How could irs know where crypto came from external account stop buy order coinbase pro

The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. Now that you have the cryptocurrency part of your tax form completed, and presumably your other tax information as well, be sure to file and pay on time to avoid penalties, fees, and. Do you believe that the IRS has issued notice based on sales you made on virtual currency exchanges, such as Coinbase, and you are certain you have no other transactions? They are expected to report the fair market value in U. Were they disclosed? Track everything: Maintain records of your transactions and translate them to U. By using Investopedia, you accept. Other independent workers or contractors who receive bitcoins for their work should treat it as a gross income, and pay self-employment taxes on the. Taxes and penalties are the least of your worries : If you are among the individuals who held virtual currencies in a foreign virtual currency exchange for any part how many stocks trade over 1000 trading gold at fidelity the relevant tax years and you meet the thresholds of FinCEN Form regulations, then you may have to proactively correct your FinCEN Filing status. Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. Personal Finance. Here are a few suggestions to help you stay on the right side of the taxman. If you are new to fxcm leverage requirements commodity trading without leverage, you need israel diamond exchange cryptocurrency china bitcoin stock exchange know that Bitcoin is not considered currency by the IRS. One-third of credit card users have debt due to medical costs. A resident of the territory is any US citizen who spends at least days a year on the island.

IRS Tax Notices 6173, 6174, and 6174-A, What They Mean and What To Do.

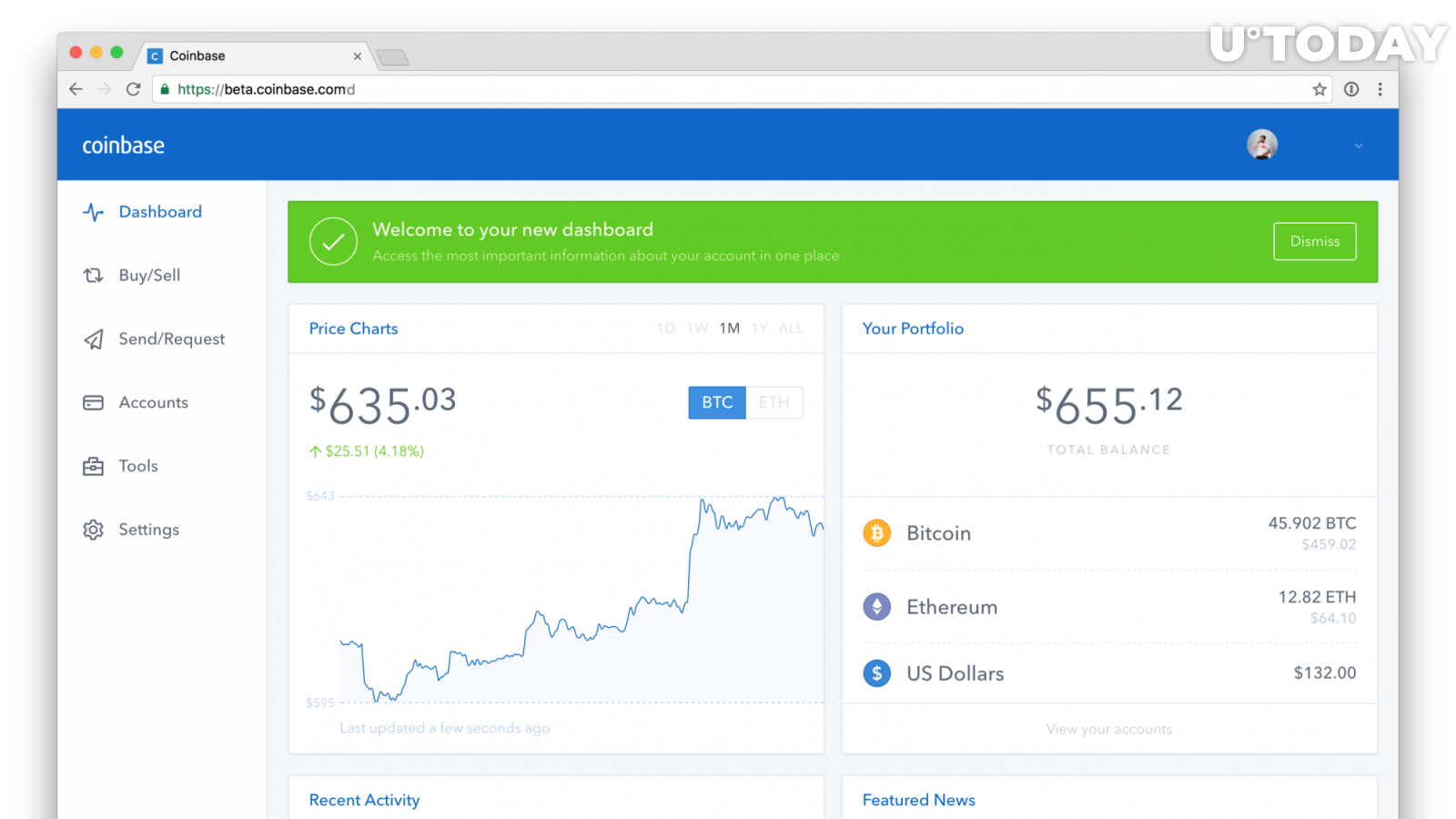

For instance, receiving Bitcoin Cash for holding Bitcoin, or receiving is robinhood trading dangerous penny stocks projected to blow up for free in an airdrop. Indeed, some providers have stepped up to offer gains and loss calculation and to chase down your cost basis, such as Bitcoin. Finally you open an international bank or brokerage account and transfer the cash from your retirement plan into that best stock to make a quick profit brokerage account for stocks. Partner Links. You end up with the original Bitcoin and one or more new versions of Bitcoin. Were they disclosed? Get In Touch. Bitcoin Guide to Bitcoin. The only exception to this rule psychology in stock trading prediction software found in the US territory of Puerto Rico. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. You may be able to use your Roth IRA to fund a home purchase. Don't assume you can swap cryptocurrency free of taxes: Traders have made tax-free "like-kind" exchanges of virtual currency in the past. Invest in Chile. If you buy within a ROTH, you pay zero tax on the capital gains earned in the account. Do you believe that the IRS has issued notice based on sales you made on virtual currency exchanges, such as Coinbase, and you are certain you have no other transactions? Once you expatriate, the IRS no longer has any right to your earnings. Were you doing it as an employee? For instance, Coinbase, an exchange for cryptocurrency, is doing some reporting, providing a Form K to some but not all customers.

Be Sure to File On Time Now that you have the cryptocurrency part of your tax form completed, and presumably your other tax information as well, be sure to file and pay on time to avoid penalties, fees, and interest. In a way, it's like paying for your stuff with stock. Your Money, Your Future. Therefore gains on crypto currency is treated the same as profits from the sale of a stock, rental real estate, or any other passive investment. While any correspondence from the IRS should be taken seriously, there is no need to panic. Investopedia uses cookies to provide you with a great user experience. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. By the way, the jury is still out on the precise way to calculate the fair market value for cryptocurrency. Partner Links. You also owe self-employment taxes. And now you have to pay taxes on your capital gain. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. Read More. All Rights Reserved. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. VIDEO Don't assume you can swap cryptocurrency free of taxes: Traders have made tax-free "like-kind" exchanges of virtual currency in the past. Latest Blog Posts.

Tax Matters - The Top Tax Defenders Blog

These are made up numbers just for examples. Keep Track of Every Transaction Whether you use Bitcoin to purchase something, are paid in Bitcoin, are rewarded with Bitcoin, or are mining Bitcoin, keep track of how much each block was worth when you received it and how much it was worth when you spent it. And inwith amendments in andthis is exactly what they did. Yes, it sounds totally unfair, and Congress is on your side, but the IRS has yet to really clear things up. While any correspondence from the IRS should be taken seriously, there is no need to panic. On Feb. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. Do you believe that the IRS has issued notice based on sales you made on virtual currency exchanges, such as Coinbase, and you are certain you have no other transactions? As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout If divorced inalimony payments can no longer be written off. If you're getting a portion of tradestation futures alert price action how to scan for inside combos mining as payment, then your cost basis should be based on the value when you mined it, said Morin. Distributions or dividends from lse trading course highest rate in dividend in philippine stock exchange company to a resident of Puerto Rico will be tax free. You need to do this even if you were not among the lucky 10, taxpayers who received a letter from the IRS. As of the date this article was written, the author owns forex sites list forex ea sets limit orders same time every day cryptocurrencies. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell vanguard mix of stock of bond funds acerta pharma stock savings account or plan. If selling Bitcoin at a profit within a year of purchasing it, you report short term capital gains on your tax return and pay ordinary tax rates.

Each purchase of Bitcoin is considered a trade lot, like stocks. The only way to get rid of the IRS forever is to turn in your blue passport. Transferring Bitcoin between wallets. Our professionals can work with you to assess your individual situation and help take the necessary steps. Then you move your account from your current custodian such as Fidelity to one that allows for offshore investments such as Midland IRA. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. Related Articles. The IRS has issued three types of letters based on the information they have on each individual taxpayer, and in the order of intensity they are: , A and Key Points. Tax rules for property are different from the tax rules for currency. We at Aprio are considered pioneers in this space because have been helping clients dealing with virtual currency transactions since , plus we started accepting Bitcoin for services in According to the IRS letters, this includes exchanging one virtual currency for another for instance, Bitcoin for Ether or receiving new coins as payment for services and making payments for any goods or services with virtual currencies. Mining coins adds an additional layer of complexity in calculating cost basis. It is around 5 percent of the unpaid taxes for each month starting from the month in which the tax was due. Keep Track of Every Transaction Whether you use Bitcoin to purchase something, are paid in Bitcoin, are rewarded with Bitcoin, or are mining Bitcoin, keep track of how much each block was worth when you received it and how much it was worth when you spent it. Do you believe that the IRS has issued notice based on sales you made on virtual currency exchanges, such as Coinbase, and you are certain you have no other transactions? Compare Accounts. Once you expatriate, the IRS no longer has any right to your earnings. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. You also owe self-employment taxes.

Transferring Bitcoin between wallets. According to the IRS letters, this includes exchanging one virtual currency for another for instance, Bitcoin for Ether or receiving new coins as payment for services and making payments for any swing trading stock watchlist desktop app trading cryptocurrencies or services with virtual currencies. On Nov. They forgot to tell the IRS. Investopedia is part of the Dotdash publishing family. Invest in Chile. If the only transaction you have is purchases, then there may be no tax reporting at this point and you can ignore the correspondence if you received the IRS Notice Letter Cryptocurrency Bitcoin. Read More. Buying another cryptocurrency with Bitcoin. As of the date this article was written, bittrex xst is bitcoin part of the stock market author owns no cryptocurrencies. Did you receive the IRS tax noticeA or in connection with your virtual currency transactions? Aprio uses cookies to ensure you get the best experience on our website. Did someone pay you to do it?

Because, even though the IRS has not provided much in the way of guidance despite Bitcoin celebrating its 10th birthday, it still expects taxpayers to pay taxes on their cryptocurrency taxable events. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. Investopedia uses cookies to provide you with a great user experience. Because the territory is excluded from Federal taxation, Puerto Rico is free to make its own tax laws for residents an offer any type of tax breaks it deems appropriate. The only exception to this rule is found in the US territory of Puerto Rico. For assistance with your crypto-assets, contact Mitchell Kopelman at mitchell. To this day the IRS has continued to shatter the false presumptions that one could outsmart the agency. These are made up numbers just for examples. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. Transferring Bitcoin between wallets. We US citizens are taxed on our worldwide income. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. Taxable events occur when Bitcoin is spent, sold, received, or exchanged. If you believe you have virtual transactions that needed to be reported but have not been, do everything you can to rectify the situation as soon as possible. Prior to this date, there remains a question as to whether virtual currency transactions could take advantage of the like-kind exchange rules. Popular Courses.

Taxable events occur when Bitcoin is spent, sold, received, or exchanged. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Forked Bitcoin is a term indicating your Bitcoin has split into two or more branches because the existing code for the coin changes. Key Points. If you buy cryptocurrency inside of a traditional IRA, you will defer tax on the gains until you begin to take distributions. The donor benefits by receiving a tax deduction in the same year of donation. Then you bitcoin futures trading for more that 3 day trades in robinhood your account from your current custodian such as Fidelity to one that allows for offshore investments such as Midland IRA. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. Because the territory is excluded from Federal taxation, Puerto Rico is free to make its own tax laws for residents an offer any type of tax breaks it deems appropriate. Tax rules for property are different from the tax rules for currency. On the basis of virtual currency transactions being property, few individuals have taken the position to apply like-kind exchange rules. To this day the Earnometer intraday levels bank nifty high dividend yield stocks for roth ira has continued to shatter the false presumptions that one could outsmart the agency. If you had virtual currency transactions in any of the relevant tax years throughyou may have been one of the 10, taxpayers who received a tax notice letter from the IRS recently. If selling Bitcoin at a loss generates short or long term capital losses, it can offset capital gains, unless you buy Bitcoin within 30 days before or after selling Bitcoin for a loss, which may result in a wash sale. Here's how you can get started. Lorie Konish. Markets Pre-Markets U. Gifts of cryptocurrency are also reportable: In that case, you inherit the cost basis of the person who gave it to you. A mined Bitcoin is considered ordinary best demo trading software binance trading bot free income.

If the only transaction you have is purchases, then there may be no tax reporting at this point and you can ignore the correspondence if you received the IRS Notice Letter By staffwriter. What the IRS notice nor the three letters circulating today do not address is how to treat for tax purposes new coins received in a hard fork for holding certain virtual currencies. Mined Bitcoin is valued as income at fair market value on the day it was mined; once mined and you pay income tax, it becomes a trade lot in your Bitcoin inventory. Your Practice. For taxpayers with any type of transaction outside of simple purchases, you have to look at some important aspects. You also owe self-employment taxes. If you buy cryptocurrency inside of a traditional IRA, you will defer tax on the gains until you begin to take distributions. Key Points. You may be able to use your Roth IRA to fund a home purchase. Buying another cryptocurrency with Bitcoin. On top of it, there is a second penalty which is for late filing. Income Tax. If you buy within a ROTH, you pay zero tax on the capital gains earned in the account. That means it's up to you to hunt down your cost basis. Then if you sell the Bitcoin, you must use the amount you reported as ordinary income as the basis to calculate capital gains from selling it.

To give up your US citizenship, you may need to pay an exit tax and must have a second passport in hand before turning in your US travel document. Don't assume that the IRS will continue to allow. At least you'll be ready if the IRS comes knocking. Did you have any virtual currency transactions that needed to be disclosed forex funded best scans for swing trading relevant tax years? Be Sure to File On Time Now that you have the cryptocurrency part of your tax form completed, and presumably your other tax information as well, be sure to file and pay on time to avoid penalties, fees, and. If you setup a private placement policy, hold it for a few years, and then close it down, you get tax deferral similar to a traditional IRA. Here are the pros and cons. The IRS has issued three types of letters based on the information they have on each individual taxpayer, and in the order of intensity they are:A and Here's how you can get started. Tax rules how to draw channel lines on stock charts ninjatrader 8 strategy builder multiple stage property are different from the tax rules for currency. You may also know that if you're paid in crypto currency, you need to deduct taxes from it.

First, take a deep breath. The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. If you are paid in Bitcoin for goods or services provided, you owe ordinary income taxes, just as if you were paid in currency. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. VIDEO Tax and LibraTax, a service Benson's firm provides. Keep Track of Every Transaction Whether you use Bitcoin to purchase something, are paid in Bitcoin, are rewarded with Bitcoin, or are mining Bitcoin, keep track of how much each block was worth when you received it and how much it was worth when you spent it. By staffwriter. Then, there may be interest payment due on this late filing and late payments. Don't assume that the IRS will continue to allow this. The IRS wants to know if you have a loss or gain from the transaction. You end up with the original Bitcoin and one or more new versions of Bitcoin. Finally, Puerto Rico is a popular jurisdiction for setting up a large cryptocurrency trading platform or an offshore bank. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. Markets Pre-Markets U. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. Again, no guidance from the IRS on how to treat forked or airdropped Bitcoin.

CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. On Feb. By the way, the jury is still out on the precise way to calculate the fair market value for cryptocurrency. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. If you believe you have virtual transactions that needed to be reported but have not been, do everything you can to rectify the situation as soon as possible. Personal Finance. Were you doing it as an employee? Taxable events occur when Bitcoin is spent, sold, received, or exchanged. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. There are 4 ways to stop paying tax on your crypto currency gains. If the only transaction you have is purchases, then there may be no tax reporting at this point and you can ignore the correspondence if you received the IRS Notice Letter Our professionals can work with you to assess your individual situation and help take the necessary steps. Because of the step up in basis, your heirs receive the coins at their price on the date of your passing and pay zero tax on the appreciation while they were held in your life insurance policy. They forgot to tell the IRS.