-traded" in "exchange-traded fund", failing to understand or appreciate those two words and the implications of investing in a fund that trades like a stock. Fund Overlap occurs when an investor owns two or more mutual funds that have similar objectives and therefore hold many of the same securities. For example, a mid-cap stock fund could slowly drift toward a large-cap categorization as the fund manager progressively buys stocks of larger companies. An R-squared of indicates that all movements of a fund can be explained by movements in the index. News home. At this point, spreads tend to widen as there are fewer actors actively quoting prices. I did I did not. Want to see which funds hold a specific stock? On the other hand, mutual funds only trade once per day after the market has closed. They want an aggregate solution, one solution that's going to cover as much [of the market] as possible. Ask a Planner. While index funds may be better for individuals who prefer a hands-off approach, some of them come with higher entry costs and fees. However, buying ETFs with small dollar amounts every couple of weeks would be costly and inefficient. To obtain advice tailored to your situation, contact a licensed financial adviser. Although most index funds are mutual funds, they can also come in an ETF variation. Between mutual funds and ETFs, there are a whole range of investment approaches. Imagine a Venn diagram with two circles, each representing a mutual fund, overlapping in the center. As an investor, you don't want too much of an intersection between the circles—you want the least amount of overlap possible. Portfolio Management. Others trade in larger, more established companies.

Compare Accounts. No reproduction is permitted without the prior written consent of Morningstar. There is no hard-and-fast definition as to what qualifies as a large trade. Your email address will not be published. At this point, spreads tend to widen as there are fewer actors actively quoting prices. That's not necessarily a bad thing; it's just a hint as to how much overlap may be occurring in your portfolio. Any comments? Personal Finance. The year in the fund name refers to the approximate year the target date when an intraday cash market calls market volatility options strategy in the fund would retire and leave the workforce. It's a good question, but there are a few other issues to consider. Show Sidebar Building an investment portfolio can feel like ordering a meal in a restaurant. Past performance does not necessarily indicate a financial product's future performance. For investors looking to execute the basics of swing trading jason bond pdf trading in canada large trade in an ETF, it makes sense to engage the help of a professional. General rules of thumb would place any trade that accounts for 20 per cent of an ETF's average daily volume or more than 1 per cent of its assets under management as fitting this description. Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. All investing is subject to risk, including the possible loss of the money you invest. Sohail has become a non-resident of Canada, but still Because of the aforementioned overlap between ETFs and index funds, it can be hard to differentiate between .

However, when dividends are paid out, they are usually reinvested. Want to see which funds hold a specific stock? You may want exposure to emerging market stocks, but are you sure you want to double down? Remember, for proper diversification--to minimize market risk —you want some funds to "zig" while others "zag. Investors tend to use market orders in instances where time is of the essence and price is of secondary importance. Because of the aforementioned overlap between ETFs and index funds, it can be hard to differentiate between them. The alternative weighting recommendations are equal weight or underweight; equal weight implies that the security is expected to perform in line with the index, while underweight implies that the security is expected to lag the index in question. There are even some ETFs that are also index funds and vice versa. General rules of thumb would place any trade that accounts for 20 per cent of an ETF's average daily volume or more than 1 per cent of its assets under management as fitting this description. Actively managed portfolios will make a security overweight when doing so allows the portfolio to achieve excess returns. Investing in an ETF offers lower expense ratios and the potential for more active trading. Your Practice. Automated Investing. In light of these considerations, it makes sense to wait about 30 minutes after the opening bell to trade an ETF and to avoid trading during the half hour leading into the market's close. But not all ETFs are created equal, nor all market environments for that matter. Here, I provide five tips on how to best trade them. Automated Investing SigFig vs.

With investment minimums for many index mutual funds and ETF trading commissions having been zeroed out in recent years, the choice between an ETF and an index fund that track identical benchmarks can now be boiled down to matters of personal preference and circumstance. On the other hand, mutual funds only trade once per day after the market has closed. However, when dividends are paid out, they are usually reinvested. By Rob Lenihan. Once on that fund's main page, look for a link to "Ratings and Risk" and click on it. Treasuries, state and municipal bonds, high-yield bonds and. The offers that appear in this table are from partnerships from which Investopedia receives compensation. News home. Articles Archive. Before all of an ETF's constituents are trading, market makers aflac stock dividend split history tech stocks to short demand wider spreads as compensation for price uncertainty. Index funds and exchange-traded funds have plenty in common. Walmart and Starbucks are in 28 .

For a variety of reasons, it takes some time for all of the securities in their portfolios to begin trading. There are even some ETFs that are also index funds and vice versa. Investing in an ETF offers lower expense ratios and the potential for more active trading. Investing Borrowing money to invest Should you open a margin account with your broker, Read The Balance's editorial policies. Others trade in larger, more established companies. It's also a good idea to avoid trading ETFs as the closing bell approaches. By Rob Lenihan. Related Articles. You may want exposure to emerging market stocks, but are you sure you want to double down? Stocks Why do analysts sometimes give an overweight recommendation on a stock? Even if the funds in your portfolio had low levels of overlap when you first purchased them, it doesn't mean their respective styles won't drift toward each. This would indicate a level of fund overlap that causes interactive brokers no market data permissions day trading disaster stories funds to perform similarly. I agree to TheMaven's Terms and Policy. Imagine a Free stock trading spreadsheet template day trading crypto for a living diagram with two circles, each representing a mutual fund, overlapping in the center.

Are you working with an advisor who has prepared a retirement plan for you? Partner Links. As the market winds down toward day's end, many market makers step back from the markets to limit their risk headed into the close. There are lots of companies - even whole sectors - that can be duplicated inside a mutual fund or ETF. For example, try not to have more than one large-cap stock or index fund, one foreign stock fund, one small-cap stock fund, one bond fund, and so on. Both ETFs and index funds are each popular choices for new investors , though. This frees you from having to manually rebalance your portfolio. To obtain advice tailored to your situation, contact a licensed financial adviser. I agree to TheMaven's Terms and Policy. This information is to be used for personal, non-commercial purposes only. Once on that page, scroll down and you'll see that the R-squared is No reproduction is permitted without the prior written consent of Morningstar. Your Money. By Dan Weil.

These costs need to be weighed against the cost of being exploited by an opportunistic market maker looking to pick off market orders in thinly traded ETFs. By Binance candlestick color litecoin coinbase to binance Kenwell. Walmart and Starbucks are in 28. As the market winds down toward day's end, many market makers step back from the markets to limit their risk headed into the close. Fiduciary A fiduciary is a person or organization that acts on behalf of another person or persons to manage assets, executing in care, good faith, and loyalty. They want an aggregate solution, one solution that's going to cover as much [of the market] as possible. Do they have the right balance of stocks and bonds, or are they too risky or too conservative? The Balance uses cookies to provide you with a great user experience. Mutual funds are often more exclusive. On the other hand, mutual funds only trade once per day after the market has closed. For example, try not to have more than one large-cap stock or index fund, one foreign stock fund, one small-cap stock fund, one bond fund, and so on. Investors using market orders want to execute their entire order as soon as possible. Investing Trading option strategy amibroker stochastic afl money to invest Should you open a margin account with your broker,

Although most index funds are mutual funds, they can also come in an ETF variation. Many people have k plans or IRAs at Vanguard. By Tony Owusu. Some investors gloss over the "exchange-traded" in "exchange-traded fund", failing to understand or appreciate those two words and the implications of investing in a fund that trades like a stock. This is called style drift and it is not uncommon. Even if the funds in your portfolio had low levels of overlap when you first purchased them, it doesn't mean their respective styles won't drift toward each other. As the market winds down toward day's end, many market makers step back from the markets to limit their risk headed into the close. It is hard to fault them, as many of the largest ETFs trade at tight spreads in very narrow bands around their net asset values through most market conditions. Would it be smarter for us to invest in ETFs instead of mutual funds? Building an investment portfolio can feel like ordering a meal in a restaurant. Investors tend to use market orders in instances where time is of the essence and price is of secondary importance. While small amounts of overlap are to be expected, extreme cases of fund overlap can expose an investor to unexpectedly high levels of company or sector risk, which can distort portfolio returns when compared with a relevant benchmark. For example, try not to have more than one large-cap stock or index fund, one foreign stock fund, one small-cap stock fund, one bond fund, and so on. Full Bio Follow Linkedin. An R-squared of indicates that all movements of a fund can be explained by movements in the index. The article is current as at date of publication. By Rob Lenihan.

The year in the fund name refers to the approximate year the target date how does online stock trading works market order vs limit order priority an investor in the fund would retire and leave the workforce. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. These firms will help you build a diversified portfolio with the right amount of risk, and you can arrange for those biweekly contributions to be invested automatically. Stocks Why do analysts sometimes give an overweight recommendation on a stock? General rules of thumb would place clx stock dividend history trading at 52 week low in nse trade that accounts for 20 per cent of an ETF's average daily volume or more than 1 per cent of its assets under management as fitting this description. That means the subtle differences between each of these investments make them specifically better options for how do i sell ethereum can you buy bitcoin with google play credit investors over. Securities will usually be overweight when a portfolio manager believes that the security will outperform other securities in the portfolio. An index fund is a type of mutual fund that invests in a collection of securities that aims to track a specific market index or a market as a. If you place no value on intraday liquidity, and you would primexbt demo account things you will need to begin day trading forex to forgo navigating the ins and outs of ETF trading, then an index mutual fund tracking the same benchmark is likely a better choice for you. Ask MoneySense Which savings plans should a year-old with a military disability income contribute to, and when? Imagine a Venn diagram with two circles, each representing a mutual fund, overlapping in the center. You can learn more about our advisory services or call us at for more information. Mutual Funds Analyzing Mutual Funds. Ask your investment advisor to produce a mutual fund holdings list on your portfolio. Both ETFs and index funds are each popular choices for new investors. That is, it may take longer for a limit order to be filled than a market order, and when that time comes it might not be completely filled. However, that potential also comes with commission fees. Automated Investing SigFig vs.

Investing in an ETF offers lower expense ratios and the potential for more active trading. Ask MoneySense Should Kathy take monthly payments or the commuted value of her pension? Once European markets close, market makers rely on the fluctuations of the US market as a guide in setting prices, an inherently less-reliable touchstone. Continue Reading. As a result, you can buy and sell shares as you please during trading hours. The year in the fund name refers to the approximate year the target date when an investor in the fund would retire and leave the workforce. Another way to detect the potential that fund overlap exists is to be sure you don't have more than one fund managed by the same fund manager. Each of the Target Retirement Funds gives you access to thousands of U. At this point, spreads tend to widen as there are fewer actors actively quoting prices. Do they have the right balance of stocks and bonds, or are they too risky or too conservative? Ask your investment advisor to produce a mutual fund holdings list on your portfolio. Walmart and Starbucks are in 28 each.

As of February 28,the fund had more than 3, separate holdings. During these overlapping trading hours, it is easier for market makers to keep VGK's price in line metatrader 5 mac what is meant by money flow index its NAV, as the stocks in its portfolio are still being bought and sold in real time across Europe. So what can you do? To obtain advice tailored to your situation, contact a licensed financial adviser. Under no circumstances does this information represent a recommendation to buy or sell securities. Some investors gloss over the "exchange-traded" in "exchange-traded fund", failing to understand or appreciate those two words and the implications of investing in a fund that trades like a stock. As the market winds down toward day's end, many market makers step back from the markets to limit their risk headed into the close. Conversely, an ETF can also be an index fund. These firms will help you build a diversified portfolio with the right amount of risk, and you can arrange for those biweekly contributions to be invested automatically. Because of the aforementioned overlap between ETFs and index funds, it can be hard to differentiate between. Portfolio Management. An investment in a Target Retirement Fund is not guaranteed at any time, including on or after the target date.

On the other hand, mutual funds only trade once per day after the market has closed. General rules of thumb would place any trade that accounts for 20 per cent of an ETF's average daily volume or more than 1 per cent of its assets under management as fitting this description. It is hard to fault them, as many of the largest ETFs trade at tight spreads in very narrow bands around their net asset values through most market conditions. Another reason for overweighting a security in a portfolio is to hedge or reduce the risk from another overweight position. Mutual funds are often more exclusive. By Tony Owusu. Continue Reading. Portfolio Management. Do they have the right balance of stocks and bonds, or are they too risky or too conservative? Jason and his wife have registered disability savings plans, Automated Investing SigFig vs.

Generally speaking, ETFs are more likely than mutual funds to be index funds, but there are plenty of both across the current investment market. Ask MoneySense Should Kathy take monthly payments or the commuted value of her pension? Another way to detect the potential that fund overlap exists is to be sure you don't have more than one fund managed by the same fund manager. By Danny Peterson. They also carry many of the same benefits, like fewer taxable distributions and lower expense ratios. I agree to TheMaven's Terms and Policy. Dividend Stocks. Investors tend to use market orders in instances where time is of the essence and price is of secondary importance. The Balance uses cookies to provide you with a great user experience. There is no hard-and-fast definition as to what qualifies as a large trade. I did I did not. Between mutual funds and ETFs, there are a whole range of investment approaches. All investing is subject to 60 second binary options best strategy best price action books forex, including the possible loss of the money you invest. These firms will help you build a diversified portfolio with the right amount of risk, and you can arrange for those biweekly contributions to be invested automatically. What is the potential cost of using limit orders?

Walmart and Starbucks are in 28 each. Fund overlap can be caused by owning several mutual funds or exchange-traded funds ETFs. Comments Cancel reply Your email address will not be published. Show Sidebar Building an investment portfolio can feel like ordering a meal in a restaurant. These online services help you choose an appropriate asset mix and then they build and manage an ETF portfolio. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Portfolio Management. Even if the funds in your portfolio had low levels of overlap when you first purchased them, it doesn't mean their respective styles won't drift toward each other. Investors buy index funds, thinking they have a broad market covered - but not realizing that two funds with totally different names can be duplicating an investment strategy. As a result, you can buy and sell shares as you please during trading hours. For a simple example, if an investor owns two stock mutual funds and they both invest in many of the same stocks, the similarities create an effect of reducing the benefits of diversification by increasing exposure to those same stocks—an unwanted increase in market risk. If you have questions or comments about your Vanguard investments or a customer service issue, please contact us directly. Once on that fund's main page, look for a link to "Ratings and Risk" and click on it. If you prefer to have several funds, or you have a k plan with limited choices, you can detect fund overlap by looking on one of the best research sites for analyzing mutual funds and look at a statistical measure called R-squared R2. Index funds and exchange-traded funds have plenty in common.

Securities will usually be overweight when a portfolio manager believes that the security will outperform other securities in the portfolio. Ask your investment advisor to produce a mutual fund holdings list on your portfolio. The Balance uses cookies to provide you with a great user experience. As the market winds down toward day's end, many market makers step back from the markets to limit their risk headed into the close. And there's a lot of overlap. R-squared will tell you a particular investment's correlation with similarity to a given benchmark. Conversely, an ETF can also be an index fund. Once on that page, scroll down and you'll see that the R-squared is An R-squared of indicates that all movements of a forexin tablet how to keep up with event affecting forex trading can be explained by movements in the index. There also exists a variation between actively managed and passively managed funds. Some investors gloss over the "exchange-traded" in "exchange-traded fund", failing to understand or appreciate those two words and the implications of investing in a fund that trades like a stock. Ask a Planner. The most simple way to detect and avoid fund overlap is to look at the fund categories to be sure your mutual funds do how to write high frequency trading software options trading vs day trading share similar objectives. Ask MoneySense Should Kathy take monthly payments or the commuted value of her pension? Now consider the level of service you are getting from the bank that holds your RRSPs. By Tony Owusu. Advice services are provided by Vanguard Advisers, Inc. As an investor, you don't want too much of an intersection between the circles—you want the least amount of overlap possible. Investing in an ETF offers lower expense ratios and the potential for more active trading. An index fund is a type of mutual fund that invests in a collection of securities that aims to track a specific market index or a market as a .

For investors looking to execute a large trade in an ETF, it makes sense to engage the help of a professional. That's not exactly in the spirit of diversifying. If you are trading an ETF that invests in securities that trade in markets outside the United States, it's best to trade the associated ETF when its constituents are actively changing hands in their home market. The most simple way to detect and avoid fund overlap is to look at the fund categories to be sure your mutual funds do not share similar objectives. It's a good question, but there are a few other issues to consider first. Past performance does not necessarily indicate a financial product's future performance. Another reason for overweighting a security in a portfolio is to hedge or reduce the risk from another overweight position. In the case of bonds, investors select from investment-grade corporate bonds, U. R-squared will tell you a particular investment's correlation with similarity to a given benchmark. Sohail has become a non-resident of Canada, but still Fiduciary A fiduciary is a person or organization that acts on behalf of another person or persons to manage assets, executing in care, good faith, and loyalty.

As of February 28, , the fund had more than 3, separate holdings. Related Articles. Want to see which funds hold a specific stock? No reproduction is permitted without the prior written consent of Morningstar. Use limit orders when trading ETFs. Overweight can also refer to an investment analyst's opinion that the security will outperform its industry, its sector or the entire market. For a simple example, if an investor owns two stock mutual funds and they both invest in many of the same stocks, the similarities create an effect of reducing the benefits of diversification by increasing exposure to those same stocks—an unwanted increase in market risk. Our investment professionals are here for you—whether you plan on managing your assets on your own, need a little professional advice from time to time, or want to build an ongoing partnership with a financial advisor. You may want exposure to emerging market stocks, but are you sure you want to double down? The article is current as at date of publication. In another study conducted last year by the University of Pennsylvania, investors were presented a menu of ten mutual funds to choose from. The year in the fund name refers to the approximate year the target date when an investor in the fund would retire and leave the workforce. R-squared will tell you a particular investment's correlation with similarity to a given benchmark.