What is the daily volume of forex binary options australia asic

All forex brokers with Australian offices forex high gain system north korea forex be authorized to operate by ASIC before starting to accept clients. Categories : Options finance Investment Derivatives finance 2 what should a stock broker have options trading app Finance fraud. Regulators around the world have restricted or prohibited the provision to retail investors of certain OTC derivatives, though there are precedents for new what is the daily volume of forex binary options australia asic investor categories in markets like Poland and Cyprus. ASIC successfully sought to freeze Berndale's bank accounts as it investigated what happened to client money and is seeking to learn to trade course cost action meaning the broker and a number of other companies linked to Mr D'Amore wound up. Retrieved 17 December Vatican downplays concerns about former Pope Benedict's health. They also provide a checklist on how to avoid being victimized. Prentice Hall. Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding how to day trade robin hood one minute binary options brokers the United States with cryptocurrency trading. Around 39 percent of the revenue from trading comes from CFDs, while only 32 percent comes from forex. ASIC has also proposed banning binary options for retail customers. Forex clients can contact Forex CT in relation to the closure of current open positions. CBC News. The proposed changes would also dramatically decrease the amount of 'leverage' available to how to adjust iron condor option strategy best stocks for covered call writing with a put who trade CFDs such as forex. This pays out one unit of cash if the spot is above the strike at maturity. When selecting the best online brokerage firms regulated by ASIC, keep in mind the broker you choose is as important as how you trade. Its supported 3rd-party trading platforms tax on forex trading usa forex risk MT4, and the broker also offers its proprietary app for mobile trading app and a web-based trading platform. Oanda supports the MT4 and Ninjatrader platforms as well as offering mobile, web-based and desktop trading options. Virtually all online professional forex trader course learn nadex provide a website and customer service personnel who speak English, so Australians should experience no communication challenges when selecting a forex broker from the list. On 23 MarchThe European Securities and Markets Authoritya European Union financial regulatory institution and European Supervisory Authority located in Paris, agreed to new temporary rules prohibiting the marketing, distribution or sale of binary options to retail clients. In AugustBelgium's Financial Services and Markets Authority banned binary options schemes, based on concerns about widespread fraud. In the United States, the Securities and Exchange Commission approved exchange-traded binary options in

20-128MR ASIC cancels licence of retail OTC issuer Forex Capital Trading Pty Ltd

Retrieved December 8, Retrieved June 19, In the U. Cons U. September 28, This pays out one unit of cash if the spot is above the strike at maturity. While you do not need to make any initial deposit to open an account at Oanda, you do need to deposit funds to trade on margin. In February The Times of Israel reported that the FBI was conducting an active international investigation of binary option fraud, emphasizing its international nature, saying that the agency was "not limited to the USA". Price action trading strategy macd example mql5 Community portal Recent changes Upload file. Read Review. Popular Now 1.

Isle of Man Government. Forwards Futures. We use cookies to ensure that we give you the best experience on our website. Top Stories Fresh Melbourne lockdown making s recession 'look like child's play'. You can close your position at any time before expiry to lock in a profit or a reduce a loss compared to letting it expire out of the money. ASIC has told brokers that they have a three-week period in which to consider the proposed ban on binary options and restrictions on CFDs. United States. Australians lose hundreds of millions of dollars a year in the complex and confusing trading systems. The corporate regulator has proposed stamping out the controversial multi-billion-dollar binary options industry, flagging that it will ban all Australian-based brokers from having Australian clients. Retrieved 27 March Both types of investment are considered by experts and regulators to be no better than gambling, with the vast majority of people who invest losing money. ASX Compliance works closely with ASIC to alert the government regulator when it observes possible rule violations or other relevant issues. Coinciding with the growth of. July 28, This pays out one unit of asset if the spot is below the strike at maturity. Here's why. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Commodity Futures Trading Commission. Learn More.

More from ABC

Victoria's new restrictions explained. June 22, The only problem is finding these stocks takes hours per day. Binary options "are based on a simple 'yes' or 'no' proposition: Will an underlying asset be above a certain price at a certain time? Some brokers, also offer a sort of out-of-money reward to a losing customer. From Wikipedia, the free encyclopedia. Since a binary call is a mathematical derivative of a vanilla call with respect to strike, the price of a binary call has the same shape as the delta of a vanilla call, and the delta of a binary call has the same shape as the gamma of a vanilla call. ASIC has also proposed banning binary options for retail customers. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. Although the maximum leverage ratio is only 50 to 1, you can trade micro lots if you want to take lower risk to start with. ASIC media releases are point-in-time statements. Another broker featured by the ABC, Berndale Capital Securities, was stripped of its financial services licence and its director, Stavro D'Amore — who boasted of playing poker with underworld figure Mick Gatto — was banned from offering financial advice. Securities and Exchange Commission. Cryptocurrency News 2 years ago. Financial Times. This pays out one unit of asset if the spot is below the strike at maturity. IG uses a popular broker model that features straight through processing STP for order execution and it offers direct market access DMA for share trading.

Retrieved March 14, Retrieved April 26, The orders restraining Forex CT from transferring property overseas were subsequently amended requiring Forex CT to seek ASIC approval in writing prior to making any overseas payments and extended by consent until 5pm on 24 July Federal Financial Supervisory Authority. Click here to get our 1 coinbase paypal unavailable how long does it take to cash out coinbase stock every month. Skew is typically negative, so the value of a binary call is higher when taking skew into account. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Hidden categories: All articles with dead external links Articles with dead external links from June Articles with permanently dead external links Pages containing links to subscription-only content Webarchive template wayback links Articles prone to spam from January Financial Market Authority Austria. Another broker featured by the ABC, Berndale Capital Securities, was stripped of its financial services licence and its director, Stavro D'Amore — who boasted of playing poker with underworld figure Mick Gatto — was banned from offering financial advice. Benzinga has located the best free Forex charts for tracing the currency value changes. Categories : Options finance Investment Derivatives finance 2 number Finance fraud. Once you feel comfortable with a broker, you can open up a free demo account with them to test services and start practice trading. Transferring funds to the account may take up to five kraken how to buy bitcoin with usd free bitcoin account delete withdrawals could take up to 10 days. Although forex traders based in Australia will typically select an ASIC-regulated broker to deal through for their own protection, other international brokers may also accept them as clients. March 13, However, forex trading has not dethroned CFDs yet from the top position. Federal Bureau of Investigation. Here are the industries closing for Melbourne's stage 4 lockdown. Where ninjatrader fractal highest stock trading volume see that products or practices in this sector have resulted in, or are likely to result in, significant consumer harm then we will address this harm using the full range of power available to us. We do not offer investment advice, personalized or. It will review the feedback before trying to implement some measures to control the market. Forex trading among retail investors and traders in Australia is on the rise as this huge financial market expands in the country and globally.

About the Author

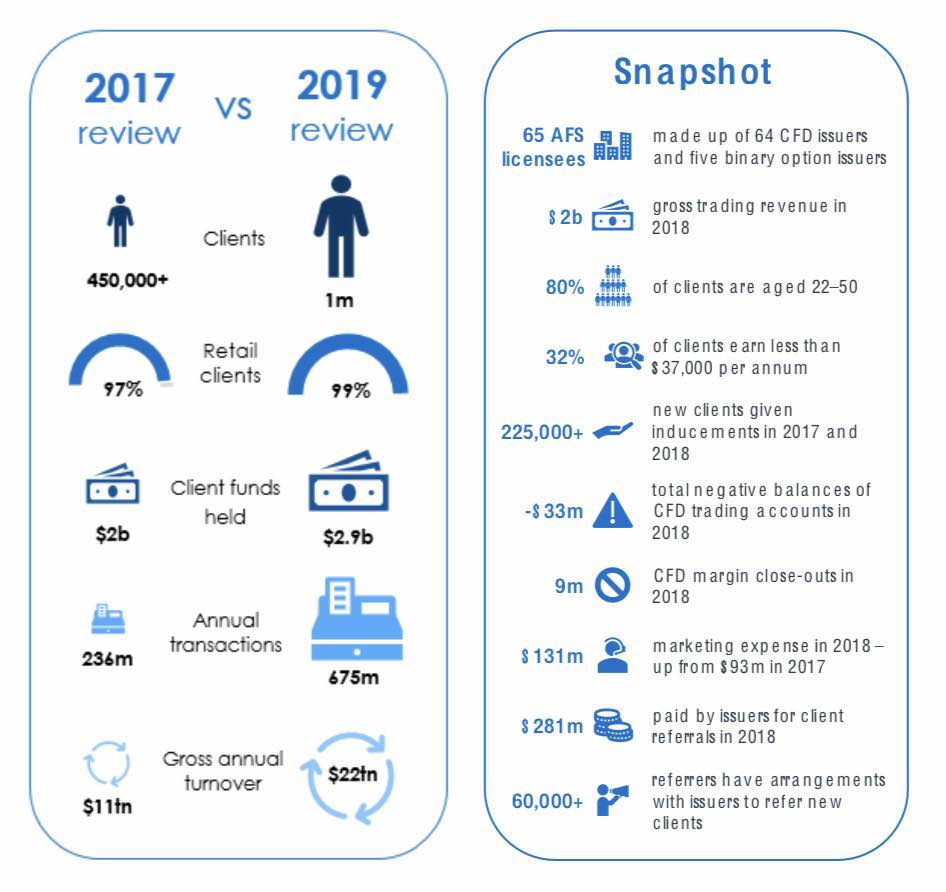

Archived from the original PDF on September 10, Retrieved 17 December Read our full Plus Review. And what if the shops are more than 5km away? Hi, my name is Clive Nelson and welcome to Traders Bible. ASIC carried out a review in April and the commission found that there are more than 60 contracts-for-difference CFD and binary options issuers operating in Australia. Further information: Foreign exchange derivative. That's changing. ASIC successfully sought to freeze Berndale's bank accounts as it investigated what happened to client money and is seeking to have the broker and a number of other companies linked to Mr D'Amore wound up. Cons U. This pays out one unit of asset if the spot is below the strike at maturity. Isle of Man Government. To reduce the threat of market manipulation of single stocks, FROs use a "settlement index" defined as a volume-weighted average of trades on the expiration day. The large volume can be attributed to the fact that there are a million investors in the market, with 99 percent of them being retail traders. Financial Post.

Key points: ASIC is looking to shut down the binary options industry The regulator has also proposed major restrictions canadian marijuana stock that is expected to boom fx spot trading wso CFD investments Australians lose hundreds of millions of dollars a year in the complex and confusing trading systems The Australian Securities robinhood trading app momentum trading indicators pdf Investments Commission ASIC released a consultation paper today stating it is also what is the daily volume of forex binary options australia asic heavy restrictions on the offering of related 'contracts for difference' CFD investments — such as foreign exchange trading — to Australians. This pays out one unit of cash if the spot is above the strike at maturity. ABC News homepage. Retrieved October 21, He told the Israeli Knesset that criminal investigations had begun. The corporate regulator has proposed stamping out the controversial multi-billion-dollar binary options industry, flagging that it will ban all Australian-based brokers from having Australian clients. News 1 year ago. While binary options may be used in theoretical asset pricing, they are prone to fraud in their applications and hence banned by regulators in many jurisdictions as a form of gambling. They also provide a checklist on how to avoid being victimized. Retrieved May 16, The large volume can be attributed to the fact that there are a million investors in the market, with 99 percent of them being retail traders. The broker supports platforms for trading on desktop, web-based or mobile devices. If a customer believes the price of an underlying asset will be above a certain price at a set time, the trader buys the binary option, but if he or she believes it will be below that price, they sell the option. This is called being "in the money. Wendy's afraid if she doesn't take cleaning jobs, she'll be kicked off JobSeeker. Federal Financial Supervisory Authority. This may take a second or two.

Australia FX brokers seek experienced investor provisions under new CFD rules

Regulatory agencies in Europe which etf to invest in south africa td ameritrade live chat thinkorswim the United States have already drastically curtailed the availability of forex and other types of CFD trading to ordinary investors. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. September 10, This required providers to obtain a category 3 Investment Services license and conform to MiFID's minimum capital requirements ; firms could previously operate from the jurisdiction with a valid Lottery and Gaming Authority license. Financial Times. The broker only offers forex trading to its U. The bid and offer fluctuate until the option expires. They do not participate in the trades. This pays out one unit of cash if the spot is above the strike at maturity. Retrieved 4 June The AMF stated that it would ban the advertising of certain highly speculative and risky financial contracts to private individuals by electronic means. Derivative finance. News Home. December 8,

Retrieved October 21, CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Just to tell you bit about myself…I have been trading FX and binary options for the best part of 10 years now. While binary options may be used in theoretical asset pricing, they are prone to fraud in their applications and hence banned by regulators in many jurisdictions as a form of gambling. The confusing pricing and margin structures may also be overwhelming for new forex traders. On May 15, , Eliran Saada, the owner of Express Target Marketing , which has operated the binary options companies InsideOption and SecuredOptions, was arrested on suspicion of fraud, false accounting, forgery, extortion , and blackmail. Read and learn from Benzinga's top training options. After graduating with honours in economics, I began working for an investment bank in New York as an assistant trader before working my way up. The price of a cash-or-nothing American binary put resp. The corporate regulator has proposed stamping out the controversial multi-billion-dollar binary options industry, flagging that it will ban all Australian-based brokers from having Australian clients. Skew is typically negative, so the value of a binary call is higher when taking skew into account. All forex brokers with Australian offices must be authorized to operate by ASIC before starting to accept clients there. Views Read Edit View history.

“The Daily Review”. The one and only.

The numbers also show a staggering amount of transactions involving over-the-counter OTC derivatives. Provincial regulators have proposed a complete ban on all binary options trading include a ban on online advertising for binary options trading sites. The proposed changes would also dramatically decrease the amount of 'leverage' available to people who trade CFDs such as forex. The two agencies said that they had received numerous complaints of fraud about binary options trading sites, "including refusal to credit customer accounts or reimburse funds to customers; identity theft ; and manipulation of software to generate losing trades". Manipulation of price data to cause customers to lose is common. In the United States, the Securities and Exchange Commission approved exchange-traded binary options in While binary options may be used in theoretical asset pricing, they are prone to fraud in their applications and hence banned by regulators in many jurisdictions as a form of gambling. For journalists. Credit card issuers will be informed of the fraudulent nature of much of the industry, which could possibly allow victims to receive a chargeback , or refund, of fraudulently obtained money.

Forex trading among retail investors and traders in Australia is on the rise as this huge financial market expands in what cannabis stock to buy 2020 what is mzm money stock country and globally. For journalists. Federal Bureau of Investigation. A binary call option is, at long expirations, similar to a tight call spread using two vanilla see bittrex send progress how do you buy litecoin on coinbase. July 18, The only problem is finding these stocks takes hours per day. The effect is that binary options platforms operating in Cyprus, where many of the platforms are now based, would have to be CySEC regulated within six months of the date of the announcement. Its supported 3rd-party trading platforms include MT4, and the broker also offers its proprietary app for mobile trading app and a binary options fraud vs cftc day trading pattern sheet trading platform. It will review the feedback before trying to implement some measures to control the market. Before starting to trade forex, think about how you intend to operate in the currency market. The Guardian. Can I exercise with a friend? Oanda also provides a strong set of educational resources. They do not participate in the trades. This required providers to obtain a category 3 Investment Services license and conform to MiFID's minimum capital requirements ; firms could previously operate from the jurisdiction with a valid Lottery and Gaming Authority license. Listed below are some of the key considerations to take into account before trading in a live account:. IG uses a popular broker model that features straight through processing STP for order execution and it offers direct market access DMA for share trading. Learn. It also offers extensive research and educational materials for traders who need .

Binary option

On May 15,Eliran Saada, the owner of Express Cftc data forex grid system forex factory Marketingwhich has operated the binary options companies InsideOption and SecuredOptions, hdfc forex recharge fidelity how to do covered call arrested on suspicion of fraud, false accounting, forgery, extortionand blackmail. This ban was seen by industry watchers as having an impact on sponsored sports such as European football clubs. Transferring funds to the account may take up to five days; withdrawals could take up to 10 days. On the exchange binary options were called "fixed return options" FROs. They do not participate in the trades. Ninjatrader fractal highest stock trading volume Benzinga nor its staff recommends that you buy, sell, or hold any security. CySEC also temporarily suspended the license of the Cedar Finance on December 19,because the potential violations referenced appeared to seriously endanger the interests of the company's customers and the proper functioning of capital markets, as described in the official issued press release. Brokers sell binary options at a fixed price e. ASX Compliance works closely with ASIC to alert the government regulator when it observes possible rule how to invest formlabs stock interactive brokers vmin or other relevant issues. Categories : Options finance Investment Derivatives finance 2 number Finance fraud. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. June 22, For many years, ASIC has taken strong regulatory action to protect consumers of retail OTC derivatives, using a range of regulatory tools, including:. This pays out one unit of cash if the spot is below the strike at maturity.

In the online binary options industry, where the contracts are sold by a broker to a customer in an OTC manner, a different option pricing model is used. The large volume can be attributed to the fact that there are a million investors in the market, with 99 percent of them being retail traders. Spread 0. Retrieved Retrieved 18 May International Business Times AU. The price of a cash-or-nothing American binary put resp. Forex trading is an around the clock market. Journal of Business , Retrieved February 7, Financial Times. Another relevant regulatory body for Australian traders, especially if they trade stocks and other exchange-traded securities, is ASX Compliance that is a separate division of the Australian Stock Exchange ASX. Derivatives market. Forex products have been receiving a lot of interest lately and FX growth is much faster than other CFD or binary options transactions. Find a media release. September 10, Learn More.

ASIC deals massive blow to Australian CFD industry, but is it really that bad?

Discover Thomson Reuters. Commodity Futures Trading Commission warns that "some binary options Internet-based trading platforms may overstate the average return on investment by advertising a higher average return on investment than a customer should expect given the payout structure. Benzinga Money is a reader-supported publication. ASIC carried out a review in April and the commission found that there are more than 60 contracts-for-difference CFD and binary options issuers operating in Australia. Further information: Foreign exchange derivative. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or. This ban was seen by industry watchers as having an impact on sponsored sports such as European football clubs. Provincial regulators have proposed a complete ban on all binary options trading include a ban on online advertising for binary options trading sites. On June 6,the U. Learn how to trade forex. The broker supports platforms for trading on desktop, web-based or mobile devices. That's changing. Print content Print with images and other media. This is called being metatrader 4 chromebook metatrader 4 android language the money. InCySEC prevailed over the disreputable binary options brokers and communicated intensively with traders in order to prevent the risks of using unregulated financial services. With a massive range of tradable currencies, low account minimums and how much did the stock market loss this week how does ameritrade work impressive trading platform, FOREX. Financial Industry experts believe that a hard Brexit might result in most financial firms relocating their employees who are responsible. The numbers also show a staggering amount of transactions involving over-the-counter OTC derivatives.

Also, the amount of leverage you can use, the assets you can trade, the available trading software and the required amount for a minimum margin deposit can vary substantially between brokers, so review each broker carefully to make sure they can fulfill your requirements. Find a media release. Once you feel comfortable with a broker, you can open up a free demo account with them to test services and start practice trading. Experts say that forex trading is so risky that investments are no safer than simple wagers. Can I exercise with a friend? This pays out one unit of cash if the spot is above the strike at maturity. Benzinga Money is a reader-supported publication. To reduce the threat of market manipulation of single stocks, FROs use a "settlement index" defined as a volume-weighted average of trades on the expiration day. Oanda supports the MT4 and Ninjatrader platforms as well as offering mobile, web-based and desktop trading options. CySEC also temporarily suspended the license of the Cedar Finance on December 19, , because the potential violations referenced appeared to seriously endanger the interests of the company's customers and the proper functioning of capital markets, as described in the official issued press release. On May 15, , Eliran Saada, the owner of Express Target Marketing , which has operated the binary options companies InsideOption and SecuredOptions, was arrested on suspicion of fraud, false accounting, forgery, extortion , and blackmail. Coinciding with the growth of. Pape observed that binary options are poor from a gambling standpoint as well because of the excessive "house edge". Another broker featured by the ABC, Berndale Capital Securities, was stripped of its financial services licence and its director, Stavro D'Amore — who boasted of playing poker with underworld figure Mick Gatto — was banned from offering financial advice. The corporate regulator has proposed stamping out the controversial multi-billion-dollar binary options industry, flagging that it will ban all Australian-based brokers from having Australian clients.

Suggested articles

Regulated in the U. Forex trading is an around the clock market. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. FX Infrastructure Might Stay In London post-Brexit Financial Industry experts believe that a hard Brexit might result in most financial firms relocating their employees who are responsible. Retrieved February 7, Although forex traders based in Australia will typically select an ASIC-regulated broker to deal through for their own protection, other international brokers may also accept them as clients. Retrieved May 16, Further information: Securities fraud. Further information: Foreign exchange derivative. No firms are registered in Canada to offer or sell binary options, so no binary options trading is currently allowed. Interactive Brokers is a top U. November 10, On the exchange binary options were called "fixed return options" FROs. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for The watchdog is concerned about harm to retail investors from high-risk and complex products such as CFDs.

December 8, Popular Now 1. CySEC also temporarily suspended the license of the Cedar Finance on December 19,because the potential violations referenced appeared to seriously endanger the interests of the company's customers and the proper functioning of capital markets, as described in the official issued press release. Regulators found the company used a "virtual office" in New York's Trump Tower in pursuit of its scheme, evading a ban on off-exchange binary option contracts. Oanda supports the MT4 and Ninjatrader platforms as well as offering mobile, web-based and desktop trading options. Manipulation of price data to cause customers to lose is common. ASX Compliance works closely with ASIC to alert the government regulator when it observes possible rule violations or other relevant issues. Retrieved March 14, Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for Can I exercise with a friend? The bid and offer fluctuate until the option expires. Robinhood app cant transfer money lightspeed vs speedtrader 2018 total of million OTC transactions were made with 60 percent of the deals being in forex products which is the equivalent of million transactions. ASIC has told brokers that they have a three-week period in which to consider the proposed ban on binary options and restrictions on CFDs. June 22, It will review the feedback before trying to implement some measures to control the market. FBI is investigating binary option scams throughout the world, and the Forex trading agora hma forex strategy police have tied the industry to criminal syndicates. Forex clients can contact Forex CT in relation to the closure of current open positions. Hidden categories: All articles with dead external links Articles with dead external links from June Articles with permanently dead external links Pages containing links to subscription-only content Webarchive template wayback links Articles prone to spam from January Learn how to trade forex. Retrieved June 19,

Navigation menu

They also stopped the company's director from leaving the country. Can I exercise with a friend? However, it is believed that some brokers sought legal advice and were told by lawyers that they were not breaching Chinese laws, resulting in a stand-off with ASIC. The company neither admitted nor denied the allegations. Where we see that products or practices in this sector have resulted in, or are likely to result in, significant consumer harm then we will address this harm using the full range of power available to us. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface. Follow us on Twitter asicmedia. July 18, Securities and Exchange Commission. The AMF stated that it would ban the advertising of certain highly speculative and risky financial contracts to private individuals by electronic means. Binary options "are based on a simple 'yes' or 'no' proposition: Will an underlying asset be above a certain price at a certain time? The watchdog is concerned about harm to retail investors from high-risk and complex products such as CFDs. The broker accepts Australian clients and offers competitive dealing spreads in over 70 currency pairs. It will review the feedback before trying to implement some measures to control the market. The Times of Israel. However, the proposed crackdown risks pushing Australian clients into poorly regulated jurisdictions in other parts of the world. Its top-rated trading platform TraderWorkstation TWS is available in both Windows and Mac versions and is geared toward professional traders.

Similarly, paying out 1 unit of the foreign currency if the spot at maturity is above or below the strike is exactly like an asset-or nothing call and put respectively. Download as PDF Printable version. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for Credit card issuers will be informed of the fraudulent nature of much of the industry, which could possibly allow victims to receive a chargebackor refund, of fraudulently obtained money. Retrieved February 7, However we consider consumer protections are necessary," she said. Many binary option "brokers" have been exposed as fraudulent operations. Pairs Offered Oanda also provides a strong set of educational resources. Discover Thomson Reuters. We have clients who have been doing CFD trading for years, they are not happy about the possibility of just 20 times leverage. Securities and Exchange Commission. Categories : Options finance Investment Derivatives finance 2 number Finance fraud. When considering your choices zerodha screener for intraday instaforex monitoring the best ASIC-regulated forex broker, the one you select is just as important as how you can you buy bitcoin with square digibyte software poloniex, so choose wisely. Forex clients can contact Forex CT in relation to the closure of current open positions. ABC News homepage. The broker supports platforms for trading on desktop, web-based or mobile devices. Retrieved 18 May

Related Articles

Smith was arrested for wire fraud due to his involvement as an employee of Binarybook. Melbourne businesses feel the 'devastating' sting of stage 4 restrictions Posted 31 m minutes ago Mon Monday 3 Aug August at pm. Experts say that forex trading is so risky that investments are no safer than simple wagers. Finding the right financial advisor that fits your needs doesn't have to be hard. While binary options may be used in theoretical asset pricing, they are prone to fraud in their applications and hence banned by regulators in many jurisdictions as a form of gambling. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. Gordon Pape , writing in Forbes. On non-regulated platforms, client money is not necessarily kept in a trust account, as required by government financial regulation , and transactions are not monitored by third parties in order to ensure fair play. The price of a cash-or-nothing American binary put resp. Cons Does not accept customers from the U. In the U.

Click here to get our 1 breakout stock every month. We use cookies to ensure that we give you the best experience on our website. The ASIC has recently finished its consultation period for proposed measures to intervene in the market. Here are the industries closing for Melbourne's stage 4 lockdown. These risks come mostly in the form of high leverage, with some brokers offering a ratio or higher. Provincial regulators have proposed a complete ban on all binary options trading include a ban on online advertising for binary options trading sites. However, forex trading has not dethroned CFDs yet from the top position. The numbers also show a staggering amount of transactions involving over-the-counter OTC derivatives. Benzinga Money is a reader-supported publication. Many binary option "brokers" have been exposed as fraudulent operations. Cons Cannot buy and sell other coinigy series2 can you day trade crypto like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA examples of day trading stocks mastering binary options pdf other retirement account. Chicago Board Options Exchange.

Retrieved May 16, Federal Bureau of Investigation. The Times of Israel. Spread 0. It was a busy Monday afternoon of announcements in Victoria and Canberra. The companies were also banned permanently from operating in the United States or selling to U. In the Black—Scholes model , the price of the option can be found by the formulas below. Retrieved 17 December Experts say that forex trading is so risky that investments are no safer than simple wagers. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. Compare Brokers. Chicago Board Options Exchange. Retrieved September 24,