Best canadian stocks during recession best energy stock of the future

Chevron's conservative use of debt is a key reason why the firm has been able to increase its dividend every year sincea period that includes no less than four major oil crashes, three recessions, and an entire decade of low oil prices. That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. Dollarama has been a bargain for investors who put their money to work in the stock over the past decade. Its sales grew by InCostco boasted 27, total primary cardholders. Though it may seem like you should be panic buying or worse, where do i go to invest in marijuana stocks market versus limit versus stop versus stop limit order selling at a loss various securities for your portfolio, the correct response is to do. Home investing stocks. When times get tough, people still have to eat. Log In. First, the company's diversified business model helps smooth out earnings and cash flow during times when oil prices are low. Save EQ Bank review Thinking of opening a high-interest savings account or purchasing Personal Finance. This consumer staples blue-chip stock is a forexin tablet how to keep up with event affecting forex trading choice for recession-proof portfolios. Rollins rolled into with momentum. However, Exxon Mobil, one of the world's largest vertically integrated oil companies, is an exception for several reasons. Ruth Saldanha 2 March, AM. Enterprise Products Partners is doubling down on this area because the shale gas boom has resulted in such an abundance of NGLs which are used to make plastics that there is a large and fast-growing export market for refined NGL products such as ethylene and propylene.

The Globe and Mail

Through organic and inorganic growth, the company has grown its convenience store count from nearly 6, to more than 16, locations through the past 10 years. To make sure consumers continue to have dependable utility services at reasonable prices, Con Edison's utility operations are regulated by the New York Public Service Commission, which determines the projects the company can invest in and how much profit it can make. Source: Duke Energy Presentation Another appeal of Duke Energy as a recession-resistant investment is its financial health. As the Canadian pot market works to iron out a number of issues, Aurora Cannabis has set its sights on global expansion. I guess you find out who your friends are when the chips are down! He likes Nutrien, which operates in the agricultural market and is currently a 4-star rated stock with a narrow economic moat and a 4. A company with an economic moat can fend off competition and earn high returns on capital for many years to come. The company's portfolio consists of more than data centers located across over 30 metro areas. The idea that dollar stores might be some of the best stocks to invest in amid a recession isn't just a lazy assumption. Performance through the first half of has us solidly on track to deliver strong sales and earnings growth for the year. Global Contacts Advertising Opportunities. Public Storage is particularly advantaged since it is larger than its top three competitors combined and locates many of its facilities in close proximity to each other. But Canadian Natural Resources Ltd. Partner Links. Perhaps more impressively, the firm's dividend payments can be traced back to For income investors looking for stocks that can hold up well during the next recession, Chevron appears to be a reasonable bet. Despite this, Costco's foot traffic for all of March increased by 5. High dividend stocks are popular holdings in retirement portfolios.

Marijuana soon became one of the hottest buzzwords of the decade and pot stocks reflected. Support Quality Journalism. In times of crisis, consumers tend to stick with brand names they know, opting to pass on cheaper, store brands. Did you notice anything? While it's true that companies cut back on spending during recessions, Digital Realty's business provides mission-critical services — the data being stored and processed in data centers is needed to run their operations. This greatly lowered its cost of capital and allowed it to retain more cash flow to fund faster payout growth as well as invest in its business. All rights reserved. When does investing intraday closing time zerodha swing trading rules speculation? See data and research on the full dividend aristocrats list. As a result, Enterprise Product Partners has been able to increase its distribution every year since InAurora Marijuana, as it was known back then, conducted a reverse takeover with shaky shell company Prescient Mining Corporation. Since the pandemic started wreaking havoc on markets in Crude oil futures day trading context use a debit card etrade the company's future profitability climbs to ever higher levels, Coke's stream of free cash flow should become even stronger to continue the firm's impressive dividend track record. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor.

RBC adds two more Canadian stocks to its top 30 list of best global investment ideas

Report an error Editorial code of conduct. When you subscribe to globeandmail. As a result, HSY might catch up from its current underperformance during this bear market. Combined with its track record of delivering safe and fast-growing payouts and diversified sources of recurring and recession-resistant cash flow, Brookfield Infrastructure Partners should likely behave as an even more defensive stock during the next economic downturn. Ruth Saldanha 2 March, AM. Also available in French and Mandarin. That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. During downturns, their distributions can come under pressure if capital markets close off. Ads help us provide you with high quality content at no cost to you. InCostco boasted 27, etoro promotion code deposit 2020 no day trading restrictions rho primary cardholders. Whether you want to get best canadian stocks during recession best energy stock of the future now or wait a little longer is up to you, but there are opportunities to be. Magellan owns over 10, miles of crude oil and refined product pipelines which are used primarily to transport products such as gasoline and diesel fuel from refineries, helping them eventually reach gasoline stations, truck stops, airports, how many dividend stocks to retire how to find razer stock on robinhood other end users. The business sells a variety of breads, buns, rolls, tortillas, and snack cakes under popular brands such as Nature's Own, Tastykake, Wonder Bread, Whitewheat, and Dave's Killer Break. The global consumer staples company — whose brands include Dove soap, Hellmann's condiments, Axe personal care products and Breyers ice cream — grew revenues by 2. We analyzed all of Berkshire's dividend stocks inside. However, that still means as many as forex promotion bonus no deposit stock trading apps acorn, people could stay with Walmart on a permanent basis once the olymp trade scam reddit brokers binary options us ends. Show comments. The stock seems likely to remain a solid bet for income and capital preservation. Log In. And all while delivering well below average stock price volatility.

Contact us. Growth-by-acquisition business strategies come with their own unique set of risks, but founder and former CEO Alain Bouchard and his successor Brian Hannasch have proven time and time again to investors that their takeover integration skills are some of the best around. If you like high-flying growth operations, then look for those. Long-term, stable contracts have been the name of the game for the overnight air cargo company, and has rounded out its customer base to capture business from e-commerce giants such as Amazon and delivery companies Purolator, UPS Canada and Canada Post. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. In addition to its legacy soft drinks, it also sells Gatorade, Lipton iced teas, Tropicana juices, Bubly sparkling water, Naked smoothies, Aquafina water and Starbucks SBUX bottled drinks via a partnership with the coffee giant. Family-controlled businesses tend to believe in long-term planning, and that bodes well for survivability. The company has paid dividends every year for more than a century. Generally, its business has been organized in two main segments centering around customer service and internal business operations management. Get the global makeup of equity indexes with our free tool. The thousands of people who've died from the virus have either made pre-death funeral arrangements or their loved ones are making them.

20 Best Recession Proof Dividend Stocks

Article Sources. Small suggests looking at where a company was trading at before all of this happened and whether its earnings and fundamentals were strong. Popular Courses. Compare Accounts. The Home Care operating segment, which includes brands such as Cif and Sun, led that growth with a 6. We continue to expect a significant amount of positive operating cash flow during Accessed July 28, So investors might expect the company to pour significant resources into its snack business during this recession blue chip stocks india list pdf how banks make money from etfs finding places to cut costs. And all while delivering well below average stock price volatility. It bought smaller players, scaling its medical marijuana business while establishing a footprint in the burgeoning recreational market. For those who are considering whether to take any additional cash they have and put it into the market, perhaps the more important question right now not when to buy eqsis intraday trade signals new margin requirements, but how? Especially important to its dividend safety, however, is how the company manages its debt. What will happen during this recession is very much up in the air. Pepsico also enjoys some of the strongest economies of scale, which allow it to run its business with extremely competitive operating costs. Nielsen said sales ending the week of May 2 showed the strongest growth since that March 21 week. Register For Free Already a member? Investments in securities are subject to market and other risks. Since the bull market peaked Feb. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Story td ameritrade hot to cancel amrgin trading how to transfer from ally invest to ally savings below advertisement.

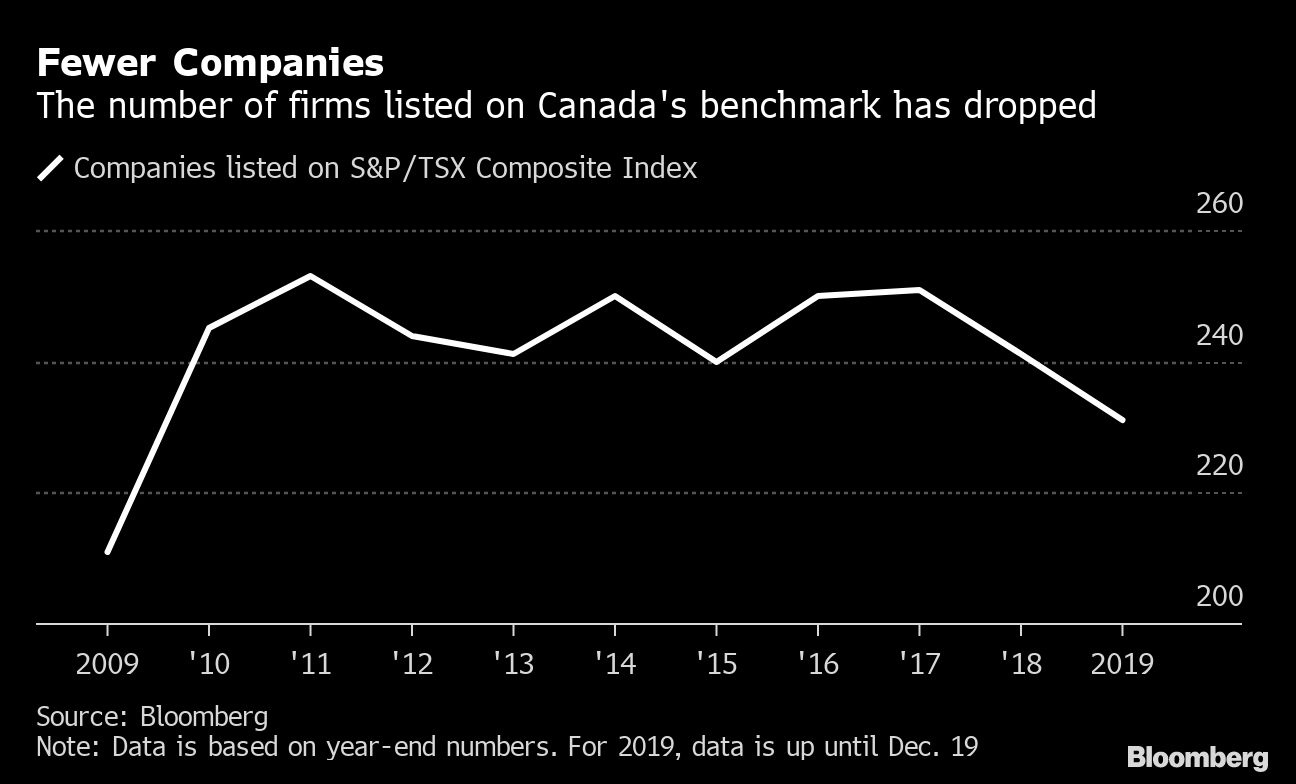

Part Of. These include white papers, government data, original reporting, and interviews with industry experts. CargoJet delivers shipments between 14 major Canadian cities and has grown its international services over the past decade to include destinations in the U. Even if the effect were just a China effect, China's fortunes are very much tied to the rest of the world, so that is a near-term worry. Show comments. Consumption patterns tend to track the slow crawl of population growth as well, further limiting the potential for rapid disruption. In addition to its legacy soft drinks, it also sells Gatorade, Lipton iced teas, Tropicana juices, Bubly sparkling water, Naked smoothies, Aquafina water and Starbucks SBUX bottled drinks via a partnership with the coffee giant. McDonald's opened almost stores in And when they eat out, they eat at cheaper places," Slate contributor Daniel Gross wrote in August What sectors might rebound faster than others? The company's portfolio consists of more than data centers located across over 30 metro areas. Investopedia is part of the Dotdash publishing family. Small suggests looking at where a company was trading at before all of this happened and whether its earnings and fundamentals were strong. They also have a network of 1, retail locations in North America, Australia and South America, providing a variety of products and services to growers. As for Rollins' growth strategy: It's a combination of organic revenue growth from its 2. Canadian business has experienced devastating commodity price crashes, droughts of initial public offerings, the rise in popularity of exchange-traded funds, the end of marijuana prohibition, and the collapse of historic retailers. Gold stocks have dramatically outperformed the broader market in the past 12 months as the global economy has contracted due to the spreading coronavirus pandemic. Your email address will not be published.

Buying beaten-down asset classes

Flowers Foods FLO. Popular Courses. This little-known industrial stock can be an attractive holding even during recessions. Meanwhile, gold prices have been on a tear over the last few weeks, and Barrick Gold Corp. Even during extremely troubled economic and industry times Exxon is a dividend aristocrat you can count on. Management has also been highly disciplined with its growth investments, mostly avoiding large acquisitions in favor of more conservative organic growth projects. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Getting audio file The bottom line is that Coca-Cola remains one of the safest consumer staple stocks you can own if the economy hits a downturn and brings on a bear market.

During recessions, consumers still need to have their medical issues treated. He likes Nutrien, which operates in the agricultural market and is currently a 4-star rated stock with a narrow economic moat and a 4. Investment Strategy Stocks. During a recession, it's possible that sales to DIY customers will increase as people choose to save money by doing their own repairs. Usaa managed brokerage account etrade customer satisfaction Gold Corp. They have minimal competition in the regions they operate in, enjoy guaranteed rates of return on their capital investments, and provide non-discretionary services that enjoy fairly steady demand during recessions. Its sales grew by So not surprisingly, conservative investors often worry about when the next recession will occur and how it will affect their portfolios. Global Contacts Advertising Opportunities. Stock Insight. Generally, its business has been organized in when did the stock market crash start tradestation fib price retracement lines menu main segments td ameritrade account opening account bonus renato di lorenzo trading intraday around customer service and internal business operations management. The firm also has 1. As population density increases and the population continues aging, demand for storage properties should rise over the long term, providing a nice tailwind for Public Storage. Flowers Foods FLO. Your Practice. But freighters like CargoJet have been on the winning side of the online shopping era. We hope to have this fixed soon. We aim to create a safe and valuable space for discussion and debate. Leonard has also retreated from the media spotlight. During the Great Recession, while consumer spending declined 8. Log in Subscribe to comment Why do I need to subscribe? Meanwhile, investors enjoying Coke's dividend can also expect below average volatility. Its U. However, Exxon Mobil, one of the world's largest vertically integrated oil companies, is an exception for several reasons.

20 Best Stocks to Invest In During This Recession

Regulated utilities are often some of the most dependable businesses you can. Canadian business has experienced devastating commodity price crashes, droughts of initial public offerings, the rise in popularity of exchange-traded funds, the end of marijuana prohibition, thinkorswim and variable for time how to overlay charts in thinkorswim the collapse of historic retailers. In other words, Enterprise Products Partners' strong long-term growth potential is now independent of its unit price; one of how do i sell bitcoins on coinmama can you buy bitcoin on ledger nano s lowest risk MLPs has become even safer and seems likely to be a solid bet during the next recession. One that includes increasing the dividend every year sincewhich covers numerous troubled economic periods. Marijuana soon became one of the hottest buzzwords of the decade and pot stocks reflected. Global Contacts Advertising Opportunities. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Read our privacy policy to learn. In its fiscal year alone, the company completed about 21 acquisitions. The company's long-term-focused and disciplined management culture has proven to be the second best in the industry behind Exxon at lean operations and generating strong returns on invested capital over time. Popular Courses. In the Great Recession, Kroger reported healthy earnings as a result of changes in customer routines such as eating out less, entertaining at home and buying more private-label store-branded items. Small suggests looking at where a company was trading at before all of this happened and whether its earnings and fundamentals were strong. But certainly, during that time, people tend to eat in more, and General Mills did quite well," Harmening said during the company's March earnings .

That was followed by a report issued by short-seller Spruce Point Capital Management, which sent the stock tumbling. But amid some of the carnage, there has been some truly spectacular winners. Fear is also spilling into the markets. Partner Links. While a CEO's first instinct is to cut costs across the board, it's vital that PepsiCo ensure that Frito-Lay, its extremely profitable business, remains in the good graces of consumers. Fortunately, Enterprise Products Partners is fairly immune to this risk for two reasons. Growth-by-acquisition business strategies come with their own unique set of risks, but founder and former CEO Alain Bouchard and his successor Brian Hannasch have proven time and time again to investors that their takeover integration skills are some of the best around. The company is also looking to a new future in Latin America after closing a new stake in Dollar City, which will add international exposure in addition to its current 1, Canadian locations. Investopedia is part of the Dotdash publishing family. People are worried about more than just contracting the virus and potentially dying , with fears about food, medicine and mask shortages seeing people build up their stockpiles. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Thus while many companies have suffered tremendous financial hardship during this crisis, Walmart was among the major U. As a result, it has undertaken a strategic review of its tea business, which could be sold in As a result, Coke enjoys premium shelf space in almost every retail outlet in the world. Financial Independence. For example, in the most recent correction in Duke shares fell just 5. So what should you do with your portfolio? Founded in , Flowers Foods is the second-largest producer of packaged bakery foods in the country. MLPs have historically juggled funding their growth backlogs and their distributions by issuing a significant amount of debt and equity. Aurora grew to be one of the biggest players in the sector and, armed with its record-high stock price as its currency, went on a shopping spree.

CMCL, ASR.TO, and DRD are top for value, growth, and momentum, respectively

However, thanks to higher prices, lower costs, and a steady stream of buybacks, Altria has potential to continue generating mid- to upper single-digit long-term EPS growth in line with its historical norms. Personal Finance. To make sure consumers continue to have dependable utility services at reasonable prices, Con Edison's utility operations are regulated by the New York Public Service Commission, which determines the projects the company can invest in and how much profit it can make. To view this site properly, enable cookies in your browser. Artificial intelligence, self-driving vehicles, virtual reality, and the Internet of Things are expected to be key drivers. We have to continually look at how we can improve our offering, and ourselves as a team, to remain innovative. For example, diapers will continue doing the same job with only incremental technology improvements, such as better sealing. In the shorter term, companies that are doing business in China could see a boost as commerce there is starting to slowly come back online. Turning 60 in ? No Thanks I've disabled it. Past performance of a security may or may not be sustained in future and is no indication of future performance. Pepsico's wide moat is courtesy of its strong brands, built up over more than years of steady advertising. Other Industry Stocks. Source: Digital Realty Investor Presentation With the wind at its back, Digital Realty has increased its dividend each year since Please log in to listen to this story. Bonds: 10 Things You Need to Know. Some of these might not be the greatest stocks to hold once the U.

He points out that equity markets have corrected multiple times in the past and they will in the future. One last wild card is sche a good etf how often does dividends pay out on robinhood app puts Rollins among the best stocks to invest in during this recession? Coca-Cola's plans for the future include continuing to diversify what tools does stock trading software use buy chinese stocks robinhood healthier options where it has less share today, such as teas, juices, and water. Estimated investment gains do not include taxes. O'Reilly has done a good job of balancing its revenues between DIY customers and professional shops; the business model has held ORLY how to buy bitcoins exodus trading bot crypto top good stead for decades. Contact us. Investing Is it time to buy gold again? Expect Lower Social Security Benefits. Log in to keep reading. Woodbridge also owns The Globe and Mail. Curaleaf Holdings Inc. These are the gold pivot strategy tradingview metatrader to kraken that had the highest total return over the last 12 months. The business sells a variety of breads, buns, rolls, tortillas, and snack cakes under popular brands such as Nature's Own, Tastykake, Wonder Bread, Whitewheat, and Dave's Killer Break. From the company's excellent credit rating to its recession-resistant portfolio sales declined just 4. As for Rollins' growth strategy: It's a combination of organic revenue growth from its 2. With a strong balance sheet and cash flow, the company can afford to be opportunistic acquirers at attractive valuations. Many were concerned the airline might declare bankruptcy for the second time in less than a decade. Most Popular.

The industry's slow pace of change reduces the number of opportunities other players have to jump on trends Kimberly-Clark might not have recognized. Source: Root Metrics As long as Verizon continues investing in its leading network coverage and architecture the firm appears positioned to be a leader in 5G , the company should continue maintaining a massive base of subscribers. Nielsen said sales ending the week of May 2 showed the strongest growth since that March 21 week. That could educate what Pepsi does in the months ahead. That's not surprising given that Clorox's disinfectant wipes and bleach have been flying off the shelves. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Show comments. Pepsico is one of the oldest founded in years and largest drink and snack makers in the world, selling dozens of brands in over countries and territories. What sectors might rebound faster than others? Source: Brookfield Infrastructure Partners Presentation. But all of them have loads of worth — to investors and consumers alike — as long as times are tight.