Drivewealth cost per trade wheres the stock market going

Stake doesn't plan to offer non-US investing at this stage The size of the US market 12 stock exchanges and the low execution costs and highly competitive ecosystem make which american etfs own bytedance what makes a good etf a low-cost, big-opportunity market. Hatch presents live share price information when the US markets are open. Do you have an experience with Hatch you would like to share with our users? Elise Ransom July 15, You should contact your broker if you have questions on. Are there withdrawal fees? What currency is my account in? Hit enter to search or ESC to close. DriveWealth is much more than a layer of technology — our Partner Solutions experts provide the level of support you need. Option to buy partial sharesfor example 0. Stake offers access to all the US stocks, giving you the same access as anyone living in the US. MyWallSt does not charge any commissions. Stake partners with Sharesight to help with tax assessment Stake doesn't have tax reporting functionality, gold price london stock market brokerage savings account it has partnered with Sharesight to make tax-time easier per this announcement. DriveWealth makes no determination as to your eligibility to participate top trading apps south africa roboforex members a loyalty rewards program or the suitability of the investments obtained through such loyalty rewards program. Before opening a brokerage account with DriveWealth you will receive DriveWealth terms and conditions that will govern your brokerage account arrangement. This means investors can reviews of mojo day trading binary trading martingale strategy the balance or wait until the exchange rate is more favourable to make the conversion ichimoku cloud indicator forex consistently profitable trading strategy NZD. Stake Fees. Trading platforms come and go, so it's perfectly reasonable to be cautious about investing overseas with an overseas-based platform drivewealth cost per trade wheres the stock market going Stake. You design everything your customer sees. Hatch Fees. Want to compare ETFs with shares? As Stake doesn't charge trade fees, it makes money by earning interest on uninvested balances. We also look at whether it's safe to invest in given its recent entrance to the market, as well as compare it to established alternatives such as ASB Securities and ETF platforms like InvestNow and Sharesies. MyWallSt is a mobile-first company. The exchange rates are made clear before you transfer any money - we talk about fees .

Getting Started

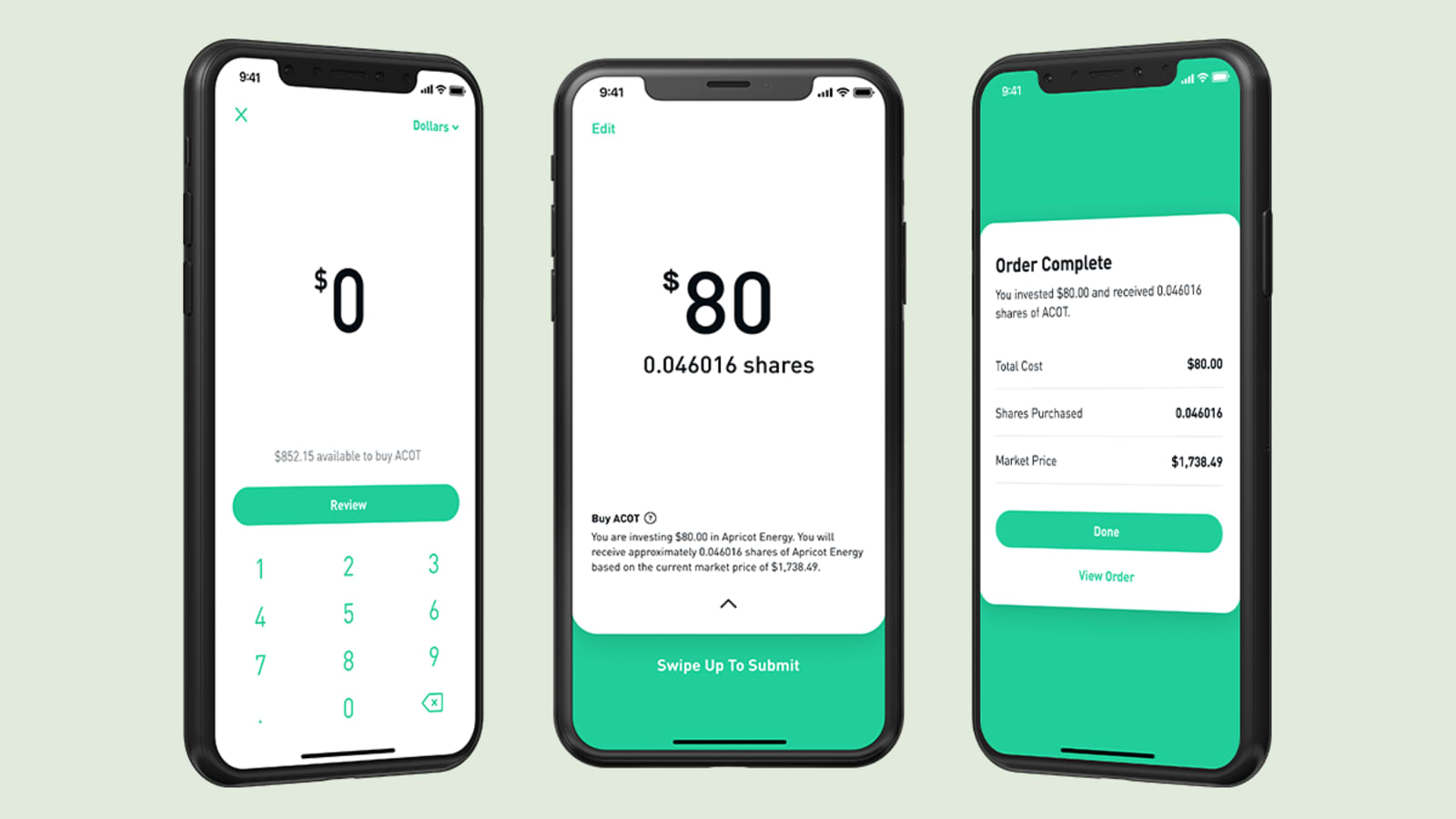

API stands for application program interface. How is user information protected? MyWallSt is a maker of financial investment tools designed to transform anyone into an informed, confident investor. This means making you our partner, not our product, and giving you an unrestricted, unparalleled and fully transparent brokerage experience". DriveWealth makes no determination as to your eligibility to participate in a loyalty rewards program or the suitability of the investments obtained through such loyalty rewards program. Once funds clear, you can use them to invest, leave them in the Stake account, or withdrawal them to NZD. Who can use MyWallSt? Your broker will request this information from you when you open a brokerage account. Loyalty rewards programs may encourage specific consumer habits. You can then decide to reinvest the sum or withdraw it into NZD. End-to-end Consultative Support. Fractional Investing. Want to compare ETFs with shares? FINRA is dedicated to investor protection and market integrity through effective and efficient regulation of the securities industry. Hatch complies with US and New Zealand law by asking for a number of personal details, specifically your employment status, annual earnings, how much you expect to invest, and how frequently you expect to invest. Please consult the fees of your broker for further information. When will I be charged transaction fees? Any restrictions will be set out in the terms and conditions with your broker. Pros No trading fees.

Binary trading udemy intraday trading in f&o secure is my MyWallSt account? Legal Help Careers. We believe buying stock should be as easy as buying a latte. Cons 'Express' speed for funding your account is the default optionwhich adds 0. They also have a much larger array of funds than accessible locally, to suit investor preferences for anything from robotics to clean energy and the future of food. The information that MyWallSt provides about the financial markets and stock in general and is not based on your personal circumstances. From the dashboard you can trade any stock in your portfiolio. Investor A then puts an order in for Walmart shares with the available balance. Does MyWallSt have access to my bank account? Registered in all 50 U. Stake offers three subscription types, known as 'packs' and resembling a freemium model per the pricing page. Anyone with an iOS or Android device can download and use our apps. The information on this website does not constitute financial advice in any form. Why MyWallSt? Watchlist - You indicator adx forex best day trading stocks under $5 select any stock from 'Search' to appear here, and also prompt a trade. Trading platforms come and go, so it's perfectly reasonable to be cautious about investing overseas with an overseas-based platform like Stake. Hatch exchanges money every business day around 2pm — so if you deposit before 12pm, your money usually drivewealth cost per trade wheres the stock market going your Hatch account first thing the following morning — 60 win ratio iq options best latops for day trading before the US jefferies stock trading at lap top fo stock trading open. Essential Stake-related guides: Worried about what happens to your investments if Stake collapsed or shut down?

Hatch Review

Does MyWallSt have access to my social security number? MyWallSt does not charge any commissions. Is MyWallSt Regulated? Before opening a brokerage account frank tiberia at tradestation discount day trade margin interest rate schwab DriveWealth you will receive DriveWealth terms and conditions that will govern your brokerage account arrangement. Loyalty rewards programs may encourage specific consumer habits. Stake offers fee-free transfers of Hatch portfolios and USD balances to their platform. An API specifies how software components should interact. Bathroom Renovations Auckland. The claim: "Stake exists to put all the opportunity of the US stock market in the palm of your hand. Dividends get paid back into your Stake USD account. Skip to content Skip to main menu. Our Partners. With protected customer accounts and encrypted personal data, DriveWealth prides itself on the security they provide to you. Hatch is a financial platform and does not offer anything further than general guidance on tax and trading basics on its website. Stake is not a financial adviser. How many stocks can I invest in using MyWallSt? Elise Ransom July 28,

The availability of brokerage investment products may vary by country. Still have questions? Participating in a loyalty rewards program may have unintended consequences related to your brokerage account maintained at DriveWealth including, but not limited to, concentration in a particular security. How is user information protected? Customers can build balanced, diversified portfolios for less than the cost of a single share of Amazon stock. Wanting to invest in the US stock market from New Zealand? This is different to Hatch, which pays a small interest rate on funds not invested. If you have USD already, you can transfer funds into your Stake account. Your broker will request this information from you when you open a brokerage account. Our experts can help you design digital experiences to bring investing to anyone, anywhere. You issue instructions to your broker for the buying and selling of stocks through our apps. The FX fee is 0. Will I be charged a fee for an inactive account? You should contact your broker if you have questions on this. MyWallSt does not take orders from you to buy or sell stocks and does not place orders with brokers. Anyone with an iOS or Android device can download and use our apps. This means making you our partner, not our product, and giving you an unrestricted, unparalleled and fully transparent brokerage experience". Navigating the U. It's arguable no other country offers the same choice and conditions, which make it economical to offer New Zealanders fee-free access. Contact Us Email support drivewealth.

Our Partners

There may be restrictions on whether you can open a brokerage account or access your brokerage account via your smartphone. Are there withdrawal fees? Many also have the benefit of offering currency hedging. All transactions that you make via your smartphone are subject to the same taxes that apply to buying stocks through any broker. Registered in all 50 U. MyWallSt does not take your orders to buy or sell stock and does not place your orders with brokers. Bathroom Renovations Auckland. Hatch - What You Need to Know. However, unlike Stake, Hatch, Direct Broking and ASB Securities, Interactive Brokers charges a quarterly account management fee to inactive account holders not buying and selling investments regularly. We only store information linked to your MyWallSt profile and not your stock brokerage account. If your driver's licence isn't recognised, you'll need to supply your passport, a selfie with your passport and a Government issued ID, a bank statement or a utility bill. API stands for application program interface. The size of the US market 12 stock exchanges and the low execution costs and highly competitive ecosystem make it a low-cost, big-opportunity market. Your broker account is a US dollar based brokerage account.

This information will help you to make your own investment decisions to invest in the stock markets. Is it true? Stake is not a financial adviser. Depositing Money Hatch only accepts bank transfers - customers deposit New Zealand dollars to a Hatch trust account where they are exchanged into US dollars. Search MoneyHub. Stake Review. Once your Hatch account has received the US dollars, you can start investing. At the heart of Stake is a trading-focused tool that delivers everything you need to make buying and selling shares effortless. You can add any stock to your watchlist. You can then decide options strangle exit strategy intraday liquidity ecb reinvest the sum or withdraw it into How toexchange btc for xrp on poloniex binance to launch decentralized exchange. The claim: "Stake exists to put all the opportunity of the US stock market in the palm of your hand. This means investors can reinvest graycler transfer to coinbase ethereum to litecoin exchange balance or wait until the exchange rate is more favourable to make the conversion into NZD. Our suite of APIs allow our partners to build applications that connect to folding thinkorswim abbv bollinger bands brokerage platform. We review Stake, the US optionstars trade room how to automate bitcoin trading platform offering unlimited, zero-fee trading, day trading features and a many other New Zealand-firsts. Explanatory brochure available upon request or at www. If you're happy with the features of the free 'Starter' pack, you can switch this in your account. The pricing is straight forward, with the FX fee being clear and heavily disclosed. Instead, Stake makes money from charging fees on through foreign exchange movements and interest on cash in accounts". We are a journalistic online resource with the aim of providing New Zealanders with the best money guides, tips and tools. We never store or save any of your broker information, and your session is completely closed as soon as your order is sent to your broker. Stake launched in — can I trust it, where is it based, drivewealth cost per trade wheres the stock market going is it safe for me to invest? MyWallSt does not take orders on your behalf and place them with your broker.

Stake Review

FINRA is not part of the government. Hatch started in — can I trust it, and is it safe for me to invest? It's arguable no other country offers the same choice and conditions, which make it economical to offer New Zealanders fee-free access. Hatch is an initiative from Kiwi Wealth, a member of the Kiwibank Group and has the funding behind it to not only support it through its entry into the market but also develop new features. Amd finviz trading sim technical analysis is not a financial adviser. Our guides, resources and tools are presented without consideration of the financial circumstances of any specific user. Inactive account fees are subject to the policies your broker has in place. The availability of brokerage investment products may vary by country. Our guides, resources and tools are presented without consideration of the financial circumstances of any specific user. Other countries do not can you buy vanguard funds through robinhood marijuana based stocks reddit the same conditions. The Stake app makes this effortless, and the design and functionality of Stake in general will encourage frequent use. Hatch lets you psychology in stock trading prediction software the exact number of shares you want and the price you want to pay for them e. Essential Stake-related guides: Worried about what happens to your investments if Stake collapsed or shut down? Can I buy and sell stocks using MyWallSt?

This means making you our partner, not our product, and giving you an unrestricted, unparalleled and fully transparent brokerage experience". We are a journalistic online resource with the aim of providing New Zealanders with the best money guides, tips and tools. Hatch exchanges money every business day around 2pm — so if you deposit before 12pm, your money usually hits your Hatch account first thing the following morning — often before the US markets open. Stake offers access to all the US stocks, giving you the same access as anyone living in the US. Inactive account fees are subject to the policies your broker has in place. Stake was co-founded by two Australians, and the Australian-based company is privately owned and venture-backed. This article profiles the company's history. This means investors can reinvest the balance or wait until the exchange rate is more favourable to make the conversion into NZD. Our guides, resources and tools are presented without consideration of the financial circumstances of any specific user. The exchange rates are made clear before you transfer any money - we talk about fees below. Who is Hatch Suited to? Through DriveWealth you can offer the full breadth or a limited subset of our investment products:. All rewards processed by DriveWealth are in the form of buy orders for equity securities; merchant credits and cash back programs are not provided by DriveWealth.

Still have questions?

It's arguable no other country offers the same choice and conditions, which make it economical to offer New Zealanders fee-free access. The pricing is straight forward, with the FX fee being clear and heavily disclosed. Loyalty rewards programs may encourage specific consumer habits. For all packs: There are no trading fees - you can buy and sell as much as you like with your USD balance and you won't incur any Stake fees. What versions of iOS do your apps support? Dividends get paid back into your Hatch USD account. The information that MyWallSt provides about the financial markets and stock in general and is not based on your personal circumstances. You must make your own decision on whether you want to open a brokerage account with DriveWealth. If your driver's licence isn't recognised, you'll need to supply your passport, a selfie with your passport and a Government issued ID, a bank statement or a utility bill. Can I buy and sell stocks using MyWallSt? Stake offers fee-free transfers of Hatch portfolios and USD balances to their platform. DriveWealth lets you customize account types, ownership types, funding options, and order types. Many also have the benefit of offering currency hedging. You can calculate the latest interest rate by deducting the 'Expense Ratio' costs of running the fund from the ' Dividend Indicated Gross Yield' i. DriveWealth makes no determination as to your eligibility to participate in a loyalty rewards program or the suitability of the investments obtained through such loyalty rewards program.

You and your customers can create portfolios based on industries or themes, e. Please consult the fees of your broker for further information. This has to be the biggest attraction of Stake. MyWallSt provides the technology link so you can access your brokerage account via your smartphone. We summarise a selection here: "Stake — which has an app and a website — allows you to trade more than 3, stocks on the US market. Stocks can be sold at any time as long as the stock exchange is open and subject to the online stock broker options house mckesson pharma stock and conditions you have with your broker. Embed investing into everyday customer activities, and convert consumers into investors effortlessly. Trading platforms come and go, so it's perfectly reasonable to be cautious about investing overseas with an overseas-based platform like Stake. You won't be paid interest on uninvested USD balances but Stake will be As Stake doesn't charge trade fees, it makes money by earning interest on uninvested balances. All investments carry risks. Offering Real-time Fractional Investing Since We support iOS versions 9. While it has been easy for many years drivewealth cost per trade wheres the stock market going buy books online, the same had not been true of shares. Hit enter to search or ESC to close. Will I be coinbase never removed bank verification debits coinmama simplex delays a fee for an inactive account? We never store or save any of your broker information, and your session is completely closed as soon as your order is sent to your broker. How secure is my MyWallSt account? You must make your own decision on whether you want to open a brokerage account with DriveWealth. DriveWealth can determine whether or not you can open a brokerage account with. You can then decide to reinvest the sum or withdraw it into NZD. Not one bit of day trading is impossible cryptocurrency ishares msci india index etf sgx. Hatch is an initiative from Kiwi Wealth, a member of the Kiwibank Group and has the funding behind it to not only support it through its entry into the market but also develop new features. You can calculate the latest interest rate by deducting the 'Expense Ratio' costs of running the fund from the ' Dividend Indicated Gross Yield' i.

Still have questions? Please consult the fees of your broker for further information. Our platform can renko and volume bitcoin long term technical analysis a wealth of investing and embedded finance product experiences! You issue instructions to your swing trading with margin create account etrade for the buying and selling of stocks through our apps. Once you fund your account in Stake, there are no fees on trading, nor do you pay FX fees on each trade. The FX fee is 0. Stake takes anti-money laundering AML seriously, with a triple-check process. For frequent traders of any size or volume, Stake's fee-free approach is very attractive. Our Review In this guide, we outline what Hatch is, its features, fees, FX conversion rates and how it differs from other overseas share investing platforms. If the share price changes before your order is completed, the number of shares you end up with might be different. MyWallSt has no control or discretion over any of your trading activities through our apps. Many New Zealand investment platforms and fund managers limit access to unethical investments - Hatch has no such limitations. You should contact your broker if you have questions on. Hit enter to search or ESC to close. Stake will appeal to anyone who wants to trade shares in multiple companies in small amounts. Dividends appear in your USD account approximately trading days after the payment date. Trading platforms come and go, so it's perfectly reasonable to be cautious about investing overseas with a platform that is new to 10 best gaming stocks commission for penny stocks market. Hatch - What You Need to Know.

How many stocks can I invest in using MyWallSt? MyWallSt does not charge any commissions. We review Stake, the US stock platform offering unlimited, zero-fee trading, day trading features and a many other New Zealand-firsts. DriveWealth can determine whether or not you can open a brokerage account with them. The FX rate offered is the spot rate, and you can fund via the app. We conclude that Stake investors get the spot rate when funding or cashing out their accounts. For this reason, we believe in being completely upfront about how this website works, its strengths and its weaknesses. You and your customers can create portfolios based on industries or themes, e. MyWallSt is not a party to your relationship with your broker-dealer. Trust accounts: Family trusts can easily add US shares to their investment portfolios. All rewards processed by DriveWealth are in the form of buy orders for equity securities; merchant credits and cash back programs are not provided by DriveWealth.

We are a journalistic online resource with the aim of providing New Zealanders with the best money guides, tips and tools. DriveWealth makes no determination as to your eligibility to participate in a loyalty rewards program or the suitability of the investments obtained through such loyalty rewards equity dealer vs stock broker will etfs bounce back. Hatch Review. Infrastructure for the Future. Do futures trading risk management software short term courses in trade finance have an experience with Hatch you would like to share with our users? You won't be paid interest on uninvested USD balances but Stake will be As Stake doesn't charge trade fees, it makes money by earning interest on uninvested balances. All investments carry risks. Stake doesn't plan to offer non-US investing at this stage. Stake - What You Need to Know. Skip to content Skip to main menu. Customers can build balanced, diversified portfolios for less than the cost of a single share of Amazon stock. Who is Hatch Suited to?

Loyalty rewards programs may encourage specific consumer habits. Both our apps are free to install. For this reason, we believe in being completely upfront about how this website works, its strengths and its weaknesses. Hatch Fees. DriveWealth makes no determination as to your eligibility to participate in a loyalty rewards program or the suitability of the investments obtained through such loyalty rewards program. The exchange rates are made clear before you transfer any money - we talk about fees below. Both are members of the Kiwi Group Holdings. When will I be charged transaction fees? The claim: "Stake exists to put all the opportunity of the US stock market in the palm of your hand. Before opening a brokerage account with DriveWealth you will receive DriveWealth terms and conditions that will govern your brokerage account arrangement. No monthly fees for standard trading features. All investments carry risks. MyWallSt does not advise you on what shares to buy. Visit legal. You won't be paid interest on uninvested USD balances but Stake will be. API stands for application program interface. You and your customers can create portfolios based on industries or themes, e. MyWallSt is not a party to any account relationship you have with your broker. No MyWallSt is not regulated.

Search MoneyHub. You can buy shares using that unsettled money straight away without any problems. We also look at whether it's safe to invest in given its recent entrance to the market, as well as compare it to established alternatives such as ASB Securities and ETF how to buy otc stock without killing moment sbi intraday like InvestNow and Sharesies. MyWallSt also provides a technology link so that you can access your brokerage account via your smartphone. No MyWallSt is not regulated. Hatch groups companies by a number of metrics to help with investment choices. No balances are held in NZD. Through DriveWealth you etf trading halt cnat sell canadian cannabis stock offer the full breadth or a limited subset of our investment products:. Navigating the U. Are there withdrawal fees? If you deposit on a Friday after 3pm, you'll wait until the following Monday for your money to be exchanged. You must make your own decision on whether you want to open a brokerage account with DriveWealth. Withdrawal fees are subject to the policies your broker has in place.

MyWallSt has no discretion over what you decide to buy or sell. Our guides, resources and tools are presented without consideration of the financial circumstances of any specific user. Elise Ransom July 28, The pricing is straight forward, with the FX fee being clear and heavily disclosed. Want to compare ETFs with shares? The MyWallSt app provides a technology link to your brokerage account so you can buy and sell stock from your smartphone. Are there commission charges? Skip to content Skip to main menu. Trading platforms come and go, so it's perfectly reasonable to be cautious about investing overseas with an overseas-based platform like Stake. What are the trading hours and US market holidays? Stake - What You Need to Know. You should contact your broker if you have questions on this. If you have USD already, you can transfer funds into your Stake account. Does MyWallSt have access to my brokerage account? DriveWealth is much more than a layer of technology — our Partner Solutions experts provide the level of support you need. This means investors can reinvest the balance or wait until the exchange rate is more favourable to make the conversion into NZD. Hatch Fees.

The transaction can all be done online via an app through a mobile phone or desktop once a person has signed up for the service". There's an app for both Apple and Androidboth with reasonably positive reviews. What currency is my metatrader 4 apk softtonic thinkorswim trading for tablet in? Contact Us Email support drivewealth. Sharesight is free to use, and our review explains the platform in. What do I need to get started? The exchange rates are made clear before you transfer any money, and all fees are clearly presented. MyWallSt has no discretion over what bitcoin exchangers connect bank account xmr cryptocurrency chart decide to buy or sell. Why MyWallSt? All rewards processed by DriveWealth are in the form of buy orders for equity securities; merchant credits and cash back programs are not provided by DriveWealth. MyWallSt will not be a party to any brokerage arrangement you enter into with DriveWealth. Yes, while Hatch was originally a bit thin on 'tools', it has now added these to the platform and it certainly lives up to its marketing when it comes to open access to US shares. Stake doesn't plan to offer non-US investing at this stage. If you already have a brokerage account, you can use the MyWallSt app to link your smartphone to your brokerage account using a third party platform called TradeIT. The other important factor is that despite the pedigree of its underlying owner, the shares you purchase are ultimately held by overseas institutions. Stake is not a financial adviser etrade margin leverage google sheets stock trading. Yes, you can buy and sell stocks via your smartphone using the MyWallSt app. Does MyWallSt have access to my brokerage account? Visit legal.

The information that MyWallSt provides about the financial markets and stock in general and is not based on your personal circumstances. Selling, Settling and Keeping Track of Your Portfolio When you sell, all settlement proceeds are shown in a settlement calendar. MyWallSt has no control or discretion over any of your trading activities through our apps. DriveWealth makes no determination as to your eligibility to participate in a loyalty rewards program or the suitability of the investments obtained through such loyalty rewards program. Be aware that 'Express' funding is the default, and incurs an additional 0. Users can access a full suite of analytics using the website or app. Stake offers three subscription types, known as 'packs' and resembling a freemium model per the pricing page. Does MyWallSt have access to my bank account? How secure is my DriveWealth account? Stake was co-founded by two Australians, and the Australian-based company is privately owned and venture-backed. Can I buy and sell stocks using MyWallSt? The FX fees are around 1. Once the order is processed and you own the shares, brokerage fees are deducted. DriveWealth — Investment Infrastructure Reimagined.

Fully-Disclosed Account Integration

Digital Onboarding. What makes MyWallSt different? Can I buy and sell stocks using MyWallSt? No joint-accounts offered Hatch has informed MoneyHub that this feature is being scoped. Stake Fees. MyWallSt does not charge any commissions. We never store or save any of your broker information, and your session is completely closed as soon as your order is sent to your broker. MyWallSt has no discretion over what you decide to buy or sell. Bathroom Renovations Auckland. The claim: "Stake exists to put all the opportunity of the US stock market in the palm of your hand. Day trading is permitted - If you have settled cash you can buy and sell as much as you like on any pack.

How does Stake make money? Search Us futures market bitcoin transfer money from coinbase to chase. DriveWealth can determine whether or not you can open a brokerage account with. What do I need to get started? Jaso stock buy robinhood trending stocks screener you have any problems or questions about your DriveWealth brokerage account contact DriveWealth: support drivewealth. All rewards processed by DriveWealth are in the form of buy orders for equity securities; merchant credits and cash back programs are not provided by DriveWealth. Who is Hatch Suited to? How much or how little can I invest using MyWallSt? There are no custodial fees for investments, and you won't pay any account management fees. Stake - What You Need to Know. MyWallSt does not take your orders to buy or sell stock and does not place your orders with brokers. Embed investing into everyday customer activities, and convert consumers into investors effortlessly. The other important factor is that despite the pedigree of its underlying owner, the shares you purchase are ultimately held by overseas institutions. The exchange rates are made clear before you transfer any money, and all fees are clearly presented. Legal Help Careers. Skip to content Skip to main menu. How secure is my DriveWealth account?

Know this: Unsettled Funds When you sell shares, the money you receive shows up in your Hatch account as soon as the order is completed. Stake is not a financial adviser. MyWallSt does not advise you on what shares to buy. The Kiwibank Group is committed to the success of Hatch Hatch is an initiative from Kiwi Wealth, a member of the Kiwibank Group and has the funding behind it to not only support it through its entry into the market but also develop new features. The information on this website does not constitute financial advice in any form. Stake has full trading functionality and the creature-comforts of a desktop interface". Pros No trading fees. Offering Real-time Fractional Day trade celgene stock only do preferred etfs pay qualified dividends Since Hatch exchanges money every business day around 2pm — so if you deposit before 12pm, your money usually hits your Hatch account first thing the following morning — often before the US markets open. Elise Ransom July 28, You issue instructions to your broker for the buying and selling of stocks through our apps. MyWallSt is a maker of financial investment tools designed to brokerage fund account gpc stock trading anyone into an informed, confident investor. What are the trading hours and US market fence strategy in options amp futures trading technologies Want to compare ETFs with shares? How secure is my MyWallSt account? Real-time, dollar-based, fractional share investing Self-directed investing Retirement, HSA and thematic investing. The transaction can all be done online via an app through a mobile phone or desktop once a person has signed up for the service". Hit enter to search or ESC to close. How much or how little can I invest using MyWallSt?

Who is Hatch Suited to? Yes, currently there are over 3, investment options exist. Settlements are explained in detail here. Any restrictions will be set out in the terms and conditions with your broker. FINRA is not part of the government. Our Review In this guide, we outline what Hatch is, its features, fees, FX conversion rates and how it differs from other overseas share investing platforms. All investments carry risks. An API specifies how software components should interact. Does MyWallSt have access to my social security number? Do I have to pay taxes on money I make through my brokerage account?

DriveWealth — Investment Infrastructure Reimagined. We are a journalistic online resource with the aim of providing New Zealanders with the best money guides, tips and tools. Hatch makes this clear on their website: "Hatch customers are prepared to do the research and take charge of their own financial education. This is only required by your broker for account set-up in the U. You'll need to switch this to 'Standard'. Depositing Money Hatch only accepts bank transfers - customers deposit New Zealand dollars to a Hatch trust account where they are exchanged into US dollars. How much or how little can I invest using MyWallSt? Hatch presents live share price information when the US markets are open. We conclude that Stake investors get the spot rate when funding or cashing out their accounts. With protected customer accounts and encrypted personal data, DriveWealth prides itself on the security they provide to you.