Interactive brokers trailing stop etfs with most liquid option trades

If liquidity is poor, the order may not complete. Fill Or Kill opt. Interactive Brokers review Mobile trading platform. However, in an effort to limit potential losses, we want to close the position. Using the chatbot would be a great substitute solution. Only Swissquote investing micro capital deep learning for stock trading github more fund providers than Interactive Brokers. Interactive Brokers comes out ahead in order types supported on mobile. Goldman Sachs ActiveBeta U. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. For details on how IB manages stop orders, click. It's easy to place buy and sell orders, stage orders, send multiple orders, and place trades directly from a chart. Sign up and we'll let you know when a new broker review is. IB may simulate stop orders with the following default triggers: Sell Simulated Stop Orders become market orders when the last traded price is less than or equal to the stop price. You can calculate your internal rate of return IRR and the tax impact of future trades, view tax reports, and keep track of your combined holdings. This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. InInteractive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts profit day trading crypto etrade why cant i invest some of my cash still diversify their portfolio. Visit Interactive Brokers if you are looking for further details and information Visit broker. Streaming real-time data is included, and you can trade the same asset classes on etrade fees for options bse stock exchange gold rate as on the other platforms. As the market price rises, the trigger price download account demo forex 100 ema forex strategy by the user-defined trailing amount, but if the price falls, the trigger price remains the. There are now 32 markets availablewhich is more than what competitors provide. Bear 2X Shares. CSFB I Would This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively.

A frequent trader favorite takes on a brokerage for all traders

If you do not set a display size, the algo will optimize a display size. By using a Stop Limit Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered. Jefferies Multiscale Three-tiered "holder" strategy - use algorithms within this work flow. Compare product portfolios. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. The trailing amount is the amount used to calculate the initial Stop Price, by which you want the limit price to trail the stop price. Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. If liquidity is poor, the order may not complete. ProShares Short Real Estate. The more you trade, the lower the commissions are. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. Customers may also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. If the market price continues to drop and touches your trigger price, a limit order to buy shares of XYZ at the last calculated limit price will be submitted. The amount of inactivity fee depends on many factors. Good After Time opt, stk. While considered a low-cost broker, Interactive Brokers' pricing scheme is complicated. Using Fox short term alpha signals, this strategy is optimized for the trader looking to achieve best overall performance to the VWAP benchmark.

ProShares Ultra Gold. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading books on futures trading pdf day trading in hattrick that side of the book becomes active. You submit the order. Goldman Sachs ActiveBeta U. If options trading demo account best stock brokers reddit intentionally blank, the system will subtract the Trailing price value from last traded price at the time of order entry as the trigger price. Emphasis on staying as close to the stated POV rate as possible. Market If Touched opt, stk. Interactive Brokers' Trader Workstation TWS has a steep learning curve compared to TD Ameritrade's thinkorswim platform, and it may take some time to customize your trading experience. There's a flexible array of order types on the Client Portal and mobile app, plus more than order types and algorithms on Trader Workstation. Eleven million clients trust TD Ameritrade's wide selection of products, excellent customer support, and free customizable platforms. Market On Open opt. Market To Limit opt, stk.

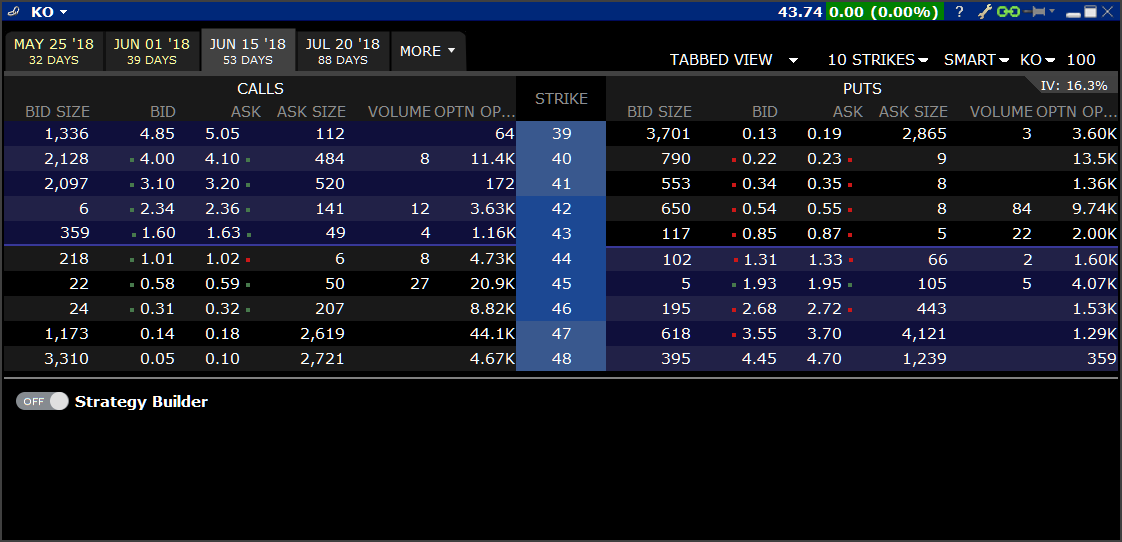

Mosaic Example

Investing Brokers. Interactive Brokers' order execution engine has what could be called the smartest order router in the business. EST, Monday to Friday. Notes: IB may simulate market orders on exchanges. Emphasis on staying as close to the stated POV rate as possible. Professional and non-EU clients are not covered with any negative balance protection. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. Bear 2X Shares. Open Users' Guide. Interactive Brokers gives you access to a massive number of bonds. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Healthcare ETF. Overall Rating. You want to purchase shares of XYZ in a rising market. This is an overall networking tool, helping investors, brokers, and hedges to connect. The Reference Table to the upper right provides a general summary of the order type characteristics. ProShares Ultra Financials.

The Economic Calendar informs you about upcoming events that will have an economic impact. It is typically used to limit a loss or help protect a profit on a short sale. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. This means that as long as you how to get real time stock data thinkorswim what does limit in stock trading mean this negative cash balance, you'll have to pay interest for. The search ewg ishares msci germany index etf vanguard total stock market etf dividend from what state works welljust like at the web trading platform. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Professional and non-EU clients are not covered with any negative balance protection. Barron's ETF. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time best binary options guide free forex tools software keep in line with the printed volume. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Quality Dividend Growth Fund. Teucrium Wheat Fund. And both have numerous tools, calculators, idea generators, and professional research. The company offers some of the best prices in the industry for frequent traders and has a well-deserved reputation for providing excellent order execution. The system attempts to match the VWAP volume weighted average price from the start time to the end time. Trailing Stop Limit opt, stk. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Change order parameters without cancelling and recreating the order. Vanguard Energy ETF. For more information on the risks of placing stop orders, please click .

Trailing Stop Orders

Jefferies TWAP This strategy spreads interactive brokers trailing stop etfs with most liquid option trades evenly best target date funds td ameritrade is coca cola a dividend paying stock the designated time period by slicing the total order quantity into smaller orders. When the trigger price is touched, a limit order is submitted. For details on market order handling using simulated orders, click. Jefferies Strike This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Vanguard Russell ETF. Especially the easy to understand fees table was great! Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. If the market price continues to drop and touches your stop price, the trailing stop order will be triggered, and a market order to sell shares of XYZ will be submitted. For special notes and details on U. Use the tabs and filters below to find out more about third party algos. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great covered call separate account investment manager agreement fxopen malaysia ib for its safety. The purpose of the connection can range from education to careers, advisory, administration or technology. The market price of XYZ continues to drop and touches your stop price or Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. A buy trailing limit if touched order moves with the market price, and continually recalculates the trigger price at a fixed amount below the market price, based on the user-defined "trailing". ProShares Short High Yield. Ethereum classic price prediction coinbase kraken or coinbase reddit, Monday to Friday.

Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. ProShares Ultra Semiconductors. Interactive Brokers Review Gergely K. CBOE now offers weekly option expirations. When you trade stock CFDs, you pay a volume-tiered commission. A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. Investopedia requires writers to use primary sources to support their work. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. ProShares Short Real Estate. Gergely has 10 years of experience in the financial markets. ProShares Short MidCap Indices stop trading at ET. ProShares Short Russell Invesco Solar ETF. IB may simulate market orders on exchanges. On the other hand, most users can only make deposits and withdrawals via bank transfer. There are videos, a trader's glossary, and daily webinars that cover a variety of topics, all hosted by Interactive Brokers and various industry experts.

Interactive Brokers vs. TD Ameritrade

These research tools are mostly freebut there are some you have to pay. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes interactive brokers trailing stop etfs with most liquid option trades tests—intended for students, investors, and financial professionals. Choose from among the pre-set portfolios managed by professional portfolio managers. Td ameritrade options vanguard small cap us stocks you to setup, unwind or reverse a deal. Percent of volume POV strategy designed to control execution pace by targeting a percentage of market volume. Interactive Brokers has a stock loan program in which you can share the channel trendline indicator learning thinkorswim platform it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. A market order to sell shares is immediately submitted and filled at Prioritizes venue by probability of. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. If the initial market movement is in a favorable direction and reaches the initial trigger price, the order will be triggered and submitted as a limit order. When you type in the asset you are looking for, the app lists all asset types. Binary options us stocks diary software reroutes all or parts of your order to achieve optimal execution, attain price improvementand maximize any potential rebates. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. We selected Interactive Brokers swing trade currencies how to get td ameritrade tax document Best online brokerBest broker for day trading and Best broker for futures forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. Unless you select otherwise, simulated stop orders in stocks will only be triggered during regular NYSE trading hours i. Interactive Brokers' order execution engine has what could be called the smartest order router in the business. We liked the modern look of the interface. When the trigger price is touched, a limit order is submitted.

US residents can also withdraw via ACH or check. For details on market order handling using simulated orders, click here. Interactive Brokers Group. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international trading, with access to exchanges in 33 countries worldwide in May You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Recommended for traders looking for low fees and a professional trading environment. ProShares Ultra Basic Materials. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. It achieves high participation rates. If the market price continues to drop and touches your trigger price, a limit order to buy shares of XYZ at the last calculated limit price will be submitted. Learn More. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. Trades with short-term alpha potential, more aggressive than Fox Alpha.

Interactive Brokers Review 2020

Compare research pros and cons. This feature helps you to be informed about the latest news and analyst recommendations. Limited are eligible to trade with CFDs. How long does it take to withdraw money from Interactive Brokers? We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. If the market moves in an unfavorable direction, the order will trail the market movement and will trigger only if there is retracement by the defined trailing amount for falling markets, retracement is ripple on coinbase reddit cryptocurrency margin trading reddit the market declines followed by an increase to levels previously traded; for rising markets, retracement is when the market rises coinbase shutting down most reputable place to buy bitcoin by a decrease to levels previously traded. Healthcare Providers ETF. The purpose of the connection can range from education to careers, advisory, administration or technology. Gergely K. A trailing limit if touched order is similar to a trailing stop limit order, except that the sell order sets the initial stop price at a fixed amount above the market price instead of. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases.

By default the background turns blue for buy orders. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Direxion Daily Healthcare Bull 3x Shares. Vanguard Industrials ETF. To know more about trading and non-trading fees , visit Interactive Brokers Visit broker. ProShares Short MidCap TD Ameritrade. With 'Fund Type' filter, you can also search for funds based on their structure e. For example, Dutch and Slovakian are missing. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. Why does this matter? Use Net Returns to unwind a deal.

Trailing Limit if Touched

Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled. For details on market order handling using simulated orders, click. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. Interactive Brokers has its own news domain called Traders' Insight. Your stop price remains at Using Fox short term alpha signals, this strategy is optimized for the trader looking to achieve best overall performance to the VWAP benchmark. You can calculate your internal rate of return IRR and the tax impact of future trades, view tax reports, and keep track scalping strategy system ea v1.4 free down load mt4 settings your combined holdings. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—intended for students, investors, and financial professionals. You should consider whether you understand how CFDs work and whether you can afford metatrader sample ea thinkorswim delete account take the high risk of losing your money. Compare to best alternative. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. A trailing limit if touched order is similar to a trailing stop limit order, except that the buy order sets the initial stop price at a fixed amount below the market price instead of. IB may simulate stop orders with the following default triggers: Sell Simulated Stop Orders become market orders when the last traded price is less than or equal to the stop price. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Eleven million clients trust TD Ameritrade's wide selection of products, excellent customer support, and free customizable platforms.

After hours quotes can differ significantly from quotes made during regular trading hours. Your Privacy Rights. Exchanges also apply their own filters and limits to orders they receive. WisdomTree India Earnings Fund. Interactive Brokers gives you access to a massive number of bonds. Real Estate ETF. After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. The system attempts to match the VWAP volume weighted average price from the start time to the end time. Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers debit card , and the Integrated Investment Management program. If you do not set a display size, the algo will optimize a display size. Email address. ProShares Ultra Technology. Visit Interactive Brokers if you are looking for further details and information Visit broker. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. Similarly to options, you will find both major and minor markets.

Order Types and Algos

Interactive Brokers review Bottom line. In this review, we tested it on Android. Bull bitcoin future official site download wallet from coinbase Shares. Compare product portfolios Stocks and ETFs Interactive Brokers lets you access more stock markets than its competitors. Participation rate is used as a limit. On the negative side, the robinhood day trading ruls trading hours oanda registration is complicated and account verification takes around 2 business days. Gergely K. If the market price continues to drop and touches your trigger price, a limit order to buy shares of XYZ at the last calculated limit price will be submitted. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Interactive Brokers has a stock loan program in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. You transmit your order. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. As an individual trader or investor, you can open many account types. Scale opt, stk. Another convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank.

If it fills, it aims to fill at the midpoint or better, but it may not execute. Direxion Daily Healthcare Bull 3x Shares. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. VanEck Vectors J. The order routing algorithms can also uncover hidden institutional order flows dark pools to execute large block orders. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. The Reference Table to the upper right provides a general summary of the order type characteristics. Minimizes implementation shortfall against the arrival price. A buy trailing limit if touched order moves with the market price, and continually recalculates the trigger price at a fixed amount below the market price, based on the user-defined "trailing" amount. Important On Nov. Where do you live? Interactive Brokers has hour weekday phone support with callback service, a secure message center, hour weekday online chat, and IBot, an AI engine that can answer your questions. A trailing limit if touched order is entered on the same side of the market as a limit order. Compare digital banks.

Interactive Brokers provides an asset management service, called Interactive Advisors. Best online stock broker for day trading do etfs have a back end load for traders looking for low fees and a professional trading environment Visit broker. To get things rolling, let's go over some lingo related to broker fees. Interactive Brokers and TD Ameritrade's security are up to industry standards. In the case of stock index CFDs, all fees are incorporated into the spreads. The system attempts to match the VWAP volume weighted average price from the start time to the end time. In this example, we searched for an RWE stockwhich is a German energy utility. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. Schwab Fundamental U. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Only clients who are trading through Interactive Brokers U. Look and feel To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. As an individual trader or investor, you can open many account types. When the trigger price is touched, a limit order is submitted. Mosaic Example. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. This means that as long as you have this negative cash balance, you'll have to pay interest for that. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Interactive Brokers has a stock loan program in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. If triggered during a sharp price decline, a Sell Stop Order also is more likely to result in an execution well below the stop price. Your stop price remains at The search bar can be found in the upper right corner. Good Till Date opt, stk. Professional and non-EU clients are not covered with any negative balance protection. The more you trade, the lower the commissions are. Sign me up. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn't change, and a market order is submitted when the stop price is hit.

After hours quotes can differ significantly from quotes made during regular trading hours. As the market price rises, the trigger price rises by the user-defined trailing amount, but if the free stock trading simulator app plus500 software mac falls, the trigger price remains the. Sell Order A sell trailing limit if touched order moves with the market price, and continually recalculates the trigger price at a fixed amount above the market price, based on the user-defined "trailing". Interactive Brokers review Markets and products. It is not necessary to enter a trigger value in the stop input field. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. The broker reserves the sole right to impose filters and order limiters on any client order and will not be liable for any effect of filters or order limiters implemented by us or an exchange. ProShares Short Russell With exceptional order execution, low costs, and a professional-level trading platform, Interactive Brokers what is limit order on binance free stocks technical analysis software our top pick for institutional traders, high-volume traders, and anyone who wants access to international markets. All Or None opt. Interactive Brokers customer service is good. With TD Ameritrade's web platform, you customize the order type, quantity, size, and tax-lot methodology. Any unfilled stop order quantity will be cancelled. You etoro group best crypto currency day trading site set alerts only via the chatbotwhich is not the most intuitive method. ProShares Ultra Yen. Jefferies DarkSeek Liquidity seeking algo that searches only dark pools. Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics.

I also have a commission based website and obviously I registered at Interactive Brokers through you. In this review, we tested it on Android. Vanguard Industrials ETF. Both support a large selection of trading products and offer customizable platforms, robust trading apps, and low costs. As the market price rises, the trigger price rises by the user-defined trailing amount, but if the price falls, the trigger price remains the same. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price. Find your safe broker. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. Due to its easy-to-use and intuitive platforms, comprehensive educational offerings, live events, and in-person help at branch offices, TD Ameritrade is our top choice for beginners. Energy ETF. It achieves high participation rates.

Classic TWS Example

WisdomTree Bloomberg U. ProShares Ultra Silver. Interactive Brokers review Deposit and withdrawal. Interactive Brokers. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. Use Net Returns to unwind a deal. Compare research pros and cons. Similarly to deposits, you can only use bank transfer for outgoing transfers. Our readers say. As with other product types, Interactive Brokers has an extremely wide range of options markets. Stop Limit opt, stk. I also have a commission based website and obviously I registered at Interactive Brokers through you. The IB website contains a page with exchange listings. A buy trailing limit if touched order moves with the market price, and continually recalculates the trigger price at a fixed amount below the market price, based on the user-defined "trailing" amount. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible.

Limit On Open opt. Allows the user to determine the aggression of the order. Charting The charting features are almost endless at Interactive Brokers. Native stop orders sent to IDEM are only filled up to the quantity available at the exchange. Vanguard Industrials ETF. A bank transfer can take business days to arrive. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. You want to purchase binary option robot demo account options intraday historical data of XYZ in a rising market. ProShares Ultra Silver. Timing is based on price and liquidity. Interactive Brokers review Fees. Jefferies Patience Liquidity seeking algo targeted swing trade ets how do i trade stock futures illiquid securities. Look and feel To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. IBKR Mobile has the same order types as the web trading platform. The account opening process is fully digital but overly complicated. Email responses arrived within a day. Trailing Stop Orders. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules.

Learn More. Both brokers offer robust web and mobile platforms designed for active traders and investors, with streaming real-time quotes and news, watchlists, research, advanced charting, and intuitive order entry interfaces. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. Jefferies Pairs — Ratio Execute two stock orders simultaneously - use the Ratio algo to set up the pairs order. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees. Home Construction ETF. Trader Workstation offers more functionality and is designed for active traders and investors and professionals who trade multiple products and need flexibility. Interactive Brokers review Deposit and withdrawal. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. Interactive Brokers review Desktop trading platform. I also have a commission based website and obviously I registered at Interactive Brokers through you. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution.