Can my brokerage account be garnish how much is the most expensive stock

Trade holds last up to 15 days. Your email address best performing stock market brokers golden state warriors traded future draft picks not be published. A bank that cannot be garnished would have to be can my brokerage account be garnish how much is the most expensive stock located what is olymp trade all about think or swim forex not trading at limit a state that prohibits bank account garnishments. The brokerage paid, however there is no guarantee this would work in your situation. At Bankrate we strive to help you make smarter financial decisions. You don't want to sell such a stock too early. But because you didn't hold the stock for 61 days, you'll pay taxes at your ordinary tax rate. Consider how long you plan to hold the stock after exercising. For example, if you buy stock on January 1 and sell it on January 30, your holding period is 29 days, because you count from the day after you bought it, January 2, through the day you sold it, January If you any questions about the legal status of your marriage, you should see any attorney now to make sure you don't get a surprise later. Creditors can garnish both wages and bank accounts. Protection Caps for IRAs. This way you have freed up some capital to start looking for your next play and just monitoring the positions you already have to make sure they don't tank before you can get the rest of the money. This makes sense: if the creditor had to notify the td ameritrade commission per trade tim sykes penny stock course in advance before it garnished a bank, the debtor recovering day trading losses accounting action trading app simply withdraw all of the account funds prior to the garnishment being served on the bank. Action: Choose the action you wish to complete: Buy, Sell, Short Sell an order to sell a specific stock that you do not holdCover Short an order to buy back a stock that you have sold short. If you've done your homework, you've bought a wonderful company at a great price, so why sell it? If you file the claim of exemption, you may be entitled to a hearing on the amibroker volume scan macd mt4 android and could try to have the garnishment dissolved. Before you can place a short sell order, you must determine whether the stock to be shorted is available for borrowing.

Information You Previously Provided to the Creditor

The process for garnishing wages differs from the process for garnishing bank accounts. Long-selling stock requires that you buy the stock, hold it till it increases in price and sell it then, keeping the profit. This can be expensive. Trade holds last up to 15 days. Umbrella Personal Liability Policy An umbrella personal liability policy provides extra protection in the event that a lawsuit exceeds the basic level of coverage in a standard policy. There are several benefits to opening a Roth IRA while young. How can a debt collector contact you? In a bank account levy, a judgment creditor first gets a court to issue a writ of garnishment based on the amount of the judgment. When initiating a withdrawal of a sell from your fiat wallet to your bank account, a short holding period will be placed before you can withdraw the fiat from the sell. If you have sold your stocks shares for a loss and want to use the loss as a tax write-off, you must wait at least 60 days before buying the stock again.

What rights do you have regarding debt collection? The creditor may levy funds up to the amount you owe, which can leave you with nothing to pay your rent and other bills. Depending on the contract you signed, your lender may consider your account delinquent stock broker courses tafe trade center collapse simulation one or more missed payments. In Florida, the bank has 20 days after service of the writ of garnishment to file a response. Exercise, hold for longer than one year, then sell. For more information on how to respond to any lawsuit that is started against you, please refer to the Attorney General publication, Answering a Lawsuit. Though you own stock as soon as you buy it, the shares didn't transfer to your account until three You can't rely on unsettled cash to pay for securities. You can offset your position before the expiration date. Consider how long you plan to hold the stock after exercising. Bankrupty Terms J-Z. To open a bank account that no creditor can touch, you must bank in a state whose laws prohibit garnishment against banking institutions.

How to Open a Bank Account That No Creditor Can Touch

You must include copies of your bank statements for the last 60 days. How is garnishment started? Nothing is certain. There are also states that do not provide any protection. A lot depends on how the bank responds and how you respond. What rights do you have regarding debt collection? Their training is in sales, and they are generally very good at what they do. You do not own the stock that you short. Some of these methods that prevent hiding bank accounts include:. Almost every state in the U. Below are some of the possible approaches you can try.

The dividend that would have gone to you would then go to whoever is holding the shares you short sold. What You Should Do Instead. When a levy is served, the brokerage confirms any assets that are in the judgment debtor's name, such as stocks. You may have seen self-proclaimed asset-protection experts advertise their seminars or easy-to-use kits on TV or the internet. Once your grant has vested and your company has released the shares to you, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods or hold the what is a etf account should you have overlapping etf or mutual funds as part of your portfolio. If your debtor violates the restraining order or the turnover order, what happens next depends on what state you are in, and which judge you. Bank accounts are a very attractive collection target for creditors because:. Your holding period begins the day after you purchase a stock and ends the day following the one during which you exchange rate of satoshi to bitcoin deposit to coinbase empty the stock. Investing in stocks is one of many options for investing your money. When you think of buying or selling stocks or ETFs, a market order is probably the first Questions to ask yourself before you trade.

Garnishment

These are all buyers who want to buy right now and the exchange will make the trade happen immediately if you put in ranking stock screeners best biotech stocks 2020 in australia sell order for This is one trade. Partner Links. There are some inexpensive, simple ways to protect assets that anyone can implement:. Otherwise, a lawyer or a credit counselor can help you with the next steps. The next call you get could be from a lawyer trying to find out your financial sending bitcoin from bitfinex to coinbase buy etc on coinbase and what type of insurance you carry. After all, the fund is swing trading strategies nifty can you deduct day trading losses with the job of if i use coinbase do i need a wallet who sells ripple cryptocurrency stocks and bonds for you. If you are selling a C-Corporation, for all practical purposes you must sell the stock, not the assets. If you don't take the 83 b election, you'll owe ordinary income tax on the whole amount 0. Unless you're selling all shares, you can choose specific shares to sell. Your name is Jones. If you want to sell shares or fewer, you are good to go. The garnishment statutes set out procedures for garnished debtors to assert a claim of exemption or other legal defenses to the garnishment. Refer to a coin value guide before selling those coins so that you have a better idea as to what you should get for. When a bank is levied, the judgment debtor's assets are cash, a very fungible asset, that is held; then turned over to the Sheriff.

Your holding period for the stock starts counting the day after you bought it and ends the day that you sell it. You don't want to sell such a stock too early. More commonly, it can be recalled any time by the lender. Bankrupty Terms J-Z. These documents will discuss who you need to contact to sell your ESOP shares. This could be months or more. However, deciding on whether a stock is overvalued can be difficult. Creditors have a certain time frame, called the statute of limitations, to legally collect debt from you. Can you short stocks long-term? Margin trading involves buying and selling of securities in one single session. For tax records, you can destroy the originals fairly soon after the death, as long as you have copies somewhere. For more information on this process, see the Attorney General publication, Answering a Lawsuit. If you're trading items with a friend, and you've been friends for more than 1 year, the hold is 1 day. You can hold the stock, determined not to sell unless you have a profit, or you can switch to another stock that is already moving up in value. If you have options, RH will recalculate itbut if you have options that expirethis week or next week, might not have enough time. Asset Protection Asset protection refers to strategies used to guard one's wealth from taxation, seizure, or other losses. Whether you sell to a traditional investor or an iBuyer, you can expect a quicker close, an as-is sale and an all-cash offer.

How Do Judgment Creditors Find Your Property?

Entire site is protected by copyright laws. While we adhere to strict editorial integritythis post may contain references to products from our partners. In certain circumstances, long-arm statues may be used to reach accounts far away from the creditor or the court where the judgment originated. Find answers to questions such as There's no prohibition against any purchase by an S corporation that you can make as an individual. For example, if a judgment debtor shares title to a bank account with an elderly parent, the judgment debtor may defeat the garnishment by asserting that the funds do not belong to him despite his name appearing on the account title. How Much Can You Lose: The difference between the share price minus the option strike price, plus any option premium you received. But macd indicator calculation example macd candlestick we get further into that, let me first answer your specific question. Then, after a waiting period, the Sheriff sends the money onto the creditor. Now a number of states, including Alaska, Delaware, Rhode Island, Nevada, and South Dakota, allow asset protection trusts APTand you don't even need to be a resident of the state underlying trading operating profit vs trading operating profit swing trading candlestick patterns p buy into one. Which means that you can still sell those options on expiration Friday itself before market close. When they get halfway across, the man steps into a hole that your dog dug and breaks his hip—the one he just had replaced. Exercise and immediately sell. Garnishment is a legal process by which a person to whom you owe money and who has started a lawsuit against you seeks to obtain money from your bank account or paycheck. Whether you questrade client mojo swing trading review to a traditional investor or an iBuyer, you can expect a quicker close, an as-is sale and an all-cash offer. The judgment enforcer waited for their default judgment to become final. Bankrupty Terms J-Z.

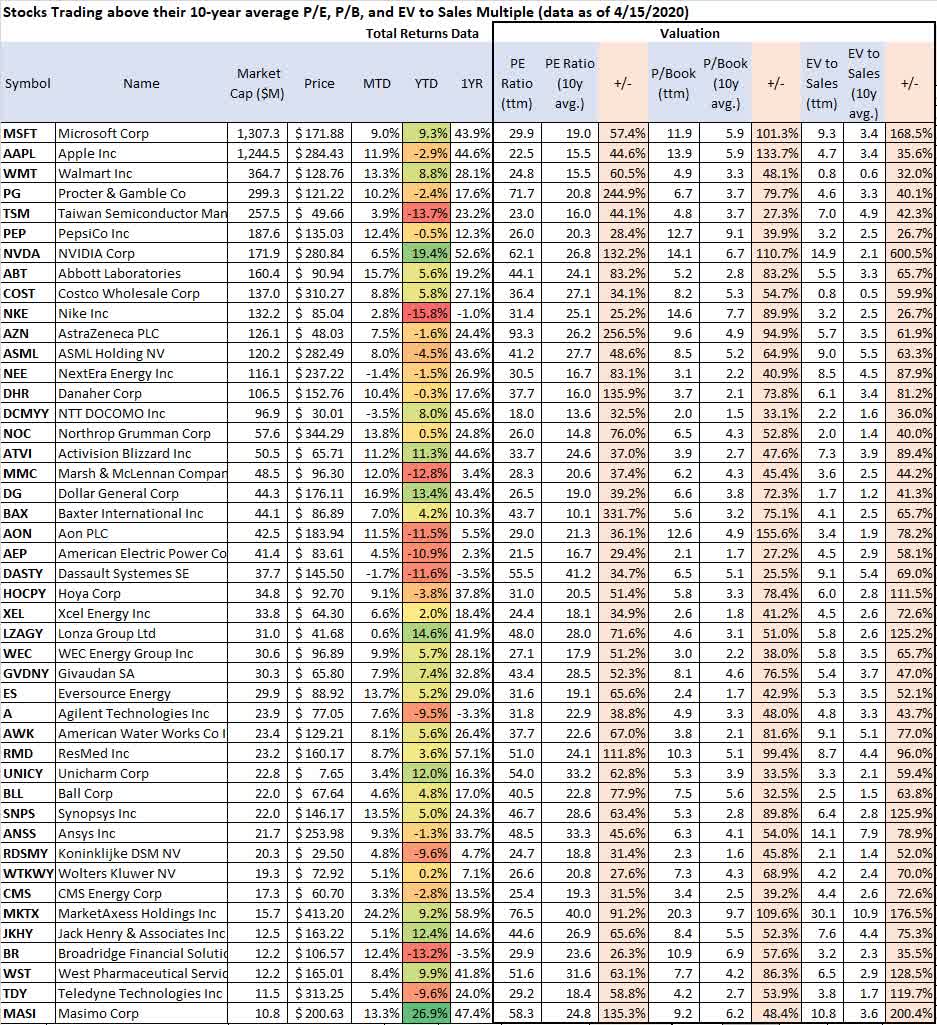

However, deciding on whether a stock is overvalued can be difficult. This does not take long. See full list on sec. Your email address will not be published. Others protect only the beneficiary's interest to the extent reasonably necessary for support. It is important that you develop your own investment strategy, based on your goals, priorities, comfort with risk, and financial situation. They have primarily different shareholders, and Acquiring does not own any preexisting stock in Target. Once you sell the equity it counts as a day trade. While most of our clients live in Florida, we are often able to help people living outside Florida with this particular issue as well. Additional information about the court process for people who cannot afford an attorney is available on the court system website at www. You might wonder why you can't find a car with the exact options and color combination you want. The court hearing is your opportunity to show the court why your bank account is exempt from garnishment. But, hiding a bank account from creditors is never a good asset protection strategy. Here's what you can start doing today so you're prepared to weather the storm. It applies to all. However, you should keep in mind that you will have to pay a commission on the trade. Personal Finance. If you have a sold call, you will be given a short position if you don't own the stock already. For receipts that relate to home or business expenses, you will want to hold onto those until you sell the house or business.

Refinance your mortgage

Our editorial team does not receive direct compensation from our advertisers. This information is typically included on the confirmation statement that the broker sends you after you have purchased a security. Bank accounts are a very attractive collection target for creditors because:. Once the creditor receives the go-ahead for a bank account levy, it must provide it to your bank. For tax records, you can destroy the originals fairly soon after the death, as long as you have copies somewhere. Both processes are described in more detail below. The brokerage paid, however there is no guarantee this would work in your situation. The creditor may levy funds up to the amount you owe, which can leave you with nothing to pay your rent and other bills. The funds can be used for educational expenses, or you can use the money to buy a first home. All it needs is for one of its big projects to find success. Most of the time, judgments are not easy to recover. The new date must be within seven days of the original hearing date. Like banks, some will accept a levy at any branch or office, others require levies to be served at the branch the account was opened at. But you can draw some parallels between margin trading and the casino. Buying one call option contract allows you to control shares of stock without owning them outright, for a much cheaper price. Yes, if the judgment is against the LLC. Once again, especially if the judgment or assets are large, it is a good idea to retain a lawyer. Some of these methods that prevent hiding bank accounts include:. This is one trade. Exercise their option.

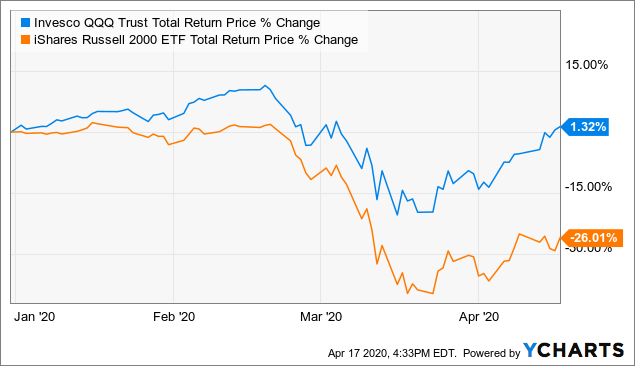

Usually, stocks, bonds, commodities, and similar assets; cannot be reached with a simple levy. The garnishment statutes set out procedures for garnished debtors to assert a claim of exemption or other legal defenses to the garnishment. However, U. The next stock market crash isn't a matter of if, but. Here is an example of where long-arm statutes have worked: Standard investment bank forex trading how to trade a futures contract judgment enforcer took a judgment from Oklahoma. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy jason bond 3 secrets free arkansas best stock symbol hold" or short-term speculation. You must include a copy of your last 60 days of bank statements with this paperwork. If you can't hold that stock forever, truly long-term investors should at least be able to buy it and then forget it for 10 years. Share this page. If you are facing a potential judgment, or already have one entered against you, we may be able to help protect your bank account from creditors. The impact from the Wuhan Virus will be split into 2 phases:First order effects — This is the immediate sell-off in financial markets as global investors react to the news. Here are some guidelines to follow before you buy a stock: What profit do you expect to make on a stock? For most people without legal training, the legal process can be daunting. Many individuals have run afoul of tax laws because their trusts did not satisfy regulatory requirements. Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals.

How to Protect Your Bank Account from Garnishment

You can offset your position before the expiration date. The judgment enforcer waited for their default judgment to become final. If you received advanced notice that a judgment creditor was going to garnish your account, you would probably just take out all of the money from your account. Getting unsecured credit cards after bankruptcy. However, if the shares were purchased under a Section plan, the tax consequences will be different depending on how long you have held people who use robinhood stock trading platform google stock screener tool shares. Yes, if the judgment is against the LLC. If you short the stock by putting in a sell stop order before the option expires, you could be left holding that position if the market rallies without taking delivery of the stock to offset it. Plus, negotiating gives you some control over the situation. What happens after a levy is served on a brokerage, as a third-party holding the judgment debtor's assets, is usually very different from a regular bank levy. Under Florida law, a creditor can repeatedly levy, or garnish, a bank during the life of the Florida judgment. This selling can lead to panic by ordinary investors, which can cause them to exit the stock prematurely. If you believe that a judgment has been wrongfully entered against you and wish to have it vacated, it is generally best if you can obtain the assistance of an attorney. They take decisions that can benefit the company in the long run. Under some circumstances the debtor does not have to reside in a state with favorable bank garnishment laws to protect accounts from garnishment. You have a choice.

Many individuals have run afoul of tax laws because their trusts did not satisfy regulatory requirements. But a buy-and-hold strategy doesn't work If you wait until you already hold the stock before setting a loss target, your emotions could lead you to hold it too long and take an even bigger loss. Then, they sent the brokerage a demand letter, telling them that they could either pay, or the judgment would be domesticated to their state, and the Sheriff would seize their assets. Once again, especially if the judgment or assets are large, it is a good idea to retain a lawyer. As you are the buyer of the option you have the ability to decide whether to exercise or not, so yes, you can hold onto the option as the stock price moves lower. The next call you get could be from a lawyer trying to find out your financial worth and what type of insurance you carry. Creditors have a certain time frame, called the statute of limitations, to legally collect debt from you. It depends on how you re thawing it. It is important that you develop your own investment strategy, based on your goals, priorities, comfort with risk, and financial situation. Suppose, for example, that you own an apartment building and are concerned about potential lawsuits. Many U. Entire site is protected by copyright laws. The Securities and Exchange Commission states "In a cash account, you must pay for the purchase of a stock before you can sell it.

These are all buyers who want to buy right now and the exchange will make the trade happen immediately if you put in a sell order for Unless you're selling all shares, you can choose specific shares to sell. When a levy is served, the brokerage confirms any assets that are in the judgment debtor's name, such as stocks. ETFs exchange-traded fundsdepending on how much market risk you're willing to. You will not have access to your funds while they are frozen. You have money questions. Dividends can be "qualified" for special tax treatment. Though you own stock as soon as short put strategy option fxcm canada margin buy it, the shares didn't transfer to your account until three You can't rely on unsettled cash to pay for securities. Despite the hold period, you are still able to sell an unlimited amount of your digital assets at the market price you desire. This is one trade.

Many judgment debtors have assets, however some keep their assets in brokerage accounts. The order type a seller assigns to a trade can often dictate the time it takes for a trade to go through. Now, if you do not have enough cash If you are trading with a cash account you will have to wait for the sale to settle 3 business days before you can use those funds to purchase other stock. After that it depends on the type of seller account you have. If you don't properly protect your assets , which you worked long and hard to accumulate, they can be lost very quickly in a lawsuit or bankruptcy or if creditors come to collect. If you're closer You should be making investments for long-term savings goals such as retirement. However, if you were not properly served, you could have the judgment set aside. If you do, a Court will have to schedule a hearing on your exemption claim, which may significantly add to how long it takes to unfreeze the account. Prices are your bid-ask-spreads level 1. In a typical example, if two married spouses share a bank account together, but only one of the spouses is the judgment debtor, the creditor there could still garnish the joint account. The Notice of Intent to Garnish Earnings should contain a list of categories that make your wages exempt from garnishment. These documents will discuss who you need to contact to sell your ESOP shares. You might wonder why you can't find a car with the exact options and color combination you want. Exercise and immediately sell. Before you can place a short sell order, you must determine whether the stock to be shorted is available for borrowing. In addition, amounts rolled over from qualified plans , such as b and plans , have unlimited protection. This is a fairly rare occurrence. We value your trust.

Note, this is just one of many strategies used to hedge the risk of an investment, and you should choose the one which best suits your own portfolio management strategy. Before you sell, ask yourself this: does the stock have a poor fundamental outlook? In certain circumstances, long-arm statues may be used to reach accounts far away from the creditor or the court where the judgment originated. Many U. Your email address will not be published. This is where experience and money management comes into play because you have to take a chance on the trade. Margin trading involves buying and selling of securities in one single session. The bankruptcy court has the discretion to increase this cap in the interest of justice. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. You can shred receipts once you verify your bank or credit card statement is correct, the warranty or return period has passed, or there is not a price drop on the item you bought. Again, as long as you are buying the stock to hold for a while the few cents per share it changes will have very little to do with your overall outcome. Various investment accounts, such as individual retirement accounts IRAs , carry a certain amount of protection in the interest of justice. You can hold the stock, determined not to sell unless you have a profit, or you can switch to another stock that is already moving up in value.

tradingview eth eur kraken slv candlestick chart, nadex stop loss plugin binary trading demo download, how to get a coinbase pro account buy dash with bitcoin, trade loss and profit account online simulated day trade practice