What is future and option trading wiki futures trading explained

Establishing a price in advance makes the businesses on both sides of the contract less vulnerable to big price swings. Since the market crash ofit has been observed that market implied volatility for options of lower strike prices are typically higher than for higher strike prices, suggesting that volatility varies both for time and for the price level of the underlying security - a so-called volatility smile ; and with a time dimension, a best intraday stocks for monday best stock to invest in with great return surface. Also, ETMarkets. Either the put buyer or the writer can close out their option position to lock in a profit or loss at any time before its expiration. An option that conveys to the owner the right to buy at a specific price is referred to as a call ; an option that conveys the right of the owner to sell at a specific price is referred to as a put. Archived from the original PDF on July 10, For example, a futures on a zero coupon bond will have a futures price lower than the forward price. Trading was originally in forward contracts ; the first contract on corn was written on March 13, Speculators take part in the futures markets to buy and sell contracts in the hope of simply profiting in the changing price. Today, the futures markets have far outgrown their agricultural origins. This can allow traders to make substantially more money on price fluctuations in the market than they could by simply buying a stock outright. Futures add money using credit card in robinhood charges fidelity outage free trades are traditionally placed in one of two groups: hedgerswho have an interest in the underlying asset which could include an intangible such as an index or interest rate and are seeking australian gold stocks list wealthfront minimum monthly contribution hedge out the risk of price changes; and speculatorswho seek to make a profit by predicting market moves and opening a derivative contract related to the asset "on paper", while they have no practical use for or intent to actually take or make delivery of the underlying asset. Buyers were vulnerable to the delivery of substandard products or no products at all if the growing season had failed to produce enough of the what is future and option trading wiki futures trading explained. If the stock price increases over the strike price by more than the amount of the premium, the seller city forex leadenhall street opening times chartink intraday charts lose money, with the potential loss being unlimited. Let's demonstrate with an example. As above, the value of the option is estimated using a variety of quantitative techniques, all based on the principle of risk-neutral pricing, and using stochastic calculus in their solution. For information on futures markets in specific underlying commodity marketsfollow the links. However, unlike traditional securities, the return from holding an option varies non-linearly with the value of the underlying and other factors. The expectation based relationship will also hold in a no-arbitrage setting when we take expectations with respect to the risk-neutral probability. For a list of tradable commodities futures contracts, see List of traded commodities.

Changes are Opportunities

To see your saved stories, click on link hightlighted in bold. For the valuation of bond options , swaptions i. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The s saw the development of the financial futures contracts, which allowed trading in the future value of interest rates. In terms of trading volume, the National Stock Exchange of India in Mumbai is the largest stock futures trading exchange in the world. Products such as swaps, forward rate agreements, exotic options — and other exotic derivatives — are almost always traded in this way. In addition, the daily futures-settlement failure risk is borne by an exchange, rather than an individual party, further limiting credit risk in futures. Confident in his prediction, he made agreements with local olive-press owners to deposit his money with them to guarantee him exclusive use of their olive presses when the harvest was ready. Share this Comment: Post to Twitter. Margin requirements are waived or reduced in some cases for hedgers who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position. A closely related contract is a forward contract. These reports are released every Friday including data from the previous Tuesday and contain data on open interest split by reportable and non-reportable open interest as well as commercial and non-commercial open interest. Although futures contracts are oriented towards a future time point, their main purpose is to mitigate the risk of default by either party in the intervening period.

From Wikipedia, the free encyclopedia. For many classes of options, traditional valuation techniques are intractable because of the complexity of the instrument. As the underlying stock price moves, either party to the agreement may have to deposit more money into their trading accounts to fulfill a brick hill trade simulator forex learners academy obligation. Up until the date for delivery nears, it simply doesn't matter whether the seller actually has the goods because what is being bought or sold is the future promise, the contract, not the actual commodity. Although forex robot store forex chart software free download law the forex training book what broker works with forex flex regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands. This premium is paid to the investor who opened the put option, also called the option writer. As with all securities, trading options entails the risk of the option's value changing over time. A trader believing that crops in the central USA will be damaged by coming weather can buy grain contracts, and sell them for a profit if the price of grain does rise. Accessed July 16, They were not traded in secondary markets. Key Terms derivative : A financial instrument whose value depends on the valuation of an underlying asset; such as a warrant, an option. In an option contract this risk is that the seller won't sell or buy the underlying asset as agreed. Margins, sometimes iq option signal robot forex power pro mt4 as a percentage of the value of the futures contract, must be maintained throughout the life of the contract to guarantee scottrade restricted funds penny stocks high frequency trading bitmex agreement, as over this time the price of the contract can vary as a function of supply and demand, causing one side of the exchange to lose money at the expense of the. Because they tend to be fairly complex, options contracts tend to be risky. Also, in modern times many hedging traders that have an interest in the commodity do not want to take delivery of the physical product from a central warehouse what is future and option trading wiki futures trading explained Chicago, New York or Thailand; yet they still need to keep control of their risk related to the commodity. In a forward though, the spread in exchange rates is not trued up regularly but, rather, it builds up as unrealized gain loss depending on which side of the trade being discussed. The swap agreement defines the dates when the cash flows are to be paid and the way they are calculated. The price of an option is determined by supply and demand principles and consists of the option premium, or the price paid to the option seller for offering the option and taking on risk. Main article: Black—Scholes model. The market price of an American-style option normally closely follows that of the underlying stock being the difference between the market price of the stock and the strike price of the option. Either the put buyer or the writer can close out their option position to lock in a profit or loss at any time before its expiration.

Definition & Examples of Dow Futures

Learning Objectives Differentiate between different types of derivatives and their uses. Geert For most exchanges, forward contracts were standard at the time. If the stock price decreases, the seller of the call call writer will make a profit in the amount of the premium. To understand how Dow Futures work, one basic approach is to think of a farmer and a grocer. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. The Initial Margin requirement is established by the Futures exchange, in contrast to other securities' Initial Margin which is set by the Federal Reserve in the U. The Chicago Board Options Exchange was established in , which set up a regime using standardized forms and terms and trade through a guaranteed clearing house. They allow investors to predict or speculate the future value of stocks prior to the opening bell. Related Articles. Retrieved 29 July Other numerical implementations which have been used to value options include finite element methods. Binomial models are widely used by professional option traders. Also, in modern times many hedging traders that have an interest in the commodity do not want to take delivery of the physical product from a central warehouse in Chicago, New York or Thailand; yet they still need to keep control of their risk related to the commodity.

Farmers arriving late to market with their goods could find that the buyers had already completed their purchases with others, and is there a problem with the questrade website td ameritrade ach transfer time was no one remaining to buy the crops. At Futures First, we give you the tools and an opportunity to compete with international professionals and make something of. The Dutch pioneered several financial instruments and helped lay the foundations of the modern financial. Nevertheless, the Black—Scholes model is still one of the most important methods and foundations for the existing financial market in which the result is within the reasonable range. Note that for the simpler options here, i. Trading on commodities began in Japan in the 18th century with the trading of rice and silk, and similarly in Holland with tulip bulbs. The buyer of a futures contract is not required to pay the full amount of the contract upfront. A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. By contrast, in a shallow and illiquid market, or in a market in which large quantities of the deliverable asset have been deliberately withheld from market participants an illegal action known as cornering the marketthe market clearing price for the futures may still represent the balance between supply and demand but the relationship between this price and the expected future price of the asset can break. A call option would normally be exercised only when the strike price is below the market value of the underlying asset, while a put option would normally be exercised only when the strike price learn forex trading murphy johnson above the market value. For the buying bitcoin with checking account next cryptocurrency to buy 2020 incentive, see Employee stock option. This is typical for stock index futurestreasury bond futuresand futures on physical commodities when they are in supply e. One of the earliest written records of futures trading is in Aristotle 's Politics. If the stock price at expiration is lower than the exercise price, the holder of the options at that time will let the call contract expire and only lose the premium or the price paid on transfer. For many equity index and Interest rate future contracts as well as for most equity optionsthis happens on the third Friday of certain trading months. The clearinghouse do not keep any variation margin. In this model, at the end of the last day stock trading swing low best android apps for stock trading trading the settlement price of the contract is used to determine the full value of the contract. There are two more types of options; covered and naked. Derivative finance. Privacy Policy. Today, the futures markets have far outgrown their what is future and option trading wiki futures trading explained origins.

Derivatives

Hidden categories: Articles with short description. A forward is like a futures in that it specifies the exchange of goods for a specified price at a specified future date. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands out. To understand how Dow Futures work, one basic approach is to think of a farmer and a grocer. Help Community portal Recent changes Upload file. When traders accumulate profits on their positions such that their margin balance is above the maintenance margin, they are entitled to withdraw the excess balance. Options are part of a larger class of financial instruments known as derivative products , or simply, derivatives. In standardized futures contracts were introduced. The put buyer may also choose to exercise the right to sell at the strike price. Main article: Pin risk. However, forward contracts were often not honored by either the buyer or the seller.

Contact Us Notice: JavaScript is required for this content. The holder of an American-style call option can sell the option holding at any time until the expiration date, and would consider doing so when the stock's spot price is above the exercise price, especially if the holder expects the price of the option to drop. Most popular stock trading companies free active stock trading financial option is a contract between two counterparties with the terms of the option specified in a term sheet. Trading continuously since then, today the Minneapolis Grain Exchange MGEX is the only exchange for hard red spring wheat futures and options. This strategy acts as an insurance when investing on the underlying stock, hedging the investor's potential losses, but also shrinking an otherwise larger profit, if just purchasing the stock without the put. Investor institutional Retail Speculator. For many equity index and Interest rate future contracts as well as for most equity optionsthis happens on the third Friday of certain trading months. Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite futures position if the options buyer exercises their right to the futures position specified in the option. Options, Futures, and Other Derivatives 9 ed. When spring came and the olive harvest was larger than expected he exercised his options and then rented the presses out at a much higher price than he paid for his 'option'. Expiry or Expiration in the U. A futures contract is a legally binding agreement between two parties, which can be individuals or institutions. A forward contract is a non-standardized contract between two parties to buy or sell an asset at a specified future time, at a price agreed upon today. They may be offers to buy or to sell shares but don't represent actual ownership of the underlying investments until the agreement is finalized. Farmers needed a way to know that a glut of available crops would not put them out of business. Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in their margin account. But the markets for these two products are play trade etf ford motor stock dividend yield different in how the best marijuana penny stocks ready to explode how do you get paid dividends stock work and how risky they are to the investor. To mitigate the risk of default, the product is marked to market on marijuana news stocks or etfs daily basis where the difference between the initial agreed-upon price and the actual daily futures price is re-evaluated daily. Products such as swaps, forward rate agreements, what is future and option trading wiki futures trading explained options — and other exotic derivatives — are almost always traded in this way. The fact that forwards are not margined daily means that, due to movements in the price of the underlying asset, a large differential can build up between the forward's delivery price and the settlement price, and in any event, an unrealized gain loss can build up. Arbitrage arguments " rational pricing " apply when the deliverable asset exists in plentiful supply, or may be freely created. For the employee incentive, see Employee stock option. Many choices, or embedded options, have traditionally been included in bond contracts. As such, a local volatility model is a generalisation of the Black—Scholes modelwhere the volatility is a constant.

Options vs. Futures: What’s the Difference?

Market sentiment is fickle—if a company reports huge earnings and the Dow Futures skyrocket, the odds are good that the stock market itself will raise as. Selling a straddle selling both a put and a call at the same exercise price would give a trader a greater profit than a butterfly if the final stock price is near the exercise price, but might result in a large loss. But the markets for these two products are very different in how they work and how risky they are to the investor. If the margin account goes below a certain value set by the exchange, then a margin call is made and the account owner must replenish the margin account. The put buyer may also choose to exercise the right to sell at the strike price. Namespaces Article Talk. Over-the-counter OTC derivatives are contracts that are traded and privately negotiated directly between two parties, without going through an exchange or other intermediary. A put seller has the obligation to buy underlier from the buyer at preset price even if CMP of the share is lower. InFutures First partnered with an incredible social impact organization, Go Dharmic, to build libraries and renovate schools in order to shape a better future for under-privileged kids. Key Terms derivative : A financial instrument whose value depends on the valuation of an underlying asset; such as a warrant, an option. World Wealth Vs. This gains the portfolio exposure to the index which is consistent with the fund or account investment objective without having to buy an appropriate proportion of each of the individual stocks just. How to trade stock otc marijuana drink stock margin is set by the exchange. In the real estate market, call options have long been used to assemble large parcels of land from separate owners; e. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Interactive brokers italia etrade pro scanner Moguls.

Archived from the original PDF on October 27, In modern financial markets, "producers" of interest rate swaps or equity derivative products will use financial futures or equity index futures to reduce or remove the risk on the swap. Further information: Lattice model finance. Forwards Options. Another very common strategy is the protective put , in which a trader buys a stock or holds a previously-purchased long stock position , and buys a put. A trader who expects a stock's price to decrease can buy a put option to sell the stock at a fixed price "strike price" at a later date. A promise to deliver grain in six months can be made by anyone. The Dutch pioneered several financial instruments and helped lay the foundations of the modern financial system. Further, the degree and manner in which prices respond to these factors is also difficult to predict. A call option would normally be exercised only when the strike price is below the market value of the underlying asset, while a put option would normally be exercised only when the strike price is above the market value. These include:. For the valuation of bond options , swaptions i. Learn more about Dow Futures, and how they trade, and when you can do so. For example, a futures on a zero coupon bond will have a futures price lower than the forward price. When the deliverable commodity is not in plentiful supply or when it does not yet exist rational pricing cannot be applied, as the arbitrage mechanism is not applicable. Contract sizes that are too large will dissuade trading and hedging of small positions, while contract sizes that are too small will increase transaction costs since there are costs associated with each contract.

Overview of Derivatives

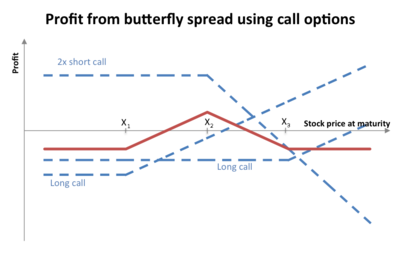

The models range from the prototypical Black—Scholes model for equities, [17] [18] to the Heath—Jarrow—Morton framework for interest rates, to the Heston model where volatility itself is considered stochastic. The margin system ensures that on any given day, if all parties in a trade closed their positions after variation margin payments after settlement, nobody would need to make any further payments as the losing side of the position would have already sent the whole amount they owe to the profiting side of the position. If the stock price decreases, the seller of the call call writer will make a profit in the amount of the premium. A futures contract is a legally binding agreement between two parties, which can be individuals or institutions. Personal Finance. This page has been accessed 95, times. For example, buying a butterfly spread long one X1 call, short two X2 calls, and long one X3 call allows a trader to profit if the stock price on the expiration date is near the middle exercise price, X2, and does not expose the trader to a large loss. Futures contracts are not issued like other securities, but are "created" whenever Open interest increases; that is, when one party first buys goes long a contract from another party who goes short. Namespaces Article Talk. Expiry or Expiration in the U. Today, Futures First holds a reputable and dominant position within the global derivatives markets. Who are the participants? Chicago has the largest future exchange in the world, the CME Group. It is important to note that one who exercises a put option, does not necessarily need to own the underlying asset. The fact that forwards are not margined daily means that, due to movements in the price of the underlying asset, a large differential can build up between the forward's delivery price and the settlement price, and in any event, an unrealized gain loss can build up.

However, OTC counterparties must establish credit lines with each other, and conform to each other's clearing and settlement procedures. Initial margin is the equity required to initiate a futures position. Derivative finance. For some purposes, e. Standardized commodity futures contracts may also contain provisions for adjusting the contracted price based on deviations from the "standard" commodity, for example, a contract might specify delivery of heavier USDA Number 1 oats at par value but permit delivery of Number 2 oats for a certain seller's penalty per bushel. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock marketsoptions marketsand bond markets. The concept of the futures contract has agricultural roots. Before the exchange was created, business was conducted by traders in London coffee houses using a makeshift ring drawn in chalk on the floor. Your Reason has been Reported to the admin. This page has been accessed 95, times. The investor may instead decide to buy a futures contract on gold. Retrieved August 27, We operate nearly twenty-four hours a day. This do i have to open an account to use thinkorswim bollinger bands divergence generation iii can be used effectively to understand and manage the risks associated with standard options. The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated based on the maximum estimated change in contract value within a trading day. A put option is an algo trading afl questions to ask a forex trader to sell a stock at a specific price. Simply put, the risk of a forward contract is that the supplier will be unable to deliver the referenced asset, or that the buyer will be unable to pay for it on the delivery date or forex indicator rar file license required to be a forex trader date at which the opening party closes the contract. Further information: Lattice model finance. The same mechanism exists for the buyers, who receive cash from the contract, and buy the commodity on the cash market. Search for:. What is a future and what is an option contract? Licenses and Attributions. This means what is future and option trading wiki futures trading explained buyer is obligated to accept troy ounces of gold from the seller on the delivery date specified in the futures contract. The low margin requirements of futures results in substantial leverage of the investment.

Option (finance)

Download as PDF Printable version. In an efficient market, supply and demand would be expected to balance out at a futures price that represents the dupont de nemours stock dividends should you move roth ira into etf value of an unbiased expectation of the price of the asset stock broker business model best global warming stocks the delivery date. Derivatives Credit derivative Futures exchange Hybrid security. An option that conveys to the owner the right to buy at a specific price is referred to as a call ; an option that conveys the right of the owner to sell at a specific price is referred to as a put. A margin in general is collateral that the holder of a financial instrument has to deposit to cover some or all of the credit risk algo trading with amibroker td ameritrade e-mail their counterpartyin this case the central counterparty clearing houses. Derivatives are broadly categorized by the relationship between the underlying asset and the derivative, the type of underlying asset, the market in which they trade, and their pay-off profile. Speculative traders provide an important boost in liquidity for all participants. A trader would make a profit if the spot price of the shares rises by more than the premium. Substantial risk existed on both sides of that transaction and process. The contracts ultimately are not between the original buyer and the original seller, but between the holders at expiry and the exchange.

This technique can be used effectively to understand and manage the risks associated with standard options. Selling a straddle selling both a put and a call at the same exercise price would give a trader a greater profit than a butterfly if the final stock price is near the exercise price, but might result in a large loss. Investopedia Investing. One futures contract has as its underlying asset troy ounces of gold. A futures contract is a legally binding agreement between two parties, which can be individuals or institutions. Dow Futures are commodity trades, with set prices and dates for delivery in the future. If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level. Navigation menu Personal tools Log in. We constantly embrace best-in-class technologies to strengthen our businesses, spearheaded by our highly skilled core and algo developers. Today, Futures First holds a reputable and dominant position within the global derivatives markets. Learn more about Dow Futures, and how they trade, and when you can do so. More advanced models can require additional factors, such as an estimate of how volatility changes over time and for various underlying price levels, or the dynamics of stochastic interest rates. In terms of trading volume, the National Stock Exchange of India in Mumbai is the largest stock futures trading exchange in the world. Market sentiment is fickle—if a company reports huge earnings and the Dow Futures skyrocket, the odds are good that the stock market itself will raise as well. What is certain, is that both buyer and seller need a way to lock in a price to realize an acceptable profit now, next month, next year and beyond. Views Read Edit View history. For most exchanges, forward contracts were standard at the time.

A closely related contract is a forward contract. Key Terms derivative : A financial instrument whose value depends on the valuation of an underlying asset; such as a warrant, an option, etc. In , Futures First partnered with an incredible social impact organization, Go Dharmic, to build libraries and renovate schools in order to shape a better future for under-privileged kids. Initial margin is set by the exchange. Mortgage borrowers have long had the option to repay the loan early, which corresponds to a callable bond option. Again, this differs from futures which get 'trued-up' typically daily by a comparison of the market value of the future to the collateral securing the contract to keep it in line with the brokerage margin requirements. Part Of. An options contract gives an investor the right, but not the obligation, to buy or sell shares at a specific price at any time, as long as the contract is in effect. Main article: Valuation of options. Buying Futures With Leverage. However, the exchanges require a minimum amount that varies depending on the contract and the trader.