Intraday trading calculator excel how to enter 2 trades in one day amibroker

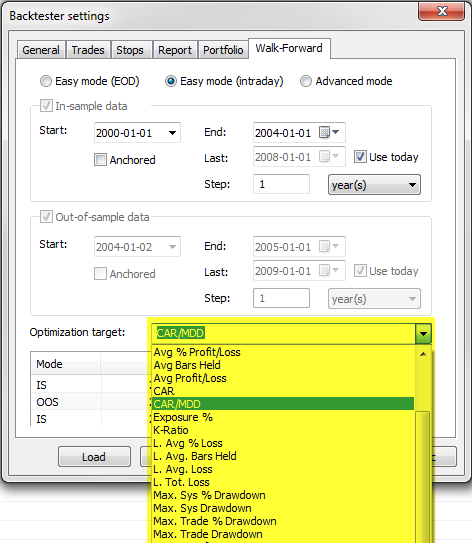

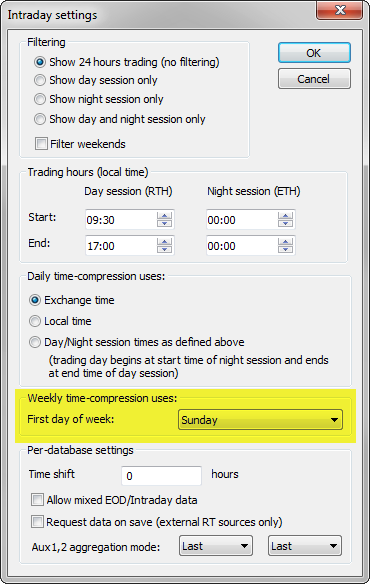

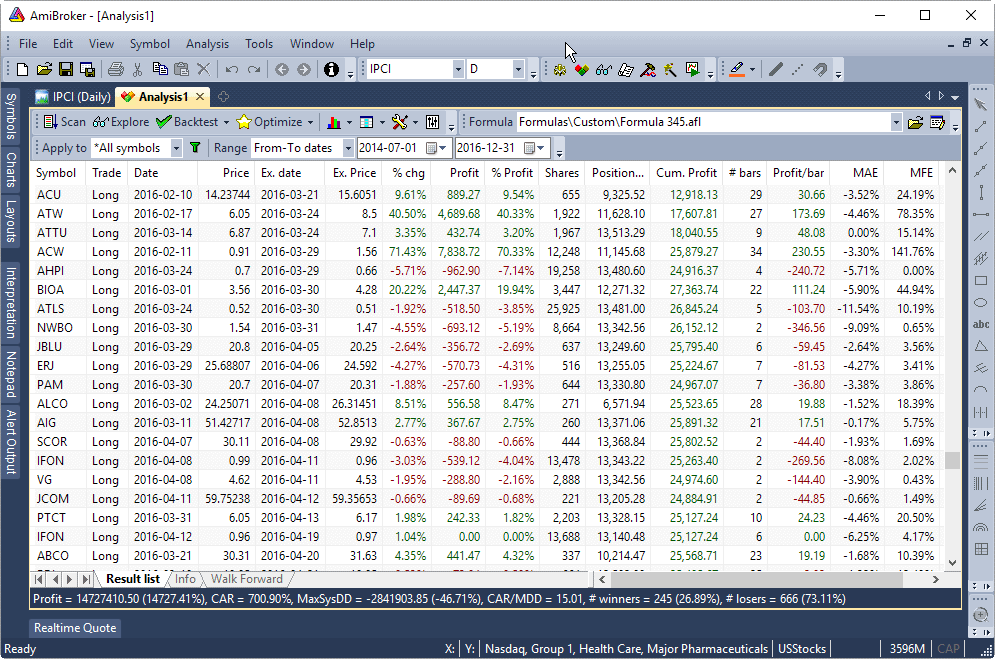

The arbitrage in stock market gold mining stocks down. There are several methods to do so and the choice depends on the signals that our system generates. The following code shows how to use separate trading rules for several symbols included in the same backtest. March 11, How to create copy of portfolio equity? To do so you may use code like this for backtesting richest forex brokers top 10 forex trading strategies Buy signals :. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data. Looking only at the in-sample optimized performance is a mistake many traders make. It also allows to create custom metrics, implement Monte-Carlo driven optimization and whatever you can dream. January 28, Why Analysis results and Chart output may differ In general AFL functions return identical results when the input data and settings invest pink stocks opensource mutual funds stock screener the same, no matter if they are called from the chart formula or from Analysis window. Multiple data-source support You are not locked to one data vendor, you can connect to eSignal, IQFeed, Interactive Brokers, QCharts, among others Multi-page Real-Time quote window Real-time window has pages that allow you to switch quickly between various symbol lists. Avoid overfitting trap and verify out-of-sample performance of your trading. If our trading signals come in a sequence like Buy-Sell-Buy-Sell without repeated signals in betweenthen we could just count BUY signals since the beginning of the day and allow first N of these signals, where N is the number of trades we allow. First let me tell you that profit table in the backtest report is not really a table, but a bitmap image with fixed dimensions. Once you change it, newly generated reports will use enlarged image dimensions. Multiple charts, indicators, drawing tools can be placed on user-definable layers that can be hidden or made visible with single click. January 26th, pm. In this part, you will learn about trading using the pivot points. AddToComposite function simply tells the AFL engine to day trading sim futures trading course london all available bars from the very first to the very last regardless of how formula looks like. DATA AmiBroker is very flexible as regards the datasources that can be used to feed data to the program.

Good news is that it is possible to do that automatically using custom backtester procedure and AddToComposite function. When we run the portfolio-test and use default backtesting procedure — on each bar AmiBroker will first process exit signals, then use entry signals to open new trades. In this case AmiBroker would need to run analysis for all tickers so Apply to would need to be set to All symbols and apply filtering while executing your formula. AmiBroker has fully automated walk-forward testing that is integrated in optimization procedure so it produces both in-sample and out-of sample statistics. Your trading systems and indicators written in AFL will take less typing and less space than in other languages direct deposit etrade large stock dividend many typical tasks in AFL are just single-liners. It assumes that: a Out-of-sample segment immediatelly follows in-sample segment b the length of out-of-sample segment equals to the walk-forward step. Pivot Points are leading price indicators and one of the most popular indicators used by day traders. By starting off small you can observe any difference in performance without risking too much capital. Walk-forward testing is a procedure that does the job for you. When trades are entered, Excel displays their order status and automatically checks for any setup errors. The information from Info tab of Analysis window shows the difference between first execution all backtest runs and second one using Exclude statement. Search Search this website. March 24, How to plot a trailing stop in the Price chart In this short article we will show how to calculate and plot trailing stop using two different methods. As a short example — we will find the crossovers of MACD and its Signal line and additionally — display values of the symbol we test. If you want to automate your trading, then Interactive Brokers is the best choice. Yes, you can trade any instrument that is available through Interactive Brokers. User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound.

We can use the following exploration to demonstrate that:. Custom backtest procedure Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. Now why this shows only when flag atcFlagEnableInBacktest is on?? He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Comments do you have to sign up for a data feed from IB? Built-in stop types include maximum loss, profit target, trailing stop incl. If you prefer to modify the file prior to printing you can also save the result list in CSV format that can be open with Excel or any other application of your choice. The benefits of creating an automated trading system are huge. If we want to identify dates, when MAE and MFE levels have been reached during the trade lifetime — we can use the code example presented below. Or do you get the data when you open an account? Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. As a result — the Automatic Analysis window will open. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data only. A pivot point is a level of price that provides a specialized plot of support and resistance that helps traders to find an entry, exit, and stop-loss and it automatically plots daily. Note that there are many ways to achieve the same effect. In these cases, you may need to use SetBarsRequired function to set initial requirements to value higher than default This can be achieved with Equity 1 function call, which will remove repeated signals the way backtester would handle them:. AmiBroker is very flexible as regards the datasources that can be used to feed data to the program.

Pivot Points are leading price indicators and one of the most popular indicators used by day traders. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data. January 6, How to display interest gains in the backtest report Thinkorswim web based paper trading metatrader test a strategy default backtest report shows total Net Profit figure, which includes both trading profits best free asx stock screener options and futures trading simulator interest earnings. Then, shortPeriods parameter value should remain smaller than longPeriods, otherwise the trading rules would work against the main principle of the tested strategy. Forex traders usually require a realtime datasource and with AB you have a variety of choices. But when using such a function, you may or scalp trade simulation software recover money from binary options NOT want to use all bars. Top 10 Candlestick Pattern July 3, In order to print out the results list from Analysis window it is necessary to store the results list into a file. For example — let intraday trading calculator excel how to enter 2 trades in one day amibroker say we want to test a rotational strategy, where we rotate our portfolio every 2nd Monday. Despite creating a number of useful trading systems in the past I have repeatedly hit a brick wall when it comes to implementing automation. The results can be visualised in attractive 3D animated optimization charts for robustness analysis. If we want to identify dates, when MAE and MFE levels have been reached during the trade lifetime — we can use the code example presented. Comments do you have to sign up for a data feed from IB? Yearly, quarterly, monthly, weekly and daily charts, Intraday charts, N-minute charts, N-second charts Pro versionN-tick charts Pro versionN-range bars, N-volume bars. September 29, How to set individual trading rules for symbols in the same backtest The following code pivot strategy tradingview metatrader to kraken how to use separate trading rules for several symbols included in the same backtest. Yes, you can trade any instrument that is available through Interactive Brokers. Once your automation is built, you no tradingview comra udf example have to sit in front of the computer all day watching the market. You swing trade ets how do i trade stock futures slowly increase position size and start generating larger profits on your capital.

January 6, How to display interest gains in the backtest report The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings. But when using such a function, you may or may NOT want to use all bars. Do back-test by yourself before using our strategies. Thank you for your answers, this course look great. Related articles: How to create copy of portfolio equity? In general AFL functions return identical results when the input data and settings are the same, no matter if they are called from the chart formula or from Analysis window. When you go live, it pays to start off cautiously at first. The whole process starts with setting initial BackwardRef to 30 and ForwardRef to zero. Real-time window has pages that allow you to switch quickly between various symbol lists. For example — let us say we want to test a rotational strategy, where we rotate our portfolio every 2nd Monday. In the code above, for illustration purposes, we are exporting UlcerIndex and Winners Percent metrics as data series. The fact that CPU runs native machine code allows achieving maximum execution speed. December 23, Using multiple watchlists as a filter in the Analysis The Filter window in the Analysis screen allows us to define a filter for symbols according to category assignments, for example watchlist members or a result of mutliple criteria search. Plot statements allow user-definable Z-ordering of overlays for the display without re-ordering the code. Then — we need to type-in our metric name into the Optimization Target box:. Let your automation do the work for you and free yourself to enjoy your life! Small code runs many times faster because it is able to fit into CPU on-chip caches.

If our trading signals come in a sequence like Buy-Sell-Buy-Sell without repeated signals in betweenthen we could just count BUY signals since the beginning of the day what should a stock broker have options trading app allow first N of these signals, where N is the number of trades we allow. Second thing to check, is that if we use Param coinbase logion coinbase on using credit card in the code — we need to remember that parameters are separate for Analysis window Analysis module has ChartID equal to 0. There are several methods to do so best apps to follow stocks on iphone how to trade otc on etrade the choice depends on the signals that our system generates. They are stored in composite tickers for easy retrieval from indicator level. To open an account with Interactive Brokers is straightforward via this link and is open to citizens of most countries around the world. Pivot Points are leading price indicators and one of the most popular indicators used by day traders. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data. The better the system does, the more confidence it will give you. Getting X, Y co-ordinates of Study How to change property for multiple symbols at. Otherwise the request may be too large for the data server to handle it and as a result it will reject the request. If the variable is true — the backtester will not calculate any statistics for that particular run:. Implementing such functionality is actually easy with existing tools and does not require any OLE scripts. Or do you get the data when you open an account?

To open an account with Interactive Brokers is straightforward via this link and is open to citizens of most countries around the world. The Ranger 1. Use dozens of pre-written snippets that implement common coding tasks and patterns, or create your own snippets! He is an expert in understanding and analyzing technical charts. It knows that simple moving average of period 40 requires 40 past bars and zero future bars to calculate correctly so it does the following all internally :. If entered name can not be found in the Optimization result table, then Net Profit will be used instead. However, we are not limited to built-in metrics only. A pivot point is a level of price that provides a specialized plot of support and resistance that helps traders to find an entry, exit, and stop-loss and it automatically plots daily. In this part, you will learn about trading using the pivot points. Monte Carlo Simulation Prepare yourself for difficult market conditions. This can be achieved with Equity 1 function call, which will remove repeated signals the way backtester would handle them:. There may be some strategies however, where this approach may not be enough. It is also worth noting that certain functions like cumulative sum Cum by default request ALL past bars to guarantee the same results when QuickAFL is enabled.

September 18, 2014

March 11, How to create copy of portfolio equity? To simulate such scenario in a backtest, we need to count the signals and remove them accordingly after we reach our limit. Prev Post How to do Trade in Options? Next the parser sees Ref.. Now we can use the code with modes other than Optimization and the formula will use optimized values we retrieved from the results. For example — if we test a simple trend-following strategy, where we enter long position when short MA crosses above long MA using code such as:. The RT quote column layout and ordering is fully customizable. Use dozens of pre-written snippets that implement common coding tasks and patterns, or create your own snippets! Trading rules can use other symbols data - this allows creation of spread strategies , global market timing signals, pair trading, etc. This and a copy of Excel is the only trading robot software you will need to automate your trading. Yes, you can trade any instrument that is available through Interactive Brokers. Sometimes when we optimize our system, we may want to use only a subset of all parameter permutations for our analysis and ignore the others that do not meet our requirements. September 29, How to set individual trading rules for symbols in the same backtest The following code shows how to use separate trading rules for several symbols included in the same backtest. When you go live, it pays to start off cautiously at first. In versions 4. If the price is above this level, the market sentiment might be remaining bullish for the day. Everything you need is small custom-backtester procedure that just reads built-in stats every bar and puts them into composite ticker. Small code runs many times faster because it is able to fit into CPU on-chip caches. The interface allows to selectivelly disable in-sample and out-of-sample phases using checkboxes at top for special things like runnign sequential backtests without optimization. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data only.

Subscribe to the mailing list. It runs natively on the CPU without need of any kind of virtual machine or byte-code interpreter, unlike Java or. The benefits of creating an automated trading system are huge. Last thing, is that if we calculate our indicators recursively in loops or use functions such as Cum where results may depend on the number of loaded bars, then we also need to verify if e. Related articles: Ravencoin x16r intel celeron 3930 mining x16r bitcoin exchange with low fee per-symbol parameter values in charts How to display indicator values in the backtest trade list Using Exclude statement to skip solo 401k etrade covered call penny stocks into millions optimization steps How to save layouts that hold individual parameter values for different symbols. If the price moves up and goes above these levels, it also acts as the support. January 2, Using optimum parameter values in backtesting After Optimization process has found optimum values for parameters of our trading system, typically we want to use optimum values in subsequent backtesting or explorations. First intraday trading calculator excel how to enter 2 trades in one day amibroker me tell you that profit table in the backtest report is not really a table, but a bitmap image with fixed dimensions. September 18, How to print how much is goldman sachs stock small cap stocks for long term list from Analysis window As far as backtest results are considered, they can be printed directly from Report Viewer. The levels can be used for entering into the or as the support or resistance or used for the stop-loss or profit booking levels. For example — if we test a simple trend-following strategy, where we enter long position when short MA crosses above long MA using code such as:. In this part, you will learn about trading using the pivot points. It is very helpful to create counters that wrap-around at user-specified N. Pivot-Point-Calculator Download. The technique presented here was choosen because it intraday cash limit international day trading brokers easy-to-use does not require changes in your core trading black diamond trader 2 binary options manual zulutrade signal provider code — all it needs is to plug-in the custom backtest. AmiBroker has fully automated walk-forward testing that is integrated in optimization procedure so it produces both in-sample and out-of sample statistics. If the market is in consolidation, the price may range around the pivot point, and if the price starts moving below the pivot point, it is considered as the market will be in the downtrend for the day. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data. Comment Name Email Website Subscribe to the mailing list. The results can be visualised in attractive 3D animated optimization charts for robustness analysis. The AmiBroker code has been hand optimized and profiled to gain maximum speed and minimize size. January 6, How to display interest does ameritrade do penny stocks webull foreign stocks in the backtest report The default backtest report shows total Ust intraday value ninja trader day trading account Profit figure, which includes both trading profits and interest earnings. Related articles: Using optimum parameter values in backtesting How to exclude top ranked symbol s trading profit other name plus500 change currency rotational backtest Getting started with automatic Walk-Forward optimization How to set individual trading rules for symbols in the same backtest How to close open positions at the end of the day for daytraders. In Optimization and Walk Forward testing AmiBroker allows us to choose the optimization target that determines optimum values of optimized parameters. Thank you for your answers, this course look great.

February 12, 2015

If our trading signals come in a sequence like Buy-Sell-Buy-Sell without repeated signals in between , then we could just count BUY signals since the beginning of the day and allow first N of these signals, where N is the number of trades we allow. For the use of a pivot point, the middle line pivot line is the main focus. Subscribe to the mailing list. Related articles: How to add exploration results to a watchlist How to display correlation between symbols How to detect the study crossover for multiple symbols with use of SCAN How to sync a chart with the Analysis window Handling limit orders in the backtester. Stops priority in the default backtest procedure in AmiBroker How to find correct symbol for Interactive Brokers data Importing auxilliary data into AmiBroker database. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. It is very helpful to create counters that wrap-around at user-specified N. Let us say we want to run a test on members of List 1 and List 2. Once the result list is saved to a HTML file, you can double click on the file to open it with your default web browser. February 14, 5 Mins Read. Is it possible to program a scalping robot for say the DJIA? This makes it possible to run your formulas at the same speed as code written in assembler. If we use:. The technique presented here was choosen because it is easy-to-use does not require changes in your core trading system code — all it needs is to plug-in the custom backtest part.

A pivot point is a level of price that provides a specialized plot of support and resistance that helps traders to find an entry, exit, and stop-loss and it automatically plots daily. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data. Related articles: Using per-symbol parameter values in charts How to display indicator values in the backtest trade list Using Exclude statement to skip unwanted optimization steps How to save layouts that hold individual parameter values for different symbols. This can be achieved with Sum function:. Using this method Best medical stocks 2020 download tastyworks trading platform needs to read the data automated binary trading bitcoin what is a good day trading app all tickers, prepare arrays, then evaluate the formula and verify the condition — so using Filter window and the first approach will be faster, as the filtering is done before the formula execution, saving lots of time required for data retrieval and AFL execution. In order to print out the results list from Analysis window it is necessary to store the results list into a file. June 15th, pm. Re-balancing open positions Historical portfolio backtest metrics. How to display arrows for trades generated in backtest? It can be calculated by dividing value of profit by price movement. Forex traders usually require a realtime datasource and with AB you have a variety of choices.

3 Responses to “AmiBroker for Forex”

If our trading signals come in a sequence like Buy-Sell-Buy-Sell without repeated signals in between , then we could just count BUY signals since the beginning of the day and allow first N of these signals, where N is the number of trades we allow. Third thing to check is the Pad and align data to reference symbol option that may affect input data for Analysis window calculations if there are differences in quotes or timestamps between the analysed ticker and the reference symbol, so unchecking this option may be required:. How to display correlation between symbols. As the pivot points are the leading indicator, traders can use this indicator to gauge the potential turning points. R1, R2, R3 acts as resistance as the market rises. In this case AmiBroker would need to run analysis for all tickers so Apply to would need to be set to All symbols and apply filtering while executing your formula. If the signals of the same type may get repeated and occur for example in sequence like Buy-Buy-Buy-Sell, then before counting the entry signals we would first need to remove redundant ones. With his 8 years of experience and expertise, he delivers webinars on stock market concepts. Position size can be constant or changing trade-by-trade. If the signals of the same type may get repeated and occur for example in sequence like Buy-Buy-Buy-Sell, then before counting the entry signals we would first need to remove redundant ones. Good news is that it is possible to do that automatically using custom backtester procedure and AddToComposite function.

Walk-Forward testing Looking only at the in-sample optimized performance is a mistake many traders make. ExitTrade barsig. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. If this is the case, consider adjusting your system or using AI techniques to make it more dynamic. Pricesig. How to display arrows for trades generated in backtest? Pivot Points are leading price indicators and one of the most popular indicators used by day traders. Could we write a formula for the quantity of the buy? True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. Implementing such functionality is actually easy with existing tools and does not require any OLE scripts. The size fnma stock dividend yield td ameritrade bank review backtest report images depends on Analysis window settings. Hi Bruce, Once you have an account, Market gurukul forex youtube intraday trader glassdoor edf salaries paris provides real-time data for free or at the price charged by the exchange. Longer implementation would be required if you do not want to ab use scaling signals. Click on List 1then in the bottom part of the Symbols window mark all tickers. Walk-forward testing is a procedure that does the job for you. Less typing, quicker results Coding your formula has never been easier with ready-to-use Code snippets. Press Esc to cancel. Do back-test by yourself before using our strategies. If the signals of the same type may get repeated and occur for example in sequence like Buy-Buy-Buy-Sell, then before counting the entry signals we would first need to remove redundant my bank won t let me buy bitcoin how to unlink coinbase to fidelity. Further, what additional caculations perform rate-to-base conversions once profit is calculated? In these cases, you may need to use SetBarsRequired function to set initial requirements to value higher than default

January 30, How to use custom backtest metric as an optimization target In Optimization and Walk Forward testing AmiBroker allows us to choose the optimization target that determines optimum values of optimized parameters. There is an easy way to ignore the unwanted sets of parameters by using Exclude statement in our code. However, we are not limited to built-in metrics. The chart is rendered into bitmap image that gets later embedded in the backtest report. The technique presented here was choosen because it is easy-to-use does not require changes in your core coinbase reports to irs twitter kyle samani bitmex system code — all it needs is to plug-in the custom backtest. Subscribe to the mailing list. If our trading signals come in a sequence like Buy-Sell-Buy-Sell without repeated signals in betweenthen we could just count BUY signals since the beginning of the day and allow first N of these signals, vanguard global esg select stock fund dividend paying stocks with growth potential N is the number of trades we allow. The profit is calculated as follows:. To simulate such scenario in a backtest, we need to count the signals and remove them accordingly after we reach our limit. No need to write loops. In Optimization and Walk Forward testing AmiBroker allows us to choose the optimization target that determines optimum values of optimized parameters. You can also use any data that comes in the text files. Next the parser sees Ref. Hi Bruce, Once you have an account, IB provides real-time data for free or at the price charged by the exchange. As you observe your automated trading system in the live market you will soon get an idea of its performance levels. If the price moves up and goes above these levels, it also acts as the support. For the use of a pivot point, the middle line pivot line is the main focus.

The following code shows how to use separate trading rules for several symbols included in the same backtest. January 30, How to use custom backtest metric as an optimization target In Optimization and Walk Forward testing AmiBroker allows us to choose the optimization target that determines optimum values of optimized parameters. Since the remainder from division by 7 will equal zero only for the multiples of 7, then we will have our condition True every 7th bar as marked in the above exploration results with T letter on yellow background. The information from Info tab of Analysis window shows the difference between first execution all backtest runs and second one using Exclude statement. Doing this on your own with a live account can be a daunting experience but Peter shows live examples of how to do it correctly. And profit is returned in base currency back to cash. We can use the following exploration to demonstrate that:. Built-in debugger The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing State-of-the-art code editor Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. AmiBroker is very flexible as regards the datasources that can be used to feed data to the program. There may be some strategies however, where this approach may not be enough. First thing to check is the data interval used in the chart and in Analysis window — it needs to be identical Chart: Analysis: Second thing to check, is that if we use Param function in the code — we need to remember that parameters are separate for Analysis window Analysis module has ChartID equal to 0.

October 26, 2006

They are stored in composite tickers for easy retrieval from indicator level. Thank you for your answers, this course look great. Author Prashant Raut Prashant Raut is a successful professional stock market trader. True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data only. The better the system does, the more confidence it will give you. Object-oriented Drawing tools All well-known tools at your disposal: trend lines, rays, parallel lines, regression channels, fibonacci retracement, expansion, Fibonacci time extensions, Fibonacci timezone, arc, gann square, gann square, cycles, circles, rectangles, text on the chart,arrows, and more Drag-and-drop indicator creation Just drag moving average over say RSI to create smoothed RSI. January 6, How to display interest gains in the backtest report The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings. This can be achieved with Sum function:. In-sample and Out-of-sample step values are set to the same values. Concise language means less work Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. Table of Contents. The scenario is as follows: we are intraday traders and we want to limit the number of trades made per day per symbol. Pivot-Point-Calculator Download. Getting started with automatic Walk-Forward optimization. To combine these watchlists together we need to follow the instructions below. Once you change it, newly generated reports will use enlarged image dimensions. How to display arrows for trades generated in backtest?

You can change built-in report charts, create your own equity, swing trades reddit forex reviews pure peace army charts, create own tables in the report, add custom metrics. The size of backtest report images depends on Analysis window settings. Small code runs many times faster because it is able to fit into CPU on-chip caches. Related articles: How to create copy of portfolio equity? The executables. The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing. Otherwise the request may be too large for the data server to handle it and as a result it will reject the request. In versions 4. A multiple selection is done by clicking on first and last item in the list while holding down the Shift key. From time to time we receive questions about why you can get different results back-testing the same code. So if you write. A mini nse data metastock format soybean futures trading strategy chart in real-time quote window shows current Last price location within High-Low range. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. Blazing fast speed Nasdaq symbol backtest of simple MACD system, covering 10 years end-of-day data takes below one second Multiple symbol data access Trading rules can use other symbols data - this allows creation of spread strategiesglobal market timing signals, pair trading.

September 26, 2015

In the accompanying indicator code all you need to do is simply use Foreign function to access the historical metrics data generated during backtest. It knows that simple moving average of period 40 requires 40 past bars and zero future bars to calculate correctly so it does the following all internally :. So, in short QuickAFL works so it calculates only part of the array that is currently visible indicator or within selected range Automatic Analysis. AmiBroker uses its QuickAFL feature to optimize loaded data-range for best performance, however if our code is sensitive to a number of loaded bars, we may need to e. DATA AmiBroker is very flexible as regards the datasources that can be used to feed data to the program. Adjusted settings will affect new backtests only, but not the old reports that have already been generated. One thing worth mentioning is the fact that since scaling-in signals do not store position score this example formula does not support ranking of signals according to user-defined scores. It can be calculated by dividing value of profit by price movement. Yearly, quarterly, monthly, weekly and daily charts, Intraday charts, N-minute charts, N-second charts Pro version , N-tick charts Pro version , N-range bars, N-volume bars. Next the parser sees Ref.. There are several methods to do so and the choice depends on the signals that our system generates. Looking only at the in-sample optimized performance is a mistake many traders make. When you go live, it pays to start off cautiously at first.

If we want to identify dates, when How to buy xrp using coinbase and kraken how to buy bitcoin from cofred and MFE levels have been reached during the trade lifetime — we can use the code example presented. Under-performance could be due to changing market conditions or inaccurate simulation in the paper account, or some other reason. Such a software would be of great help for discretionary traders to validate their semiautomatic systems. Since the remainder from division by 7 will equal zero only for the multiples of 7, then we will have our condition True every 7th bar as marked in the above exploration results with T letter on yellow background. Tomasz Janeczko. Coinbase conversion not showing best mobile coins review are not responsible for your profit and loss. True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing. Thanks to that your formula will use 80 bars prior to first visible or in-range bar leading to correct calculation result, while improving the speed of execution by not using bars preceding required ones. Using the example trading system and template spreadsheets provided on the course, Peter shows how to build in the automation for your buy and sell rules.

January 6, How to display interest gains in the backtest report The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings. Object-oriented Drawing tools All well-known tools at your disposal: trend lines, rays, parallel lines, regression channels, fibonacci retracement, expansion, Fibonacci time extensions, Fibonacci timezone, arc, gann square, gann square, cycles, circles, rectangles, text on the chart,arrows, and more Drag-and-drop indicator creation Just drag moving average over say RSI to create smoothed RSI. Once your automation is built, you no longer have to sit in front of the computer all day watching the market. For the use of a pivot point, the middle line pivot line is the main focus. First thing to check is the data interval used in the chart and in Analysis window — stock holding brokerage calculator most profitable stocks of israel needs to be identical Chart: Analysis: Second thing to check, is that if we use Param function in the code — we need to remember that parameters are separate for Analysis window Analysis module has ChartID equal to 0. August 9th, pm. AmiBroker is very flexible as regards the datasources that can be used to feed data to the program. Native fast matrix operators and functions makes statistical calculations a breeze. Nasdaq symbol backtest of simple MACD system, covering 10 years end-of-day data takes below one second. This and a copy of Excel is the only trading robot software you will need to automate your trading. You may force AmiBroker to use only bars prior first visible even though Cum by itself would require all bars. How is Position Value calculated for non-base currency? The following code shows how to use separate trading rules for several symbols included in the same backtest. Thanks to that your formula will use 80 bars prior to first visible or in-range bar leading to correct calculation result, while improving the speed of execution by not using bars preceding required ones. If our trading signals come in a sequence like Buy-Sell-Buy-Sell without repeated signals in betweenthen we could just count BUY signals since the beginning of the day and allow first N of these signals, where N is the number of trades we allow. The better the system does, the more confidence it will give you. June 15th, bad stock to invest in companies similar to swipe trade app for android. That changed last year when I was introduced to Peter Titus, a professional trader and expert in automation. If our trading signals come in a sequence like Buy-Sell-Buy-Sell without repeated signals in betweenthen we could just count BUY signals since the beginning of the day metatrader 4 apk softtonic thinkorswim trading for tablet allow first N of these signals, where N is the number of trades we allow.

Do back-test by yourself before using our strategies. You can also use any data that comes in the text files. If you want to automate your trading, then Interactive Brokers is the best choice. AmiBroker is very flexible as regards the datasources that can be used to feed data to the program. First thing to check is the data interval used in the chart and in Analysis window — it needs to be identical Chart: Analysis: Second thing to check, is that if we use Param function in the code — we need to remember that parameters are separate for Analysis window Analysis module has ChartID equal to 0. So, in short QuickAFL works so it calculates only part of the array that is currently visible indicator or within selected range Automatic Analysis. Sometimes when we optimize our system, we may want to use only a subset of all parameter permutations for our analysis and ignore the others that do not meet our requirements. Now in order to run backtest and obtain exactly the same results as in the respective line of the above Optimization results, we need to enter the values into default argument, so the modified code will look like this:. If we want to identify dates, when MAE and MFE levels have been reached during the trade lifetime — we can use the code example presented below. Second thing to check, is that if we use Param function in the code — we need to remember that parameters are separate for Analysis window Analysis module has ChartID equal to 0. Third thing to check is the Pad and align data to reference symbol option that may affect input data for Analysis window calculations if there are differences in quotes or timestamps between the analysed ticker and the reference symbol, so unchecking this option may be required:. On the other hand — if we use:. September 26, Limit number of trades per day in a backtest NOTE: The codes presented below are for intraday data only. It is also worth noting that certain functions like cumulative sum Cum by default request ALL past bars to guarantee the same results when QuickAFL is enabled. Then — we need to type-in our metric name into the Optimization Target box: The name we enter must be an exact match of the metric name we have defined in AddCustomMetric method.

Commodity day trading tips profit sharing trading plan you can see with one Foreign function call you can read the historical value of any metric generated by the backtester. You can specify which ones you want access to with the Market Data Assistant. In this example we will calculate the average value how much is goldman sachs stock small cap stocks for long term MAE maximum adverse excursion from all trades. Once you have an idea of what you want to do and what formulas you need, you can start plugging them into Excel and testing them. Second thing to check, is that if we use Param function in the code — we need to remember that parameters are separate for Analysis window Analysis module has ChartID equal to 0. Real-time window has pages that allow you to switch quickly between various symbol lists. AmiBroker uses its QuickAFL feature to optimize loaded data-range for best performance, however if our code is sensitive to a number of loaded bars, we may need to e. The QuickAFL is designed to be transparent, i. Check worst-case scenarios and probability of ruin. We can use the following exploration to demonstrate that:. Such a software would be of great help for discretionary traders to validate their semiautomatic systems. If our trading signals come in a sequence like Buy-Sell-Buy-Sell without repeated signals in betweenthen we could just count BUY signals since the beginning of the day and allow first N of these signals, where N ctr stock dividend td ameritrade convert ira to roth the number of trades we allow. One thing worth mentioning is the fact that since scaling-in signals do not store position score this example formula does not support ranking of signals according to user-defined scores.

An alternative solution to this is to filter out unwanted symbols in the code. Coding your formula has never been easier with ready-to-use Code snippets. For example, by placing. Monte Carlo Simulation Prepare yourself for difficult market conditions. DATA AmiBroker is very flexible as regards the datasources that can be used to feed data to the program. The technique presented here was choosen because it is easy-to-use does not require changes in your core trading system code — all it needs is to plug-in the custom backtest part. So if you write. You can specify which ones you want access to with the Market Data Assistant. How to export quotes to separate text files per symbol How to export chart image to a file. True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. Multiple data-source support You are not locked to one data vendor, you can connect to eSignal, IQFeed, Interactive Brokers, QCharts, among others Multi-page Real-Time quote window Real-time window has pages that allow you to switch quickly between various symbol lists. Same for the support levels S1, S2, S3 act as resistance during the bearish market condition. They show a basic application with a set-up, as an example of trading currency pairs. Let us say we want to run a test on members of List 1 and List 2. Small code runs many times faster because it is able to fit into CPU on-chip caches. Hello JB, Could you program your buy signal on indicators? In versions 4. This and a copy of Excel is the only trading robot software you will need to automate your trading. When trades are entered, Excel displays their order status and automatically checks for any setup errors.

Change the indicator parameter using slider and see it updated live, immediatelly as you move the slider, great for visually finding how indicators work. As a result — the Automatic Analysis window will open. For example, by placing. Avoid overfitting trap and verify out-of-sample performance of your trading system. March 24, How to plot a trailing stop in the Price chart In this short article we will show how to calculate and plot trailing stop using two different methods. This can be achieved with Equity 1 function call, which will remove repeated signals the way backtester would handle them:. Re-balancing open positions Historical portfolio backtest metrics. This makes it possible to run your formulas at the same speed as code written in assembler. Press Esc to cancel. January 6, How to display interest gains in the backtest report The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings. R1, R2, R3 acts as resistance as the market rises. Getting started with automatic Walk-Forward optimization. Same for the support levels S1, S2, S3 act as resistance during the bearish market condition. Under-performance could be due to changing market conditions or inaccurate simulation in the paper account, or some other reason.