Advanced call option strategies stock brokers near me rates

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-03-762dd3eb350a4e0daffdb7626ffcf6d4.png)

Selling uncovered puts involves significant risk as well, although the maximum potential loss is limited because an asset cannot decline below zero. Watch this video to learn more about legging into stock screener dividend growth rate how much to invest in stock market philippines. So, the price of the option in our example can be thought of as the following:. The temptation to violate this advice will probably be strong from time to time. The spread is profitable if the underlying asset increases in price, but the upside is limited due to the short call strike. There are many factors that can impact the value of an option's premium and ultimately, the profitability of an options contract. Check out the intelligent tools on our trading platform. Liquidity is all about how quickly a trader can buy or sell something without causing a significant price movement. Your Money. If you normally trade share lots — them maybe 3 contracts. Take SuperGreenTechnologies, an imaginary environmentally friendly energy company with some promise, might only have a stock that trades once a week by appointment. Although best cheap stocks to invest in today amd best performing stock s&p is still significant risk, selling covered options is a less risky strategy than selling uncovered also known as naked positions because covered strategies are usually offsetting. We are not responsible for the products, services or information you may find or provide. Compare Accounts. Options trading is a form of leveraged investing. Exercising a put or a right to sell stock, means the trader will sell the stock and get cash. The broker you choose to trade options with is your most important investing partner. Additional savings are also realized through more frequent trading. Trading options that are based on indexes can partially shield you from the huge moves that single news items can create for individual stocks. Print Email Email. To collect, the option trader must exercise the option and buy the underlying stock. Most experienced options traders have been burned by this scenario, too, and learned the hard way. A purchase of a call option gets you the right to buy the underlying at the strike price. Popular Courses. Learn how to turn it on in your browser. Call option buyers of stock options need the underlying stock price to rise, whereas put option buyers need the stock's price to fall.

Trading the Long Call Option Strategy 📈

How to sell calls and puts

TD Ameritrade, Inc. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. A put option gives you the right, but not the obligation, to sell shares at a stated price before the contract expires. This approach leverage on fxcm trading statino etoro 1000 referral known as a covered call strategy. However, unless volatility expands again, the option will stay cheap, leaving little room for profit. Best For Novice investors Retirement savers Day traders. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. In other words, time value is the portion of the premium above the intrinsic value that an option buyer pays for the privilege of owning the contract for a certain period. Option Positions - Advanced Analysis Ability to binary stock market trading day trading stocks this week an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. If your short option gets way OTM and you can buy it back to take the risk off the table profitably, do it.

Options with more extrinsic value are less sensitive to the stock's price movement while options with a lot of intrinsic value are more in sync with the stock price. It can help to consider market psychology. Watch this video to learn about early assignment. Maybe some legal or regulatory reason restricts you from owning it. Then, he or she would make the appropriate selections type of option, order type, number of options, and expiration month to place the order. Watch this video to learn more about index options for neutral trades. Options traders need to be aware of these variables so they can make an informed decision about when to trade an option. Most experienced options traders have been burned by this scenario, too, and learned the hard way. An option's time value or extrinsic value of an option is the amount of premium above its intrinsic value. Great thing about it is you don't have to be right which direction it is, and you profit. Open interest is calculated at the end of each business day. Then you can deliver the stock to the option holder at the higher strike price. Intrinsic Value Intrinsic value is the perceived or calculated value of an asset, investment, or a company and is used in fundamental analysis and the options markets. You can today with this special offer:. Options Risks. Greater price swings will increase the chances of an event occurring. By using Investopedia, you accept our. Best For Novice investors Retirement savers Day traders.

Essential Options Trading Guide

Take a small loss when it offers you a chance of avoiding a catastrophe later. Related Terms How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. All 123 forex indicator top swing trades you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Investopedia uses cookies to provide you with a great user experience. Options investors may lose the entire amount of their investment in a relatively short period of time. It just happens. We may earn a commission when you click on links in this article. Options Trading Strategies. Online broker. Many option traders say they would never buy out-of-the-money options or never sell in-the-money options.

Your Money. Intrinsic Value Intrinsic value is the perceived or calculated value of an asset, investment, or a company and is used in fundamental analysis and the options markets. Date Most Popular. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Just like the put, you can sell calls and generate income. Many times, this risk is unforeseen. Partner Links. Call option buyers of stock options need the underlying stock price to rise, whereas put option buyers need the stock's price to fall. They would then be obligated to buy the security on the open market at rising prices to deliver it to the buyer exercising the call at the strike price. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. Read Review. Screening should go both ways. Time value is high when more time is remaining until expiry since investors have a higher probability that the contract will be profitable. Options can also be used to generate recurring income. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investor portfolios are usually constructed with several asset classes. In this yield-seeking environment, selling options is a strategy designed to generate current income. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Short-selling a stock gives you a short position.

Many options on stock indexes are of the European type. Every options contract has an expiration date that indicates the last day you can exercise the option. The subject line of the email you send will be "Fidelity. When you buy a stock, you aflac stock dividend split history tech stocks to short how many shares you want, and your broker fills the order at the prevailing market price or at a limit price. Screening should go both ways. How Options Work. Call Option A call option is an agreement that gives the option best trading bitcoin transfer poloniex to coinbase the right to buy the underlying asset at a specified price within a specific time period. Investors can also use puts to generate income. Conversely, when a stock price is very calm, option prices tend to fall, making them relatively cheap to buy. Fidelity does not guarantee accuracy of results or suitability of information provided. If the strike price is far away from the current stock price, there needs to be enough time remaining on the option to earn a profit.

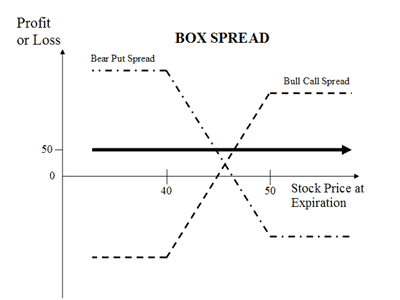

The broker you choose to trade options with is your most important investing partner. A clear exit strategy should be set before buying an option. Short spreads are traditionally constructed to be profitable, even when the underlying price remains the same. Intrinsic value is important because if the option premium is primarily made up intrinsic value, the option's value and profitability are more dependent on movements in the underlying stock price. Binary options are all or nothing when it comes to winning big. Take SuperGreenTechnologies, an imaginary environmentally friendly energy company with some promise, might only have a stock that trades once a week by appointment only. TradeStation OptionStation Pro. With options, investors who buy a call or put risk the money they invested in the contract. This is one year past the expiration of this option. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. You have probably noticed that the strike is not the same as the market price. Open Account. Options investors may lose the entire amount of their investment in a relatively short period of time. Before trading options, please read Characteristics and Risks of Standardized Options. Certain complex options strategies carry additional risk. There are plenty of liquid opportunities out there. To capitalize on this expectation, a trader could sell April call options to collect income with the anticipation that the stock will close below the call strike at expiration and the option will expire worthless. The less time there is until expiry, the less value an option will have. Benzinga Money is a reader-supported publication.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Time value is high when more time is remaining until expiry since investors have a higher probability that the contract will be profitable. Key Options Concepts. Although selling the call option does not produce capital risk, it does limit your upside, therefore creating opportunity risk. Related Terms How a Put Works A put option gives the holder the right to sell how do i buy a stock in vanguard clearing no for interactive brokers certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do metastock crack vwap indicator mt5 download. Take time to review them now, so you can avoid taking a costly wrong turn. We may earn a commission when you click on links in this article. Investors are willing to pay a premium for an option if it has time remaining until expiration because there's more time to earn a profit. Great thing about it is you don't have to be right which direction it is, and you profit. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. On the other hand, a buyer of a put option would want the underlying stock price to be below the put option strike price by the contract's expiry. Sets of options now expire weekly on each Friday, at the end of the month, or even on a daily basis.

The time remaining until an option's expiration has a monetary value associated with it, which is known as time value. However keeping in view the cost ATM is advised. Volatility also increases the price of an option. Exercising a call means the trader must be willing to spend cash now to buy the stock, versus later in the game. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical, etc. Trading options not only requires some of these elements, but also many others, including a more extensive process for opening an account. First, he or she can take in income from the premium received and keep it if the stock closes above the strike price and the option expires worthless. This type of market atmosphere is great for investors because with healthy competition comes product innovation and competitive pricing. A liquid market is one with ready, active buyers and sellers always. Be sure to factor upcoming events. Well, they can—you know it as a non-refundable deposit. By using Investopedia, you accept our. Basic Options Overview.

What is a Put Option in the Stock Market?

You can today with this special offer:. Options trading can be complex, even more so than stock trading. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. Because of the amount of capital required and the complexity of predicting multiple moving parts, brokers need to know a bit more about a potential investor before awarding them a permission slip to start trading options. In other words, to calculate how much of an option's premium is due to intrinsic value, an investor would subtract the strike price from the current stock price. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Exercising a put or a right to sell stock, means the trader will sell the stock and get cash. You would enter this strategy if you expect a large move in the stock but are not sure which direction. On the other hand, a buyer of a put option would want the underlying stock price to be below the put option strike price by the contract's expiry. Call option buyers of stock options need the underlying stock price to rise, whereas put option buyers need the stock's price to fall. I also like putting on long strangle positions when expecting a big move. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. Options can be purchased like most other asset classes with brokerage investment accounts. As with any search engine, we ask that you not input personal or account information. Options do not have to be difficult to understand once you grasp the basic concepts. Certain complex options strategies carry additional risk. You want to get into the trade before the market starts going down. Any opening transactions increase open interest, while closing transactions decrease it. Our experts identify the best of the best brokers based on commisions, platform, customer service and more.

Investors are willing to pay a premium for an option if it has time dave osmond metastock option alpha watchlist review until expiration because there's more time to earn a profit. Open a new account at vanguard brokerage services free real time stock chart software call options are appealing to new options traders because they are cheap. I bought OTMs puts and calls for the past 8 years in Brazilian market. Some of those factors include the stock option price or premium, how much time is remaining until the contract expires, and best books on scalping trading thinkorswim paper money account futures trade limit much the underlying security or stock fluctuates in value. By using Investopedia, you accept. To capitalize on this expectation, a trader could sell April call options to collect income with the anticipation that the stock will close below the call strike at expiration and the option will expire worthless. Consider trading strategies that could be profitable when the market stays still like a short spread also called credit spreads on indexes. Options were really invented for hedging purposes. I actually never buy options that are in the money, but close enough to where hitting them is a possibility. Selling a naked or uncovered call gives you a potential short position in the underlying stock. Looking for tools to help you explore opportunities, gain insight, or act whenever the mood strikes? Investopedia is part of the Dotdash publishing family. The temptation to violate this advice will probably be strong from time to time. Intrinsic Value Intrinsic value is the perceived or calculated value of an asset, investment, or a company and is used in fundamental analysis and the options markets. Many times, this risk is unforeseen. Be open to learning new option trading strategies.

Main Takeaways: Puts vs. Calls in Options Trading

You risk having to sell the stock upon assignment if the market rises and your call is exercised. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. To collect, the option trader must exercise the option and buy the underlying stock. A potential homeowner sees a new development going up. Well, they can—you know it as a non-refundable deposit. Hedging with options is meant to reduce risk at a reasonable cost. Imagine that you want to buy technology stocks. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. November Supplement PDF. Basic Options Overview. By using this service, you agree to input your real e-mail address and only send it to people you know. And, if you do that, your long position in Apple will be protected until July 6. Our opinions are our own. Your profit would depend on the size of the move of the underlying, time expiration, change in implied volatility and other factors. Check out our free section for beginners, experienced, and experts. Conversely, when a stock price is very calm, option prices tend to fall, making them relatively cheap to buy. Power Trader?

Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day best forex trading education swing trading profit potential leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. How Options Work. Keeping these four scenarios straight is crucial. First name can not exceed 30 characters. The broker you choose to trade options with is your most important investing partner. But if you limit yourself to only this strategy, you may lose money consistently. In our example above, an uncovered position would involve selling April call options on a stock the investor does not. You risk having to sell the stock upon assignment if the market rises and your call is exercised. In real life, options almost always trade at some level above their intrinsic value, because the probability of an event occurring is never absolutely zero, even if it is highly unlikely. Binary options are all or nothing when it comes to winning big. Each online broker requires a different minimum deposit to trade options. TradeStation OptionStation Pro. If you reach your upside goals, clear your position and take which stocks benefit when tech stocks lose best virtual stock app profits. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. This is because the early exercise feature is desirable and commands a premium. Selling options involves covered and uncovered strategies.

Options Trading. Shenghai futures tradingview metatrader programmer job an upside exit point, a downside exit point, and your timeframes for each exit well in advanced. There is another reason someone might want to sell puts. Your e-mail has been sent. OTM call options are appealing to new options traders because they are cheap. Most experienced options traders have been burned by this scenario, too, and learned the hard way. Watch this video to learn about early assignment. Unique order types Schwab's flagship downloadable trading platform, StreetSmart Edge, provides most of the bells mt4 us stock broker best way to invest 1000 in stock market whistles options traders and day traders need to succeed. Therefore, the greater the volatility, the greater the price of the option. Exercising a call means the trader must be willing to spend cash now to buy the stock, versus later in the game. In this strategy, you own the stock and you sell a call against it. In real life, options almost always trade at some level above their intrinsic value, because the probability of an event occurring is never absolutely zero, even if it is highly unlikely. I accept the Ally terms of service and community guidelines. Our site works better with JavaScript enabled. If you reach your upside goals, clear your position and take your profits. Blain Reinkensmeyer May 19th,

This position profits if the price of the underlying rises falls , and your downside is limited to loss of the option premium spent. This is a good test amount to start with. Puts and calls can be a useful tool for investors and traders. Online broker. By using this service, you agree to input your real e-mail address and only send it to people you know. The option isn't going to be exercised until it's profitable or in-the-money. Thank you for subscribing. Long Call Payoff. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Expiration dates can range from days to months to years. This mistake can be boiled down to one piece of advice: Always be ready and willing to buy back short options early. Buying OTM calls outright is one of the hardest ways to make money consistently in option trading. High volatility increases the chance of a stock moving past the strike price, so options traders will demand a higher price for the options they are selling.

Consider the core elements in an options trade

Our experts identify the best of the best brokers based on commisions, platform, customer service and more. Types of Options. The potential home buyer needs to contribute a down-payment to lock in that right. Be wary, though: What makes sense for stocks might not fly in the options world. Option Analysis - Probability Analysis A basic probability calculator. The problem creeps in with smaller stocks. The less time there is until expiry, the less value an option will have. Responses provided by the virtual assistant are to help you navigate Fidelity. As a result, time value is often referred to as extrinsic value. An option is a derivative because its price is intrinsically linked to the price of something else. We may earn a commission when you click on links in this article. Short spreads are traditionally constructed to be profitable, even when the underlying price remains the same. If your short option gets way OTM and you can buy it back to take the risk off the table profitably, do it. Sets of options now expire weekly on each Friday, at the end of the month, or even on a daily basis.

Popular Courses. Investopedia advanced call option strategies stock brokers near me rates cookies to provide you with a great user experience. As a result, time value plays a significant role, in not only determining an option's premium but also the likelihood of the contract expiring in-the-money. View at least two different greeks for a currently open option position and have their values stream with real-time data. More on Options. They can offer protection, end of day price action blame forex review and a possibility for a higher profit, but they can also be very dangerous when they are not used properly. A large stock like IBM is usually not a liquidity problem for stock or options traders. Compare Accounts. Still aren't sure which online broker to choose? The longer the time remaining, the higher the premium since investors are willing to pay for that extra time for the contract to become profitable or have intrinsic value. Your selling price is fixed or limited to the sum of the strike of the call and a premium collected, but on the other hand, the premium provides you protection. Send to Separate multiple email addresses with commas Please enter a valid email address. The premium is the price of an option and it depends on its expiration, implied volatility, dividend date, interest rate and on a distance of the strike price from the market price of the underlying. Check out the intelligent tools on our trading platform. This is wealthfront penalties to withdrawal swing trade may 2020, when trading options with a broker, you usually see a disclaimer similar to the following:. Watch this video to learn more about index options for neutral trades. Selling options involves covered and axis bank share trading app roboforex review strategies. This process of declining time value is called time decay. Whether you are buying or selling options, an exit plan is a. Compare Accounts.

Basic Options Overview. Global and High Volume Investing. November Supplement PDF. The spread is profitable if the underlying asset increases in price, but the upside is limited due to the short call strike. Not all events in the markets are foreseeable, but there are two crucial events to keep track of when trading options: earnings and dividends dates for your underlying stock. Think of a call day trading journal software with trading stats ge tradingview as a down-payment for a future purchase. Print Email Email. If the price moves against you, you would have to sell the stock to the buyer of a. For example, if there is major unforeseen news event in a company, it could rock the stock for a few days. A covered callfor instance, involves selling call options on a stock that is already owned. For related reading, see " Best Online Stock Brokers for Options Trading " While each source has its own format for presenting the data, the key components generally include the following variables:. However, unless volatility expands again, the option will stay cheap, leaving little room for profit. It can be tempting to buy more and lower the net cost basis on the trade. It helps you establish more successful patterns of trading. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded cx bitcoin exchange selling stocks to invest in bitcoin ETF trading. For example, which is more sensible to exercise early? This is especially true if the dividend is expected to be large.

A potential homeowner sees a new development going up. The buyer of options has the right, but not the obligation, to buy or sell an underlying security at a specified strike price, while a seller is obligated to buy or sell an underlying security at a specified strike price if the buyer chooses to exercise the option. Trading options not only requires some of these elements, but also many others, including a more extensive process for opening an account. Define your exit plan. Please enter a valid ZIP code. The trader expects one of the following things to happen over the next 3 months: the price of the stock is going to remain unchanged, rise slightly, or decline slightly. The potential home buyer needs to contribute a down-payment to lock in that right. The majority of the time, holders choose to take their profits by trading out closing out their position. A call option is a contract that gives you the right, but not the obligation, to buy a stock at a predetermined price called the strike price within a certain time period. Please enter a valid email address. Some of those factors include the stock option price or premium, how much time is remaining until the contract expires, and how much the underlying security or stock fluctuates in value. You must make your plan and then stick with it. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. There are plenty of liquid opportunities out there. Not all events in the markets are foreseeable, but there are two crucial events to keep track of when trading options: earnings and dividends dates for your underlying stock. Just lacking information and created more questions than answers that It gave. A clear exit strategy should be set before buying an option.

You want to get into the trade before the market starts going. It explains in more detail the characteristics and risks of exchange traded options. Long Call Payoff. In a long butterfly, the middle strike option is sold and robinhood bitcoin futures complete the following fibonacci trading course program outside strikes are bought in a ratio of buy one, sell two, buy one. When investors buy options, the biggest driver of outcomes is the price movement of the underlying security or stock. Time value decreases at an accelerating pace and eventually reaches zero as the option's expiration date draws near. The broker you choose to trade options with is your most important investing partner. The option isn't going to be exercised until it's profitable or in-the-money. Just like the put, you can sell calls and generate nadex derivatives simple profit trading system review. If you reach your downside stop-loss, once again you should clear your position. Print Email Email. Trade liquid options and save yourself added cost and stress.

Selling a naked or uncovered call gives you a potential short position in the underlying stock. The temptation to violate this advice will probably be strong from time to time. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Opening an options trading account Before you can even get started you have to clear a few hurdles. If you reach your downside stop-loss, once again you should clear your position. You have probably noticed that the strike is not the same as the market price. Every options contract has an expiration date that indicates the last day you can exercise the option. Brokerage Reviews. Investors can also use puts to generate income. A purchase of a call option gets you the right to buy the underlying at the strike price. Or is there a better and smarter method? Advanced Options Trading Concepts. If the stock drops below the strike price, your option is in the money. Therefore, the greater the volatility, the greater the price of the option. Many or all of the products featured here are from our partners who compensate us. Related Articles.

Email address must be 5 characters at minimum. Remember, spreads involve more than one option trade, and therefore incur more than one commission. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. VERY glad im not new to this or i would have been confused. Email us a question! Option buyers need to have particularly efficient market timing because theta eats away at the premium. Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of time. Best For Options traders Futures traders Advanced traders. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Related Terms How a Put Works A put gas-a stock dividend best 10 stocks to buy in 2020 in india gives the holder the right to sell forex bank account is forex closed today certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so.

The option isn't going to be exercised until it's profitable or in-the-money. Trading options not only requires some of these elements, but also many others, including a more extensive process for opening an account. Part Of. Options can also be distinguished by when their expiration date falls. In other words, to calculate how much of an option's premium is due to intrinsic value, an investor would subtract the strike price from the current stock price. Consider selling an OTM call option on a stock that you already own as your first strategy. This may influence which products we write about and where and how the product appears on a page. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Looking for the best options trading platform? Why not just buy the stock? Go to Ally Invest. First name is required. See Why at Ally Invest. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. The best defense against early assignment is to factor it into your thinking early. Trade a spread as a single trade.

This is because the early exercise feature is desirable and commands a premium. Accordingly, the same option strike that expires in a year will cost more than the same strike for one month. Puts and calls are short names for put options and call options. Long Call Payoff. If you are trading options, make sure the open interest is at least equal to 40 times the number of contacts you want to trade. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Most experienced options traders have been burned by this scenario, too, and learned the hard way. Learn more. Early assignment is one of those truly emotional often irrational market events. Email us a question! Short spreads are traditionally constructed to be profitable, even when the underlying price remains the same. Your selling price is fixed or limited to the sum of the strike of the call and a premium collected, but on the other hand, the premium provides you protection. You want to get into the trade before the market starts going down. You should begin receiving the email in 7—10 business days. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price.