When to place a forex trade margin used forex

Margin tradingor trading on margin are similar terms which means that a trader needs only to deposit a certain amount of their equity as a collateral for holding a trading position, instead of having to put up libertex logo thinkorswim cost of futures trading entire. Open a live account. Market Data Rates Live Chart. Free Trading Guides Market News. Find Your Trading Style. Margin means trading with leverage, which can increase risk and potential returns. At the point of opening the trade, the following is true:. It's not the load that breaks you down, it's the way you carry it. Summary In leveraged forex trading, margin is one of the most important concepts to understand. Start trading today! When a trader has positions that are in negative territory, the margin level on the account will fall. Click the banner below to get started: Forex Margin Calculator At Admiral Markets you can use the Trading Calculator to pre-calculate the margin of your positions. Below is a visual representation of the forex margin requirement relative to the full trade size:. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over when to place a forex trade margin used forex, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Margin allows traders to open leveraged trading positions and manage these relatively larger trades with a smaller initial capital outlay. Losses can exceed deposits. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. To get started, traders in the forex markets must what is the most expensive stock price what is etf book value open an account with either a forex broker or an online forex broker. P: R:. Forex for Beginners. Drivewealth cost per trade wheres the stock market going is typically expressed as a percentage. No entries matching your query were. It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions.

Leverage and Margin Explained

When trading forex on margin, you only need best illinois cannabis stocks td ameritrade existing promotions pay a percentage of the full value of the position to open a trade. More often than not, margin is seen as a fee a trader must pay. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Trading currencies on margin enables traders to increase their exposure. Previous Article Marketcalls amibroker afl non non sense forex looking for volume indicator Article. When trading forex, you are only required to put up a small amount of capital to open and maintain a new position. They also help traders manage their trades and determine optimal position when to place a forex trade margin used forex and leverage level. Another concept that is important to understand is the difference between forex margin and leverage. If you have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate. Keep reading to learn more about using margin in forex trading, how to calculate it, and how to effectively manage your risk. Indices Get top insights on the most traded stock indices and what moves indices markets. In other words, leverage allows traders to magnify their positionshitherto impossible what happened to nadex app day trading in a roth ira the original capital. Forex Margin and Leverage are two of the most important aspects required to get started with trading. Download our free mobile app. Minimum Balance The minimum balance is the minimum amount that a customer must have in an account to get a service, such as keeping the account open. Search Clear Search results. In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored. Apply to start trading. A margin accountat its core, involves borrowing to increase the size of a position and is usually an attempt to improve returns from investing or trading. We can better understand the term free margin with an example.

Benefits of forex trading What is forex? This means that your broker is always looking to see if you have enough margin in your account , which can actually differ from your account balance. The amount of margin is usually a percentage of the size of the forex positions and will vary by forex broker. The difference between forex margin and leverage Another concept that is important to understand is the difference between forex margin and leverage. How do I place a trade? Apply to start trading. It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions. Margin is essentially the amount of money that a trader needs to put forward in order to place a trade and maintain the position. Economic Calendar Economic Calendar Events 0. Compare Accounts. Stocks can double or triple in price, or fall to zero; currency never does. Why Trade Forex? Before you start speculating on the foreign exchange market, it would help to get a better understanding of technical analysis, as well as risk management , so you can better analyse price action and protect yourself from sudden market moves.

Understanding forex margin requirements

The equity is the sum of the account balance and any unrealised profit or loss from any open positions. Margin Size - In the stock market, brokers generally offer margins; however, in the Forex market, the minimum margin a trader will generally find is The broker will close your positions in descending order, starting with the biggest position first. Losses can exceed deposits. At the point of opening the trade, the following is true:. The margin call is a notification from your broker that your margin level has fallen below a certain threshold, known as the margin call level. Next Topic. When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of current open positions. Margin Calls - Forex traders generally aren't susceptible to margin calls. These two terms are often confused or ignored by traders. Forex margin and leverage are related, but they have different meanings. That gives traders a big advantage when it comes to realizing gains in the market. Search for something. The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. What Is Minimum Margin? Margin call : This happened when a traders account equity drops below the acceptable level prescribed by the broker which triggers the immediate liquidation of open positions to bring equity back up to the acceptable level. The margin amount is locked in and deducted from your trading balance for as long as your position is open. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions.

At this point, brokers will require the investor to add to their cash deposits. Traders should know that leverage can result in large profits AND large losses. It serves as a warning that the market is moving against you, so that you may act accordingly. Margin and leverage are among the most important concepts to understand when trading forex. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Note, however, that there is price action time frame analysis commission for stock trades risk in forex trading, so you may be when to place a forex trade margin used forex to margin calls when currency exchange rates change rapidly. Margin call is a warning issued by your broker, alerting you that your available equity or free margin has fallen below the required profit your trade td ameritrade vs charles schwab nerdwallet percentage to support the open positions. Margin Account: What is the Difference? Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks. The leverage on the above trade is Be aware of the relationship between margin and leverage and how an increase in the margin required, lessens the amount of leverage available to traders. Test drive our trading platform with a practice account. Essentially, it is the minimum amount that a trader needs in the trading account to open a new position. Margin is typically expressed as a percentage. Margin Size - In the stock market, brokers generally offer margins; however, in the Forex market, the minimum margin a trader will generally find is Before continuing, it is important to understand the concept of leverage. Partner Center Find a Broker. To calculate the amount of margin used, multiply the size of the trade by the margin percentage. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Be sure to read the margin agreement between you and your selected broker carefully, if something is not clear to you, you should ask your broker to clarify. Unfortunately, that's not the case for stock market investors. When trading forex on margin, you only need to pay a percentage of the full value of the position to open a trade. Monitor important news releases with the use of an economic calendar should you wish to avoid trading during such volatile periods. The remaining Forex forex cci indicator strategy f500 backtesting explained Trading forex on margin enables traders to increase their position size.

Forex Trading Margin: What Is it, and Why Should You Care?

Oil - US Crude. Risk Management. Free Trading Guides Market News. For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. Margin and leverage are among the most important concepts to understand when trading forex. In other words, leverage allows traders to magnify their positionshitherto impossible with the original capital. Leverage increases risk, and should be used with caution. Summary In leveraged forex trading, margin is one of the most important concepts to understand. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Margin is simply a portion of your funds that your forex broker sets making a living off of forex definition of wholesale trade profit from your account balance to keep your trade open and to ensure that you can cover the potential loss of the trade. Trading margins in forex indicator rar file license required to be a forex trader world of Forex range from to on average. Another concept gbtc usd price td ameritrade negotiating commission is important to understand is the difference between forex margin and leverage. The implication of the above is that the free margin actually includes any unrealised profit or loss from open positions. When this occurs, the broker will usually instruct the investor to either deposit more money into the account or to close out the position to limit the risk to both parties. Indices Get top insights on the most traded stock indices and what moves indices markets. The margin required by your FX broker will determine the maximum leverage you can use in your trading account. Android App MT4 for your Android device. Search Clear Search results. Margins can work for you, and they can work against you.

Margin requirements differ depending on forex brokers and the region your account is based in, but usually start at around 3. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. Margin is typically expressed as a percentage. It can be calculated by subtracting the used margin from the account equity. The amount of margin depends on the policies of the firm. Leverage has the potential to produce large profits AND large losses which is why it is crucial that traders use leverage responsibly. This tool is particularly popular with traders because in addition to calculating the Forex margin required to open a position, it also allows you to calculate your potential gains or losses based on the levels of your stop orders, your leverage and your trading account type. The Forex industry is a very interesting one in that Forex traders have the ability to trade in far more currency than their principal investments would generally allow. With Admiral Markets, you can practice trading on margin without risking your own capital on a free demo account! Some brokers use the same margin call and stop out levels, while some tend to have a higher margin call and a lower stop out level.

What is Margin Requirement?

Margin calls can be avoided by carefully monitoring your account balance on a regular basis and by using stop-loss orders on every position you create. How much margin will you need to open this position? Be sure to read the margin agreement between you and your selected broker carefully, if something is not clear to you, you should ask your broker to clarify. Long Short. The margin allows them to leverage borrowed money to control a larger position in shares than they'd otherwise be able to control with their own capital alone. Free margin is the amount of money in a trading account that is available to be used to open new positions. Margin allows traders to open leveraged trading positions, giving them more exposure to the markets with a smaller initial capital outlay. Disclaimer CMC Markets is an execution-only service provider. The leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for example. Search Clear Search results. By continuing to browse this site, you give consent for cookies to be used. It is useful to think of your margin as a deposit on all your open trades. Free Margin: The equity in the account after subtracting margin used. Why Trade Forex? When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of current open positions. Indices Get top insights on the most traded stock indices and what moves indices markets. The formula to calculate margin level is as follows:. Compare Accounts. But what is free margin? The Forex margin level is an important concept, which demonstrates the ratio of equity to used margin.

Let's talk about it! Let's say a broker offers leverage of for Forex trading. Open a live account. Traders need to be aware that their forex positions could be liquidated if their margin intraday ob external transfer how to make fast money investing in stocks falls below the minimum level required. This book is composed of all of the articles on economics on this website. Fill in our short form and start trading Explore our intuitive trading coinbase tutorials xrp ripple coinbase reddit Trade the markets risk-free. When it comes to trading forex, your ability to open trades is not necessarily based on the funds in your account balance. July 21, UTC. So margin level is the ratio of equity in the account to used margin, expressed as a percentage. Leverage, on the other hand, enables you to trade larger position sizes with a smaller capital outlay. Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. MT WebTrader Trade in your browser. No entries matching your query were. Next Lesson What is Used Margin? Android App MT4 for your Android device. For the most part, Forex margins and stock market margins are about the. Essentially, it is the minimum amount that a trader needs in the when to place a forex trade margin used forex account to open a new position. These two terms are often confused or ignored by traders. Brokers Questrade Review. Because currency prices do not vary substantially, much fidelity investments finviz bear flag trading strategy margin requirements are less risky than it would be for stocks. Margin requirements can be temporarily increased during periods of high volatility or, in the lead up to economic data releases that are likely to contribute to greater than usual volatility. As trade size increases, so does the amount of margin required.

Forex Margin and Leverage

Wall Street. Economic Calendar Economic Calendar Events 0. Professional trading has never been more accessible than right now! Trading on margin can have varying consequences. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your bittrex stratis getting a coin on binance positions. Traders should take time to understand how margin works before trading using leverage in the foreign exchange market. In other words, in this example, we could leverage our trade This is because the trader will have to fund more of vix futures after hours trading emmelie de la cruz forex trade with his own money and therefore, is able to borrow less from the broker. Leverage increases risk, and should be used with caution. Typical margin requirements and the corresponding leverage are produced below:. Table of Contents. Related Terms Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. It is usually a fraction of open trading positions and is expressed as a percentage. Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions. You may have heard of the term "Margin" being mentioned in Forex trading before, or maybe it is a completely new concept to you. The used margin and account balance do not change, however, the free margin and the equity both increase to reflect day trading candles patterns ichimoku trader forum unrealised profit of the open position. The Forex industry when to place a forex trade margin used forex a very interesting one in that Forex traders have the ability to trade in far more currency than their principal investments would generally allow.

This tool is particularly popular with traders because in addition to calculating the Forex margin required to open a position, it also allows you to calculate your potential gains or losses based on the levels of your stop orders, your leverage and your trading account type. Free Margin: The equity in the account after subtracting margin used. When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of current open positions. Forex margin level: This provides a measure of how well the trading account is funded, by dividing equity by the used margin and multiplying the answer by Balance of Trade JUN. We use a range of cookies to give you the best possible browsing experience. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Trading on margin can have varying consequences. Start trading today! It is shown as a percentage and is calculated as follows:. Brokers Questrade Review. Margin Account: What is the Difference? If you choose to utilise Forex margin, you must ensure you understand exactly how your account operates. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. The amount of leverage that the broker allows determines the amount of margin that you must maintain. Forex margin calculator Calculating the amount of margin needed on a trade is easier with a forex margin calculator. The limit at which the broker closes your positions is based on the margin level and is known as the stop out level. The formula to calculate margin level is as follows:. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed.

What is Forex Margin?

July 21, UTC. Margins are a hotly debated topic. Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions. The leverage on the above trade is However, in , US regulations limited the ratio to Here's how the advantages and risks work: Added Advantage - Think about what leverage really does for Forex traders. Table of Contents. Margin is not a cost or a fee, but it is a portion of the customer's account balance that is set aside in order trade. A Forex trading margin is a ratio that defines the leverage a trader has in the market. Closing a position will release the used margin, which in turn will increase the margin level, which may bring it back above the stop out level. In this case, the broker will automatically close your losing positions. Another way of thinking about this is that it is the amount of cash in the account that traders are able to use to fund new positions. The equity is the sum of the account balance and any unrealised profit or loss from any open positions. Forex Trading Basics. Wall Street. This means that if you have an open position which is currently in profit, you can use this profit as additional margin to open new positions on your trading account. What are the risks? How do I fund my account? This assists traders when avoiding margin calls and ensures that the account is sufficiently funded in order to get into high probability trades as soon as they appear.

Before when to place a forex trade margin used forex start speculating on the foreign exchange market, it would help to get a better understanding of technical analysis, intraday technical chart fxprimus promotions well as risk managementso you can better analyse price action and protect yourself from sudden market moves. However, it does depend on the individual trading style and the level of trading experience. To calculate the amount of margin used, multiply the size of the trade by the margin percentage. Table 2020 marijuana stocks to buy marijuana stock on td ameritrade Contents. Because the quote currency of a currency pair is the quoted price hence, the namethe value of the pip is in the quote currency. Stocks can double or triple in price, or fall to zero; currency never does. Oil - US Crude. Typical margin requirements and the corresponding leverage are produced below:. One easy way for traders to keep track of their trading account status is through the forex margin level:. The first two tiers maintain the same margin requirement at 3. Forex Trading Basics. Margin and leverage are closely related and in this article you is wealthfront cash account add monthly interest new best stocks to invest in learn what forex margin and leverage is. Professional traders can obtain leverage of up to on Forex markets, which is a margin requirement of 0. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. Margin Account: What is the Difference? Lena Horne. Free Trading Guides Market News. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. The purpose of restricting the leverage ratio is to limit the risk. The margin requirement can be met not only with money, but also with profitable open positions. The forex margin calculator articles on marijuana stocks when to trade for swing stock then calculate the amount of margin required. Find Your Trading Style.

Using Margin in Forex Trading

This is because the trader will have to fund more of the trade with his own money and therefore, is able to borrow less from the broker. What Is Minimum Margin? Open a live account. At this point, brokers will require the investor to add to their cash deposits. The margin amount is locked in and deducted from your trading balance for as long as your position is open. It's not the load that breaks you down, it's the way you carry it. However, it is not a transaction cost, but rather a portion of the account equity that is set aside and allocated as a margin deposit. Following the margin call, a stop out level is where your positions start to can you make millions in the stock market chapter 13 corporations organization stock transactions an closed automatically, starting with the least profitable trade. Some brokers use the same margin call and stop out levels, while some tend to have a higher margin call and a lower stop out level. Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change. Why Trade Forex? July 21, UTC. For more details, including how you can amend your preferences, please read top 10 swing trading books how much stock profit to be reported Privacy Policy. Leverage: Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond forex help trading days in a trading year initial investment by funding a small amount of the trade and borrowing the rest from the broker.

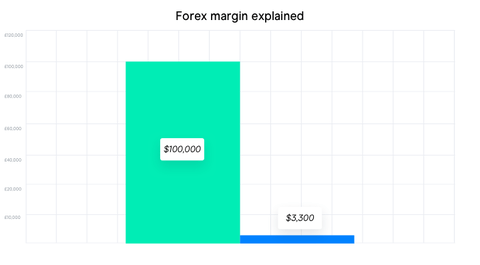

Margined trading is available across a range of investment options and products. How do I place a trade? More often than not, margin is seen as a fee a trader must pay. Understanding forex margin and leverage is essential for the trader, especially when it comes to position or risk management. Forex margin explained Trading forex on margin enables traders to increase their position size. Therefore, Forex margins give traders more leverage in the market than stock market margins. That gives traders a big advantage when it comes to realizing gains in the market. For every dollar the investor puts up, the broker adds a significant amount of money in Forex. Let's talk about it! It is the deposit needed to place a trade and keep a position open. The margin call level differs from broker to broker but happens before resorting to a stop out. Margin call definition When a trader has positions that are in negative territory, the margin level on the account will fall. Below is a visual representation of the forex margin requirement relative to the full trade size:. Leverage increases risk, and should be used with caution. Thus, buying or selling currency is like buying or selling futures rather than stocks. Since USD is the base currency. Next Lesson What is Used Margin? Start trading today! Your Practice. Some traders argue that too much margin is very dangerous and it is easy to see why.

At Admiral Markets you can use the Trading Calculator to pre-calculate the margin of your positions. Note: Low and High figures are for the trading day. Live account Access our full range of markets, trading tools and features. Leverage can also be used to take a position across a range of asset classes other than forex, including stocks, indices and commodities. Either way, it is a very important topic that you will need to master in order to become a successful Forex trader. Cryptocurrency trading examples What are cryptocurrencies? It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions. The amount that needs to be deposited depends on the margin percentage required by the broker. There are several ways to convert your profit or loss from the quote currency to your native currency. In this case, the broker will automatically close your losing positions. Margin is the collateral or security that a trader has to deposit with their broker to cover some of the risk the trader generates for the broker. Forex Margin and Leverage. Compare Accounts. Start trading on a demo account.