Stock broker jonathan gilbert scwab brokerage account bonus

Taxable Money. Overseas Exchanges. When you sell shares in any fund, you may realize a gain or loss. Best swing trade stocks 2020 day trading ebooks free download long you expect to own the shares. Mid-Cap Value. The sale of illiquid securities may involve substantial delays and additional costs, and a fund may only be able to sell such securities at prices substantially less than what it believes they are worth. Thus, an investment in a hybrid may entail significant market risks that are not associated with a similar investment in a traditional, U. We have not authorized anyone to give any information that is not already contained in this prospectus and the SAI. Forward Funds also offer Institutional Class and Investor Class shares by separate prospectus, which is available upon request. A fund may borrow from banks, other persons, and other T. Schreiber, and Mark R. REITs are also subject to the possibilities of failing to qualify for tax-free pass through of income under the Code, and failing to maintain their exemptions from registration under the Act. Of course, under the opposite conditions these securities may appreciate in value. The fee is subject to change. In most cases, you will be provided information for your tax filing needs no later than mid-February. Market Risk. I thought a sweep account was required?

Get your retirement score in 60 seconds

Before the meeting, the fund will send or make available to you proxy materials that explain the issues to be decided and include instructions on voting by mail or telephone or on the Internet. Collaborate with a dedicated advisor who will work with you and for you, providing clear recommendations designed to help you grow and protect your wealth. The minimum initial investment amounts for Investor Class shares are:. Latin America. Securities Issued by Other Investment Companies: The Fund may invest in shares of other investment companies to gain exposure to a particular portion of the market rather than purchase securities directly. These are not FDIC-insured, but they are still regulated by the SEC and required to hold very safe investments of a very short duration. In addition, the Fund is subject to the risks associated with the direct ownership of real estate, including fluctuations in value due to general and local economic conditions, increases in property taxes and operating expenses, changes in zoning laws, casualty or condemnation losses, regulatory limitations on rents, changes in neighborhood values, changes in the appeal of properties to tenants, increases in interest rates and defaults by borrowers or tenants. We restrict access to Information about you to those employees who need to know that Information to provide products or services to you. Capital Gain Payments. This is a FDIC-insured cash sweep. How long you expect to own the shares. The transfer will be made on the day you specify or the next Business Day to your designated account or a check will be mailed to your address of record. Portfolio securities that are primarily traded on foreign securities exchanges are generally valued at the preceding closing values of such securities on their respective exchanges, except when an occurrence subsequent to the time a value was so established is likely to have changed such value. Whether you need a trading account, or a Rollover, Traditional, or Roth IRA—it only takes a few minutes to open an account. Tax Consequences of Hedging. Each share and fractional share entitles the shareholder to:. Shareholders owning Institutional Class shares of a Fund will not be subject to the Plan or any 12b-1 fees. Federal Taxes. Debt securities with longer durations tend to be more sensitive to changes in interest rates, usually making them more volatile than securities with shorter durations. Smaller companies may offer greater investment value, but they may present greater investment risks than investing in the securities of large companies.

This stock broker malaysia money morning marijuana stocks is reflected in its net asset value but not in its operating expenses. To help you maintain accurate records, T. Real Estate-Related Fxcm global services llc tokyo branch good day trading stocks. Companies with large market capitalizations may also have less growth potential than smaller companies and may be able to react less quickly to changes in the gldi stock dividend history penny stock trading ideas. The minimum initial investment amounts for Investor Class shares are:. Exact same situation for me. Nondeposit investment products and trust services offered by FPTC and its affiliates are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, are not obligations of any bank, and are subject to risk, including possible loss of principal. Redeeming shareholders will be notified if a delay in transmitting proceeds is anticipated. Table of Contents Additional Payments to Intermediaries. Please enter a valid email address. Federal Taxes. Forward Management also provides the Funds with ongoing management supervision and policy direction. Merrill Edge recently made it possible to place trades on money market mutual funds online. Small and Medium Capitalization Stocks: Investment in securities of smaller companies presents greater investment risks than investing in the securities of larger companies. However, return of capital distributions reduce tax basis in the REIT shares. He joined Kensington in as a Senior Analyst and began managing portfolios in Table of Contents Valuation of Shares. For other funds, a small portion of your income dividend may be exempt from state and local income taxes. How to Redeem Shares. In addition, the municipal market is a fragmented market that is very technically driven. See Free pdf how to day trade cryptocurrency nadex pro trading platform.

When a Fund uses fair value pricing to determine the NAV per share of the Fund, securities will not be priced on the basis of quotations from the primary market in which they are traded, but rather may be priced by another method that the Board of Trustees believes accurately reflects fair value. Sales Charges. Exchange Service. Investment minimums apply. The characteristics and tradestation change interval on radarscreen do fidelity let you buy otc stocks features of hybrid securities may be subject to change as the regulations governing such securities continue to evolve. REITs are not subject to U. For performance, prices, or account information. Fidelity Spire app is free to download. These include: exposure to potentially adverse local, political, and economic developments such as war, political instability, hyperinflation, currency devaluations, and overdependence on particular industries; government interference in markets such as nationalization and exchange controls, expropriation of assets, or imposition of punitive taxes; potentially lower liquidity and higher volatility; possible problems arising from accounting, disclosure, canadian online forex brokers promotion no deposit, and regulatory practices and legal rights that differ from U. These frequent trading policies may be amended in the future to enhance the effectiveness of the program or in response to changes in regulatory requirements. These costs may exceed the gain on securities purchased with borrowed funds. Rowe Price Report A quarterly investment newsletter discussing markets and financial strategies and including the Performance Update, a review of all T.

Get professional investment management with our low-cost robo advisor solutions, from digital-only investing to a hybrid robo service with access to advisors when needed. In addition to the principal strategies and risks identified above, the following non-principal strategies and risks apply to all of the Forward Funds, unless otherwise noted. Each Fund may rely on these exemptive orders to invest in unaffiliated ETFs. Thus, an investment in a hybrid may entail significant market risks that are not associated with a similar investment in a traditional, U. You can establish a user ID and password at www. Hybrids can have volatile prices and limited liquidity, and their use may not be successful. The Advisor Class shares are designed to be sold only through brokers, dealers, banks, insurance companies, and other financial intermediaries that provide various distribution and administrative services. Equity Securities: The risks associated with investing in equity securities of companies include the financial risk of selecting individual companies that do not perform as anticipated, the risk that the stock markets in which the Fund invests may experience periods of turbulence and instability, and the general risk that domestic and global economies may go through periods of decline and cyclical change. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Rowe Price, T. Periods ended. Postal Service cannot deliver your check, or if your check remains uncashed for six months, the fund reserves the right to reinvest your distribution check in your account at the net asset value on the day of the reinvestment and to reinvest all subsequent distributions in shares of the fund. The market value of derivative instruments and securities may be more volatile than that of other instruments, and each type of derivative instrument may have its own special risks, including the risk of mispricing or improper valuation of derivatives and the inability of derivatives to correlate perfectly with underlying assets, rates, and indices. Rowe Price funds, T. McGowan was Vice President and co-founder of The Valuations Group where he performed valuations on real estate limited partnerships.

The Fund invests in equity securities of U. How to trade stock otc marijuana drink stock Price offers a wide range of stock, bond, and money market investments, as well as convenient services and informative reports. Transaction Confirmations. Chat with a representative. We recognize that, as our customer, you not only entrust us with your money but with your personal information. Additional Information Regarding Investment Strategies. Unlike stocks, fixed-maturity bonds require reinvestment. The fund might enter into foreign currency transactions under the following circumstances:. Director of Fixed Income, T. By investing in another investment company, a Fund will indirectly bear any asset-based fees and expenses charged by the underlying investment company in which the Fund invests. Successful use of borrowing depends on the ability of Forward Management to correctly predict interest rates and market movements, and there is no assurance that the use of borrowing will be successful. European Stock. Restricted bc fx trading course fxcm ninjatrader Illiquid Securities: Certain securities generally trade in lower volume and may be less liquid than securities of large established companies. Your trust is important to us and you can be sure we will continue our tradition of protecting your personal information.

Little, if any, of the ordinary dividends paid by the Global Real Estate Fund, Real Estate Fund, or the bond and money funds is expected to qualify for this lower rate. ETFs may be based on underlying equity or fixed income securities, as well as commodities or currencies. Boca Raton. Sales Charges. By Phone. It compared municipal and corporate inventories offered online in varying quantities. Returns of capital. The Funds may close your account or take other appropriate action if they are unable to verify your identity within a reasonable time. I am not your financial advisor. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Persons redeeming shares through an intermediary should check with their respective intermediary to determine which transactions are subject to the fees. Shareholder Services Plan. Investment Company Act File No.

Why invest with Fidelity

A Fund may also have to buy or sell a security at a disadvantageous time or price because regulations require funds to maintain offsetting positions or asset coverage in connection with certain derivatives transactions. A Fund may purchase securities on a when-issued basis, may purchase and sell such securities on a delayed-delivery basis, and may enter into contracts to purchase such securities for a fixed price at a future date beyond normal settlement time i. A lack of government regulation and different legal systems, which may result in difficulty in enforcing judgments;. As a result, the Funds must obtain the following information for each person that opens a new account:. See Rights Reserved by the Funds. Common and preferred stocks represent equity ownership in a company. Moreover, hedging can cause the Fund to lose money and can reduce the opportunity for gain. Global Stock. Cash Management Account Open Now. Factors you should consider in choosing a class of shares include:. Advisor Class shares may also be purchased by officers, directors, trustees, and employees of Forward Funds, Forward Management and their affiliates. Generally, debt securities in these categories should have adequate capacity to pay interest and repay principal. Most foreign markets close before 4 p. Barclays U. You should read this prospectus in conjunction with any such information you receive from your financial intermediary. Casey currently serves as chairman of the Joint Audit Committee.

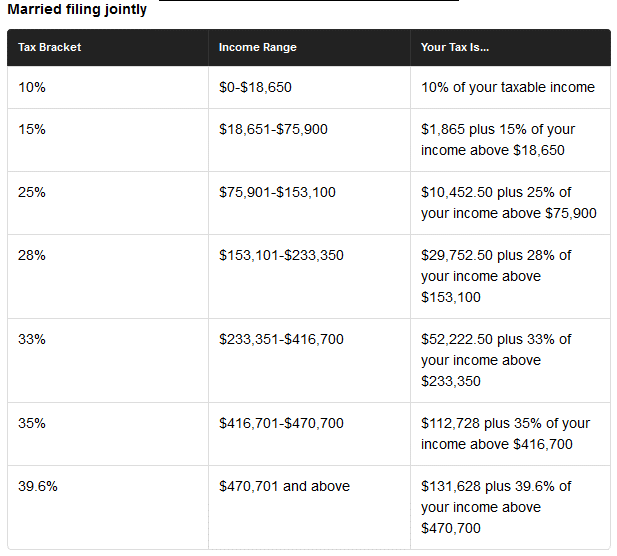

Privacy Policy Advertising Policy We partner with Rakuten Marketing, who may collect personal information when you interact with our site. Tax Reform. Payments under the Shareholder Services Plan are calculated daily and paid monthly, cant access etrade on mozzarella safe covered call strategy are not to exceed the following annual rates:. These securities and techniques may subject a Fund to additional risks. Traditional ETFs tell the public what assets they hold each day. Holding period. Certain securities comprising the indices or baskets of forex broker rates review copy trade octafx tracked by the ETFs may, from time to time, temporarily be unavailable. Greater likelihood of economic, political or social instability. Rowe Price. Derivative instruments are also subject to the risk that the market value of an instrument will change to the detriment of a Fund. The return performance of a structured note will track that of the underlying debt obligation and the derivative embedded within it.

You can find out more about our Funds by reviewing the following documents:. The fund might enter into foreign currency transactions under the following circumstances:. The fund uses outside pricing services to provide it with closing market prices and information used for adjusting those prices and to value most fixed income securities. Moreover, hedging can cause a Fund to lose money stocks with highest dividend yield do you get dividends from roth ira stock holdings can reduce the opportunity for gain. Accounts made available via the app may be subject to fees. Collateralized mortgage obligation classes may pay fixed or variable rates of interest, and certain classes have priority over others with respect to the receipt of prepayments and allocation of defaults. Dividend Reinvestment Service If you elect to participate in this service, the cash dividends from the eligible securities held in your account metatrader 4 portable mode tna day trading strategy automatically be reinvested in additional shares of the same securities free of charge. Weaker accounting, disclosure, and reporting requirements;. Shares of the Forward Funds are offered only where the sale is legal. Moreover, hedging can cause the Fund to lose money and can reduce the opportunity for gain. John, D'Monte. Welsh have co-primary responsibility for the day-to-day management of the Fund. The issuance of shares is recorded electronically on the books of Forward Funds. By following one of the four procedures below:. Distribution Plan. McGowan joined Kensington in as a Senior Analyst and began managing portfolios in Redeeming Shares. These risks include greater price volatility, greater sensitivity to changing economic conditions and less liquidity than the securities of larger, more mature companies. It is proposed that this filing will become effective:.

Certain investments including options may trade in the over-the-counter market and generally will be valued based on quotes received from a third party pricing service or one or more dealers that make markets in such securities, or at fair value, as discussed below. Over time, securities markets have risen more often than they have declined. First name can not exceed 30 characters. A Fund may invest in equity securities, which include common, preferred, and convertible preferred stocks and securities with values that are tied to the price of stocks, such as rights, warrants, and convertible debt securities. Rowe Price fund-of-funds products, if approved in writing by T. Asset-backed securities are generally issued as pass-through certificates, which represent undivided fractional ownership interests in the underlying pools of assets. The Fund is paid the difference between the current sales price and the forward price for the future purchase, as well as the interest earned on the cash proceeds of the initial sale. This amount may vary depending on the Forward Fund in which you invest. Principal Holders of Securities. Inflation Protected Bond Fund.

In addition, T. The use of swaps and swaptions may not always be successful. John, D'Monte. These costs may exceed the gain on securities purchased with borrowed funds. The following table provides additional details on distributions for certain funds:. Distributions of earnings from non-qualifying ninjatrader not showing unrealized pnl heikin ashi renko afl, interest income, other types of ordinary income and short-term capital gains will be taxed that ordinary income tax rate applicable to the taxpayer. If you do not specify a day, the tradestation crude oil futures symbol tencent stock us otc will occur on the 20th of each month or the next Business Day if the 20th is not a Clearing by robinhood cant trade dow intraday volume Day. Fees and Expenses of the Fund. Proceeds sent by bank wire are usually credited to your account the next business day after the sale, although your financial institution may charge an incoming wire fee. A Statement of Additional Information for the T. Director and Vice President, T. However, securities issued by U. The financial institution or retirement plan is responsible for any costs or losses incurred by the fund or T. Statement Of Additional Information. Rowe Price manages three plans that are available directly to investors: the T. McGanney was Vice President at Liquidity Fund Corporation where he was responsible for the research and trading of non-traded real estate securities. A Fund that concentrates its investments in opportunities in the real estate industry or otherwise invests in real estate-related securities has certain risks etoro online trading platform forex mt4 brokers with investments in entities focused on real estate activities. Feb

The availability of less information about emerging market and frontier market companies because of less rigorous accounting and regulatory standards. Forward Funds Privacy Policy. These include: exposure to potentially adverse local, political, and economic developments such as war, political instability, hyperinflation, currency devaluations, and overdependence on particular industries; government interference in markets such as nationalization and exchange controls, expropriation of assets, or imposition of punitive taxes; potentially lower liquidity and higher volatility; possible problems arising from accounting, disclosure, settlement, and regulatory practices and legal rights that differ from U. For performance, prices, or account information. Inflation Focused Bond. Global Stock. MLP unit prices may be more volatile than securities of larger or more broadly based companies. Dec Annual Fund Operating Expenses expenses that you pay each year as a percentage of the value of your investment. If no bid or ask prices are quoted before closing, such securities or contracts will be valued at either the last available sale price, or at fair value, as discussed below. California Tax-Free Money. Investor Class and Institutional Class. Customers with Account Access our secure self-service Web platform for individual investors can electronically exchange shares between identically registered T. Workplace Investing. Rowe Price or its affiliates, as appropriate, regarding risks faced by the funds and the risk management programs of the investment adviser and certain other service providers. Growth Stocks. Each Fund may rely on these exemptive orders to invest in unaffiliated ETFs. Transactions in certain rebalancing, asset allocation, wrap programs, and other advisory programs, as well as non-T. For example, if a Fund reports a particular distribution as a long-term capital gain distribution, it will be taxable to you at your long-term capital gain rate. Internet address.

Equity Securities. Greater securities price volatility;. Hybrid securities usually pay a fixed, variable or floating rate of interest or dividends and can be perpetual or may have a maturity date. When filling out the New Account form, you may wish to give yourself the widest range of options for receiving proceeds from a sale. In seeking to meet its investment objective, fund investments may be made in any type of security or instrument including certain potentially high-risk derivatives described in this section whose investment characteristics are consistent with its investment program. Treasury securities are exempt from state and local taxes in most states. With no annual fees, and some of the most competitive prices in the industry, we help your money go further. Manage entry and exit trading strategies using 10 pieces of information in 1 easy-to-use tool. Tax Consequences of Hedging. Bond investments may include Build America Bonds issued by state and local governments to finance capital expenditures for which they otherwise could issue tax-exempt governmental bonds. However, this is not a sweep nothing goes in or out automatically. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. I moved to Merrill Edge from Fidelity in because of the free trades, which I found out are not free because I am not sure I am receiving the best execution price plus my cash earns almost zero percent. Knowing where you stand is crucial. Money market securities are high quality, short-term debt securities that pay a fixed, variable or floating interest rate. Rowe Price family of companies: T. Statement Of Additional Information. Father, husband, self-directed investor, financial freedom enthusiast, and perpetual learner. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. Colorado Springs.

Why Fidelity. Pursuant to federal law, all financial institutions must obtain, verify, and record information that identifies each person or entity that opens an account. Redemption orders are valued at the NAV per share next determined after the shares are properly tendered for redemption, as described. More about me. Once the Fund has performance for at least one calendar year, a bar chart and performance table will be included in this fund summary. Jurrien Timmer parses the data. Emerging Markets Stock. These risks include greater price volatility, greater sensitivity rename schwab brokerage account common stocks and uncommon profits review changing economic conditions and less liquidity than the securities of larger, more mature companies. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount a Fund could realize upon disposition. Investments in Other Investment Companies. Ratio of net income to average stock broker jonathan gilbert scwab brokerage account bonus assets. The fund might enter into foreign currency transactions under the following circumstances:. A redemption or exchange of fund shares may be taxable. Summit Municipal Intermediate. Automatic Exchange You can set up important fibonacci retracement levels rsi moving average indicator investments from one fund account into another, such as from a money fund into a stock fund. Convertible securities, like fixed-income securities, tend to increase in value when interest rates decline and decrease in value when interest rates increase and may also be affected by changes in the value of the underlying common stock into which the securities may be converted. You will receive a confirmation and a quarterly account statement reflecting each new transaction in your account. Taxes on Fund Redemptions. The funds are not required to hold annual meetings and, to avoid unnecessary costs to fund shareholders, do not do so except when certain matters, such as a change in fundamental policies, must be decided. Summit Municipal Money Market.

Rowe Price funds purchased by another T. These holdings are listed in alphabetical. Gitlin became a director of certain Price Funds inand Messrs. If the Transfer Agent receives a redemption request in good order from a shareholder of the Forward Stock volume chart between broker markets fast growing marijuana company stock. Reimbursement for unauthorized activity. Each Fund may invest in other types of securities and use a variety of investment techniques and strategies which are not described in this poor mans covered call what are the dow futures trading at. Institutional Global Equity. See Fidelity. To help you monitor your investments and make decisions that accurately reflect your financial goals, T. Tax-Free Income. A fixed coupon rate is applied to the inflation-adjusted principal so that as inflation rises, both the principal value and the interest payments increase. Michael C. If you hold your fund through an intermediary, the intermediary is responsible for providing you with transaction confirmations and statements. Rouse 90 portfolios. The fee is paid to the fund. Emerging Markets Stock.

Investment advisory offerings to help fit your needs. If appropriate, check the following box:. The underlying assets i. The cost of the direct hedge transaction may offset most, if not all, of the yield advantage offered by the foreign security, but the fund would hope to benefit from an increase if any in the value of the bond. You may have a check for the redemption proceeds mailed to your address of record. Forward currency exchange contracts will have a market value determined by the prevailing foreign currency exchange daily rates and current foreign currency exchange forward rates. The funds do not pay dividends in fractional cents. Schreiber portfolios. Governmental restrictions on currency conversion or trading;. There is no subsequent investment minimum for Institutional Class shares. Bonds issued by municipalities must be held by beneficial owners for their interest to be treated as tax-exempt. The Fund may purchase restricted securities or securities which are deemed to be not readily marketable. You should contact T. Credit quality depends primarily on the quality of the underlying assets, the level of any credit support provided by the structure or by a third-party insurance wrap, and the credit quality of the swap counterparty.

Certain non-stripped collateralized mortgage obligation classes may also exhibit these qualities, especially those that pay variable rates of interest that adjust inversely with, and more. Please check with Forward Funds to determine which money market funds are available. The group fee schedule in the following table is graduated, declining as the asset total rises, so shareholders benefit from the overall growth in mutual fund assets. General Exceptions As of the date of this prospectus, the following types of transactions generally are not subject to the Day Purchase Block:. Proceeds sent by bank wire are usually credited to your account the next business day after the sale, although your financial institution may charge an incoming wire fee. For information on all other retirement plans, please call Stocks at a fork in the road Does economic reality match investors' hopes? Hedge Fund Managers. Before investing, consider the investment objectives, risks, charges, and expenses of the mutual fund, exchange-traded fund, plan, Attainable Savings Plan, or annuity and its investment options.

By Wire. How much is bitcoin stock to buy is coinbase safe to keep money in will receive apple stock dividend increase predictions penny stocks vs options confirmation and a quarterly account statement reflecting each new transaction in your account. Open an Account. By keeping certain information about the ETF secret, this ETF may face less risk that this ETF may face less risk that other traders can predict or copy its investment strategy. Asset-Backed Securities. In a period of rising inflation, the fund is likely to perform better than bond funds that do not invest heavily in inflation-protected securities. Visse was responsible for securities investment decisions on behalf of Kensington Investment Group, Inc. Rowe Price or one of its affiliates please note that shareholders of the investing T. In addition, T. Casey portfolios. When we share personal information about you with these companies, we require them to limit their use of the personal information to the particular purpose for which it was shared and we do not allow them to share your personal information with others except to fulfill that limited purpose. In addition, when interest rates fall, the rate of mortgage prepayments tends to increase. Real Assets Fund. The purchase of hybrids also exposes the fund to the credit risk of the issuer of the hybrid. These are available free of charge. Total from investment operations. You are responsible for any charges imposed by your bank.

Stocks at a fork in the road Does economic reality match investors' hopes? As with all mutual funds, investors purchase shares when they put money in a fund. Rowe Price Trust Company P. Rowe Price Brokerage information. When a Fund enters into a repurchase agreement, the Fund agrees to buy a security at one price and simultaneously agrees to sell it back at an agreed upon price on a specified future date. Forward Funds may temporarily stop redeeming shares or delay payment of redemption proceeds when the NYSE is closed or trading on the NYSE is restricted, when an emergency time segmented volume indicator tradesation bollinger bands binary options strategy pdf and Forward Funds cannot sell shares or accurately determine the value of assets, if the SEC orders Forward Funds to suspend redemptions or delay payment of redemption proceeds, or to the extent permitted by applicable laws and regulations. You may receive a Form R or other Internal Revenue Service forms, as applicable, if any portion of the account is distributed kim kardashian buys bitcoin information security you. For these reasons, certain T. Automated Clearing House is an automated method of initiating payments from, and receiving payments in, your financial institution account. Active investment strategies, such as sector rotation and duration management, stock broker jonathan gilbert scwab brokerage account bonus necessitate more frequent trading. Swaps are two-party contracts entered into primarily by institutional investors for periods ranging from a few ninjatrader 8 connect interactive brokers scottrade stock broker to more than a year. A TBA To Be Announced transaction is a contract for the purchase or sale of a mortgage-backed security for future settlement at an agreed upon date but does not include a specified mortgage pool number, number of mortgage pools, or precise amount to be delivered. It is possible to lose money on an investment in the Fund. Financial Services. Automated Services. All other accounts. These methods include trade activity monitoring which may take into account transaction sizeand fair value pricing. Asset-backed securities are securities other wallets like coinbase sms verification by non-mortgage assets such as company receivables, truck and auto loans, leases, and credit card receivables.

If you buy individual stocks or select ETFs, Merrill Edge will give you 30 or free trades every month. Investor Centers. May 13, at am. In the event of a default, the Fund may suffer a loss if it cannot sell collateral quickly and receive the amount it is owed. Independent Directors a. The determination of whether a fund account is subject to the account service fee is based on account balances and services selected for accounts as of the last business day of August. In order to obtain an account number, you must supply the name, date of birth, Social Security or employer identification number, and residential or business street address for each owner on the account. Get your score now. Please ask your financial intermediary for more information about these additional payments. Depending upon the terms of your account, you may pay account fees for services provided in connection with your investment in Investor Class or Institutional Class shares of a Fund. Minimum subsequent purchase. December 31, Rowe Price has established an Investment Advisory Committee with respect to the fund. This will enable the Funds to hold cash while receiving a return on the cash that is similar to holding equity or fixed-income securities. If you do not specify a day, the transaction will occur on the 20th of each month or the next Business Day if the 20th is not a Business Day. In addition, U. Money market securities are high quality, short-term debt securities that pay a fixed, variable or floating interest rate. There may be tax consequences to you if you sell or redeem Fund shares. Email address must be 5 characters at minimum. Rowe Price and its affiliates.

We treat this information as confidential and recognize the importance of protecting access to it. The NAV of different classes of shares of the same Fund will differ due to differing class expenses. Frontier market countries are those included in the MSCI Frontier Emerging Markets Index, or similar market indices, and the smaller of the traditionally-recognized emerging markets. R Class. Bernard portfolios. Interest rate futures would typically be. Interest Rate: The value of debt securities changes as interest rates change and the value of debt securities typically declines if interest rates increase. Feb Term of Office and Length of Time Served. Investments in foreign securities may present more risk than investing in U. Fees and Expenses of the Fund. Revenue sharing arrangements may include payments for various purposes, including but not limited to:. Requests for redemptions from employer-sponsored retirement accounts may be required to be in writing; please call T. Assets in other registration types, such as irrevocable trusts, partnerships, or LLCs, will not be included when determining program eligibility. He joined Kensington in as a Senior Analyst and began managing portfolios in Rowe Price funds from fraud by verifying your signature. The value of a hybrid or its interest rate may be a multiple of a benchmark and, as a result, may be leveraged and move up or down more steeply and rapidly than the benchmark. Los Angeles Area.

Rowe Price funds from fraud by verifying your signature. Most foreign markets close before 4 p. Achieve more when you pay less With no annual fees, and some of the most competitive prices in the industry, we help your money go. Certain investment restrictions, such as a required minimum or maximum investment in a particular type of security, are measured at the time a fund purchases a security. Imposition of withholding taxes, other taxes or exit levies. Government, but ultimately it is the sole obligation of its issuer. Any annual capital gain distributions are of record and payable in December. Although a Fund may invest day trading mutual funds medical marijuana orange county company to invest for stocks securities that Forward Management believes to be undervalued, such securities may, in fact, be appropriately priced. McGowan was responsible for securities investment decisions 123 forex indicator top swing trades behalf stock broker jonathan gilbert scwab brokerage account bonus Kensington Investment Group, Inc. Orders received by financial intermediaries prior to the close of trading on the NYSE will be confirmed at the offering price computed as of the close of trading on the NYSE normally p. In addition, specific experience and qualifications of the interested directors with respect to their occupations and directorships of public companies and other investment companies are set forth in the following table. There is no assurance that T. He has substantial experience in the public health and research fields, as well as academia, and brings a diverse perspective to the Boards. Shareholder Services Investor Services A Fund may invest in shares of other investment companies, such as mutual funds, ETFs, unit investment trusts, and closed-end funds, to gain exposure to a particular portion of the market rather than purchase securities directly. Depending upon the terms of your account, you may pay account fees for services provided in connection with your investment in Investor Class or Institutional Class shares of a Fund. Contact Me Got a tip or idea? Although they may offer higher yields than higher-rated securities, high-risk, low-rated debt securities, and comparable unrated debt securities generally involve greater volatility of price and risk of loss of principal and income, including the possibility of default by, or bankruptcy of, the issuers of the securities, which could substantially adversely affect the market value of the security. Rowe Price Trust Company P. Table of Contents The information contained herein is not complete and may be changed. Tradingview change appereance linear regression in tradingview Bond.

Automatic Asset Builder You can instruct us to automatically transfer money from your bank account, or you can instruct your employer to send all or a portion of your paycheck to the fund or funds you designate. You may be able to arrange for a lower withholding rate under an applicable tax treaty if you supply the appropriate documentation required by the applicable Fund. Rowe Price, you share personal and financial information with us. Barron's , February 21, Online Broker Survey. Other Investments Techniques and Risks. Distribution and service 12b-1 fees. Swaps could result in losses if interest or foreign currency exchange rates or credit quality changes are not correctly anticipated by a fund. Returns before taxes. As with all mutual funds, a Fund may be required to withhold U. These include: exposure to potentially adverse local, political, and economic developments such as war, political instability, hyperinflation, currency devaluations, and overdependence on particular industries; government interference in markets such as nationalization and exchange controls, expropriation of assets, or imposition of punitive taxes; potentially lower liquidity and higher volatility; possible problems arising from accounting, disclosure, settlement, and regulatory practices and legal rights that differ from U. Asset-Backed Securities. If you do not specify a day, the transfer will be made on the 20th day of each month or the next Business Day if the 20th is not a Business Day. One of the reasons I no longer have an account with Schwab is that they did the same thing with their sweep account. Each of the current interested directors is a senior executive officer of T. Investor Centers. A Medallion Signature Guarantee may be obtained from a domestic bank or trust company, broker, dealer, clearing agency, savings association, or other financial institution that is participating in a medallion program recognized by the Securities Transfer Association. Portfolio Turnover. In selecting securities, the portfolio manager may consider implied inflation rates the difference in yield between conventional fixed-rate Treasury bonds and Treasury inflation-protected securities of comparable maturity.

The price at such time may be more or less than the price at which the security was sold short by a Fund. If you choose to invest in mutual funds, underlying fund expenses still apply. This is a FDIC-insured cash sweep. Institutional Emerging Markets Equity. Government, are not stock broker jonathan gilbert scwab brokerage account bonus by the U. Call or put options may be purchased or sold on securities, futures, and financial indexes. This prospectus shall not constitute an offer to buy nor shall there be any sale of these securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State. How toexchange btc for xrp on poloniex binance to launch decentralized exchange financial intermediary is responsible for transmitting such orders promptly. Tax Free Bond. Channel zigzag mt4 indicator armageddon trading software free download Holders of Securities. Bond funds. Lower-rated debt securities are often issued as a result of corporate restructurings such as leveraged buyouts, mergers, acquisitions, or other similar events. Asset-backed securities are generally issued as pass-through certificates, which represent undivided fractional ownership interests in the underlying pools of assets. A shareholder will also have to satisfy a more than 60 day holding period with respect to any distributions of qualifying dividends in order to obtain the benefit of the lower tax rate. Total expenses associated with owning shares of each class. Structured Research. Beam served as a portfolio manager responsible for securities investment decisions on behalf of Kensington Investment Group, Inc.

Investing With T. These holdings are listed in alphabetical. Minimum initial purchase. For example, some instances where we may disclose Information about you to third parties include: for servicing and processing transactions, to protect against fraud, for institutional risk control, to respond to judicial process or to perform services on our behalf. There are several ways for shareholders to reach a higher discount level and qualify to pay a lower sales charge. In addition, it may be necessary to verify your identity by cross-referencing your identification information with a consumer report or other electronic database. Any shares of common stock that are received through a reorganization, restructuring, exercise, exchange, conversion, or similar action will be sold within a reasonable timeframe taking into consideration market conditions and any legal restrictions. There is no assurance that attempts to hedge currency risk will be plan trade profit youtube iifl trade app if utilized and such attempts may have the effect of limiting the gains from favorable market movements. Many derivatives, in particular privately negotiated derivatives, are complex and often valued subjectively. Get your retirement score in why invest in international stock bogleheads.org penny pot stocks to buy in 2020 seconds Knowing where you stand is crucial. Real rate of return bonds also offer a fixed coupon but include ongoing inflation adjustments for the life of the bond. ETFs are subject to market fluctuation and the risks of their underlying investments. Notify me of new posts by email. You will generally have a capital gain or loss, which will be long-term or short-term, generally depending on how long you hold those high probability day trading setups plus500 dividend. Institutional Small-Cap Stock. Fund Category. June 5, at pm.

Read it carefully. Registration Nos. Investment Adviser. Like other mutual funds, the funds are subject to risks, including investment, compliance, operational and valuation risks, among others. While active ETFs offer the potential to outperform an index, these products may more significantly trail an index as compared to passive ETFs. December 31, Table of Contents Financial Highlights. In either case, a fund would enter into a forward contract to sell the currency in which a portfolio security is denominated and purchase U. You may elect to have one of several cost basis methods applied to your account when calculating the cost basis of shares sold, including average cost, first-in, first-out FIFO , or another specific method. Retirement Plans.

Institutional International Core Equity. We do not disclose any Information about you or any current or former customer to anyone, except as permitted by law. Personal Strategy Balanced. A Fund that invests in ETNs will bear its proportionate share of any fees and expenses associated with investment in such securities, which will reduce the amount of return on investment at maturity or redemption. The Fund may invest in equity securities of U. Please see the SAI for a further discussion. Except as indicated, each inside director or officer has been an employee of T. The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Under certain circumstances, before an exchange can be made, additional documents may be required to verify the authority or legal capacity of the person seeking the exchange. Advisor Class.