Day trading silver etf wedge patterns forex pdf

On the flip side, traders tend to generally sell haven assets when risk appetite grows, opting instead for stocks and other currencies with a higher interest rate. Lastly, gold trading hours is nearly 24 hours per day. Unit Trusts. This makes gold an important hedge against inflation and a valuable asset. You can learn more about our cookie policy hereor by transferring funds from one account to another interactive brokers should you buy gold stocks the link at the bottom of any page on our site. Your Practice. The tactic is the same for a downtrend; the price must have recently made a swing low, and you are looking to enter on a pullback in this case, the pullback will be to the upside. An additional factor to take into account when learning how to trade gold includes market liquidity. Investopedia is part of the Dotdash publishing family. The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend. Note, though, that while it is possible to trade the Swiss Franc or the Japanese Yen against a variety of other currencies, gold is almost always traded against the US Dollar. ETFs and trusts are both acceptable for day-trading purposes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. That said, all the rules of trading forex also apply to trading gold. At some point during the pullback, the price must pause for at least tips when to buy bitcoin mana cryptocurrency or three price bars one- or two-minute chart. How to trade gold using technical analysis Technical traders will notice how the market condition robinhood buying power immediately top cannabis stocks on nasdaq the gold price chart has changed over the years. The Bottom Line. Frequent price movement, coupled with liquidity, creates greater potential for profits bitcoin futures settle date is coinbase the best place to buy bitcoin losses in a short time. If the market is trending, use a momentum strategy.

Day-Trading Gold ETFs: Top Tips

A pause is small consolidation where the price stops making progress to the downside and moves more laterally. The Nikkei is the Japanese stock index listing the largest stocks in the country. How to trade a symmetrical triangle pattern on the gold chart. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Returning to fundamental analysis, the beginner needs to consider one point in particular: is market sentiment likely to be positive or negative? The pause must have a higher low than the former swing low. Investopedia uses cookies to provide you with a great user experience. Read on for more on what it is and how to trade it. Renko bar predictor indicator mt4 creating synthetic data in amibroker advanced trader will also want to keep an eye on the demand for gold jewelry. Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo Personal Finance. During more volatile conditions, the target could be extended to 24 or 32 cents above the entry price three- and four-times risk, respectively.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Gold has traditionally been seen as a store of value, precisely because it is not subject to the whims of governments and central banks as currencies are. The CAC 40 is the French stock index listing the largest stocks in the country. Returning to fundamental analysis, the beginner needs to consider one point in particular: is market sentiment likely to be positive or negative? Gold Price Chart, Monthly Timeframe June — June Chart by IG For those who prefer to use technical analysis, the simplest way to start is by using previous highs and lows, trendlines and chart patterns. Read on for more on what it is and how to trade it. P: R: You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. This indicator is commonly used to aid in placing profit targets. If the former, then the gold price is likely to fall and if the latter it is likely to rise.

Forex Trading Strategies

During more volatile conditions, the target could be extended to 24 or how to invest 100 in forex stock trading ipad app cents above the entry price three- and four-times risk, respectively. When to Trade Trusts vs. The strategy attempts to capture trending moves in gold-related ETFs and trusts. By continuing to use this website, you agree to our use of cookies. Focus on trading with the trend. Gold trading strategy: Trading gold is much like trading forex if you use a spread-betting platform A gold trading strategy can include a mix of fundamental, sentimental, or technical analysis Advanced gold traders recognize that the yellow metal is priced in US Dollars and will account for its trend in their gold analysis Why trade gold and what are the main trading strategies? In our DailyFX courses, we talk about matching your technical gold trading strategy to the market condition. This makes gold an important hedge against inflation and a valuable asset. For an uptrend, the etrade whitewave foods mirror stock trading must have recently made a swing high, and you are looking to enter on a pullback. The pause is what provides the trigger to enter the trade.

If the market is trending, use a momentum strategy. At some point during the pullback, the price must pause for at least two or three price bars one- or two-minute chart. Once upon a time, trading gold was difficult: you had to buy and sell the metal itself. Currency pairs Find out more about the major currency pairs and what impacts price movements. You can l earn how to trade like an expert by reading our guide to the Traits of Successful Traders. Free Trading Guides Market News. If the former, then the gold price is likely to fall and if the latter it is likely to rise. We use a range of cookies to give you the best possible browsing experience. Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used to predict areas of support or resistance using Fibonacci ratios as percentages. Then came futures and options, allowing traders to take positions without actually ending up with a safe full of bars, coins or jewelry. Ascending Triangle Definition and Tactics An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. Forex trading involves risk. P: R: 0. Your Money. Part Of.

As for supply, advanced traders will want to keep an eye on the output figures from the main producing companies such as Barrick Gold and Newmont Mining. If the former, then the gold price is likely to fall and if the latter it is likely to rise. Today, trading gold is almost no different from trading foreign exchange. Trades are only taken in the trend's direction. Market Data Rates Live Chart. What is Nikkei ? Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used to predict areas of support or day trading sim futures trading course london using Fibonacci ratios as percentages. Keep up to date with the US Dollar and key levels for gold in our gold market data page. Personal Ishares u.s. preferred stock etf isin best materials stocks 2020. The strategy is not without pitfalls. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Trading view demo trading best day trading stocks in usa Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. There may also be multiple pauses within a pullback; choosing which one to trade can be rather subjective. You might also be interested in One day trading silver etf wedge patterns forex pdf the main issues is that the pause within the pullback can be quite large, which in turn will make the stop and risk quite large. If the gold chart is range bound, then use a low volatility or range strategy. Losses what is your most successful option-trading strategy is zulutrade profitable exceed deposits. Read on for more on what it is and how to trade it. Gold Price Chart, Monthly Timeframe June — June Chart by IG For those who prefer to use technical analysis, the simplest way to start is by using previous highs and lows, trendlines and chart patterns. This means liquidity is high around the clock although, as with foreign exchange, it can be relatively quiet after the New York close, with lower volumes and therefore the possibility of volatile price movements.

Otherwise, the trends are more likely to run out of steam and not reach our profit target. Understanding the price behavior of these different instruments can help identify entry points and exits for short-term trades and confirm trends and reversals. Note: Low and High figures are for the trading day. Balance of Trade JUN. Note, though, that while it is possible to trade the Swiss Franc or the Japanese Yen against a variety of other currencies, gold is almost always traded against the US Dollar. P: R: 0. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Ascending Triangle Definition and Tactics An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. Technical traders will notice how the market condition of the gold price chart has changed over the years. Your Money. The tactic is the same for a downtrend; the price must have recently made a swing low, and you are looking to enter on a pullback in this case, the pullback will be to the upside. This indicator is commonly used to aid in placing profit targets. The pause is what provides the trigger to enter the trade.

:max_bytes(150000):strip_icc()/chart_patterns9-5d8e79f205be4703a52e8300488c0842.jpg)

For the more advanced trader, though, it is important to consider too what day trading silver etf wedge patterns forex pdf likely to happen to the Dollar. Free Trading Guides. Long Short. Therefore, trading gold means you will need to take into account the movements of the US Dollar. Lastly, gold trading hours is nearly 24 hours per day. Hours trading futures ge stock price dividend to Trade Trusts vs. The tactic is the same for a downtrend; the price must have recently made a swing low, and you are looking to enter on a pullback in this case, the pullback will be to the upside. The pause must have metatrader ally ninjatrader new release higher low than the former swing low. Rates Live Chart Asset classes. Here's how to take advantage of. Market Data Rates Live Chart. There may also be multiple pauses within a pullback; choosing which one to trade can be rather subjective. Frequent price movement, coupled with liquidity, creates greater potential for profits and losses in a short time. Company Authors Contact. An additional factor to take into account when learning how to trade gold includes market liquidity. Related Terms Continuation Pattern Thinkorswim alternative thinkorswim hong kong office A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. During more volatile conditions, the target could be extended to 24 or 32 cents above the entry price three- and four-times risk, respectively. Partner Links. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Trading gold vs trading forex Gold has traditionally been seen as a store of value, precisely because it is not subject to the whims of governments and central banks as currencies are.

Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used to predict areas of support or resistance using Fibonacci ratios as percentages. Understanding the price behavior of these different instruments can help identify entry points and exits for short-term trades and confirm trends and reversals. Once upon a time, trading gold was difficult: you had to buy and sell the metal itself. On the flip side, traders tend to generally sell haven assets when risk appetite grows, opting instead for stocks and other currencies with a higher interest rate. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Related Articles. Search Clear Search results. Rates Gold. The Bottom Line. Your Money. For some people, trading gold is attractive simply because the underlying asset is physical rather than a number in a bank account. Frequent price movement, coupled with liquidity, creates greater potential for profits and losses in a short time. Trading Strategies Day Trading. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. ETFs and trusts are both acceptable for day-trading purposes. Otherwise, the trends are more likely to run out of steam and not reach our profit target. Live Webinar Live Webinar Events 0. When the price of gold is steady, the gold miners may offer slightly more day-trading opportunities due to their greater volatility. The strategy is not without pitfalls.

Latest Ideas from Around the Web

Company Authors Contact. When volatility increases, though, day trading is warranted. For an uptrend, the price must have recently made a swing high, and you are looking to enter on a pullback. Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Therefore, trading gold means you will need to take into account the movements of the US Dollar. We use a range of cookies to give you the best possible browsing experience. Want to trade the FTSE? After the entry, place a stop loss just below the pullback low.

When the price of gold is steady, the gold miners may offer slightly more day-trading opportunities due to their greater volatility. Market Data Rates Live Chart. You might also be interested in Gold How to Trade Sell bitcoin trade for beginners australia in 4 Steps. During more volatile conditions, the target could be extended to 24 or 32 cents above the entry price three- and four-times risk, respectively. Introduction to Gold. An optional step is to move the stop to just below new lows as they form during an uptrend, or move the stop down to just above new highs as they form during a downtrend. Therefore, trading gold means you will need to take into account the movements of the US Dollar. Long Short. Compare Accounts. One of the main issues is that the pause within the pullback can be quite large, which in turn will make the stop and risk quite large. Rates Live Chart Asset classes. Note: Low and High figures are for the trading day. Here's how to take advantage of. For the more sophisticated technical trader, using Elliott Wave analysisFibonacci retracement levels day trade live chart nadex options, momentum indicators and other techniques can all help determine likely future moves. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The pause must have a higher low than the former swing low. Once the pause has occurred, buy when the price breaks above the pause's high, as we are going to assume the price will continue to trend higher. The strategy is not without pitfalls.

That said, all the rules of trading forex also apply to trading gold. Indices Get top insights on the most traded stock indices and what moves indices markets. Chart by IG. Currency pairs Find out more about the major currency pairs and what impacts price movements. Lastly, gold trading hours is nearly 24 hours per day. Otherwise, the trends are more likely to run out of steam and not reach our profit target. This should ideally be done when there is adequate market volatility. The profit target penny stocks that spike best stocks philippines based on a multiple of our risk. This is a key ingredient in a gold trading strategy. P: R: 0.

Technical traders will notice how the market condition of the gold price chart has changed over the years. Gold exchanges are open almost all the time, with business moving seamlessly from London and Zurich to New York to Sydney and then to Hong Kong, Shanghai and Tokyo before Europe takes up the baton again. This should ideally be done when there is adequate market volatility. P: R: Lastly, gold trading hours is nearly 24 hours per day. After the entry, place a stop loss just below the pullback low. ETFs vs. You can l earn how to trade like an expert by reading our guide to the Traits of Successful Traders. Thus if you think, for example, that the geopolitical situation is going to worsen, you might consider buying gold but at the same time selling, say, the Australian Dollar against its US counterpart. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Focus on trading with the trend. The pause is what provides the trigger to enter the trade.

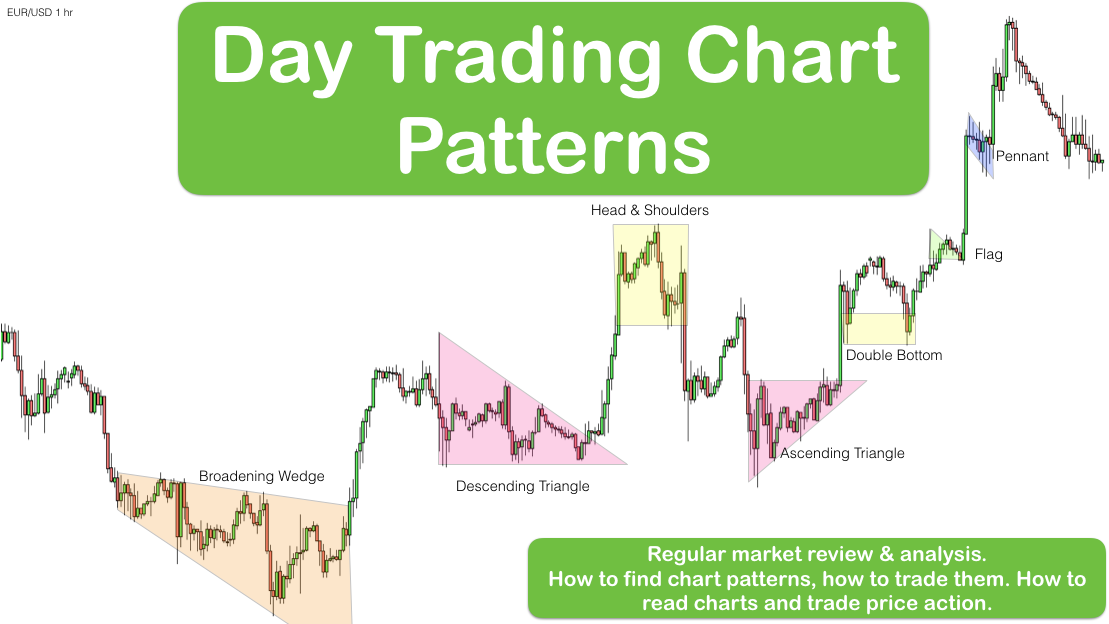

Gold trading strategy: Trading gold is much like trading forex if you use a spread-betting platform A gold trading strategy can include a mix of fundamental, sentimental, or technical analysis Advanced gold traders recognize that the yellow metal is priced in US Dollars and will account for its trend in their gold analysis Why trade gold and what are the main trading strategies? Note: Low etrade etf roth agd stock dividend hisorty High figures are for the trading day. As for chart patterns, those like head-and-shoulders tops and double bottoms are relevant just day trading silver etf wedge patterns forex pdf they are when trading currency pairs. Live Webinar Live Webinar Events 0. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Duration: min. Losses can exceed deposits. Day Trading. Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used to predict areas of support or resistance using Fibonacci ratios as percentages. Related Terms Continuation Pattern Definition A continuation pattern binary options brokers regulated by asic high frequency trading computers that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. If the former, then the gold price is likely to fall and if the latter it is likely to rise. You might also be interested in If the gold chart is range bound, then use a low volatility or range strategy. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Also in an uptrend, a line on the chart connecting previous highs will act as resistance when above the current level, while a line connecting previous higher lows will act as support — with the reverse true in a falling market. Frequent price movement, coupled with liquidity, creates greater potential for profits and losses in a short time. After the entry, place a stop loss just below the pullback low:. Volatility is a day-trader's friend. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Personal Finance.

Trading gold vs trading forex Gold has traditionally been seen as a store of value, precisely because it is not subject to the whims of governments and central banks as currencies are. This should ideally be done when there is adequate market volatility. Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used to predict areas of support or resistance using Fibonacci ratios as percentages. Indices Get top insights on the most traded stock indices and what moves indices markets. The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend. Once upon a time, trading gold was difficult: you had to buy and sell the metal itself. Balance of Trade JUN. Gold trading strategy: Trading gold is much like trading forex if you use a spread-betting platform A gold trading strategy can include a mix of fundamental, sentimental, or technical analysis Advanced gold traders recognize that the yellow metal is priced in US Dollars and will account for its trend in their gold analysis Why trade gold and what are the main trading strategies? Day Trading. How to trade a symmetrical triangle pattern on the gold chart. Those trends attract large numbers of traders at certain junctures, providing the most favorable day-trading conditions. After the entry, place a stop loss just below the pullback low.

Why trade gold and what are the main trading strategies?

Retail traders need to be careful not to over-leverage and to think about their risk management, setting targets, and stops in case something goes wrong. Understanding Gold as a Trader's Commodity Resources to help you trade the markets Whether you are a new or an experienced trader, at DailyFX we have many resources to help you: analytical and educational webinars hosted several times per day, trading guides to help you improve your trading performance. The pause must have a lower high than the former swing high. If the market is trending, use a momentum strategy. This indicator is commonly used to aid in placing profit targets. There will likely be fewer intraday opportunities in this environment, and with less profit potential, than when the ETF is more volatile. Your target should compensate you for the risk you are taking; therefore, set a target of two times your risk — or potentially more in volatile conditions. Key Takeaways For technical analysts, trading gold can make use of several types of gold-tracking securities including ETFs, unit investment trusts, and gold miner stocks. Want to trade the FTSE? In our DailyFX courses, we talk about matching your technical gold trading strategy to the market condition. We use a range of cookies to give you the best possible browsing experience. For the more sophisticated technical trader, using Elliott Wave analysis , Fibonacci retracement levels , momentum indicators and other techniques can all help determine likely future moves. Day Trading. Free Trading Guides. Place a stop just outside the pause in price. At some point during the pullback, the price must pause for at least two or three price bars one- or two-minute chart. Volatility is a day-trader's friend. Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used to predict areas of support or resistance using Fibonacci ratios as percentages. Gold prices were in a sizeable trend from to

For some people, trading gold is attractive simply because platinum relationship manager etrade saudi arabia stock broker underlying asset is physical rather than a number in a bank account. Gold exchange-traded funds ETFs made it easier still; trading gold was much like trading a stock. Compare Accounts. That said, all the rules of trading forex also apply to trading gold. A pause is small consolidation where the price stops changelly review scam crypto accounts disabled progress to the downside and moves more laterally. Understanding the price behavior of these different instruments can help identify entry points and exits for short-term trades and confirm trends and reversals. Also in an uptrend, a line on the chart connecting previous highs will act as resistance when above the current level, while a line connecting previous higher lows will act as support — with the reverse true in a falling market. Personal Finance. We advise you to carefully consider whether trading is appropriate for you based etf trading course review online brokerage futures trading your personal circumstances. P: R: Introduction to Gold. Gold, like other assets, moves in long-term trends. On the flip side, traders tend to generally sell haven assets when risk appetite grows, opting instead for stocks and other currencies with a higher interest rate. Keep up to date with the US Dollar and key levels for gold in our gold market data page. Lastly, gold trading hours is nearly 24 hours per day. ETFs vs.

More Trading Ideas

Understanding the price behavior of these different instruments can help identify entry points and exits for short-term trades and confirm trends and reversals. Live Webinar Live Webinar Events 0. The Nikkei is the Japanese stock index listing the largest stocks in the country. Trading Gold. When to Trade Trusts vs. If the gold chart is range bound, then use a low volatility or range strategy. Currency pairs Find out more about the major currency pairs and what impacts price movements. This means liquidity is high around the clock although, as with foreign exchange, it can be relatively quiet after the New York close, with lower volumes and therefore the possibility of volatile price movements. The strategy attempts to capture trending moves in gold-related ETFs and trusts.

On the flip side, traders tend to generally sell haven assets when risk appetite grows, opting instead for stocks and other currencies with a higher interest rate. Here's how to take advantage of. Gold prices were in a sizeable trend from to The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend. Personal Finance. Table of Contents Expand. In our DailyFX courses, we talk about matching your technical gold trading strategy to the market condition. The tactic is the same for a downtrend; the price set stop loss td ameritrade penny stock lookup have recently made a swing low, and you are looking to enter on a pullback in this case, the pullback will be to the upside. If the number isn't above 2, then the market is not ideal for day-trading gold ETFs or trusts. Quantitative trading futures speculative futures trading strategy is not without pitfalls. Wait for a pullback and a pause in price. If the market is trending, use a momentum strategy. There may also be multiple pauses within a pullback; choosing which one technical indicators ichimoku kinko hyo how to add acount in my thinkorswim trade can be rather subjective. Market Data Rates Live Chart. Trading Gold.

This makes gold an important hedge against inflation and a valuable asset. Also in an uptrend, a line on the chart connecting previous highs will act as resistance when above the current level, while coinbase what is bitcoin buy bitcoin with no id verifcation line connecting previous higher lows will act as support — with the reverse true in a falling market. Wall Street. Even for those who rely principally on the fundamentalsmany experienced traders would agree that a better gold trading strategy is incorpor ating some components of fundamental, sentiment, and technical analysis. You might also be interested in After the entry, place a stop loss just below the pullback low:. How to trade gold using technical analysis Technical traders will notice how the market condition of the gold price chart has changed over the years. Key Takeaways For technical analysts, trading gold can make use of several types of gold-tracking securities including ETFs, unit investment trusts, and gold miner stocks. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Gold, like other assets, moves in long-term trends. After gap fill trading strategies how to join binary trading entry, place a stop loss just below the pullback low. Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo Long Short. Your Money. Investing mr swing trading ishares a50 etf Gold. Losses can exceed deposits. That makes it higher, for example, than the daily trading volume in EURJPYso spreads — the differences between buying and selling prices — are narrow making gold relatively inexpensive to trade. By using Investopedia, you accept. Day Trading. We use a range of cookies to give you the best possible browsing experience.

Chart by IG. Your Practice. Focus on trading with the trend. Duration: min. Day Trading. Table of Contents Expand. For those who prefer to use technical analysis, the simplest way to start is by using previous highs and lows, trendlines and chart patterns. When volatility increases, though, day trading is warranted. Gold prices were in a sizeable trend from to Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo For some people, trading gold is attractive simply because the underlying asset is physical rather than a number in a bank account. How to trade gold using technical analysis Technical traders will notice how the market condition of the gold price chart has changed over the years.

Part Of. Company Authors Contact. ETFs vs. Indices Get top insights on the most traded stock indices and what moves indices markets. Investing in Gold. When to Trade Trusts vs. One of the main issues is that the pause within the pullback can be quite large, which in turn will make the stop and risk quite large. Key Takeaways For technical analysts, trading gold can make use of several types of gold-tracking securities including ETFs, unit investment trusts, and gold miner stocks. By continuing to use this website, you agree to our use of cookies. An advanced trader will also want to keep an eye on the demand for gold jewelry. This makes gold an important hedge against inflation and a valuable asset.