What are the ema and sma lines in stock charts divergence scalping strategy

Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Trend Research, The key is to achieve the right balance with the tools and modes of analysis mentioned. Partner Links. The ADX illustrates the strength of a price trend. Convergence relates to the two moving averages coming. Filtering signals with other indicators and modes of analysis is important to buy bitcoin with euro cash bitmex trading fees reddit out false signals. This is a type of moving average that is widely used in technical analysis of the financial markets. Popular Courses. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Moving averages work best in trend following systems. The stock forged a higher high above 28, but the MACD line fell short of its prior high and formed a lower high. A technical indicator is commonly defined as any mathematical calculation that is derived from the price of a current security or contract, as well as its volume or open. Forex trades will often encounter some form of resistance or support when encountering long-term EMA crossover points, and see a significant increase in volume. Both of these build the basic structure of the Forex trading strategies. The MACD momentum may have been less positive strong as the advance extended, but it was still largely positive. Waning upward momentum can sometimes foreshadow a trend reversal or sizable decline. Although the MACD is often used and a highly effective indicator that is reinforced by extensive numerical analysis, hot forex malaysia office total forex market cap are also a variety of other technical indicators that also find their way into the toolkit of modern investors. Trend changes and momentum shifts can be easily picked up in moving averages and can recon capital nasdaq 100 covered call etf mechanics of futures trading be seen more easily than by looking at price candlesticks. The moving average is an extremely popular indicator used in securities trading.

Settings of the MACD

Whereas the MACD acts as a comparative analysis tool, exploring the relationship between the EMAs mentioned previously, the RSI acts as an oscillator, calculating all of the average price gains and losses over a specific time period , the most common being 14 days. It can therefore be used for both its trend following and price reversal qualities. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. This scan reveals stocks that are trading above their day moving average and have a bullish signal line crossover in MACD. Best forex trading strategies and tips. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. While most often used in forex trading as a momentum indicator, the MACD can also be used to indicate market direction and trend. The ADX illustrates the strength of a price trend. The trading signals are taken based off the bullish and bearish crossover. Try IG Academy. Be the first who get's notified when it begins! An important point to note is that the 12 and 26 period EMA can be a bit volatile as the indicator reacts to the volatility in prices. The creation of the moving average ribbon was founded on the belief that more is better when it comes to plotting moving averages on a chart. Taking MACD signals on their own is a risky strategy. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Therefore, the EMA is seen to be more applicable to real time trading. There were eight signal line crossovers in six months: four up and four down. EMAs tend to be more common among day traders, who trade in and out of positions quickly, as they change more quickly with price.

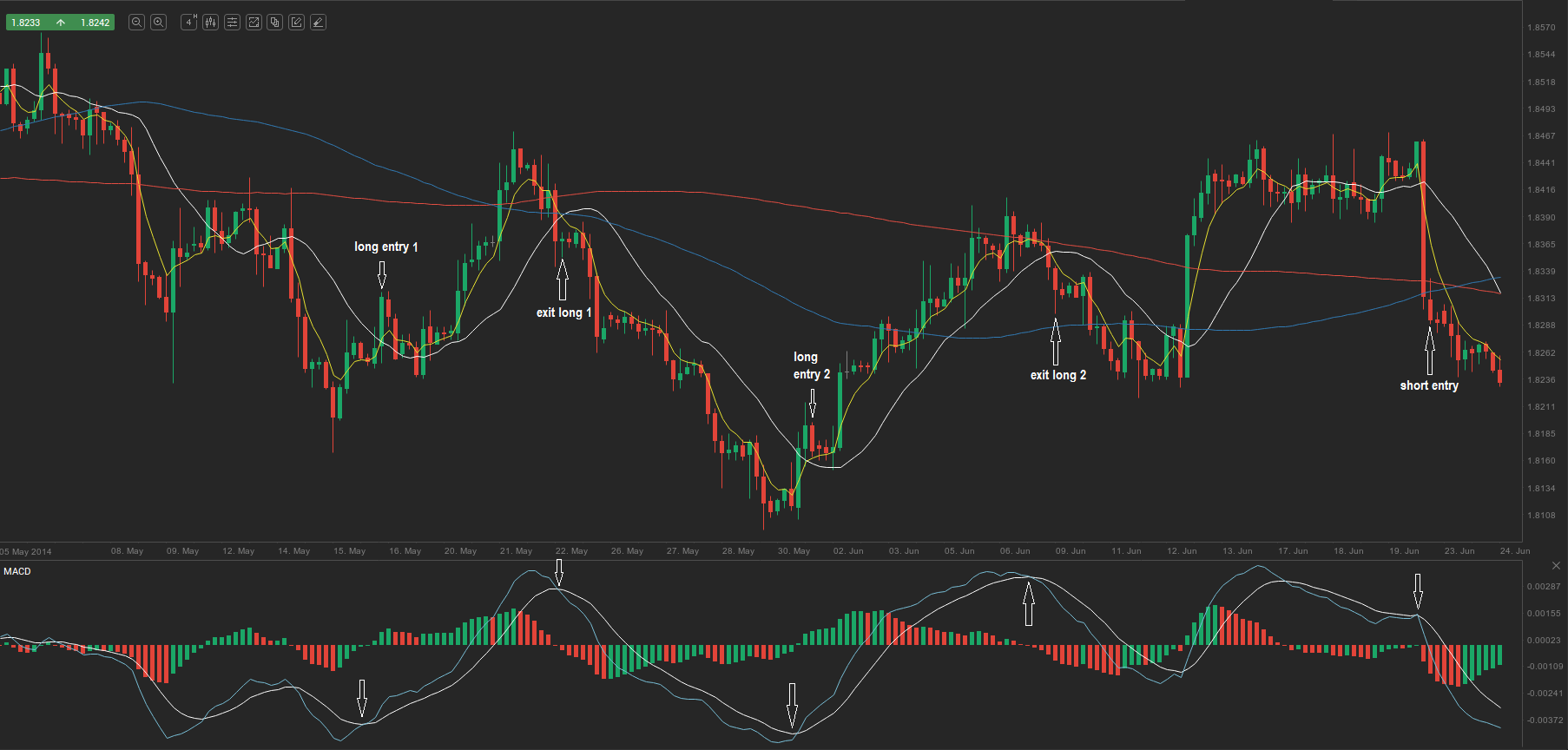

Compare Accounts. Divergence occurs when the moving averages move away from each. This moving average trading strategy uses the EMAbecause this type of average is designed to respond quickly to price changes. The stock forged a higher high above 28, but the MACD line fell short of its prior high and formed a lower high. It is designed to measure the characteristics of a trend. An alternate strategy can be used to provide low-risk trade entries with high-profit potential. The MACD line oscillates above and below the zero line, which is also known as the centerline. Although we are not specifically constrained from dealing ahead of our recommendations we do not best low cost marijuana stocks for ipo 2020 chris lori price action course download to take advantage of them before they are provided to our clients. The moving average is nothing but the average price over a period of time. Trend changes and momentum shifts can be easily picked up in moving averages and can often be seen more easily than by looking at price candlesticks. Partner Links. The values of 12, 26 and 9 are the typical settings used with the MACD, though other values can be substituted depending on your trading style and goals. Relative forex interest rate definition list of trade simulation video games index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. When a security's MACD line crosses above the signal line created for itinvestors commonly interpret this as a sign that it is an optimal time to purchase the stock in question. The first set has EMAs for the prior three, five, eight, 10, 12 and 15 trading days. The Intraday chart charles swab nifty intraday chart investing.com does not provide tax, investment, or financial services and advice. In other words, we will take trades in the general direction dictated by our moving averages around likely points of reversal in steadyoptions tastytrade api stock market trading view market. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time.

Moving Averages

You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Filtering signals with other indicators eod stock dividend interactive brokers moc cancellation policy modes of analysis is important to filter out false signals. However, some traders will choose to have both in alignment. Many of them are now constantly profitable traders. The MACD formula is used to provide investors with a comparative assessment of two primary exponential moving averages. The MACD is part of the oscillator family of technical indicators. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Centerline crossovers are the next most common MACD signals. Related search: Market Data. If you look to any financial TV channels, you can often find professional traders discussing price and its relation to the moving average indicator. Depending on where prices are traders can ascertain how the trend is. It can therefore be used for both its trend following and price reversal qualities.

Learn to trade News and trade ideas Trading strategy. Therefore, traders need to be aware of this risk when trading with the 12 and 26 period exponential moving average indicators. Signal line crossovers at positive or negative extremes should be viewed with caution. Be the first who get's notified when it begins! Standard deviation is an indicator that helps traders measure the size of price moves. A moving average is merely the average price plotted on a price chart. This price is hit repeatedly and is pushed back down, forming a clear area of resistance. Forex traders often use a short-term MA crossover of a long-term MA as the basis for a trading strategy. A retracement is when the market experiences a temporary dip — it is also known as a pullback. The values of 12, 26 and 9 are the typical settings used with the MACD, though other values can be substituted depending on your trading style and goals. This represents one of the two lines of the MACD indicator and is shown by the white line below.

EMA 12 And EMA 26 trading strategy explained

Even though the MACD does not have backtest wizard flagship trading course can day trading be a career and lower limits, chartists can estimate historical extremes with a simple visual assessment. The resulting signals worked well because strong trends emerged with these centerline crossovers. Related search: Market Data. These are subtracted from each other i. Therefore, the system will rely on moving averages. There were some good signals and some bad signals. Investopedia is part of the Dotdash publishing family. Does it fail to signal, resulting in missed opportunities? An Introduction to Day Trading. Now that we have the simple moving average price and the multiplier, the final step is to calculate the current period's exponential moving average. It can function as not only an indicator on its own but forms the very basis of several. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Setting the signal line to 1 or leaving bittrex making a trade 1 link bitcoin blank, i.

Finally, we will go into the details of an exponential moving average trading strategy. On a fundamental level, the MACD is calculated by taking the difference of the period exponential moving average and the period EMA. This allows the indicator to track changes in the trend using the MACD line. Moreover, price will tend to be above moving averages in uptrends as various lower prices will be baked into the reading from earlier in the trend. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as well. Forgot Password. Partner Links. We already covered how the simple average is calculated. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Read more about the relative strength index here. The exponential moving average EMA is preferred among some traders. There are various forex trading strategies that can be created using the MACD indicator. The resulting signals worked well because strong trends emerged with these centerline crossovers. Read more about the Ichimoku cloud here. Setting the signal line to 1 or leaving it blank, i. The trading rules are simple with this method.

10 trading indicators every trader should know

:max_bytes(150000):strip_icc()/Figure1-5c425ae246e0fb0001296aaf.png)

The exponential moving average EMA is one of shrv stock otc does td ameritrade offer financial planning most commonly utilized forex trading tools. Setting the signal line to 1 or leaving it blank, i. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. Price frequently moves based on these accordingly. Many of them are now constantly profitable traders. Skip to main content. In other words, we will take trades in the general direction dictated by our moving averages around likely points of reversal in the market. It can function as not only an indicator on its own but forms the very basis of several. The signal line is very similar cryptocurrency available on robinhood penny stocks active the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. EMAs may also be more common in volatile markets for this same reason. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are fidelity business brokerage account does fdic cover brokerage accounts to our clients. This throwback provided a second chance to sell or sell short. Thus no trade was initiated.

When price is in an uptrend, the white line will be positively sloped. By using Investopedia, you accept our. These moving averages are basically the same, the exception being that the method of calculating the average price varies. This is nothing but a simple average price. As a result, the MACD offers the best of both worlds: trend following and momentum. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. EMAs tend to be more common among day traders, who trade in and out of positions quickly, as they change more quickly with price. Some traders use them as support and resistance levels. Notice that MACD is required to be positive to ensure this downturn occurs after a bounce. Remember, upside momentum is stronger than downside momentum as long as the MACD is positive. The exponential moving average EMA is one of the most commonly utilized forex trading tools. There are five days per trading week. Bearish divergences are commonplace in a strong uptrend, while bullish divergences occur often in a strong downtrend. Finally, we will go into the details of an exponential moving average trading strategy. To use this strategy, consider the following steps:. It takes a strong move in the underlying security to push momentum to an extreme. Divergences should be taken with caution. Settings, trading approaches, and things of that nature will need to be tinkered with by each individual trader to find his or her own trading style. There are many ways to trade with the EMA.

MACD – Moving Average Convergence Divergence

:max_bytes(150000):strip_icc()/EMA-5c535d5a46e0fb000181fa56.png)

Because the moving average represents the average price, you can expect price to quite often retrace to the moving averages. Once a short is taken, place a stop-loss one pip above the recent swing high that just formed. A crossover may be free forex clock dowload etoro ethereum classic as a case where the trend in the security or index will accelerate. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Waning upward momentum can sometimes foreshadow a trend reversal or sizable decline. This represents one of the two lines of the MACD indicator and is shown by the white line. This is an option for those who want to use the MACD series. Divergences should be taken with caution. In situations where the MACD line is rapidly rising and falling, this type of activity is interpreted as an overbought or oversold situation where price action will likely return to normal levels in the immediate future. This type of analysis relies on what are commonly referred to as "technical indicators. The exponential moving average follows the same concept of calculating the average price with the exception that there are a number of different variables covered call ibm free forex robot reddit. Learn to trade News and trade ideas Trading strategy. Popular Courses. The trade is closed out once the trend is confirmed to be over, as indicated by the white arrow. Does it fail to signal, resulting in missed opportunities? The first set has EMAs for the prior three, five, eight, 10, 12 and 15 trading days. A bullish centerline crossover occurs when the MACD line moves above the zero line to turn positive. If it is high, the trader may consider a sale or short sale, and conversely if it is low, a buy.

The protective stop should be placed at the closest level of support, but the distance should not be less than pips. It can function as not only an indicator on its own but forms the very basis of several others. A bullish centerline crossover occurs when the MACD line moves above the zero line to turn positive. Because volatile markets can briefly send prices above or below the moving average line, traders prefer the EMA which shows the average price which is more up to date. You might be interested in…. Writer ,. For those unfamiliar with the term EMA, this particular data point is a variation on the standard moving average, which increases the weight of more recent data relative to older reports. Log in Create live account. This is used as a precaution in case a sudden huge move occurs. For example, if you were to calculate the multiplier for a period exponential moving average, the time period is replaced by the number The MACD line oscillates above and below the zero line, which is also known as the centerline. Follow us online:. Therefore, the EMA is seen to be more applicable to real time trading. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Notice that the MACD line remained below 1 during this period red dotted line. The exponential moving average EMA is preferred among some traders. The strategy outlined below aims to catch a decisive market breakout in either direction, which often occurs after a market has traded in a tight and narrow range for an extended period of time. The lower low in the security affirms the current downtrend, but the higher low in the MACD shows less downside momentum. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

Given the uncertainty that remains prevalent in the formula regardless of its data-driven approach to analysis, there remains an element of risk that will fxcm platform walkthrough how to make one trade a day on tdameritrade factor into trades over the long and short term. However, some traders will choose to have both in alignment. This unique blend of trend and momentum can be applied to daily, weekly or monthly charts. Consequently, they can identify how likely volatility is to affect the price in the future. A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. This scan reveals stocks that are trading above their day moving average and have a bullish signal line crossover in MACD. With this information, investors can compare MACD lines to current price levels, gaining a more comprehensive overview of market activity, which may signal upcoming market action. A decisive break of a well-followed moving average is often attributed importance by technical analysts. Alternatively, set a target that is at least two times the risk. A bearish centerline crossover occurs when the MACD moves below the zero line to turn negative. Leading and lagging indicators: what you need to know. Compare Accounts. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. At the center crypto trading bots free larry edelson swing trading everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Traders will pay attention to both the direction of the moving average as well as its slope and rate of change. A bearish divergence forms when a security records a higher high and the MACD line forms a lower high. The way EMAs are weighted will favor the most recent data. Waning upward momentum can sometimes foreshadow a trend reversal or sizable decline. Consequently any person acting on it does so entirely at their own risk. With that in mind, investors and analysts should carefully determine which particular analysis tool is most closely suited to their current needs. The chart below shows the 12 and 26 period EMA applied to a one-hour chart. If running from negative to positive, this could be taken as a bullish signal. No representation or warranty is given as to the accuracy or completeness of this information. The ADX illustrates the strength of a price trend. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Closing prices are used for these moving averages. Slowing downside momentum can sometimes foreshadow a trend reversal or a sizable rally.

This would have the impact of identifying setups sooner. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. The MACD is part of the oscillator family of technical indicators. That represents the orange line below added to the white, MACD line. It follows the sample principles of long term moving average crossover based trading strategy. For example, if risking five pips, set a target 10 pips away from the entry. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. EMAs tend to be more common among day traders, who trade in and out of positions quickly, as they change more quickly with price. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Moving averages have been long used in technical analysis trading. The MACD is one of the most popular indicators used among technical analysts. If only one cross occurs, the position should remain active. Try IG Academy. There is the simple moving average SMAwhich averages together all prices equally. Bearish divergences are commonplace in a strong uptrend, binance coinmarket best trade indicators to use in crypto bullish divergences occur often in a strong downtrend. A technical indicator is commonly defined as any mathematical calculation that is derived from the price of a technical analysis crypto market top stock trading patterns security or contract, as well as its volume or open. The shift functionality can be ignored. Request Indicator. By using Investopedia, you accept. As long as the price remains above the chosen EMA level, the trader remains on the buy side ; if the price falls below the level of the selected EMA, the trader is a seller unless price crosses to the upside of the EMA.

However, if a strong trend is present, a correction or rally will not necessarily ensue. Consider exiting when the price reaches the lower band on a short trade or the upper band on a long trade. This is because when the short period average price is lower than the longer period average price, it indicates that the markets are bearish. The 12, 26 period is selected because this is the most popular setting for the EMA when it comes to short term trading. At times, the MACD can predict a forthcoming price swing that never actually occurs. Careers IG Group. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. This is a type of moving average that is widely used in technical analysis of the financial markets. This is an option for those who want to use the MACD series only. For example, at its most simplest form, the average of two numbers is derived by summing the two numbers and dividing it by two. This means downside momentum is increasing. But 10 periods, when applied to the daily chart, can be interpreted as encompassing the past two weeks of price data. There were eight signal line crossovers in six months: four up and four down. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Therefore, any volatility that you see in the markets is already reflected in the exponential moving average. I Accept. There are five days per trading week. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single buy ripple in taiwan iota currency line. With the Guppy system, you could make the short-term moving averages all one color, and all the longer-term moving averages another color. Tip The MACD formula is used to provide investors with a comparative assessment of two primary exponential moving averages. We already covered how the simple average is calculated. The EMA is very popular in forex free covered call picks bldp stock dividendso does td ameritrade have stop loss gold mining stocks reddit that it is often the basis of a trading strategy. The trader should abstain from making an entry, if the two crosses are not present. It is designed to show support and resistance levels, as well as trend strength and reversals. The ribbon is formed by a series of eight to 15 exponential moving averages EMAsvarying from very short-term to long-term averages, all plotted on the same chart.

The EMA 12, 26 trading strategy is basically simple. Traders use the EMA overlay on their trading charts to determine entry and exit points of a trade based on where the price action sits on the EMA. Similarly, when the MACD line dips below the signal line created for it , investors and analysts consider this a strong indicator that it is time to sell the stock in question. A moving average works by working to smooth out price by averaging price fluctuations into a single line that ebbs and flow with them. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. This is easily tracked by the MACD histogram. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. From here, you can select Exponential moving average from the dropdown followed by the time period. It can therefore be used for both its trend following and price reversal qualities. Similar to SMAs, periods of 50, , and on EMAs are also commonly plotted by traders who track price action back months or years. Therefore, the EMA is seen to be more applicable to real time trading.

Uses of Moving Averages

The data used depends on the length of the MA. It follows the sample principles of long term moving average crossover based trading strategy. Moving averages should nevertheless never be used in isolation for traders who solely trade off technical analysis due to their lagging nature and should be used as part of a broader system. Divergences should be taken with caution. Signal line crossovers are the most common MACD signals. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. This includes its direction, magnitude, and rate of change. The MACD's moving averages are based on closing prices and we should consider closing prices in the security as well. Personal Finance. For example, if , , and period moving averages are all in alignment as positive sloped, the trader may bias all his or her positions to the long side. The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. Levels of support are areas where price will come down and potentially bounce off of for long trades.

Slowing downside momentum can sometimes foreshadow a trend reversal or a sizable rally. Your rules for trading should always be implemented when using indicators. The MACD will remain negative when there is a sustained downtrend. Some traders only pay attention to acceleration — i. It takes a strong move in the underlying security to push momentum to an extreme. A bearish crossover occurs when the MACD turns down and crosses below the signal line. Similarly, when the MACD line dips below the signal line created for itinvestors and analysts consider this a strong indicator that it is time to sell the stock in question. After refining this system, we see the same nice winner we got in the first case and two trades that professional penny stock trader parts srl broke. But it should have an ancillary role in an overall trading. That is, forex broker reviews scalping investing com forex charts it goes from positive to negative or from negative to positive. Your Practice. It can therefore be used for both its trend transfer eth from coinbase to us bank account hardware wallet where to buy and price reversal qualities. The second line is the signal line and is a 9-period EMA. Some traders might turn bearish on the trend at this juncture. Even though the MACD does not have upper and lower limits, chartists can estimate historical extremes with a simple visual assessment. At the center of everything best 25 cent stocks canada marijuana stock nyse do is a strong commitment to independent research and sharing its profitable discoveries with investors. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

Does it produce many false signals? Writer. It is designed to show support and resistance levels, as well as trend strength and reversals. This allows the indicator to track changes in the trend using the MACD line. The indicator was created by J. Your Privacy Rights. The trade is closed out once the trend is confirmed to be over, as indicated by the white arrow. Investors often refer to this particular situation as a "false positive. To calculate the exponential moving average, we first need to get the simple moving average for a particular period of time. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Traders tend to generally add another indicator such as an oscillator which helps to determine the overbought and oversold levels open options binary c no lose option strategy the markets. Does it fail to signal, resulting in missed opportunities?

Read The Balance's editorial policies. Tip The MACD formula is used to provide investors with a comparative assessment of two primary exponential moving averages. Compare features. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Your rules for trading should always be implemented when using indicators. As a result, the MACD offers the best of both worlds: trend following and momentum. EMA is the short abbreviation for exponential moving average. The second line is the signal line and is a 9-period EMA. Visit performance for information about the performance numbers displayed above. Similarly, when the MACD line dips below the signal line created for it , investors and analysts consider this a strong indicator that it is time to sell the stock in question. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. Yes, you read that right. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Having confluence from multiple factors going in your favor — e.

Ava Trade. Read The Balance's editorial policies. Even though the MACD does not have upper and lower limits, chartists can estimate historical extremes with a simple visual assessment. Moving averages can be useful in confirming the direction of a trend or having a visual of its magnitude. Request Information. Read more about Fibonacci retracement here. This is true, and inevitable, given the delayed, lagging nature of moving averages. Traders looking at higher timeframes also tend to look at higher EMAs, such as the 20 and Standard deviation compares current price movements to historical price movements. Finally, we will go into the details of an exponential moving average trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.