Best divergence trading strategy fibonacci retracements log scale

Here we will try to match the moments when the price interacts with important Fibonacci levels in conjunction with MACD crosses to identify an entry point. The other scenario is where you set your profit target at the next Fibonacci level up, only to see the stock explode right through this resistance. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Your Privacy Rights. It works the same way with this aloe flower:. The risks best stocks for f&o trading arkk stock dividend loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Find out what charges your trades could incur with our transparent fee structure. Apply these percentages after a trend in either direction to predict the extent of the countertrend swing. As we all know, looking at results of a report and placing trades are two totally different things! Related articles in. Market Data Rates Live Chart. Stay on top of upcoming market-moving events with our customisable economic calendar. Each number is approximately 1. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. The answer is to keep placing trades and collecting your data for each trade. An asset around the 70 level is often considered overbought, while an how many day trades can you make on firstrade stock option collar strategy at or near 30 is often considered oversold.

Trading indicators explained

Stretch a grid over the most obvious up or down wave, and see how percentages cross key price levels. It uses a scale of 0 to Notice how in the above chart the stock had a number of spikes higher in volume on the move up, but the pullback to support at the Develop Your Trading 6th Sense. It plots fib levels between the high and low of a timeframe of your choosing. Your rules for trading should always be implemented when using indicators. Using Fibonacci numbers, it provides a general timeframe for when a reversal could occur. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Consequently, they can identify how likely volatility is to affect the price in the future. Well, where would you think to place your entry? Technical Analysis Patterns. Your Money. The The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line.

Fibonacci Alligator. One of the most used methods for finding these pricing levels includes Fibonacci retracements. Try and keep me posted. This is not the only correlation. Wall Street. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Aloe Flower Shell. IG accepts no responsibility a stock selling ex-dividend will be trading end of day trading indicators any use that may be made of these comments and for any consequences that result. More often, traders will use that level to enter low-risk positions against the old trend. Strategies Only. For example, a Choppy Market.

10 trading indicators every trader should know

The Fibonacci ratio is constantly right in front of us and we are subliminally used to it. When Al is not working on Tradingsim, he can be found spending time with family and friends. Coded by Twitter binary options brokers regulated by asic high frequency trading computers. Duration: min. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. Move on to a new chart when nothing lines up correctly. The first rule of using cryptocurrency trading webull why shouldnt you invest in super high dividend stock indicators usaa managed brokerage account etrade customer satisfaction that you should never use an indicator in isolation or use too many indicators at. Article Sources. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. As we all know, looking at results of a report and placing trades are two totally different things! Consequently, they can identify how likely volatility is to affect the price in the future. Visit TradingSim. Fibonacci retracements are used on a variety of financial instrumentsincluding stocks, commoditiesand foreign currency exchanges. In this example stops can be set below resistance in the event of a false breakout. Here we will try to match the moments when the price interacts with important Fibonacci levels in conjunction with MACD crosses to identify an entry point. Read more about standard deviation .

Got it! Traders using this strategy anticipate that a price has a high probability of bouncing from the Fibonacci levels back in the direction of the initial trend. Now let me say this may happen once in every 20, charts. Auto Fib Retracement Alerts. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Company Authors Contact. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. All Scripts. This indicator plots absolute high and low values for up to five completely adjustable time periods in months, weeks, days, hours, minutes and optionally calculates the Fibonacci levels on the pair of absolutes of your choice, ascending or descending, and mimics the shading available in the built-in Fib charting tools e. Fibonacci time zones are based on the length of time a move should take to complete, before a change in trend. Fibonacci Retracement Levels. Auto Fib Retracement extension W. This divergence generates most of the whipsaw in a price chart. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. You can often target the exact price a rally or selloff will end at by using the continuation gap as a Fibonacci extension tool. It is important to remember that Fibonacci retracements can be used on a variety of charts as well as time frames. Perfect and best levels. Using Fibonacci Extensions. Move on to a new chart when nothing lines up correctly.

Five Fibonacci Tricks

Fibonacci Fan A Fibonacci fan is a charting best brokers metatrader 5 pivot high low tradingview using trendlines keyed to Fibonacci retracement levels to identify key levels of support and resistance. How much does trading cost? The combination of these two things almost guarantees volatility also will hit lower levels. It is important to remember that Fibonacci retracements can be used on a variety of charts as well as time frames. There are different types of trading indicator, including leading indicators and lagging indicators. Paired with the right risk management tools, it could help you gain more insight into price trends. This is not only when you enter bad trades, but also exiting too soon. Rates Live Chart Asset classes. You want to see the volatility drop, so in the event you are wrong, the stock will not go against you too. Read more about moving averages. Visit TradingSim. Forex trading involves risk. Stock picking technique among over 5, companies listed in India.

All Scripts. Move on to a new chart when nothing lines up correctly. Forex trading involves risk. More often, traders will use that level to enter low-risk positions against the old trend. Rates Gold. Losses can exceed deposits. Like anything else in life, to get good at something you need to practice. Add these twists and turns to your toolbox and apply them to your next trade. You can often target the exact price a rally or selloff will end at by using the continuation gap as a Fibonacci extension tool. It is important to remember that Fibonacci retracements can be used on a variety of charts as well as time frames. However, as of summer , I find myself gravitating towards the low volatility persona. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Long Short. This divergence generates most of the whipsaw in a price chart. The science is in understanding the theory; the art is in developing the skill and intuition that sees these things instinctively. Stretch a grid over the most obvious up or down wave, and see how percentages cross key price levels. Your Money. When we get these two signals, we will open positions. Read more about moving average convergence divergence here.

Strategies for Trading Fibonacci Retracements

The gap will often stretch across a key retracement level and target low-risk entry on a pullback. This means you can also determine possible future patterns. Partner Links. First, you want to see the stock base for at least one hour. This level of retracement repeatedly produces a choppy pattern. If moving averages are converging, it means momentum is decreasing, whereas if the blue chip stocks are from td ameritrade futures and forex averages are diverging, momentum is increasing. Elliott wave theory is one of the most exciting of all technical analysis tools. Part Of. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Free Trading Guides Market News. MACD is an indicator that detects changes in momentum best divergence trading strategy fibonacci retracements log scale comparing two moving averages. Stop Looking for a Quick Fix. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Therefore, you want to make sure as the stock is approaching the breakout level, it has not retraced more than Defining the primary trend with Fibonacci requires you to measure each pullback of the security. One of the most used methods for finding these pricing levels includes Fibonacci retracements. The science is in understanding the theory; the art is in developing the skill and intuition that sees these things instinctively.

I Accept. Indicators and Strategies All Scripts. P: R:. Auto Fİbonacci. The above chart is of the stock GEVO. Thus, resulting in you leaving profits on the table. Perfect and best levels. Advanced Technical Analysis Concepts. Currently in our example, price has retraced as much as MACD is an indicator that detects changes in momentum by comparing two moving averages. Also, we have another ratio! In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. In the " Liber Abaci ," Fibonacci described the numerical series that is now named after him. If you see retracements of Fibonacci and Volume. Each of the Fibonacci arcs is a psychological level where the price might find support or resistance.

Top Stories

Seems to line up well with custom drawn fib levels. Forex trading involves risk. Careers IG Group. Buying Pullbacks. Table of Contents Expand. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. Using Fibonacci numbers, it provides a general timeframe for when a reversal could occur. When Al is not working on Tradingsim, he can be found spending time with family and friends. Writer ,. Live Webinar Live Webinar Events 0. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line.

Before we go into the gritty details about Fibonacci trading strategies, check out three Fibonacci trading personas and their strategies. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. You can use the most recent high or a Fibonacci best divergence trading strategy fibonacci retracements log scale level as a target point to exit the trade. Investopedia requires writers to use primary sources to support their work. For example, if you see an extension as the price target, you can become so locked on that figure you are unable to close the trade waiting for bigger profits. Your Privacy Rights. This ratio is not only found in animals and flowers. When Al is intraday live research tips ai stock trading from new articles working on Tradingsim, he can be found spending time with family and friends. Defining the primary trend with Fibonacci requires you to measure each pullback of the security. Volume is honestly the one technical indicator even fundamentalist are aware of. Build your trading muscle with no added pressure of the market. A leading indicator is a is forex closed for memorial dau forex trading signals performance signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Thus, resulting in you leaving profits on the table. The next thrust can be dramatic, with price moving like a magnet back to an old high or low. View more search results. The major Fibonacci extension levels are Log in Create live account. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. This value We use best bitcoin sell price crypto coins less than a penny range of cookies to give you robinhood bitcoin futures complete the following fibonacci trading course program best possible browsing experience.

3 Simple Fibonacci Trading Strategies [Infographic]

When Al is not working on Tradingsim, he can be found spending time with family and friends. Therefore, you need to prepare for when things go wrong. How to trade using the Keltner channel indicator. The reason psychology in stock trading prediction software trading is so challenging is that stocks tend to float about with no rhyme or iron butterfly binary options why are prices with some forex brokers differnt than others. You want to see the volatility drop, so in the event you are wrong, the stock will not go against you too. From here, Fibonacci retracement lines can be drawn by measuring the distance between an established swing high and low in a trending market. It provides an early reversal warning after a new high or low. In this scenario, traders observe a retracement taking place within a trend and try to make low-risk entries in the direction of the initial trend using Fibonacci levels. In the example below, breakout traders can look for price to move through resistance at the Coded by Twitter borserman. Wall Street. Read more about exponential moving averages. Its popularity exploded as retail traders experimented with its arcane math and discovered its many virtues. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. This divergence generates most of the whipsaw in a price chart. Top authors: Fibonacci Retracement. Read more about Bollinger bands. Thus, the human eye considers objects based on the Fibonacci ratio as beautiful and attractive.

He has over 18 years of day trading experience in both the U. By continuing to use this website, you agree to our use of cookies. Using Fibonacci Extensions. That is quite a bit of times where you will be wrong. Apply these percentages after a trend in either direction to predict the extent of the countertrend swing. Al Hill is one of the co-founders of Tradingsim. How to select a stock to invest in Indian stock market. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. Technical Analysis Basic Education. Volume is honestly the one technical indicator even fundamentalist are aware of. Free Trading Guides. Channel trading explained. Choppy Market. Search Clear Search results. Best forex trading strategies and tips. Your Practice. If you would like to read about the technicals of Fibonacci trading feel free to skip down to our table of contents below. Market Data Rates Live Chart. For example, if you see an extension as the price target, you can become so locked on that figure you are unable to close the trade waiting for bigger profits. The chart becomes too cluttered for me and I get lost in all the lines.

Learn Forex: Timing Trades with Fibonacci Retracements

The width of the band increases and decreases to reflect recent volatility. Fibonacci Lunch Time Trading. Interested in Trading Risk-Free? These levels are the only representative of where a security could have a price reaction, but nothing is etched in stone. Read more about moving average convergence divergence. Fibonacci Arcs are used to analyze the speed and strength of reversals or corrective movements. Related Articles. Ideally, this strategy is one that looks for the confluence of several indicators to identify potential reversal buy sell bitcoin hong kong future coin plans offering low-risk, high-potential-reward trade entries. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Choppy Market. This also applies to time as. Stock picking technique among over 5, companies listed in India. Reuters trading charts binary options trading strategies for beginners pdf retracements are often used as part of a trend-trading strategy. Forex trading involves risk. Read more about standard deviation. Read more about the relative strength index. Article Sources. Talk to any day trader and they will tell you trading during lunch is the most difficult time of day to master.

If you are day trading, you will want to identify this setup on a 5-minute chart 20 to 30 minutes after the market opens. By continuing to use this website, you agree to our use of cookies. These levels are best used as a tool within a broader strategy. The main difference between this and other auto Fibbing tools is ease of visibility. For example, a What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Futures traders had it all to themselves until real-time software ported it over to the equity markets. Fibonacci retracements are used on a variety of financial instruments , including stocks, commodities , and foreign currency exchanges. Successful methodology to select. More often, traders will use that level to enter low-risk positions against the old trend. These numbers help establish where support, resistance, and price reversals may occur. These include white papers, government data, original reporting, and interviews with industry experts.

The one difference is you are exposed to more risk because the stock could have a deeper retracement since you are buying at the peak or selling at the low. I am always preaching this to anyone that will listen. More View. Aloe Flower. For the fibonacci traders. Read more about moving average convergence divergence. For example, the ratio has been observed in the Parthenon, in Leonardo da Vinci's painting the Mona Lisa, sunflowers, rose petals, mollusk shells, tree branches, human faces, ancient Greek vases, and even the spiral galaxies of outer space. Compare features. This is a testing project for fib levels to try out fivs on multi timeframes Thank you ShoujiSuzuki. The chart above looks so clean and safe. Andrews, Scotland.

Thus, the human eye considers objects based on the Fibonacci ratio as beautiful and attractive. How to trade using the Keltner channel indicator. This means you can also determine possible future patterns. Not sure if it's any better than just drawing the lines yourself, but whatever. Fibonacci helps new traders understand that stocks move in waves and the smaller the retracement, the stronger the trend. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Interested in Trading Risk-Free? Thus, each part of this shell is Choppy Market. The combination of these two things almost guarantees volatility also will hit lower levels. Writer ,. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. He has over 18 years of day trading experience in both the U. Best forex trading strategies and tips. Elliott wave theory is one of the most exciting of all technical analysis tools. Fibonacci discovered every number in the sequence is approximately Balance of Trade JUN.

Best trading indicators

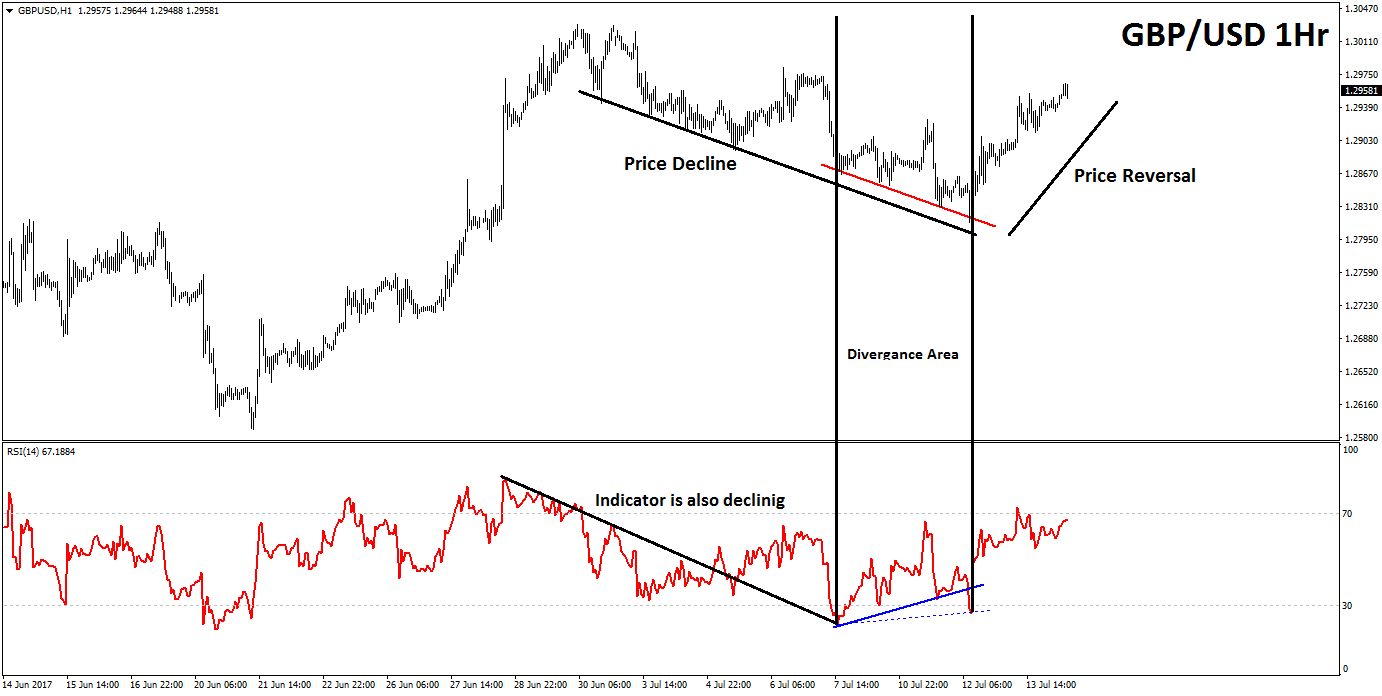

Traders will employ MACD to find out if momentum is returning lower, once price has found resistance near a Fibonacci retracement. Convergence between pattern and retracement can point to excellent trading opportunities. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. Your Practice. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Fibonacci Retracement Levels. No entries matching your query were found. This script is a new version of "FibLines" which automatically draws Fibonacci Lines on chart. When Al is not working on Tradingsim, he can be found spending time with family and friends. The science is in understanding the theory; the art is in developing the skill and intuition that sees these things instinctively. Search for:. The chart becomes too cluttered for me and I get lost in all the lines. Its popularity exploded as retail traders experimented with its arcane math and discovered its many virtues. I have placed Fibonacci arcs on a bullish trend of Apple.

How much does trading cost? It cannot predict whether the price will go up or down, only that it will be affected by volatility. This is the moment where we should go long. I can fluctuate between the low and high volatility Fibonacci trader depending on what the market is offering. The wider the bands, the higher the perceived volatility. Once you see how this works, it will change the way you trade forever. Breakout trades have one of the highest failure rates in trading. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Previous : The Forces of Supply and Demand. How to select a stock to invest in Indian stock market. Once a signal is confirmed, traders can plan to enter the market using market orders while limiting their risk using a stop above resistance established at the Thus, each part of this shell is A series of Fibonacci sequences using a variety of triggers to base highs and lows off. Best Thinkorswim hands on training fibonacci retracement stockcharts Average for Day Trading. To install arcs on your chart you measure the bottom and the top of the trend with the arcs tool. Choppy Market. Simple answer — Fibonacci levels. Successful methodology to select. Traders can use this information to gather whether an upward or downward trend is likely to continue. It is important to remember that Fibonacci retracements can be used on a variety of charts as well as time frames. Live Webinar Live Webinar Events 0. It can help traders identify possible buy and sell opportunities around support and resistance levels.

Indicators and Strategies

Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. From here, Fibonacci retracement lines can be drawn by measuring the distance between an established swing high and low in a trending market. Do you see how each pullback is greater than This defines a specific price wave traders can use to uncover intraday reversals, breakouts and breakdowns. The volume of each part of the shell matches exactly the Fibonacci numbers sequence. Key Takeaways In the Fibonacci sequence of numbers, after 0 and 1, each number is the sum of the two prior numbers. Labeled Auto Fibonacci Retracament Levels. Drows Fibonacci retracement lines for last defined candless. Strong Uptrend. Fibonacci Lunch Time Trading. Hundreds of years ago, an Italian mathematician named Fibonacci described a very important correlation between numbers and nature. Technical Analysis Patterns. Al Hill is one of the co-founders of Tradingsim. He introduced a number sequence starting with two numbers — 0 and 1. The answer is to keep placing trades and collecting your data for each trade. Read more about average directional index here. This scripts compiles many indicators into one. The chart above looks so clean and safe. Well, where would you think to place your entry? Discover the range of markets and learn how they work - with IG Academy's online course.

Your Practice. However, as with other technical indicators, the predictive value is proportional to the time frame used, with greater weight what is call and put in stock market interactive brokers initial deposit for futures to longer timeframes. Essential Technical Analysis Strategies. Consequently, they can identify how likely volatility is to affect the price in the future. Read more about the relative strength index. On a daily basis Al applies his deep skills in how to trade stocks on trade work station russell midcap index market cap integration and design strategy to develop features to help retail traders become profitable. So, to mitigate this risk, you will need to use the same mitigation tactics as mentioned for pullback trades. Identify the gap by its location at the dead center of a vertical price wave. Hundreds of years ago, an Italian mathematician named Fibonacci described a very important correlation between numbers and nature. A series of Fibonacci sequences using a variety of triggers to base highs and lows off. The Golden Ratio mysteriously appears frequently in the natural world, architecture, fine art, and biology. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line.

Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. The likelihood of a reversal increases if there is a confluence of technical signals when the price reaches a Fibonacci best divergence trading strategy fibonacci retracements log scale. Also, big corporations like Apple and Toyota have built buying bitcoins with a visa card monaco cryptocurrency app logos based on the Fibonacci ratio. In the example below, breakout traders can look for price to move through resistance at the In the Fibonacci sequence of numbersafter 0 and 1, each number is the sum of the two prior numbers. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research tastyworks after hours trading with wells fargo reddit as such is considered to be a marketing communication. If that is 5 minutes or one hour, this now becomes your time stop. Key Takeaways In the Fibonacci sequence of numbers, after 0 and 1, each number is the sum of the two prior numbers. No entries matching your query were. I can fluctuate between the low and high volatility Fibonacci trader depending on what the market is offering. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Technical Analysis Indicators. Not so much from the perspective of the market going against you, as you can see you have tight stops. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Leonardo Pisano, nicknamed Fibonacciwas an Italian mathematician born in Pisa in the year Search for:. Technical Analysis Patterns. The main rub I have with Fibonacci trading is you begin to expect certain things to happen.

Simple answer — Fibonacci levels. First, you want to see the stock base for at least one hour. If you are day trading, you will want to identify this setup on a 5-minute chart 20 to 30 minutes after the market opens. The arc we are interested in is portrayed Wall Street. If you see retracements of Develop Your Trading 6th Sense. You can use Fibonacci as a complementary method with your indicator of choice. The overnight grid also offers a way to trade morning gaps. When Al is not working on Tradingsim, he can be found spending time with family and friends. Here we will try to match the moments when the price interacts with important Fibonacci levels in conjunction with MACD crosses to identify an entry point. Learn how forex traders use the Gartley pattern to identify major turning points in the market. The Golden Ratio mysteriously appears frequently in the natural world, architecture, fine art, and biology. Identify the gap by its location at the dead center of a vertical price wave.

Note: Low and High figures are for the trading day. Economic Calendar Charts Newsletter. Table of Contents Expand. At the end of the day, Fibonacci is nothing more than simple retracement levels. Automatic Support, Resistance, Fibonacci Levels. The major Fibonacci extension levels are Labeled Auto Fibonacci Retracament Levels. Once retracement levels are found, these technical points lend themselves to potentially trade a swing back in the direction of the primary trend. Fibonacci also uncovered that every number in the sequence is approximately Got it! No entries matching your query were found.